Traders Trust is a Forex broker that offers trading services through its Classic, Pro, and VIP accounts. This broker has a $50 minimum deposit, 0% deposit and withdrawal fees, and high leverage (up to 1:3000).

Traders Trust offers Social Copy Trader and MAM accounts, which enable account managers to trade 70+ instruments and allow traders to earn passive income.

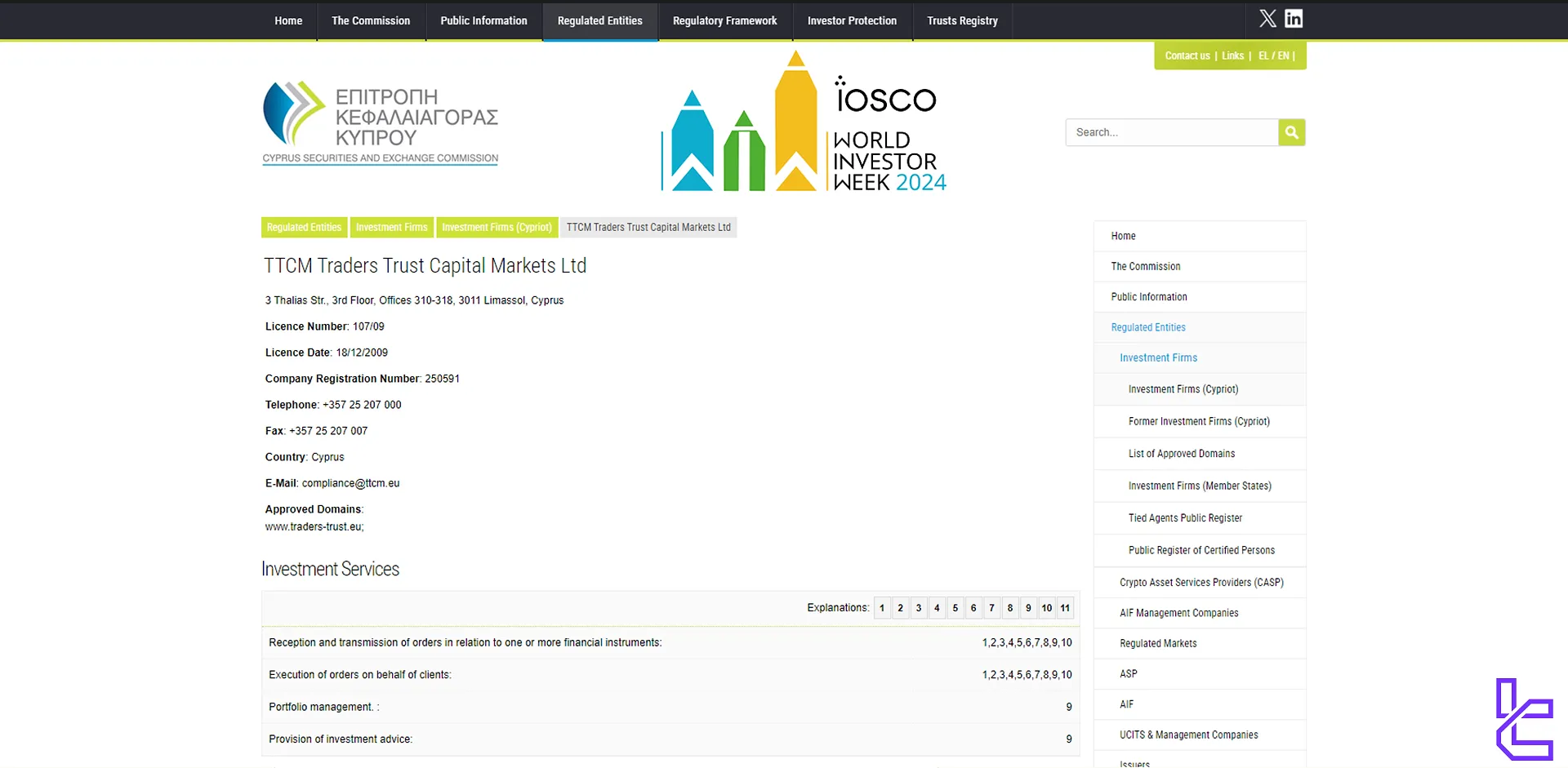

Traders Trust Broker Company Information & Regulation Status

Traders Trust has over a decade of experience providing trading services. The company operates under two main entities:

- TTM Traders Trust Ltd: Regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 107/09.

