- TradingFinder

- Education

- Forex Education

- Financial Glossary

Financial Glossary

Understanding financial terminology enhances trading Analysis, decision-making, and trade execution. Common terms include spread, leverage, liquidity, and pending orders. Terminology varies across trading styles and markets. In price action trading, terms such as pin bar and liquidity grab are frequently used. In ICT trading, concepts like fair value gaps (FVG) and market maker models are essential. In RTM trading, traders use terms like flip levels (FL) and Quasimodo level (QML). On TradingFinder, a specialized financial glossary is available, covering key trading terms across different strategies and markets to help traders apply accurate terminology in their Analysis.

Risk Management in Financial Markets: Guide to Effective Risk Control Strategies

Risk management refers to the identification, analysis, and control of harmful factors, applicable in all financial markets such as...

Swing Trading - Strategies Based on Price Reversals, Breakouts, & Retracements

In swing trading, traders analyze the overall market trend and various economic data to identify the long-term direction of price...

Refinement Trading Strategy; Capital Management Adjustment

In financial markets, none of the trading strategies is reliable in their initial phase. Changes in market structure, price...

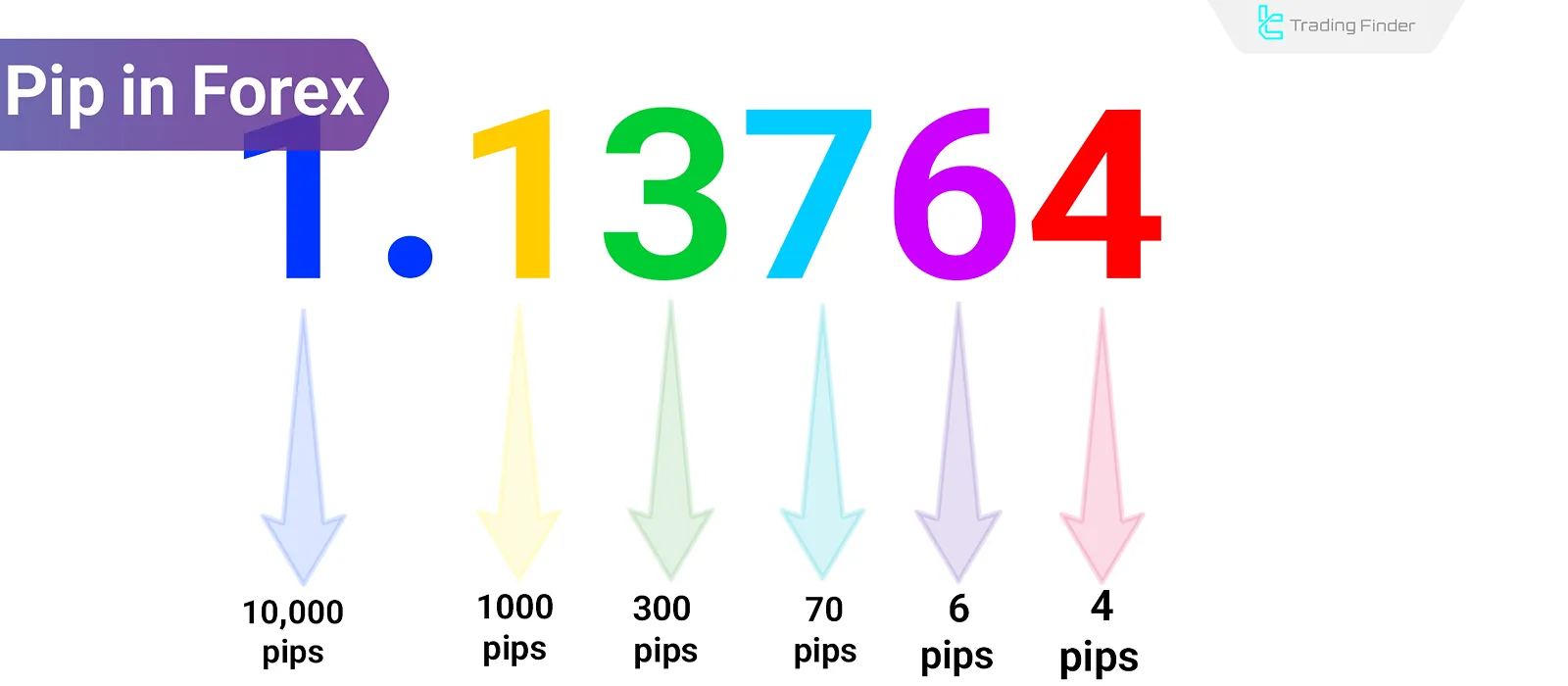

Pip in Trading: Applications in Capital & Risk Management + Calculation Formula

A pip (PIP) is the standard unit of measurement for price changes in currency pairs and serves as the main basis for...

What Is Social Trading? Copy Trading, Mirror Trading, and Signal Trading

Social trading refers to leveraging the experience and skills of other individuals in your trading strategy. Onsocial trading...

