Scandinavian Capital Markets is one of Sweden's oldest brokerages, established in 2011, and users trade more than 40 billion dollars annually in it.

More than 3 thousand people are actively using Scandinavian Capital Markets Broker services; That's because of features such as STP/NDD order execution and Segregated Client Funds.

Scandinavian Capital Markets is a Swedish broker founded by Arif Alexander Ahmad

Scandinavian Capital Markets is a Swedish broker founded by Arif Alexander Ahmad

Scandinavian Capital Markets Introduction and Regulation

Scandinavian Capital Markets, established in 2011, is a Swedish-based forex and CFD broker that has quickly gained recognition in the financial trading community.

The company prides itself on its Scandinavian heritage, emphasizing transparency, security, and ethical business practices. Key points about Scandinavian Capital Markets:

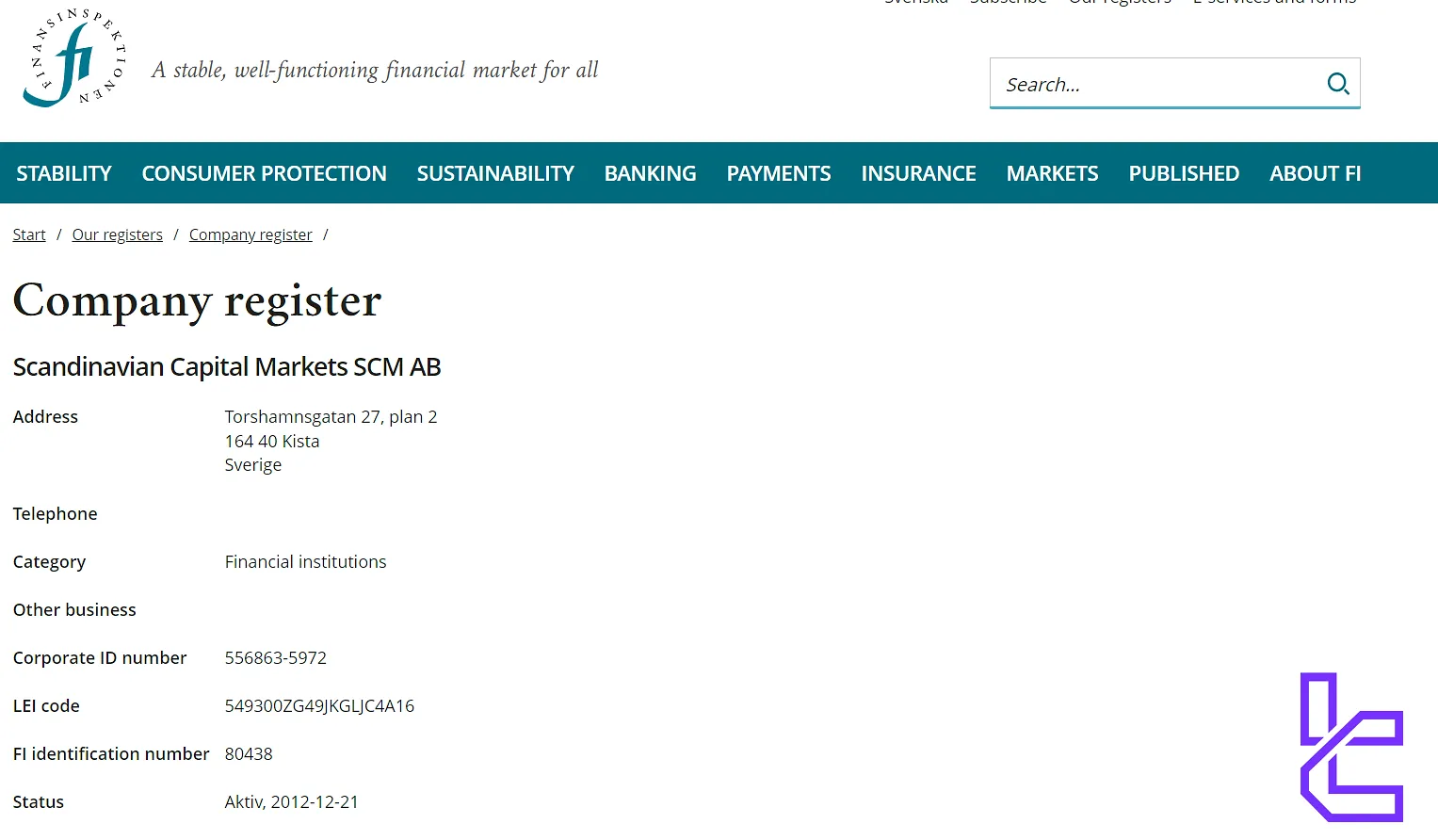

- It's regulated by Sweden's Finansinspektionen (FI), the country's financial supervisory authority;

- It's regulated by Vanuatu Financial Services Commission (VFSC) with 700472 license number;

- Adheres to strict EU financial regulations and directives;

- Implements robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures;

- Provides a secure trading environment with segregated client funds.

Headquartered in Stockholm and overseen by the Swedish Financial Supervisory Authority, it caters primarily to institutional clients and high-volume traders.

