- TradingFinder

- Education

- Forex Education

- Trading Education

Trading Education

Trading refers to the buying and selling of financial assets with the aim of making a profit from price fluctuations. This activity is based on three main pillars: market analysis, risk management, and selecting a trading style suited to market conditions and individual goals. Market analysis in TradingFinder is divided into two categories: technical analysis and fundamental analysis. In technical analysis, the focus is on price behavior, and the trader identifies trend structures, support and resistance zones, and uses charts, price patterns, indicators, and tools such as price action. In fundamental analysis, TradingFinder utilizes economic data such as interest rates, inflation reports, central bank monetary policies, and corporate financials to analyze the intrinsic value of an asset. Trading styles include scalping, day trading, swing trading, and position trading. The trading style is selected by considering the timeframe used, risk tolerance, available time for trading and type of target market.

What Is a Trading Plan? Including Strategy, Journaling, and Risk Management

A trading plan is a set of rules that governs all activities of a trader. A properly written trading plan helps mitigate the...

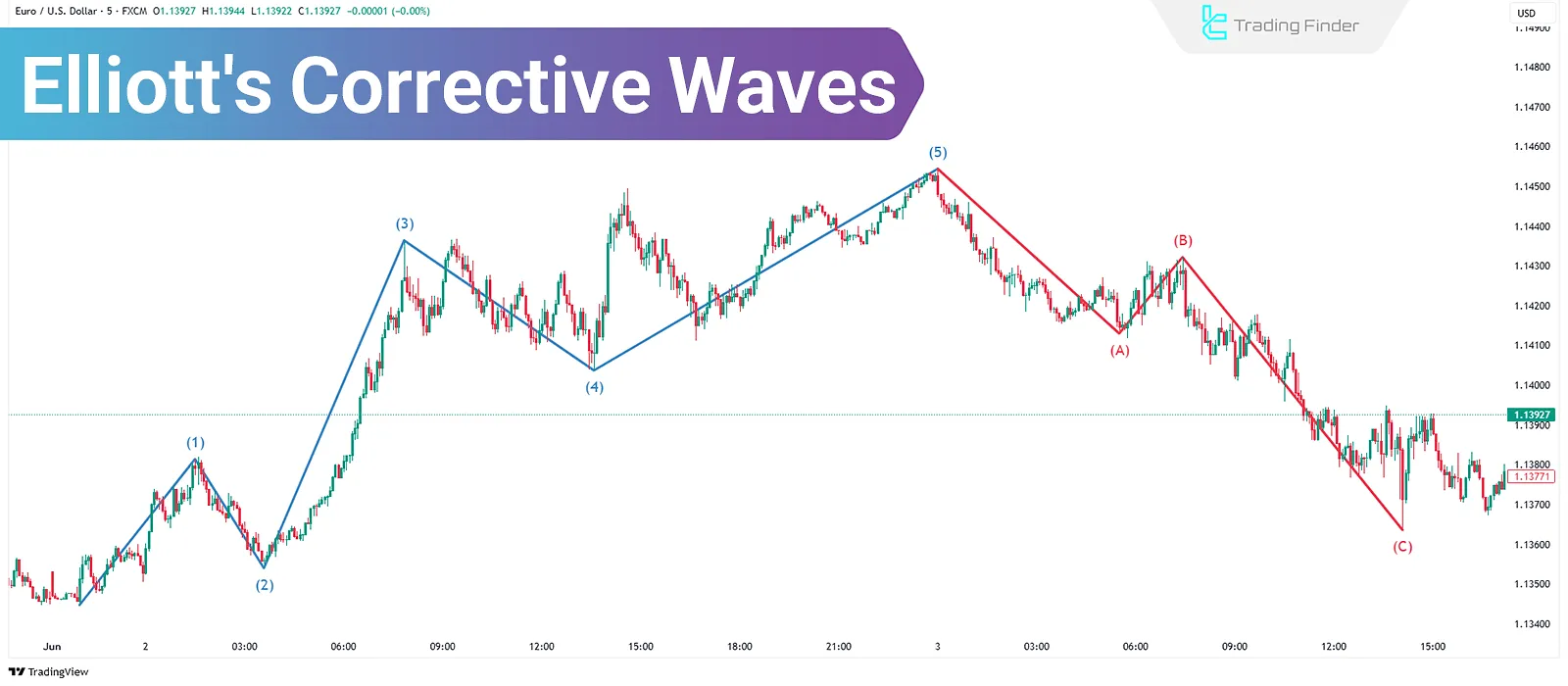

Corrective Waves in Elliott Theory: Zigzag, Triangle, and Combination Patterns

Corrective Waves in Elliott Wave Theory are composed of three sub-waves and move against the prevailing trend. Unlike motive waves...

