ModMount is an NDD brokerage company, providing commission-free Forex trading, and access to Commodity Futures. The broker accepts Apple Pay, Google Pay, and Crypto payments

ModMount (Is it Regulated?)

ModMount Services Limited is registered in the Seychelles and is regulated by the Seychelles Financial Services Authority under license number SD119. It’s in the same group of companies as FXNovus broker and Peaksight Ltd (regulated by CySEC).

ModMount implements 128-bit SSL encryption to protect private information

ModMount implements 128-bit SSL encryption to protect private information

Founded in 2022 and featuring Trading Central integration, one-click execution, and a multilingual UI, the broker aims to attract day traders. Key features of ModMount:

- Offshore regulated (FSA)

- Leverage options up to 1:400

- Trading servers in a SAS (70 certified areas)

- 160+ trading instruments

- Commodity futures

ModMount ensures negative balance protection, segregated funds, and an overall secure trading environment. Its operations are tailored to those favoring manual CFD trading in sectors such as Forex, commodities, indices, equities, the Futures market, and cryptocurrencies.

ModMount Specific Details

Let's drill down into some of the specific details that make ModMount unique in the crowded world of online Forex brokers.

Broker | ModMount |

Account Types | Classic, Silver, Gold, Platinum, VIP |

Regulating Authorities | FSA |

Based Currencies | USD, EUR, CHF |

Minimum Deposit | $250 |

Deposit Methods | Credit/Debit Cards, Wire Transfer, Crypto, Gpay, ApplePay, EFT, PIX, WebPay, Gcash, PayMaya, Mobile Money, Sticpay, Jeton |

Withdrawal Methods | Credit/Debit Cards, Wire Transfer, Crypto, Gpay, ApplePay, EFT, PIX, WebPay, Gcash, PayMaya, Mobile Money, Sticpay, Jeton |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:400 |

Investment Options | None |

Trading Platforms & Apps | WebTrader, Proprietary Mobile/Desktop App |

Markets | Forex, Metals, Indices, Commodities, Shares, Crypto, CFDs |

Spread | Variable based on the account type |

Commission | None |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Chart Analysis, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Partnership |

Islamic Account | N/A |

PAMM Account | No |

Customer Support Ways | Email, Phone, Live Chat, Ticket |

Customer Support Hours | 24/7 |

ModMount Broker Account Types

The company offers 5 main account types, which are basically the same. The only difference between them is their spread. Classic, Silver, Gold, Platinum, and VIP are the names of ModMount accounts with the following key features.

Min Deposit | $250 |

Max Leverage | 1:400 |

Margin Call | 100% |

Stop Out | 20% |

Min Order Size | 0.01 lots |

Max Order Size | 50 lots |

All accounts maintain core features like instant execution and access to the broker's full instrument range.

ModMount Upsides and Downsides

Like any broker, ModMount comes with its own set of strengths and weaknesses.

To give you a balanced view, we’ll weigh the broker's advantages against its disadvantages.

Pros | Cons |

Maximum leverage of 1:400 | Lack of licensing from tier-1 regulatory bodies |

Multilingual Support | Limited platform options (no MT4/5) |

Commission-free trading | Geographical restrictions |

24/7 access to market | High entry barrier |

ModMount Registration and Verification

ModMount streamlines account creation with a simple sign-up flow, followed by a mandatory KYC verification to meet global regulatory standards. Traders can quickly access the platform and begin trading once verification is complete.

#1 Start Registration

Go to the ModMount official website and click on “Start Trading” to open the sign-up form.

#2 Fill Out Personal Details

Complete the registration form with your basic information, including:

- Name

- Contact number

#3 Upload Identity Documents

Submit a passport or driver’s license as proof of identity, along with a recent utility bill or bank statement as proof of address.

#4 Verify Payment Method

To ensure secure transactions, upload documentation verifying your card or e-wallet used for funding.

Once all steps are completed and approved, your ModMount trading account becomes fully active.

What Trading Platforms Are Available on ModMount?