- Traders Trust Capital Markets (TTCM) Ltd: Regulated by the Financial Services Authority (FSA) of Seychelles.

These regulatory oversights give traders a sense of security and ensure that the broker adheres to strict financial standards.

Traders Trust Broker Summary of Specifications

Here's a quick overview of what Traders Trust offers:

Broker | Traders Trust |

Account Types | Classic, Pro, VIP |

Regulating Authorities | CySEC, FSA |

Based Currencies | USD, EUR, JPY, GBP |

Minimum Deposit | $50 |

Deposit Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill, USDT, BTC |

Withdrawal Methods | Visa/MasterCard, Paypal, Bank wired, Neteller, Skrill, USDT, BTC |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:3000 |

Investment Options | Copy trading, MAM accounts |

Trading Platforms & Apps | MT4, cTrader |

Markets | Forex, indices, cryptocurrencies, oil, stocks, metals |

Spread | Floating from 0.0 pips |

Commission | From $1.5 per lot |

Orders Execution | Market |

Margin Call/Stop Out | 50%/20% |

Trading Features | Demo account, |

Affiliate Program | Yes |

Bonus & Promotions | 50k convertible bonus, loyalty program, cashback rebate |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat, phone |

Customer Support Hours | 24/5 |

Restricted Countries | Iran, Syria, North Korea, Lebanon, USA, Australia, and more |

