Trading 212 offers 3 account types [Invest, CFD, ISA], with the first one recommended for investing in stocks and ETFs. Margin call and stop-out levels are 45% and 25%, respectively. The maximum leverage across all accounts is 1:200, and FX trading fees range from0.15% to 0.5%.

All client funds are held in segregated bank accounts under strict FCA and FSCS protection up to £85,000, ensuring high-level fund security and transparent regulatory oversight.

Company Information & Regulation

Trading 212 was founded in 2004 by Borislav Nediakov and Ivan Ashminov, with its headquarters nestled in the heart of London, United Kingdom.

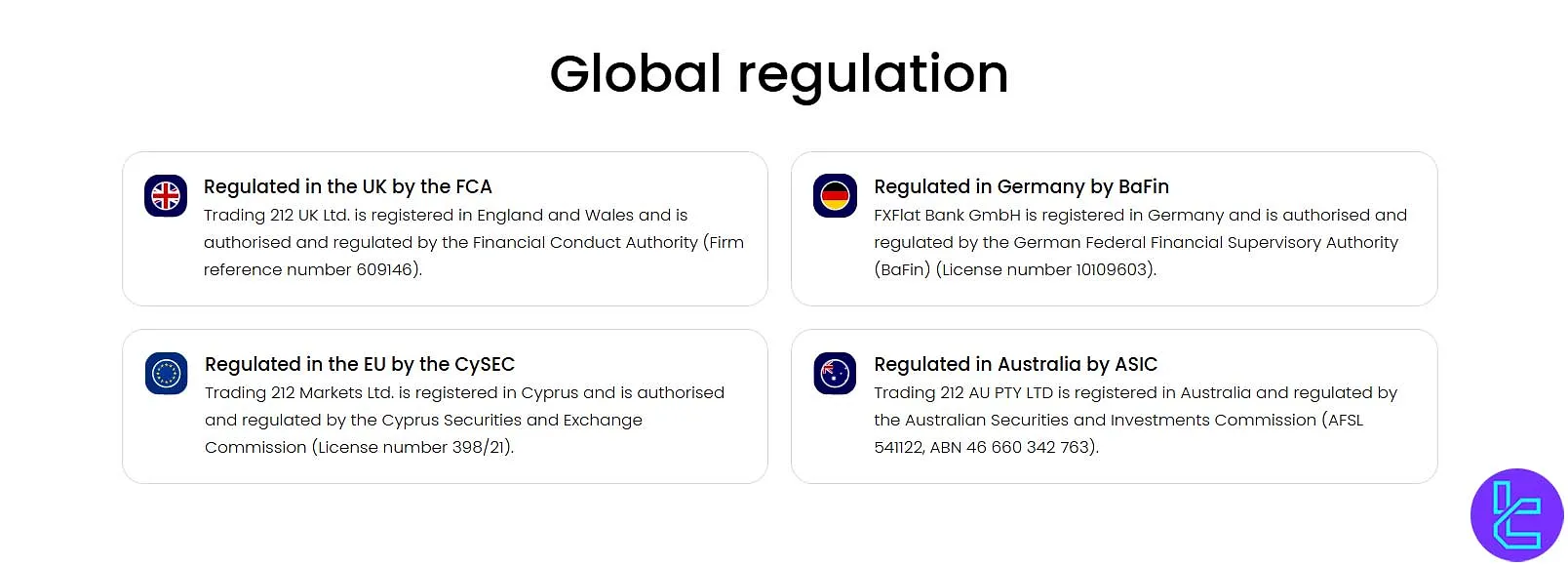

What makes Trading 212 unique is its solid regulatory framework. The broker operates under the solid supervision of some major financial authorities:

Parameter / Branch | Trading 212 UK Ltd. | Trading 212 Markets Ltd. | FXFlat Bank GmbH (via Trading 212) | Trading 212 AU Pty Ltd | Trading 212 Ltd. (Bulgaria) |

Regulation | FCA (609146) | CySEC (398/21) | BaFin (10109603) | ASIC (AFSL 541122) | FSC (RG-03-0237) |

Regulation Tier | 1 | 1 | 1 | 1 | 1 |

Country | United Kingdom | Cyprus (EU) | Germany | Australia | Bulgaria |

Investor Protection / Compensation Scheme | FSCS – up to £85,000 | ICF – up to €20,000 | EdB/EdW – up to €20,000 | N/A | Bulgarian ICF – up to €20,000 |

Segregated Funds | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 (retail clients), 1:200 (Pro clients) | 1:30 (retail clients), 1:200 (Pro clients) | 1:30 (retail clients), 1:200 (Pro clients) | 1:30 (retail clients), 1:200 (Pro clients) | 1:30 (retail clients), 1:200 (Pro clients) |

Client Eligibility | UK + selected non-EU countries | EU member states | Germany + EU clients | Australia + non-EU clients | EU and EEA residents |

The company is located at Aldermary House, 10-15 Queen Street, London, EC4N 1TX.

Client funds are protected by up to EUR 1 million in Lloyd’s indemnity insurance, exceeding typical retail investor protection standards.

