Moomoo has started its work at the heart of Silicon Valley, USA. They have expanded their branches in 5 other countries [Singapore, Australia, Japan, Canada, and Malaysia] and has +23M users. Moomoo Broker has won over 100 awards, and its average trading volume exceeded 500 billion dollars.

Moomoo is an American Broker that serves more than 23 million people

Moomoo is an American Broker that serves more than 23 million people

Moomoo Broker Introduction and Regulation

Moomoo Technologies Inc. is a forex broker founded by “Neil McDonald, Nate Palmer, Keith Chan, and Darren Parsons”. Over the past 6 years, Moomoo has signed several cooperation agreements with the most important organizations, including Nasdaq, leading to 23 million people using their services.

But what does this agency have to say in the field of regulation?

- SEC and FINRA in the US

- MAS and SC in Singapore

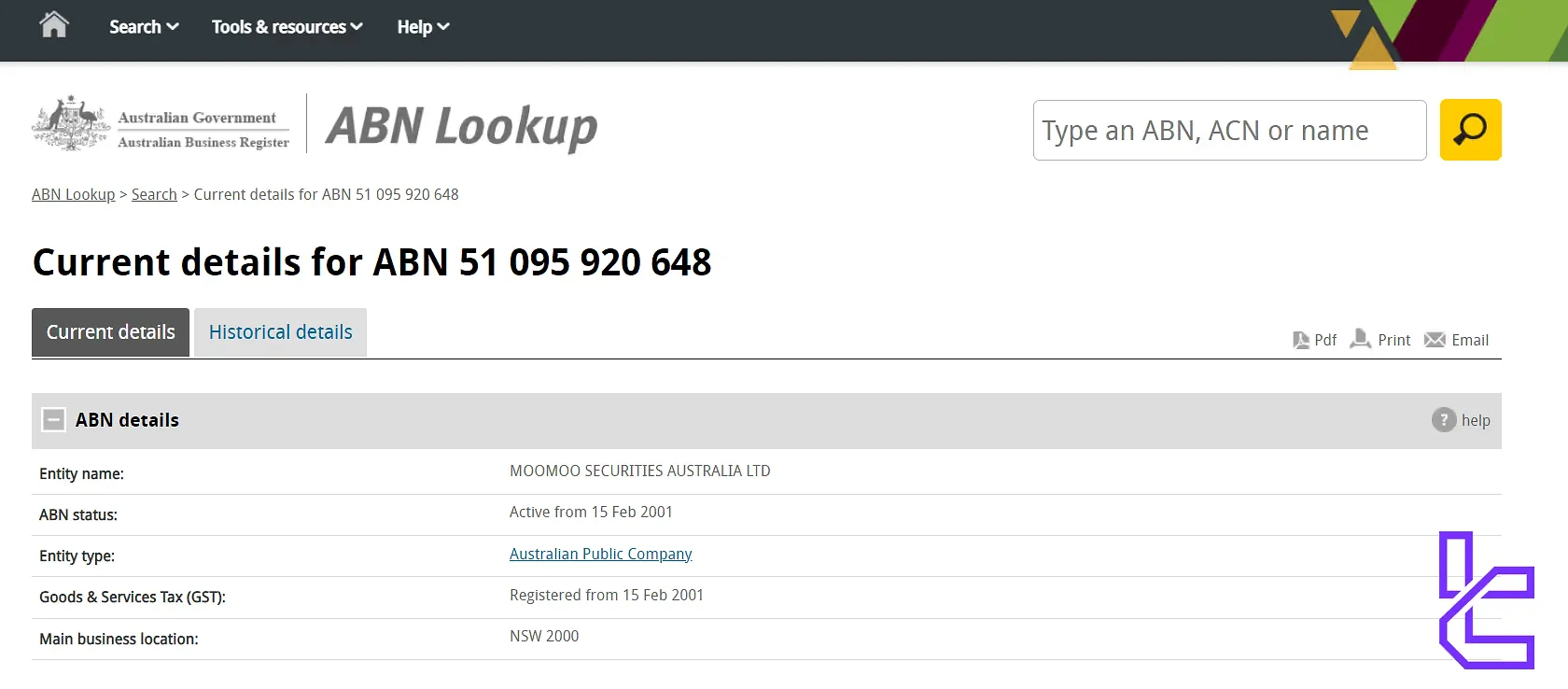

- ASIC in Australia

- CIRO in Canada

- JFSA in Japan

Moomoo Forex Broker ASIC Regulatory License

Moomoo Forex Broker ASIC Regulatory License

The company offers SIPC insurance coverage up to $500,000 per client. In addition, the platform applies robust encryption protocols, two-factor authentication (2FA), and real-time fraud monitoring to safeguard client data and funds.

