- TradingFinder

- Education

- Technical analysis Education

Technical analysis Education

Technical analysis is a method for evaluating price movements in financial markets, emphasizing price charts, chart patterns, trends, trading volume, and indicators. Unlike fundamental analysis, which assesses an asset’s intrinsic value based on economic and financial factors, technical analysis relies on historical price behavior and structured patterns to identify high-probability trading opportunities. Classical technical analysis tools include trendlines, support and resistance levels, price channels, oscillators, and momentum indicators. These tools assist traders in defining market direction, measuring trend strength, and pinpointing precise entry and exit points. Modern technical analysis extends beyond conventional tools, incorporating market structure, liquidity dynamics, and order flow. Advanced methodologies such as price action, the Smart Money Concept (SMC), Inner Circle Trader (ICT) strategies, harmonic patterns, Elliott Waves, and the Read the Market (RTM) approach enable traders to identify institutional liquidity zones, track price manipulation, and refine execution strategies with greater accuracy. TradingFinder offers a comprehensive suite of educational content and analytical tools, bridging classical and modern technical analysis. It equips traders with specialized insights into liquidity models, market structure interpretation, and price movement assessments, enhancing their ability to navigate complex market conditions.

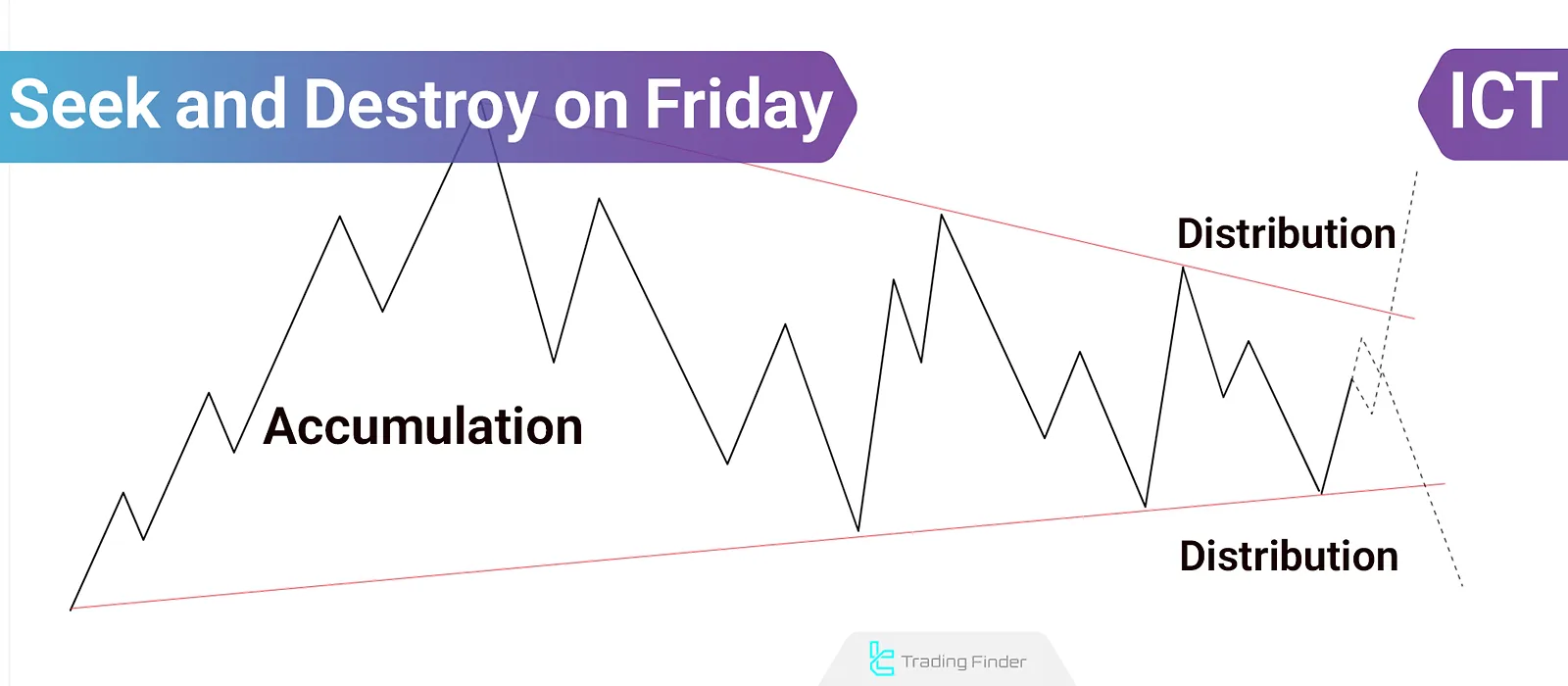

Friday Seek and Destroy Strategy in ICT: Accumulation and Distribution Explained

In the Friday Seek and Destroy strategy within the ICT methodology, the market typically enters an accumulation or distribution...

RTM Diamond Pattern; Reversal Formation at Primary Market Highs and Lows

The RTM diamond pattern is one of the core setups in RTM that misleads buyers and sellers when market-makers and large...

Types of Price Gaps in Technical Analysis [Breakaway, Continuation, Exhaustion]

Types of price gaps refer to discontinuities on a price chart where no trading activity has occurred. These types of gaps in...