Table of Features and Key Details

In this section of the review, as always, we will provide a table of the main specifications of Trading 212 as one of the forex brokers:

Broker | Trading 212 |

Account Types | Invest, CFD, and ISA |

Regulating Authorities | FCA, CySEC, ASIC, BaFin, FSC |

Based Currencies | USD, GBP, EUR, and Local Currencies |

Minimum Deposit | 1 USD for Invest and ISA Accounts $10 for CFD Accounts |

Deposit Methods | Visa, Visa Electron, MasterCard, Maestro, PayPal, Apple Pay, Google Pay, Skrill, Wire Transfer |

Withdrawal Methods | Visa, Visa Electron, MasterCard, Maestro, PayPal, Apple Pay, Google Pay, Skrill, Wire Transfer |

Minimum Order | 0.1 |

Maximum Leverage | 1:200 |

Investment Options | Interest on Cash, Share Lending |

Trading Platforms & Apps | Proprietary Platforms |

Markets | Forex, Stocks, Commodities, Indices, Treasury, ETFs |

Spread | Varies |

Commission | No Commission on Trading |

Orders Execution | Market |

Margin Call/Stop Out | 45%/25% |

Trading Features | Dedicated Account for Trading Stocks |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

PAMM Account | None |

Customer Support Ways | Live Chat, Email, Ticket |

Customer Support Hours | 24/7 |

Trading Account Types

Trading 212 falls into the category of brokers with low variety in account types, offering 3 accounts.Account Specifics:

- Invest: Recommended for investing in stocks and ETFs, with more than 13,000 global symbols available

- ISA (Individual Savings Account): Tax-efficient investing for UK residents, available only for clients from Great Britain

- CFD: For trading CFDs on various markets such as Forex, indices, and more, with negative balance protection and FSCS government protection up to £85K

The minimum deposit starts at just $1 for the Invest account and $10 for the CFD account. This low barrier to entry makes it accessible for beginners and retail traders alike.

It's crucial to understand that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Always ensure you fully understand the risks involved before trading CFDs.

Significant Benefits and Drawbacks

To give you a balanced view, let's explore the pros and cons of the brokerage:

Benefits | Drawbacks |

Commission-Free Trading | No Support For Popular Third-Party Platforms Like MetaTrader |

Low Minimum Deposit Requirement | No Phone Support |

Regulated by Reputable Financial Authorities | - |

Very High Number of Tradable Symbols | - |

Getting Started: How to Sign Up and Verify

To begin trading with Trading212, you need to create an account and verify your identity. This quick setup process connects you to one of the most accessible trading platforms in the market.

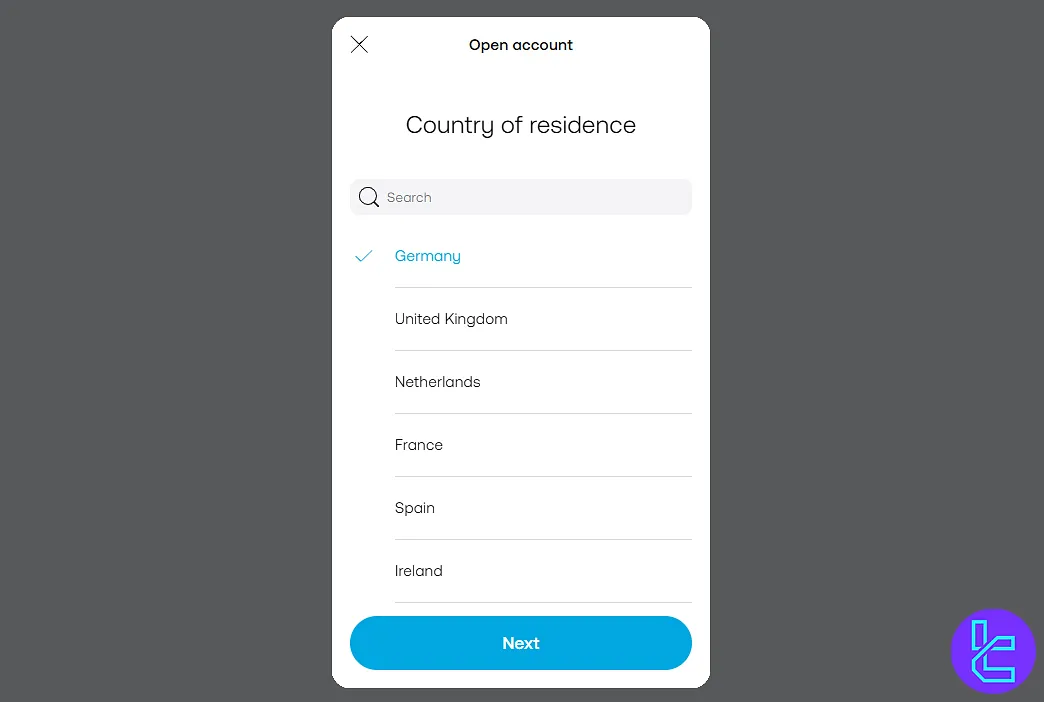

Registration involves selecting your country, securing your account, and activating it through email verification. Once complete, you’ll be ready to proceed with profile completion and KYC verification.

#1 Go to the Official Website

Visit the broker's official website and click on "Open Account" to access the registration form.

Click the Open Account button on the home page to start registration with Trading 212

Click the Open Account button on the home page to start registration with Trading 212

#2 Select Your Country of Residence

Choose your country to ensure account setup, regulations, and available instruments match your local requirements.