Its core strengths include a zero-commission model, deep liquidity via STP-ECN, and professional-grade platforms including MT4, MT5, and cTrader, all optimized for transparency and speed.

Table of Specifications

This table provides a quick overview of the Forex broker's key offerings and specifications, highlighting its competitive edge in the forex market. SCM Specifications:

Broker | Scandinavian Capital Markets |

Account Types | Free forever, Growth, Institutional |

Regulating Authorities | FL, VFSC |

Based Currencies | USD, EUR, GBP |

Minimum Deposit | $25 |

Deposit Methods | Bank Wired, Visa, MasterCard, American Express, Skrill, USDT, USDC |

Withdrawal Methods | Bank Wired, Visa, MasterCard, American Express, Skrill, USDT, USDC |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy trading |

Trading Platforms & Apps | MT4, MT5, FIX API, cTrader |

Markets | Forex, Cryptocurrency, Commodities, Indices |

Spread | Floating from 0.0 pips |

Commission | $0 on Free forever account, $4 on Growth account, and custom on Institutional |

Orders Execution | STP/NDD |

Margin Call/Stop Out | 100%/80% |

Trading Features | STP/NDD Execution Type, Copy Trading, 1:500 Maximum Leverage, $0 Commission, Raw Spread |

Affiliate Program | Yes |

Bonus & Promotions | Yes [20% Affiliate] |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Phone Call, Live Chat, Indoor Meeting |

Customer Support Hours | 24/5 |

Restricted Countries | USA, Cuba, Sudan, North Korea, Syria, Belarus, Iran, Iraq, Lebanon, Libya, and Many More |

What Are Scandinavian Capital Markets Account Types?