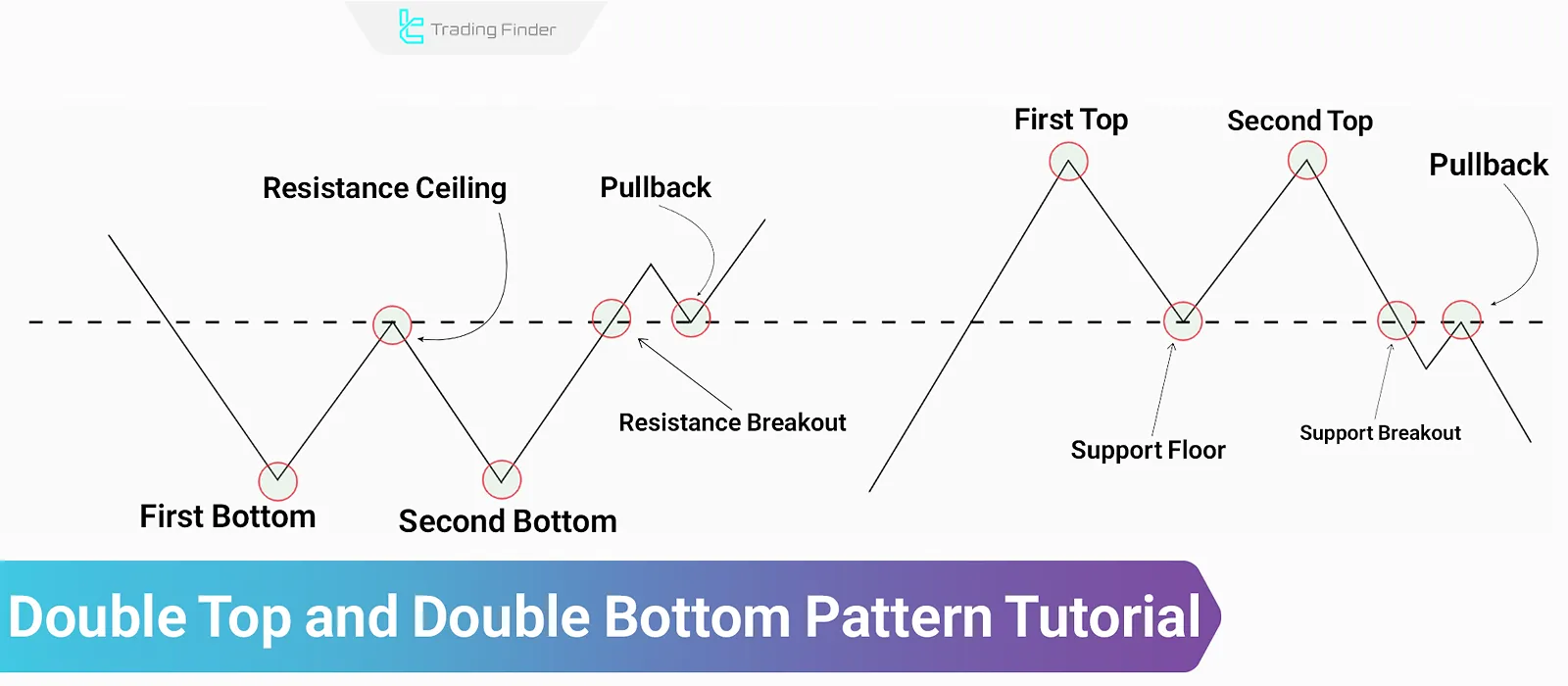

Double Top and Double Bottom – Classic Reversal Pattern

The double top and double bottom patterns are classified under classic reversal patterns in technical analysis. These patterns are...