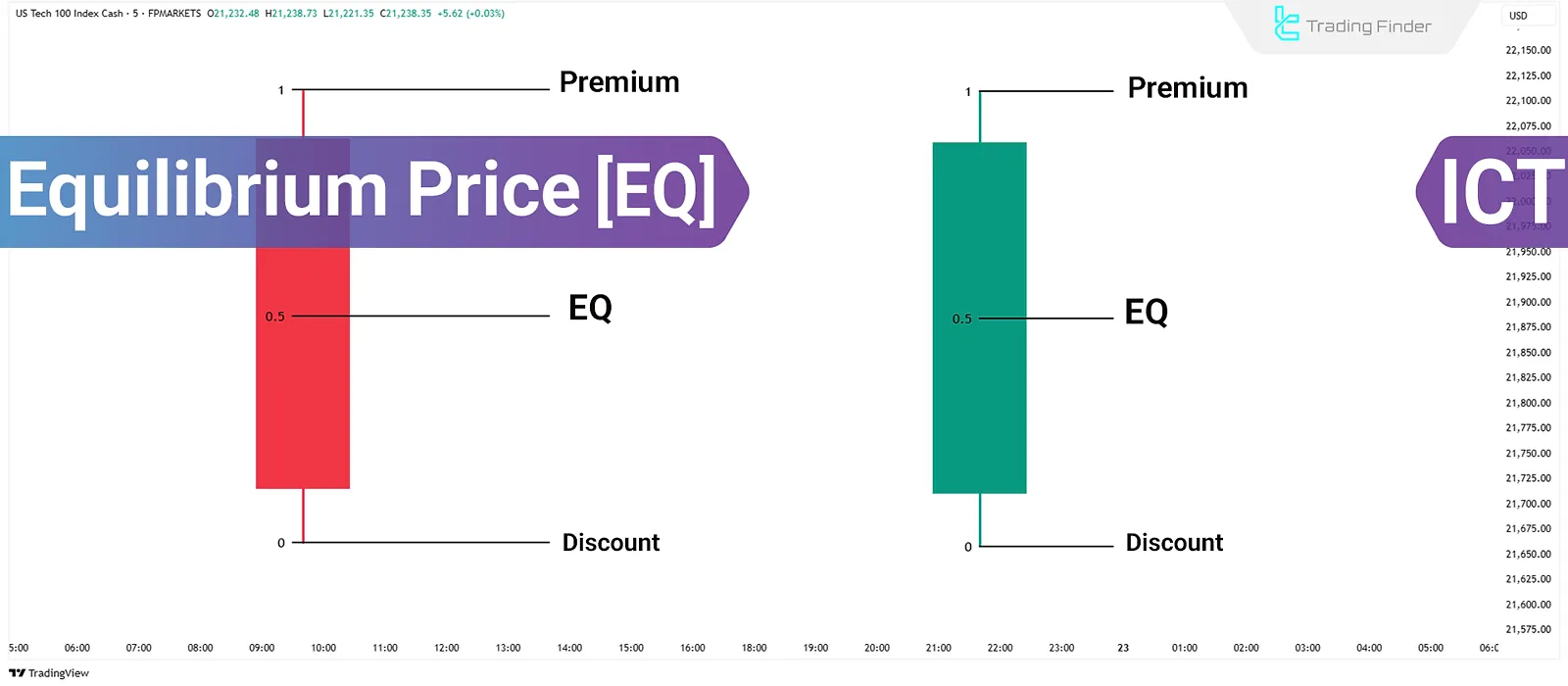

ICT Style Price Equilibrium: How to Calculate & Use It with PD Array Components

In the ICT methodology, price equilibrium refers to the midpoint between the highest and lowest wick of a...

What is a Trading Plan? A Guide to Building a Trading Plan for Different Markets

Atrading plan is a set of rules that governs all activities of a trader. A properly written trading plan helps mitigate the...

