FXCM is a multi-regulated Forex broker with licenses from top-tier authorities such as FCA, ASIC, CySEC, ISA, and FSCA.

This broker offers 3 account types, including CFD, Active Trader, and Corporate accounts, with up to 1:1000 maximum leverage on MT4, TradeStation, and TradingView platforms.

FXCM Company Information and Regulations

FXCM, short for Forex Capital Markets, has been a major player in the online Forex and CFD trading since 1999. With over two decades of experience, FXCM has weathered many storms in the volatile world of forex trading.

However, FXCM's journey hasn't been without its bumps:

- In 2017, the U.S. Commodity Futures Trading Commission (CFTC) slapped FXCM with a $7 million fine for fraudulent misrepresentation to customers and regulators. This led to FXCM withdrawing its CFTC registration, effectively ending its operations in the United States.

- The company has also faced regulatory actions from other authorities, including the UK Financial Conduct Authority (FCA) and the National Futures Association (NFA) in the US.

- In 2017, FXCM's parent company, FXCM Group, Inc., file for bankruptcy. Subsequently, Jefferies Financial Group (formerly Leucadia National Corporation) acquired FXCM.

Despite these setbacks, FXCM has managed to maintain a strong global presence. The FXCM Group is currently regulated by several respected financial authorities:

- Financial Conduct Authority (FCA) in the UK

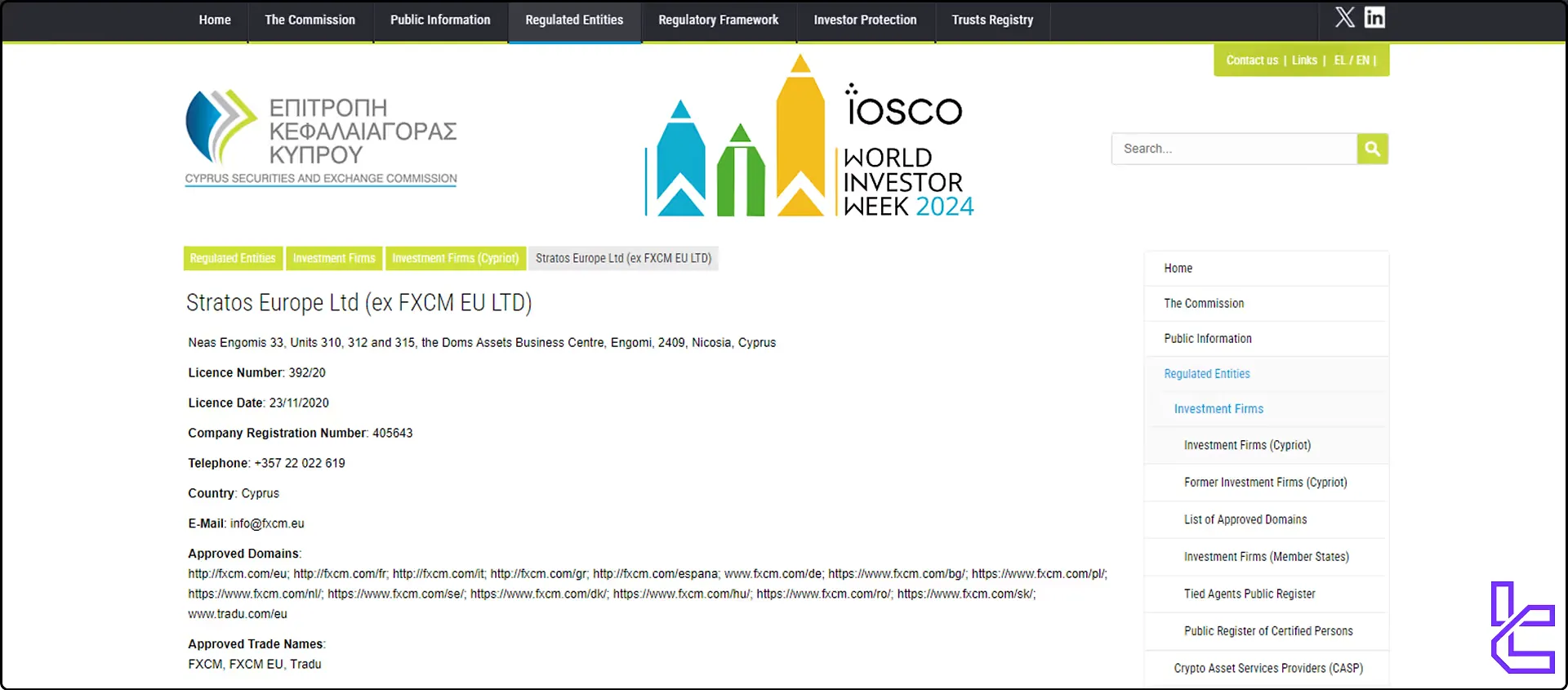

- Cyprus Securities and Exchange Commission (CySEC) [license no. 392/20]

- Australian Securities and Investments Commission (ASIC)

- Financial Sector Conduct Authority (FSCA) in South Africa [no. No 46534]

- Israel Securities Authority (ISA)

FXCM Summary of Specifications

FXCM has established itself as a go-to platform for Forex and CFD trading enthusiasts. Here's a quick rundown of what FXCM brings to the table:

Broker | FXCM |

Account Types | CFD account, Active Trader account, Corporate account |