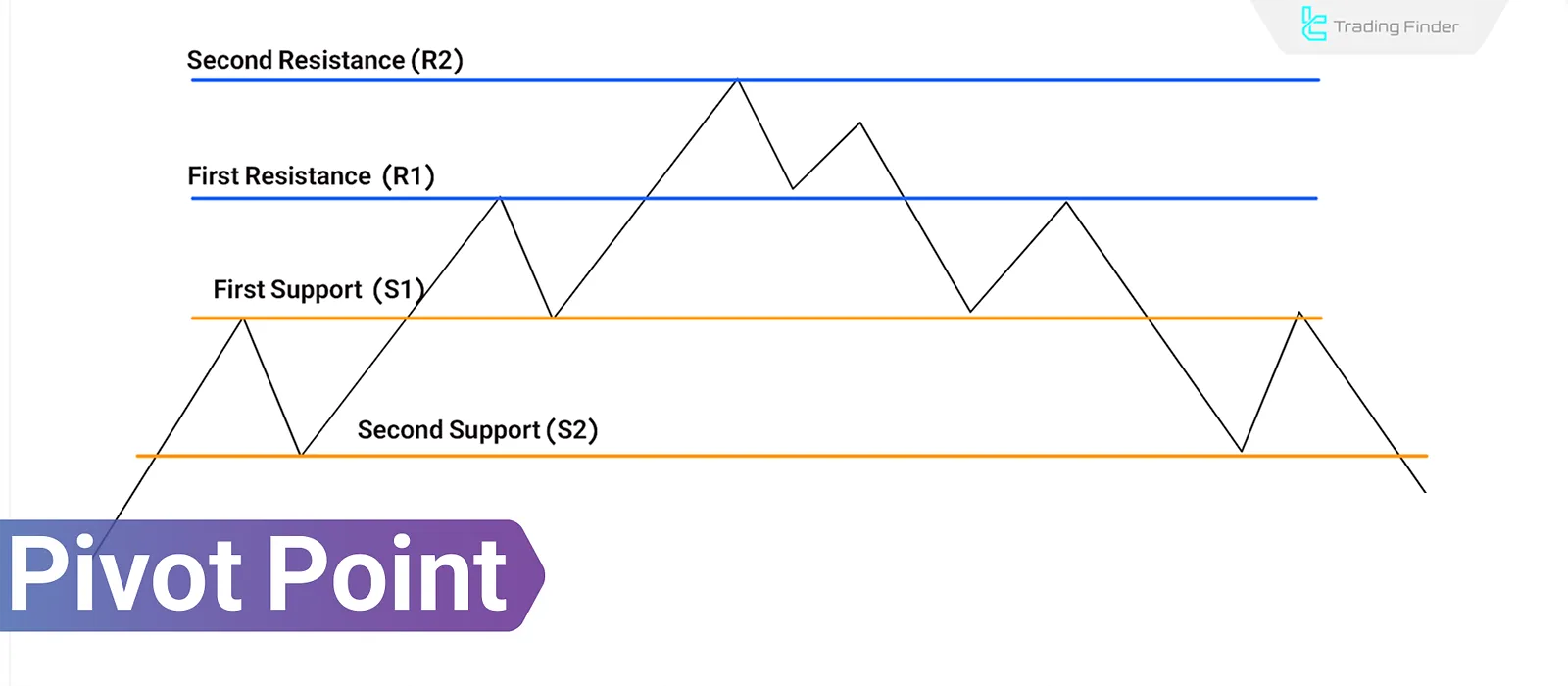

Pivot Point in Technical Analysis: Entry, Exit, Stop-Loss, and Price Targets

A Pivot Point in Technical Analysis is a computational method that identifies key market levels for the next trading day based on...