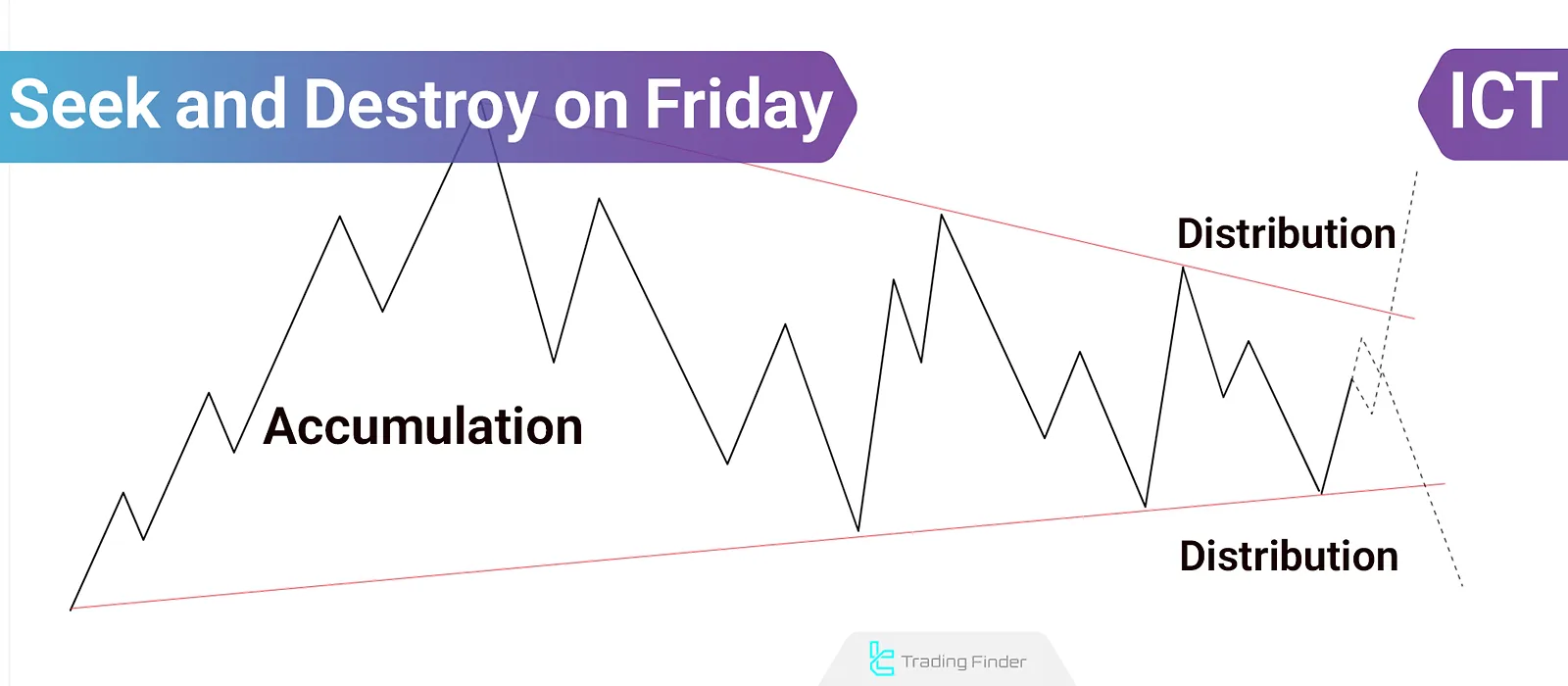

Friday Seek and Destroy Strategy in ICT: Accumulation and Distribution Explained

In the Friday Seek and Destroy strategy within the ICT methodology, the market typically enters an accumulation or distribution...

What Is the RTM Diamond Pattern? Trading the Diamond Pattern in the RTM Style