Regulating Authorities | FCA, ASIC, CySEC, ISA, FSCA |

Based Currencies | USD |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Withdrawal Methods | Visa/MasterCard, Bank wired, Neteller, Skrill |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:1000 |

Investment Options | Algo trading, copy trading |

Trading Platforms & Apps | MT4, TradingView, TradeStation |

Markets | Forex, indices, commodities, crypto, shares |

Spread | Floating from 0.2 pips |

Commission | No |

Orders Execution | Market |

Margin Call/Stop Out | 50% |

Trading Features | Demo account, Islamic account |

Affiliate Program | Yes |

Bonus & Promotions | Welcome bonus, cashback bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone, WhatsApp |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, USA, Sudan, and more |

FXCM Account Types Overview

FXCM offers a trio of account types designed to cater to different trading styles and experience levels:

Mini Account

- Perfect for beginners

- Low minimum deposit requirement ($50)

- Ideal for practicing and gaining experience

- Variable spreads from 0.2 pips

- 1:400 maximum leverage

Standard Account

- Suited for more experienced traders

- Minimum Spread is 0.2 pips

- 1:30 maximum leverage

- Margin call at 50%

Active Trader Account

- Tailored for high-volume traders

- $25,000 minimum deposit

- Additional bonuses and cash rebates

- 1:30 maximum leverage

This tiered approach allows traders to select an account that best aligns with their trading goals, risk tolerance, and capital availability.

FXCM Broker Strengths and Weaknesses

Like any Forex broker, FXCM has its strengths and weaknesses. Let's break them down:

Advantages | Disadvantages |

Over 20 years of experience in the forex industry | Bankruptcy record |

Diverse product range | $50 per year inactivity fee |

Regulated by top-tier authorities (FCA, ASIC, CySEC) | $40 withdrawal fee on bank transfers |