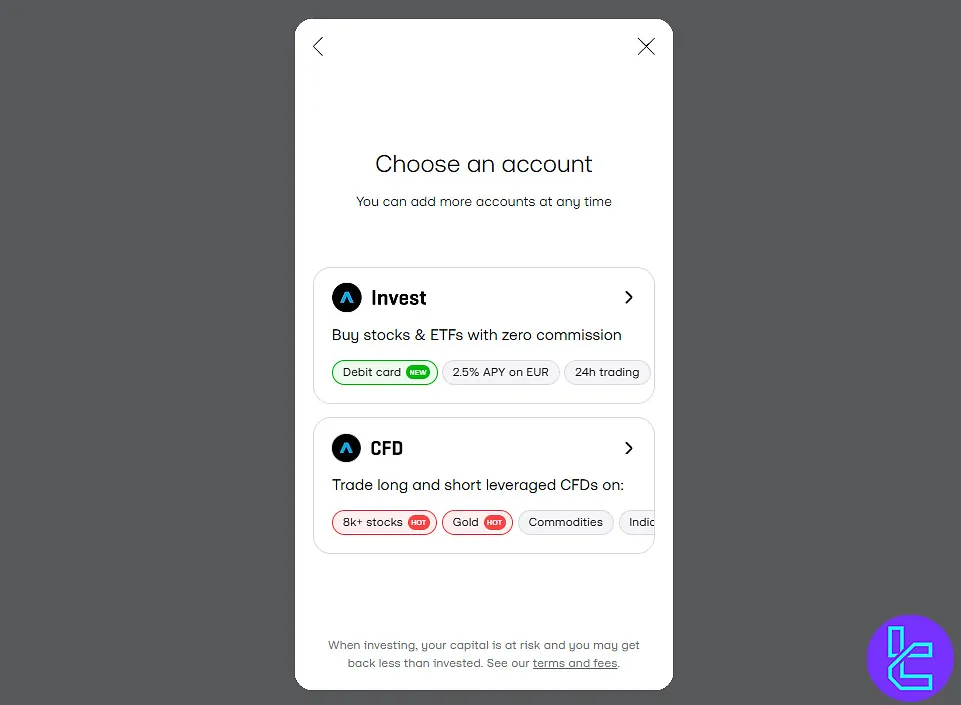

#3 Choose Your Account Type

Select between Invest for stocks & ETFs, or CFD for leveraged trading and short-term market opportunities.

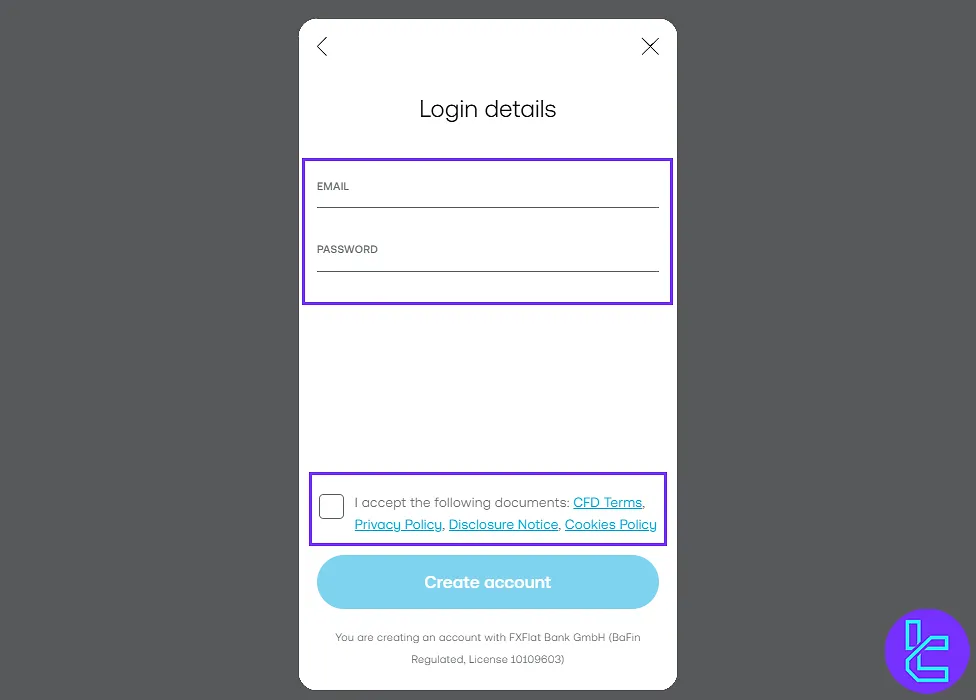

#4 Fill Out the Registration Form

Complete the signup application and provide the following information:

- Email address

- Password

Then, after reading documents, check the agreement to proceed.

