NSFX is a MFSA-regulated broker offering CFD trading with floating and fixed spreads from 0.02 pips, as well as Forex trading with a commission of $9 per lot. NSFX broker provides these services through MT4 and JForex trading platforms.

While the minimum deposit requirement for a Fixed Spread account is $300, JForex requires a minimum of $3,000 offering leverage options of up to 1:30.

NSFX (Company Information and Regulation)

NSFX Ltd. is a brand name of Alchemy Markets Ltd, registered in Malta (Company Registration Number: C56519).

Founded in 2004 and based in Malta, the broker previously maintained FCA registration in the UK. This license has since been revoked, and its regulatory compliance now solely depends on the MFSA’s jurisdiction.

NSFX; a broker with negative balance protection and segregated client funds

NSFX; a broker with negative balance protection and segregated client funds

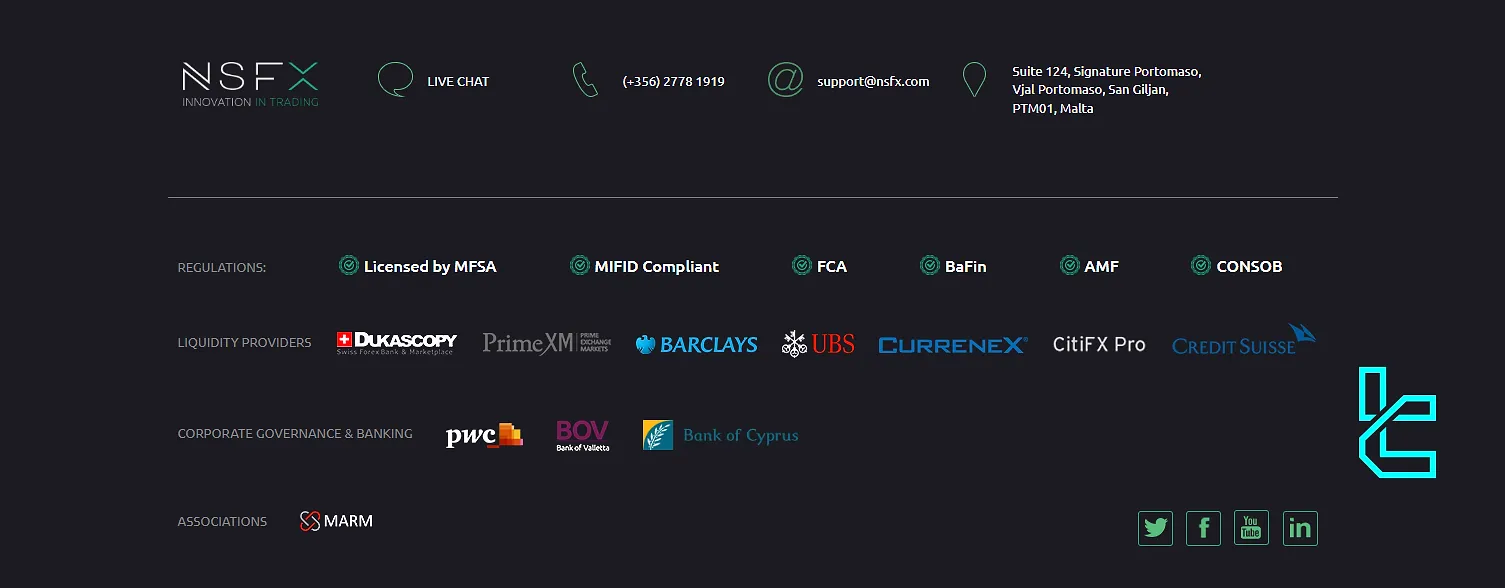

The broker is licensed by the Malta Financial Services Authority (License Number IS/56519). Key features of NSFX:

- Regulated by MFSA as a Category 3 investment services provider

- Previously held licenses from FCA, BaFin, and AMF

- Compliance with the European Securities and Markets Authority (MiFID)

- Directed by John Cassar Torreggiani

- ECN and STP technology

- Founded in 2012

NSFX Table of Specifications

To see if NSFX can fit among the top Forex brokers, let's examine a detailed Table of Specifications, including account types, leverage options, and many more.

