CapTrader is an award-winning Forex and CFD broker (4 awards) that offers over 1.2 million securities to traders in 34 countries. Traders can buy and sell various instruments in over 150 markets with floating spreads from 0.0 pips and €2 commission.

Company Information & Regulation of the CapTrader

CapTrader has been a player in the online brokerage scene for over 2 decades. With a focus on providing access to global markets, CapTrader has positioned itself as a go-to Forex broker for investors seeking international exposure.

Key points about CapTrader broker:

- Founded in 1998

- Regulated by the Central Bank of Ireland (CBI) [Registration number 4602839]

- Member of the Compensatory Fund of Securities Trading Companies (EdW)

- Operates as an introducing broker (IB) for Interactive Brokers

CapTrader's partnership with Interactive Brokers as an introducing broker allows it to offer clients access to a wide range of global markets while maintaining the security and reliability of a well-established brokerage infrastructure.

CapTrader Specifications

Let's take a closer look at what makes CapTrader stand out in the crowded online brokerage market:

Broker | CapTrader |

Account Types | Individual/Joint account, Family Depot, Company account |

Regulating Authorities | CBI |

Based Currencies | EUR, GBP, USD, CHF, CZK, PLN, DKK, NOK, SEK |

Minimum Deposit | $2000 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:20 |

Investment Options | Managed Accounts |

Trading Platforms & Apps | TradingView, TWS, mobile app, AgenaTrader |

Markets | Forex, CFDs, bonds, shares, warrants, ETFs, futures, options, investment funds, crypto |

Spread | Floating from 0.0 pips |

Commission | From $2 |

Orders Execution | Market |

Margin Call/Stop Out | 100%/50% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | Deposit bonus, cashback bonus |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, and more |

CapTrader Accounts

CapTrader offers a range of account types to suit different investor needs:

- Individual Account: The standard account for personal trading and investing.

- Family Depot: Allows management of up to 15 accounts from family members under one main account.

- Company Account: Designed for businesses looking to invest company assets in securities.

- Managed Account: For investors who prefer to have their portfolio managed by professional traders.

Additionally, CapTrader offers the choice between cash and margin accounts (available from age 21). The margin account provides access to a wider range of products, including futures and CFDs. Cap Trader also offers a demo account for beginner traders who want to learn trading Forex pairs without risking their money.

CapTrader Broker Benefits and Drawbacks

Let's weigh the pros and cons of using CapTrader as your online broker:

Advantages | Disadvantages |

Access to 150+ global markets | High initial minimum deposit (2.000€) |

Wide range of tradable assets | No top-tier regulation |

Competitive pricing and low commissions | Lack of variety in deposit and withdrawal methods |

Excellent customer support |

CapTrader Registration and Verification Guide

Opening an account with CapTrader is a straightforward process:

- Visit the CapTrader website and click on "Open Account";

- Choose your account type (individual, family, company, etc.);

- Fill in the required personal information;

- Enter your email, create a username and password for your account;

- Add your personal and contact information, then enter your identification document number;

- Complete the financial and trading experience questionnaire;

- Upload verification documents (ID, proof of address).

Remember, you can use your passport, government-issued ID, and driver’s license for identity verification. For proof of address verification, upload a utility bill or bank statement.