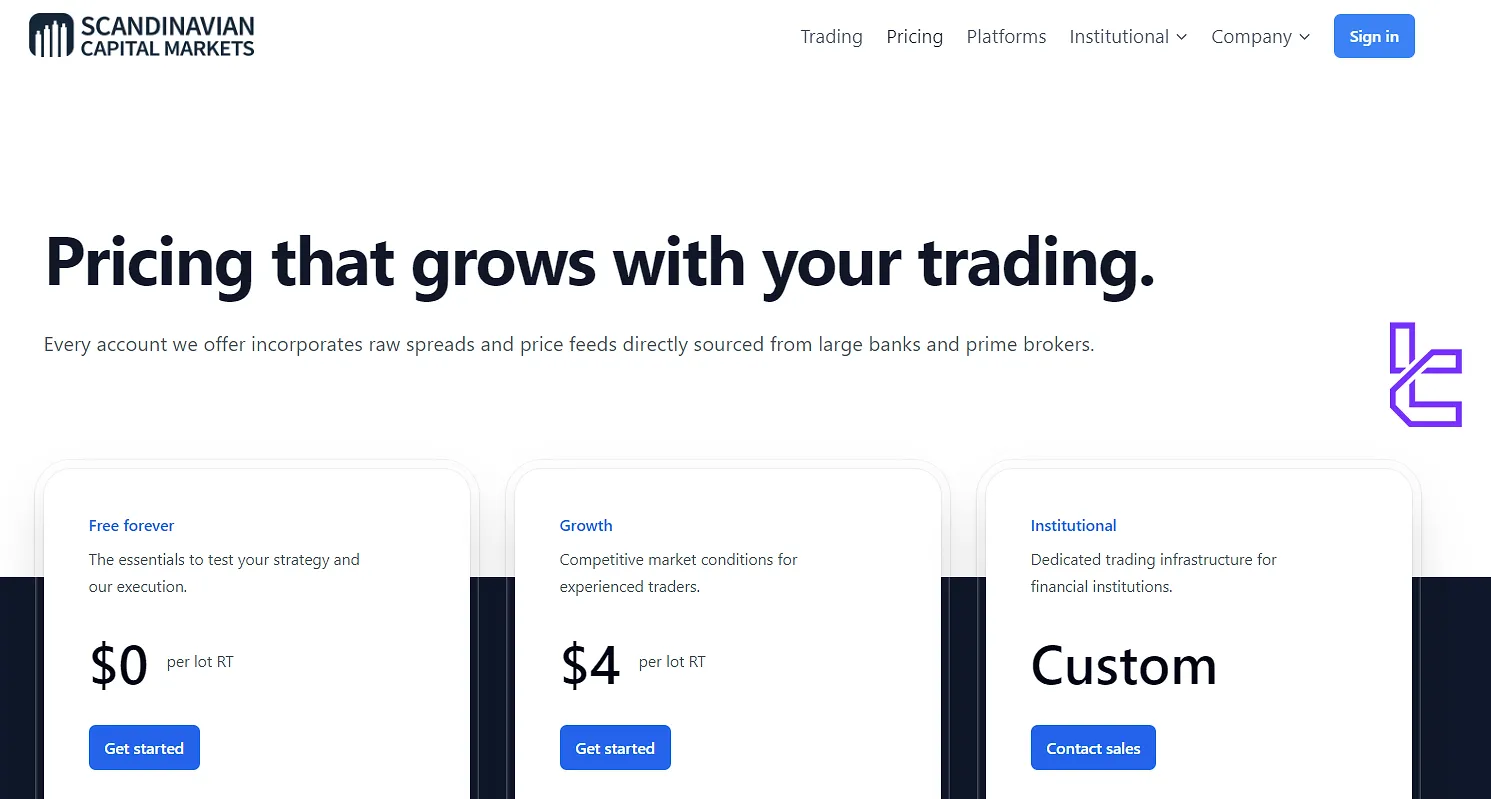

Traders can choose from three scalable account tiers:

- Free Forever: A zero-cost plan for basic strategy testing, capped at 30 lots/month

- Growth: Geared toward serious traders, offering unlimited volume with a $4/lot commission

- Institutional: Tailored for high-frequency or fund-level clients with custom pricing, FIX API, and analytics

Minimum deposits range from $25 to $10,000, depending on the plan. All accounts use raw spreads, and higher-tier clients benefit from priority support and enhanced infrastructure. Scandinavian Capital Markets account type comparison:

Specifics | Free forever | Growth | Institutional |

Raw spreads | Available | Available | Available |

Trading threshold | 30 Lots | Unlimited | Unlimited |

Maximum Leverage | 1:500 | 1:500 | Custom |

FIX API | - | Included | Included |

Custom liquidity | - | - | Available |

Commission Per Lot | $0 | $4 | Custom |

Free withdrawals | - | - | Available |

Minimum deposit | $25 | $25 | $10,000 |

24/5 Support | Available | Available | Available |

Phone Support | - | Available | Available |

Dedicated Support | - | - | Available |

Each account type is designed to provide traders with the tools and conditions they need to succeed, regardless of their trading style or experience level.

