- TradingFinder

- Education

- Forex Education

- Trading Strategies Education

Trading Strategies Education

Every trader needs a trading strategy to succeed in financial markets. This strategy should be based on technical, fundamental, or sentiment analysis. An effective strategy includes clear entry and exit rules, risk management, and emotional control, ensuring disciplined and structured trade execution. Trading strategies vary based on style and timeframe. Day traders often use scalping and breakout trading, whereas long-term traders focus on swing trading and trend following. Advanced methodologies like ICT, RTM, and Smart Money focus on liquidity flow, price manipulations, and structural breaks, allowing traders to pinpoint precise entry and exit points. Building a successful strategy requires continuous testing and optimization. On TradingFinder, traders can access specialized training on creating, testing, and refining trading strategies. Additionally, by combining technical tools, capital management techniques, and past trade performance analysis, traders can optimize their methods for the best possible results.

RSI and EMA Strategy: A Trend-Confirmed Momentum Setup

In the strategy combining RSI and EMA, the RSI indicator, by displaying overbought and oversold zones, and the EMA indicator, by...

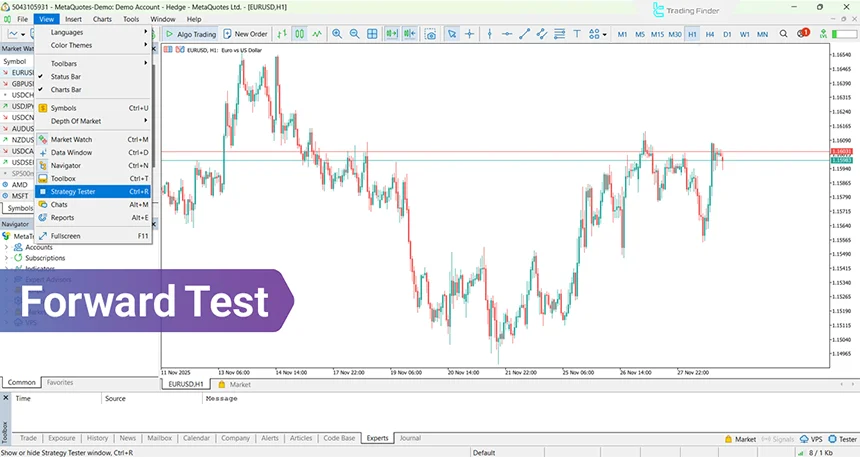

Forward Test: How to Forward Test Trading Strategies

Forward Test is a method for live evaluation of a trading strategy’s performance on real future data; a method that shows how...

What Is a Trading Style? Types of Trading Styles in Financial Markets

Choosing a trading style helps establish discipline in trading and improves the success rate of a trading strategy. Therefore,...

