Trive verification is a mandatory 3-step process that provides full access to the broker's financial services.

Required documents include proof of identity (POI) and proof of address (POA) issued within the last 3-6 months.

Trive Verification Process Overview

After completing the Trive registration, gain full access to financial services in the Trive broker by following these steps.

Trive verification steps:

- Access the verification area via "Open Live Account";

- Upload identity and address confirmation documents;

- Confirm status via email and dashboard updates.

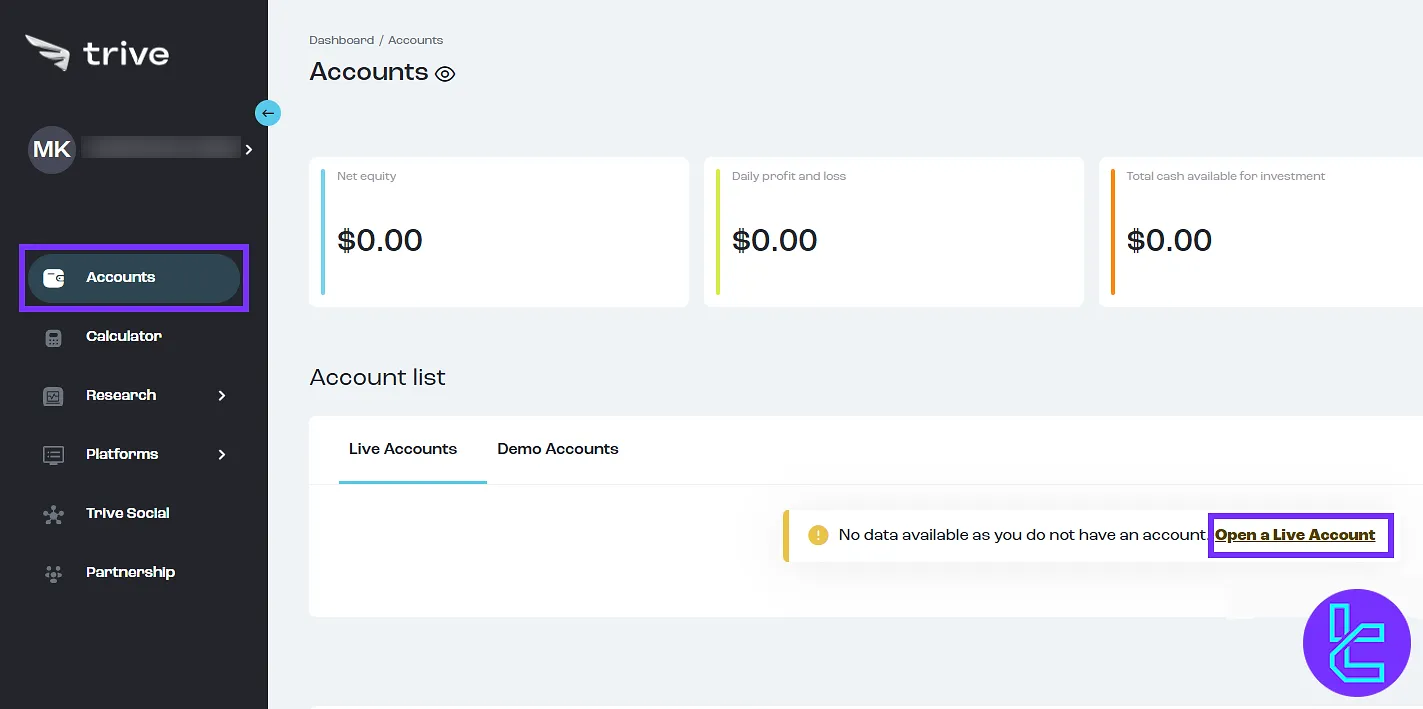

#1 Accessing the Trive Identity Confirmation Section

To begin this process, follow these steps:

- Log in to the Trive dashboard;

- Click on the "Accounts" option;

- Select "Open Live Account".