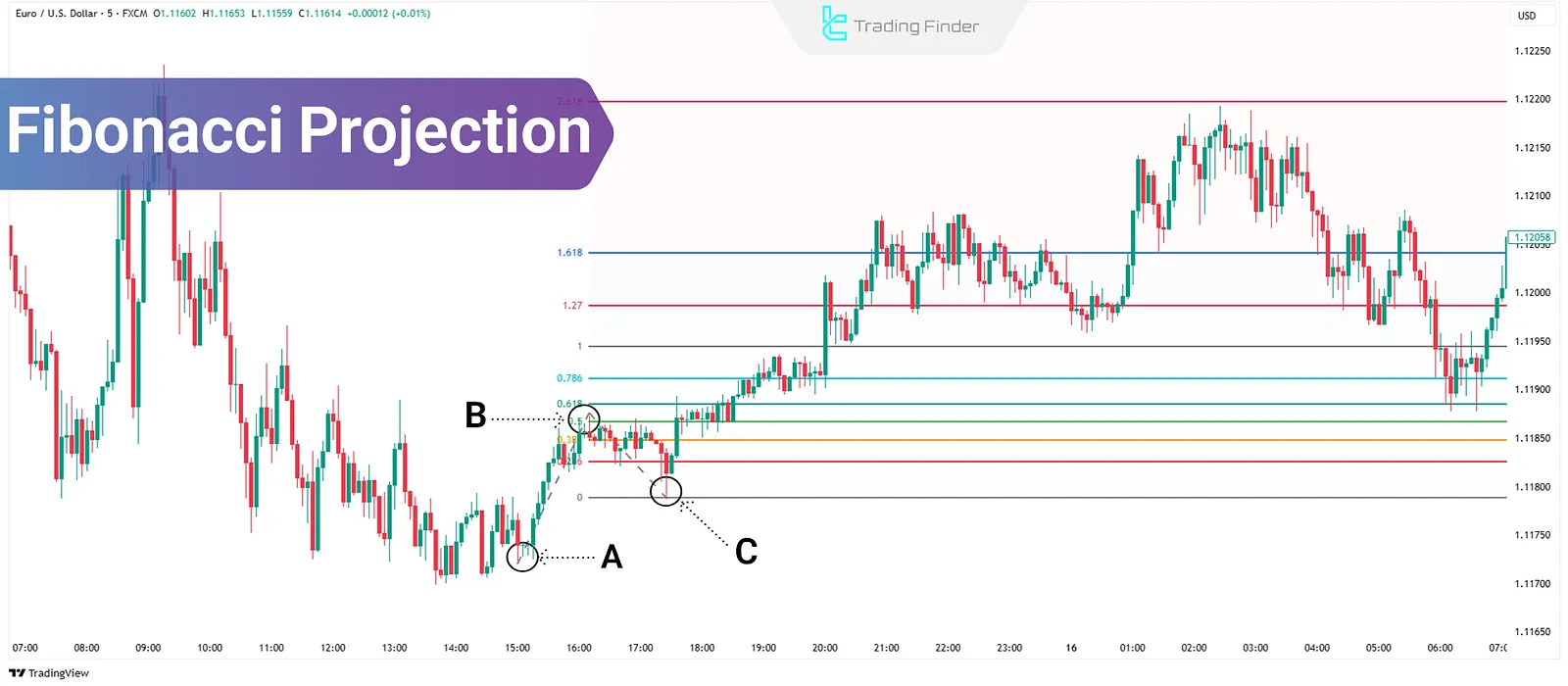

Fibonacci Projection Levels in Technical Analysis: Target Determination

Fibonacci Projection in technical analysis is a tool used to calculate price targets in the direction of a trend. By selecting...

RTM Diamond Pattern; Reversal Formation at Primary Market Highs and Lows

The RTM diamond pattern is one of the core setups in RTM that misleads buyers and sellers when market-makers and large...

What Are Maker and Taker Fees? Delayed vs. Instant Orders

When buying and selling cryptocurrencies on a tradingplatform, you must pay transaction fees. Generally, tradingfees on crypto...

