Saxo Bank offers access to 71,000 trading instruments with floating spreads from 0.4 pips and no minimum deposit requirements.

The broker was titled the Best prime-of-prime house 2022 by FX Week. The company provides free trading signals through its Saxo Trader Go platform.

Saxo Bank (Broker Information)

Saxo Bank is a fully licensed and regulated Danish investment bank that has been operating since 1992. Today, the broker manages more than €100 billion in client assets.

Saxo Bank was founded by Kim Fournais in Copenhagen in 1992

Saxo Bank was founded by Kim Fournais in Copenhagen in 1992

With over 30 years of experience in the financial industry, the broker has built a strong reputation for providing high-quality trading services to more than 1.2 million clients worldwide. Key features of Saxo Bank:

- Over 71,000 financial products across global markets

- Regulated by multiple financial authorities, including FINMA, the Danish FSA, ASIC, and FCA

- Partners with more than 200 banks and brokers

- Awards like “Best Trading Platform 2024”, “Best FX prime 2024”, and many more

- Offices in 15 countries

- Over $100B in client assets

It is a licensed bank, regulated by a total of seven Tier-1 authorities, including the FCA (UK), ASIC (Australia), MAS (Singapore), SFC (Hong Kong), JFSA (Japan), FINMA (Switzerland), and MiFID-compliant bodies across the EU.

Saxo also complies with DFSA’s Pillar II capital requirements and maintains €20 million in regulatory capital reserves.

Saxo expanded its European presence in 2018 through the €428 million acquisition of BinckBank, seamlessly migrating its client base.

With access to over 50 global exchanges and a diverse lineup of instruments, including stocks, ETFs, mutual funds, bonds, and advanced derivatives, Saxo Bank caters to both traditional investors and experienced traders seeking sophisticated tools and global exposure.

As a licensed bank, Saxo offers security and stability that sets it apart from many other online brokers. This combination of extensive product offerings, cutting-edge technology, and institutional-grade security makes the company one of the top Forex brokers.

Saxo Bank Table of Specifications

The company launched its online trading platform in 1998, one of the first in Europe. Today, it provides trading services in more than 180 countries. Key specifics of Saxo Bank broker:

Broker | Saxo Bank |

Account Types | Classic, Platinum, VIP, Pro |

Regulating Authorities | FSA, ASIC, FCA, FINMA, MAS, SFC, JFSA |

Based Currencies | AUD, CAD, CHF, EUR, GBP, HKD, JPY, USD, SGD, ZAR, SEK, PLN, NZD, NOK, HUF, CZK, DKK, CNH |

Minimum Deposit | $0.0 |

Deposit Methods | Bank Wire, Credit/Debit Cards |

Withdrawal Methods | Bank Wire, Credit/Debit Cards |

Minimum Order | Variable based on the instrument |

Maximum Leverage | 1:66 |

Investment Options | Stock Lending, Account Interest Rate |

Trading Platforms & Apps | Saxo Investor, SaxoTrader Go, SaxoTrader Pro |

Markets | Forex, Commodities, Indices, Metals, Shares, Futures, CFDs, Options, Crypto, ETFs |

Spread | Floating from 0.4 pips |

Commission | Variable based on the asset class |

Orders Execution | Market, Limit, Stop |

Margin Call/Stop Out | Variable based on the user level |

Trading Features | Economic Calendar, Passive income, Educational Materials, Affiliate |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Phone, Email, Live Chat, Ticket |

Customer Support Hours | 24/5 |

Account Offerings

Saxo Bank provides five main account types to suit different trader profiles, including Individual, Joint, Corporate, Professional, and Demo.

As their names suggest, a Joint account is shared between first-line family members, and a Corporate account is suited for legal entities and firms. Both these account types have a minimum deposit of $50,000.

But our primary focus is on the Individual and Pro accounts, which are basically the same, with some differences. Pro clients don’t experience the same regulatory protections that are designed for less experienced traders. They also take advantage of the portfolio-based margin model.