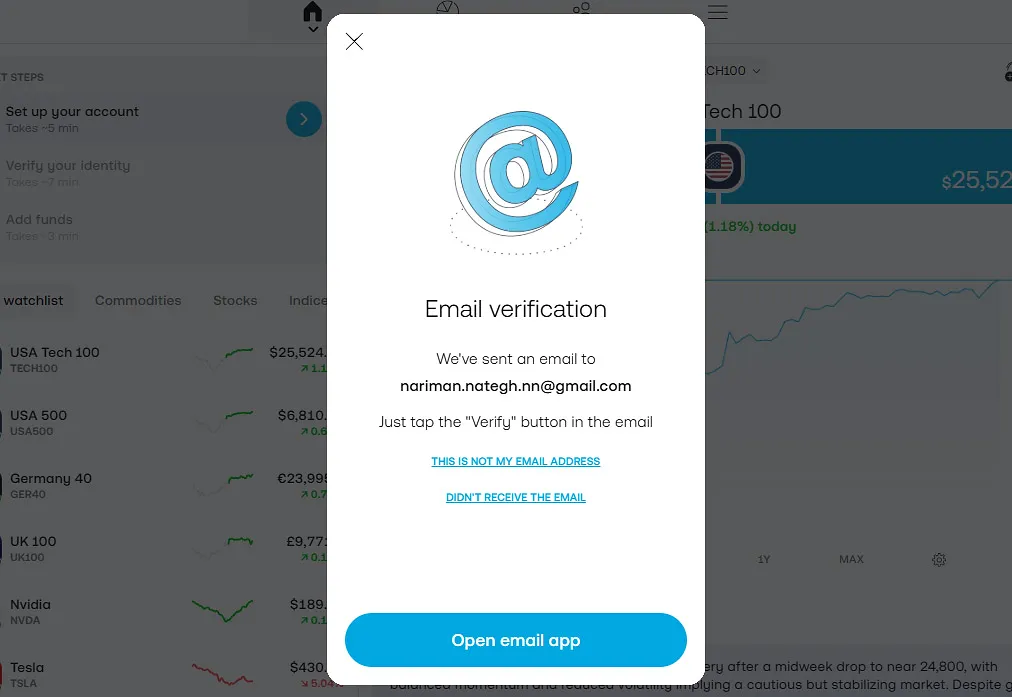

#5 Confirm Your Email

Check your inbox and verify your email using the code or link sent by the platform.

#6 Complete KYC

To deposit and trade live, upload valid identity and address documents from your dashboard, such as:

- Proof of ID: Passport or National ID

- Proof of Address: Utility bill or Bank statement

Trading Platforms: Does It Support MetaTrader 4/5?

Trading 212 offers a proprietary trading platform that's available in both web and mobile versions. The platform features TradingView-powered charting with 100+ indicators and intuitive drawing tools.

You can choose a version based on your device and preferences, but the mobile applications should be faster. Access the software through the links below:

While the proprietary platform is user-friendly and feature-rich for most traders, it's worth noting that Trading 212 doesn't support popular third-party platforms like MetaTrader 4 or 5. This could be a drawback for traders accustomed to these widely-used platforms.

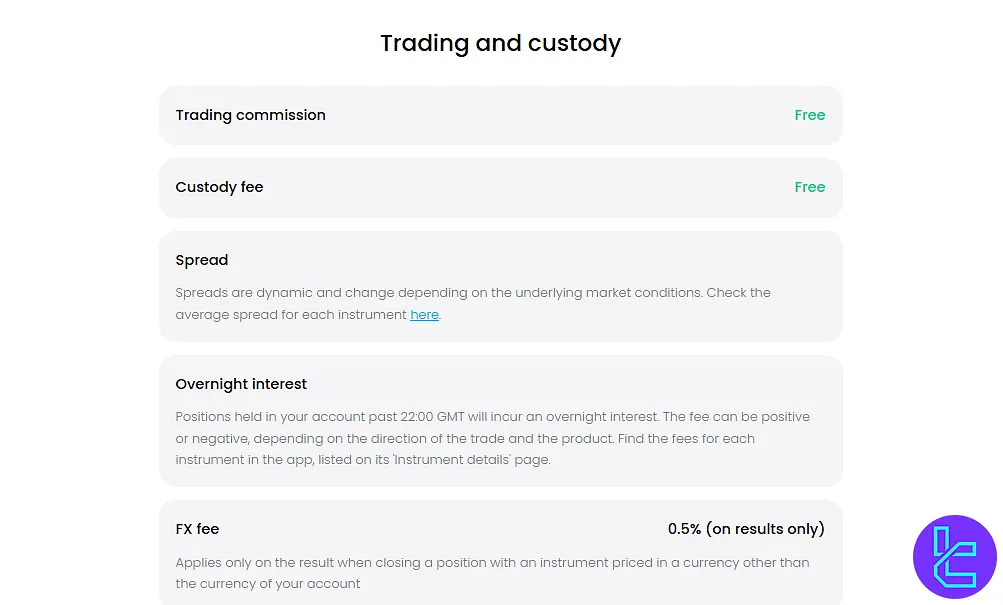

Trading Commissions and Other Costs

Trading 212's fee structure in trading, payments, and other sections is competitive, but it's important to understand the nuances. Here's a lowdown of trading commissions based on the account type:

Account Type | Invest | ISA | CFD | |

Trading Commission | None | |||

Custody Fee | None | |||

Spread | Variable | |||

FX Fee | 0.15% | 0.5% | ||

Other than the variable spreads and other fees mentioned above, there are no costs for inactivity periods, deposits, and withdrawals. However, for $2,000+ deposits made via cards, Google Pay, Apple Pay, and other similar systems, a 0.7% fee is applied.

You can use a profit calculator tool to calculate a trade's outcome by taking fees into account.

