FP Markets deposit and withdrawal methods include credit/debit cards, bank wire transfers, and payment wallets like Neteller, Skrill, PayPal, and online banking.

The platform offers 5 withdrawal options, no deposit fees, and processing times from Instant.

The minimum withdrawal is $5 for most methods and $100 for bank wire transfers.

List of Deposit and Withdrawal Methods in FP Markets

Several payment methods are supported by FP Markets Broker for both deposits and withdrawals; FP Markets Payment options:

- Credit/Debit Card

- Bank Wire Transfer

- Payment Wallets

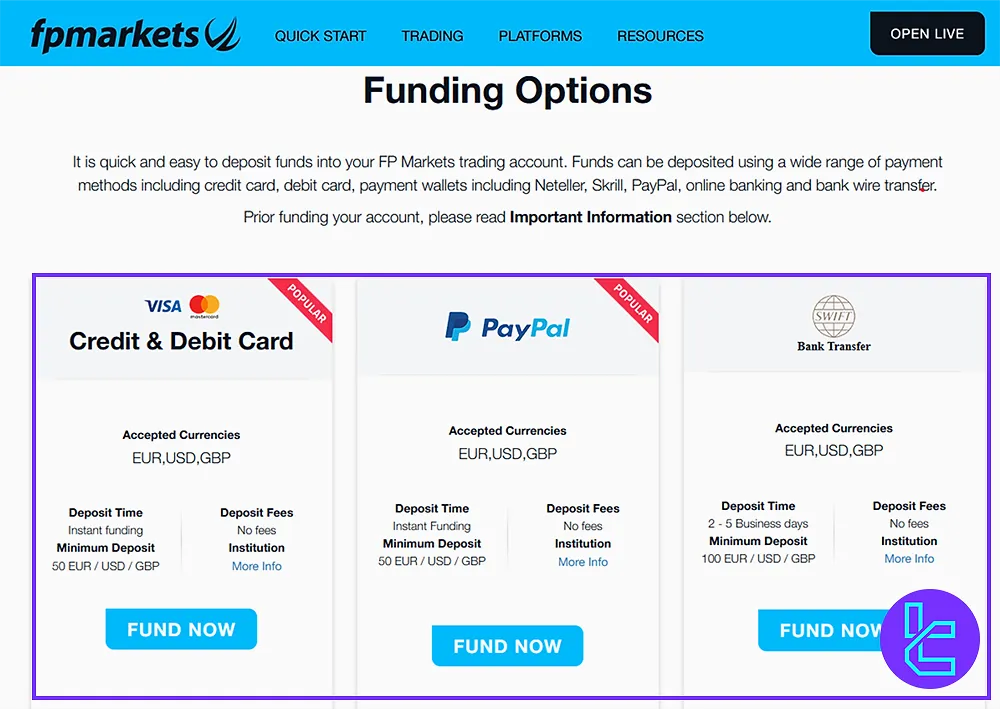

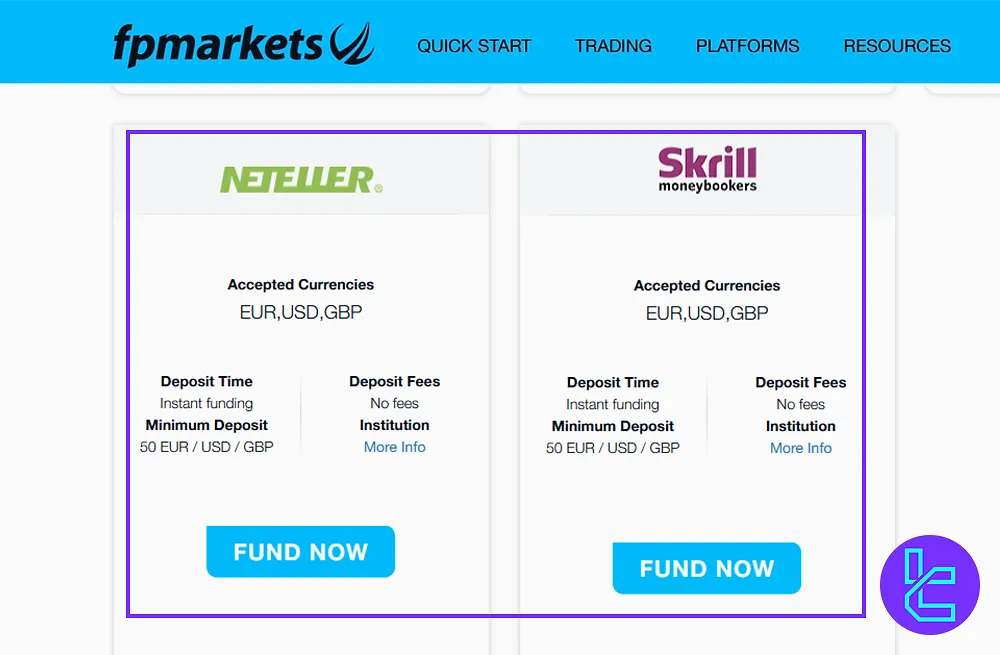

FP Markets Deposit Methods

As a Forex broker, FP Marketsprovides several deposit methods for its users. Supported Funding Options in FP Markets:

- Credit/Debit Card

- Bank Wire Transfer

- Payment Wallets (Neteller, Skrill, PayPal, Online Banking)

FP Markets Deposit Fees

One of the advantages of the company is that there are no fees for deposits made using any of their available methods; FP Markets Funding Fees:

- Credit/Debit Card: No fees

- Bank Wire Transfer: No fees

- Payment Wallets (Neteller, Skrill, PayPal): No fees

FP Markets Deposit Processing Time

The broker aims to provide quick processing times for deposits; FP Markets Deposit Time:

- Credit/Debit Card: Instant

- Bank Wire Transfer: 2–5 business days

- Neteller, Skrill, PayPal: Instant

FP Markets Withdrawal Methods

The company also offers various withdrawal methods for its clients; FP Markets Options for Cash-out:

- Credit/Debit Card

- Bank Wire Transfer

- PayPal

- Neteller

- Skrill

Traders must complete FP Markets verification before using any of the methods mentioned earlier.

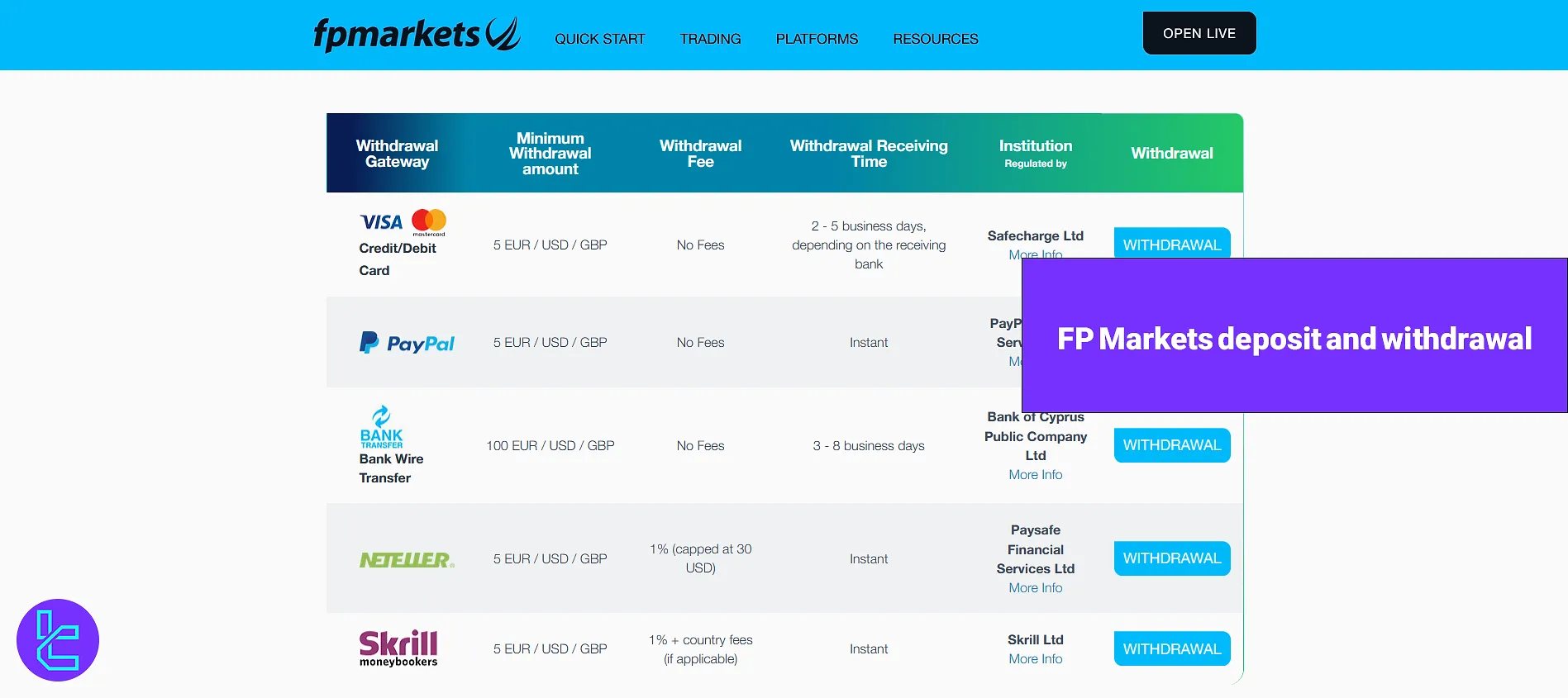

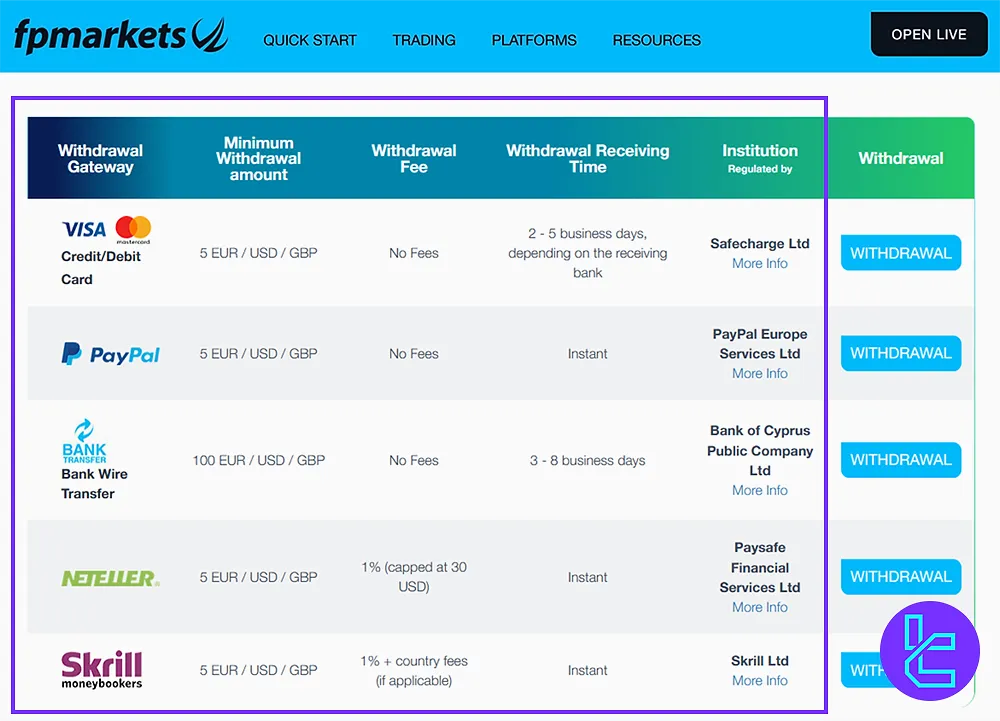

FP Markets Withdrawal Fees

Withdrawals from the broker are generally free, except for a few exceptions. FP Markets Withdrawal Costs:

- Credit/Debit Card: No fees

- PayPal: No fees

- Bank Wire Transfer: No fees

- Paysafe Financial Services Ltd: 1% (capped at $30)

- Skrill Ltd: 1% + country fees (if applicable)

FP Markets Withdrawal Processing Time

Here are the estimated processing times for withdrawals, depending on the chosen methods. FP Markets Withdrawal Time:

- Credit/Debit Card: 2–5 business days

- PayPal: Instant

- Bank Wire Transfer: 3–8 business days

- Paysafe Financial Services Ltd: Instant

- Skrill Ltd: Instant

FP Markets Payment Limits

The broker also imposes certain limits on deposits and withdrawals; FP Markets Payment Limits:

Payment Method | Deposit Limits | Withdrawal Limits |

Credit/Debit Card | Minimum $50 (EUR/GBP/USD) | Minimum $5 (EUR/GBP/USD) |

Bank Wire Transfer | Minimum $100 (EUR/GBP/USD) | Minimum $100 (EUR/GBP/USD) |