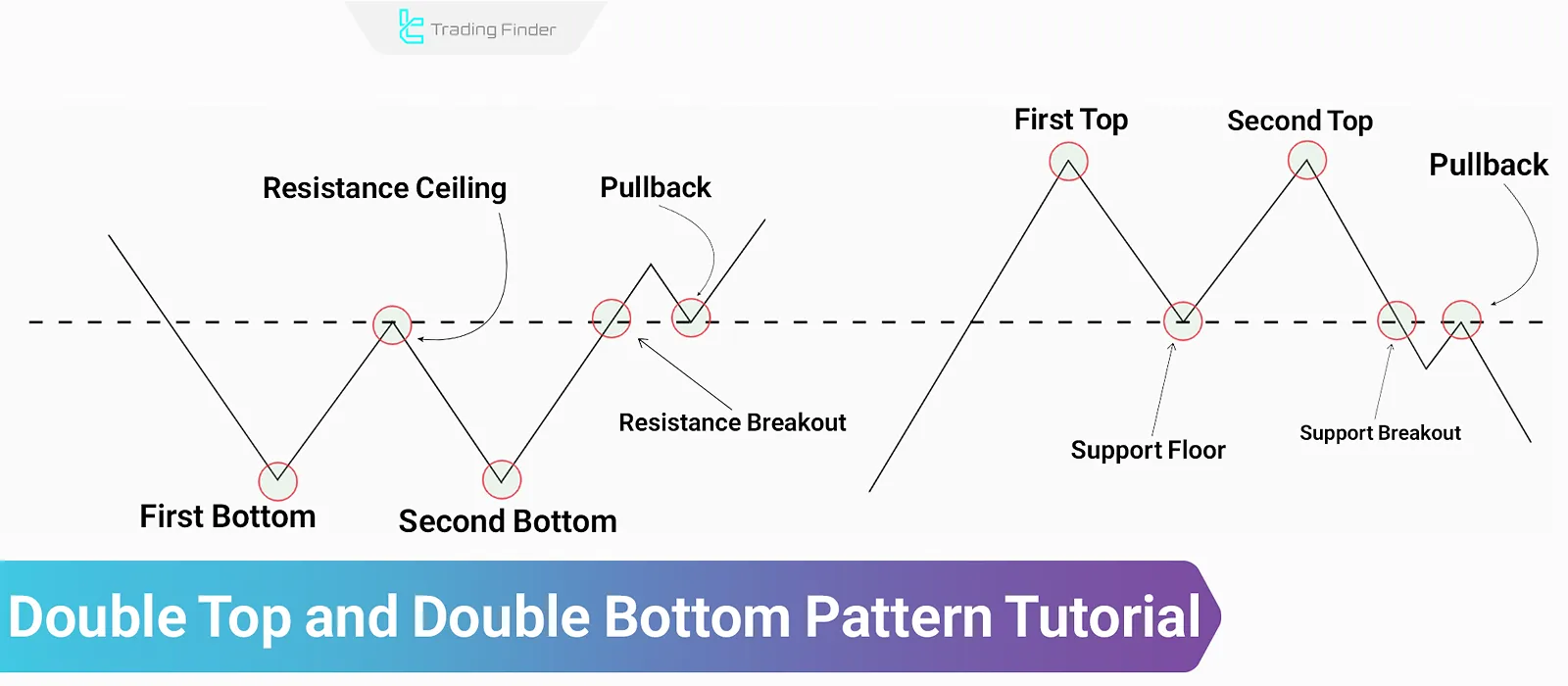

Double Top and Double Bottom – Classic Reversal Pattern

The double top and double bottom patterns are classified under classic reversal patterns in technical analysis. These patterns are...