Multiple advanced trading platforms (Trading Station, MT4, TradingView) | |

Active Trader discounts for frequent traders |

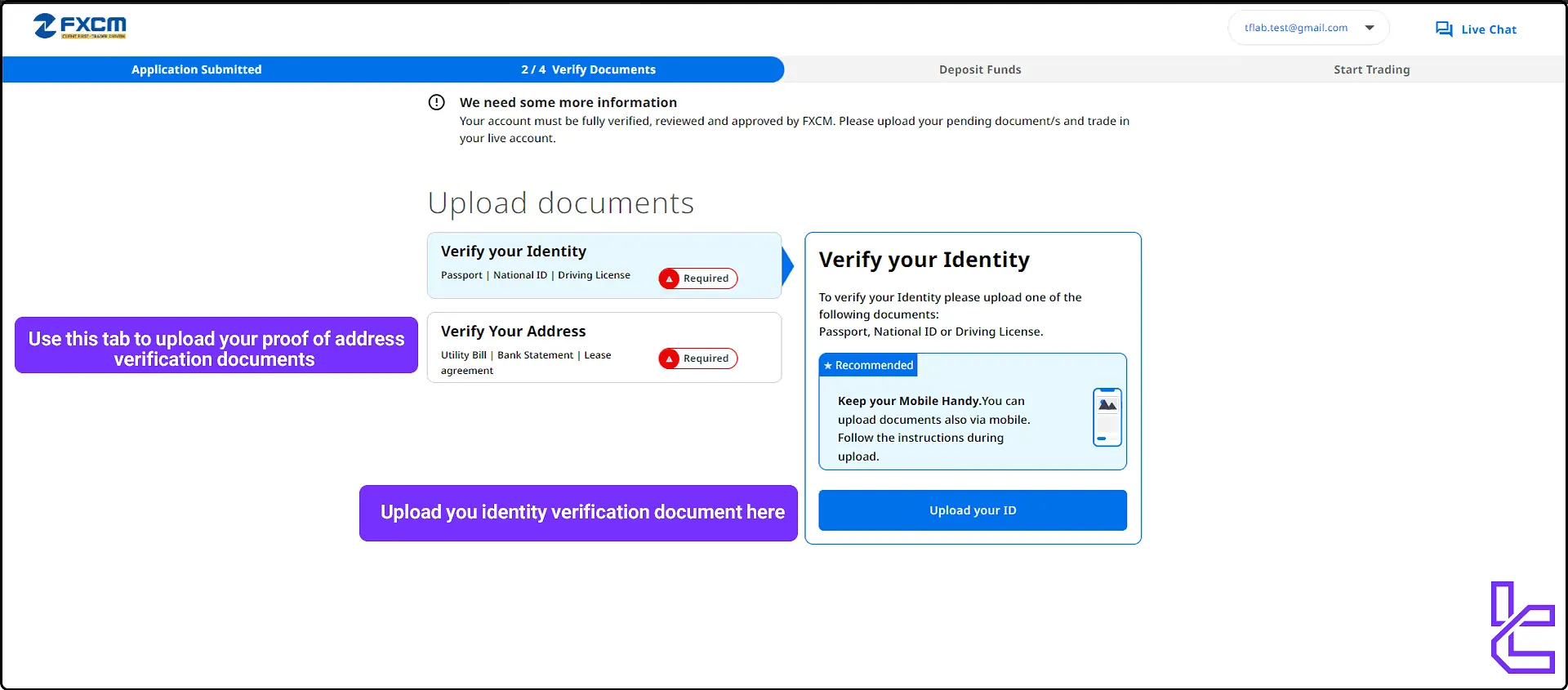

FXCM Registration & Verification Guide

Here's a step-by-step guide to open an account in FXCM broker:

- Visit the FXCM website (www.fxcm.com) and Click on the "Open Account" button.

- Enter your email, country of residency, and password;

- Choose your trading platform;

- Fill in your personal details (name, date of birth, etc.);

- Enter your address;

- Enter your phone number;

- Anwesr financial and employment questions;

- Upload your identity verification documents (passport, national ID, driver’s license);

- Upload proof of address verification documents (utility bill, bank statement, lease agreement).