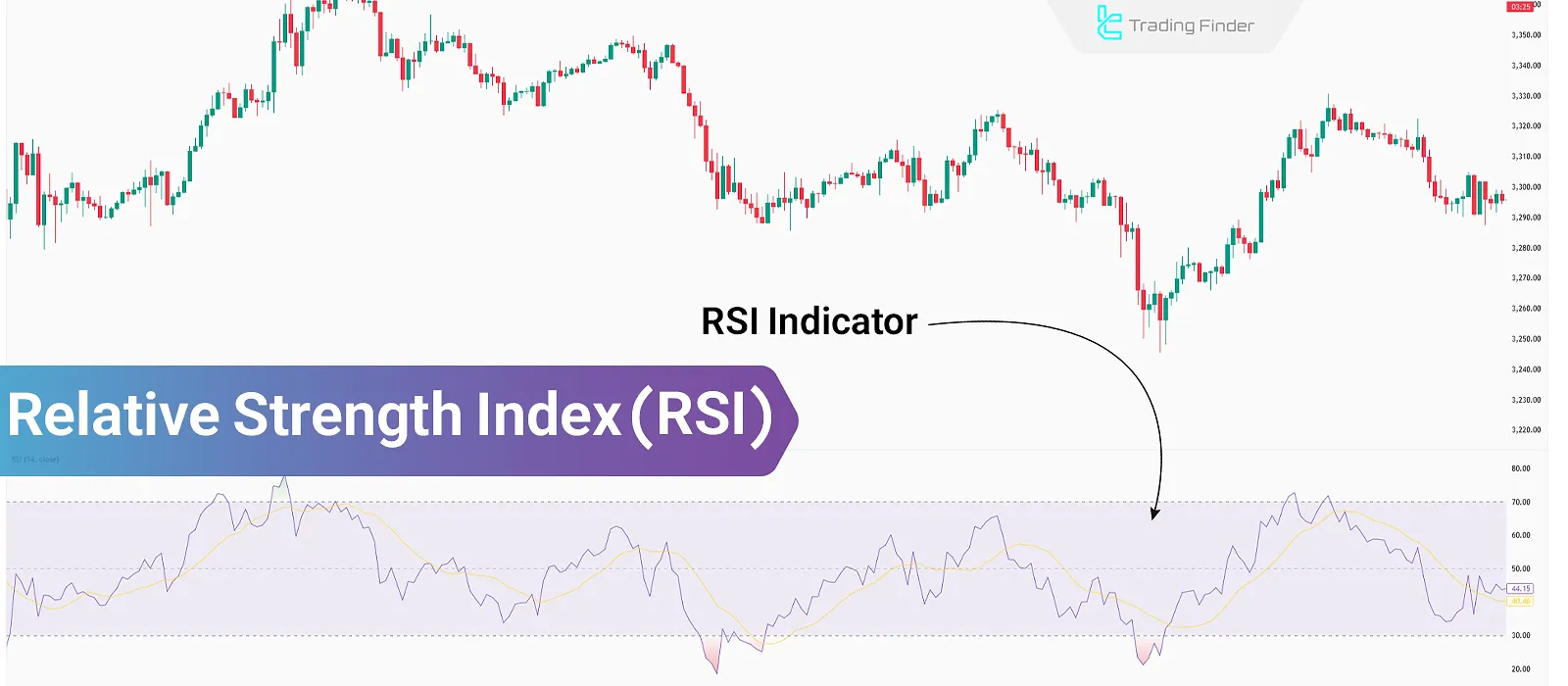

What Is RSI? Identifying Overbought and Oversold Conditions in All Markets

The Relative Strength Index (RSI) evaluates the strength of a trend by analyzing the open and close prices of candles over...