SCM Advantages and Disadvantages

While this broker offers numerous advantages, you should consider the disadvantages and weigh these against your specific trading style; Scandinavian Capital Markets Pros and Cons:

Pros | Cons |

Regulated By a Reputable European Financial Authority | Higher Minimum Deposits Compared to Some Competitors |

Offers Raw Spreads and Competitive Pricing | Limited Range of Tradable Assets Beyond Forex and CFDs |

Provides Access to Multiple Trading Platforms | No Islamic (Swap-Free) Accounts Available |

Emphasizes Transparency and Ethical Business Practices | Limited Educational Resources |

Segregated Client Funds for Enhanced Security | - |

No Dealing Desk Intervention (STP/ECN Execution) | - |

If you are looking for brokers with Islamic accounts, you can find them on our forex brokers listing page.

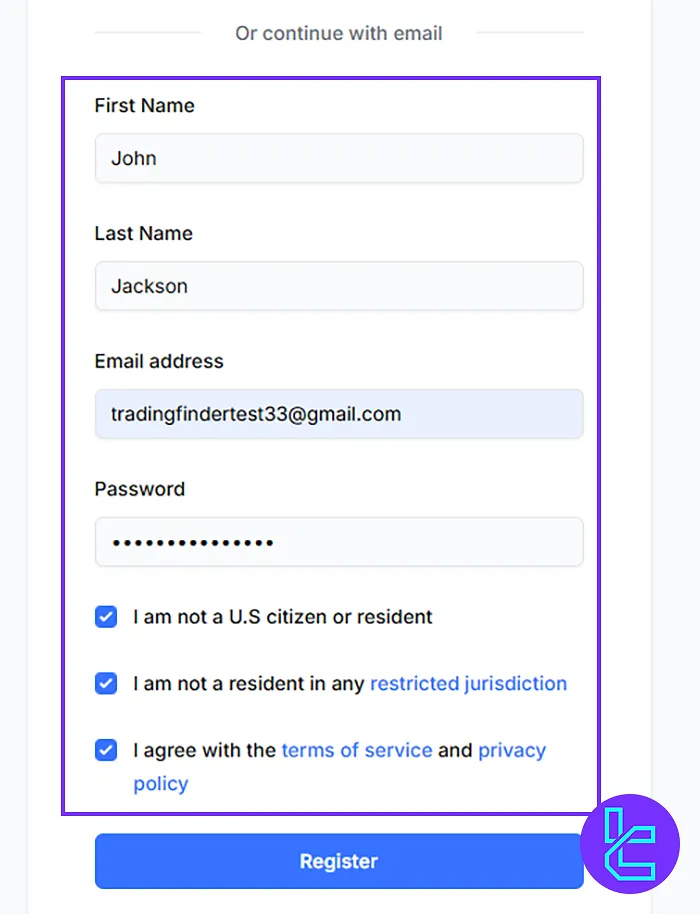

Scandinavian Capital Markets Sign Up Guide; How to Do it in 6 Minutes?

The broker offers a fast-track onboarding process designed for traders who want immediate access to a professional-grade brokerage platform. The Scandinavian Capital Markets registration process takes only 3 minutes and ensures email-verified access to your trading dashboard.

#1 Visit the Official Website

Head to the Scandinavian Capital Markets website and click on “Get Started” to launch the sign-up form.

#2 Enter Your Details

Complete the registration form by entering your personal information, including:

- First name

- Last name

- Email address

- Account password (include uppercase, lowercase, digits, and symbols)

Accept the terms, and click “Register”.

#3 Confirm Your Email

Check your inbox for a verification email from Scandinavian Capital. Click the embedded link to activate your account. Be sure to check the spam folder if you don’t see it right away.