Broker | NSFX |

Account Types | ECN, Fixed Spread, JForex |

Regulating Authorities | MFSA, MiFID |

Based Currencies | USD, GBP, EUR |

Minimum Deposit | $300 |

Deposit Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Withdrawal Methods | VISA, MasterCard, Maestro, Bank Wire, Skrill, Neteller, Fast Bank Transfers |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | None |

Trading Platforms & Apps | MT4, JForex |

Markets | Forex, Indices, Metals, Energies |

Spread | Variable based on the account type and instrument |

Commission | Variable based on the instrument |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Mobile Trading, Trading Analysis, Academy, eBooks |

Affiliate Program | Yes |

Bonus & Promotions | Partnership |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, Phone |

Customer Support Hours | Market Hours |

NSFX Account Type Offerings

The broker caters to a diverse range of traders with its three distinct account types: ECN, Fixed Spread, and JForex.

Features | ECN | Fixed Spread | JForex |

Base Currency | USD, EUR, GBP | USD, EUR, GBP | USD, EUR, GBP |

Min Deposit | $1,000 | $300 | $3,000 |

Leverage | 1:30 | 1:30 | 1:30 |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Platform | MT4 | MT4 | Proprietary Platform |

All accounts grant access to 50+ currency pairs, indices, and commodities. A $100,000 demo account is also available for practice trading.

NSFX Advantages and Disadvantages

Working with some top-tier liquidity providers like UBS, CitiFX Pro, and Dukascopy adds a layer of credibility to the broker.

However, to have a balanced view of NSFX's offerings, we must examine the downsides, too.

Pros | Cons |

Advanced proprietary JForex trading platform | Low leverage options (1:30) |

Utilizing ECN technology | Lack of licensing from tier-1 authorities |

A wide range of payment options | Limited trading platform offerings |

Negative balance protection | Relatively high minimum deposit ($300) |

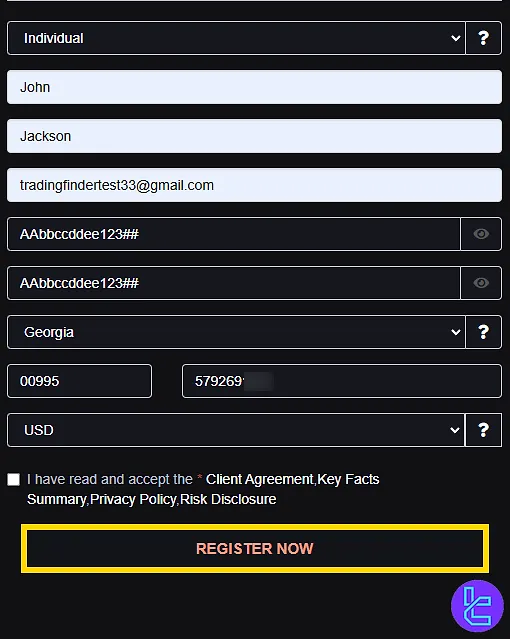

NSFX Broker Registration and Verification

The NSFX registration process is simple and takes about 4 minutes. Traders need to enter personal information, choose an account type, and verify their email address to gain access to the trading dashboard.

#1 Begin the Sign-Up on NSFX Website

Go to the NSFX homepage and click “Open Live Account” to start the registration process.

#2 Enter Personal & Account Information

Fill in your personal information, including:

- First and last name

- Password

- Country

- Phone number

Choose your account type and base currency, agree to the terms, and click “Register Now”.

#3 Verify Email & Log In

Open the confirmation email from NSFX and click “Confirm Email Address”. Then return to the website, log in using your credentials, and access the NSFX dashboard.

#4 Complete the KYC Procedure

For full trading access, complete the KYC verification steps by providing additional information and supporting documents, including:

- Proof of Identity: Passport or Driver's license

- Proof of Address: Bank statement or Utility bill

- Proof of Funds: Aphoto of your credit card (if you choose to make a deposit using this method)

NSFX Trading Platforms

We must discuss trading platforms in this NSFX review. The company utilizes two main trading solutions: MetaTrader 4 and a proprietary mobile/web application.

Note that in the broker website’s latest update, the MT4 platform is not mentioned. However, it’s still mentioned in the company’s documents.

TradingFinder has developed various advanced MT4 indicators that you can use for free

NSFX Fees and Commissions

While the broker has a transparent approach to the fee structure, the rates are hardly competitive. Note that the company offers pretty high spreads and commissions compared to its competitors.