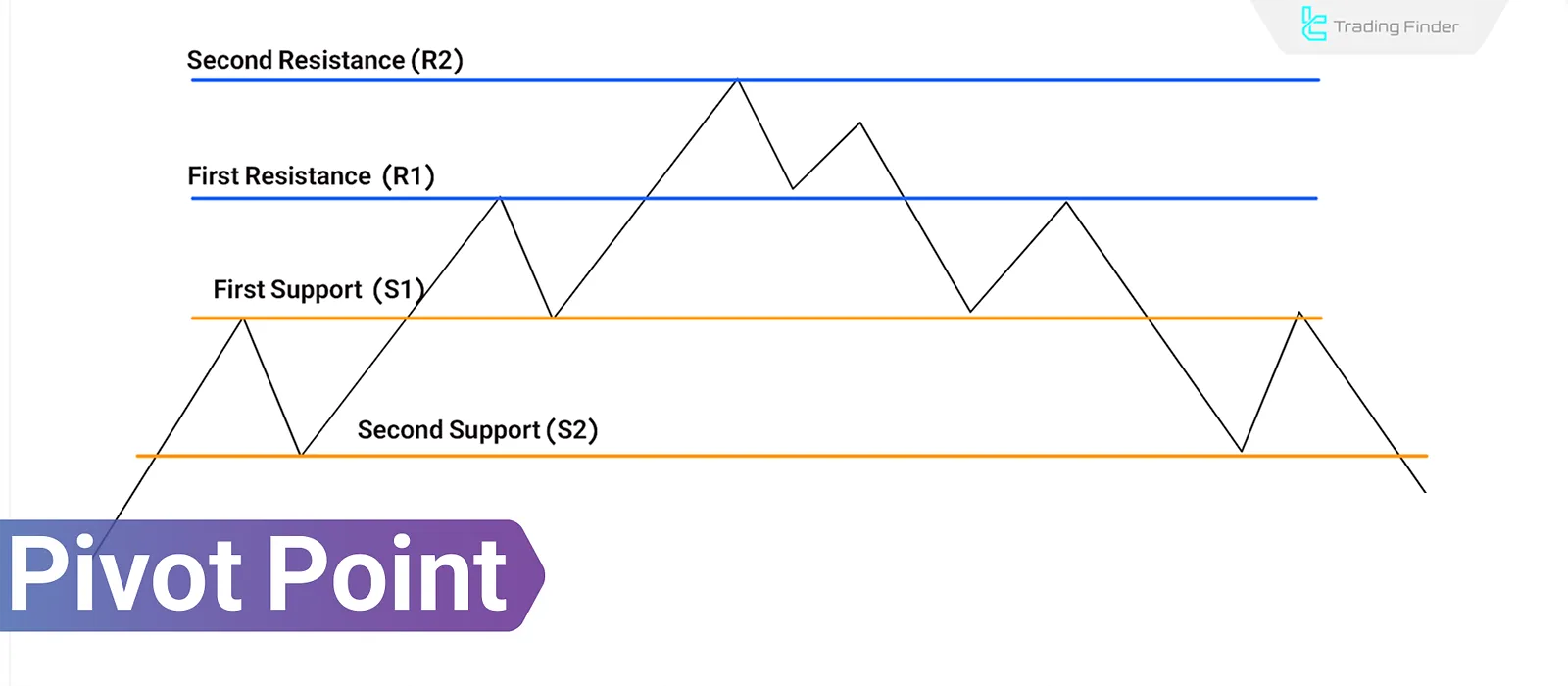

Pivot Point in Technical Analysis: Entry, Exit, Stop-Loss, and Price Targets

A Pivot Point in Technical Analysis is a computational method that identifies key market levels for the next trading day based on...