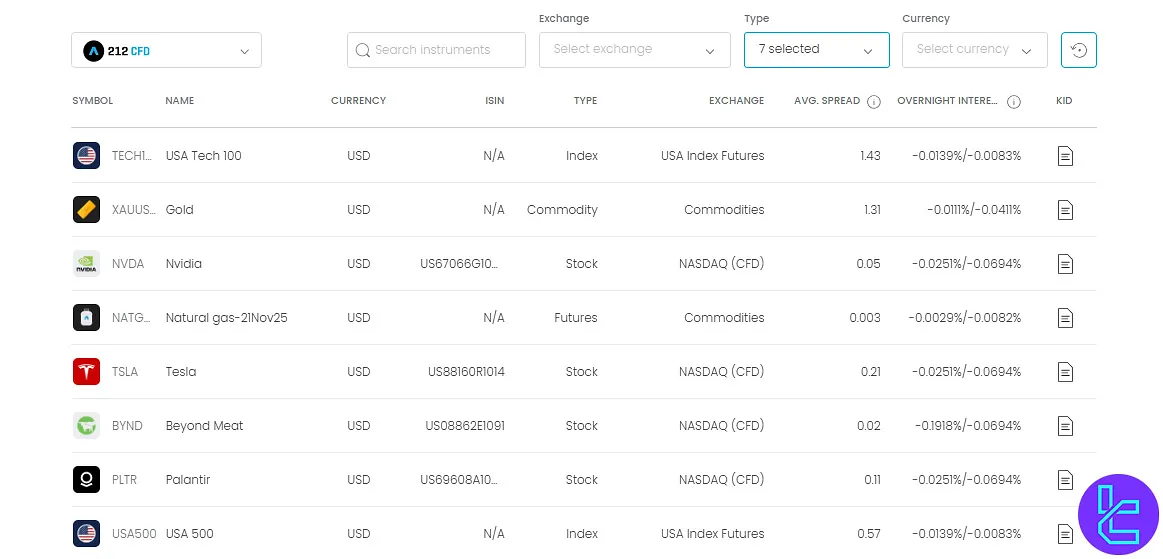

Swap Fee at Trading 212

An overnight financing, known as swap or rollover in Trading 212, is charged when a CFD position remains open past 22:00 GMT. These charges reflect the interest rate differential between currencies or instruments.

For instance, a short EUR/USD position worth €13,527 incurs ≈ €1.19 per day at a 0.0092% rate, according to Trading 212’s official example.

These key points summarize how Trading 212 handles overnight swaps and related conditions:

- Dynamic rates by asset and direction: Each instrument has distinct long/short overnight percentages displayed in its “Instrument Details” section;

- Transparent pre-trade visibility: Exact swap rates can be reviewed before opening a trade through the “i” icon on each instrument;

- No Islamic accounts: Trading 212 does not offer swap-free options for traders seeking Sharia-compliant CFD accounts.

Non-Trading Fees at Trading 212

Trading 212 maintains one of the most transparent fee structures in retail trading. The broker charges no inactivity or withdrawal fees, while only specific deposit and currency conversion situations may incur minor costs.

Its approach ensures traders retain maximum value when managing their funds.

Below are the core highlights of Trading 212’s non-trading fee policy:

- Free withdrawals: Trading 212 imposes no internal withdrawal fees; external banking costs may still apply;

- Deposit limit threshold: Card or instant deposits above € 2,000 (or equivalent) incur a 0.7 % fee;

- Currency conversion fee: A fixed 0.15 % applies when trading assets in currencies different from your base.

