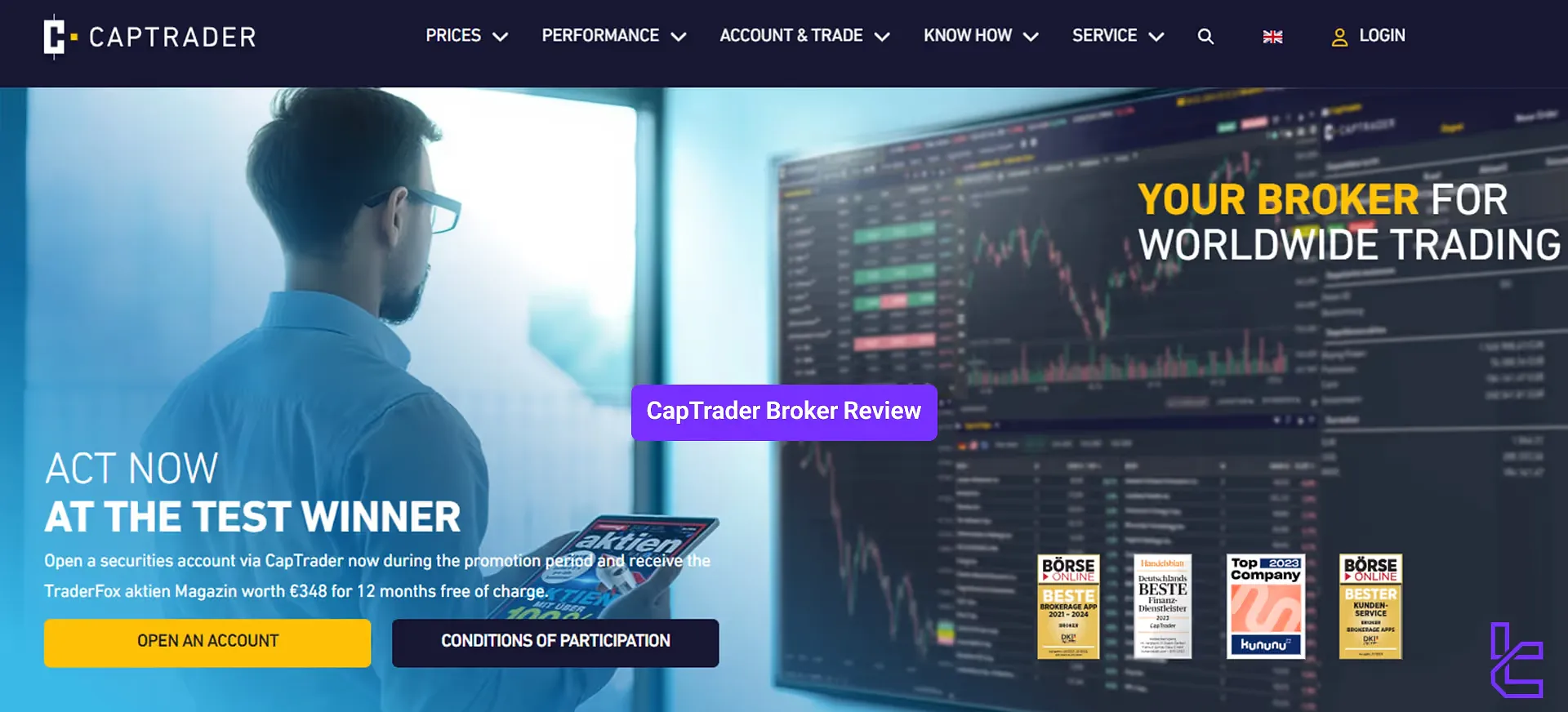

CapTrader is an award-winning Forex and CFD broker (4 awards) that offers over 1.2 million securities to traders in 34 countries. Traders can buy and sell various instruments in over 150 markets with floating spreads from 0.0 pips and €2 commission.

CapTrader operates under reputable regulations such as BaFin, FCA, and CBI, and provides its services to numerous countries worldwide. However, some countries, such as Syria and Iran, are not eligible to receive services from this broker.

Company Information & Regulation of the CapTrader

CapTrader Forex broker operates as a fully regulated brokerage firm under several European authorities.

It is directly licensed by Germany’s Federal Financial Supervisory Authority (BaFin, license 10156708), and additionally benefits from Interactive Brokers' regulatory coverage via:

- The UK Financial Conduct Authority (FCA, license 208159)

- The Central Bank of Ireland (CBI, license C423427)

These layered regulatory protections enhance CapTrader’s compliance framework and contribute to its reputation as a trustworthy platform, particularly for experienced and professional traders.

Entity Parameter / Branches | CapTrader GmbH | IBIE | IBUK |

Regulation | BaFin | CBI | FCA |

Regulation Tier | 1 | 1 | 1 |

Country | Germany | Ireland | United Kingdom |

Investor Protection Fund / Compensation Scheme | None (covered via IB structure) | ICCS (€20k) | FSCS (up to £85,000) |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:20 | 1:20 | 1:20 |

Client Eligibility | All countries except restricted (e.g. Iran, Syria) | All countries except restricted (e.g. Iran, Syria) | UK and eligible international clients |

Client funds are maintained in segregated bank accounts, ensuring that they are fully isolated from the broker’s operating capital.

CapTrader also offers negative balance protection, and clients have the right to escalate unresolved issues to the relevant financial authority in their jurisdiction.

CapTrader Specifications

Let's take a closer look at what makes CapTrader stand out in the crowded online brokerage market:

Broker | CapTrader |

Account Types | Individual/Joint account, Family Depot, Company account |

Regulating Authorities | CBI, BaFin, FCA |

Based Currencies | EUR, GBP, USD, CHF, CZK, PLN, DKK, NOK, SEK |

Minimum Deposit | $2000 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:20 |

Investment Options | Managed Accounts |

Trading Platforms & Apps | TradingView, TWS, mobile app, AgenaTrader |

Markets | Forex, CFDs, bonds, shares, warrants, ETFs, futures, options, investment funds, crypto |

Spread | Floating from 0.0 pips |

Commission | From $2 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, and more |

CapTrader Accounts

CapTrader offers a range of account types to suit different investor needs:

- Individual Account: The standard account for personal trading and investing;

- Family Depot: Allows management of up to 15 accounts from family members under one main account;

- Company Account: Designed for businesses looking to invest company assets in securities;

- Managed Account: For investors who prefer to have their portfolio managed by professional traders.

Additionally, CapTrader offers the choice between cash and margin accounts (available from age 21).

The margin account provides access to a wider range of products, including futures markets and CFDs.

Cap Trader also offers a demo account for beginner traders who want to learn trading Forex pairs without risking their money.