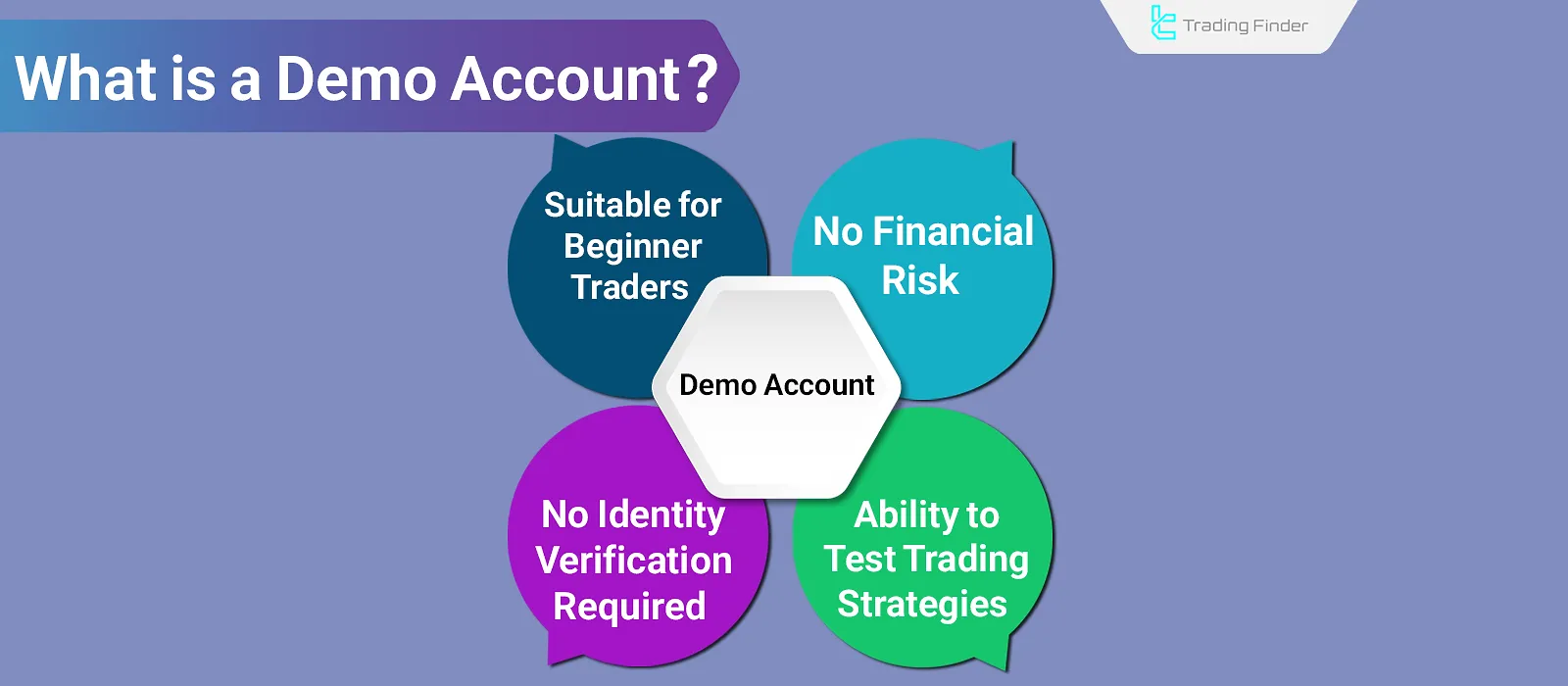

What Is Demo Account? Differences Between Demo and Real Accounts

A demo account enables users to test and evaluate trading strategies without risking real capital, providing a safe way to enhance...