ModMount offers a streamlined approach to trading platforms, focusing on its proprietary solutions rather than third-party options. The broker’s main offerings consist of a robust WebTrader and a Mobile/Desktop proprietary app.

Note that the mobile app is not available on any app store. However, you can test it via the ModMount Firebase App Distribution profile.

The platform lacks support for MetaTrader 4 and MetaTrader 5, instead focusing on browser-based manual trading.

ModMount Fees and Commissions

We must discuss the fee structure in this ModMount review. The broker has a simple fee policy consisting of only spreads. So, there are no commissions on ModMount.

Spreads differ based on the account type and instruments. We gather the spreads for some of the most popular instruments in the table below.

Account Type | EURUSD | GBPUSD | USDJPY | Crude Oil |

Classic | 2.5 | 2.8 | 2.8 | $0.14 |

Silver | 2.5 | 2.8 | 2.8 | $0.14 |

Gold | 1.8 | 2.3 | 2.3 | $0.13 |

Platinum | 1.4 | 2 | 2 | $0.12 |

VIP | 0.9 | 1.4 | 1.4 | $0.10 |

ModMount Deposit / Withdrawal

ModMount accepts deposits through major credit cards, bank wires, and a limited number of e-wallets. The minimum funding requirement is $250.

- Credit/Debit Cards: Master Card and Visa

- Bank Wire

- APMs: Crypto, Gpay, ApplePay, EFT, PIX, WebPay, Gcash, PayMaya, Mobile Money, Sticpay, and Jeton

Withdrawal processing times typically range from 1 to 3 business days, depending on the method used.

Copy Trading and Investment Plans on ModMount Broker

Unfortunately, the broker doesn’t provide copy trading software for crypto or other markets. It doesn’t offer any exclusive investment plans. Lack of passive income programs can be a letdown for those who seek to earn profits on their free assets.