CapTrader Broker Benefits and Drawbacks

Let's weigh the pros and cons of using CapTrader as your online broker:

Advantages | Disadvantages |

Access to 150+ global markets | High initial minimum deposit (2.000€) |

Wide range of tradable assets | No top-tier regulation |

Competitive pricing and low commissions | Lack of variety in deposit and withdrawal methods |

Excellent customer support | - |

CapTrader Registration and Verification Guide

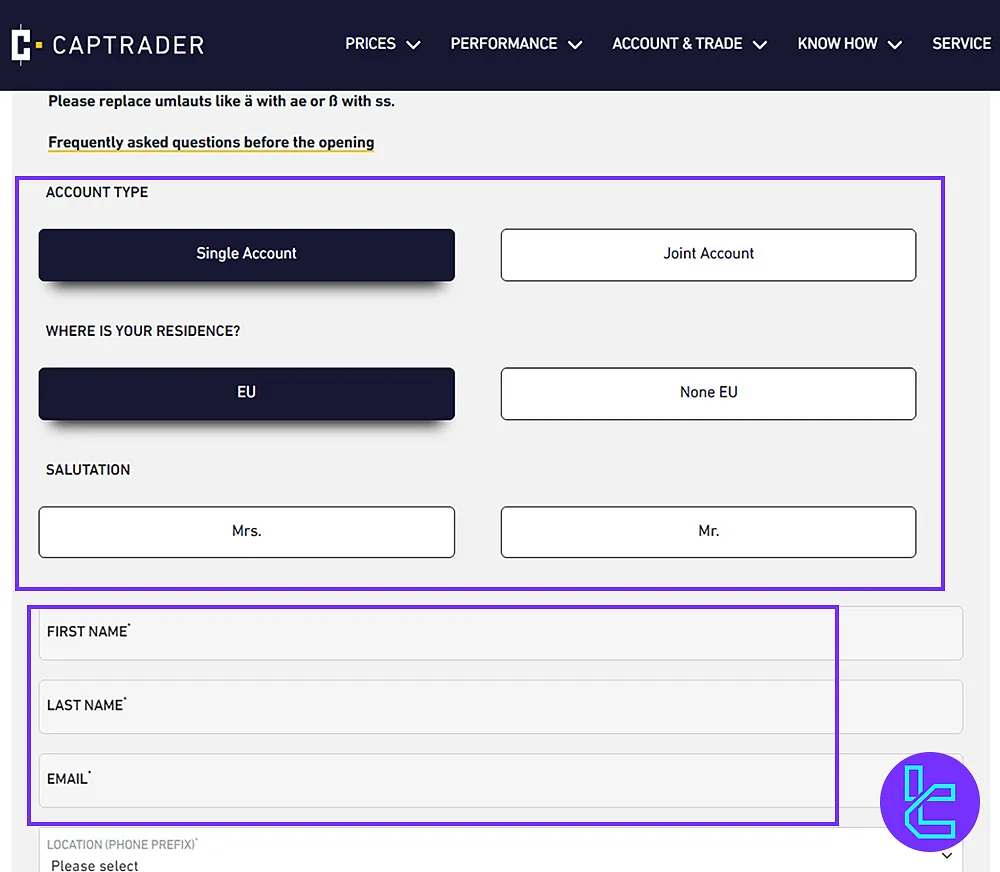

To create an account and verify it in the CapTrader broker, traders must follow a simple procedure. CapTrader registration:

#1 Go to the Official CapTrader Registration Page

Visit the broker's official site via the CapTrader section on Trading Finder. Click on “Open an Account” to initiate the process.

#2 Submit Your Personal Details

Choose your account type, specify the region of residence (EU/Non-EU), and fill in the required fields:

- Title

- Full name

- Email address

- Phone number

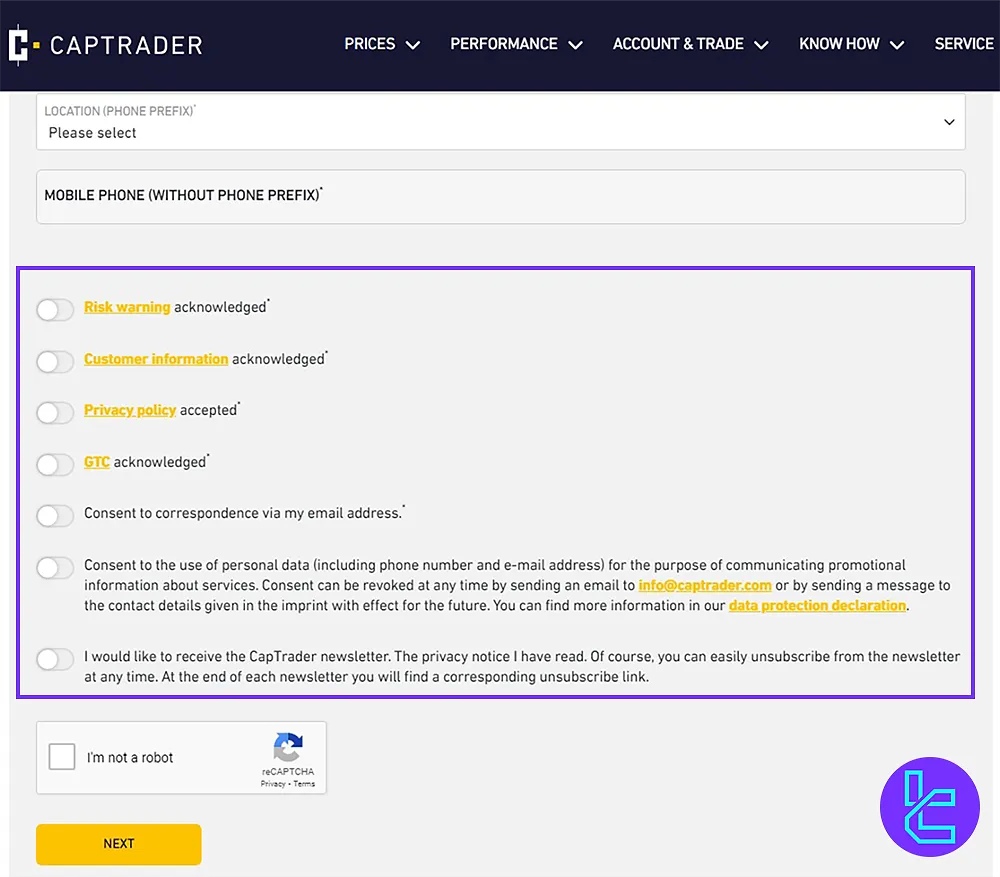

Accept the terms and conditions and pass the bot verification to proceed.

