ADSS is a financial broker with 9 awards from ForexExpo, Global Forex Awards, Forex Traders Summit Dubai, and more.

The broker features 3 live account types [Classic, Elite, Pro,] with USD and AED as their base currencies. The company is regulated by the UAE Securities and Commodities Authority (SCA).

Company Specifics & Regulating Authorities

ADSS, headquartered in Abu Dhabi, United Arab Emirates, has been serving traders for over a decade. Here's some essential information about the company:

- Established in 2010;

- Regulated by the UAE Securities and Commodities Authority (SCA) under the license number 1190047;

- Particularly focused on the MENA region;

- Located at 8th floor, CI Tower, Corniche Road, PO Box 93894, Abu Dhabi, United Arab Emirates.

It's worth noting that while SCA regulation provides some security, it's considered a mid-tier regulator compared to bodies like the FCA or ASIC.

Table of Key Details

As with the tradition of reviews on TradingFinder, in this section, we will have an overview of the main features of the Forex broker. Let's break down the key Specifics of ADSS:

Broker | ADSS |

Account Types | Standard, Elite, Pro |

Regulating Authority | SCA |

Based Currencies | USD, AED |

Minimum Deposit | $100 |

Deposit Methods | Bank Transfers, Credit/Debit Cards, Skrill, Neteller, GSD Pay, Apple Pay, Samsung Pay, UAEPGS (For UAE Accounts) |

Withdrawal Methods | Bank Transfers, Credit/Debit Cards, Skrill, Neteller, GSD Pay, Apple Pay, Samsung Pay, UAEPGS (For UAE Accounts) |

Minimum Order | 0.01 |

Maximum Leverage | 1:500 |

Investment Options | Trading Signals on MT4 |

Trading Platforms & Apps | MetaTrader 4, Proprietary Trading Platform |

Markets | Forex, Indices, Stocks and ETFs, Bonds, Commodities, Crypto |

Spread | From 0 Pips on Pro Account |

Commission | Low on Pro Account |

Orders Execution | Market |

Margin Call/Stop Out | 80-100%/50% |

Trading Features | Demo Account, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Monthly Rebate |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Phone Call, Email, Ticket |

Customer Support Hours | 24/5 |

Trading Accounts Review and Investigation

ADSS offers a tiered structure of three account types tailored for different levels of trading experience and capital:

- The Standard Account is designed for retail traders with a low entry point, a minimum deposit of just $100. It comes with spreads from 1.4 pips, no commissions, and supports swap-free trading and demo access;

- The Elite Account caters to more seasoned clients with a higher capital threshold, requiring a $100,000 deposit. It provides tighter spreads from 0.7 pips, no commissions, and access to a dedicated senior manager and exclusive events;

- The Pro Account is designed for high-volume or professional traders, who also require a $100,000 deposit. It offers raw spreads from 0.0 pips, with negotiable commission rates, support from an expert trading desk, and access to the Elite perks.

All accounts have a margin call level set at 100%, a stop-out level at 50%, and a minimum trade size of 0.01 lots. USD is the default base currency, and all accounts can be converted into Islamic (swap-free) formats.

Important Benefits and Drawbacks

Every financial firm comes with a set of pros and cons. Let's weigh the advantages and disadvantages of trading with ADSS:

Benefits | Drawbacks |

Decent Regulatory Oversight By SCA | High Minimum Deposits For Elite And Pro Accounts |