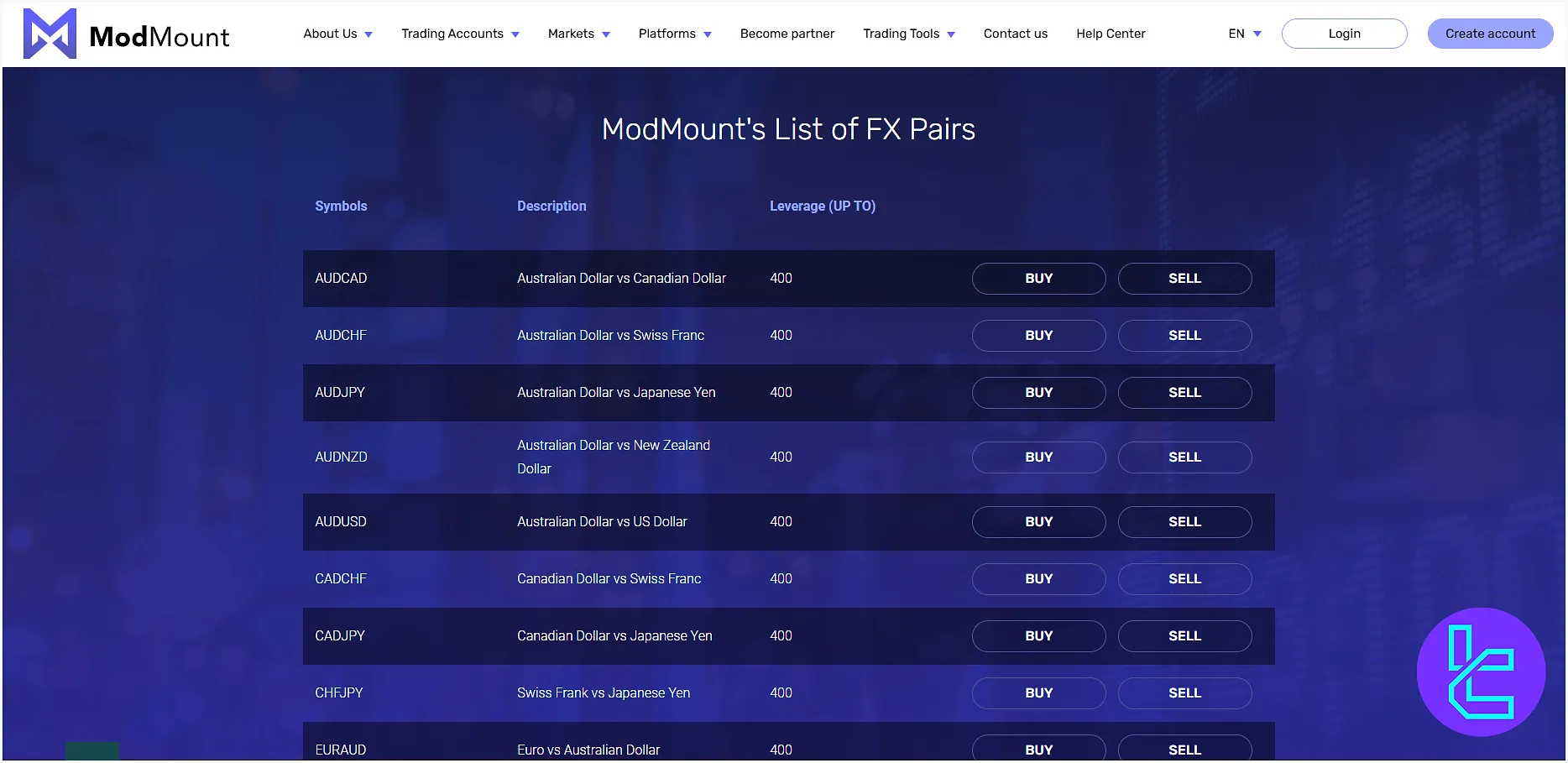

ModMount Trading Instruments

We must discuss the tradable assets in this ModMount review. The company offers 160+ trading instruments across six different asset classes, from the Forex market to stocks and Cryptocurrencies.

Trade FX pairs with leverage options of up to 1:400

Trade FX pairs with leverage options of up to 1:400

All instruments are settled via contracts-for-difference (CFDs), meaning no physical delivery of assets. This structure favors active short- and medium-term traders.

- Forex: 45+ CFDs on major, minor, and exotic currency pairs;

- Indices: 10+ global indices with leverage up to 1:200;

- Crypto: CFDs on 10 of the most popular digital assets, including BTC, BCH, ETH, LTC, XRP, DOGE, DSH, XLM, XMR, and ADA;

- Stocks: 150+ industry giants like Apple and Alibaba with leverage up to 1:5;

- Commodities: 20+ CFDs on energies (e.g., BRENT, USOIL, USCOP, NGAS, and USOIL futures) and agricultural products (e.g., wheat, Corn, and Sugar);

- Metals: Gold, Silver, Palladium, and Platinum.

ModMount Partnership Program

The company offers an attractive partnership program to reward individuals and businesses for referring new clients to the broker.

- Rewards for each successful referral

- Volume-based rebates

- Exclusive programs for top partners

You can use TradingFinder's Rebate Calculator to estimate the exact amount of your earnings.

ModMount Broker Customer Support

The company provides multilingual support through various channels, including email, live chat, and phone calls.

support@modmountltd.com | |

Live Chat | Available on the official website |

Phone | +447701421264 |

Ticket | Through the “Contact Us” page |

Higher-tier accounts benefit from dedicated account managers and priority assistance, improving response times and personalization for active clients.