FXCM Broker Trading Platforms and Applications Review

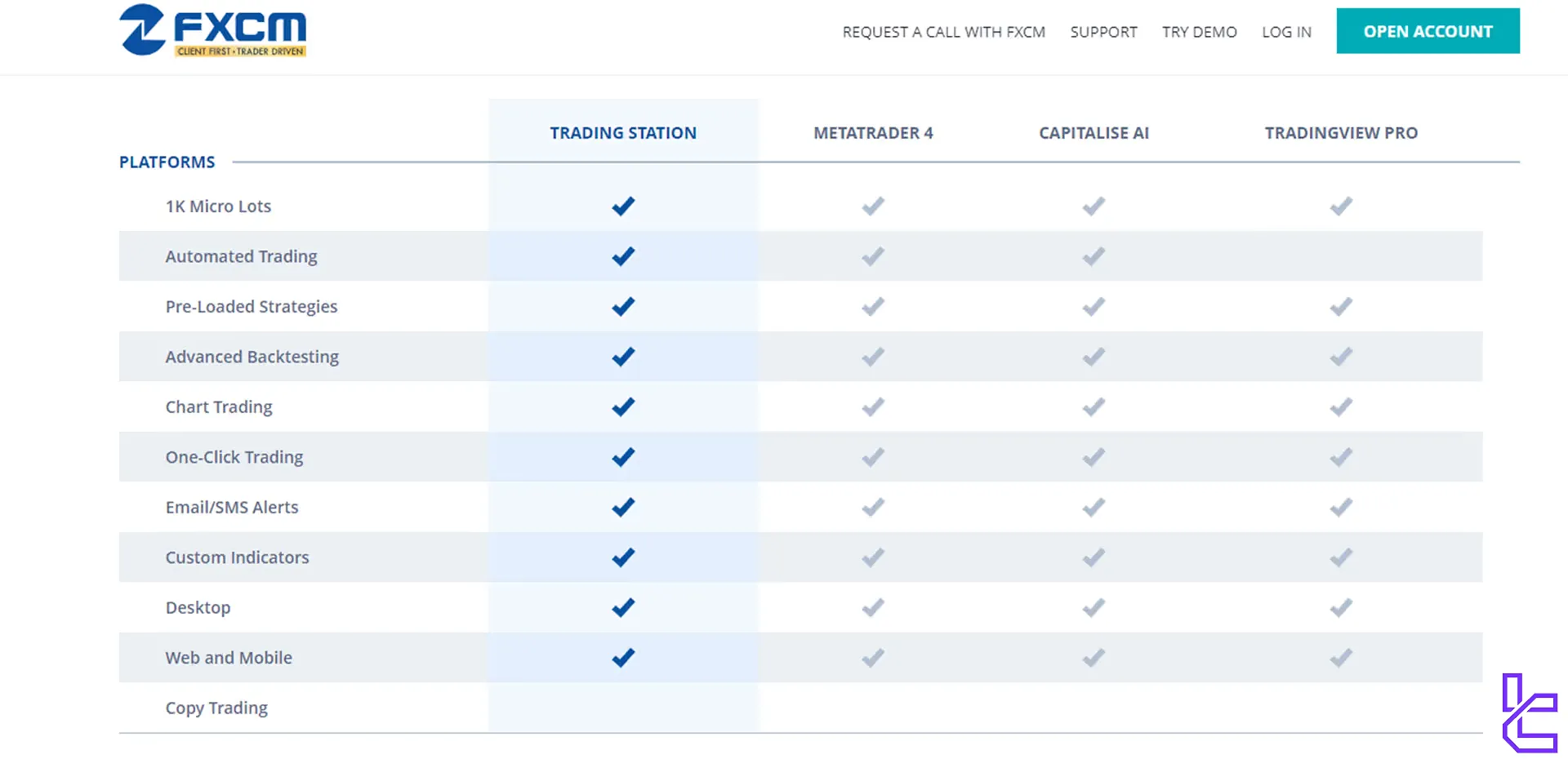

FXCM offers multiple trading platforms to suit different trading styles and preferences:

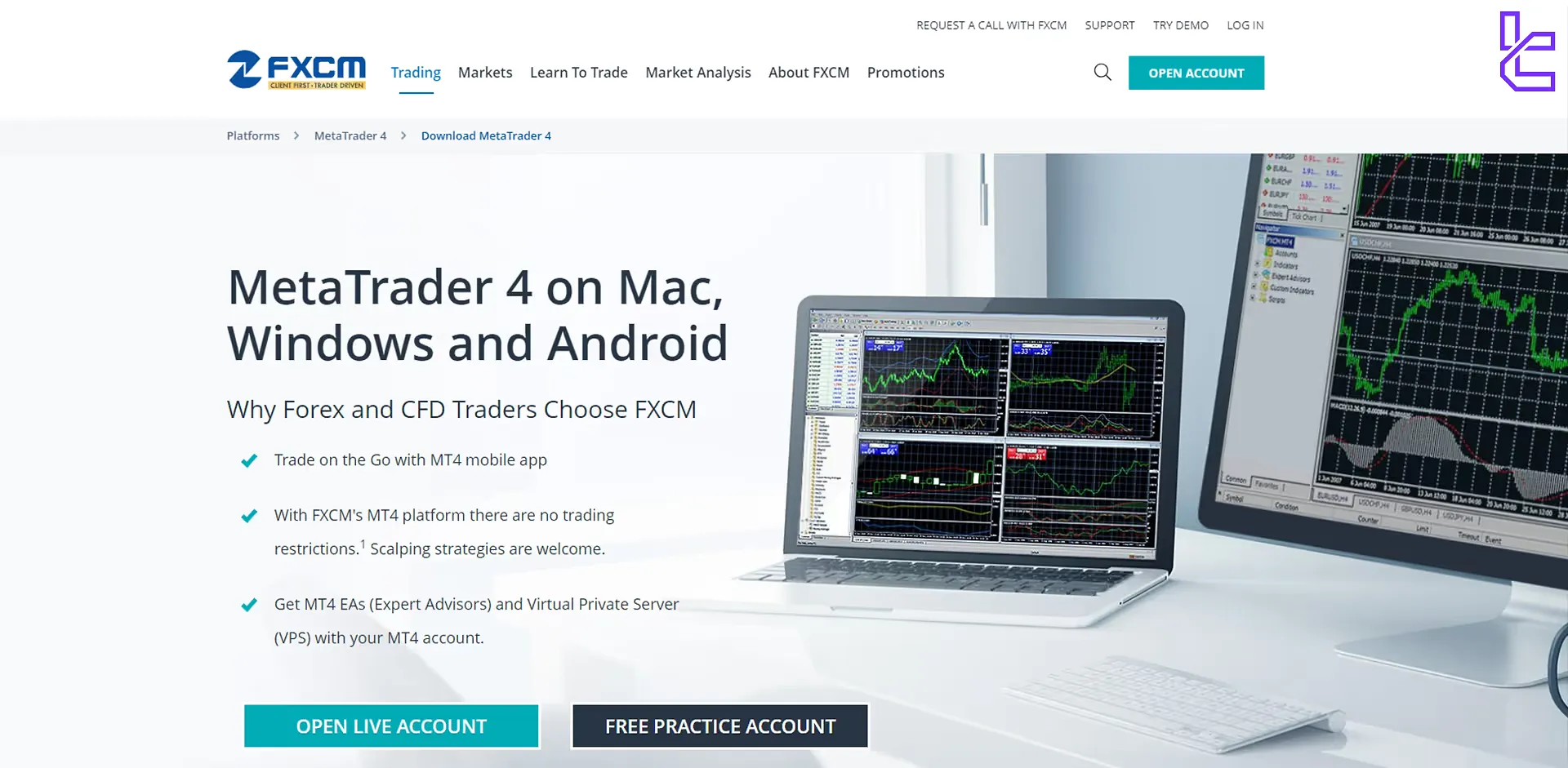

MetaTrader 4 (MT4)

MetaTrader 4 is the most well-known trading platform in the world. Key features of this platform:

- Industry-standard platform

- Advanced charting and analysis tools

- Supports automated trading and custom indicators

Links:

Trading Station

Trading Station is a powerful trading platform exclusive to FXCM broker. Key features of this platform:

- FXCM's proprietary platform

- User-friendly interface with advanced features

- Real-time news feeds and market analysis

- Available on browser, Android, and iOS

Links:

TradingView Pro

FXCm allows full integration with TradingView platform. main features of this platform include:

- Social trading features

- Extensive technical analysis tools

- A Wide variety of built-in indicators

Capitalize AI

Capitalize AI is the perfect platform for those who want to trade without involving human emotions. Main benefits of this platform:

- Innovative platform leveraging artificial intelligence

- Helps identify trading opportunities

- Automates strategy creation and backtesting

Spreads and Commissions in FXCM Broker

FXCM offers competitive pricing structures, but they can vary depending on your account type and trading volume:

- Spreads from 0.2 pips on major pairs

- No commission on CFDs

FXCM other fees:

- Inactivity fee: $50 per year

- Currency conversion fee: 0.01%

- Deposit fee: 0

- Withdrawal fee: 0 (except for bank transfers)

FXCM Deposit & Withdrawal Methods

FXCM offers a variety of options for funding your account and withdrawing your profits:

- Bank transfer

- Credit/Debit cards (Visa, MasterCard)

- E-wallets (Skrill, Neteller)

Key points to note:

- Minimum deposit is $50

- No deposit fee

- 40$ charge on bank wire withdrawals

- Withdrawals are typically processed within 1-2 business days

Copy Trading & Investment Options Offered on FXCM Broker

FXCM provides several options for those interested in copy trading and passive investment:

Capitalize AI Algo Trading

- Uses artificial intelligence to create and optimize strategies

- Backtests strategies using historical data

- Automates trade execution based on AI-generated signals

Zulu Trade Copy Trading

- ZuluTrade copy trades of experienced traders

- Social trading

- automated trade execution, allowing for hands-free portfolio management.

This option allows traders to diversify their approach, potentially benefiting from the power of AI. However, remember that past performance doesn't guarantee future results - always understand the risks involved in copy trading.

FXCM Tradable Markets and Instruments

FXCM offers a diverse range of tradable markets:

- Forex: Major, minor, and exotic pairs available

- Shares: CFDs on stocks from major global exchanges

- Commodities: Precious metals and Energy products

- Cryptocurrencies: Trade crypto CFDs such as BTC, ETH, XRP without owning the underlying asset

