SquaredFinancial is a trusted brokerage regulated by CySEC and ESMA, offering two account types, SquaredPro and SquaredElite. With no minimum deposit, traders can access diverse markets like Forex and cryptocurrencies using popular platforms like MT4 and MT5.

The Company Information & Regulation Status

Squared Financial is a well-established CFD and Forex broker serving traders since 2005. The company operates under some entities:

- Cyprus Securities and Exchange Commission (CySEC) (License Number: 329/17)

- European Securities and Markets Authority (ESMA)

- Complies with Markets in Financial Instruments Directive II (MiFID II)

- Member of the Investor Compensation Fund (ICF)

This regulatory structure allows traders to choose between different levels of regulatory protection and trading conditions. The CySEC-regulated entity offers stronger investor protections but with some restrictions on leverage. Key points about SquaredFinancial:

- Offers a wide range of trading instruments;

- Provides popular trading platforms (MetaTrader 4 and MetaTrader 5).

SquaredFinancial's commitment to regulatory compliance and transparency makes it a trustworthy option for traders seeking a reliable broker in the competitive forex and CFD market.

With a minimum deposit of $50, leverage options up to 1:500, and support for demo and Islamic accounts, SquaredFinancial caters to both beginner and advanced traders.

However, access is restricted in jurisdictions such as the UK, US, Canada, Australia, New Zealand, Iran, North Korea, and Myanmar.

Squared Financial Broker Summary of Specifics

To give you a quick overview of what SquaredFinancial offers, here's a summary table of the broker's key features:

Broker | SquaredFinancial |

Account Types | SquaredPro, SquaredElite |

Regulating Authorities | CySEC, ESMA, ICF |

Based Currencies | EUR, USD, GBP, CHF, ZAR |

Minimum Deposit | 0 |

Deposit Methods | Visa & Master cards, Crypto |

Withdrawal Methods | Visa & Master cards, Crypto |

Minimum Order | 0.01 |

Maximum Leverage | 1:30 |

Investment Options | N/A |

Trading Platforms & Apps | MT4, MT5, SquaredFinancial Mobile App |

Markets | Forex, Metals, Energy, Indices, Stocks, Crypto |

Spread | From 0.0 pips |

Commission | From 0.0 |

Orders Execution | Instant, Request, Market, Exchange |

Margin Call/Stop Out | 100%/50% |

Trading Features | Margin Trading, Copy Trading |

Affiliate Program | YES |

Bonus & Promotions | No |

Islamic Account | YES |

PAMM Account | NO |

Customer Support Ways | Phone, Email, Online Chat, Ticket System |

Customer Support Hours | 7 am until 9 pm GMT+3 |

Squared Financial caters to both beginner and experienced traders with its range of account types, diverse asset offerings, and educational resources.

The broker's competitive pricing structure, especially on the SquaredElite account, makes it an attractive option for active traders looking for tight spreads and low commissions.

