IFC Markets provides access to over 650 trading instruments across 9 markets, from Forex currency pairs to CFDs on Crypto Futures, with spreads from 0.0 pips and a 0.005% commission through its ECN account.

IFC Markets (The Company and Its Regulatory Status)

IFC Markets is a well-established brokerage firm operating in the Forex and CFD markets since 2006. During its 18 years of presence in the markets, the company has gained more than 210,000 clients across the globe. Key features of IFC Markets:

- Regulated by the Labuan Financial Services Authority (Labuan FSA) and the British Virgin Islands Financial Services Commission (BVI FSC)

- Offers a wide range of trading instruments, including the Forex market, CFDs, and commodities

- Provides multiple trading platforms, NetTradeX and the popular MetaTrader 4 and MetaTrader 5

- Known for its innovative features, such as the Portfolio Quoting Method and Continuous CFDs

To enhance client security, the broker maintains professional indemnity insurance via Lloyd’s of London (Syndicate 4000), and implements key protections like negative balance protection and fund segregation.

What further distinguishes IFC Markets is its global recognition — having earned over 33 international trading awards — and its ownership of a U.S.-patented trading innovation: the GeWorko Method.

IFC Markets Broker Table of Specifications

This table provides a comprehensive overview of IFC Markets' key features and offerings, giving potential clients a quick snapshot of what to expect from this broker.

Broker | IFC Markets |

Account Types | Standard, Micro, ECN |

Regulating Authorities | Labuan FSA, BVI FSC |

Based Currencies | USD, EUR, JPY, uBTC |

Minimum Deposit | $1 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Local Transfer, Crypto |

Minimum Order | 0.1 lots |

Maximum Leverage | 1:400 |

Investment Options | IFC Invest |

Trading Platforms & Apps | MT4, MT5, NetTradeX |

Markets | Forex, Indices, Commodities, ETFs, Stocks, Crypto, Synthetic Instruments, Crypto Futures, Metals |

Spread | Variable based on the account type and instrument |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | Stop out 10% |

Trading Features | Mobile Trading, Investment Plans, Synthetic Instruments |

Affiliate Program | Yes |

Bonus & Promotions | Partnership, Annual Interest on Free Margin |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Phone, Telegram, WhatsApp, Skype, Messenger, Live Chat, Mail |

Customer Support Hours | 24/7 |

What Are the IFC Markets Account Types?

IFC Markets offers various account types, from Classic to ECN, to cater to different trading styles and experience levels.

Features | NetTradeX (Standard, Beginner) | MetaTrader 4 (Standard, Micro) | MetaTrader 5 (Standard, Micro) |

Base Currency | USD, EUR, JPY, uBTC | USD, EUR, JPY, uBTC | USD, EUR, JPY, uBTC |

Min Deposit | $1000 | $1 | - |

Leverage | 1:200 | 1:400 | 1:400 |

Min Fixed Spread | From 1.8 pips | From 1.8 pips | From 1.8 pips |

Min Floating Spread | From 0.4 pips | From 0.4 pips | From 0.4 pips |

Stop Out | 10% | 10% | 10% |

Min Order Size | 10,000 units | 100 units | 100 units |

The Forex broker also offers an exclusive ECN account featuring super-fast execution, deep liquidity, and access to the robust MT5 platform. Key features of IFC Markets Standard ECN account:

- Raw spreads from 0.0 pips

- Minimum order size of 0.1 lots and a maximum of 10,000 lots

- 10% stop-out level

- 0.005% commission on transaction volume

- Access to 22 currency pairs and 2 precious metals

IFC Markets Broker Pros & Cons

To provide a balanced view of IFC Markets, let's examine some of its advantages and disadvantages.

Upsides | Downsides |

Low minimum deposit (from $1) | Higher spreads on some popular pairs compared to the industry average |

