BTSE is a hybrid exchange offering both spot and derivatives trading [futures & margin] services. BTSE exchange offers services to over 2 million users across more than 100 countries. This exchange has 10 VIP user levels, with costs starting from 0.2% for maker and taker fees.

BTSE Crypto Exchange Introduction & Regulation

BTSE operates under BTSE UAB, a Lithuanian-registered entity (registration number 306043132) with operational presence in both Seychelles and Lithuania. The platform has surpassed a monthly trading volume of $32 billion and serves 100+ enterprise-level B2B clients, establishing itself as a regulated and reliable exchange for large-scale traders.

BTSE cryptocurrency exchange supports over 300 trading pairs and offers 20+ core services, such as AutoTrader, All-in-One OrderBook, and yield-generating options. It also maintains an in-house BTSE Token, unlocking benefits like reduced trading fees and early access to new features.

Key Highlights of BTSE Exchange:

- Operated by BTSE UAB (Lithuania), also based in Seychelles

- 2.1M+ global users

- 300+ markets

- 100+ supported countries

- 20+ major services for trading, investing, and automation

Summary of BTSE Exchange Specifications

BTSE is structured to serve both retail and institutional traders, offering access to crypto spot and derivatives trading via a user-friendly interface. It supports high-leverage trades, diverse asset classes, and B2B integrations through APIs.

Exchange | BTSE |

Launch Date | 2018 |

Levels | 10 |

Trading Fees | From 0.2% For Maker & Taker |

Supported Coins | +300 |

Futures Trading | Yes |

Minimum Deposit | Varies By the Deposit Method |

Deposit Methods | Visa, MasterCard |

Withdrawal Methods | Visa, MasterCard |

Maximum Leverage | 100x |

Minimum Trade Amount | Varies by The Trading Pair |

Security Factors | 2FA, Cold Storage, Anti-Phishing Codes, Encryption, Account Activity Monitoring, Regular Security Audits |

Services | Staking, Copy Trading, Earn, Crypto Card, AutoTrader, All-in-One Orderbook, Multi-Asset Futures Collateral |

Customer Support Ways | Ticket, FAQ, Helpdesk |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Market |

Native Token | BTSE |

Restricted Countries | United States of America, Belarus, Canada, Cuba, Eritrea, Iran, North Korea, Syria, Singapore, Taiwan, Russia, and Venezuela |

What Are BTSE Exchange Pros and Cons?

The exchange offers strong infrastructure for high-volume trading, VIP user customization, and leverage tools, but it still lacks certain support options and has mixed public reviews. BTSE Advantages & Disadvantages:

Pros | Cons |

High trading volume and institutional-grade liquidity | No live chat or phone support |

BTSE Token benefits and staking options | Poor Trustpilot and Reviews.io ratings |

20+ integrated features for trading & automation | Limited withdrawal/deposit methods |

Up to 100x leverage on BTC and ETH pairs | Restricted in several countries |

Hybrid CEX features + B2B client focus | No MetaMask/WalletConnect support for Web3 wallets |