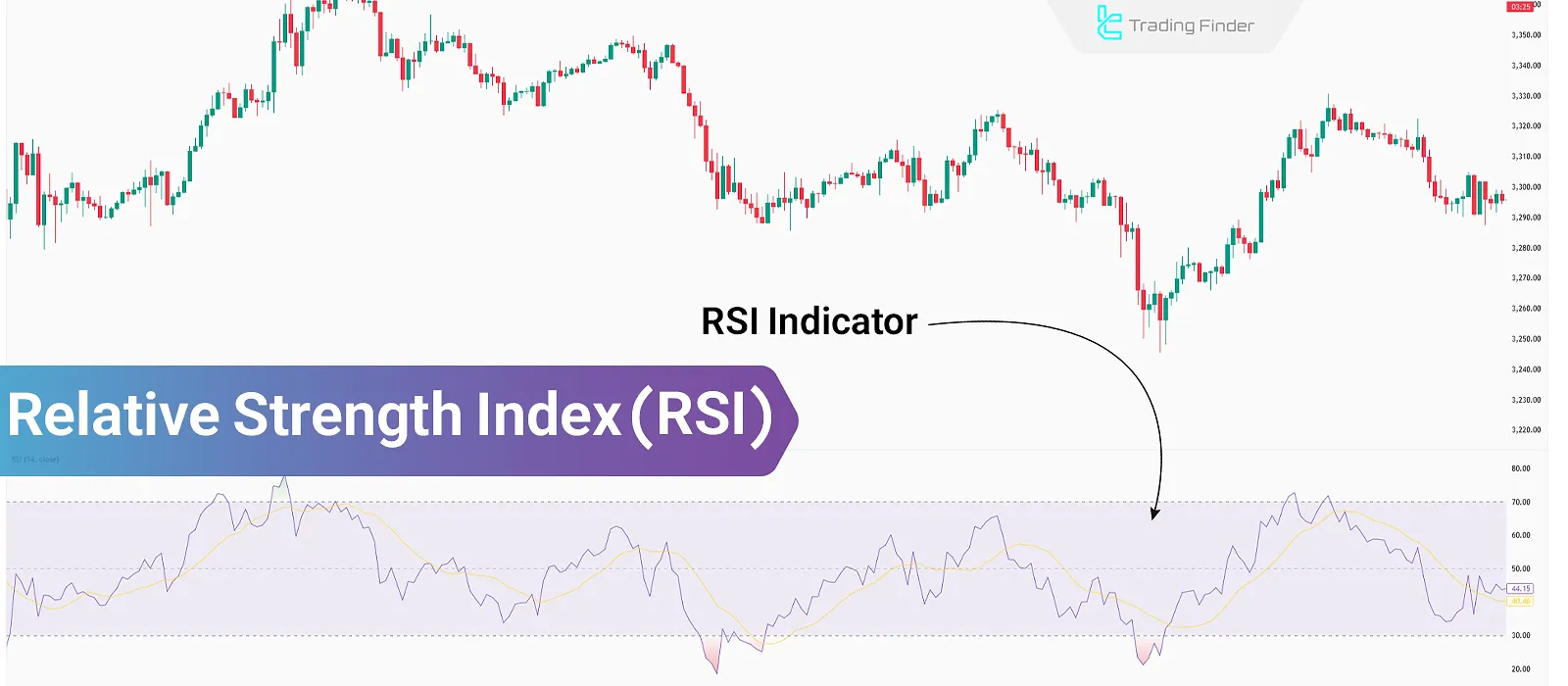

What Is RSI? Identifying Overbought and Oversold Conditions in All Markets

The Relative Strength Index (RSI) evaluates the strength of a trend by analyzing the open and close prices of candles over...