These protections ensure that users benefit from a secure and fully compliant trading environment.

Summary of Specifications

To give you a clear picture of what Moomoo offers, here's a comprehensive table of specifications:

Broker | Moomoo |

Account Types | Cash, Margin |

Regulating Authorities | SEC, FINRA, MAS, SC, ASIC, CIRO, JFSA |

Based Currencies | USD |

Minimum Deposit | $1 |

Deposit Methods | DDA, Bank Transfer, Wise, BigPay, ACH, Wire Transfer |

Withdrawal Methods | DDA, Bank Transfer, Wise, BigPay, ACH, Wire Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2 for Long Term Position, 1:1.67 for Short Term Position |

Investment Options | Copy Trading |

Trading Platforms & Apps | Proprietary App |

Markets | Stocks, Options, Futures, ETFs, Forex |

Spread | No Information Provided |

Commission | $0 for Stocks, ETFs and Options Trading |

Orders Execution | Market Execution, Day Order |

Trading Features | $0 Commission, Demo Trading, 24/7 Support, Welcome Bonus, 1:2 Maximum Leverage |

Affiliate Program | Yes |

Bonus & Promotions | Welcome Bonus, Referral Program |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Live Chat, FAQ, Phone Call, Email |

Customer Support Hours | 24/7 |

Restricted Countries | Iran, Yemen, Syria, North Korea, Crimea, Iraq, Lebanon, Somalia |

This table showcases Moomoo's competitive offerings, particularly in terms of commission-free trading, advanced market data, and comprehensive research tools. The availability of both cash and margin accounts caters to different risk appetites and trading strategies.

What are Moomoo Broker Account Types?

Moomoo offers just two accounts to cater to different trading styles and risk tolerances; Moomoo account types:

Cash Account

- Full payment for all securities purchases

- No borrowing allowed

- Limited to trading with the available cash balance

- Ideal for conservative investors and beginners

- No risk of margin calls

Margin Account

- Borrowing from the broker to purchase securities

- Enables leveraged trading and short selling

- Higher risk due to potential margin calls

- Suitable for experienced traders comfortable with leverage

Moomoo also features retirement accounts (Traditional and Roth IRAs). While joint accounts are not yet supported, clients can easily monitor performance, receive custom alerts, and manage documentation through the platform.

Pros and Cons

To help you make an informed decision, let's examine the advantages and disadvantages of using this broker. Moomoo advantages and disadvantages:

Pros | Cons |

Commission-Free Trading for US Stocks and ETFs | Limited Account Types |

Access to Chinese A-Shares and Hong Kong Markets | No Mutual Fund Trading Available |

Competitive Margin Rates | Not Ideal for Passive, Long-Term Investors |

High Interest Rates on Cash Balances | Relatively New Platform with Less Track Record |

Advanced Charting and Analysis Tools | Limited Customer Support Hours |

Paper Trading for Practice | No Cryptocurrency Trading |

User-Friendly Mobile and Desktop Apps |

Moomoo shines in its low-cost structure and advanced trading tools, making it an attractive option for active traders, especially those interested in Asian markets. However, its limitations in account types and investment products may not suit all investor profiles.