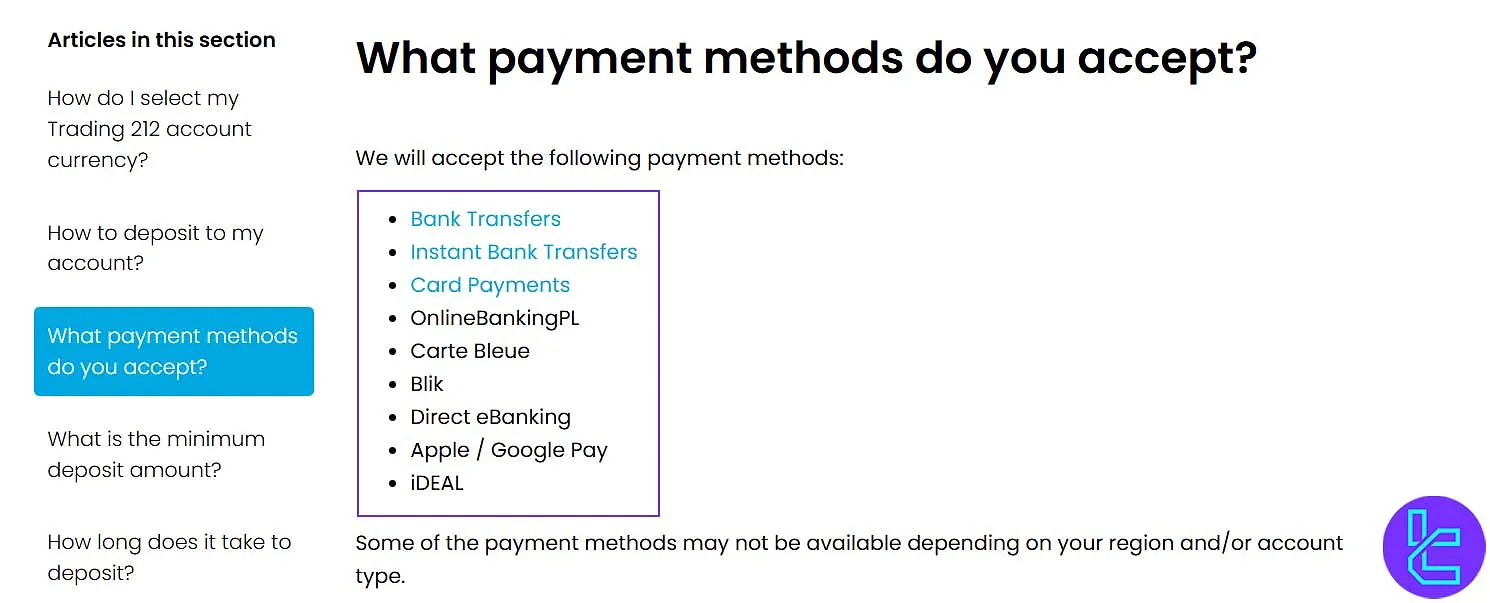

Funding and Withdrawal Methods on Trading 212

It offers a variety of deposit and withdrawal options to provide versatility for its clients. These are the supported methods:

- Credit/Debit Cards: Visa, Visa Electron, MasterCard, Maestro

- E-Payment Systems: PayPal, Apple Pay, Google Pay, Skrill

- Bank Transfers: Wire Transfer

Trading 212 ensures quick and secure processing for all deposits and withdrawals.

Deposit Methods at Trading 212

Funding your Trading 212 account is designed to be smooth, fast, and transparent. The platform supports a variety of funding channels, from classic bank transfers to instant and electronic payment systems, allowing traders worldwide to deposit funds securely in multiple currencies.

Fees, limits, and processing times vary depending on the method, account type, and region.

Below is a summary of all currently available deposit options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Transfer | USD, EUR, GBP | €1 / £1 / $1 | Free | 2 – 3 business days |

Instant Bank Transfer (Open Banking) | GBP or EUR | €1 / £1 | Free | Usually within minutes |

Card Payments (Credit/Debit) | USD, EUR, GBP | €1 / £1 / $1 | Fee-free up to £2,000 / €2,000, then 0.7% | Under 10 minutes |

E-Payment Systems | EUR, GBP, PLN | €1 / £1 / $1 | Free | Instant |

Withdrawal Methods at Trading 212

Trading 212 provides withdrawal options for major currencies with generally no broker fees. Processing typically takes up to three business days, though bank procedures or currency conversions may affect timing.

Withdrawals must follow regulatory requirements, meaning funds are returned via the same method initially used for deposit.

Check the table below for withdrawal details:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Bank Transfer | EUR, GBP, USD | €1 / £1 / $1 | Free | Up to 3 business days |

Debit/Credit Card | EUR, GBP, USD | €1 / £1 / $1 | Free | Up to 3 business days |

Trading 212 Card (ATM) | EUR, GBP | €1 / £1 | Free up to €/£ 400 per month, then 1 % | Immediate once funds on card |