Demo accounts | Lack of regulation from top-tier authorities |

Multiple trading platforms | Limited cryptocurrency offerings |

Copy trading and PAMM accounts | Geo-restrictions |

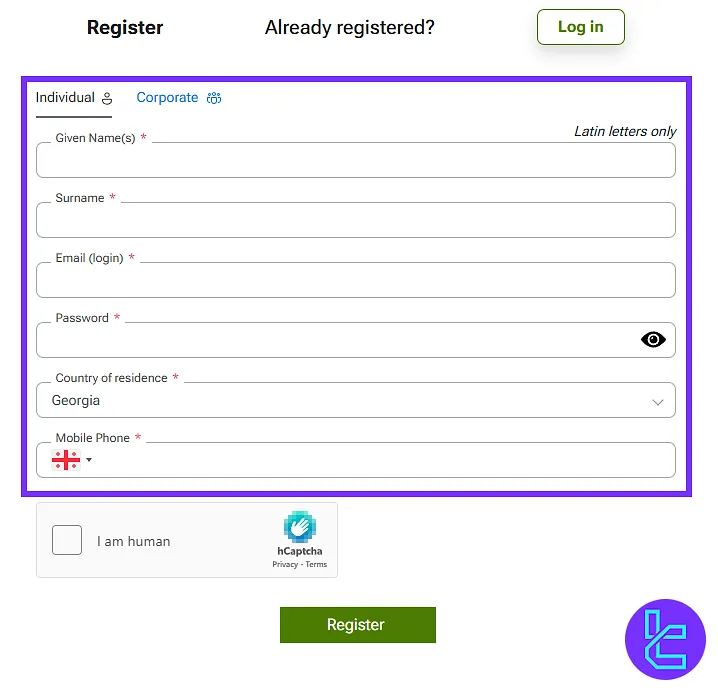

IFC Markets Registration and KYC Process

IFC Markets registration is a straightforward process that involves several steps to ensure compliance with regulatory requirements and to protect both the broker and the client.

#1 Start the Sign-Up on the Official Website

Go to the IFC Markets homepage and click “Open Account”. Fill out the registration form with such data:

- Full name

- Password

- Country

- Mobile number

Pass the captcha and submit your form to proceed.

#2 Confirm Your Email to Activate the Account

After registering, check your inbox for a verification email from IFC Markets. Click the “Confirm Email” button or follow the verification link provided.

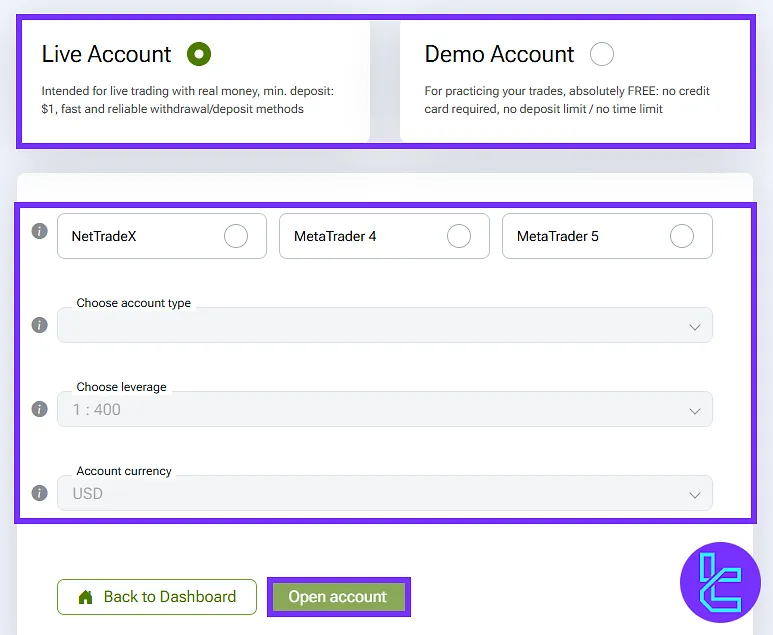

#3 Set Up Your Trading Profile

Once your email is verified, select whether you want a live or demo account. Define your trading preferences by choosing your platform (MT4, MT5, NetTradeX), desired leverage, account type, and base currency.

#4 Pass the KYC

Provide proof of identity (Passport or driving license) and proof of address (Utility bill or bank statement) for IFC Markets verification.

IFC Markets Trading Platforms

We must discuss the available trading platforms in this IFC Markets review. The broker offers a range of advanced trading platforms to cater to different trader preferences and needs.

The Proprietary Platform

MetaTrader 4 (MT4)

- Desktop

- Web

- MT4 Android

- MT4 iOS

MetaTrader 5 (MT5)

- Desktop

- Web

- MT5 Android

- MT5 iOS

IFC Markets Fees and Commissions

IFC Markets employs a competitive fee structure, with costs varying depending on the account type and trading platform chosen. The broker offers raw spreads from 0.0 pips through its ECN technology.

- Fixed spreads starting from 1.8 pips on major currency pairs (NetTradeX/MT4/MT5 Fixed)

- Floating spreads from 0.4 pips on major pairs (NetTradeX/MT4/MT5 Floating)

- ECN provides the tightest spreads from 0.0 pips

- Most account types do not charge separate commissions

- ECN has a commission of 0.005% of transaction volume

IFC Markets Payment Options

The company provides various payment options to cater to clients from different regions.