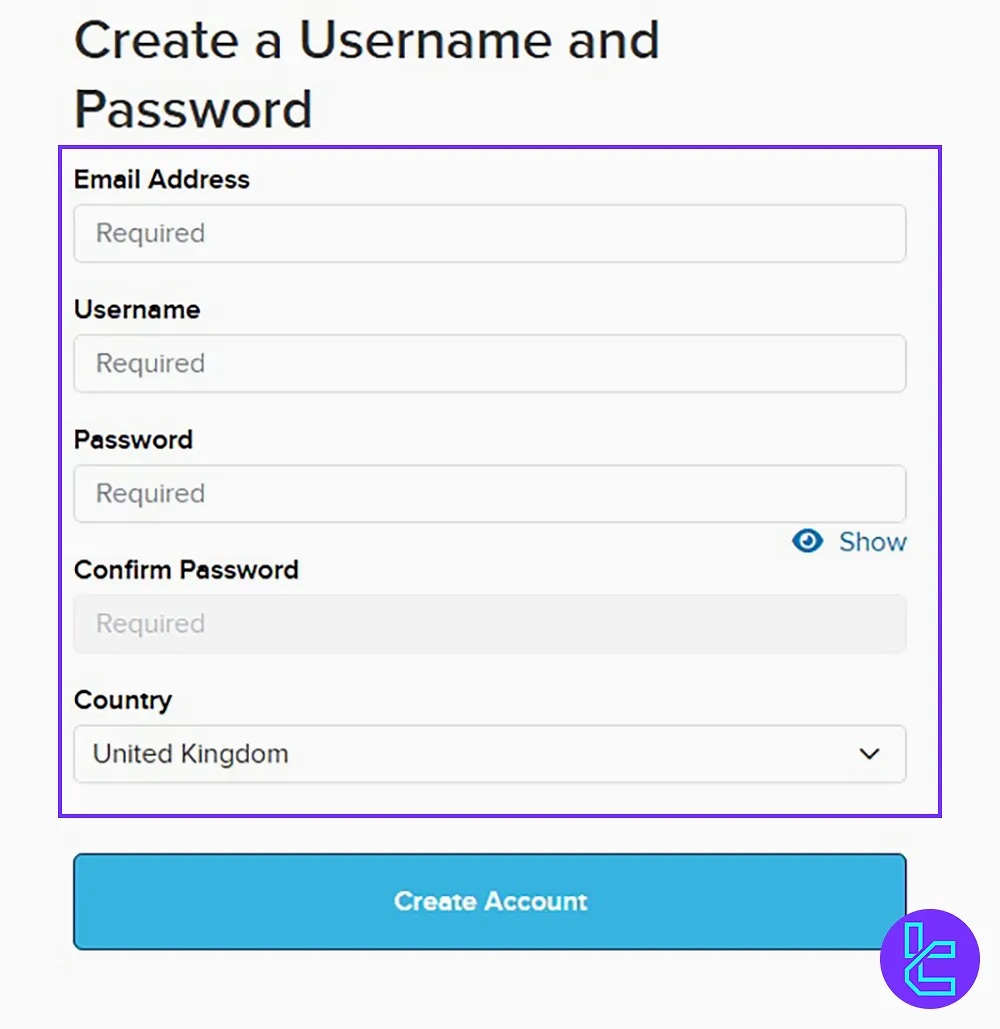

#3 Set Login Credentials

Create your username and password, re-enter your email, and click on “Create Account” to finalize registration.

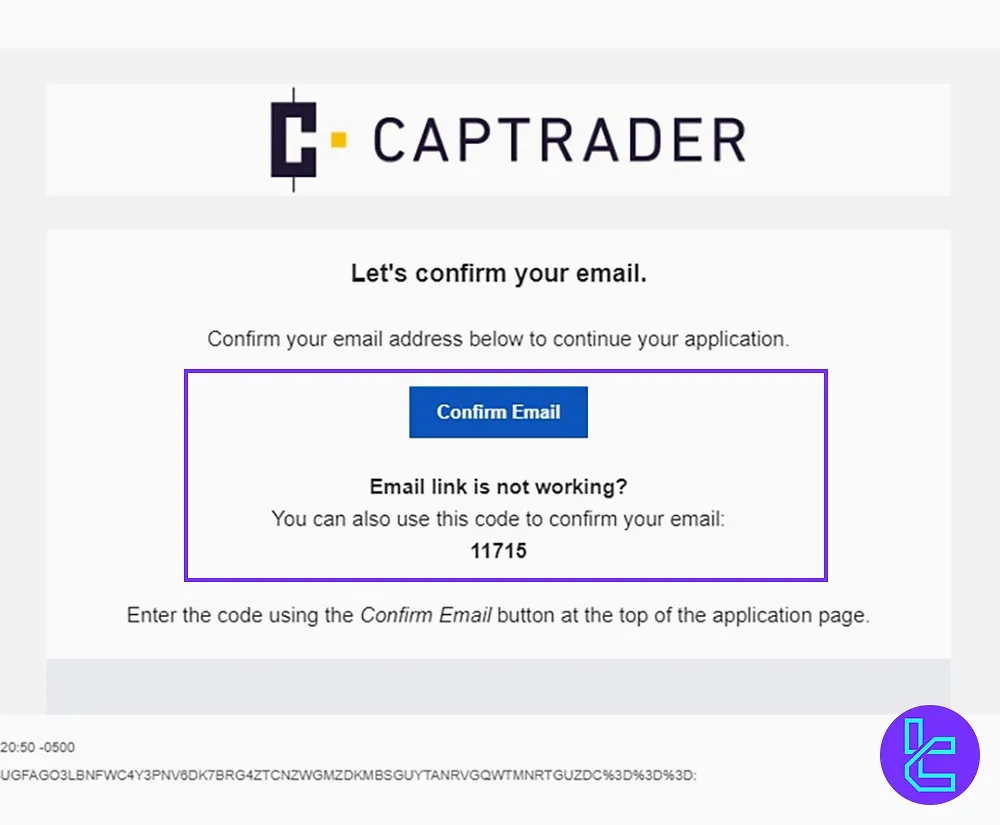

#4 Confirm Email

Access your inbox and click the confirmation link sent by CapTrader. Your trading account will then be ready for use.

#5 Verify Your Trading Account

After completing the signup process, traders must verify their accounts by uploading proof of identity (such as a passport or ID card) and proof of address (such as a utility bill or bank statement).