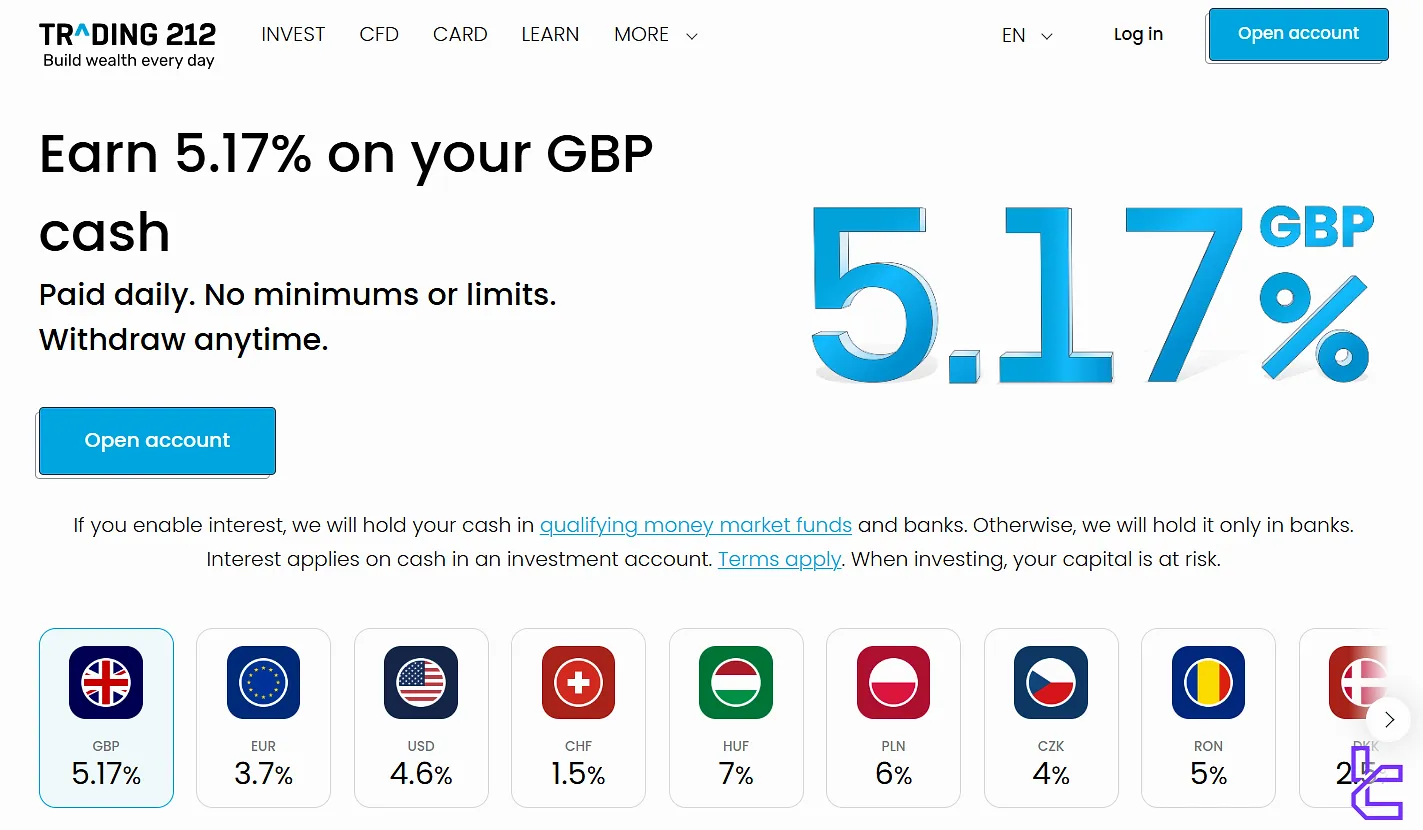

Available Copy Trading & Investment Options

While Trading 212 doesn't offer a traditional copy trading feature, unlike some other brokers, it does provide some interesting investment options.

You can earn daily interest without any limitations or minimum levels on your cash in the brokerage. The rate varies depending on the currency. Rates for some currencies:

- USD: 4.6%

- GBP: 5.17%

- EUR: 3.7%

- CAD: 3.5%

- HUF: 7%

- RON: 5%

In addition to this feature, there's a "Share Lending" service available, which works based on this process: the client lends shares to borrowers and receives interest in return.

While these features offer some level of automated investing, they don't quite match the sophistication of copy trading platforms offered by some competitors.

Trading Instruments and Markets

This section is where Trading 212 performs the best. It offers a truly wide array of more than 13,000 tradable instruments across various markets:

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Currency pairs (CFD) | 180+ | 50-100 | 1:30 (Retail) / 1:200 (Pro) | |

Indices | CFD on major / minor indices | 23 | 10-20 | 1:20 (Retail) / 1:100 (Pro) |

Stocks & ETFs | Shares, ETFs (Invest & CFD) | 5000+ | 3000-10000 | 1:20 |

Commodities | Metal, Oil, Gas, etc. futures/CFDs | 5+ | 3-5 | 1:20 (Retail) / 1:40 (Pro) |

US Treasuries | Treasury futures (CFD) | N/A | 50+ | 1:5 (Retail) / 1:50 (Pro) |

The broker also supports fractional share investing and “Pie” portfolios for automated and recurring investments. Cryptocurrency trading has been discontinued for retail clients, aligning with regulatory constraints in the UK.

It's worth noting that the availability of certain instruments may vary depending on your account type and geographical location.

Bonuses And Promotions

Based on our investigations while writing this review, Trading 212 doesn't currently offer any ongoing bonuses or promotions.

This approach does not necessarily count as a drawback since promotional offers are not actual features; they are more of marketing tools.

Trading 212 Awards

Trading 212 Awards highlight the broker’s consistent recognition for innovation, transparency, and exceptional value in online investing.

Across the UK and European markets, the company has been celebrated for its low-cost structure, user-friendly platform, and commitment to empowering everyday investors.

These awards demonstrate Trading 212’s strong reputation and leadership in the modern brokerage landscape.

Here are some of the most notable awards the broker has received in recent years:

- Best Online Trading Platform 2025 – British Bank Awards by Smart Money People

- World’s Top Fintech Companies 2025 – CNBC in partnership with Statista

- Best Free Trading App 2025 & 2023 – BrokerChooser

- Best For Low-Cost ISA – Boring Money Awards

- Best Buy ISA 2024 – Boring Money Awards

- Best Broker for Commission-Free ETFs 2023 – Broker Awards by Investing in the Web

- Best CFD Broker 2024 – Rankia Awards

Support Contact Methods And Working Hours

This brokerage provides customer support through several typical channels:

- Email: info@trading212.com

- Live Chat: Accessible through the personal account

- Ticket: Available on the website for everyone

Based on the available data, the customer support team is available 24/7. The lack of phone support and live chat option for unregistered traders could be a downside for some people.

Which Countries Are Restricted From Trading 212's Services?

The broker is available in many countries through three entities (Trading 212 UK Ltd., Trading 212 Markets Ltd., and Trading 212 AU PTY Ltd.), but there are some restrictions. Currently, the company does not accept clients from:

- United States

- Canada

- Japan

- Brazil

- Turkey

- Iran

- Cuba

- Sudan

- Syria

- North Korea

Note that this list might not contain all the banned regions.