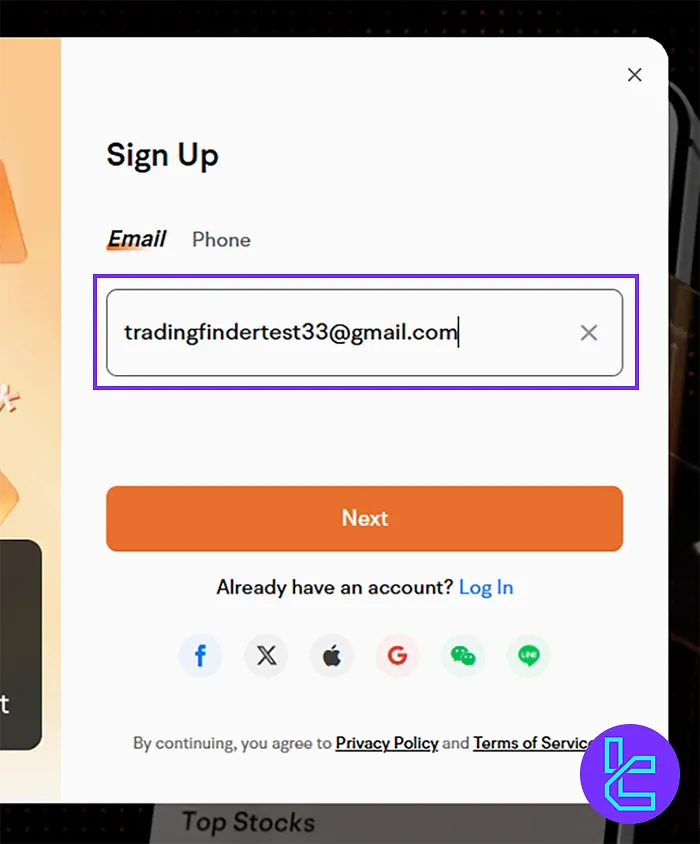

How to Open an Account in Moomoo Broker? Step-by-Step Guide!

Moomoo offers a streamlined registration experience that takes only 2 minutes, making it ideal for traders looking for quick access to global markets. The process emphasizes security and ease of use. Steps to Moomoo registration:

#1 Access the Registration Portal

Go to the Moomoo website, click “Open Account”, and begin the sign-up process.

#2 Enter Your Details

Choose to register with either your email address or phone number. Create a strong password (with uppercase, lowercase, numbers, and symbols), then proceed by clicking “Next”.

Once submitted, you'll need to verify your email or phone to activate your account. After verification, you're ready to proceed with KYC and start trading.

#3 Complete the KYC Procedure

After providing additional information, such as financial profile, address details, and more, you must upload supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