BTSE User Levels

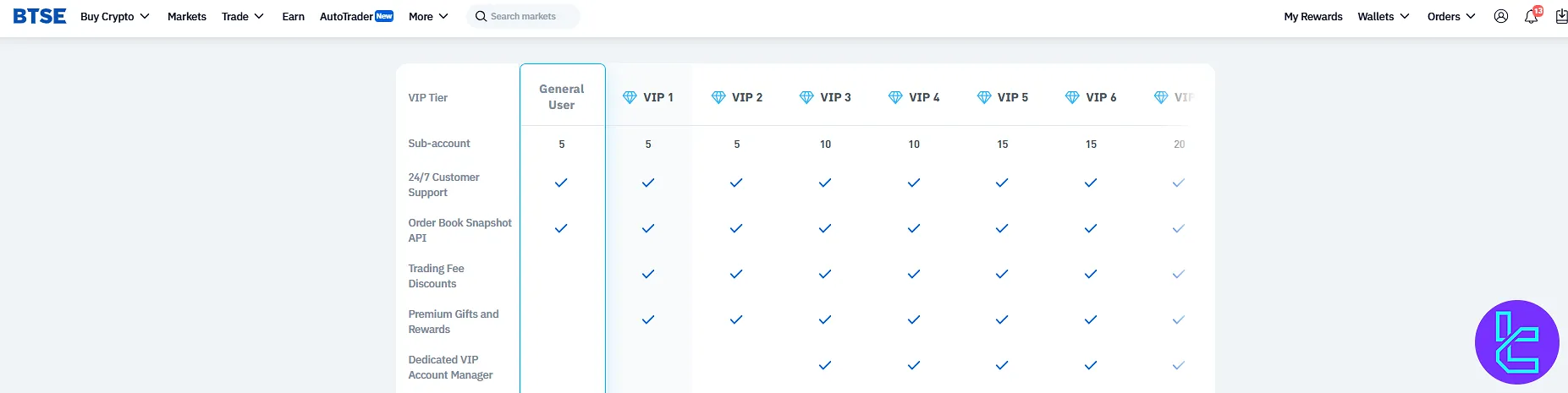

BTSE features a 10-tier VIP system that rewards users based on their trading activity.

While VIP Levels 1 to 6 gradually provide more perks, VIP Levels 7 to 10 offer similar features with tiered differences in trading volumes and fee reductions. BTSE Exchange User Levels:

VIP Tier | Sub-account | Trading Fee Discounts | Dedicated VIP Account Manager | Networking with Industry Leaders | Increased Rate Limits | Direct API Integration |

General User | 5 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 1 | 5 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 2 | 5 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 3 | 10 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 4 | 10 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 5 | 15 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 6 | 15 | ✅ | ✅ | ✅ | ❌ | ❌ |

VIP 7 | 20 | ✅ | ✅ | ✅ | ✅ | ✅ |

VIP 8 | 20 | ✅ | ✅ | ✅ | ✅ | ✅ |

VIP 9 | 20 | ✅ | ✅ | ✅ | ✅ | ✅ |

VIP 10 | 20 | ✅ | ✅ | ✅ | ✅ | ✅ |

BTSE Fee Structure

BTSE adopts a volume-based fee model, starting from 0.2% maker and taker fees at base level. As users advance through VIP levels, fees can be reduced to as low as 0% for makers and 0.025% for takers. This model benefits frequent and institutional cryptocurrency traders with fee reductions as incentives.

Higher levels also unlock rebates, API perks, and exclusive program access, making fee scaling a core part of BTSE’s retention strategy. BTSE Fees:

VIP Tier | 30d Spot Trading Volume | 30d Futures Trading Volume | Spot Maker Fee | Spot Taker Fee |

General Use | > 0 | > 0 | 0.2% | 0.2% |

VIP 1 | ≥ 100,000 | ≥ 500,000 | 0.15% | 0.15% |

VIP 2 | ≥ 250,000 | ≥ 1,000,000 | 0.1% | 0.1% |

VIP 3 | ≥ 1,000,000 | ≥ 25,000,000 | 0.08% | 0.09% |

VIP 4 | ≥ 5,000,000 | ≥ 50,000,000 | 0.06% | 0.08% |

VIP 5 | ≥ 10,000,000 | ≥ 100,000,000 | 0.05% | 0.07% |

VIP 6 | ≥ 50,000,000 | ≥ 250,000,000 | 0.03% | 0.06% |

VIP 7 | ≥ 200,000,000 | ≥ 500,000,000 | 0.02% | 0.045% |

VIP 8 | ≥ 500,000,000 | ≥ 1,000,000,000 | 0.01% | 0.04% |

VIP 9 | ≥ 1,000,000,000 | ≥ 2,000,000,000 | 0% | 0.03% |

VIP 10 | ≥ 2,000,000,000 | ≥ 4,000,000,000 | 0% | 0.025% |

How Many Coins Are Available to Trade in BTSE?

BTSE lists over 300 digital assets across various blockchain networks and categories. The platform covers a wide range of trending token types, allowing diversified exposure to emerging sectors within crypto.

Available Token Categories:

- Meme Tokens (e.g., DOGE, PEPE)

- Layer 1 Networks (e.g., BTC, ETH, SOL)

- Layer 2 Solutions (e.g., Arbitrum, Optimism)

- GameFi and AI Tokens

- BRC-20 Assets

- Solana Ecosystem Projects

- DeFi Protocols

- Ethereum Ecosystem Altcoins

- RWA (Real World Assets)

Are Margin and Futures Trading Available on BTSE?