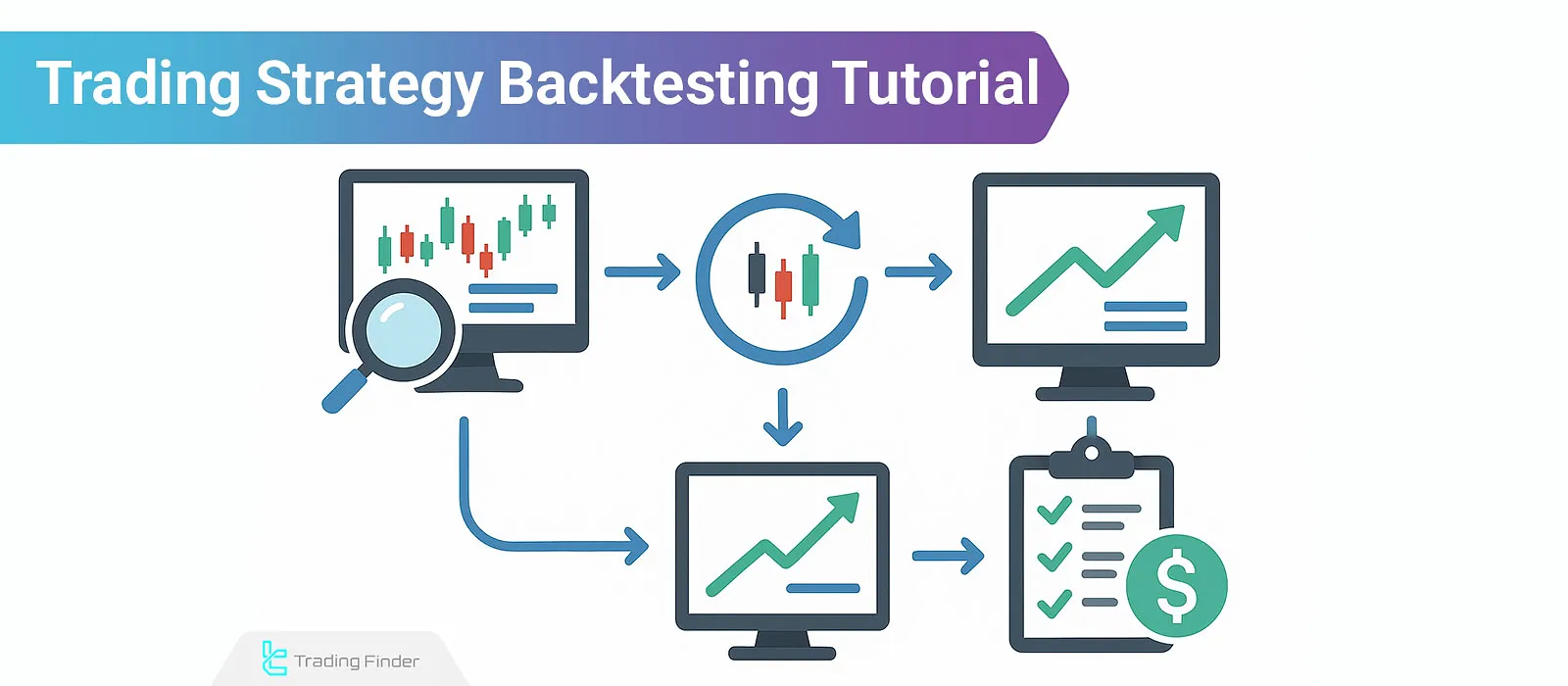

What is Back test? How to Backtest in 5 Steps

Operating in financial markets requires thorough analysis and the development of an effective trading strategy to achieve consistent...