The RTM Diamond Pattern is one of the main patterns in the RTM style that deceives both buyers and sellers. This pattern appears...

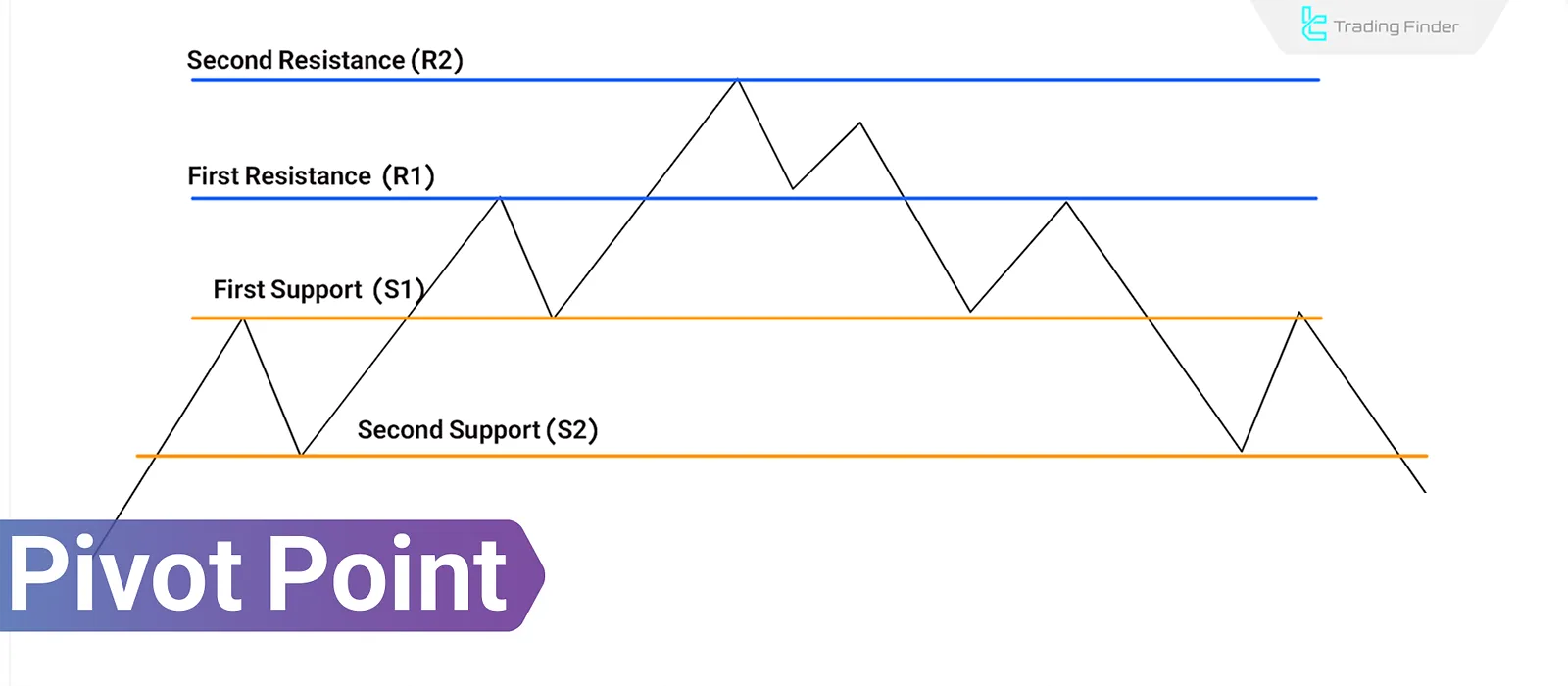

Pivot Point in Technical Analysis: Entry, Exit, Stop-Loss, and Price Targets

A Pivot Point in Technical Analysis is a computational method that identifies key market levels for the next trading day based on...