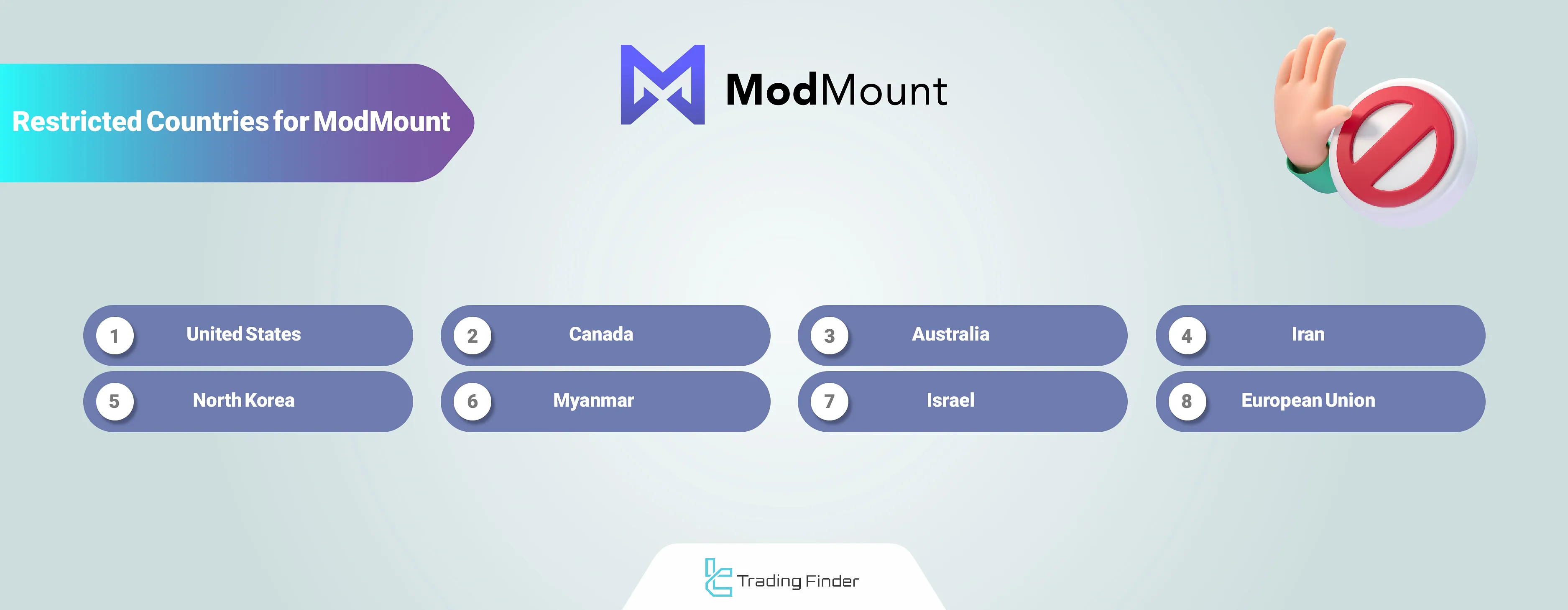

ModMount Geographical Restrictions

You must thoroughly explore the broker’s restricted countries before making a deposit. Furthermore, contact the support team to make sure you’re eligible to use ModMount services. Red flag countries on ModMount:

- United States

- Canada

- Australia

- Iran

- North Korea

- Myanmar

- Israel

- European Union

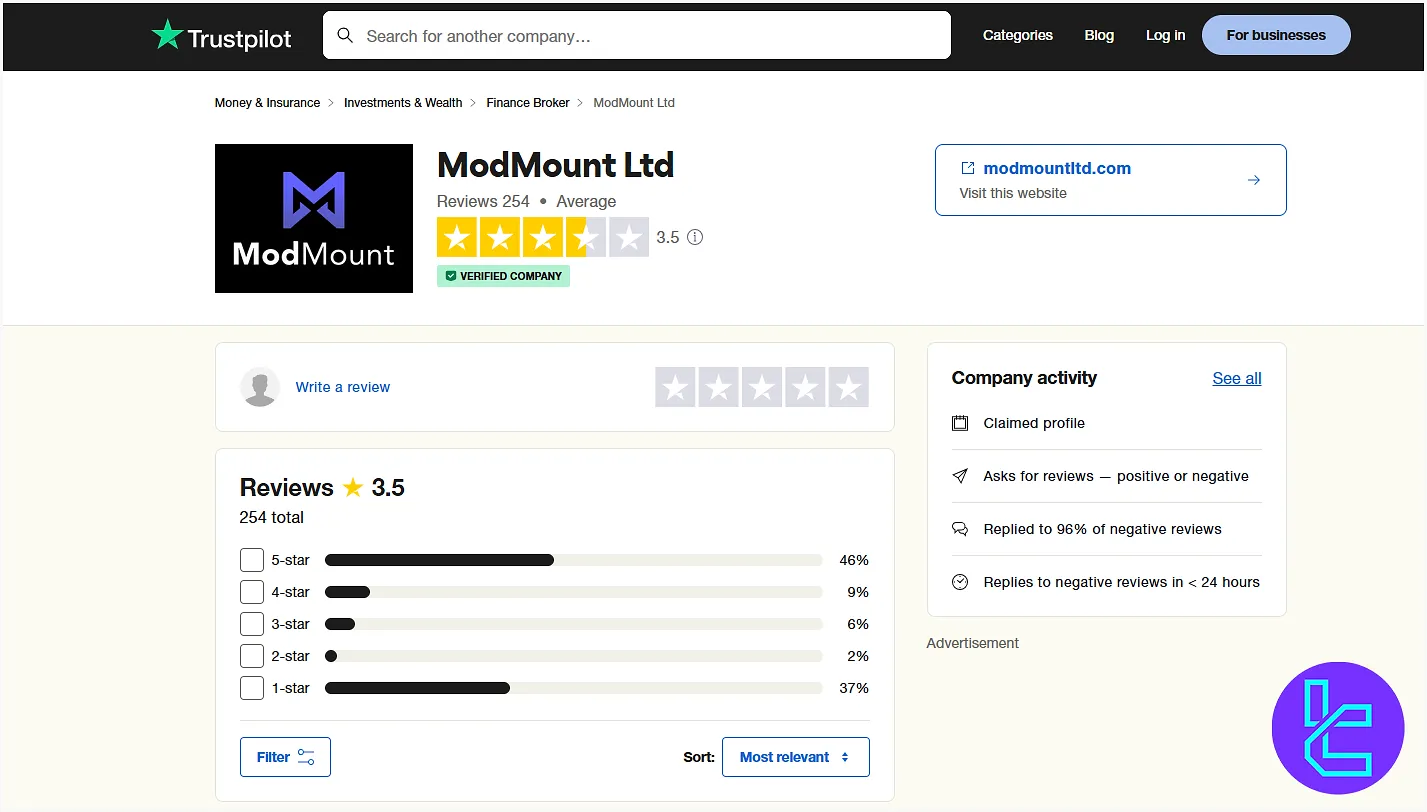

ModMount User Reviews

Trust score is a key element in this ModMount review. User reviews provide valuable insights into a broker's performance and reliability. 254 users have rated the ModMount TrustPilot profile. The broker’s overall score is 3.5 out of 5, with 37% of the reviews being 1-star.

ModMount Broker Educational Materials

The company offers a comprehensive education center and various trading tools like an economic calendar and Trading Central (live signals, technical indicator overlays, and news sentiment insights).

Note that the ModMount education center is only available to registered clients, covering various topics, including:

- Tutorials

- Forex basics

- Strategies

You can also check TradingFinder's Forex education section for additional learning materials.

ModMount vs Other Brokers

Let's check ModMount's standing in the forex trading world in comparison with the top brokers:

Parameter | ModMount Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FSA | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.9 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $250 | $10 | From $0 | $100 |

Maximum Leverage | 1:400 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | WebTrader, Proprietary Mobile/Desktop App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Classic, Silver, Gold, Platinum, VIP | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 160+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

ModMount provides direct and 24/7 access to 160+ trading products across 7 asset classes, including Forex and Crypto. The broker has a score of 3.5 on TrustPilot and doesn’t provide services to US citizens.