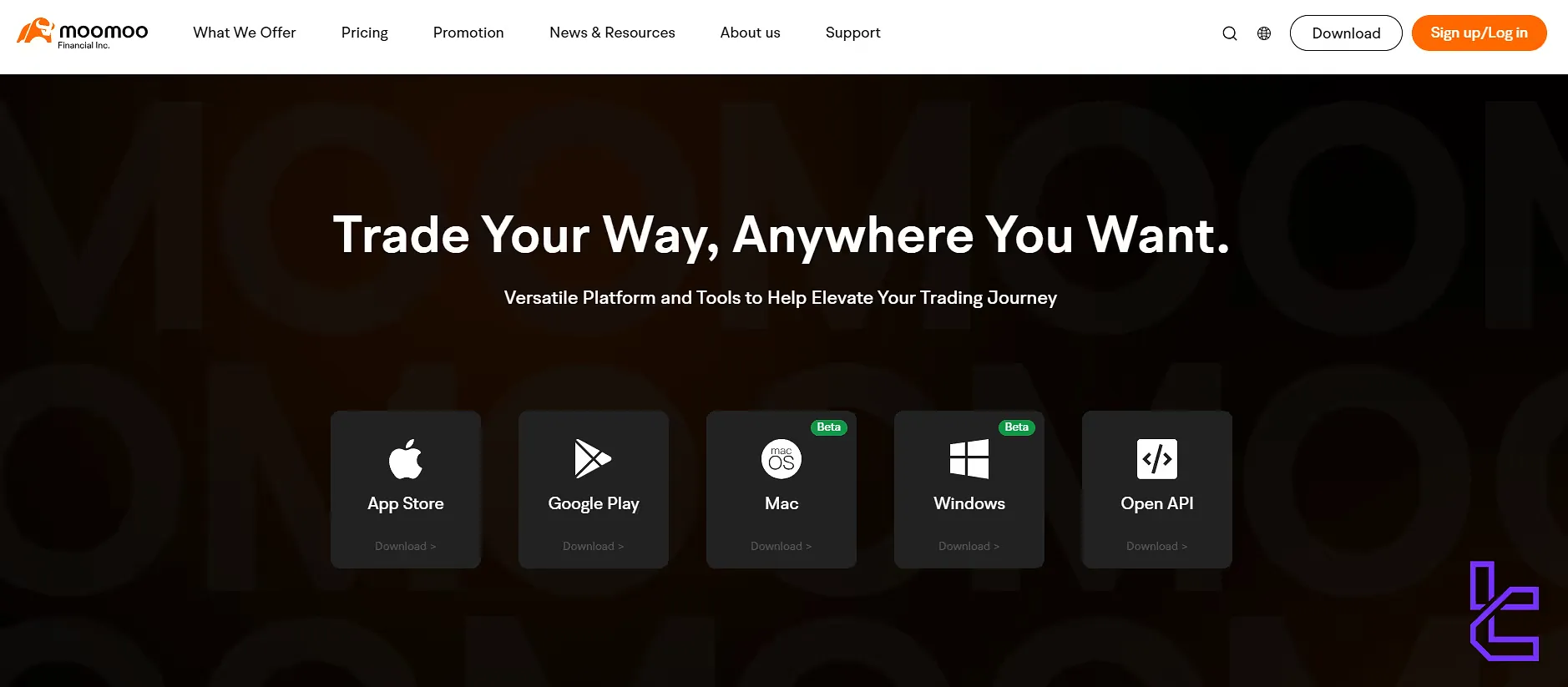

What are Moomoo Trading Platforms?

Moomoo’s cross-platform trading environment is designed for seamless transitions between devices. The desktop platform supports multi-monitor setups, advanced screeners, and real-time Level 2 data.

Moomoo Doesn’t Support Metatrader and Other Trading Platforms and has its own Platform

Moomoo Doesn’t Support Metatrader and Other Trading Platforms and has its own Platform

The mobile app delivers fast trade execution, live analytics, and instant alerts. Whether you’re at your desk or on the go, all devices stay in sync with unified watchlists and trading functionality.

Moomoo Mobile App (iOS and Android)

- User-friendly interface

- Real-time quotes and charts

- Advanced trading tools

- News and market insights

- Paper trading feature

Moomoo Desktop Application (Windows and Mac)

- More comprehensive charting capabilities

- Multi-chart layouts

- Enhanced screening tools

- Customizable workspace

Moomoo Web Platform

- Access from any browser

- Similar functionality to the desktop app

- Ideal for traders who prefer not to download software

All Versions of the Moomoo application have TradingView charts integration and offer API access for algorithmic trading.

TradingFinder has developed various TradingView indicators that you can use for free.

Commission and Fees

In Moomoo reviews, we found out that they offer a competitive fee structure, making it an attractive option for cost-conscious traders. Moomoo Fees:

Category | Pricing |

Commission [Stocks, ETFs, Options] | $0 |

Equity Options Contracts Fees | $0 |

Index Options Contracts Fees | $0.50 Per Contract |

Index Options Proprietary Fees | Varies by Exchanges |

OTC Markets Trading | $0 |

Margin Rates | 6.8% |

Moomoo's zero-commission structure for US stocks and ETFs, combined with free advanced features like Level 2 data, makes it a cost-effective choice for many traders.

With no deposit, withdrawal, inactivity, or annual account fees, the platform minimizes cost barriers for both casual and active traders.

However, it's important to note that while trading might be commission-free, there are still index options contract fees and potential margin interest to consider.

What Payment Methods Does Moomoo Broker Support?

Moomoo offers several convenient payment methods for funding your trading account:

- Direct Deposit Authorization (DDA): Instant deposits for Singapore bank accounts

- Bank Transfer: Supports SGD, USD, and HKD transfers

- Wise (formerly TransferWise): International transfers at real mid-market exchange rates

- BigPay: A Digital payment platform for easy transfers

- ACH Transfer (for US accounts): Free electronic transfer from US banks

- Wire Transfer: Available for larger deposits

Moomoo offers a diverse range of payment methods to cater to different user needs, including instant deposits, international transfers, and traditional bank transfers.

The integration with services like Wise demonstrates Moomoo's commitment to providing cost-effective and convenient funding options for global users.

What Investment Options are Available at Moomoo?

Moomoo supports copy trading as one of the best ways to indirectly invest and earn money from the financial markets. Moomoo copy trading:

- Follow and replicate trades of experienced investors;

- View performance metrics of top traders;

- Customize allocation and risk management;

- Learn from successful trading strategies.

While copy trading can be an attractive option for new investors or those looking to diversify their strategies, it's important to remember that past performance doesn't guarantee future results

What Markets are available to trade in Moomoo?

Moomoo provides clients with access to a diverse range of tradable instruments, including the Forex market, U.S. stocks, ETFs, options, the Futures market, and bonds, with support for cross-border investments in Hong Kong and Singapore.

This global reach enables portfolio diversification across key international markets, appealing to both retail and professional traders.