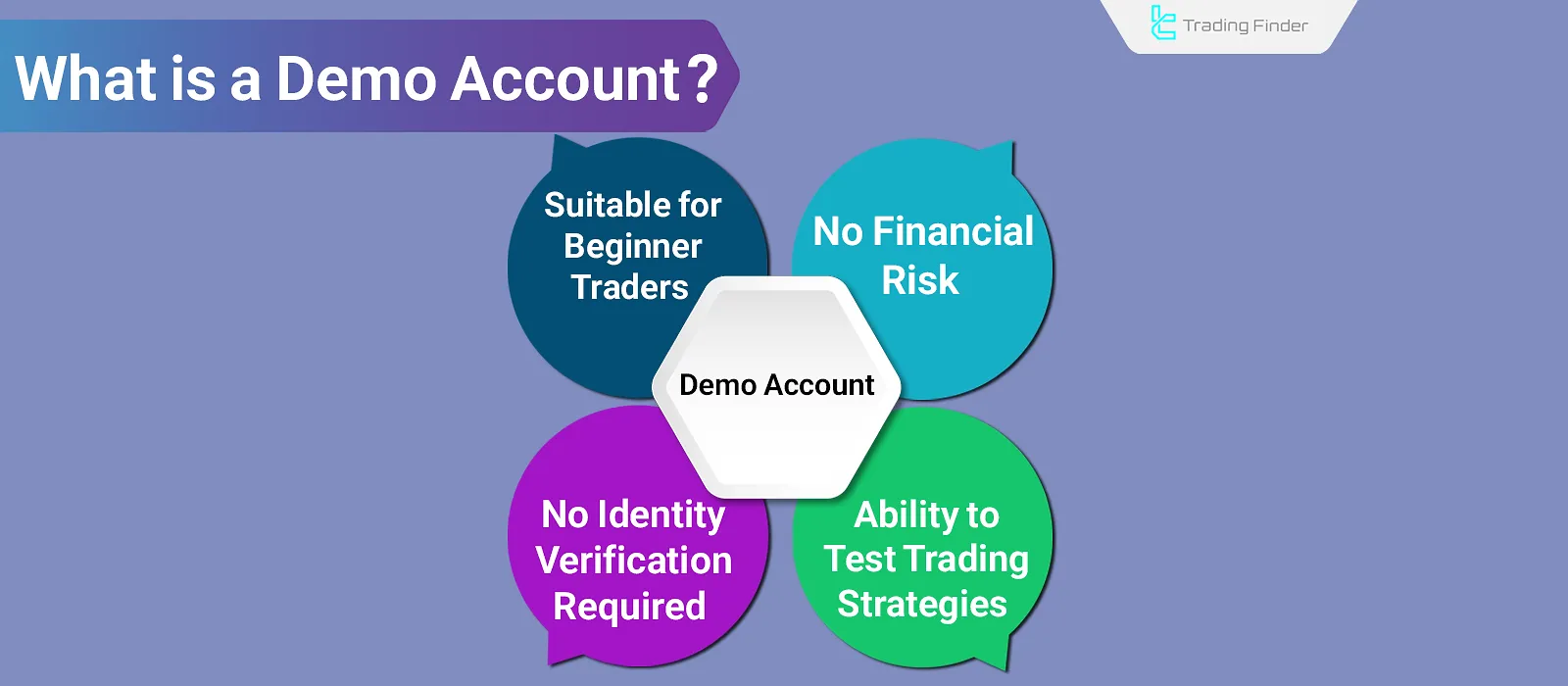

What Is Demo Account? Differences Between Demo and Real Accounts

Ademo account enables users to test and evaluate trading strategies without risking real capital, providing a safe way to enhance...