Asset Class | Commission (Per lot) | Fixed Spread (Pips) | Avg. Spread (Pips) |

Forex | $9.0 | 3.00 | N/A |

Metals | $9.0 | 0.60 Gold 0.02 Silver | 0.24 Gold 0.022 Silver |

Energies | $0.9 | 0.12 US Oil 0.15 UK Oil | 0.121 US Oil 0.145 UK Oil |

Indices | 0.05% | 6.0 Nasdaq 2.0 S&P 500 | 1.60 Nasdaq 0.41 S&P 500 |

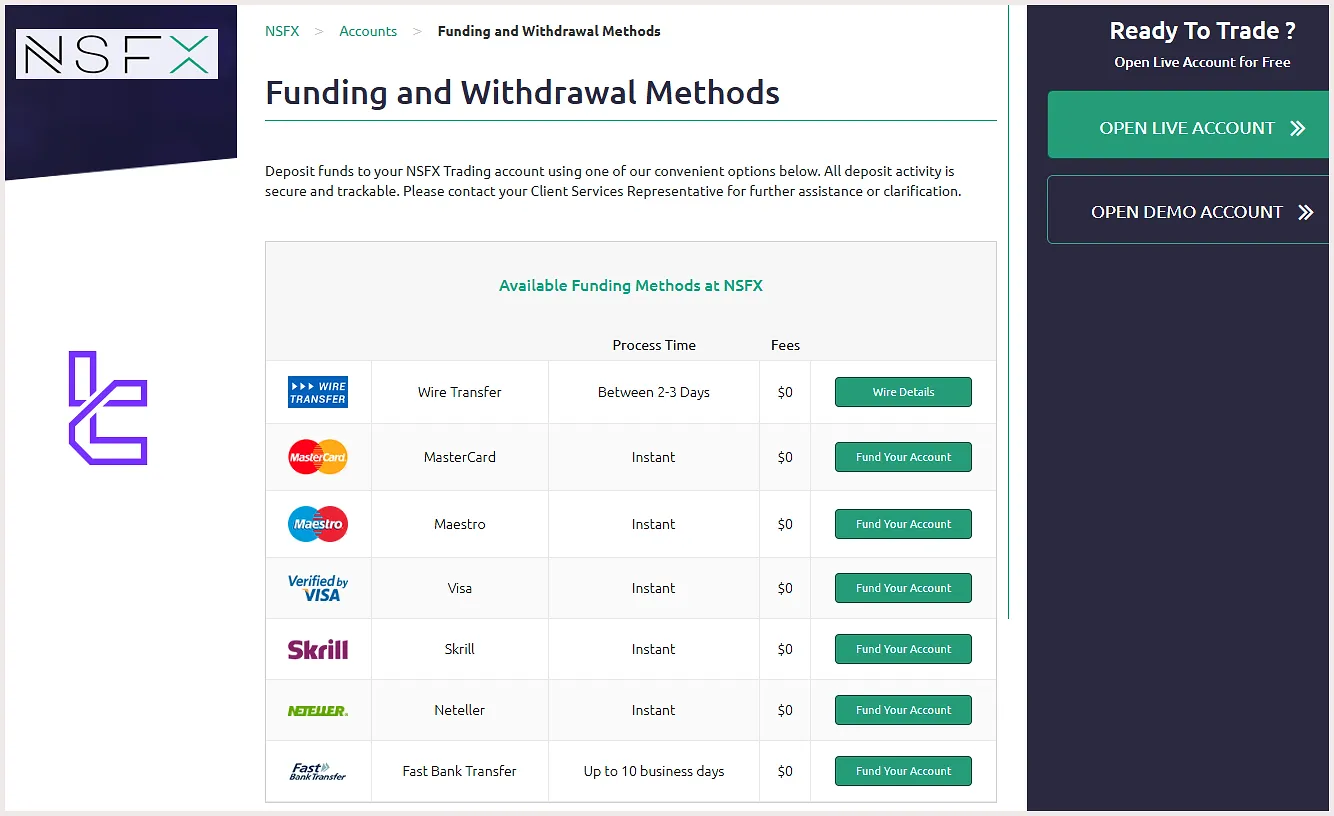

NSFX Broker Payment Methods

NSFX offers diverse funding options, including cards (Visa, MasterCard), e-wallets (Skrill, Neteller),and wire transfers.

