- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

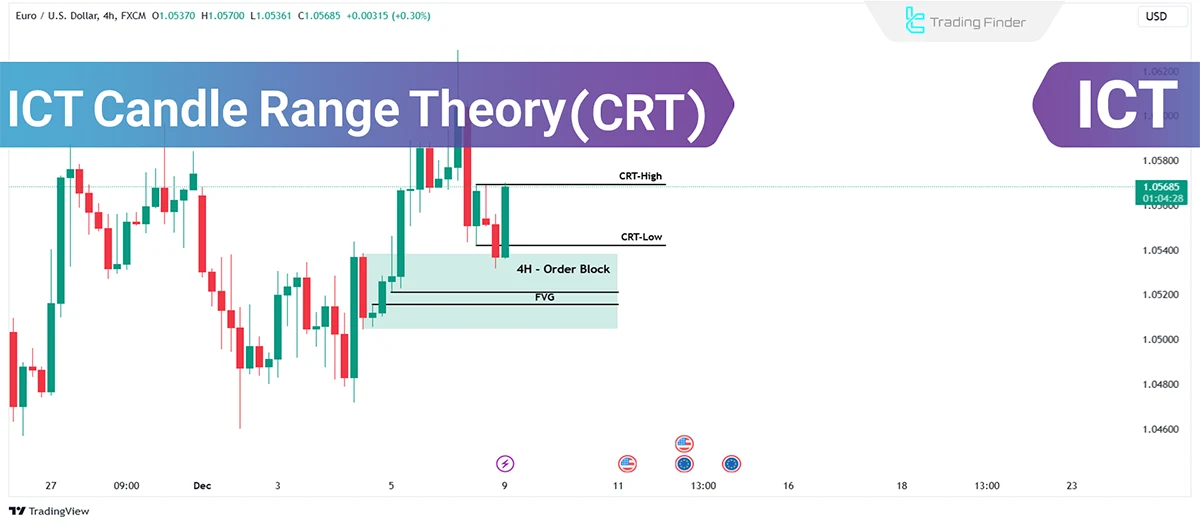

Candle Range Theory (CRT); Price Range Analysis Trading Guide

One of the patterns derived from the ICT methodology is the Candle Range Theory (CRT), which revolves around the concept of...

Learn the Concept of POI in ICT– Entering a Trade Using Points of Interest (POI)

In financial market analysis using the ICT style, Points of Interest (POI) in higher timeframes are used to analyze the ongoing...

Bearish Order Block: Explained the Ultimate ICT Smart Money Trading Guide

One of the foundational concepts in ICT trading is the Bearish Order Block (OB-), which represents the zones where smart money’s...