- Indices: Major global indices like S&P 500, FTSE 100, DAX

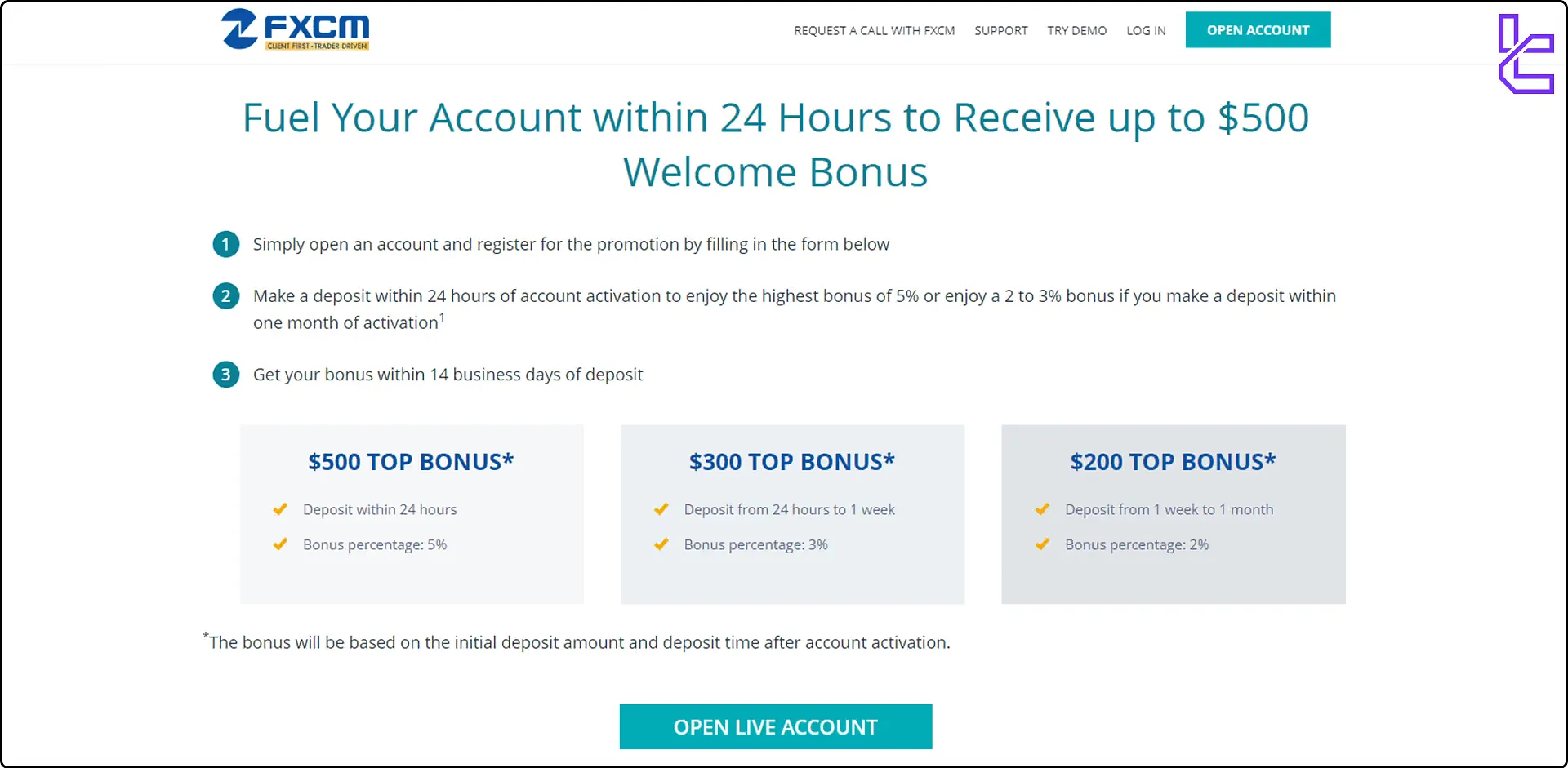

FXCM Broker Promotions and Bonuses

FXCM offers several incentives to attract and retain traders:

Welcome Bonus

FXCM offers a welcome bonus of up to $500 for traders who fund their accounts within the first 24hrs of their account registration.

Rebate Program

FXCM offers cashback bonus up to $10,000 for trading Gold in this broker. Based on your XAU trading volume, FXCM will reward you on a monthly basis.

Referral Program

Traders can earn up to $400 bonus by referring their friends to join the FXCM platform.

Remember, trading bonuses often come with specific terms and conditions. Always read the fine print and understand the requirements before participating in any promotional offers.

FXCM Broker Customer Support

It’s time to go through customer support in our FXCM review. This broker provides comprehensive support through multiple channels:

- Live Chat: Available 24/5 for quick queries

- Email: info@fxcmmarkets.com

- Phone: 00 1 646-253-1401

- WhatsApp: +44 7537 432259

Support is offered in multiple languages to cater to FXCM's global client base, and it is active 24/5. FXCM also maintains an extensive FAQ section and knowledge base on their website for self-help options.

FXCM Restricted Countries

While FXCM operates globally, regulatory restrictions mean it can't offer services in all countries. Notable restrictions include:

- Asia: North Korea, South Korea, Singapore, Iran, Syria, Afghanistan, Turkey

- Africa: Liberia, Sudan, Zaire, Zimbabwe, Burundi, Ivory Coast, Central African Republic