Individual account is an all in one solution to access more than 71,000 financial instruments with no minimum deposit. It’s also known as the Saxo account. Key features of Saxo accounts:

Account Types | Min Deposit | Max Leverage | Base Currency | Order Execution |

Classic | $0.0 | 1:30 | AUD, CAD, CHF, EUR, GBP, HKD, JPY, USD, SGD, ZAR, SEK, PLN, NZD, NOK, HUF, CZK, DKK, CNH | Market, Limit, Stop |

Platinum | $200,000 | 1:30 | ||

VIP | $1,000,000 | 1:30 | ||

Pro | $500,000 | 1:66 |

Advantages and Disadvantages of Trading with Saxo Bank

Saxo offers a robust trading environment with access to global markets and advanced tools. However, its complex offerings and tiered pricing structure may better suit more experienced traders or those with larger account balances.

Pros | Cons |

Wide range of tradable assets | Higher fees for smaller accounts |

Advanced trading platforms | Complex platforms may be overwhelming for beginners |

Strong regulatory oversight | Limited cryptocurrency offerings |

Competitive pricing for high-volume traders | No US clients accepted |

Account Opening and Verification

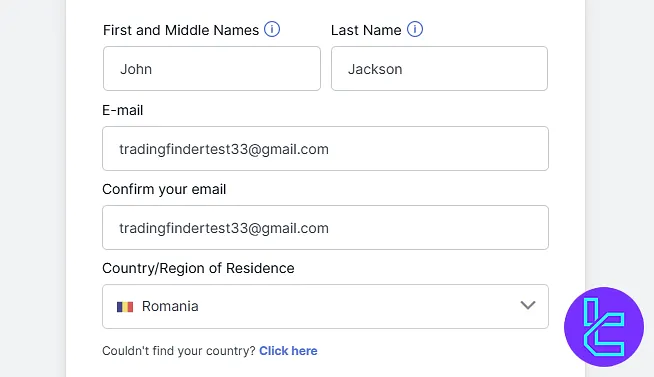

The Saxo Bank registration process grants you access to its global multi-asset trading platform, including forex, stocks, ETFs, and derivatives. Completing your account takes about 10 minutes and complies with KYC, AML, and MiFID II standards.

Steps to

#1 Access the Saxo Bank Website

Begin by visiting the official Saxo Bank website. Locate and click on the “Open Account” button at the top right of the homepage to launch the sign-up form.

#2 Provide Basic Information

In the initial form, enter your personal information, including:

- First name

- Last name

- Email address

- Country of residence

Confirm you are not a robot and proceed to the next stage.

#3 Verify Personal Identity

You’ll now be asked to provide the following information:

- Gender

- Date of birth

- Mobile phone number

This helps verify your identity and enables SMS-based 2FA for future login security.

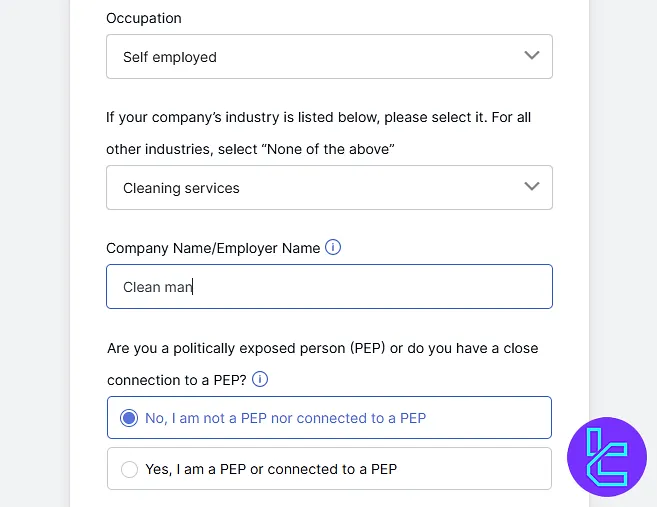

#4 Share Employment & Financial Profile

To meet regulatory requirements, disclose your financial profile:

- Current occupation

- Industry

- Employer name

- Annual income

- Source of funds

- Expected deposit amount

- Account base currency (e.g., USD, EUR)

#5 Indicate Trading Experience

Define your experience with trading instruments (e.g., forex, stocks, options) and indicate how frequently you trade monthly. Explain your familiarity with leveraged products and select the main reason for opening this account (e.g., investing, speculation).