Diverse Range Of Trading Instruments | Mixed Reviews and Trust Scores |

Proprietary Platform Alongside MT4 Offering | - |

Extensive Educational Content | - |

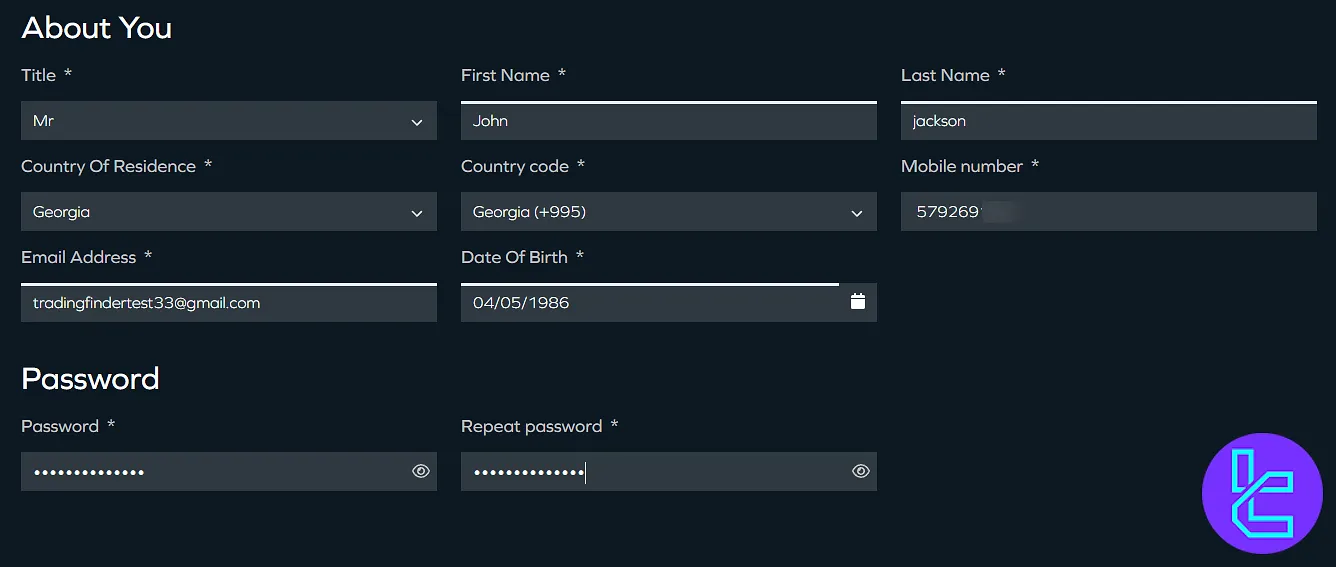

How to Create an Account and Verify on ADSS

Traders are required to open an account with the ADSS broker to use all its services. ADSS registration:

#1 Create Your Account & Select Platform

Access the registration form on the ADSS site. Fill out the form with your personal details:

- Full name

- Mobile number

- Birth date

Then, select your preferred trading platform (ADSS or MT4), define your account type, and pick a base currency.

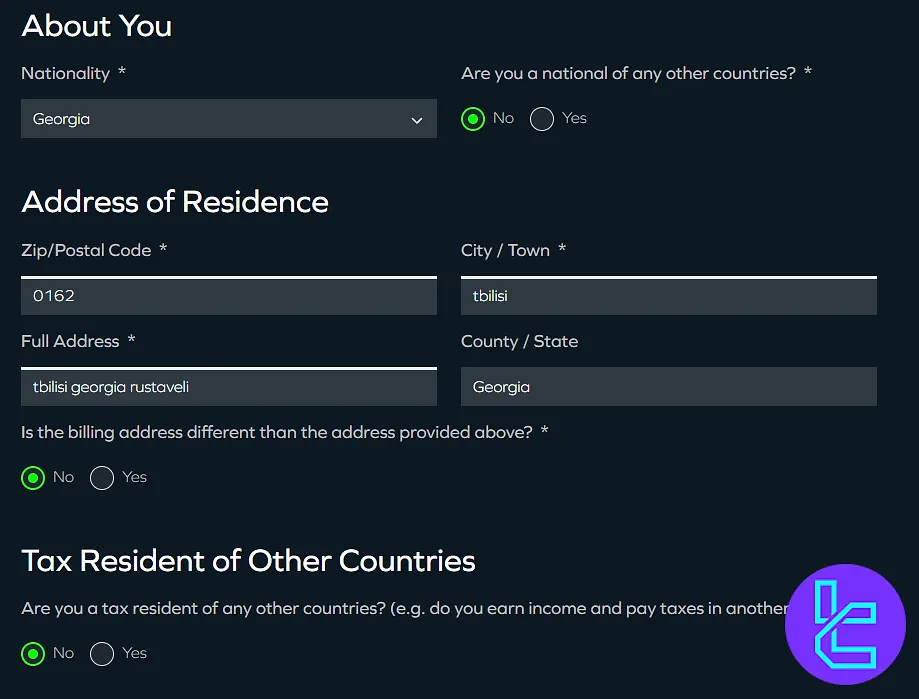

Step 2: Submit Address & Residency Details

Enter your city, region, country, and postal code. Declare your Tax ID and confirm your U.S. citizenship status.

#3 Complete Financial Information

Provide your employment status, income bracket, source of funds, and total investable assets.

#4 Declare Trading Experience

Indicate your trading background, including asset types traded, duration of experience, and frequency of trades.

#5 Finalize Profile & Submit Application

Answer compliance-related questions and accept the terms and conditions. Click “Submit” to access your ADSS dashboard.