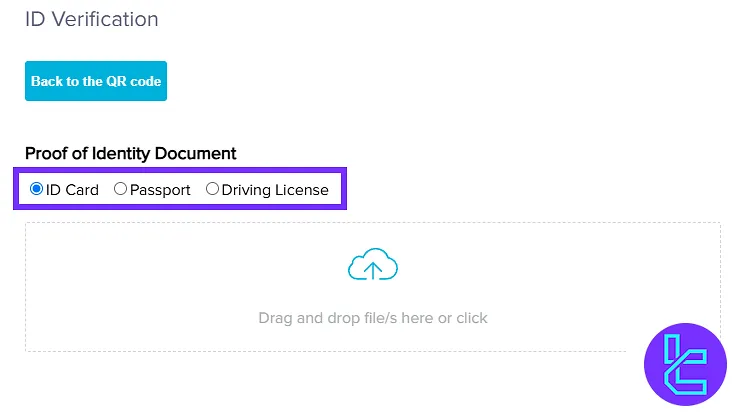

#2 Uploading Identity and Address Documents

Click on "Upload Document" to begin the manual document submission. Select the document type for identity confirmation:

- National ID card

- Passport

- Driver’s license

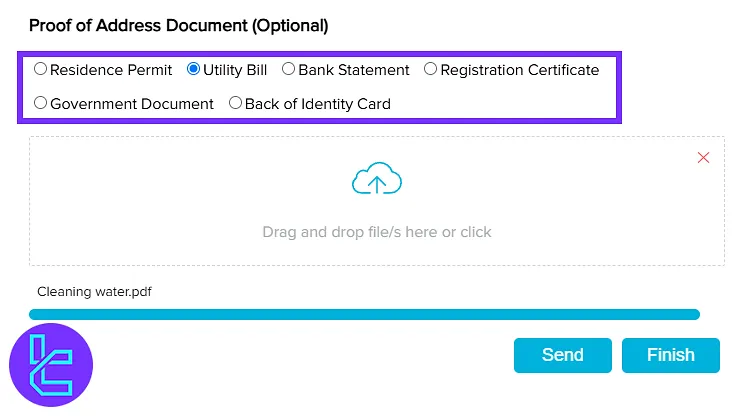

Next, select the document type for proof of address. Acceptable documents include:

- Residence Permit

- Utility Bill

- Bank Statement

- Registration Certificate

- Government Document

- Back of Identity Card

Upload the selected document and click "Send" followed by "Finish" to complete the submission.

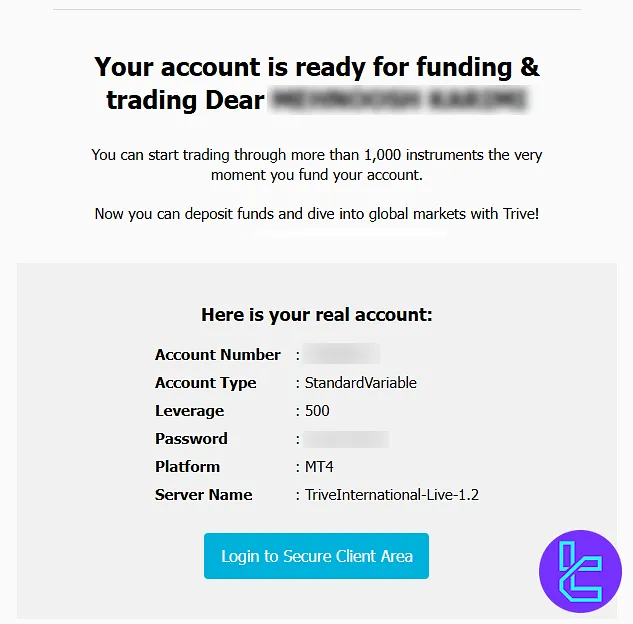

#3 Confirming User Authentication Status

After submitting the required documents, the review process begins. An email will be sent to confirm account approval once the documents are verified.

TF Expert Suggestion

The Trive verification process is efficient and takes less than 10 minutes when documents are prepared in advance. This process requires government-issued documents (eg. ID card, utility bill, passport, etc.) for verifying your identity and address.

Now that your account is fully verified, you can manage your funds using the Trive deposit and withdrawal methods. Detailed information is available on the Trive tutorial page.