CapTrader Trading Platforms and Apps

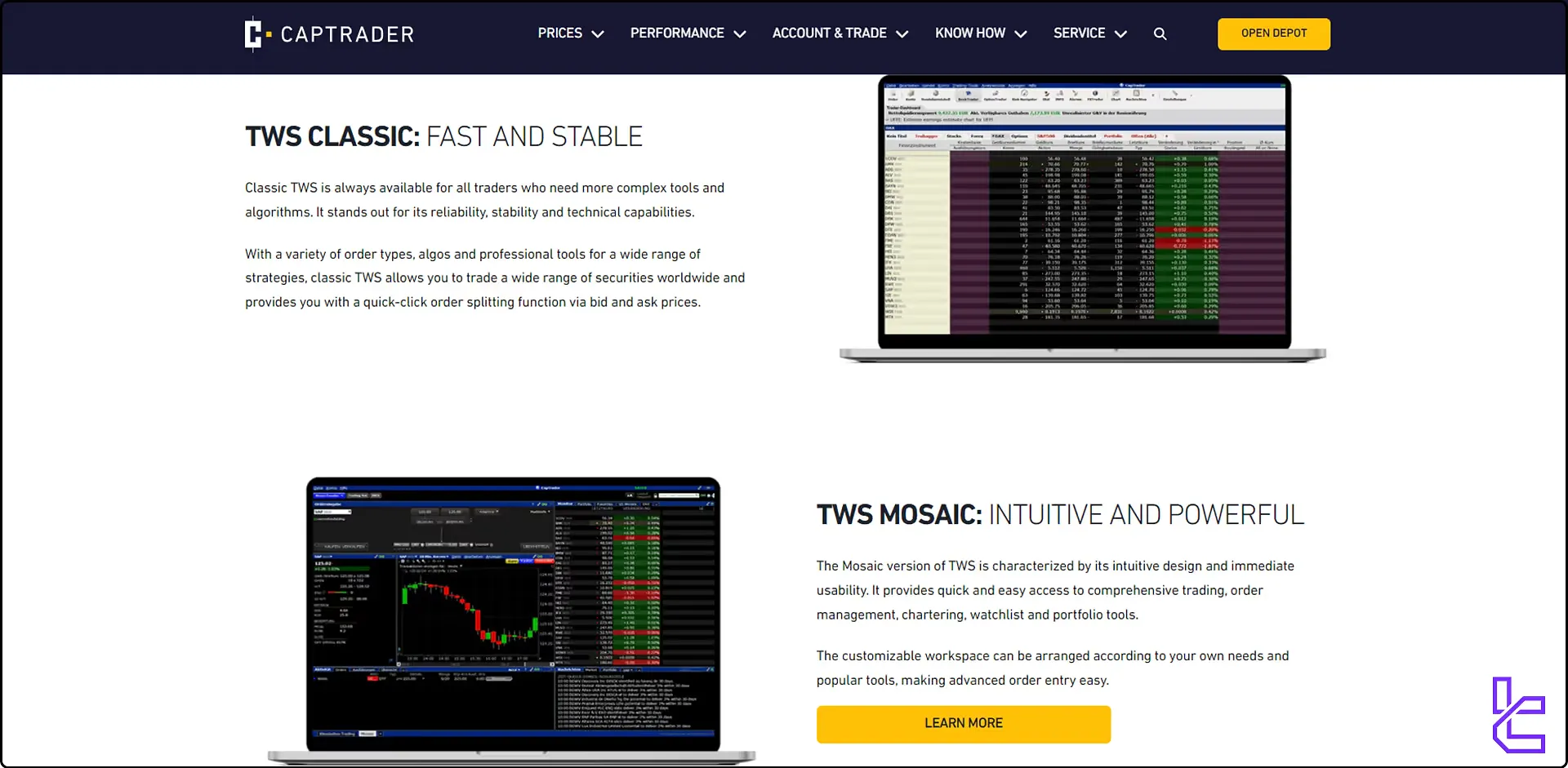

CapTrader offers a suite of advanced trading platforms to cater to different trading styles and preferences:

- Trader Workstation (TWS): A powerful desktop platform offering advanced charting, real-time data, and customizable layouts

- Client Portal: A web-based platform for account management, offering features like customizable dashboards and advanced analytics tools

- Trading View: Powerful trading platform with extensive indicators and powerful charting tools

- Agena Trader: Impressive trading platform with a variety of trading features

- CapTrader App: Available for iOS and Android, allowing traders to monitor markets and execute trades on the go

Each platform is designed to provide a seamless trading experience, with real-time market data, advanced order types, and robust risk management tools.

The variety of platforms ensures that both casual investors and active traders can find an interface that suits their needs.

