Forex, CFD and spread betting trading are available in CAPITAL INDEX broker with minimum deposit of $100. The broker is licensed by FCA United Kingdom and enables traders to use maximum leverage of 1:200.

CAPITAL INDEX Company Information & Regulation

CAPITAL INDEX (UK) LIMITED, founded in 2014, is a private limited company registered in England and Wales. With its headquarters at 75 King William Street, London, EC4N 7BE, the company has established itself as a significant player in the financial intermediation sector. CAPITAL INDEX Information:

- Company number: 09532185

- Company status: Active

- Nature of business: Financial intermediation not elsewhere classified

CAPITAL INDEX is regulated by the UK's Financial Conduct Authority (FCA), one of the most respected financial regulators globally. This regulation ensures that the broker adheres to strict financial standards, providing a layer of security for traders.

Additionally, the company is regulated by the Securities Commission of The Bahamas (SCB), further extending its global reach and regulatory compliance.

Specifications

CAPITAL INDEX forex broker stands out in the crowded forex market with its robust offering of trading instruments and user-friendly platforms. Here's a quick overview of what sets this broker apart:

Broker | CAPITAL INDEX |

Account Types | ADVANCED, PRO |

Regulating Authorities | FCA Britain, SCB Bahamas |

Based Currencies | GBP/EUR/USD |

Minimum Deposit | $100 |

Deposit/Withdrawal Methods | Bank Transfer and Credit/Debit Cards |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | MT4, MarketBook |

Markets | Forex, CFD, Spread Betting |

Spread | From 1.0 Pips |

Commission | 0.02/unit/trade (min £10 (UK)/€10 (EU)/$15 (US) per trade) |

Orders Execution | Market |

Margin Call/Stop Out | No Information Provided |

Trading Features | 24/5 Support, Demo Trading, 1:200 Maximum Leverage |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Indoor Meeting, Phone Call, Email, Live Chat |

Customer Support Hours | 24/5 |

What Accounts Does CAPITAL INDEX Offers?

CAPITAL INDEX offers two primary accounts [ADVANCED & PRO] to cater to different trading styles and experience levels; CAPITAL INDEX Account Types:

Specifics | ADVANCED | PRO |

Spreads | From 1.4 Pips | From 1.0 Pips |

Minimum Deposit | $100 | $1000 |

Base Currencues | GBP/EUR/USD | GBP/EUR/USD |

Minimum Position Size | 0.01 lot / £0.10 | 0.01 lot / £0.10 |

Commission | 0.02/unit/trade (Min £10 (UK)/€10 (EU)/$15 (US) per trade) | 0.02/unit/trade (Min £10 (UK)/€10 (EU)/$15 (US) per trade) |

Maximum Leverage | 1:200 | 1:200 |

What Are Advantages and Disadvantages?

Answer to this question helps you to have a better outlook from this broker; CAPITAL INDEX Pros and Cons:

Advantages | Disadvantages |

Regulated By FCA And SCB | No Cent Accounts for Beginners |

User-Friendly MT4 And Proprietary Platforms | Low Range of Trading Instruments |

Competitive Spreads (From 1.0 Pip) | No Passive Income Options |

No Hidden Commissions | Relatively High Minimum Deposit for Pro Account |

Suitable Educational Resources |

Sign Up & Verification: Comprehensive Guide

Opening an account in this broker is easier than what it seems and can be completed in just a few minutes. CAPITAL INDEX Sign Up Guide:

- Go to the official CAPITAL INDEX website and click on the "CREATE ACCOUNT" button;

- Choose your preferred trading platform between MT4 and MarketBook;

- Fill out the application and provide your personal information, including name, address, and contact details.

- Choose your account type between the Advanced and Pro.

- Complete the appropriateness assessment and Answer questions about your trading knowledge and experience.

- Verify your identity and to do so, upload required documents for KYC purposes (Government issued ID and proof of address).

- Fund your account and make your initial deposit using one of the available payment methods.

The verification process usually takes 1-2 business days. Once approved, you'll be able to start trading immediately.

What Are CAPITAL INDEX Trading Platforms?

CAPITAL INDEX offers two robust trading platforms including MetaTrader 4 to suit different trader preferences; CAPITAL INDEX Global Trading Platforms:

MetaTrader 4 (MT4)

- Trading-standard platform with advanced charting tools;

- Customizable interface and indicators;

- Supports Expert Advisors (EAs) for automated trading;

- Available on desktop, web, and mobile devices.