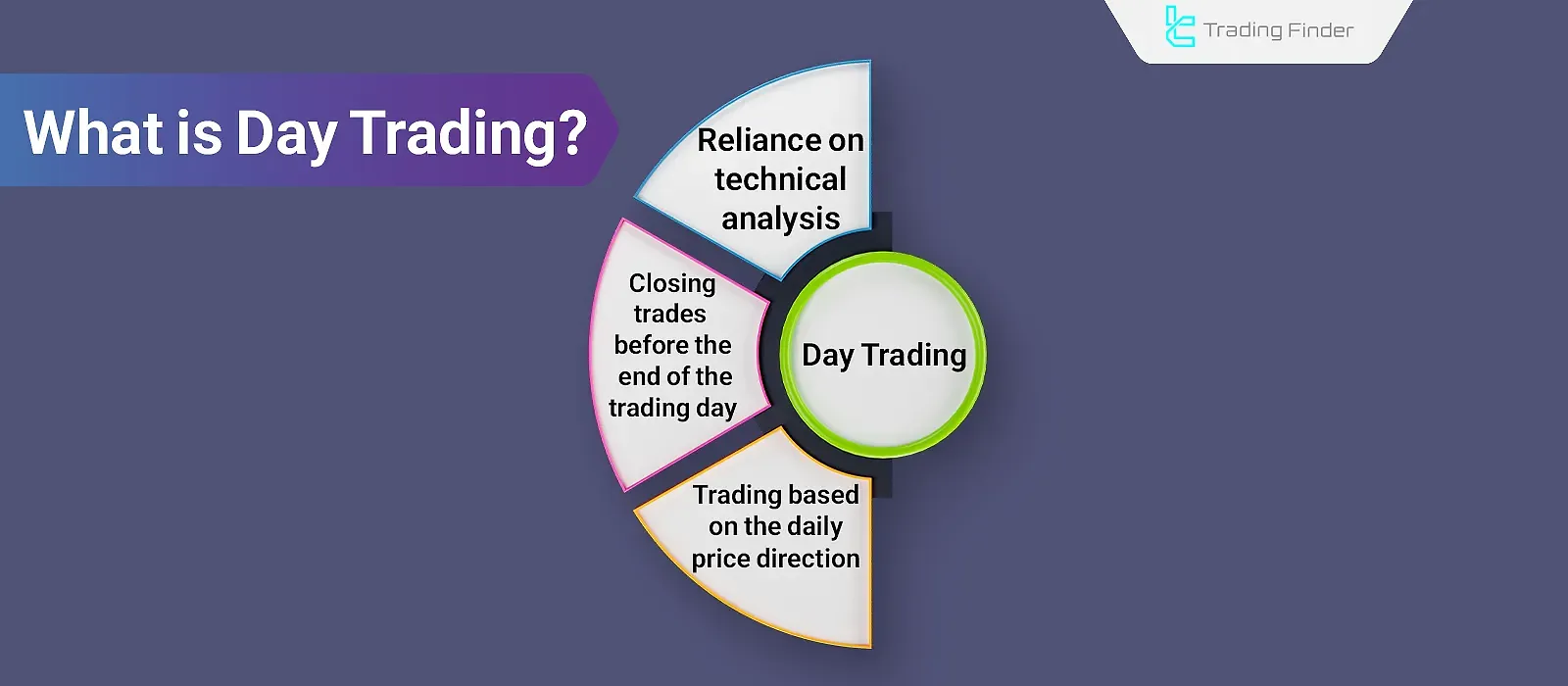

What Is Day Trading? Trade in the Direction of the Trend & Against It

In day trading, traders use technical analysis through various methods, such as ICT style and RTM style (Read The Market), to...