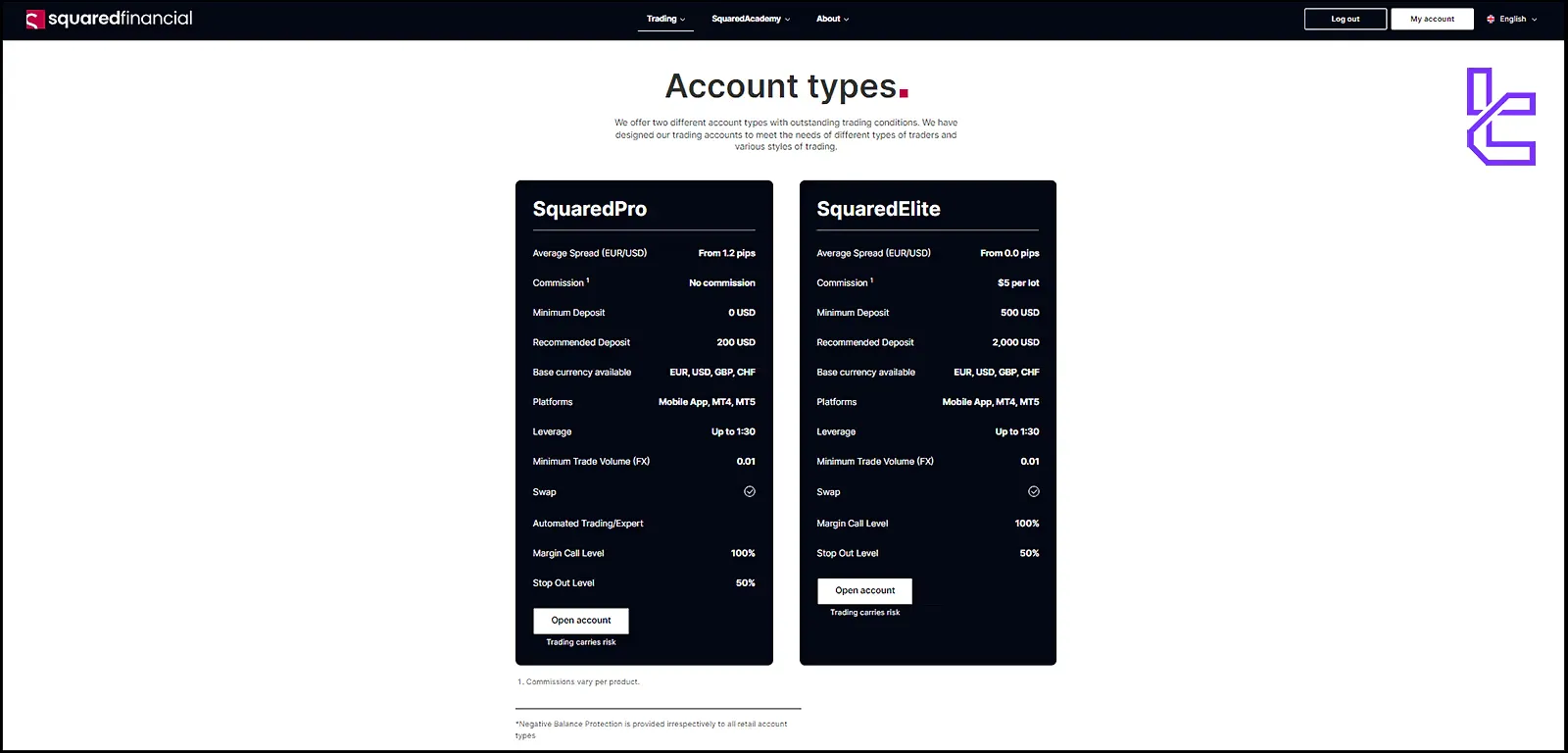

Squared Financial Account Types Comparison

SquaredFinancial offers two main types of accounts to cater to different trading styles and experience levels.

The SquaredPro is ideal for day and intraday traders, and the SquaredElite is designed for high-volume traders and scalpers.

Account Type | SquaredPro Account | SquaredElite Account |

Minimum Deposit | $0 | $500 |

Average Spreads | starting from 1.2 pips on EUR/USD | starting from 0.0 pips on EUR/USD |

Commission | No commissions | $5 commission per lot |

Maximum Leverage | 1:30 | 1:30 |

Minimum Trade Volume | 0.01 | 0.01 |

Pricing Structure | Standard | Competitive |

Both account types offer:

- Negative balance protection

- Islamic/swap-free account options

- Demo accounts for practice trading

- Access to MetaTrader 4 and MT5

- Mobile trading app support

SquaredFinancial Forex Broker Advantages and Disadvantages

Let's take a closer look at the pros and cons of trading with SquaredFinancial:

Pros | Cons |

Wide range of tradable assets (over 10,000 instruments) | Limited educational content compared to some competitors |

Competitive trading costs | Low leverage offerings |

Negative balance protection for all clients | Limited range of deposit/withdrawal methods |

Segregation of client funds for enhanced security | Lack of transparency on some fees (e.g., swap rates, currency conversion fees) |

Access to popular MT4 and MT5 | - |

Social trading | - |

Despite these drawbacks, Squared Financial remains a solid choice for many traders, especially those looking for a regulated broker with competitive pricing and diverse trading instruments.