Yes, BTSE offers both margin and futures trading with leverage up to 100x. This maximum leverage is only available for Bitcoin (BTC) and Ethereum (ETH). For all other altcoins, leverage is capped at 20x. Futures market contracts are perpetual and settle in crypto or stablecoins, giving traders flexible exposure.

The inclusion of high-leverage tools makes BTSE attractive to professional traders, but the restrictions by asset class help manage systemic risk.

How to Open an Account in BTSE Exchange? Guide for Newbies

Opening a BTSE account is a quick process involving four main steps. New users must register, provide basic information, verify their email, and then complete identity verification.

- Click on “Register” Button

- Provide Basic Information

- Verify Email Address

- Account Verification

#1 Click on “Register” Button

To start, head over to the BTSE website and click on the “Register” button.

You can sign up either with an email address or a mobile number, depending on your preference. This starts the account creation process.

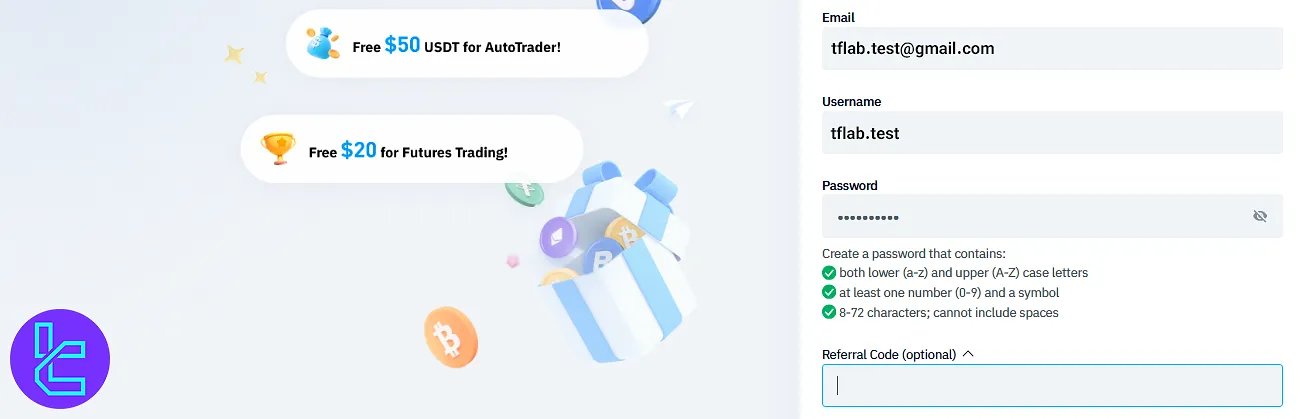

#2 Provide Basic Information

In this step, you'll be asked to submit basic credentials:

- Email Address

- Username

- Password

- Referral Code (optional)

These are essential to establish your identity and create a secure login.

#3 Verify Email Address

Once you’ve entered your email, BTSE will send a verification code to your inbox. Input this code on the registration page to confirm and activate your email. Without this step, your account remains inactive.

#4 Account Verification

Go to the “Account” tab in your dashboard and proceed with KYC (Know Your Customer) verification. You’ll need to provide:

- Email address

- Full name

- Date of birth

- ID type (e.g., Passport)

- Phone number

- Residential address

Verification unlocks full access to trading and withdrawal functionalities.

BTSE Platforms and Applications

BTSE supports both desktop and mobile trading with platforms available on web and mobile devices. The mobile app replicates the web experience with access to advanced features like order books, margin positions, and account settings.

Supported Platforms:

- Web Trading Interface

- BTSE Android App

- BTSE iOS App

What Are the Security Features of BTSE?

This exchange integrates institutional-grade security measures to protect user assets and information. Security protocols include multi-layer encryption, cold wallet storage, and user-centric tools for personal account protection. Regular audits and activity monitoring are also part of BTSE’s core defense structure.