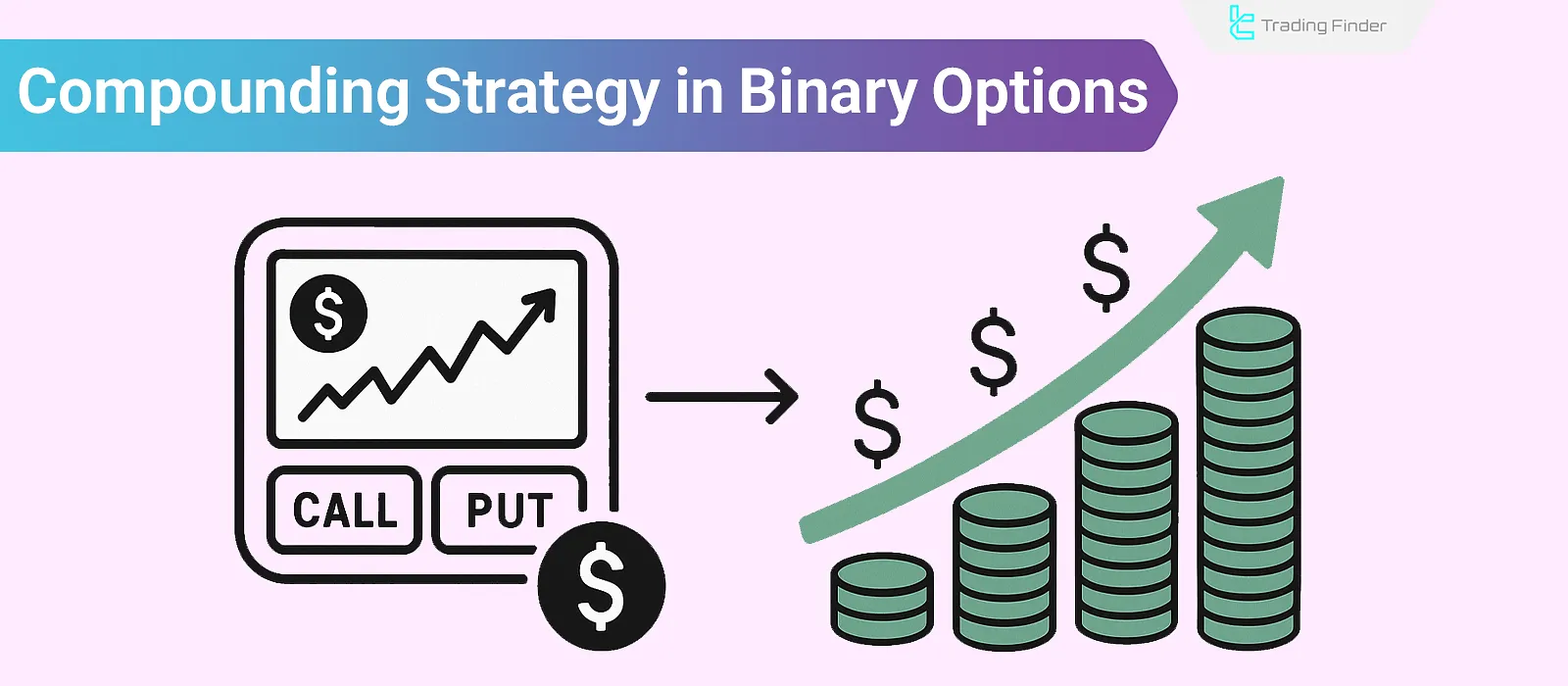

Compounding Strategy in Binary Options; Reinvesting Profits in Trades

The Compounding Strategy in Binary Options is a method where the trader does not withdraw profits from each trade. Instead, they...

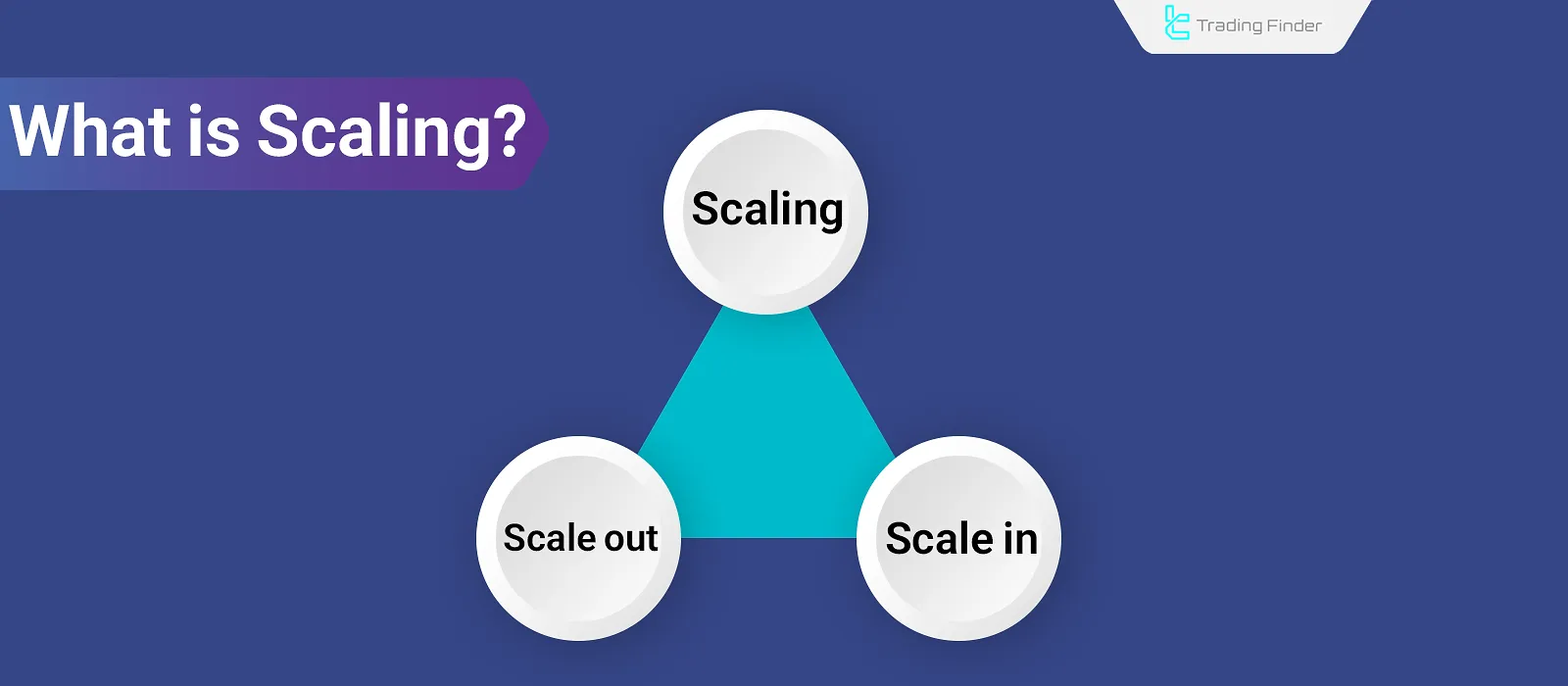

Scaling in Trading: Multi-Stage Entry and Exit with Position Size Adjustments

Scaling in trading refers to the process of increasing or decreasing the position size of a trade based on market conditions and...