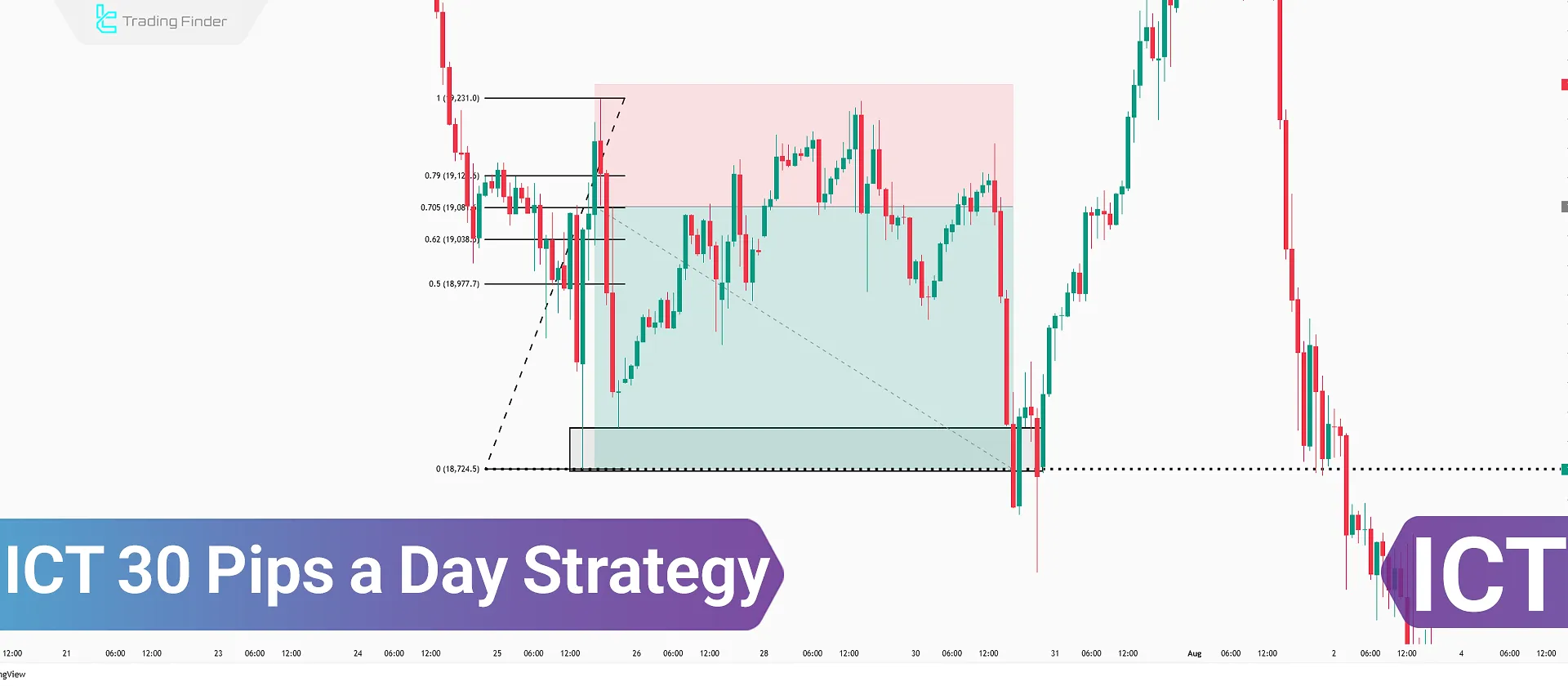

ICT 30 Pips a Day Strategy – Combining OTE & DOL to Identify Entry & Exit Points

The ICT 30 Pips a Day Strategy incorporates various concepts from the ICT Style such as Draw On Liquidity (DOL), Optimal Trade...