MarketBOOK

- Proprietary CAPITAL INDEX platform designed for both novice and experienced traders;

- Real-time market data and analytics;

- Customizable indicators and alerts;

- Advanced risk management features;

- Automated trading capabilities.

How Much Are CAPITAL INDEX Broker Spreads and Commissions?

CAPITAL INDEX spreads and commissions is based on their account types and you can compare them in the table below:

Fees | ADVANCED | PRO |

Spreads | From 1.4 Pips | From 1.0 Pips |

Commission | 0.02/unit/trade (Min £10 (UK)/€10 (EU)/$15 (US) per trade) | 0.02/unit/trade (Min £10 (UK)/€10 (EU)/$15 (US) per trade) |

It's important to note that overnight positions may incur swap fees, which is standard practice in the forex industry.

What Are Deposit & Withdrawal Methods of CAPITAL INDEX?

In this part of CAPITAL INDEX reviews, we checked its payment methods and discovered that there are only 2 available options! CAPITAL INDEX Payment Methods:

- Bank Transfer

- Credit/Debit Cards (Visa, Mastercard)

Key Points of Withdrawing or Depositing in This Broker:

- No fees for deposits or standard withdrawals;

- Same-day bank transfers incur a small charge;

- Client funds are fully segregated from company assets;

- Covered by the UK's Financial Services Compensation Scheme (up to £50,000 protection for retail clients);

- Third-party payments are not allowed.

- The minimum funding to open an account is $100 units.

Copy Trading & Investment Options Offered by CAPITAL INDEX

Unfortunately, CAPITAL INDEX does not currently offer copy trading or social trading features. This could be a drawback for traders who prefer to follow and replicate the strategies of successful traders. Additionally, there are no specific investment options or managed account services available through the platform.

What Assets Are Tradable on CAPITAL INDEX?

Unlike many other brokers such as AvaTrade or Alpari, you can’t trade 5 or 6 markets in CAPITAL INDEX! The broker’s focus is on providing the chance to trade forex market, CFDs and spread betting. CAPITAL INDEX Instruments:

- Forex: Over 50 currency pairs, including majors, minors, and exotics

Forex trading is one of the 3 products of this broker - CFDs: Indices, commodities, precious metals

- Spread Betting: Available for UK clients on various instruments

This wide selection allows traders to diversify their portfolios and take advantage of opportunities across different asset classes. However, it's crucial to remember that CFDs and spread betting are complex instruments that come with a high risk of losing money rapidly due to leverage.

Does CAPITAL INDEX Provide Bonuses?

At the time of writing, CAPITAL INDEX does not offer any bonuses or promotional offers. This approach aligns with stricter regulatory requirements in some jurisdictions, which have limited or banned trading bonuses.

Customer Support

CAPITAL INDEX customer support is available 24/5 and off at the weekends or holidays. You can contact them through multiple channels:

- Phone: Available 24/5 for urgent inquiries

- Email: For less time-sensitive questions

- Live Chat: Instant support during business hours

- In-Person Meetings: Available by appointment at their London office

The support team is staffed by experienced professionals who can assist with technical issues, account queries, and general trading advice. However, it's worth noting that 24/7 support is not available, which could be an issue for traders operating in different time zones.

