Reviewing active cryptocurrency exchanges is a sensitive and complex matter due to their direct connection with investors' assets. Trading Finder relies on the expertise and experience of digital currency market specialists to thoroughly analyze these platforms with precision and accuracy, helping users make informed choices. On this page, we will introduce you to the methodology of reviewing exchanges on Trading Finder and discuss the most important factors considered by industry experts.

Delving into the core elements of our evaluation

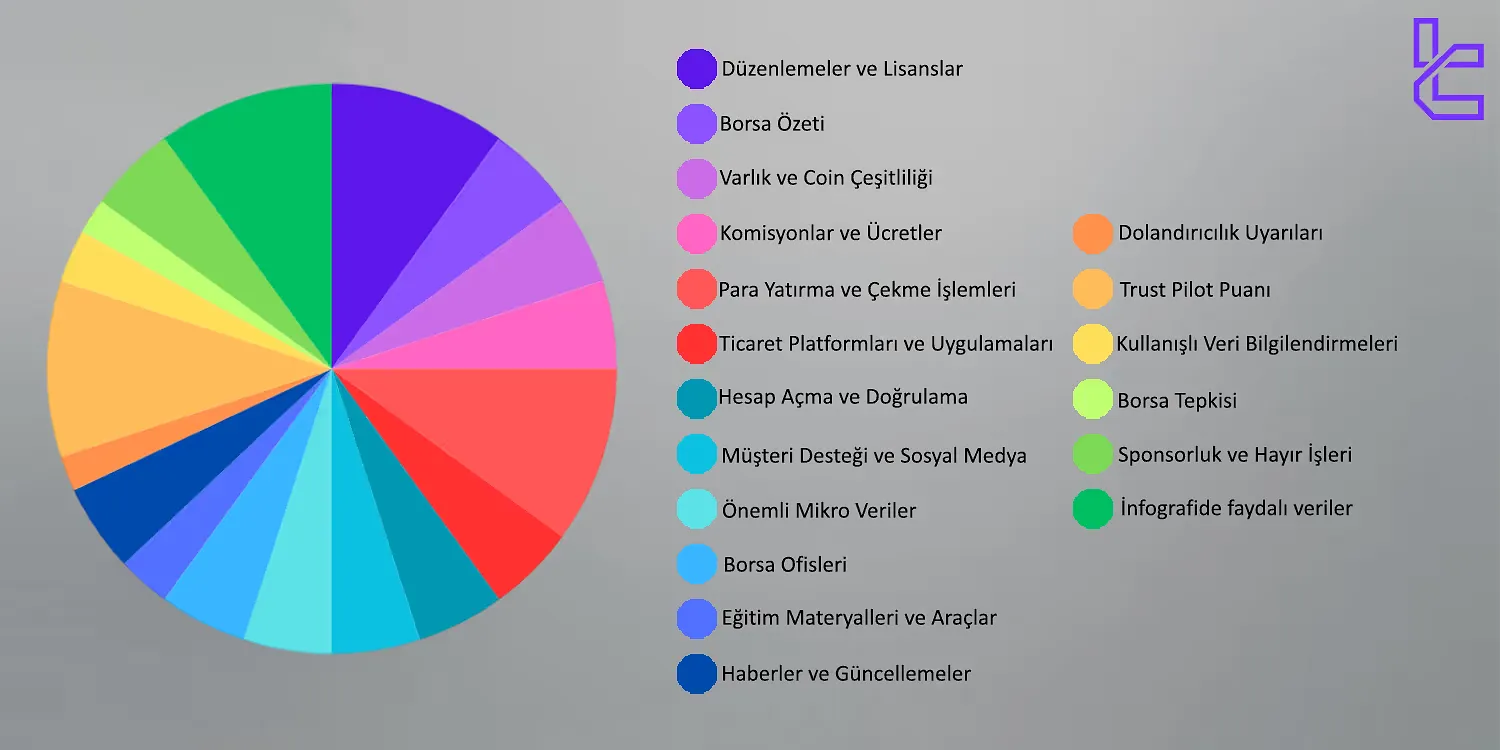

Trading Finder Experts use 18 data metrics to evaluate Exchanges:

Metric | Why it’s important |

Regulations and licenses | Trading Finder ensures the activity of each exchange by evaluating its regulation and licenses, ensuring compliance with international financial institutions and safeguarding the rights and assets of customers. |