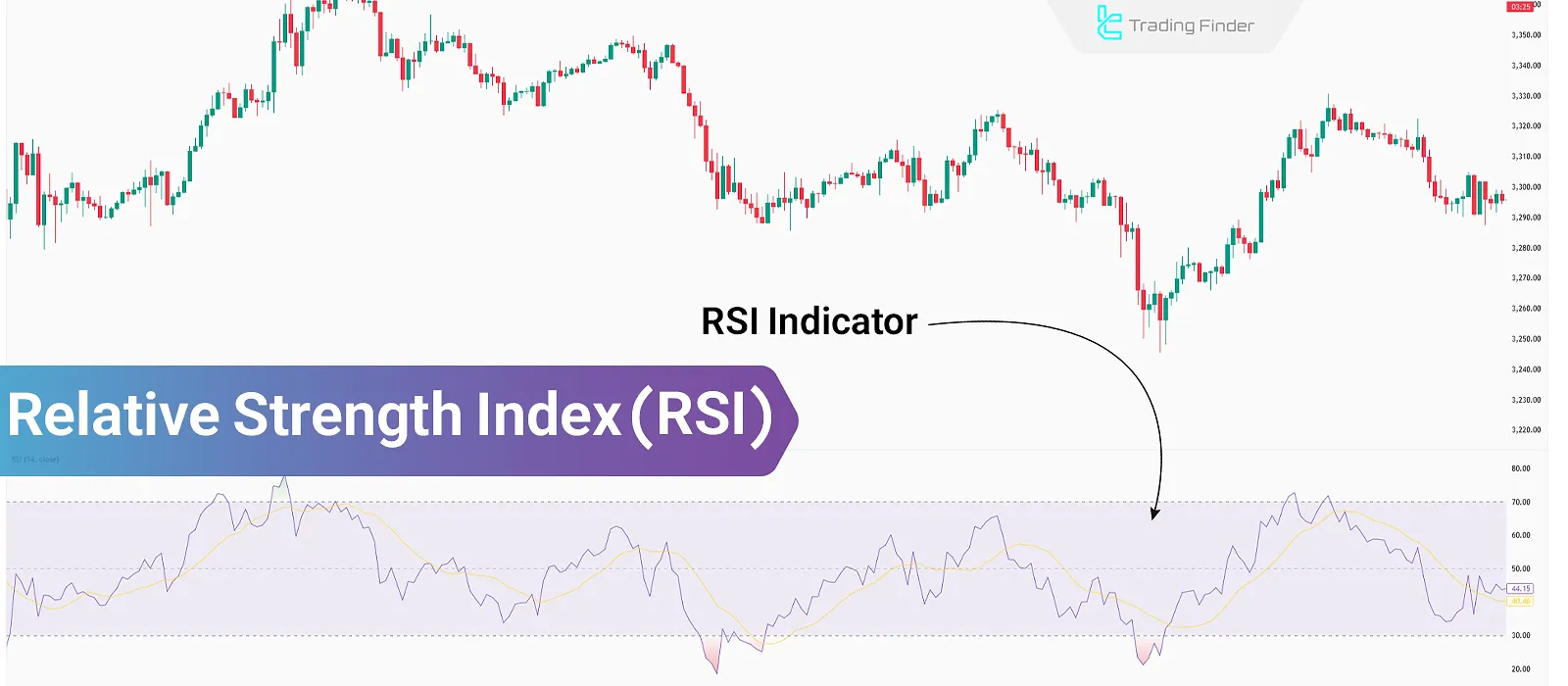

What Is the RSI Indicator? Its Applications and How to Trade It Across Different Markets

The Relative Strength Index (RSI) evaluates the strength of a trend by analyzing the open and close prices of candles over...