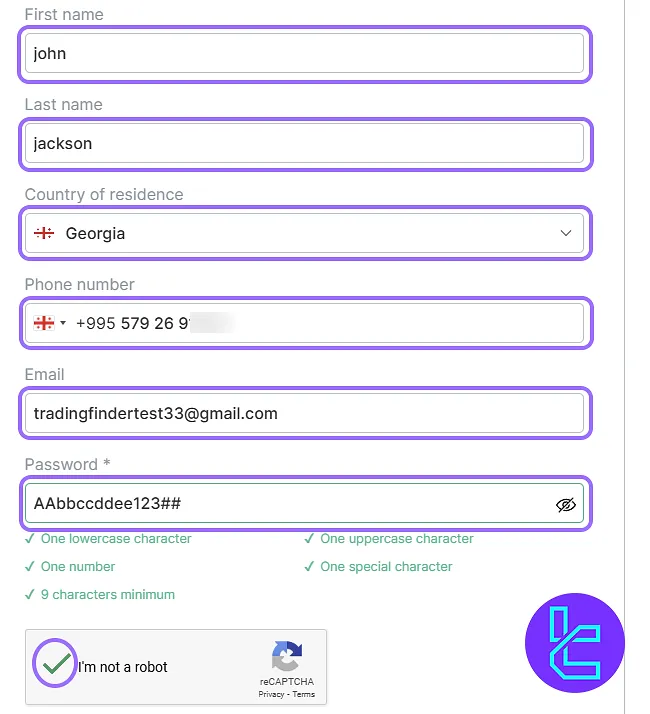

SquaredFinancial Broker Signing Up & Verification Process

The Squared Financial registration unlocks access to over 10,000 financial instruments via MT4/MT5 platforms. The process is fully online, takes around 10 minutes, and complies with international KYC/AML standards.

#1 Begin on the Official Website

Head to the SquaredFinancial website and click “Open Account” to start the application.

#2 Provide Account and Personal Information

Choose between a Personal or Corporate account, then submit your information, including:

- Full name

- Mobile number

- Country of residence

- Secure password

Confirm the captcha, and continue.

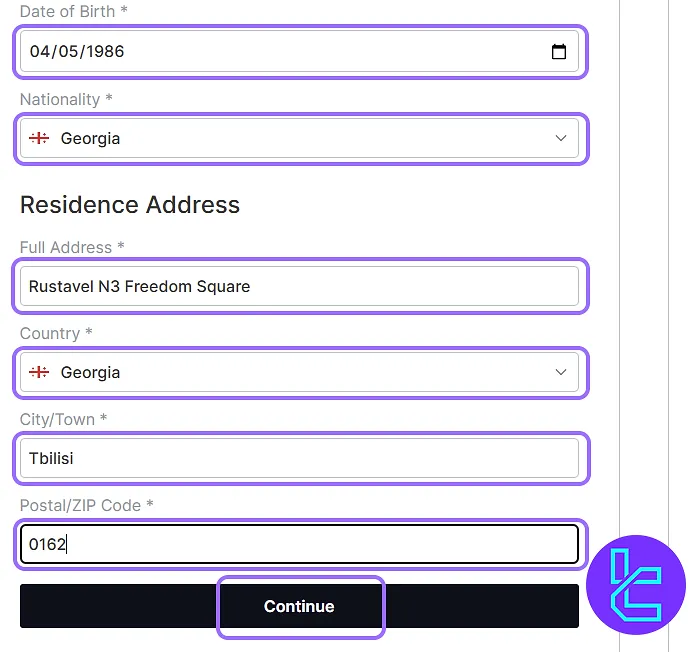

#3 Fill in Address and Employment Details

Complete the financial status form, including income range and employment type, and provide the following details:

- Full address

- Nationality

- Date of birth

#4 Declare Trading Experience & Tax Data

Specify your trading experience, education level, and tax-related info, including residency and Tax ID. Confirm no U.S. financial activity (if applicable), and finalize the registration.