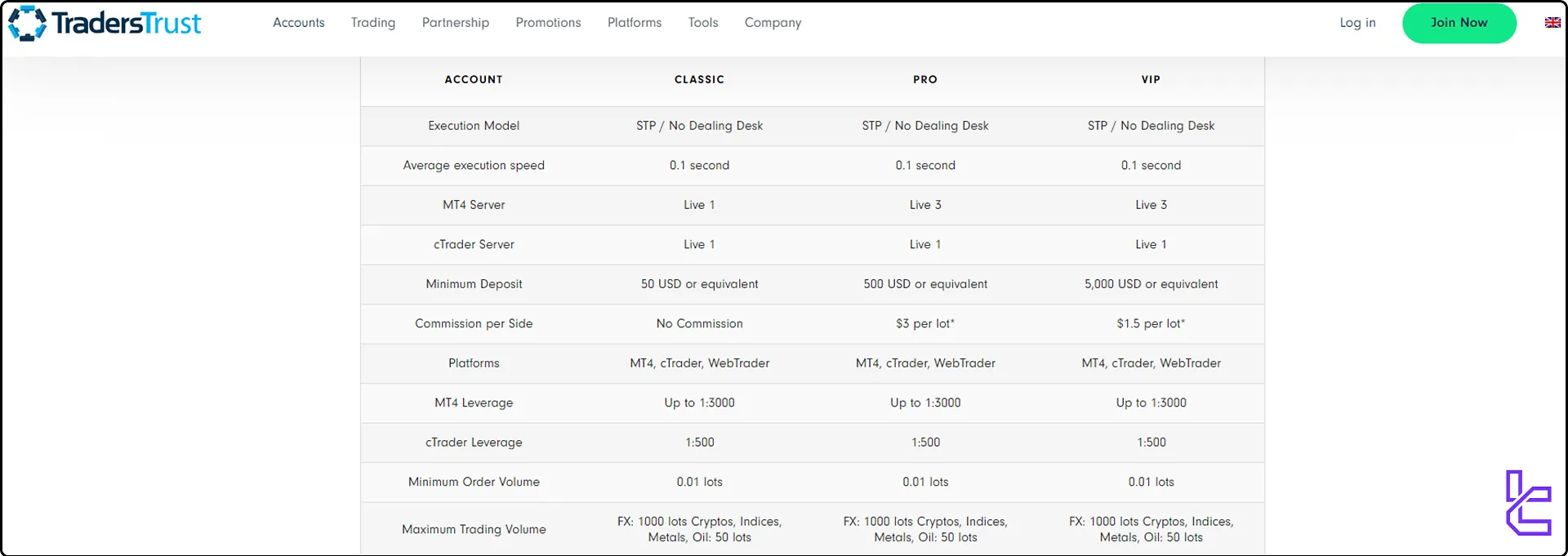

Traders Trust Account Types Overview

Traders Trust offers three main account types to cater to different trading styles and experience levels:

Account types | Classic | Pro | VIP |

Minimum deposit | $50 | $500 | $5,000 |

Minimum trading volume | 0.01 Lot | 0.01 Lot | 0.01 Lot |

Maximum Leverage | 1:3000 | 1:3000 | 1:3000 |

Spreads | Floating from 1.5 pips | Floating from 0 pips | Floating from 0 pips |

Commission | No | $3 per lot | $1.5 per lot |

All account types offer access to the full range of trading instruments and platforms. The main differences lie in the spread and commission structure, allowing traders to choose the account that best suits their trading volume and style.

It’s worth mentioning that Traders Trust also offers demo and Islamic accounts to its users.

Traders Trust Advantages and Disadvantages

Considering the benefits and drawbacks of a Forex broker is critically recommended when choosing one. Let's take a look at the pros and cons of trading with Traders Trust:

Advantages | Disadvantages |

High leverage up to 1:3000 | No US clients accepted |

Competitive spreads from 0.0 pips | No MT5 platform |

Regulated by CySEC and FSA Seychelles | $25 inactivity fee |

Wide range of trading instruments | Outdated educational resources |

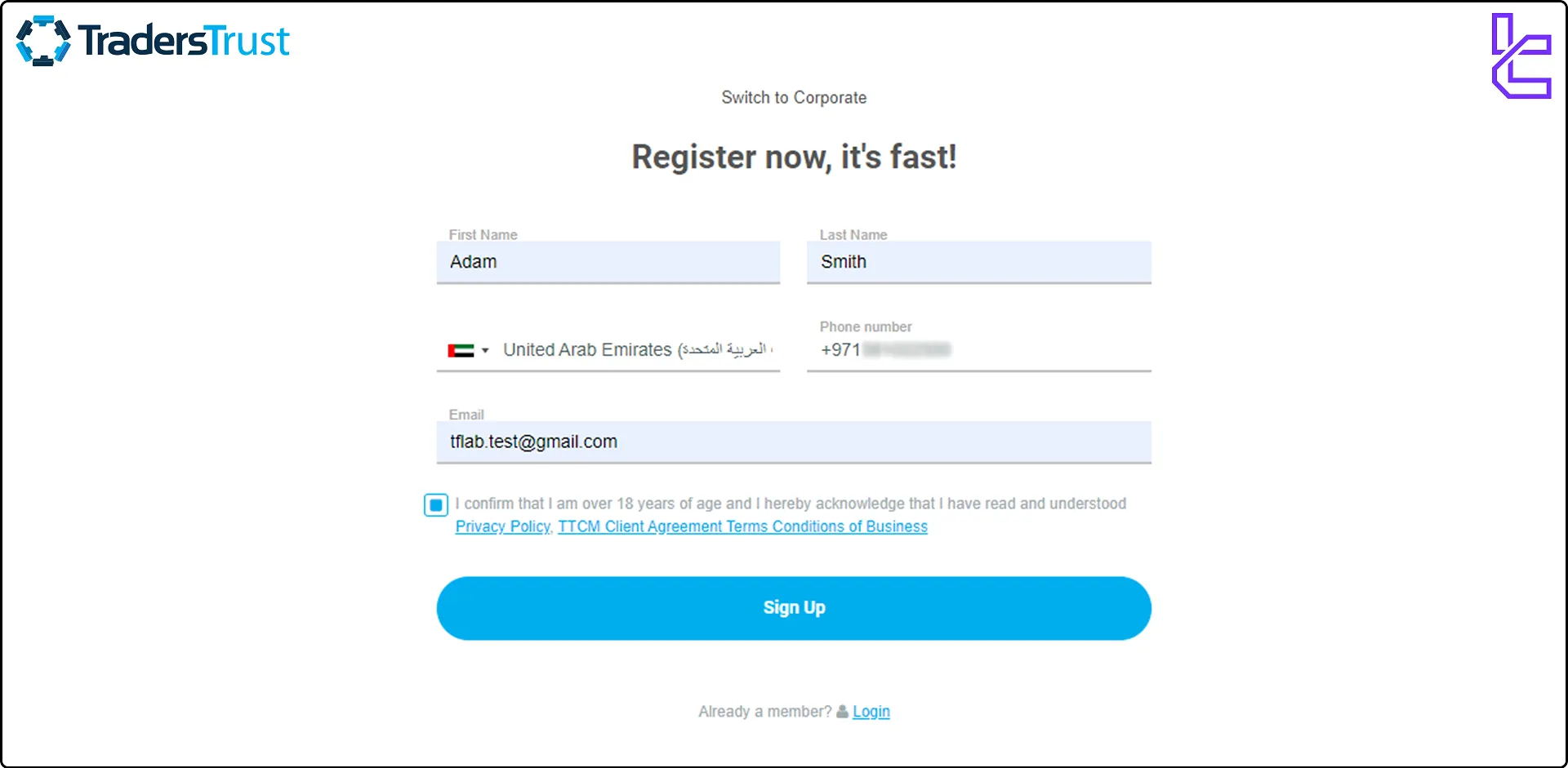

Traders Trust Registration and Verification

Opening an account with Traders Trust is a simple process:

- Visit the Traders Trust website and click on "Join Now;"

- Fill in your personal information;

- Verify your email address;

- Enter the “Upload documents” tab;

- Provide further personal data and a complete economic background profile;

- Upload ID verification documents (National ID, passport, driver’s license);

- Upload address verification documents (Utility bill, bank statement, government-issued document).

Traders Trust Broker Trading Platforms and Applications

Let’s go through the trading platforms and apps in our Traders Trust review. This broker offers two popular trading platforms to its clients:

MetaTrader 4 (MT4)

- Industry-standard platform

- User-friendly interface

- Advanced charting tools

- Available on desktop, web, and mobile

If you are interested in exploring the platform's indicators, you can visit the MT4 indicator page on the website.

Links:

cTrader:

- Modern and intuitive platform

- Advanced order types

- Available on desktop, web, and mobile

- Over 50 indicators and 6 zoom levels

Links:

The choice between MT4 and cTrader often comes down to personal preference, with cTrader offering a more modern interface and some advanced features that may appeal to certain types of traders.

Traders Trust Fees Spreads and Commissions

Traders Trust offers straightforward pricing across its account types:

Account type | Spread | Commission |

Classic Account | From 1.5 Pips | No commission |

Pro Account | From 0.0 Pips | $3 per lot per side |

VIP Account | From 0.0 Pips | $1.5 per lot per side |

The broker uses a floating spread model, meaning spreads can widen during volatile market conditions.