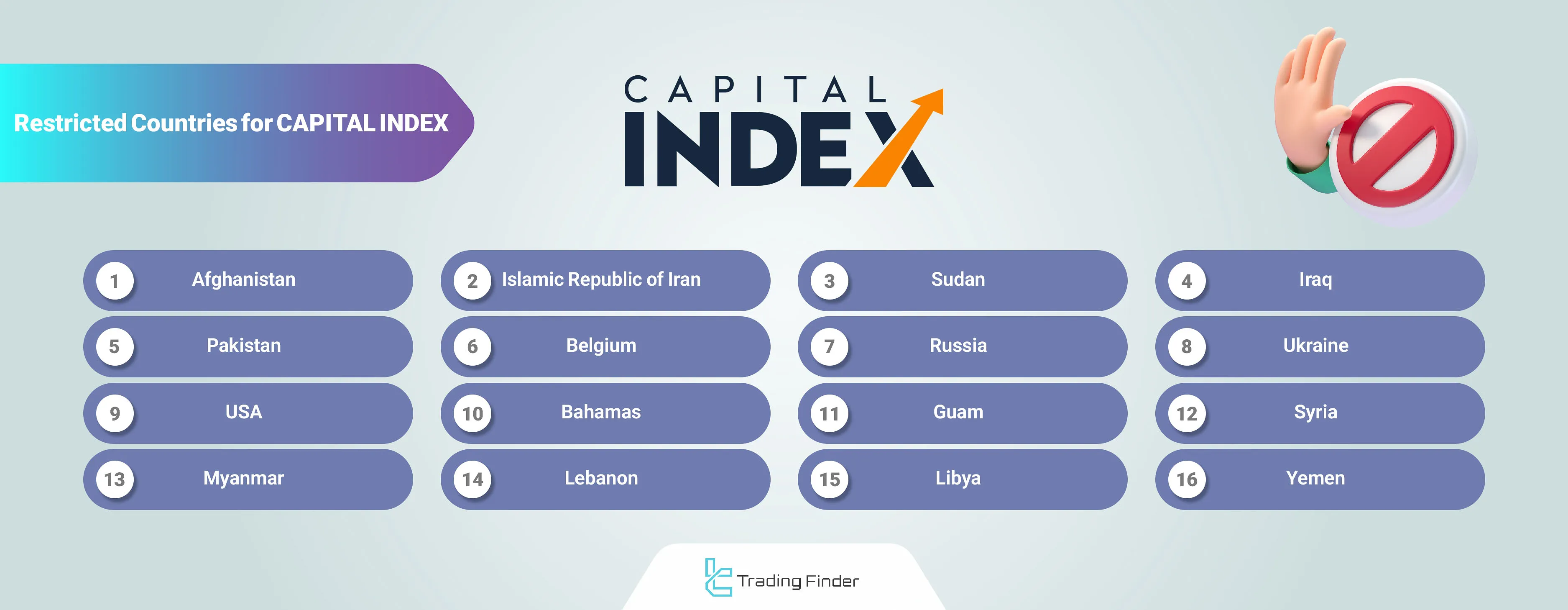

What Countries Are Banned from Using CAPITAL INDEX?

While CAPITAL INDEX serves a global clientele, there are certain countries from which they cannot accept clients due to regulatory restrictions. CAPITAL INDEX Global Restricted Countries:

- Asia: Afghanistan, Iran, Iraq, Korea (the Democratic People's Republic of), Lebanon, Maldives, Myanmar, Pakistan, Syrian Arab Republic, Yemen;

- Europe: Belgium, Bosnia and Herzegovina, Russian Federation, Ukraine;

- Africa: Burundi, Central African Republic, Congo (the Democratic Republic of the), Côte d'Ivoire, Eritrea, Guinea, Guinea-Bissau, Liberia, Libya, Mali, Somalia, South Sudan, Sudan, Zimbabwe;

- North America: Bahamas, Nicaragua, United States, Virgin Islands (U.S.);

- South America: Venezuela;

- Oceania: American Samoa, Guam, Niue.

Prospective clients should check with CAPITAL INDEX directly or refer to the terms and conditions on their website for the most up-to-date information on country restrictions.

CAPITAL INDEX Trust Scores & Reviews

As we went through CAPITAL INDEX reviews, discovered that it has received mixed reviews from traders in Trustpilot and ForexPeaceArmy, reflecting both positive experiences and areas for improvement:

- Trustpilot: 3.1/5 based on 25+ reviews;

- ForexPeaceArmy: 2.1/5 out of just 4 reviews.

While some traders have reported positive experiences with CAPITAL INDEX's customer service and trading platforms, others have expressed concerns about withdrawal difficulties and aggressive sales tactics.

As with any broker, it's essential to conduct thorough research and consider multiple sources of information before opening an account.

Educational Resources of CAPITAL INDEX

CAPITAL INDEX offers a range of educational resources to help traders enhance their skills and knowledge:

- Trading Guides: Comprehensive CFDs, forex education and general trading principles

- Glossary: Extensive list of trading terms and definitions

- Market News & Analysis: Regular updates on market trends and economic events

- Economic Calendar: Overview of upcoming economic releases and their potential market impact

While these resources provide a solid foundation, especially for beginners, the educational offering is not as extensive as some competitors. More advanced traders might find the content somewhat limited.

TradingFinder Expert Conclusion and final words

CAPITAL INDEX offers 2 account types [ADVANCED, PRO] with commission 0.02 unit per trade. Spreads start from 1.0 pips, no bonuses and lack of copy trading are some of the cons of CAPITAL INDEX broker.