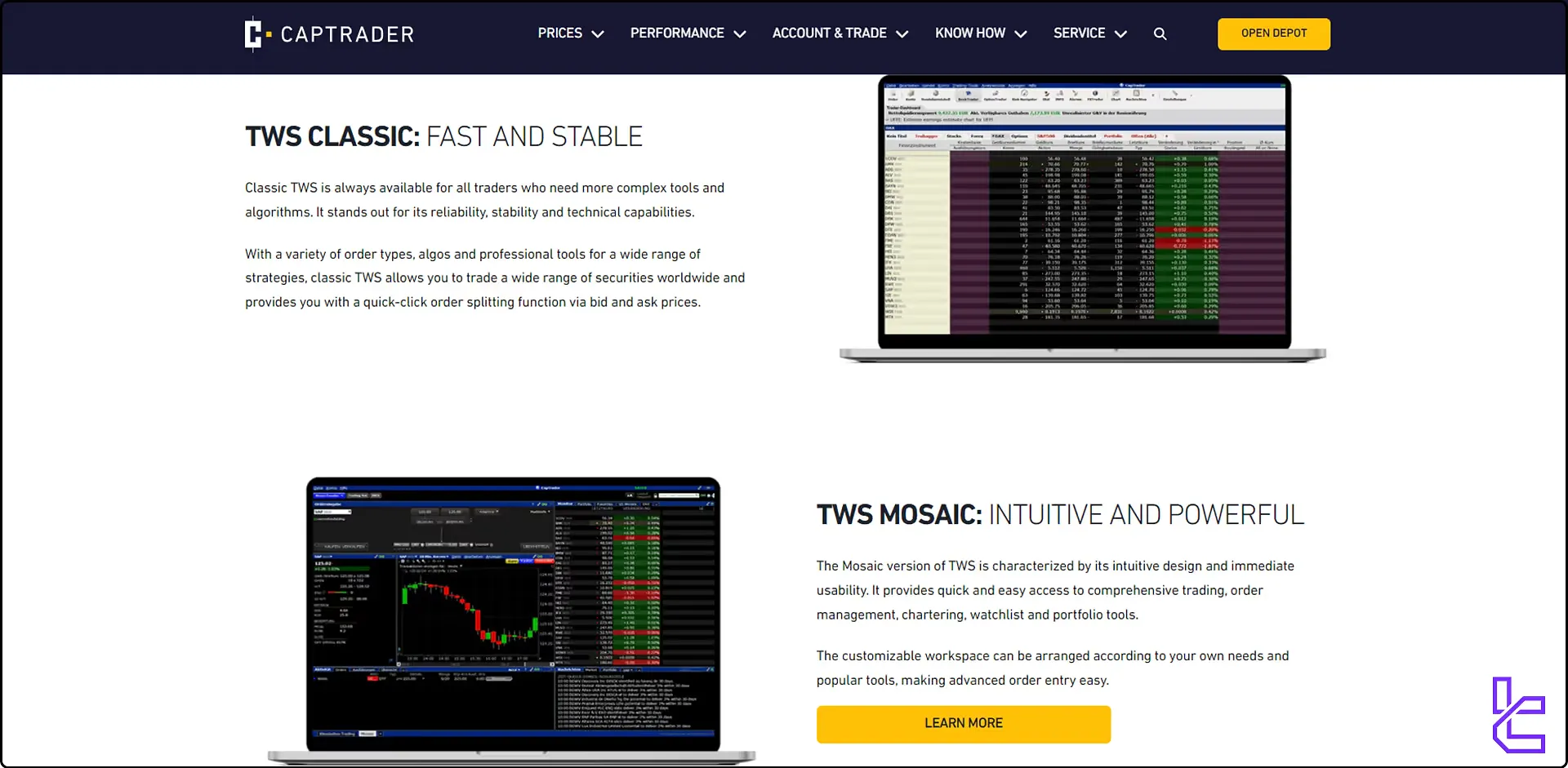

CapTrader Trading Platforms and Apps

CapTrader offers a suite of advanced trading platforms to cater to different trading styles and preferences:

- Trader Workstation (TWS): A powerful desktop platform offering advanced charting, real-time data, and customizable layouts.

- Client Portal: A web-based platform for account management, offering features like customizable dashboards and advanced analytics tools.

- TradingView: Powerful trading platform with extensive indicators and powerful charting tools.

- AgenaTrader: Impressive trading platform with variety of trading features.

- CapTrader App: Available for iOS and Android, allowing traders to monitor markets and execute trades on the go.

Links:

Each platform is designed to provide a seamless trading experience, with real-time market data, advanced order types, and robust risk management tools. The variety of platforms ensures that both casual investors and active traders can find an interface that suits their needs.