ADSS Verification

To verify your ADSS account, upload the following documents. ADSS verification:

- Passport, ID card, or driver's license as proof of identity

- A bank statement or utility bill as proof of residency

Which Trading Platforms Are Available?

Platforms act as facilities for clients to trade with a broker. ADSS offers two main trading platforms, which will be briefly discussed in the next sections.

MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms in the industry, offering a convenient user interface, useful features, and advanced analytics tools.

Proprietary Platform

ADSS has developed a proprietary app and offered it alongside MT4 as another platform. Download the application through the links below:

Spreads And Commissions Investigation

ADSS offers a varied fee structure across its instruments, with spreads and commissions depending on the chosen account type.

The Standard Account features zero commissions, but spreads vary, often exceeding the industry average on popular pairs. For instance, during live testing:

- EUR/USD averaged 1.4 pips

- GBP/JPY reached up to 4.0 pips

- Gold spreads were as high as 57 pips

By contrast, crude oil spreads were extremely low, as little as 0.02 pips

The Pro Account delivers more competitive pricing with raw spreads starting from 0.0 pips and negotiable commissions.

Overnight financing (swap) charges range from average to high. For example, a long position on EUR/USD incurs a cost of $7.5 per lot, while a short position earns $1.7. Conversely, holding GBP/JPY short can cost as much as $27.3.

ADSS is transparent with its non-trading fees:

- No deposit or inactivity fees

- A flat $5 withdrawal fee

- A 1% currency conversion fee applies to non-USD/AED deposits

This pricing structure makes ADSS particularly appealing for commodity traders (due to low oil spreads) and short-term traders looking to avoid long-term financing costs.

Available Deposit and Withdrawal Methods on ADSS

ADSS offers a wide range of deposit and withdrawal options suitable for various regions. In this section, we will have an overall look at them:

- Bank Transfers: Through bank accounts

- Credit/Debit Cards: VISA and Mastercard

- E-wallets: Skrill & Neteller

- Local Methods: GSD Pay and UAEPGS (for UAE accounts)

- Mobile Payments: Apple Pay & Samsung Pay

Most deposit methods are processed instantly, with bank wires taking 1–3 business days.

Withdrawals follow the same methods as deposits for security reasons and are also straightforward. While there are no processing delays for most methods, ADSS applies a flat $5 withdrawal fee regardless of method or amount.

Copy Trading Tools and Other Investment Facilities

Based on our investigations on ADSS's website and platforms, currently, the broker does not directly provide any options for copy trading or other services.

However, the trading platform offered by it (MT4) enables access to signals from professional traders, which can be considered a social trading option.

Tradable Instruments and Markets

ADSS attempts to do a good job in tradable markets, and it does. The brokerage offers a diverse range of symbols in several classes:

- Forex: More than 60 trading pairs such as EURUSD, NZDJPY, GBPUSD, etc.

- Indices: 22 global benchmarks including Dow Jones 30, UK 100, Germany 40, and Japan 225

- Stocks and ETFs: Over 950 instruments across tech, retail, finance, and global sectors

- Bonds: BOBL, BUND, GILT, etc.

- Commodities: 33 products including Gold, Crude Oil, Brent, Silver, Coffee, and Corn; available as spot and futures contracts

- Cryptocurrencies: Bitcoin, Litecoin, Ethereum, and Bitcoin Cash

Client Bonuses and Promotions

Per our investigations on the broker during the time of writing this review, ADSS currently offers only one promotion, and it's a rebate. Clients can earn a monthly rebate on trading 5 selected indices:

- HSENG

- SWISS

- ESTOX

- JPN225

If your trading volume in a calendar month reaches the required amount, you will receive a monthly rebate as a bonus. Please note that this offer is subject to change or may become unavailable in the future.

Contact Channels and Working Schedule

Support services in a financial firm is of utmost importance, since your money is at stake. ADSS provides support through multiple methods:

- Live Chat: On the website or through ADSS WhatsApp;

- Email: ts@adss.com;

- Phone: +971 2 657 2414;

- Support Ticket System: In the "Contact" page of the website.

Unfortunately, this company does not offer 24/7 support services, and this department works 24/5.