Method | Deposit Limitation | Withdrawal Limitation | Deposit Commission | Withdrawal Commission |

Bank Wire | $100 – unlimited | $50 – unlimited | Bank’s fee | Your bank's fee + £20 |

Credit/Debit Cards | $100 – $5,000 | $10 - $1,000 | None | Varies |

PerfectMoney | $1 - $5,000 | $1 – $5,000 | 0.5% - 1.99% | 0.5% |

Web Money | $1 – unlimited | $1 - unlimited | 20% | 0.8% (maximum $50) |

Crypto | $20 – unlimited | $20 – unlimited | None | 5 USDT-ERC20 |

Bitwallet | $10 – unlimited | $1 – unlimited | None | $1 |

IFC Markets Copy Trading and Investment Plans

Passive income is a must-discussed topic in any IFC Markets review. The broker offers copy trading and investment opportunities through its PAMM (Percentage Allocation Management Module) accounts. Key features of IFCM Invest service:

- Allows investors to allocate funds to skilled traders (managers)

- Profits and losses are distributed proportionally based on investment

- Investors can choose from a list of verified PAMM managers

- Real-time monitoring of manager performance

- Ability to invest in multiple PAMM accounts (3 – 5) to diversify risk

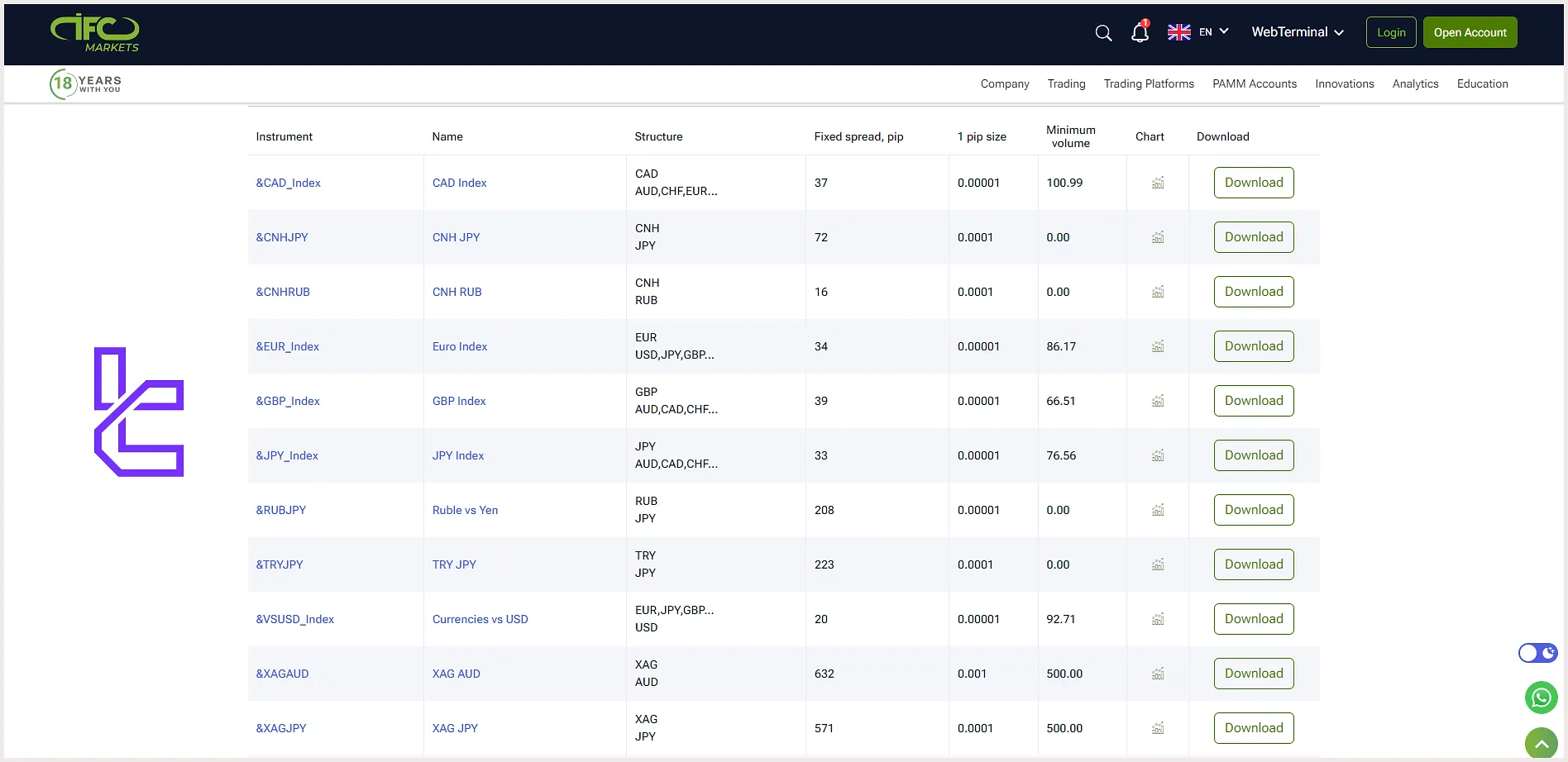

IFC Markets Broker Financial Instruments

The company offers various financial instruments catering to various trading preferences and strategies. Note that IFC Markets’ main focus is on providing CFD contracts.