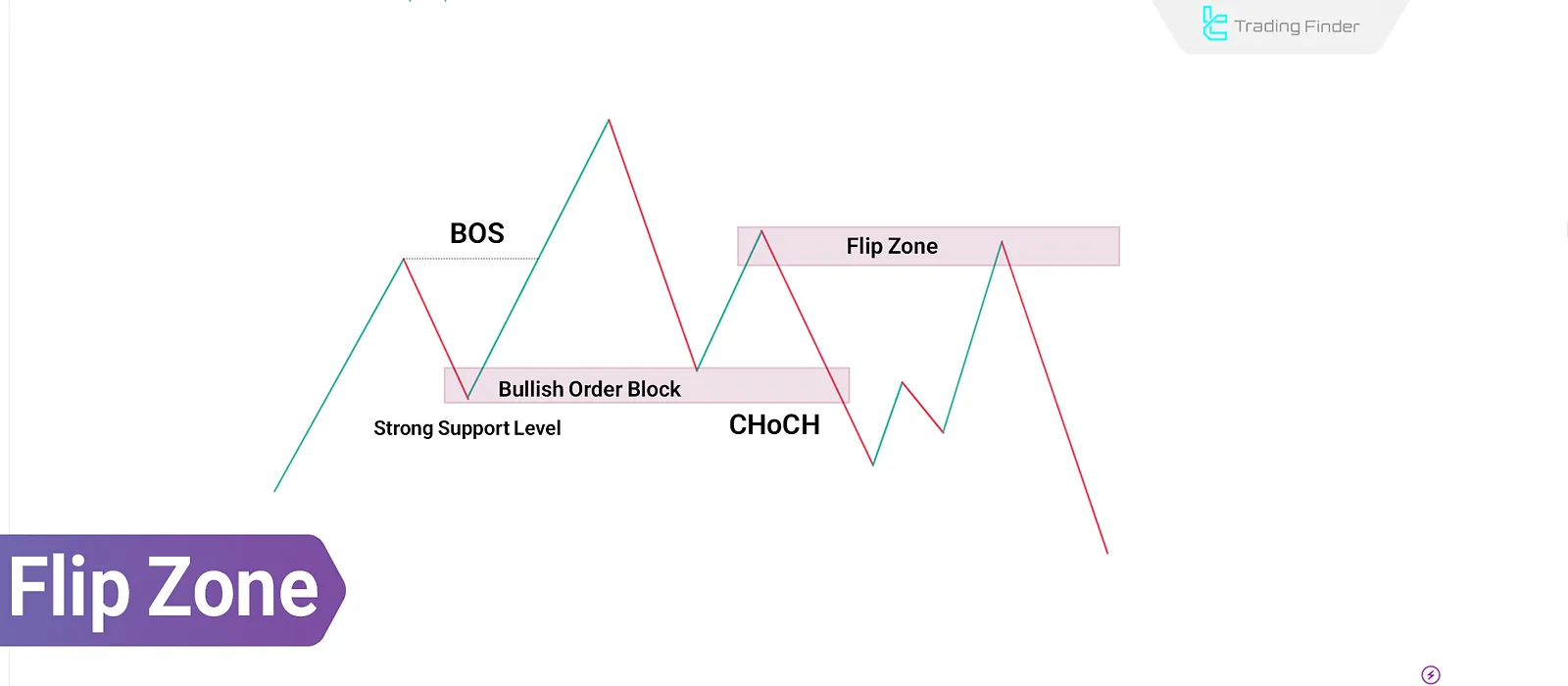

Smart Money Flip Zone & ICT Concept: Using Supply and Demand Levels

In Smart Money analysis and ICT concepts, a Flip Level in ICT is a price level where supply or demand zones are broken and...