#6 Enter Nationality and Passport Data

Provide your nationality and the passport number associated with your primary identification document. You’ll also need to declare if you hold U.S. citizenship or tax residency.

#7 Submit Tax Residency Details

List your tax residency country and input your Tax Identification Number (TIN). If applicable, you may need to include additional jurisdictions where you are a tax resident, as well as your country of birth.

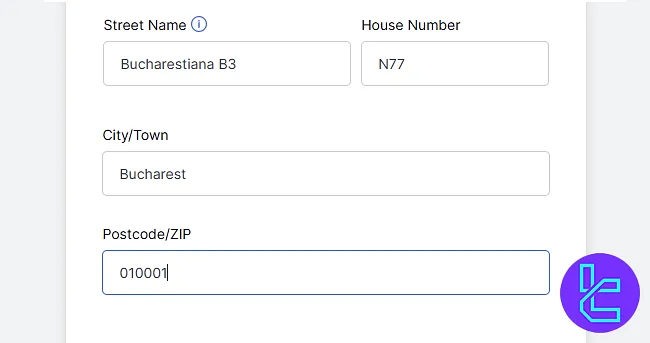

#8 Input Residential Address

Type in your full residential address, including:

- Street name

- Building or apartment number

- Postal code

- City

This is used for regulatory location checks and correspondence.

#9 Create Login Credentials and Verify

Finally, set a secure password that includes upper/lowercase letters, numbers, and symbols. Then enter the SMS verification code sent to your mobile number. Accept the terms and finalize your account setup.

#10 Complete the KYC Procedure

Now that you have access to the Saxo Bank client dashboard, you must upload KYC documents, including:

- Proof of Identity: Passport or Driving license

- Proof of Address: Utility bill or Bank statement

Saxo Bank broker aims to verify most accounts within 24 hours, though complex cases may take longer. The bank's strong regulatory compliance means thorough checks are conducted to ensure the safety and integrity of the platform.

Saxo Bank Trading Platforms

The broker offers two main trading solutions and a desktop-only app extension catering to novice and advanced traders.

- Saxo Trader GO: A robust, all-in-one platform for desktop (web trader) and mobile with 60+ indicators, Autochartist integration, synchronized watchlists, and full market research

- Saxo Trader PRO: A professional-grade terminal designed for advanced traders, supporting multi-monitor setups and algorithmic workflows

- Saxo Investor: A simplified, beginner-friendly platform for buy-and-hold investing and themed portfolios

The platforms are compatible with various operating systems.