#5 Provide KYC Documents

The SquaredFinancial verification process is a regulatory requirement and helps ensure the security of your account. Here are the required supporting documents:

- Proof of ID: Passport or Driving license

- Proof of Residency: Utility bill or Bank statement

The broker typically processes verification documents within 1-2 business days.

SquaredFinancial Forex Broker Trading Platforms

Squared Financial provides its clients with industry-standard trading platforms, including MetaTrader 4, MetaTrader 5, and the Squared Financial Mobile App, ensuring a smooth and feature-rich trading experience.

All platforms offer:

- Real-time market data

- Multiple order types (market, limit, stop)

- Risk management tools (stop-loss, take-profit)

- Customizable interface and layouts

Squared Financial broker also provides a Virtual Private Server (VPS) service for traders using automated strategies, ensuring 24/7 execution even when your computer is off.

Here are the download links to the platforms:

- MetaTrader 4 Android

- MetaTrader 4 iOS

- MetaTrader 5 Android

- MetaTrader 5 iOS

- SquaredFinancial Android

- SquaredFinancial iOS

TradingFinder has developed a wide range of MT5 and MT4 indicators that you can use for free.

SquaredFinancial Forex Broker Spreads and Commissions

SquaredFinancial's pricing structure varies depending on the account type:

Account | Average Spread (EUR/USD) | Commission |

SquaredPro | From 1.2 pips | 0 |

SquaredElite | From 0.0 pips | $5 per lot |

It's important to note that spreads are variable and can widen during low liquidity or high market volatility.

Squared Financial also charges overnight swap rates for positions held open beyond the trading day, which vary depending on the instrument and direction of the trade.

Squared Financial Broker Deposit & Withdrawal

SquaredFinancial offers a variety of payment methods for deposits and withdrawals:

- Bank Transfer

- Credit Cards

- E-Wallets

- Alternative Payment Methods

Here are the payment service providers:

- PayMaxis

- PowerCash

- SafeCharge

It's worth noting that while Squared Financial doesn't charge fees for deposits or withdrawals, third-party payment providers may apply their fees. Always check with your bank or payment provider for any potential charges.

Copy Trading & Investment Options Offered on Squared Financial Broker

SquaredFinancial broker offers a robust copy trading feature, allowing investors to automatically replicate the trades of successful traders. This service is particularly beneficial for those who lack the time or expertise to conduct their market analysis. Key features of SquaredFinancial's Copy Trading:

- Easy to Use: Start or stop copying trades with just a few clicks;

- Real-time Replication: Copied trades are executed in your account instantly;

- Diverse Strategies: Choose from thousands of traders with different strategies.

Note that Squared Financial does not offer investment options like PAMM or Managed Accounts.

Squared Financial Forex Broker Tradable Markets & Symbols Overview

Squared Financial offers a wide range of over 10,000 tradable instruments (in CFD) across various asset classes, from the Forex market to ETFs and Cryptocurrencies.

Category | Available Assets |

Forex | 40+ actively traded CFD currency pairs |

Metals | Gold, Silver |

Indices | 7 of the most important global indices |

Stocks & ETFs | CFDs on shares from major global exchanges, A selection of popular Exchange-Traded Funds |

Cryptocurrencies | Major cryptocurrencies (Bitcoin, Ethereum, Litecoin, etc.) |

Energies | 2 of the most liquid energies as CFDs |

Trading conditions (spreads, swaps, leverage) vary depending on the instrument and account type. Always check the contract specifications for each instrument before trading.