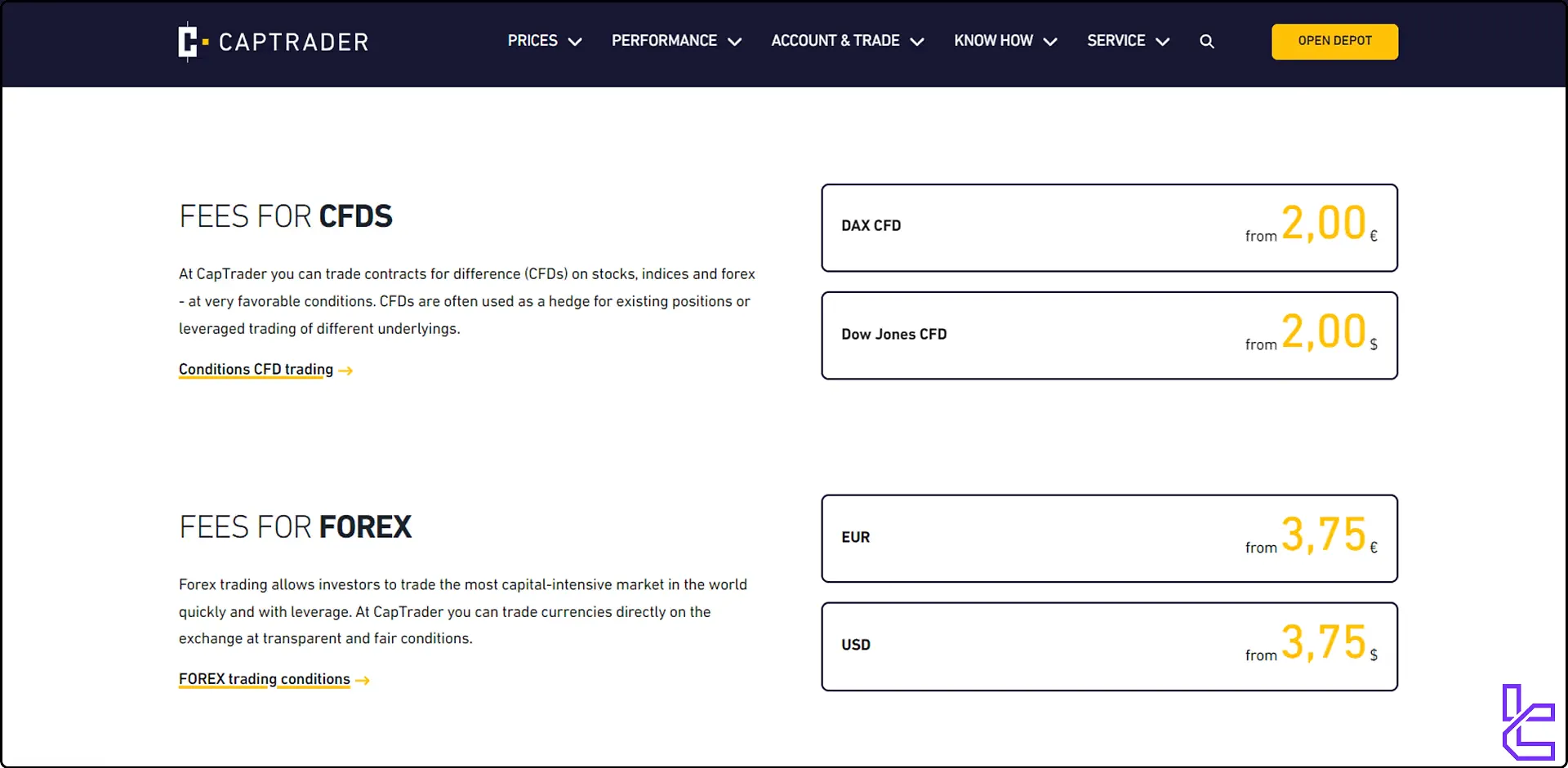

Trading Costs in CapTrader Broker (Commission and spread)

CapTrader is known for its competitive pricing structure, offering low commissions with ultra-low spreads across various asset classes:

Instrument | Commission |

Shares | From €2 |

ETFs | From €2 |

Options | From €2 |

Futures | From €1 |

Forex | From €3.75 |

CFDs | From €2 |

Warrants | From €6 |

Certificates | From €6 |

Bonds | From €8 |

This pricing structure allows traders to calculate their fees before entering a trade.