- Traders Trust other fees

- No deposit and withdrawal fees

- Standard currency conversion fee

- Rollover fees for overnight positions held open

- $25/Mon inactivity fee

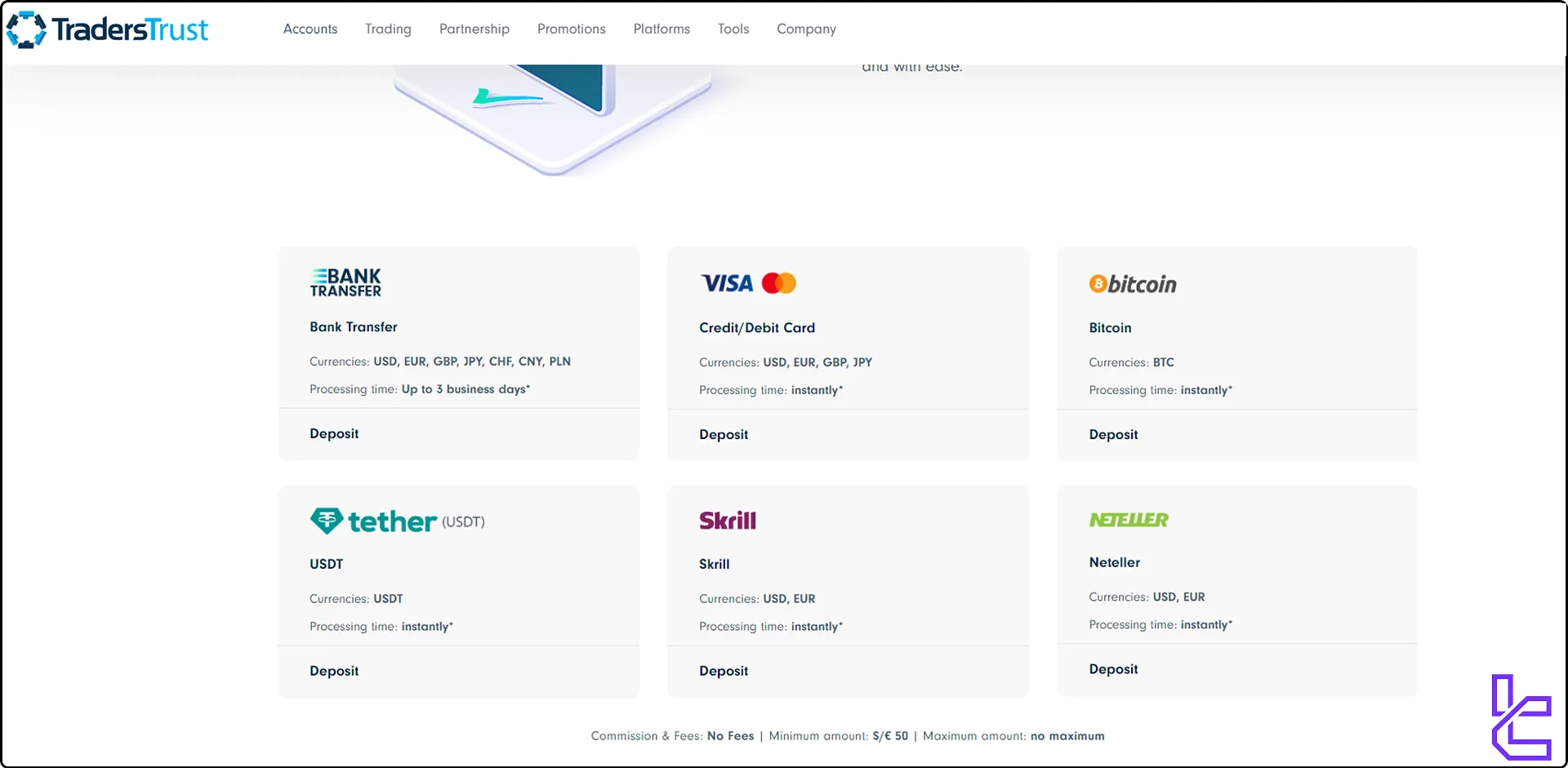

Traders Trust Deposit & Withdrawal Options

Like many other Forex brokers, Traders Trust offers a variety of deposit and withdrawal methods to cater to traders worldwide:

- Bank wire transfer

- Credit/debit cards (Visa, Mastercard)

- E-wallets (Skrill, Neteller)

- Cryptocurrencies (Bitcoin, USDT)

Key points about deposits and withdrawals:

- No fees charged by Traders Trust for deposits or withdrawals

- Minimum deposit is $50

- Most methods process instantly, except bank transfers (1-3 business days)

- Withdrawal requests processed within 24 hours

The broker's commitment to fee-free deposits and withdrawals, along with quick processing times, is a significant advantage for traders.

Traders Trust Copy Trading and Investment Options

Traders Trust offers Social Copy Trader and MAM accounts for its users:

Traders Trust Social Copy Trader

Traders Trust Social Copy Trader allows users to mirror the strategies of expert traders in real time, making trading accessible for beginners. It offers a user-friendly platform where traders can follow top performers and execute the same trades automatically.

Traders Trust MAM Account

Multi-Account Manager Account allows traders to manage multiple client accounts and execute strategies on all the accounts simultaneously. This enables high performing traders to charge clients and receive commissions for their knowledge and skills.

Tradable Markets & Symbols in Traders Trust

Traders Trust offers various trading instruments:

- Forex: Over 60 currency pairs

- Indices: Major global stock indices, including US500, EU50, and JP225

- Metals: Gold, silver, Platinum

- Stocks: CFDs on popular US and European stocks

- Cryptocurrencies: Bitcoin, Ethereum, and Litecoin

- Oil: US and UK oil

Traders Trust Broker Bonuses

Traders Trust offers several attractive promotions:

50K Convertible Bonus:

- 100% bonus on deposits up to $50,000

- Convertible to real cash through trading

- Available in MT4 Classic and Pro account

- Minimum deposit $300

Partner Loyalty Program:

- Earn by becoming a Traders Trust partner

- Receive up to 3% commission from direct clients

Cashback Rebate:

- Trade for at least 10 round turn lots per day

- Earn up to $2,000 daily cashback

Traders can also request a free VPS by trading at least 5 round turns in 1 month and keep their account balance over $2k

Traders Trust Support Channels

Traders Trust provides 24/5 customer support through multiple channels:

- Live Chat: Available on the website for quick inquiries

- Email: support@ttcm.com

- Phone: +442031295899

- FAQ section: Comprehensive answers to common questions

The support team is known for its responsiveness and ability to assist in 6 languages, enhancing the overall trading experience.

Traders Trust Restricted Countries

While Traders Trust serves clients globally, there are some restrictions. The broker does not accept clients from:

- North America: USA, Canada

- South America: Cuba, Venezuela, Puerto Rico

- Africa: Guyana, Lao People’s Democratic Republic, Uganda, Sudan

- Asia: Afghanistan, Syria, Iran, Iraq, North Korea, Japan, Yemen

- Australia and New Zealand

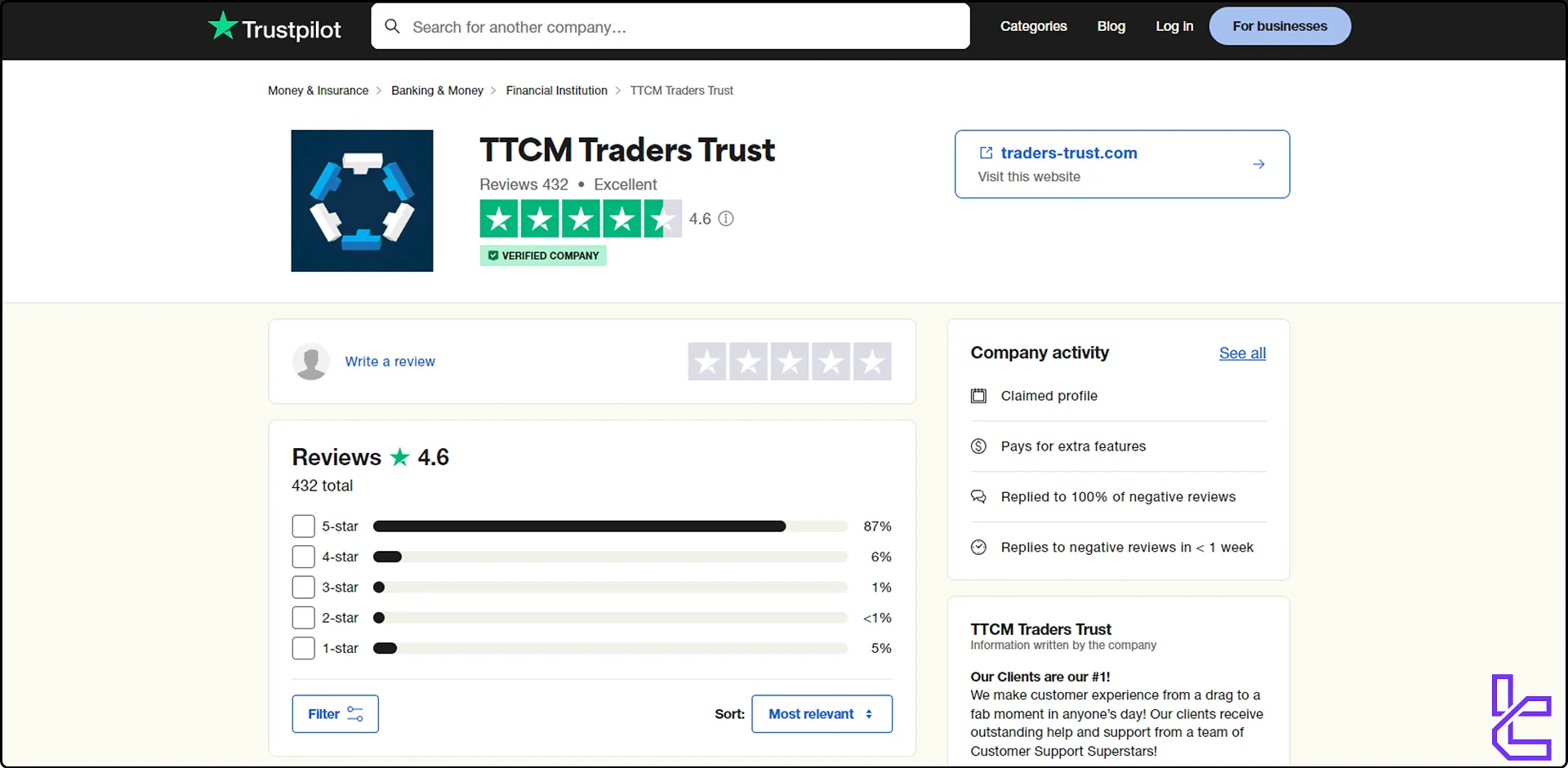

Trust Scores and Reviews of Traders Trust Broker

Traders Trust has generally positive reviews on the Trustpilot:

- Rating: 4.6 stars out of 5

- 5-star reviews: 87%

- Total number of reviews: Over 430

While the broker maintains a good overall reputation, as with any financial service, individual experiences may vary.

Traders Trust Broker Educational Resources

Traders Trust's educational offerings are somewhat limited and outdated. Their education page hasn’t been updated for over 3 years. Beginners might need to supplement their learning with external resources.

TF Expert Suggestion

Traders Trust tries to offer excellent services with low trading commissions (from $1.5 per lot), a $50k convertible bonus, and a low execution time of 0.1 seconds.

However, the high minimum deposit on the VIP accounts ($5000), the lack of MT5 trading platform, and its unavailability in multiple countries such as the US, Australia, Japan, etc., are important points to consider.