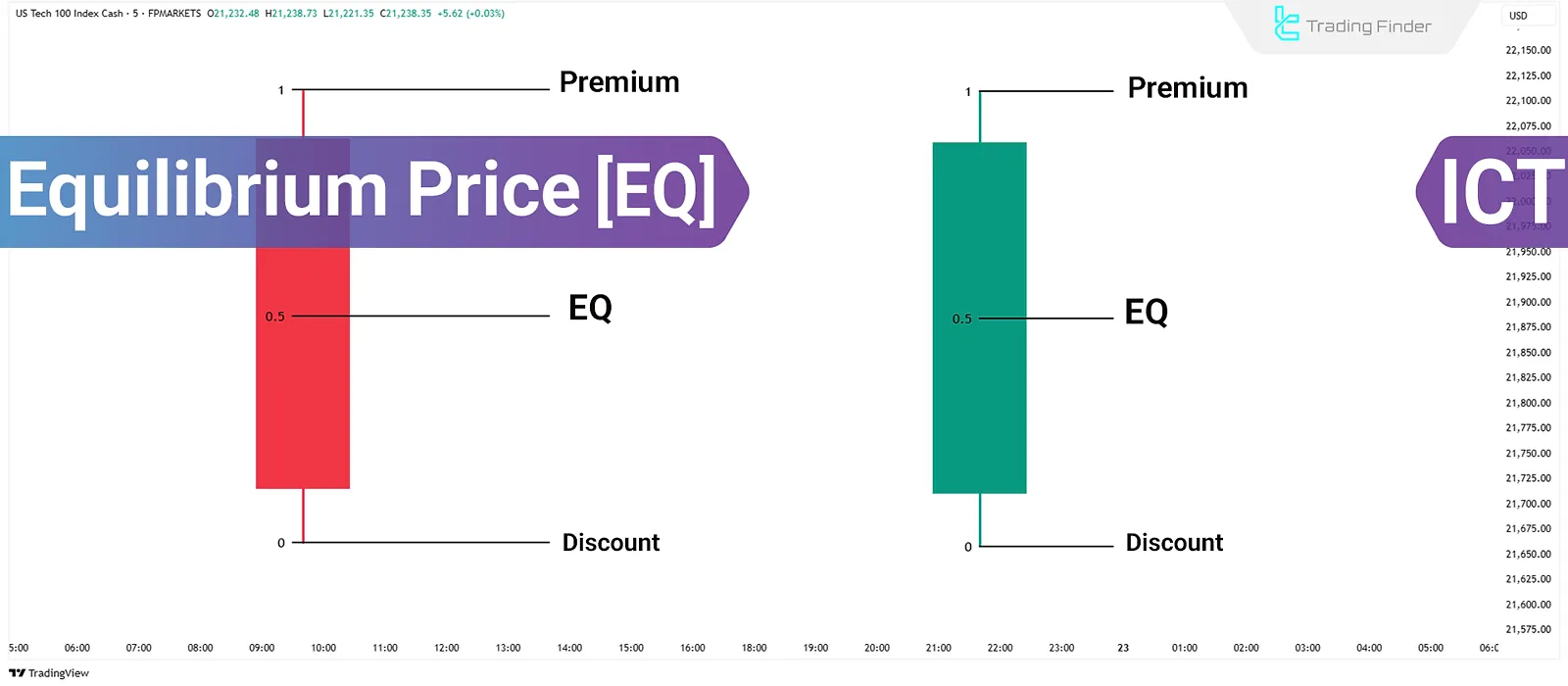

ICT Style Price Equilibrium: How to Calculate & Use It with PD Array Components

In the ICT methodology, price equilibrium refers to the midpoint between the highest and lowest wick of a...

Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]

The Fractal model in ICT style is a method for aligning price structure across timeframes and entering reactive market zones. This...

ICT Bread and Butter Buy-Setup – Scalping Strategy in Bullish Bias

When the Daily Bias in a higher time frame (HTF) is bullish, the ICT Bread and Butter Buy-Setup provides signals to enter buy...