CapTrader Payment Methods

CapTrader only offers wire transfers for both deposits and withdrawals. While wire transfers are secure, the processing time could be a major drawback for this payment method. Credit card and cryptocurrency users must look for CapTrader alternatives when depositing and withdrawing money from this platform.

Investment Options Offered on CapTrader

CapTrader offers Managed Accounts, which allows professional money managers to trade on behalf of multiple client accounts simultaneously. However, traditional social or copy trading features are not available on CapTrader's platform.

The lack of copy trading features may be a drawback for traders who prefer to follow and replicate the strategies of successful investors.

CapTrader Instrument and Symbols

CapTrader provides access to an impressive range of tradable markets and symbols:

- Currency pairs: 105 forex pairs available

- Stocks: Over 7,100 stocks from global markets

- ETFs: Access to 13,000+ ETFs

- Options: 33 options markets

- Futures: 32 futures markets

- CFDs: A wide range of CFD products

- Warrents: Various European and Asian certificates

- Bonds: over 1 million bonds

- Investment Funds: over 37,000 funds

- Crypto: Bitcoin and Ethereum futures

This diverse offering allows traders to create well-diversified portfolios and take advantage of opportunities across multiple asset classes and global markets.

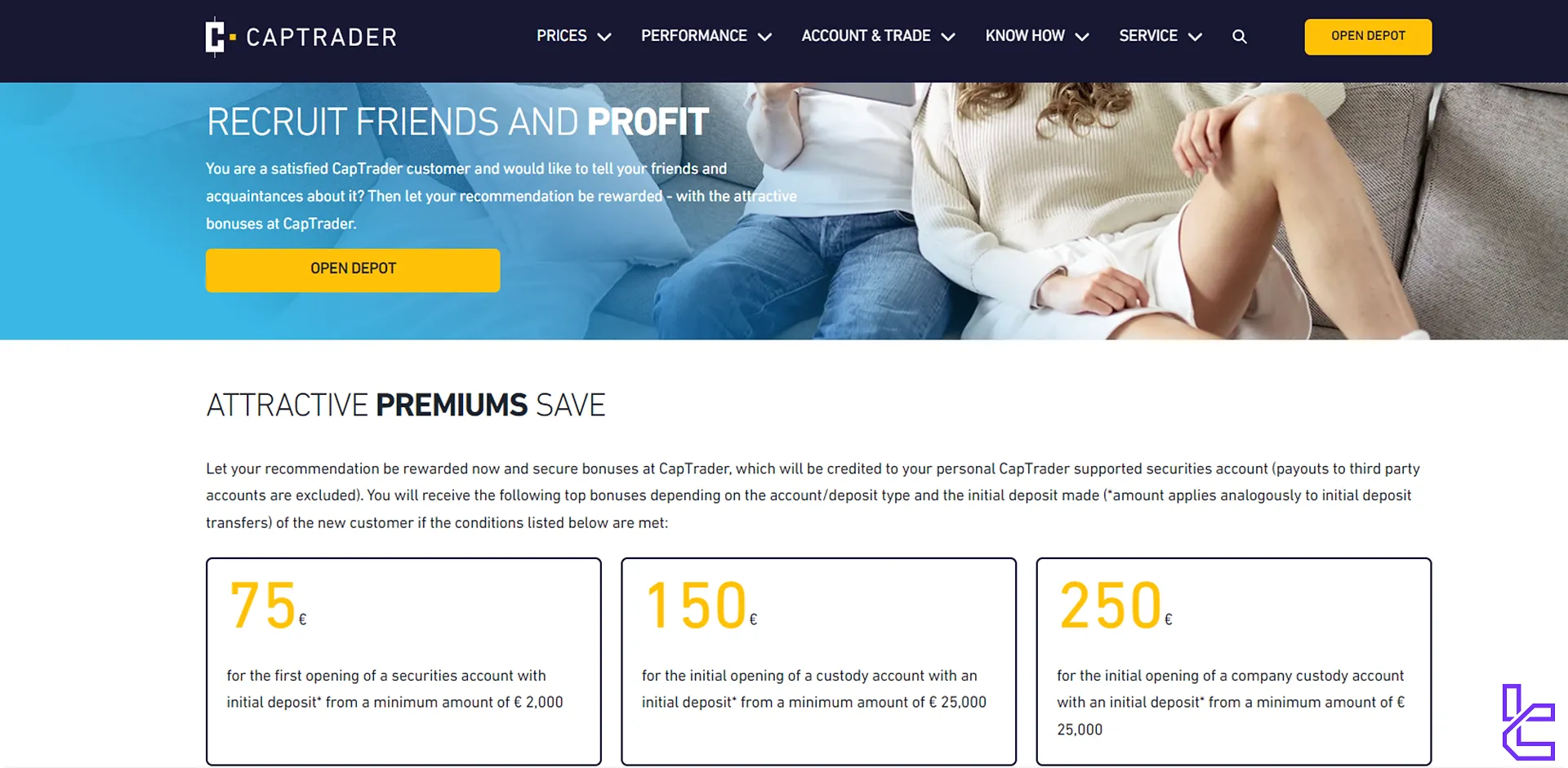

CapTrader Bonuses and Promotions

CapTrader offers a referral program called Customer Recruit Customers, where existing customers can earn bonuses for recommending new clients:

- Refer a new customer who opens an account with a minimum deposit of €2,000 (€25,000 for custody accounts)

- Earn a bonus of up to €250 for each successful referral

- Receive an additional special bonus of up to €300 in credits for US options trades

The program is open to all CapTrader customers only, with certain exclusions applying.

Support Channels in CapTrader Broker

CapTrader prides itself on providing excellent customer support:

- Phone support: 0800-8723370 Available Monday to Friday, 8:30 to 20:00 (CET)

- Email: info@captrader.com

- Live chat: Available on the website during business hours

- Help center: Comprehensive FAQ section covering various topics

The support team consists of experienced EUREX exchange traders, ensuring that clients receive knowledgeable assistance with their queries.

For most other countries, CapTrader allows account opening and trading access, provided the necessary documentation and authorizations are completed.

CapTrader Restricted Countries

While CapTrader caters to global clients, there are some restrictions on account opening for certain countries:

- Iran

- Syria

- Lebanon

- North Korea

For most other countries, CapTrader allows account opening and trading access, provided the necessary documentation and authorizations are completed.