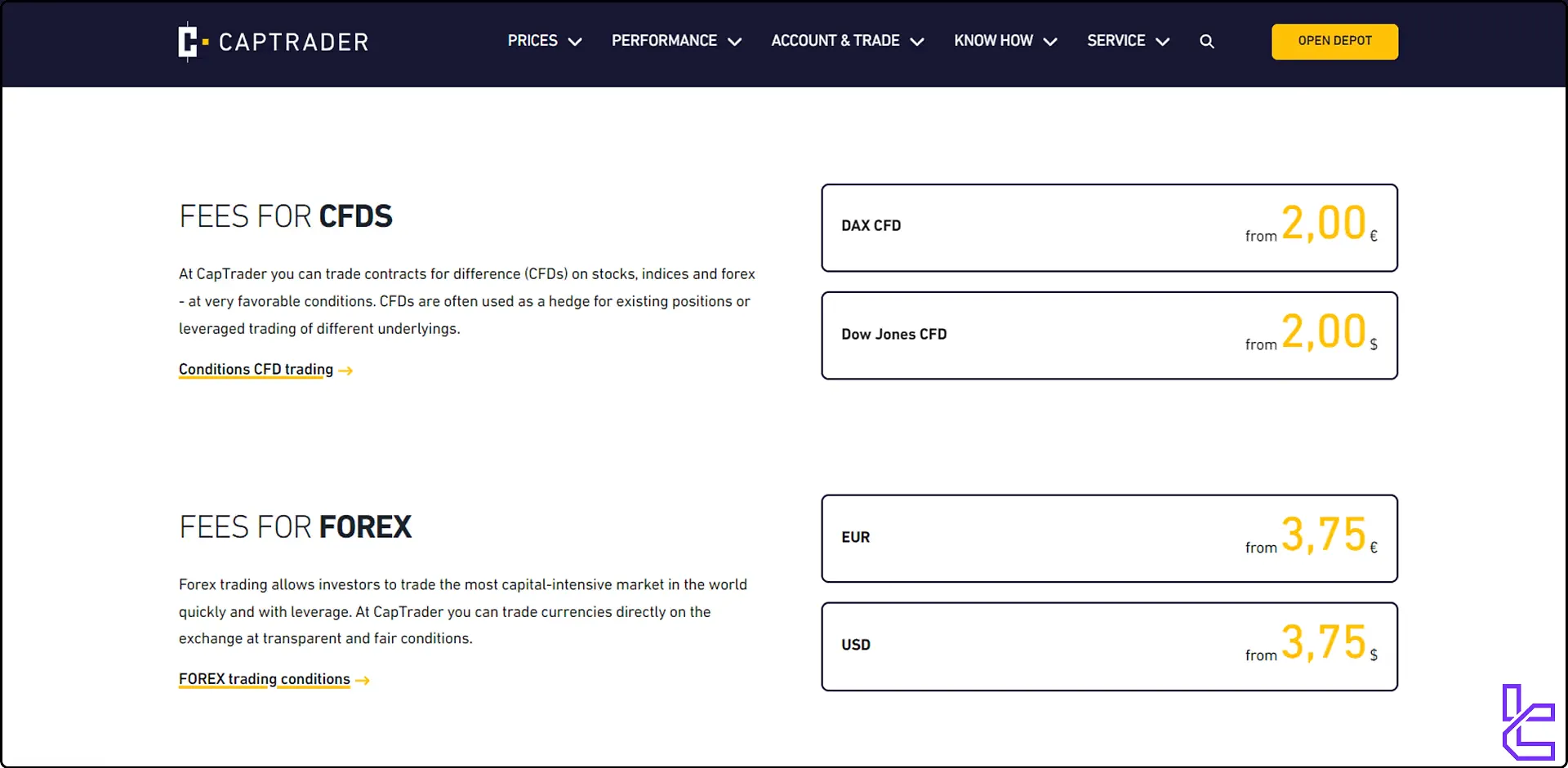

Trading Costs in CapTrader Broker (Commission and spread)

CapTrader is known for its competitive pricing structure, offering low commissions with ultra-low spreads across various asset classes:

Instrument | Commission |

Shares | From €2 |

ETFs | From €2 |

Options | From €2 |

Futures | From €1 |

Forex | From €3.75 |

CFDs | From €2 |

Warrants | From €6 |

Certificates | From €6 |

Bonds | From €8 |

This pricing structure allows traders to calculate their fees before entering a trade. Other non-trading fees in CapTrader:

- Swap Fees: Overnight positions incur a rollover fee, which varies by instrument and direction

- Inactivity Fee: A monthly fee of $1 is charged if no trades are placed and account equity remains below $1,000

- Withdrawal Fees: First withdrawal €8, €1 per transactionSubsequent withdrawals

Swap Fee at CapTrader

CapTrader charges overnight financing (swap fees) on all leveraged positions, including CFDs on stocks, indices, commodities and Forex.

For index CFD Contracts, fees depend on the contract’s interest rate; for example, Germany 40 (IBDE40) has 4.413% debit for longs and 0% for shorts.

Fees are calculated daily and applied automatically at 23:00 CET, with triple swaps on Wednesdays.

Key points:

- Fees vary per instrument based on underlying interest rates;

- Long positions usually incur costs; shorts may earn credits;

- No additional broker markup; fees are embedded in the financing rate;

- Charges are visible in the Trader Workstation (TWS) before trades;

- Swap-free (Islamic) accounts are not available.

Non-Trading Fees at CapTrader

CapTrader charges relatively few non-trading fees, making it attractive compared to many competitors.

Account custody is free, but certain actions such as deposits, withdrawals, or phone orders may incur additional costs.

Clients should also be aware of possible exposure (risk) fees and third-party charges like the LEI for legal entities.

Key Non-Trading Fees at CapTrader:

- First deposit each month free (SEPA); further deposits €1, non-SEPA up to €8;

- One free withdrawal per month; additional withdrawals up to €8 each;

- Phone order to close positions: €30 (EUR) or equivalent in other currencies;

- Risk premium/exposure fee may apply for high-risk accounts;

- LEI costs are charged to clients if required.

CapTrader Payment Methods

CapTrader only offers wire transfers for both deposits and withdrawals. While wire transfers are secure, the processing time could be a major drawback for this payment method.

Credit card and cryptocurrency users must look for CapTrader alternatives when depositing and withdrawing money from this platform.

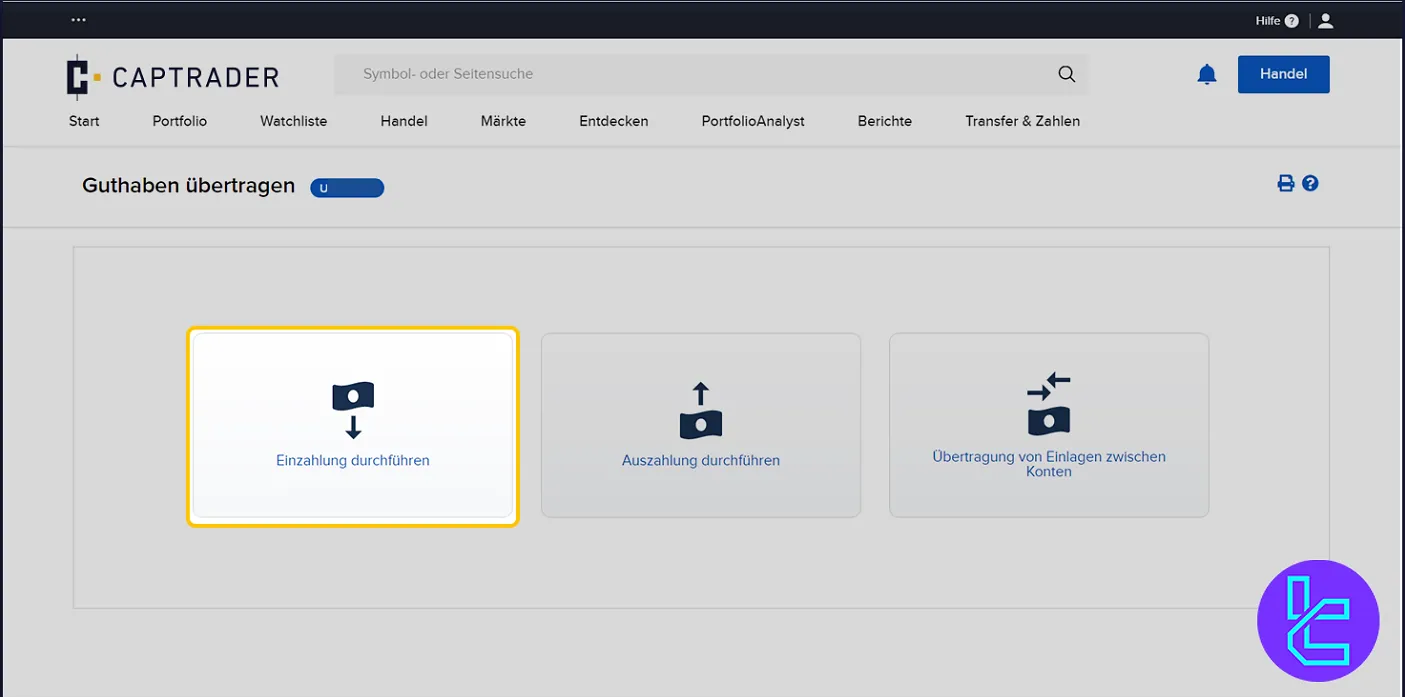

How to make a deposit in CapTrader?