Williams %R Indicator: Overbought/Oversold Detection, Reversal Signals

Indicators are computational tools based on price and volume data, used for technical analysis and generating trading signals....

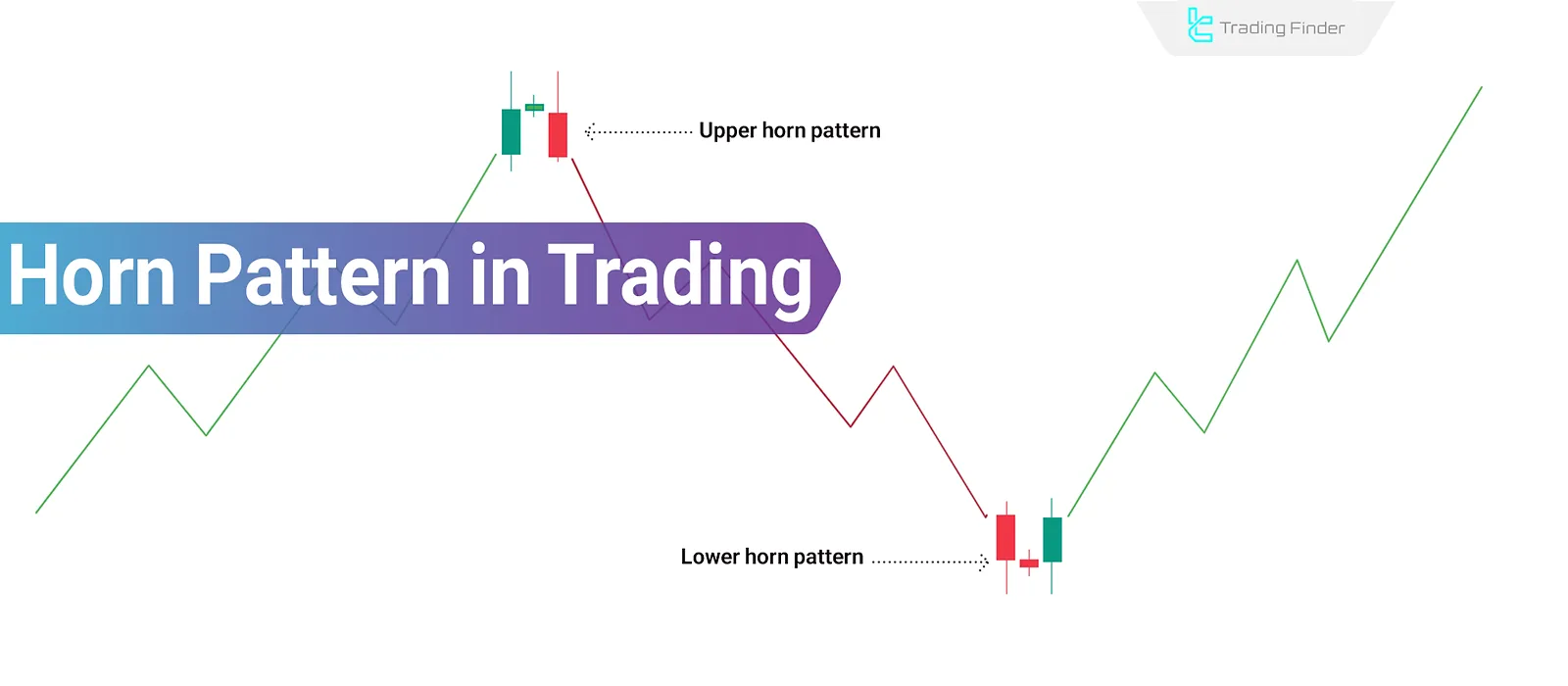

Horn Pattern Trading in Technical Analysis; Horn Top and Bottom

The Horn Pattern in technical analysis is one of the lesser-known reversal patterns that, unlike classical patterns, is based...