- Forex: Major, minor, and exotic pairs (e.g., EUR/USD, GBP/USD, and USD/RUB)

- Metals: Four precious metals, including Gold, Silver, Palladium, and Platinum

- Indices: Trade indices of top American, European, and Japanese exchanges, such as SP500, NIKKEI, USVIX, and Nd100

- Stock CFDs: Stocks of top industry giants across the globe, from China to America

- Cryptoccurrencies: Trade CFDs on fourteen of the most popular digital assets, such as BTC, DOGE, LTC, XRP, and ETH, with leverage up to 1:10

- Commodities: Trade CFDs on metals, energies, and agricultural products without expiration date

- ETFs: CFDs on shares of NYSE Exchange Traded Funds (ETFs), including SPDR Gold Trust, ISHARES U.S. REAL ESTATE, and SPDR S&P 500

- Futures: CFDs on Crypto and commodity futures

- Synthetic Instruments: Known as Personal Composite Instruments (PCI) and created by the analysts of IFC Markets

Bonus and Promotional Programs on IFC Markets

The broker offers several bonus and promotional programs to attract and retain clients. These programs are designed to provide additional value and incentives for traders.

Partnership Program

- Allows clients to earn commissions by referring new traders

- Multiple partnership types available (Introducing Broker, Affiliate, White Label)

- Competitive commission rates based on trading volume

- Marketing materials and support provided

Annual Interest on Free Margin

- Unique feature offering up to 7% annual interest on unused funds in trading accounts

- Interest calculated daily and credited monthly

IFC Markets Broker Customer Support

The company strongly emphasizes providing comprehensive 24/7 customer support in 19 languages to ensure a smooth trading experience for its clients.

support@ifcmarkets.com | |

Phone | +442039661649 |

Live chat | Accessible on the website |

Skype | skype:ifcm_cl_1?call |

Messenger | https://messenger.com/t/IFCMarketscom |

Telegram | https://telegram.me/IFCMarketsSupport |

https://wa.me/35722000149 | |

Call back request | Through the “Contact Us” page |

Post Address | AGP Chambers, 84 Spyrou Kyprianou Avenue, 4004 Limassol, Cyprus |

IFC Markets Geo-Restrictions

While the company strives to serve a global clientele, certain geo-restrictions apply due to regulatory requirements and local laws. Red flag countries on IFC Markets:

- United States of America

- Russian Federation

IFC Markets Trust Scores

Trust scores and user reviews play a significant role in assessing a broker's reputation and in this IFC Markets review. the company has garnered feedback from various review platforms, providing insights into user experiences.

3.9 out of 5.0 based on 500 ratings | |

Forex Peace Army | 2.3 out of 5.0 based on 31 reviews |

Does IFC Markets Provide Educational Materials?

Education is a cornerstone of successful trading, and IFC Markets recognizes this by offering a range of educational resources to its clients, including:

- Video Tutorials: Beginners guide, how to work with trading platforms, and technical analysis

- Books: Introduction to Forex/CFD trading, theories, and common mistakes

- Glossary: A comprehensive Forex terms library

- Trading Academy: Interactive Forex Education from A to Z

- Training Program: Educational articles, PAMM accounts, video lessons, and webinars

Comparison Against Other Brokers

This section evaluates IFC Markets' performance and services in comparison to other brokers:

Parameter | IFC Markets Broker | Exness Broker | HFM Broker | FXGlory Broker |

Regulation | Labuan FSA, BVI FSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | Variable | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | Variable | From $0.2 to USD 3.5 | From $0 | $0 |

Minimum Deposit | $1 | $10 | From $0 | $1 |

Maximum Leverage | 1:400 | Unlimited | 1:2000 | 1:3000 |

Trading Platforms | MT4, MT5, NetTradeX | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Standard, Micro, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 650+ | 200+ | 1,000+ | 45 |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

Conclusion and Final Words

IFC Markets provides access to a wide range of asset types, including Continuous CFDs and Commodity Futures through its platforms, including MT4/5 and NetTradeX.

IFC Markets broker’s wide range of services, such as PAMM accounts and 24/7 support in 19 languages has gained it a score of 3.9 on TrustPilot.