- Stocks: International stocks from major exchanges (FTSE, NASDAQ, NYSE, etc.) across 34 countries

- Options: US equity index options and Stock options

- Futures: Equity index futures, Commodity futures, and Interest rate futures

- ETFs (Exchange-Traded Funds): A Wide range of sector and index ETFs and International ETFs

- Forex: Major currency pairs, Minor and exotic pairs, and Spot forex trading

Moomoo Support Stock Trading From 34 Countries of the World

Moomoo Support Stock Trading From 34 Countries of the World

Does Moomoo Offers Bonuses and Promotions?

Moomoo offers several attractive bonus promotions to both new and existing customers:

Moomoo Welcome Bonus

- 6% APY on uninvested cash +3.5% APY "Booster Coupon" for first 3 months (total 8.1% APY)

- 5 free stocks for $100+ deposit, 15 free stocks for $1,000+ deposit

- 5% cash match on transfers of $100+ from eligible brokerages (up to $20,000)

Moomoo Referral Promotion

- $100 cash reward ($50 each for referrer and referee) for new account openings with $100+ transfer/deposit

- An additional $50 options trading cash reward for referrals approved for options trading

- 6% APY on uninvested cash for both referrer and referee

Moomoo stands out with high-yield features like an 8.1% APY on uninvested cash through its sweep program. New users can claim promotional offers, including free stock bonuses, and residents of Canada may qualify for additional cash rewards.

How to reach Moomoo Broker Customer Support?

Moomoo provides 24/7 support and has multiple channels for customer support:

- Phone Call: +1-888-721-0610 (English), +1-888-721-0660 (Chinese)

- Email: cs@us.moomoo.com

- Live Chat: Access through the app and website

- FAQ: Comprehensive FAQ section on the website

Moomoo's multi-channel support system ensures that users can get help through their preferred method of communication, enhancing the overall user experience.

Moomoo Restricted Countries

Following international sanctions and various regulatory provisions, Moomoo Broker does not offer its services to some countries in the world, which include:

- Iran

- Yemen

- Syria

- North Korea

- Crimea

- Iraq

- Lebanon

- Somalia

Moomoo Full List of Restricted Countries

Moomoo Full List of Restricted Countries

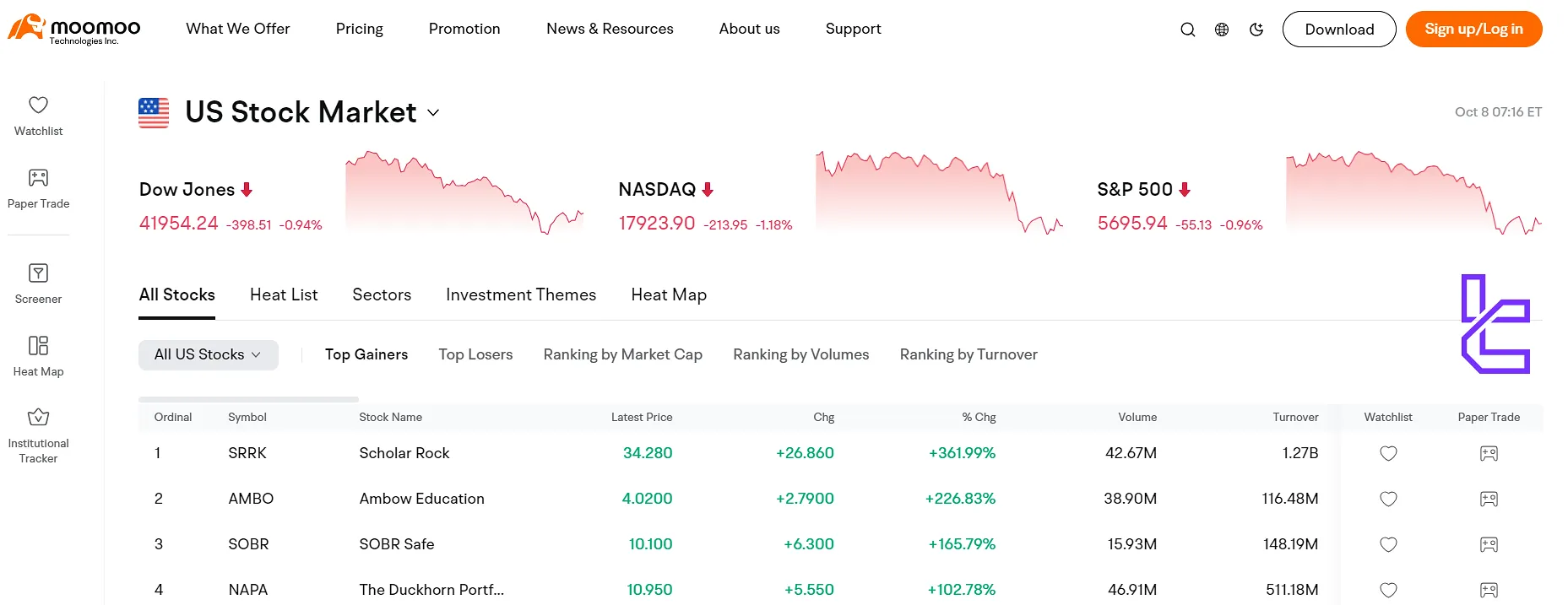

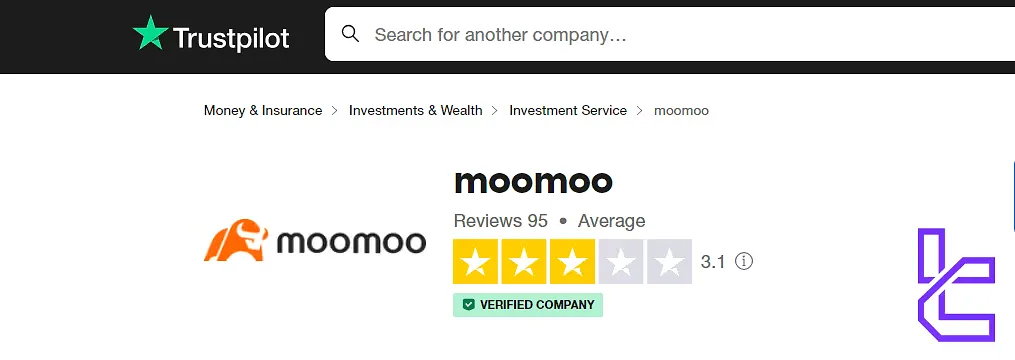

Trust Scores

Moomoo has received an average score in various sources [Trustpilot and Reviews.io] and according to users they are unhappy with some problems.

- Trustpilot: 3.1 out of 5 based on 95 reviews

- Moomoo Reviews.io: 3.2/5

Moomoo's trust score on Trustpilot

Moomoo's trust score on Trustpilot

What are Moomoo Educational Materials?

Educational resources are a core strength of Moomoo. From interactive tutorials and webinars led by market experts to a built-in paper trading simulator, the platform helps users master both trading tools and financial concepts before deploying real capital.

- Learn: Covers stock market basics, trading fundamentals, and investing principles with tutorials and videos;

- Strategies: Provides insights on day trading, swing trading, and long-term investing techniques for different trading styles;

- Guide: Offers platform tutorials to help users navigate Moomoo’s features, including chart analysis, order placement, and customizing the dashboard;

- News: Delivers real-time market updates, financial news, and analyst reports to keep users informed about market trends.

You can also check TradingFinder's Forex education section for additional learning materials.

Moomoo Comparison Table

The table below compares Moomoo's services with other brokerage companies in the market:

Parameter | Moomoo Broker | LiteForex Broker | HFM Broker | FXGlory Broker |

Regulation | SEC, FINRA, MAS, SC, ASIC, CIRO, JFSA | CySEC | CySEC, DFSA, FCA, FSCA, FSA | No |

Minimum Spread | N/A | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | From $0.0 | From $0.0 | From $0 | $0 |

Minimum Deposit | $1 | $50 | From $0 | $1 |

Maximum Leverage | 1:2 | 1:30 | 1:2000 | 1:3000 |

Trading Platforms | WebTrader, Proprietary Mobile/Desktop App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Cash, Margin | Classic, ECN, Demo | Cent, Zero, Pro, Premium | Standard, Premium, VIP, CIP |

Islamic Account | No | No | Yes | Yes |

Number of Tradable Assets | N/A | N/A | 1,000+ | 45 |

Trade Execution | Market, Instant | Market | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Instant |

Trading Finder Expert Final Words

$1 minimum deposit, 1:2 maximum leverage, $0 commission and 0.01 lots minimum order are just some of the features of MooMoo broker. This broker has 2 account types [Cash, Margin] and copy trading is available in both of them. It also offers welcome bonus to new traders.