Payment Wallets | Minimum $50 (EUR/GBP/USD) | Minimum $5 (EUR/GBP/USD) |

PayPal | N/A | Minimum $5 (EUR/GBP/USD) |

Paysafe Financial Services | N/A | Minimum $5 (EUR/GBP/USD) |

Skrill Ltd | N/A | Minimum $5 (EUR/GBP/USD) |

As you can see, the bank wire transfer has a higher minimum deposit and withdrawal amount of $100.

FP Markets Payment Terms and Conditions

Traders must consider the following terms before transferring funds in or out of the broker:

- Terms for deposits and withdrawals may change without notice;

- Processing times follow FP Markets' discretion under applicable laws;

- Daily deposit limits apply to comply with AML policies;

- Credit/debit card deposits are refunded to the same card; profits over 100 EUR/USD/GBP go to a bank or e-wallet;

- Chargebacks allow the broker to close positions and recover losses; clients must cover any deficits;

- Withdrawals are processed only to bank accounts under the account holder's name;

- Third-party payments are not accepted; use accounts in your own name;

- FP Markets covers fees only from its acquiring banks and processors;

- The broker is not liable for fees from your bank or payment provider;

- Fees like credit card cash advance charges or international bank transfer fees are the client’s responsibility;

- The broker may reverse fee coverage if deposits are not for trading purposes;

- FP Markets can choose the withdrawal method at its discretion.

Writer’s Opinion and Conclusion

FP Markets Deposit and Withdrawal requires a minimum of $50 for most funding methods and $100 for bank wire transfers.

Processing times are generally quick, with instant deposits for credit/debit cards and payment wallets, while bank wire transfers may take 2–5 business days.

Most withdrawal methods charge no fees, but Paysafe Financial Services Ltd charges 1% (capped at $30), and Skrill Ltd charges 1% plus applicable country fees.

If you would like to learn more about this broker, we suggest checking the FP Markets tutorial page.