You can fund your CapTrader account via bank transfers from a reference account (credit cards, PayPal or e-wallets are not supported).

These options are relatively limited, but generally sufficient for clients in Europe.

Below is a table summarizing the full deposit method details:

Deposit Method | Currency(s) Supported | Minimum Amount | Deposit Fee | Funding Time / Processing |

Bank Transfer / SEPA / Wire | EUR, USD, GBP, CHF, CZK, PLN, DKK, NOK, SEK | ~2,000 (or equivalent) | No fee from CapTrader (bank fees possible) | Usually 1–3 business days |

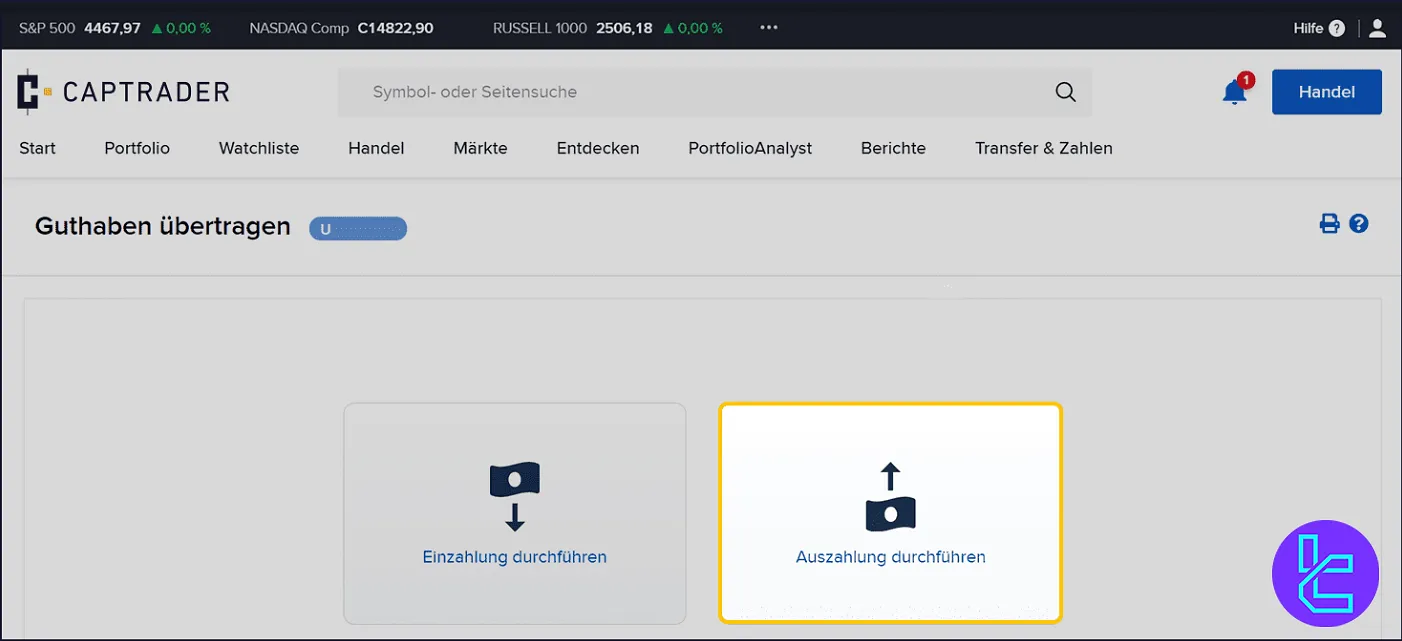

How to withdraw from CapTrader?

You can withdraw funds from your CapTrader account only to a bank account in your name, using methods that match the currency (e.g. SEPA for EUR, ACH or bank transfer for USD).

The options are limited but generally sufficient for most users in Europe.

Below is a table showing the key details for withdrawal methods at CapTrader:

Withdrawal Method | Currency(s) Supported | Minimum Amount | Withdrawal Fee | Processing Time |

SEPA / Bank Transfer | EUR | No fixed min | First withdrawal free; next SEPA €1; other bank transfers €8 | 1–3 business days |

ACH / Bank Transfer | USD | No fixed min | First withdrawal free; further transfers €8 (plus bank charges possible) | 1–3 business days |

Investment Options Offered on CapTrader

CapTrader offers Managed Accounts, which allow professional money managers to trade on behalf of multiple client accounts simultaneously.

However, traditional social trading or copy trading features are not available on CapTrader's platform.

The lack of copy trading features may be a drawback for traders who prefer to follow and replicate the strategies of successful investors.

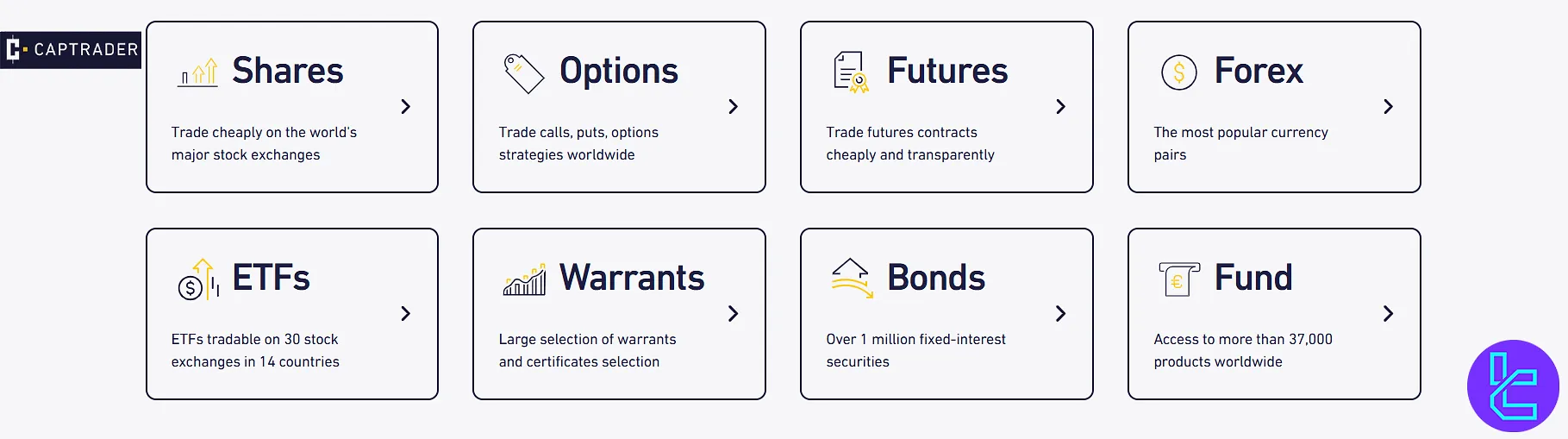

CapTrader Instrument and Symbols

CapTrader provides access to an impressive range of tradable markets and symbols:

Category | Type of Instruments | Number of Symbols / Items | Competitor Average | Max. Leverage (CapTrader) |

Shares / Stocks | Equities on 80+ exchanges | 7100+ | 5,000–15,000 | N/A |

ETFs / Funds | ETFs and mutual funds | 37,000+ | 3,000–10,000 | N/A |

Options | Stock & index options | N/A | 100–500 | N/A |

Futures | Index / commodity futures | N/A | 50–200 | N/A |

CFDs | CFDs on stocks, indices, forex, metals | 7,000+ equity CFDs | 200–500 | N/A |

Forex / Currencies | Spot forex pairs | 105 currencies | 50–200 | 1:20 |

Warrants / Certs | Derivatives beyond standard securities | N/A | 100–300 | N/A |

Bonds / Fixed Income | Bonds and fixed-income securities | 1,200,000+ | 10,000–50,000 | N/A |

Crypto / Crypto-Related Instruments | Bitcoin futures, crypto ETFs, crypto-related stocks | N/A | 5–20 | N/A |

This diverse offering enables traders to create well-diversified portfolios and capitalize on opportunities across multiple asset classes and global markets.

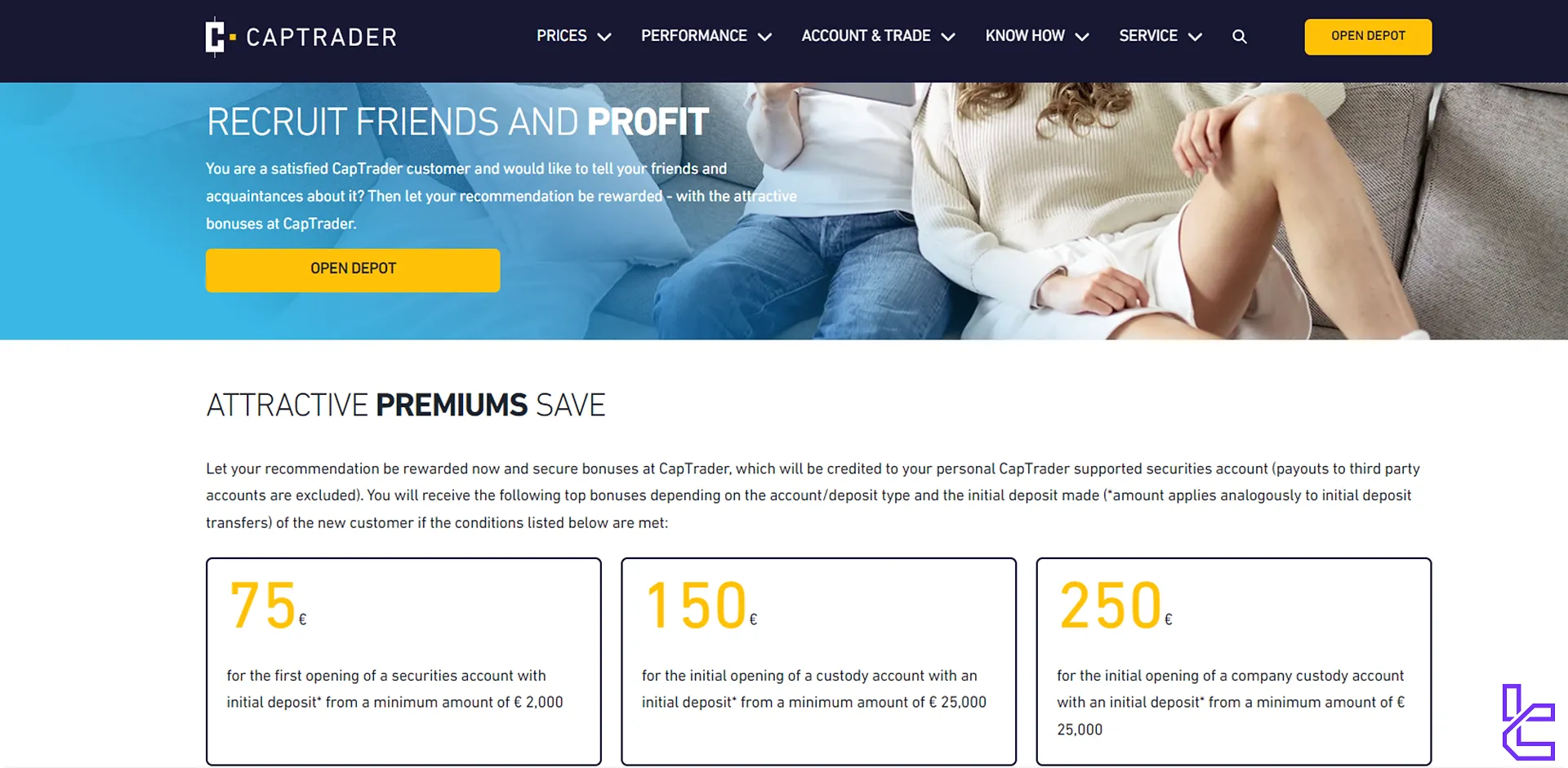

CapTrader Bonuses and Promotions

CapTrader offers a referral program called Customer Recruit Customers, where existing customers can earn bonuses for recommending new clients:

- Refer a new customer who opens an account with a minimum deposit of €2,000 (€25,000 for custody accounts)

- Earn a bonus of up to €250 for each successful referral

- Receive an additional special bonus of up to €300 in credits for US options trades

The program is open to all CapTrader customers only, with certain exclusions applying.

CapTrader Broker Awards

CapTrader has so far managed to achieve a variety of prestigious awards.

In 2025, it was honored as "Germany's Best Financial Service Provider" in the online broker category by F.A.Z. Institute, marking its sixth consecutive year receiving this accolade.

Additionally, CapTrader achieved the top position in Börse Online's "Best Performance Offer" survey, reflecting its commitment to providing outstanding trading conditions and services.