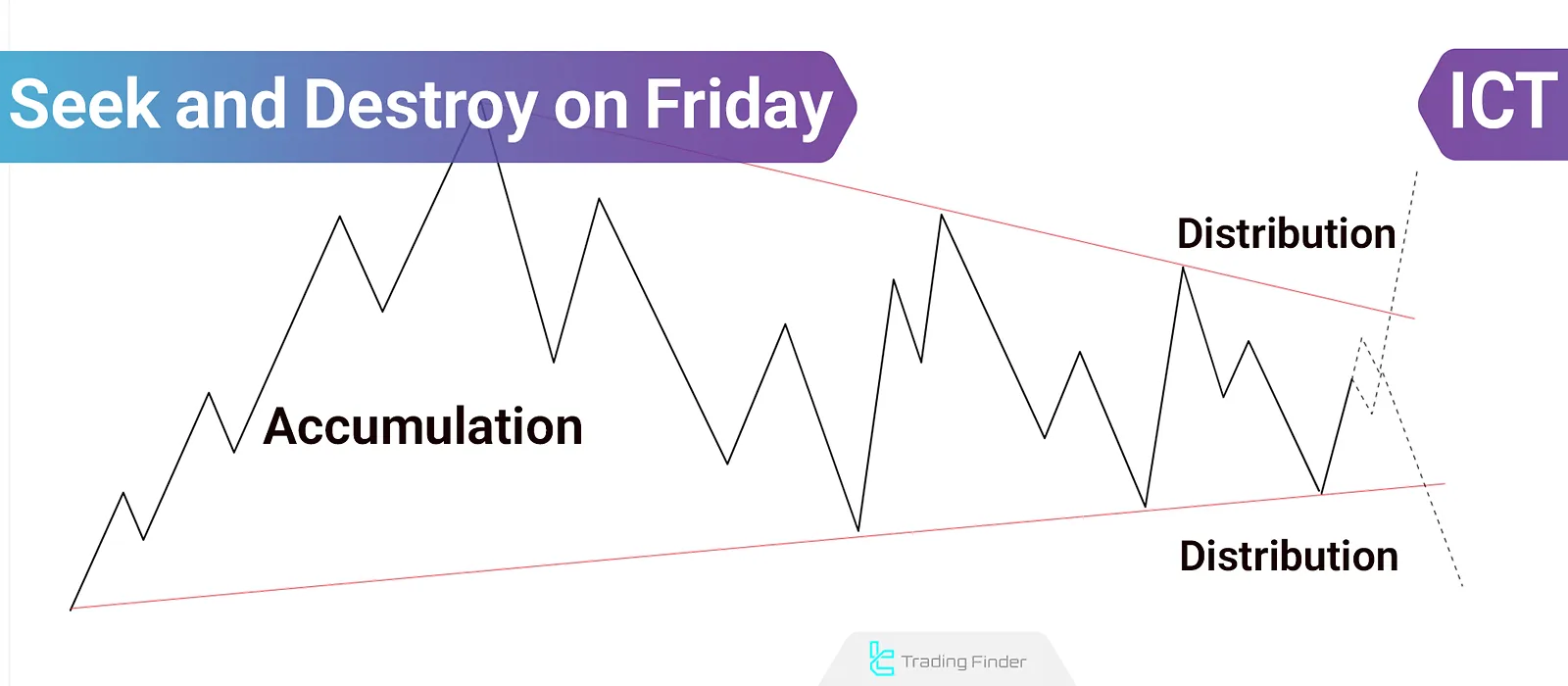

Friday Seek and Destroy Strategy in ICT: Accumulation and Distribution Explained

In the Friday Seek and Destroy strategy within the ICT methodology, the market typically enters an accumulation or distribution...

Bearish Bread and Butter Trading Strategy – Ideal ICT-Style Scalping Setup

The ICT Bread and Butter Sell-Setup, when aligned with a bearish Daily Bias, offers opportunities to enter short-term sell trades....

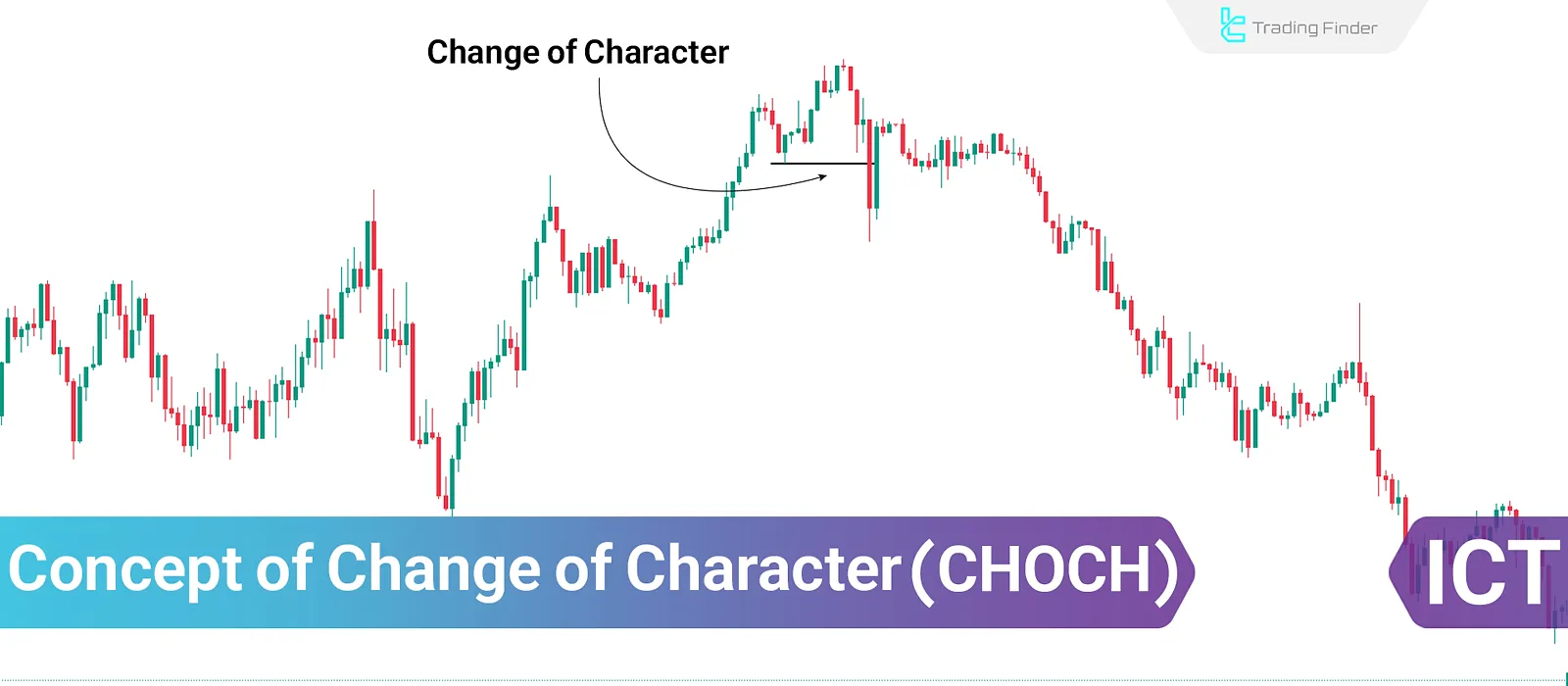

CHOCH in ICT; Best Timeframe to Identify CHOCH in Trading

In the ICT Style, a proper understanding of market structure shifts is highly important, as these changes often mark the...