- Deposits are processed instantly with no fees

- Withdrawals are free except for Skrill and Neteller (2.9% fee)

- Funds typically settle within 1 to 2 business days, depending on the method

NSFX Deposit and Withdrawal Limits and Processing Time

Method | Deposit Process | Deposit Fee | Withdrawal Process | Withdrawal Fee |

Bank Wire | Between 2-3 Days | $0 | Up to 2 Business days | $0 |

MasterCard | Instant | $0 | Up to 1 Business day | $0 |

VISA | Instant | $0 | Up to 2 Business days | $0 |

Maestro | Instant | $0 | Up to 1 Business day | $0 |

Skrill | Instant | $0 | Up to 1 Business day | 2.9% |

Neteller | Instant | $0 | Up to 1 Business day | 2.9% |

Fast Bank Transfer | Up to 10 business days | $0 | Up to 2 Business days | $0 |

Copy Trading and Investment Plans on NSFX

Offering features that enable traders to earn passive income is considered a plus point in the NSFX review. While the company does not offer an exclusive copy trading feature or structured investment plans, it supports the use of EAs.

Expert Advisors enable you to automate the trading process and earn profits by utilizing trading bots.

NSFX Trading Instruments

The broker also falls short in regard to financial markets, as it provides a limited list of trading assets (50+) across four asset classes, from the Forex market to metals and indices.

- Forex: 40 major, minor, and exotic currency pairs

- Metals: Two precious metals, including Gold and Silver

- Energies: CFDs on two energy symbols, including WTI and Brent

- Indices: CFDs on eight major global indices, including S&P 500, Dow Jones, NASDAQ, and Nikkei 225

While equities, cryptocurrencies, and derivatives like options or futures markets are not available, the broker focuses on delivering optimal conditions in its core asset classes.

NSFX Bonus and Promotional Plans

While the broker does not offer traditional bonuses or promotional plans for individual traders, they do have a comprehensive partnership program. Key features of the NSFX affiliate program:

- Commissions as CPA and revenue share

- Sub affiliate program

- Monthly payouts

- Exclusive marketing materials

NSFX Broker Support Channels

The company provides support only during market hours. Services are available in five different languages, including English, Spanish, German, French, and Italian. NSFX customer support:

support@alchemymarkets.eu | |

Phone Call | (+356) 2033 0355 |

Live Chat | Available on the official website |

The multilingual interface enhances accessibility for a broad international client base.

Red Flag Countries on NSFX

NSFX maintains a list of "red flag" countries from which they cannot accept clients due to regulatory restrictions or internal policies, including:

- United States

- Singapore

- Japan

- United Kingdome

- Russia

- Iran

- China

- North Korea

- Canada

- Congo

- Cuba

- Iraq

- Syria

- Sudan

- Ukraine

- Yemen

NSFX Trust Scores and Reviews

User satisfaction is one of the most important topics in this NSFX review. The company’s profiles on review websites don’t have many comments.

3.1 out of 5.0 based on three ratings | |

Forex Peace Army | 3.5 out of 5.0 based on seven comments |

NSFX Educational Content

The broker demonstrates a strong commitment to trader education through its comprehensive NSFX Academy, which offers four main resources.

- A step-by-step video course covering basic to advanced Forex concepts

- Personalized 1-on-1 training sessions

- Downloadable eBooks and real-time market analysis

- Interactive tools like quizzes, polls, and daily economic calendars

The “Fun Corner” adds a unique gamified experience to engage users beyond trading.

You can check TradingFinder's Forex education section for additional resources.

NSFX Comparison Table

Here is a detailed comparison between NSFX and the top forex brokers:

Parameter | NSFX Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | MFSA, MiFID | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 3.0 Pips on Forex | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $9.0 on Forex | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $300 | $200 | $5 | $50 |

Maximum Leverage | 1:30 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | MT4, JForex | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | ECN, Fixed Spread, JForex | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 50+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market, Instant | Market | Market, Instant | Market |

Conclusion and Final Words

NSFX utilizes ECN and STP technologies via its proprietary platform, JForex, and the robust MetaTrader 4. NSFX broker supports Neteller, Skrill, and Credit/Debit Cards transactions and Gold trading with spreads from 0.24 pips and a fixed commission of $9.

We also mentioned in this NSFX review that the company doesn’t accept clients from the USA and the UK, alongside 14 other countries. The broker has a rating of 3.1 on TrustPilot, which is considered an average score. If you’re not from the restricted countries, complete the NSFX registration and enjoy trading EURUSD with spreads from 1.1 pips.