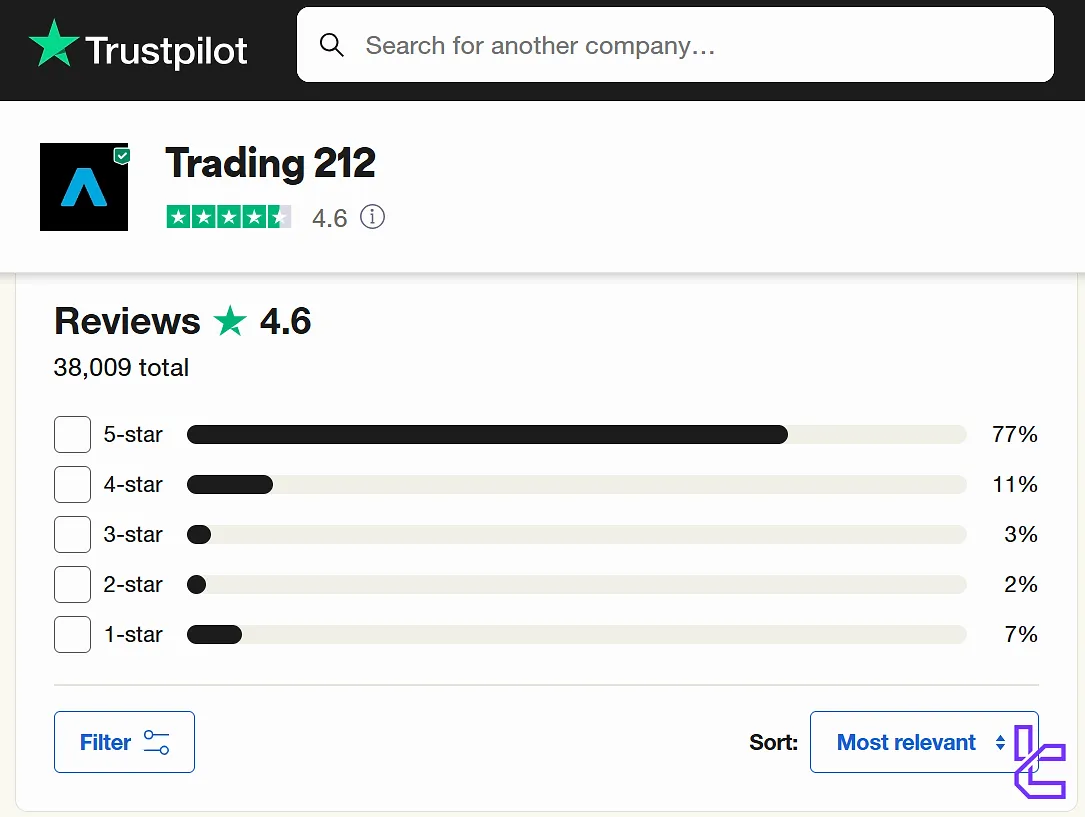

Trust Scores & User Evaluations

Some websites, like Trustpilot and ForexPeaceArmy, are well-known sources for trust scores of companies. The brokerage has received mixed reviews across the mentioned platforms:

- Trading 212 Trustpilot: 4.6/5, based on more than 38,000 reviews, with +77% being 5-star

- ForexPeaceArmy: 2.6/5, only 65 reviews

Since the number of ratings on FPA is too low compared to those on Trustpilot, we cannot rely on them. Therefore, we can say that Trading 212 is trustworthy based on the reviews received from users.

Education Content On Trading 212 Broker

The company offers a range of educational resources, although not as extensive as some competitors. To be precise, the education offered by the broker is available in 3 main forms:

- "Learn" Page: Articles on investing, dividends, and other financial topics

- YouTube: Videos providing tips and tutorials

- Help Centre: FAQs on funds, account types, instruments, and so on

While these resources provide a solid foundation, especially for beginners, more advanced traders might find the content lacking in depth.

Research content on Trading 212 is limited but includes daily market analysis, an economic calendar, and a social sentiment feed.

You can also check TradingFinder's Forex education section for additional resources.

Trading 212 vs Top Forex Brokers

Let's see Trading 212 standing in the trading world compared to other industry players.

Parameter | Trading 212 Broker | |||

Regulation | FCA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | None | ASIC, FSC, DFSA, CySEC |

Minimum Spread | N/A | From 0.0 pips | 0.1 Pips | From 0.6 Pips |

Commission | $0 | From $0.2 | None | From Zero |

Minimum Deposit | $1 | $10 | $10 | $5 |

Maximum Leverage | 1:200 | Unlimited | 1:3000 | 1:1000 |

Trading Platforms | Proprietary platform | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Invest, CFD, ISA | Standard, Standard Cent, pro, Raw Spread, Zero | Standard, Premium, VIP, CIP | Micro, Standard, Ultra Low, Shares |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 13,000+ | 200+ | 50+ | 1,400+ |

| Trade Execution | Market | Market, Instant | Market, Instant | Market, Instant |

Conclusion And Final Words

Trading 212 charges no fee for deposits/withdrawals, except for $2,000+ payments made via cards, Google Pay, Apple Pay, etc., which is a 0.7% cost.

The brokerage pays a daily interest on the cash balance, varying based on the currency; for example, it's 4.6% for USD and 3.7% for EUR.