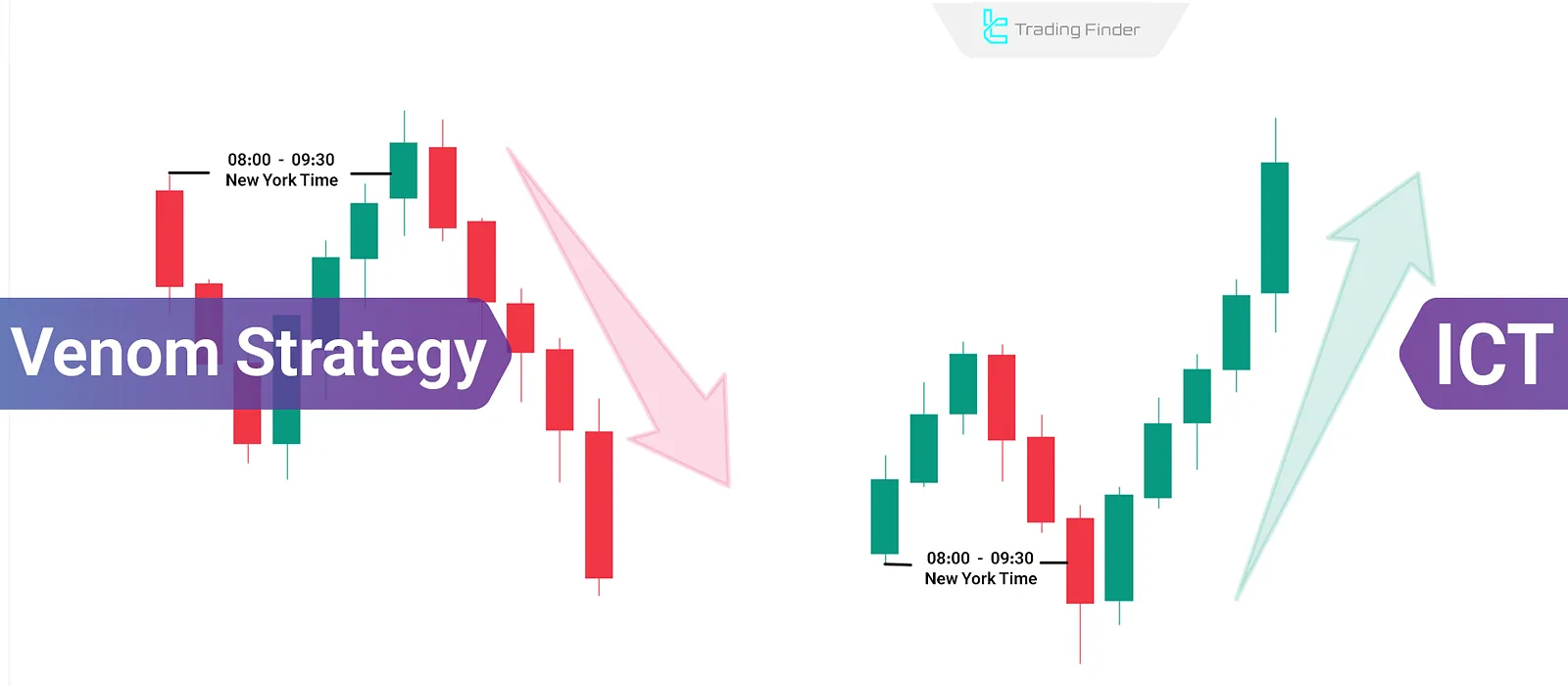

Venom Strategy in ICT Style; Intraday Trading on US Stock Indices

The Venom model (ICT Venom) is an advanced strategy in the ICT style, built upon three critical concepts of Liquidity, Time,...

![Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]](https://cdn.tradingfinder.com/image/444830/7-94-en-fractal-model-in-ict-01.webp)