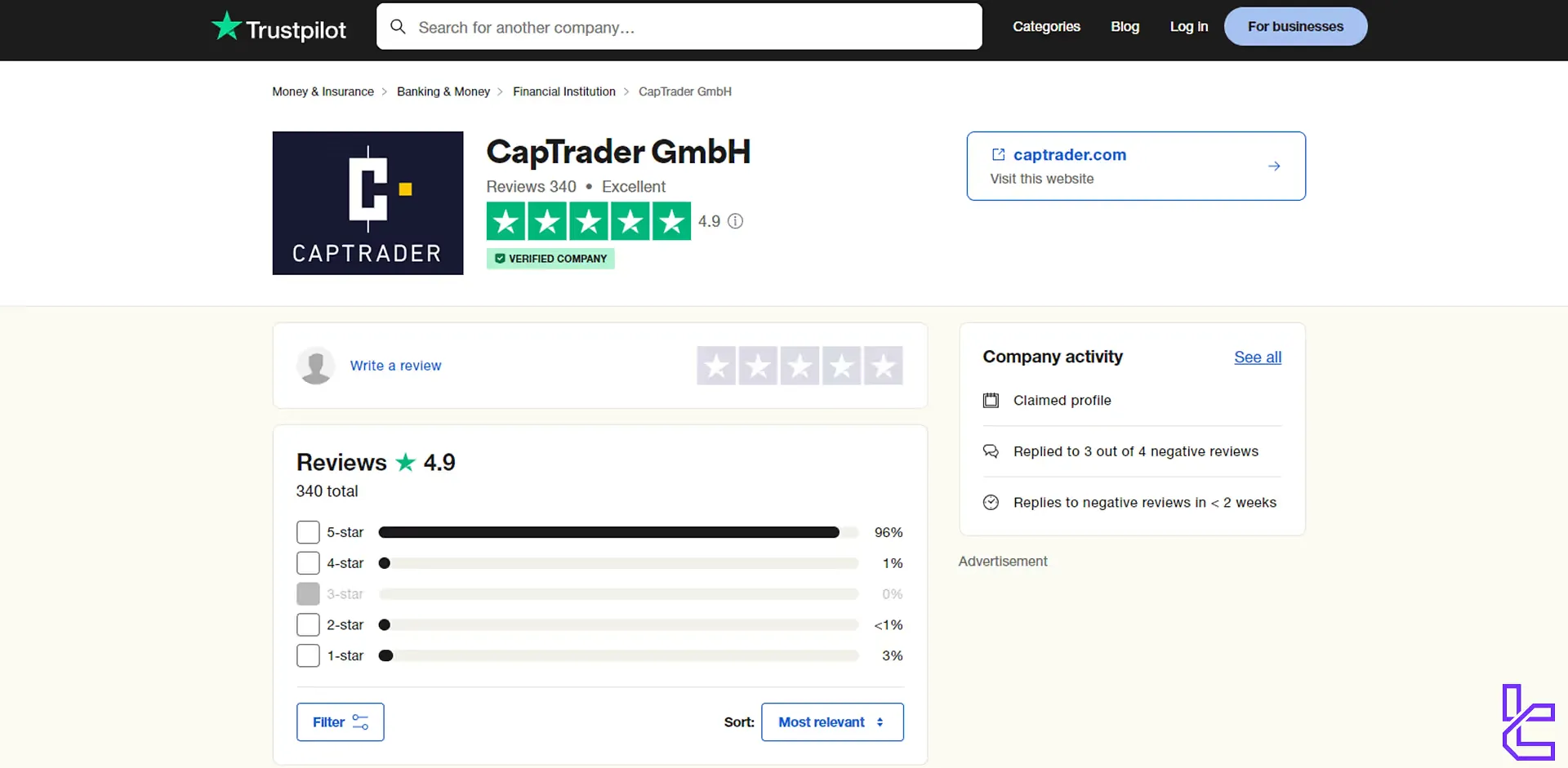

CapTrader Broker Trust Scores & Reviews

CapTrader has garnered generally positive reviews from its users on the Trustpilot website:

- 4.9 out of 5 stars (based on over 300 reviews)

- Praised for low fees and excellent customer support

- over 95%, 5 start reviews

CapTrader actively responds to negative reviews, demonstrating a commitment to addressing customer concerns and improving their services.

Does CapTrader offer Education Resources?

CapTrader offers a range of educational resources to help traders improve their skills:

- Comprehensive glossary of trading terms

- Regular blog posts covering market analysis and trading strategies

- Media library with webinar recordings and expert interviews

- Live webinars and seminars featuring renowned speakers and traders

While the educational offerings are valuable, they may not be as extensive as those provided by some competitors, particularly for absolute beginners.

TF Expert Suggestion

CapTrader offers a wide variety of tradeable instruments across 28 currencies with a minimum trade amount of €1,00. However, its high minimum deposit of $2,000 and the lack of support for popular trading platforms like MT4, MT5, and cTrader are significant drawbacks.