What Is the Martingale Strategy and How Does It Work? (Full Guide + Types)

The Martingale strategy, originally designed in the 18th century for gambling purposes, is now widely used as a capital management...

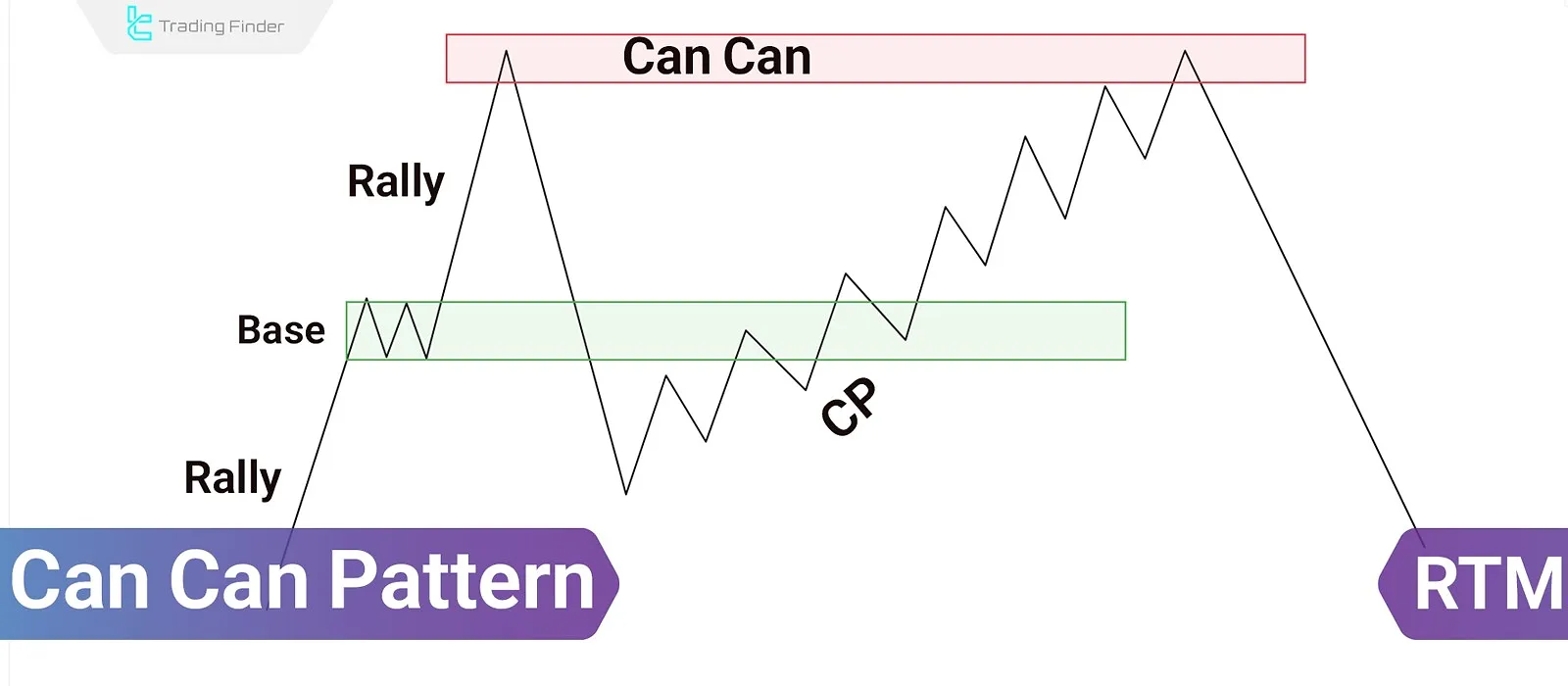

Can Can Pattern in RTM: Compression and Tap to Broken Zone (Caps)

The Can Can pattern in the RTM methodology reflects a smart price behavior designed to trap breakout traders. It is not a...