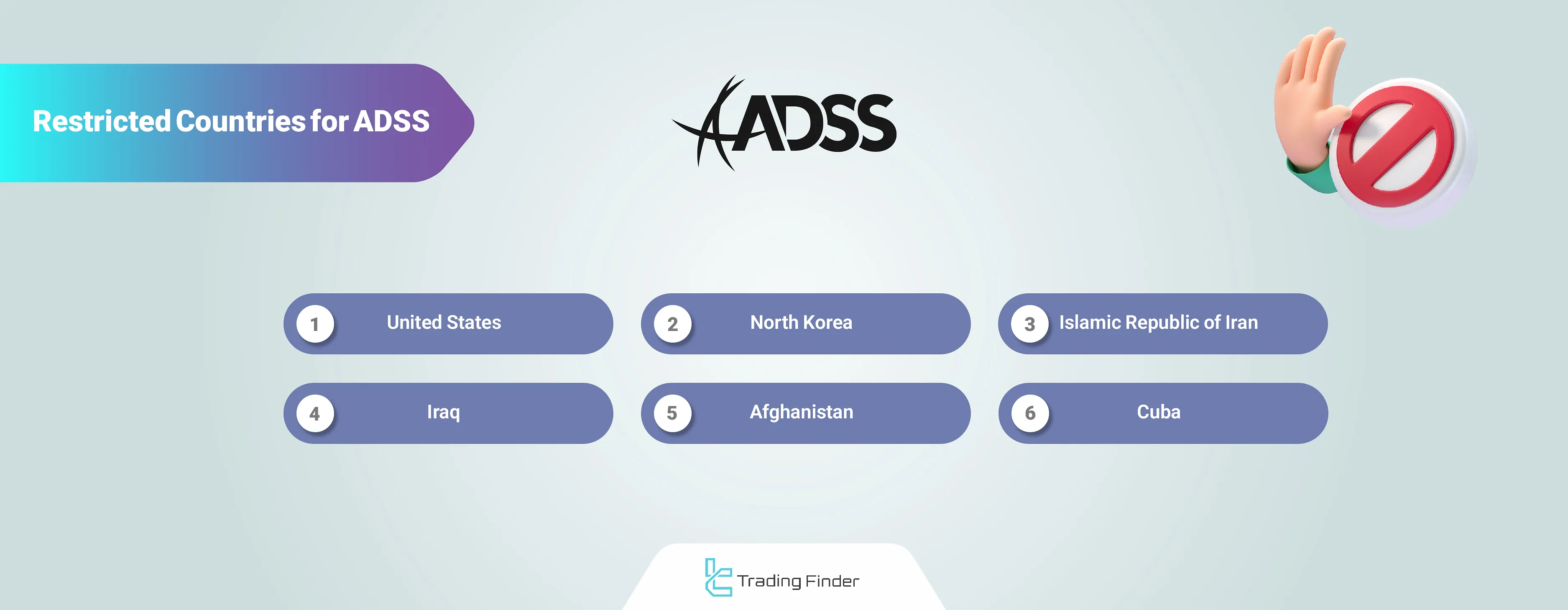

List of Restricted Countries

While ADSS doesn't publish a comprehensive list of restricted countries, it's known that residents of certain nations, especially countries under international sanctions, cannot open accounts. These typically include:

- United States

- North Korea

- Iran

- Iraq

- Afghanistan

- Cuba

The restrictions are largely due to regulatory requirements and the broker's licensing status. Always check with the broker directly or read their terms of service to confirm eligibility based on your country of residence.