What is Ichimoku? Tenkan-sen, Kijun-sen, Chikou Span, Senkou Span A & B

Ichimoku, as both an indicator and a complete trading system in technical analysis, simultaneously provides information about the...

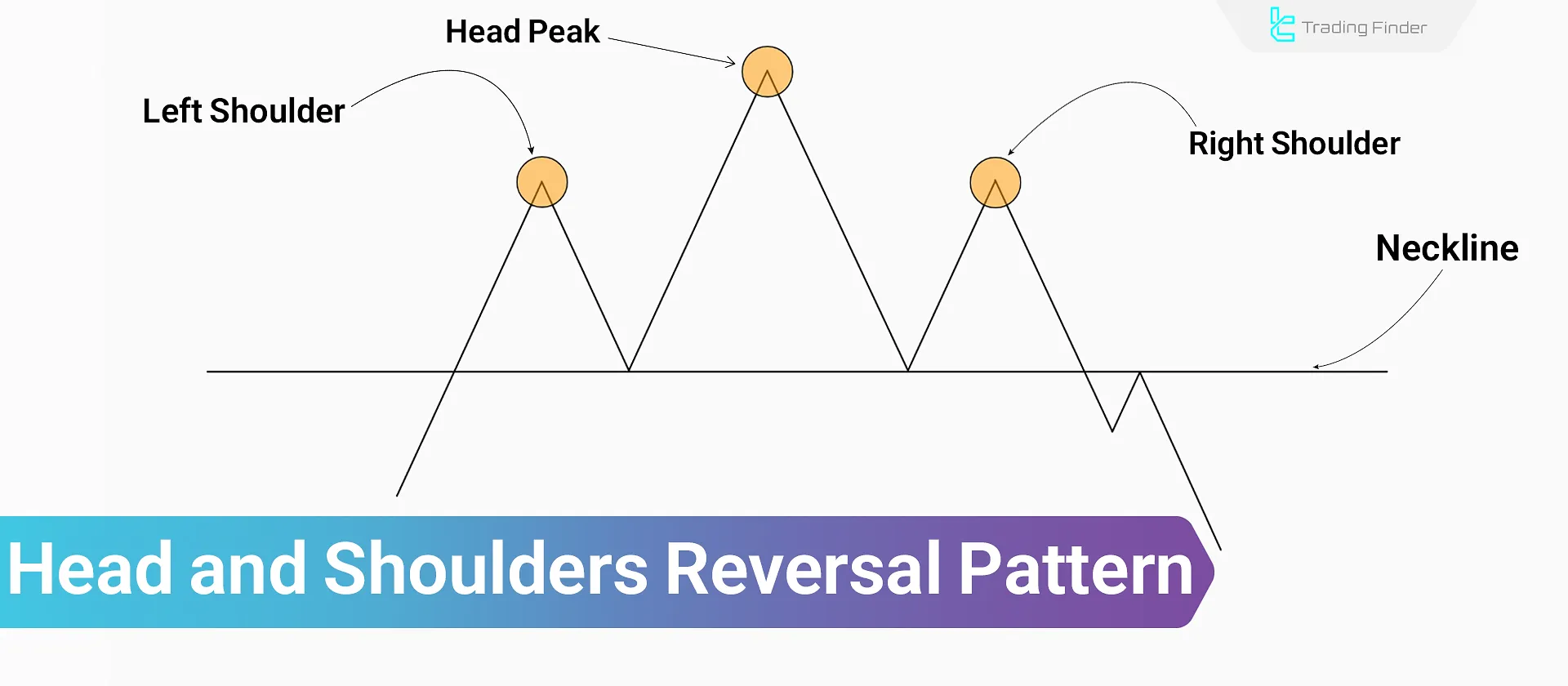

Head and Shoulders Pattern – A Combined Trading Strategy Using RSI Indicator

The head and shoulders pattern is among the classic reversal patterns that reflects shifts in supply and demand sentiment. This...