- Europe: Russian Federation, Ukraine, Belarus

- South America: Cuba, Vanuatu

- North America: USA

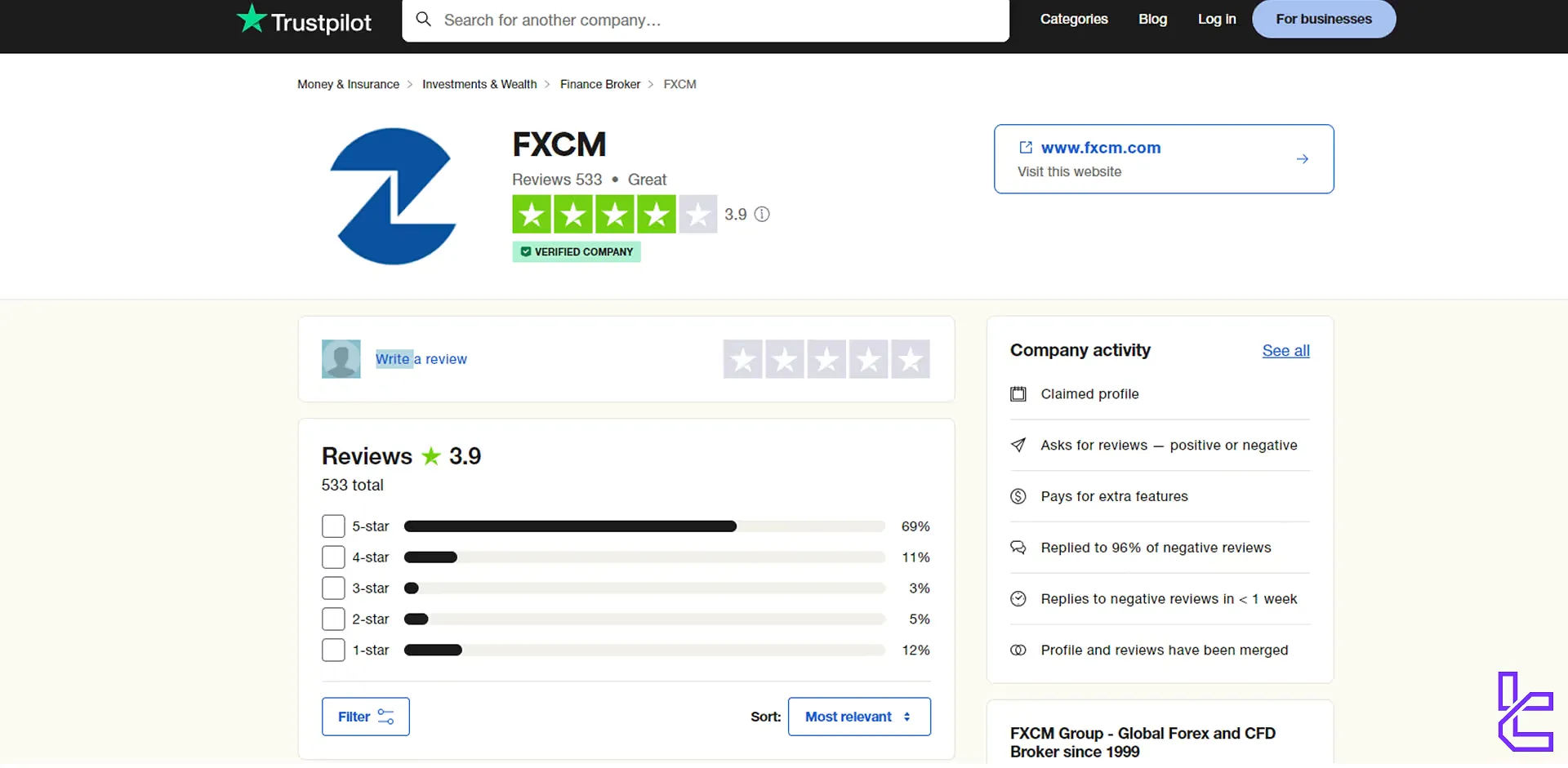

FXCM Reviews and Trust Scores

FXCM has garnered mixed reviews from traders over the years. FXCM received a score of 3.9 out of 5 on the Trustpilot website.

It's important to note that online reviews can be subjective. While they provide valuable insights, they should be considered alongside other factors like regulation, trading conditions, and personal experience.

FXCM Broker Education

FXCM offers a robust educational section to help traders of all levels improve their skills:

- Trading Guides: Comprehensive resources on forex basics, technical analysis, and trading strategies

- Video Tutorials: Visual learning aids covering platform usage and trading concepts

- Webinars: Live and recorded sessions with FXCM experts

- Trading Signals: Daily analysis and trade ideas

The education section is freely accessible, even for non-account holders.

TF Expert Suggestion

FXCM offers a low-cost trading experience, with floating spreads from 0.2 pips and no commissions on CFDs in 5 markets.

Despite that, the broker's $50 inactivity fee, $40 commission on bank withdrawals, and history of bankruptcy are important facts traders must consider about this broker.