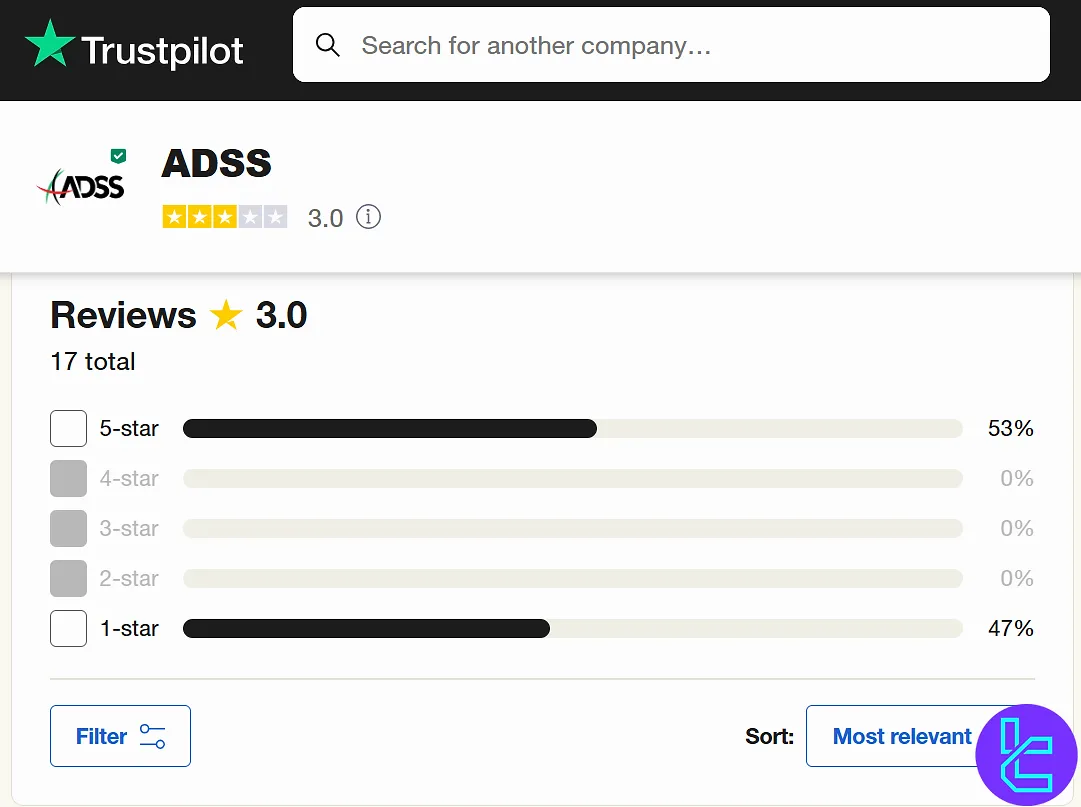

Trust Scores of ADSS Broker

This company has received mixed reviews from its clients and traders on popular and reputable platforms, including ADSS Trustpilot and ForexPeaceArmy. Trust Reviews and Ratings of ADSS:

- Trustpilot: 3.0/5, less than 20 scores, no reply from the company to negative reviews;

- ForexPeaceArmy: 2.8/5, over 20 reviews.

While this broker is generally considered trustworthy due to its regulatory status and long-standing presence in the market, these mixed reviews suggest that trader experiences can vary, and caution is required when w

Education Content

ADSS delivers a robust suite of research and educational tools, combining proprietary content with insights from reputable third-party providers. This dual approach ensures that traders receive both strategic overviews and real-time technical analysis.

On the research side, ADSS offers:

- A Dow Jones–powered news screener, delivering professional-grade market headlines

- In-house market analysis with detailed breakdowns of price action and underlying fundamentals - Access to Trading Central for verified accounts, including technical setups, trading ideas, and the Market Buzz sentiment gauge

- An economic calendar to track key macroeconomic events and forecast potential volatility

The broker’s educational portal includes:

- A wide array of articles and video tutorials

- Topics ranging from technical and fundamental analysis to risk management and trading psychology

- A searchable glossary of financial terms

- Structured content layout to support self-paced learning

Although ADSS does not currently offer video-based market research, its overall library is well-organized and suitable for traders of all levels, especially those who prefer written content and step-by-step instruction.

ADSS Compared to Other Forex Brokers

Understanding the advantages and disadvantages of trading with the ADSS in comparison with other Forex brokers helps traders decide whether this is the right broker for them.

Parameters | ADSS Broker | |||

Regulation | SCA | FSC | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA | CySEC, MiFID, CNMV, MNB, FINANSTILSYNET, ACPR, KNF, BaFin, FI, HCMC |

Minimum Spread | From 0.0 Pips on Pro Account | From 0.0 pips | From 0.0 Pips | From 0.00001 pips |

Commission | From $0 | Variable | $0 | $8 |

Minimum Deposit | $100 | $200 | $100 | $100 |

Maximum Leverage | 1:500 | 1:3000 | 1:400 | 1:300 |

Trading Platforms | MetaTrader 4, Proprietary Trading Platform | MT4, MT5, FXTM Trader App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader | MetaTrader 5 |

Account Types | Standard, Elite, Pro | Advantage, Stocks Advantage, Advantage Plus | Standard, Demo, Professional | ECN, ECN Plus, ECN VIP, Demo |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1050+ | 1000+ | 1250+ | 120+ |

Trade Execution | Market | Market, Instant | Instant | Market |

Conclusion And Final Words

ADSS is a brokerage with a 3.0 out of 5 trust score on the Trustpilot website. On ForexPeaceArmy, the company has received a 2.8/5 score.

You have the option to trade 6 markets with over 60 Forex trading pairs. The broker provides a monthly rebate bonus on 5 indices [HSENG, SWISS, ESTOX, JPN225, US2000.]