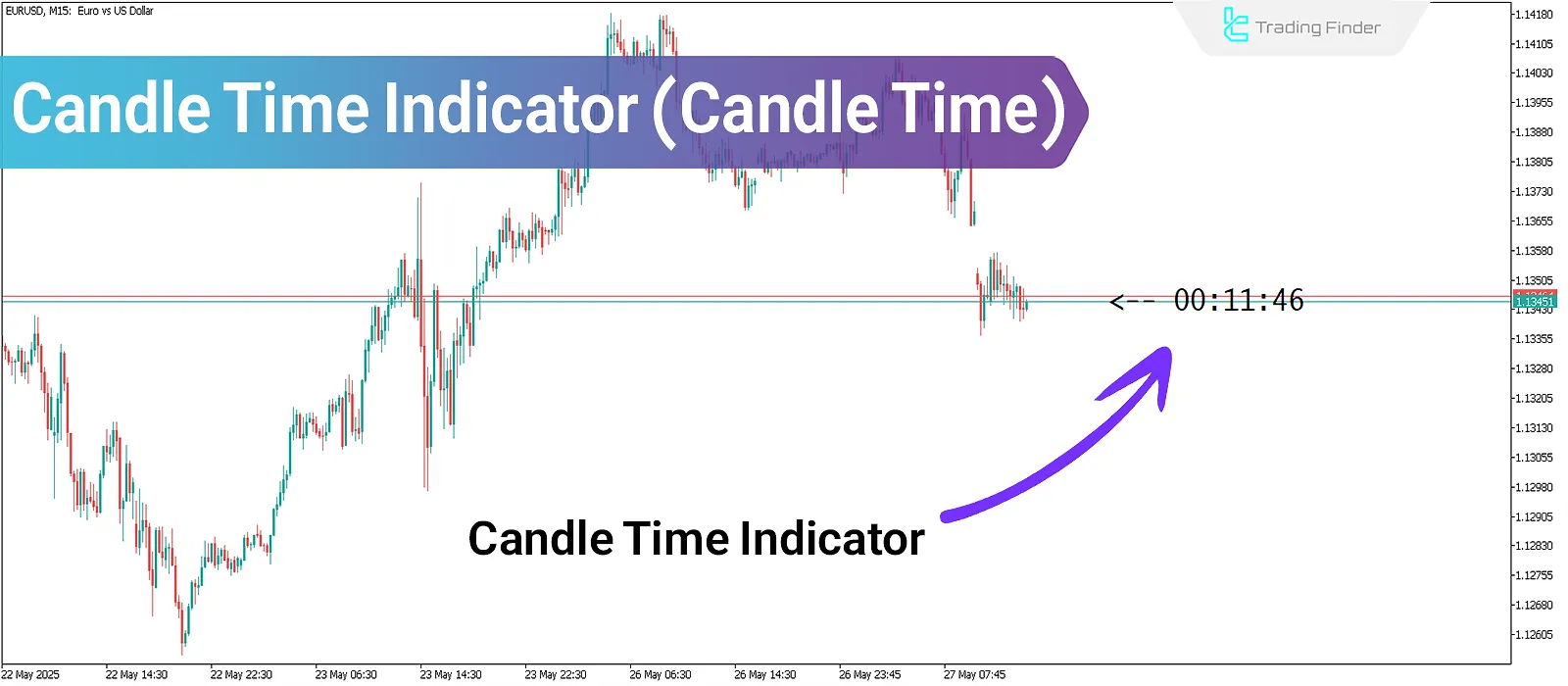

Candle Time Indicator: Countdown to the Opening & Closing of Short-Term Candles

The Candle Time Indicator enhances trading accuracy across various timeframes and strategies, including scalping. With the Candlestick...

What Is a PAMM Account? Learn how to Choose the Right PAMM Account

In the forex market, many investors cannot generate profits through direct trading due to insufficient knowledge or lack of...