A list of notable CapTrader Awards:

- Focus Money Digital service top marks, 2025

- Börse Online Best range of services, 2025

- A.Z. Institute Germany's best financial service providers, 2025

- Focus Money Highest customer satisfaction, 2025

- Focus Money Exemplary fulfillment of customer wishes, 2025

- A.Z. Institute Highest quality, 2024

- Focus Money Recommended by customers - high recommendation, 2024

- Focus Money High competence, 2024

Support Channels in CapTrader Broker

CapTrader prides itself on providing excellent customer support:

- Phone support: 0800-8723370 Available Monday to Friday, 8:30 to 20:00 (CET)

- Email: info@captrader.com

- Live chat: Available on the website during business hours

- Help center: Comprehensive FAQ section covering various topics

The support team consists of experienced EUREX exchange traders, ensuring that clients receive knowledgeable assistance with their queries.

For most other countries, CapTrader allows account opening and trading access, provided the necessary documentation and authorizations are completed.

CapTrader Restricted Countries

While CapTrader caters to global clients, there are some restrictions on account opening for certain countries:

- Iran

- Syria

- Lebanon

- North Korea

For most other countries, CapTrader allows account opening and trading access, provided the necessary documentation and authorizations are completed.

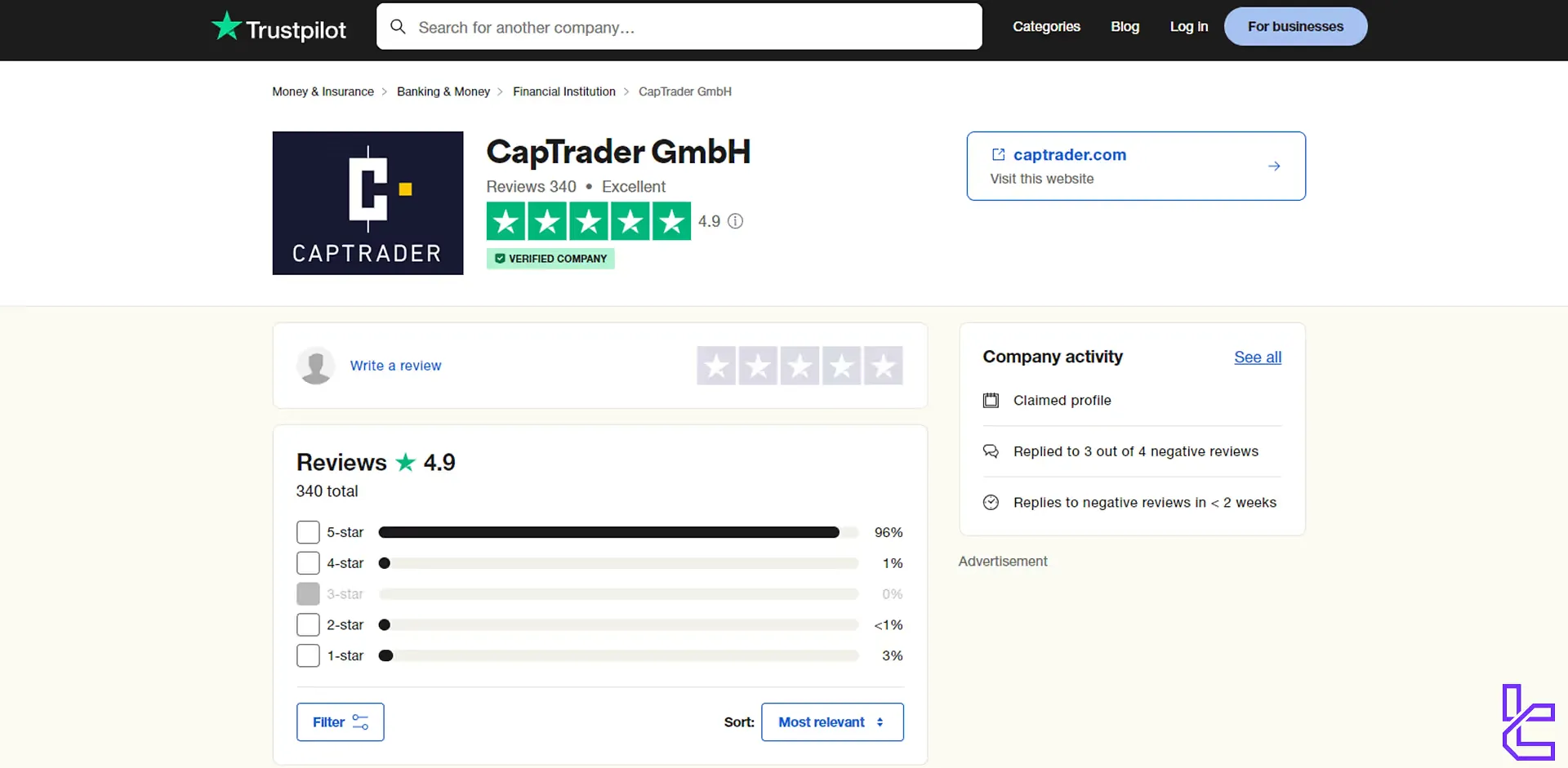

CapTrader Broker Trust Scores & Reviews

CapTrader has garnered generally positive reviews from its users on the CapTrader Trustpilot website:

- 4.9 out of 5 stars (based on over 300 reviews)

- Praised for low fees and excellent customer support

- over 95%, 5-star reviews

CapTrader actively responds to negative reviews, demonstrating a commitment to addressing customer concerns and improving their services.

Does CapTrader offer Education Resources?

CapTrader offers a range of educational resources to help traders improve their skills:

- Comprehensive glossary of trading terms

- Regular blog posts covering market analysis and trading strategies

- Media library with webinar recordings and expert interviews

- Live webinars and seminars featuring renowned speakers and traders

While the educational offerings are valuable, they may not be as extensive as those provided by some competitors, particularly for absolute beginners.

CapTrader in Comparison with Other Forex Brokers

Traders can genuinely understand the benefits and drawbacks of trading with CapTrader by comparing it to its competitors.

Parameters | CapTrader Broker | |||

Regulation | CBI, BaFin, FCA | ASIC, FSC, DFSA, CySEC | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $2 | $0 (except on Shares account) | From $0 | $0 |

Minimum Deposit | $2000 | $5 | From $0 | $1 |

Maximum Leverage | 1:20 | 1:1000 | 1:2000 | 1:3000 |

Trading Platforms | TradingView, TWS, mobile app, AgenaTrader | MT4, MT5, Mobile App | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Individual/Joint account, Family Depot, Company account | Micro, Standard, Ultra Low, Shares | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 1200000+ | 1400+ | 1,000+ | 45 |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

TF Expert Suggestion

CapTrader offers a wide variety of tradeable instruments across 28 currencies with a minimum trade amount of €1,00.

However, its high minimum deposit of $2,000 and the lack of support for popular trading platforms like MT4, MT5, and cTrader are significant drawbacks.