Risk Management in Financial Markets: Guide to Effective Risk Control Strategies

Risk management refers to the identification, analysis, and control of harmful factors, applicable in all financial markets such as...

Swing Trading - Strategies Based on Price Reversals, Breakouts, & Retracements

In swing trading, traders analyze the overall market trend and various economic data to identify the long-term direction of price...

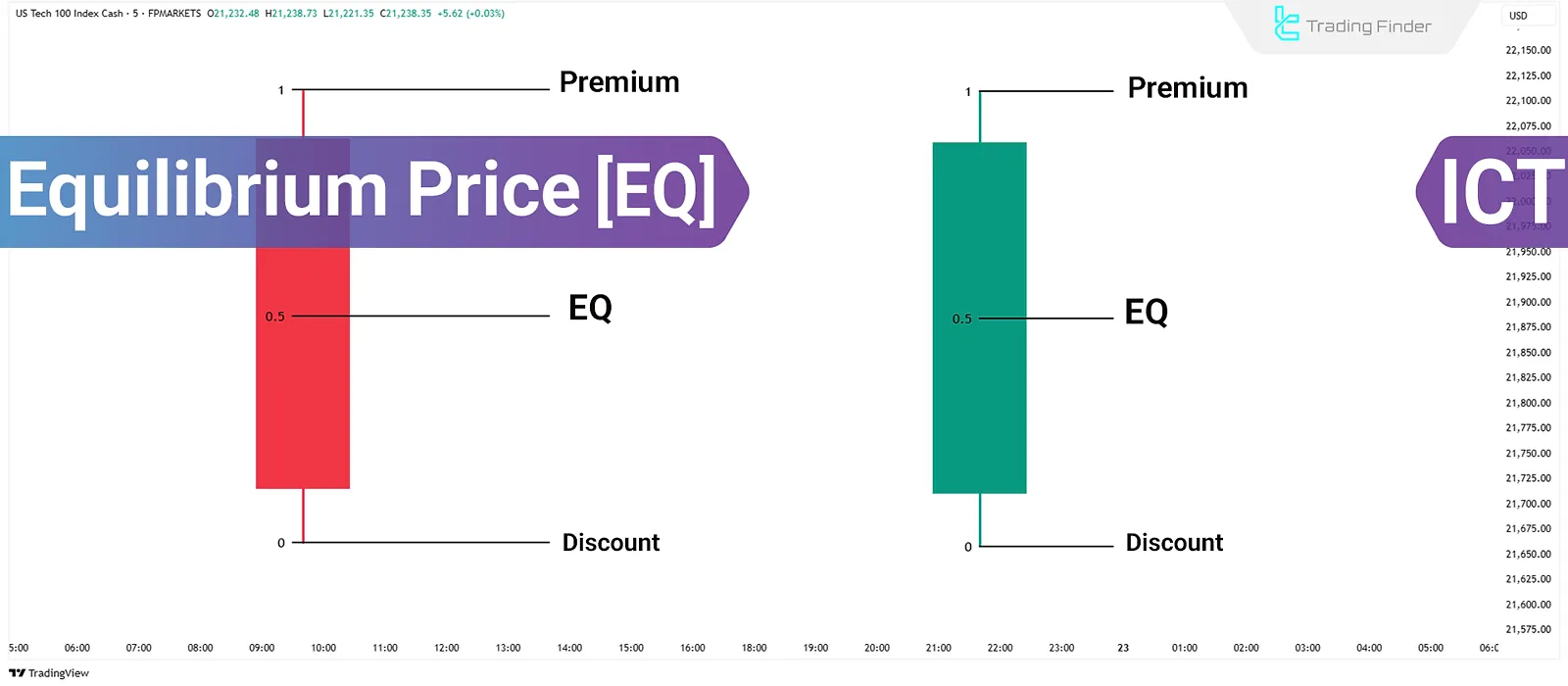

ICT Style Price Equilibrium: How to Calculate & Use It with PD Array Components

In the ICT methodology, price equilibrium refers to the midpoint between the highest and lowest wick of a...

What is a Trading Plan? A Guide to Building a Trading Plan for Different Markets

Atrading plan is a set of rules that governs all activities of a trader. A properly written trading plan helps mitigate the...