Operating System | Saxo Investor | Saxo Trader Go | Saxo Trader Pro |

Windows | No | No | Yes |

macOS | No | No | Yes |

Android | No | ||

iOS | No | ||

Web | Yes | Yes | Yes |

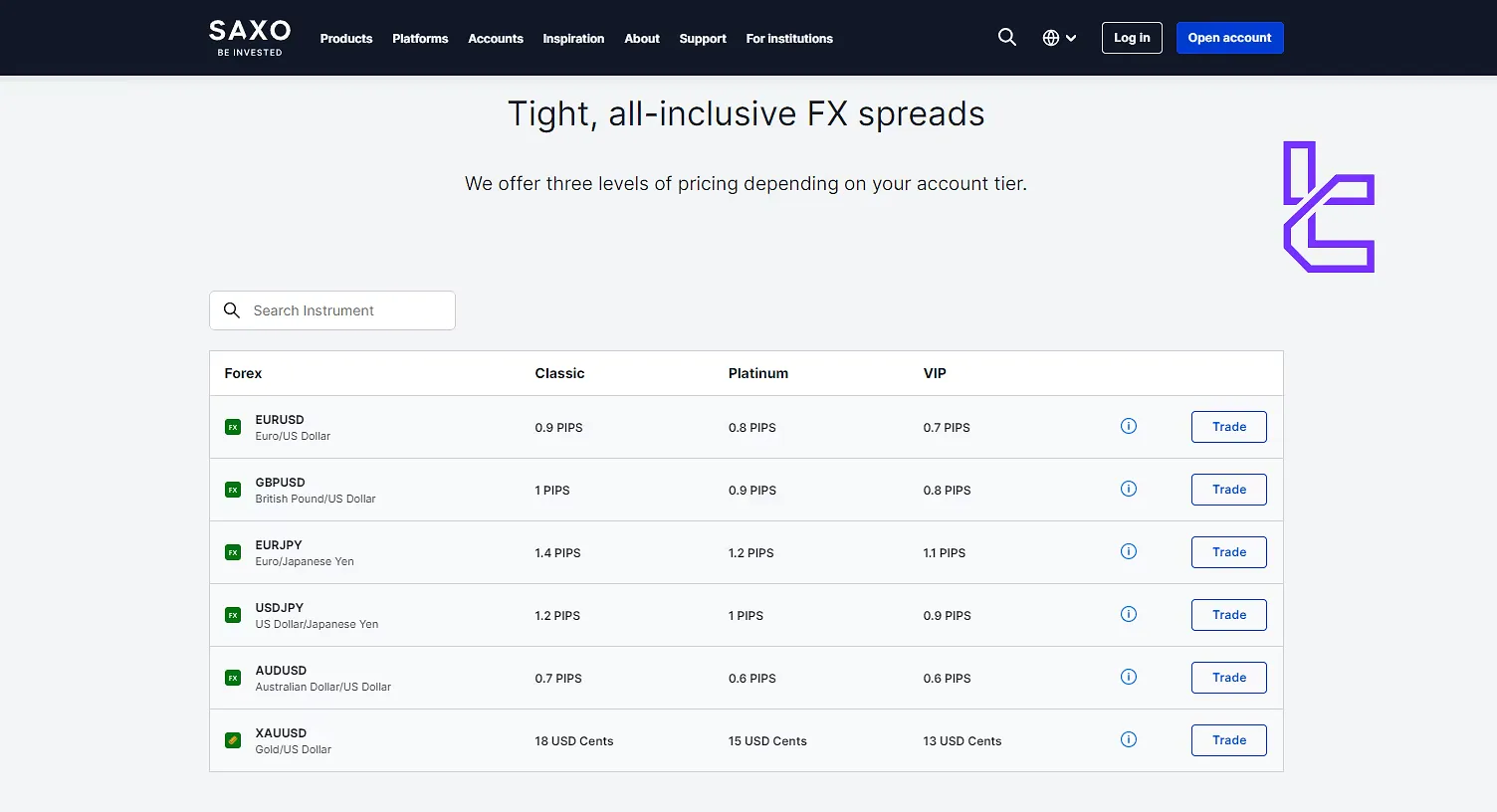

Trading Fees (Commission and Spread)

Saxo Bank's pricing structure varies depending on the account tier and traded instrument.

Account Type | Spread |

Classic | From 1.2 pips |

Platinum | From 0.7 pips |

VIP | From 0.7 pips |

Professional | From 0.4 pips |

Commissions are charged based on the type of instrument you’re trading.

Asset Class | Commission |

Forex | $0.0 |

Stocks | From $1.0 |

Futures | From $1.0 |

Options | From $0.75 |

ETFs | From $1.0 |

Bonds | From 0.05% |

Mutual Funds | $0.0 |

Note: Forex trades are commission-free unless monthly volume is under 50,000 units, in which case a $3 ticket fee applies per side.

The broker charges no commissions for deposits, withdrawals, or inactivity. However, there is a 100 EUR account termination fee, and you should also pay a 0.25% commission for currency conversion.

Note: While VIP account holders enjoy a reduced custody fee of 0.08%, Classic and Platinum accounts are subject to a 0.12% rate.

Saxo Bank Broker Payment Methods

The next subject to discuss in this Saxo Bank review is the available payment method. The broker supports various deposit/withdrawal methods to cater to different needs.

- Bank Transfer

- Credit/Debit Cards

- Quick payment (Danish Banks)

Deposits are typically processed quickly, with most electronic methods being instant. Withdrawals may take 1-3 business days to process. It's worth noting that Saxo Bank does not charge fees for deposits or withdrawals, though your bank may apply charges.

Does Saxo Bank Offer Copy Trading and Growth Plans?