Exchange summary | Trading Finder considers information such as the exchange's background, founders, management team, and their experience in the crypto space in its evaluations. |

Variety of Assets and coins | Support for various cryptocurrencies on well-known Layer 1 and Layer 2 networks is one of the most important aspects that the Trading Finder team examines when analyzing exchanges. |

Commissions & fees | Transaction fees in spot and futures markets of exchanges, as well as deposit and withdrawal fees on various networks such as TRC20, ERC20, and BEP20, have always been a major focus point of analysis for Trading Finder analysts. |

Deposits and withdrawals | The presence of diverse methods for depositing and withdrawing cryptocurrencies on exchanges, facilitating the transfer of assets between wallets and exchanges, is highly important. Trading Finder meticulously analyzes and evaluates the security, variety, and ease of deposit and withdrawal methods offered by exchanges. |

Trading platforms and Applications | Trading Finder considers the presence of a proprietary trading platform for crypto trading and the provision of the latest tools and technical analysis charts as one of the essential requirements for cryptocurrency exchanges. |

Opening Account and verification | Trading Finder evaluates the account opening process and Know Your Customer (KYC) procedure from start to finish, to ensure the efficiency of these processes. The registration and verification process is present in all Trading Finder methodologies, including Prop Firm Methodology. |

Investment & copytrade | Copying trades in the digital currency market allows traders to benefit from the expertise of experienced market participants. Trading Finder examines the availability and quality of copy trading functionality and its execution. |

customer support & social media | Trading Finder understands the importance of support in the complex world of crypto. We directly engage with exchange support team and monitors their activities on websites and social media platforms. The goal of the Trading Finder analysis team is to assess the quality of support and ensure its effectiveness in addressing user issues and improving their overall user experience. |

Important micro datas | Trading Finder ensures the credibility, accuracy and reliability of the data provided in micro-data section on exchange website and platforms. |

Exchange offices | Trading Finder always considers the presence of multiple international exchange offices and the provision of appropriate services to market participants as one of the most important criteria in analyzing crypto exchanges. |

Education materials & tools | With a deep understanding of the importance of education in the cryptocurrency space, Trading Finder seeks exchanges that continuously strive to enhance the knowledge and skills of their traders. |

Trust Pilot score | Trust Pilot is undoubtedly one of the most reputable websites active in reviewing and assessing businesses based on customer feedback. Trading Finder relies on customer reviews on this website to make a final assessment about a particular broker. |

News and updates | Staying up-to-date and providing a suitable user experience for the audience, is one of the main criterias for Trading Finder when making decisions about the quality of broker services. |

Useful data in infography | Providing education related to exchanges and cryptocurrencies in simple and optimized formats such as infographics, is one of the most important aspects that Trading Finder considers in analyzing exchanges. |

Exchange response | Trading Finder considers speed and efficiency in resolving user issues as one of its key criteria for evaluating exchanges. Our analysts believe that having access to various channels for addressing user problems, including FAQs, online chat and Help Center, plays a fundamental role in increasing user satisfaction. |

Alerts or scam reports | Trading Finder is deeply committed to the security of traders' capital. For this reason, we diligently investigate the accuracy of fraud reports by exchanges and identify suspicious cases with utmost seriousness. |

sponsorship & charities | In addition to the mentioned factors, Trading Finder places special importance on sponsorship activities and philanthropic endeavors. |

The importance of each metric in Trading Finder’s exchange evaluation

The chart provided in the next section illustrates the importance of each criterion during the analysis and review of exchanges.

About Trading Finder’s analysts

The Trading Finder analysis team consists of experts with extensive experience in highly volatile financial markets.

Our analysts leverage their knowledge and expertise to critically review the most important criteria in the exchange selection process by market participants.

Trading Finder Values

In the complex and dynamic world of financial markets (forex, stock, crypto, etc.), access to accurate and up-to-date information, practical tools and specialized analysis, plays a fundamental role in the success of traders. The Trading Finder team, understands this vital need and strives to respond by creating an innovative and comprehensive platform in the best possible way.

Conclusion

The Trading Finder team consists of experienced professionals and active participants in the crypto market and aims to provide comprehensive and accurate guidance to traders by evaluating and assessing digital currency exchanges. Our team has considered different metrics in evaluating exchanges that directly impact traders' experience in global financial markets. In this document, we have discussed important factors in analyzing exchanges and the methodology used by Trading Finder. We hope this information is useful to you.