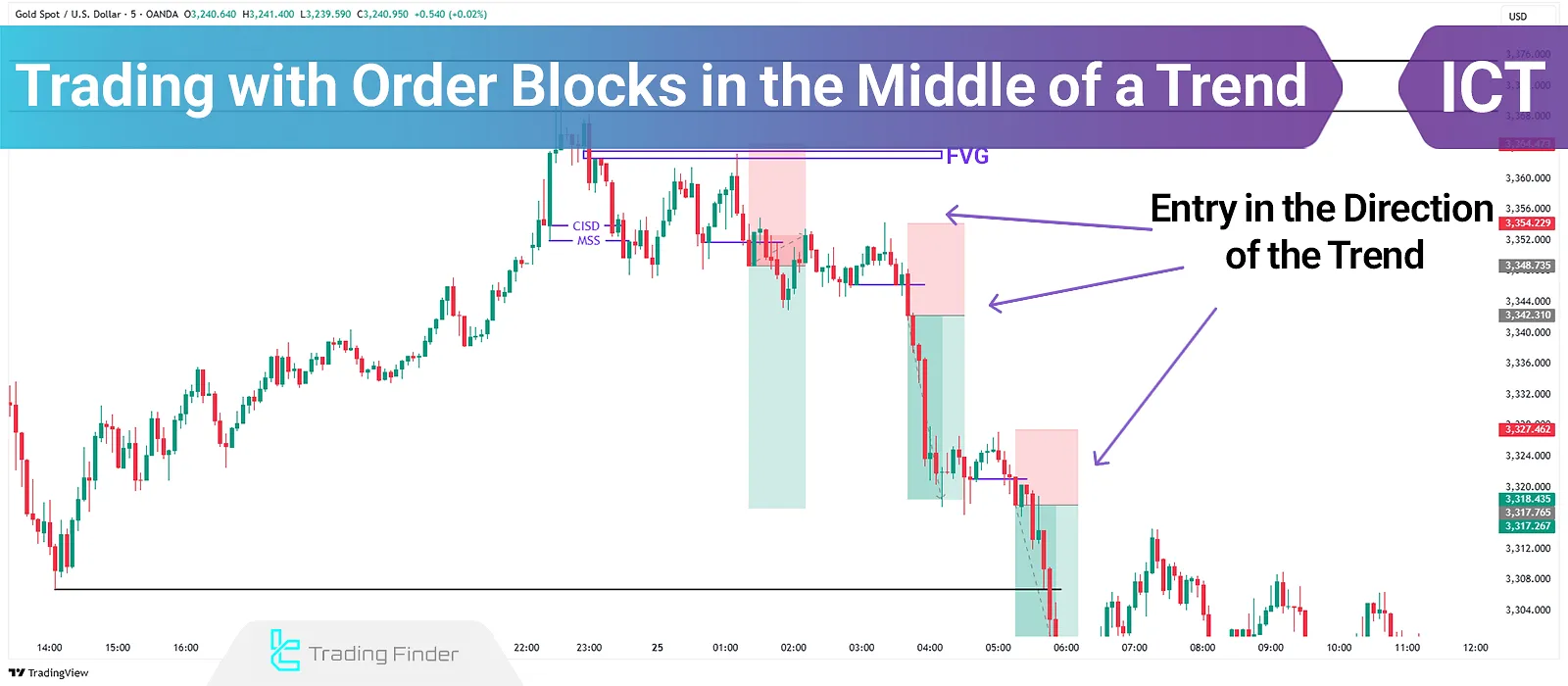

Order Block in Trend Following with ICT – Entry Using OB and FVG

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry...