Squared Financial Forex Broker Bonuses and Promotions

Currently, Squared Financial does not appear to offer any bonuses, promotions, or cashback rewards. While they have had offers like welcome bonuses or no-deposit bonuses in the past, these promotions are no longer available.

It’s important for users to check the broker’s official website for any future updates on potential bonuses or promotions, as terms and offerings can change over time.

Squared Financial Broker Support Team

Squared Financial provides customer support through various channels:

- Live Chat: Available on the website for quick queries

- Email: support@squaredfinancial.eu

- Phone: +357 22 090 227

While SquaredFinancial's support is generally responsive (Monday to Friday from 7 am until 9 pm GMT+3), some users have reported longer wait times during peak hours. The broker continually improves its support services to enhance the client experience.

Squared Financial Broker List of Restricted Countries

SquaredFinancial does not offer its services to residents of certain jurisdictions due to regulatory restrictions. The list of restricted countries includes:

- UK

- USA

- Canada

- Australia

- New Zealand

- Iran

- North Korea

- Cuba

- Syria

- Belarus

- Myanmar (Burma)

- Russia

- South Sudan

- Venezuela

This list in the SquaredFinancial Review may change over time due to evolving regulatory landscapes. Always check the broker's terms and conditions or contact customer support for the most up-to-date information regarding country restrictions.

Squared Financial Broker Trust Scores & Reviews

Squared Financial has generally medium reviews and trust scores across various platforms:

- SquaredFinancial TrustPilot: 3.6/5 stars (based on over 90 reviews);

- ForexPeaceArmy: 3.6/5 stars (based on only 4 reviews).

Positive Aspects | Areas for Improvement |

Highly regulated, providing security for traders | Complaints about Trading Policies |

Effective Trading Tools | Withdrawal Issues |

Reliable and fast trade execution | Inconsistent Customer Service |

Helpful customer support | - |

Overall, SquaredFinancial maintains a good reputation in the industry, with its regulatory compliance and transparent operations contributing to its trustworthiness.

Education on SquaredFinancial Broker

Squared Financial provides a range of educational tools to assist traders in enhancing their expertise.

Educational Resource | Description |

E-books | A collection covering fundamental and advanced trading concepts, serving as handy reference materials |

Video Tutorials | Engaging visual content addressing topics like trading techniques, market analysis, and platform usage, facilitating better understanding of complex ideas |

Glossary | A comprehensive glossary of trading terms to help both novice and experienced traders navigate industry jargon effectively |

These resources empower traders to make better decisions, fostering a supportive environment for success in the financial markets.

You can also check TradingFinder's Forex education section for additional resources.

SquaredFinancial vs Other Brokers

The table below provides a detailed comparison between Squared Financial and the top forex brokers:

Parameter | SquaredFinancial Broker | FBS Broker | Alpari Broker | FXGT Broker |

Regulation | CySEC, ESMA, ICF | FSC, CySEC | MISA | VFSC, CySEC, FSA, FSCA |

Minimum Spread | From 0.0 pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $0 | $5 | $50 | $5 |

Maximum Leverage | 1:30 | 1:3000 | 1:3000 | 1:5000 |

Trading Platforms | MT4, MT5, SquaredFinancial Mobile App | MT4, MT5, Mobile App | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | MT4, MT5 |

Account Types | SquaredPro, SquaredElite | Standard | Standard, ECN, Pro ECN, Demo | Standard+, ECN Zero, Mini Optimus, Pro |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 10,000+ | 550+ | 120+ | N/A |

Trade Execution | Market, Instant | Market | Market | Market |

Expert’s opinion and conclusion

SquaredFinancial does not require a minimum deposit and supports base currencies like EUR, USD, GBP, CHF, and ZAR.

Deposits and withdrawals are facilitated through Visa, MasterCard, and cryptocurrencies. On SquaredElite accounts, traders are charged a $5 commission.