After email confirmation, you can proceed with Scandinavian Capital Markets verification and start funding your account for trading.

#4 Complete the KYC Procedure

Submit the required KYC documents, including:

- Government-issued photo ID: Passport or Driver's license

- Proof of Residence: Utility bill or Bank statement (not older than 3 months)

Wait for verification approval and choose your preferred account type (Free Forever, Growth, or Institutional). Once approved, fund your account using one of the available payment methods.

Trading Platforms

Scandinavian Capital Markets supports a full suite of industry-standard platforms, including MetaTrader 4, MetaTrader 5, and cTrader, all accessible via desktop, web, and mobile.

This multi-platform architecture is backed by STP-ECN routing, ensuring real-time execution and institutional-grade market depth. While MT4 and MetaTrader 5 serve most forex strategies, cTrader is favored for its transparency, detailed analytics, and advanced order controls.

MetaTrader 4 (MT4)

- Industry-standard platform with a user-friendly interface

- Advanced trading tools and technical indicators

- Supports Expert Advisors (EAs) for automated trading

- Available for desktop, web, and mobile devices

MetaTrader 5 (MT5)

- Next-generation platform with enhanced features

- Multi-asset trading capabilities

- Advanced Market Depth and economic calendar

- Improved backtesting and trading strategy optimization tools

cTrader

- Modern, intuitive platform designed for ECN trading

- Customizable interface and advanced charting

- Supports algorithmic trading with cBots

- Level II pricing and one-click trading

FIX API

- Direct market access for institutional clients and high-frequency traders

- Low-latency execution and custom solutions

- Ideal for those requiring advanced integration and automation

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Scandinavian Capital Markets Fee Structure

Scandinavian Capital Markets adopts a transparent and competitive fee structure; SCM Commission and Fees:

- Spreads: Raw spreads starting from 0.0 pips

- Commissions: $0 on Free forever account, $4 on Growth account, and custom on Institutional

- Swaps: Overnight fees apply for positions held beyond the daily cut-off time

- Deposit Fees: No fees for deposits

- Withdrawal Fees: Generally free, but a $25 fee may apply for small withdrawals or inactive accounts

- Inactivity Fee: €20 per month after 12 months of no trading activity

The broker's fee structure is designed to be competitive, especially for high-volume traders.

What Payment Methods Are Available in Scandinavian Capital Markets?

Scandinavian Capital Markets offers a variety of payment methods to accommodate different client preferences:

- Bank Wire Transfer: Secure and suitable for large deposits

- Credit/Debit Cards: Visa, Mastercard, and American Express

- E-wallets: Skrill

- Cryptocurrencies: USDT (Tether), USDC (USD Coin)

The broker offers limited free withdrawals, variable based on the account type:

- Free Forever plan: 2 free withdrawals/month

- Growth plan: 4 free withdrawals/month

- Institutional: Custom terms

What Investment Plans Are Offered by SCM?

Scandinavian Capital Markets has integrated the cTrader Copy social trading platform, offering clients the opportunity to do copy trading in its “FXCopy” service; FXCopy Features:

- FXCopy allows investors to replicate the trades of successful traders;

- Precise equity-to-equity copying ensures accurate position sizing;

- Transparent performance metrics help in selecting suitable strategy providers;

- Ideal for novice traders or those looking to diversify their trading approach;

- Strategy providers can earn additional income by sharing their expertise.

The copy trading feature can be viewed as a means for traders to potentially grow their accounts by leveraging the expertise of experienced traders.

Scandinavian Capital Markets Broker Instruments and Assets

In the Scandinavian Capital Markets review, we noticed that they provide access to a diverse range of financial markets:

You can trade Forex, Indices, Commodities, and Crypto with this broker

You can trade Forex, Indices, Commodities, and Crypto with this broker

Stocks, ETFs, and bonds are not offered, aligning with the broker’s focus on liquid, high-volatility instruments for active strategies.