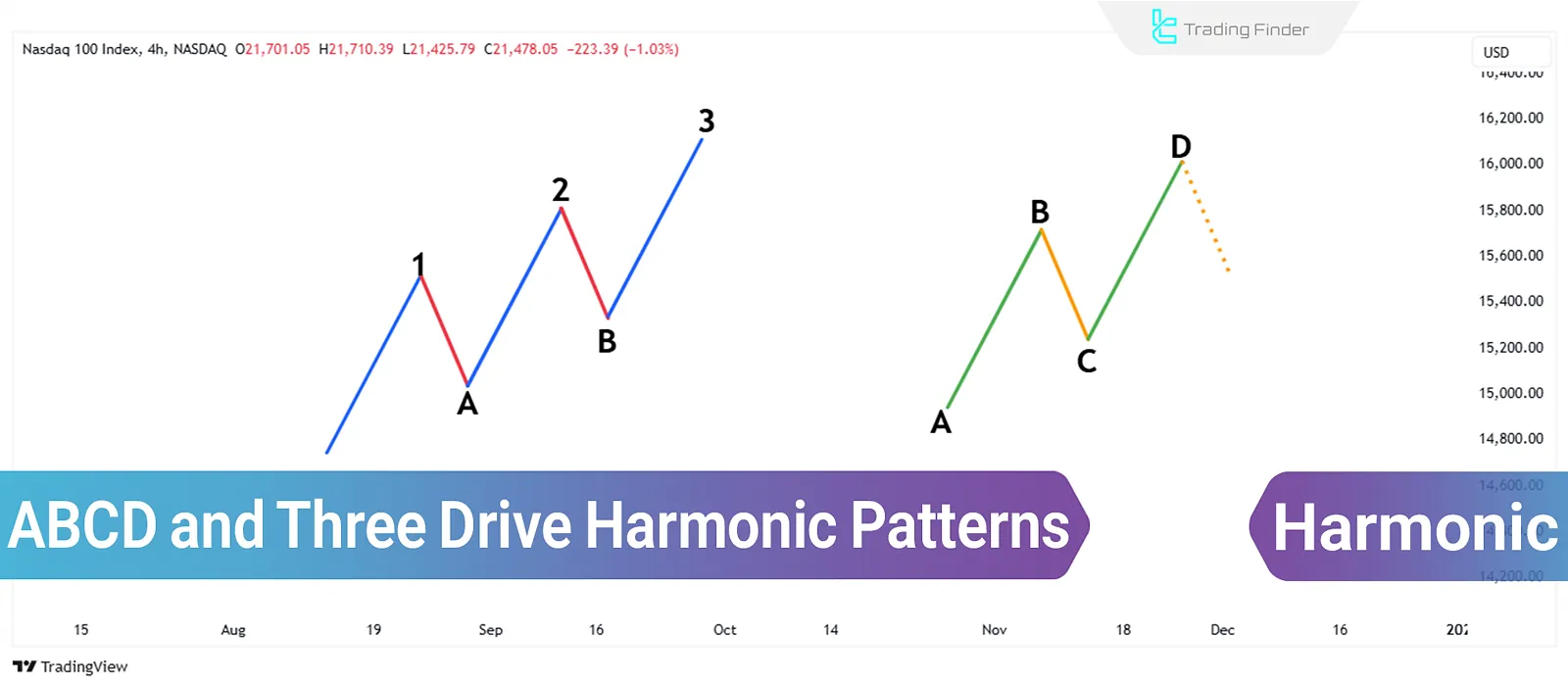

ABCD and Three-Drive; Harmonic Patterns in technical analysis & Fibonacci ratios

Harmonic patterns, based on Fibonacci ratios, are among the tools used in technical analysis. The ABCD pattern and the Three-Drive...

![Types of Price Gaps in Technical Analysis [Breakaway, Continuation, Exhaustion]](https://cdn.tradingfinder.com/image/438966/06-42-en-types-of-price-gap-1.webp)