While the broker doesn’t offer an exclusive copy trading service, it provides trading signals free of charge on the Saxo Trader Go platform. It also offers various growth and investment plans, including:

- Stock Lending: Lend your stocks and ETFs to earn interest rates;

- Account Interest Rate: Earn daily interest on your uninvested capital.

Financial Instruments on Saxo Bank Broker

The company offers an extensive range of financial instruments (more than 71,000) across 9 asset classes, from the Forex market to Crypto assets and Futures contracts.

- Stocks: Over 22,000 stocks from 50+ global exchanges like New York, London, and Hong Kong

- ETFs: Access to thousands of ETFs from major sectors, such as tech, health care, and many more

- Forex: Futures, spot, and options on 180+ currency pairs

- CFDs: Indices, commodities, stocks, and more

- Options: Listed options on major indices and stocks

- Futures: Access to global futures markets

- Bonds: Government and corporate bonds from 26 countries

- Cryptocurrencies: Limited offering of major cryptocurrencies

- Commodities: Precious metals, energy, and agricultural products

This extensive coverage supports sophisticated diversification for both retail and professional investors.

Bonus and Promotion plans

The broker offers a loyalty program called "Saxo Rewards", which we should discuss in this Saxo Bank review. Earn points for every qualifying trade and upgrade your user level.

User Level | Points | Features |

Classic | 0.0 | 24/5 support |

Platinum | 120,000 | Up to 30% lower prices, priority customer support |

VIP | 500,000 | Best prices, 24/5 access to trading experts, exclusive event invitations |

Additionally, Saxo Bank has an affiliate program that you can join to earn up to 1000 AUD from each referred client.

Referred client | Commission for each client |

VIP | $1000 |

Platinum | $600 |

Classic | $200 |

How to Reach Saxo Bank Broker Customer Support?

The brokerage company provides 24/5 multilingual support through several contact channels, including:

Phone | +61 2 8267 9000 |

PrivateSalesAU@saxomarkets.com | |

Live Chat | On the client dashboard |

Ticket | Through the client dashboard |

Restricted Countries

We must explore geo-restrictions on this Saxo Bank review.

Due to regulatory restrictions, the broker does not provide services to residents of certain countries, including:

- United States

- Japan

- Cuba

- Iran

- North Korea

- Sudan

- Syria

Saxo Bank Reviews (Trust Scores)

The broker generally receives positive reviews from clients and industry experts for its extensive product offerings and advanced trading platforms. However, there are many complaints about the complex fee structure and limited cryptocurrency offerings. Saxo Bank Broker trust scores:

3.8 out of 5 based on 6,277 reviews | |

Forex Peace Army | 2.2 out of 5 based on 83 reviews |

Educational Materials

The last agenda on this Saxo Bank review is to discuss the broker’s educational content. The company offers a comprehensive suite of educational resources, including:

- Video tutorials: Step-by-step guides on using the trading platforms

- Webinars: Regular sessions on market analysis and trading strategies

- Trading courses: In-depth lessons on various financial instruments

- Market analysis: Daily insights and commentary from Saxo's research team

- Economic calendar: Upcoming economic events and their potential market impact

Check TradingFinder's Forex education and Crypto tutorials to access additional learning materials.

Saxo Bank vs Other Brokers

The table below provides an overview of Saxo Bank's features compared to other platforms.

Parameter | Saxo Bank Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FSA, ASIC, FCA, FINMA, MAS, SFC, JFSA | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.4 pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | From $0.0 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $0 | $200 | $5 | $50 |

Maximum Leverage | 1:66 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | Saxo Investor, SaxoTrader Go, SaxoTrader Pro | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Classic, Platinum, VIP, Pro | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | No | Yes | Yes | No |

Number of Tradable Assets | 71,000+ | 2,250+ | 1400+ | N/A |

Trade Execution | Market, Instant | Market | Market, Instant | Market |

Conclusion and Final words

Saxo Bank is an ASIC-regulated broker providing access to Forex/CFDs trading alongside a dedicated trading platform, Saxo Investor, for buying and selling over 22,000 company’s shares.

There are more than 6,000 Saxo Bank reviews on TrustPilot that have gained the broker a trust score of 3.8 out of 5.