- Forex: Major, minor, and exotic currency pairs with competitive spreads and high liquidity

- Indices: Global stock market indices (e.g., S&P 500, FTSE 100, DAX), Cash and futures contracts available

- Commodities: Precious metals (Gold, Silver), Energy products (Crude Oil, Natural Gas), Agricultural commodities

- Cryptocurrencies: Major crypto pairs (e.g., BTC/USD, ETH/USD)

Bonus and Promotional Plans

While Scandinavian Capital Markets doesn't offer traditional trading bonuses, they do have an attractive affiliate program:

- Up to 20% of the revenue generated from their referrals

- Transparent tracking and reporting system

- Regular payouts and dedicated affiliate support

- Opportunity for ongoing passive income

The focus on an affiliate program rather than trading bonuses aligns with the broker's commitment to transparency and fairness in trading conditions.

Scandinavian Capital Markets Customer Support

Clients can contact the support team through email, direct phone, and a 24/5 live chat interface.

Language availability is not clearly stated, though English appears to be the primary medium.

- Email: support@scandinavianmarkets.com

- Phone Call: +46 8 525 160 29

- Live Chat: Available on the website during business hours

- Indoor Meeting: Possible for institutional clients (by appointment)

- FAQ Section: Comprehensive resource for common queries

The support team is available 24/5, providing assistance in multiple languages. The broker prides itself on responsive and knowledgeable customer service, reflecting its commitment to client satisfaction.

What Countries Are Restricted from Using Scandinavian Capital Markets Services?

While Scandinavian Capital Markets aims to serve a global clientele, there are some geo-restrictions in place:

- North America: USA, Cuba, Nicaragua, Venezuela;

- Asia: Afghanistan, Myanmar, Iraq, Iran, Indonesia, Lebanon, Malaysia, North Korea, Pakistan, Syria, Yemen;

- Europe: Belarus, Moldova, Russia;

- Africa: Burundi, Central African Republic, Congo, Guinea, Guinea-Bissau, Libya, Mali, Somalia, Sudan, South Sudan, Zimbabwe.

Scandinavian Capital Markets Restricted Countries Full List

Scandinavian Capital Markets Restricted Countries Full List

It's advisable for potential clients to check their eligibility based on their country of residence before attempting to open an account.

Scandinavian Capital Markets Broker User Satisfaction

In the Scandinavian Capital Markets review, we discovered that user feedback is generally positive based on the broker's Trustpilot profile. SCM Trust Scores:

- Scandinavian Capital Markets TrustPilot: 4.7/5 stars based on 50+ ratings

- ForexPeaceArmy: 2/5 from just 2 comments

What Are Scandinavian Capital Markets Educational Materials?

Currently, the blog is the only educational resource available in the Scandinavian Capital Markets Broker.

Scandinavian Capital Markets Blog Overview

Scandinavian Capital Markets Blog Overview

As you can see in the picture above, this broker's blog does not update weekly or daily. In any case, the following are presented in the SCM blog:

- articles on forex market analysis and trading strategies

- Insights into economic events and their impact on currency markets

- Educational content on trading psychology and risk management

You can check TradingFinder's Forex education section for additional resources.

Scandinavian Capital Markets Comparison Table

Let's compare SCM's features and services with the top forex brokers:

Parameter | Scandinavian Capital Markets Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | FL, VFSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | $25 | $10 | From $0 | $100 |

Maximum Leverage | 1:500 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MT4, MT5, FIX API, cTrader | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Free forever, Growth, Institutional | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | N/A | 200+ | 1,000+ | 2100+ |

Trade Execution | STP, NDD | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Trading Finder Expert Conclusion and Final Words

3 account types [Free forever, Growth, Institutional], 1:500 maximum leverage, $25 minimum deposit, copy trading and FIX API are some of the advantages of Scandinavian Capital Markets. On the other hand, it does not offer Islamic account and has limited educational resources.