BTSE Security Features Include:

- Two-Factor Authentication (2FA)

- Cold Storage crypto wallet for Majority of Funds

- Anti-Phishing Code Generation

- End-to-End Encryption

- Login Activity and Session Monitoring

- Frequent Security Audits and Compliance Checks

These features aim to safeguard both individual and enterprise-level accounts against breaches, phishing, and unauthorized access.

What Are the Available Methods of Deposit and Withdrawal?

BTSE allows deposits and withdrawals primarily via Visa and MasterCard. Fiat on-ramps are limited, and while crypto deposits are broadly supported, fiat withdrawal options are currently more restricted. Users looking for wire transfers or regional e-wallets may find limited integration on the platform.

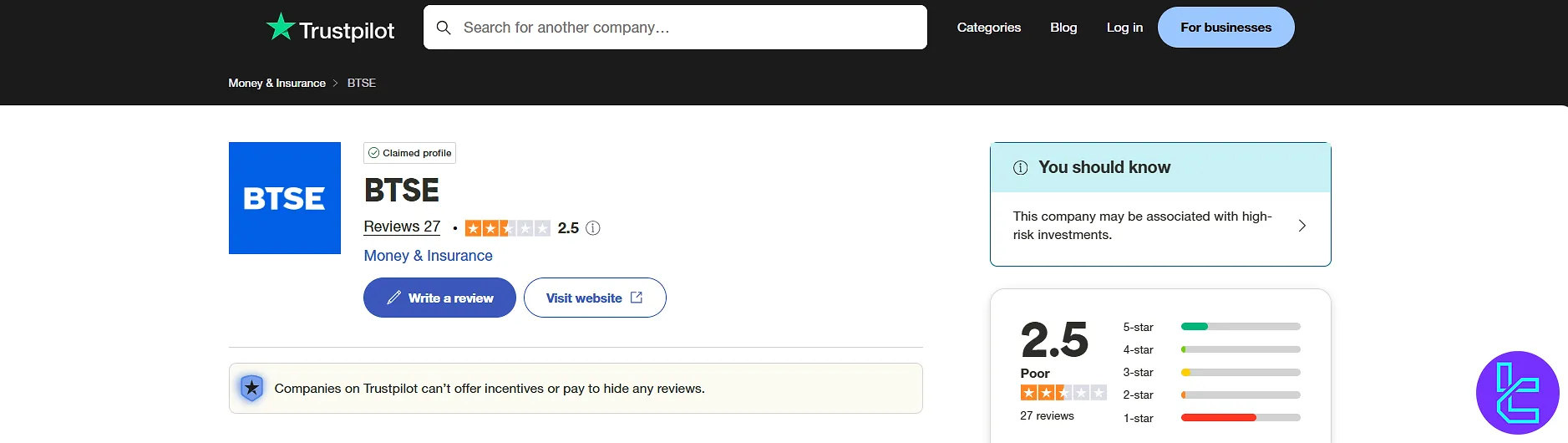

BTSE Trust Scores

Despite its professional infrastructure, BTSE has mixed reputations across review platforms. While BTSE Trustpilot reviews maintains a moderate technical trust score on aggregators, user reviews indicate a lack of satisfaction in areas like withdrawal processing and support responsiveness.

BTSE Trust Overview:

- CoinGecko: 7/10 (Trust Score)

- Trustpilot: 2.5 out of 5 (25+ reviews)

BTSE trust score page on Trustpilot - Reviews.io: 1.2 out of 5 (35+ reviews)

These scores suggest that while the platform is functional and secure, user experience—particularly around support—could be improved.

What Features Are Available in BTSE?

BTSE offers more than just trading—it also includes several investment and automation tools designed to enhance long-term capital management and short-term trading flexibility. BTSE Features:

Features | Availability |

Staking | Yes (BTSE Token Only) |

Yield Farming | Available |

Social Trading | Copytrade-based setup available |

Launchpool | Not Available |

Crypto Cards | Available |

These features aim to provide both passive and active users with more ways to grow their capital beyond trading.

BTSE Customer Support

BTSE provides customer support through ticket-based systems and knowledge-base articles. However, there is no live chat, call center, or instant messaging support available—this may cause delays in resolving urgent user issues.

Support Channels:

- Helpdesk with Searchable Articles

- Ticket Submission System

- Limited FAQ Coverage

Copytrade and Other Available Investment Methods of BTSE

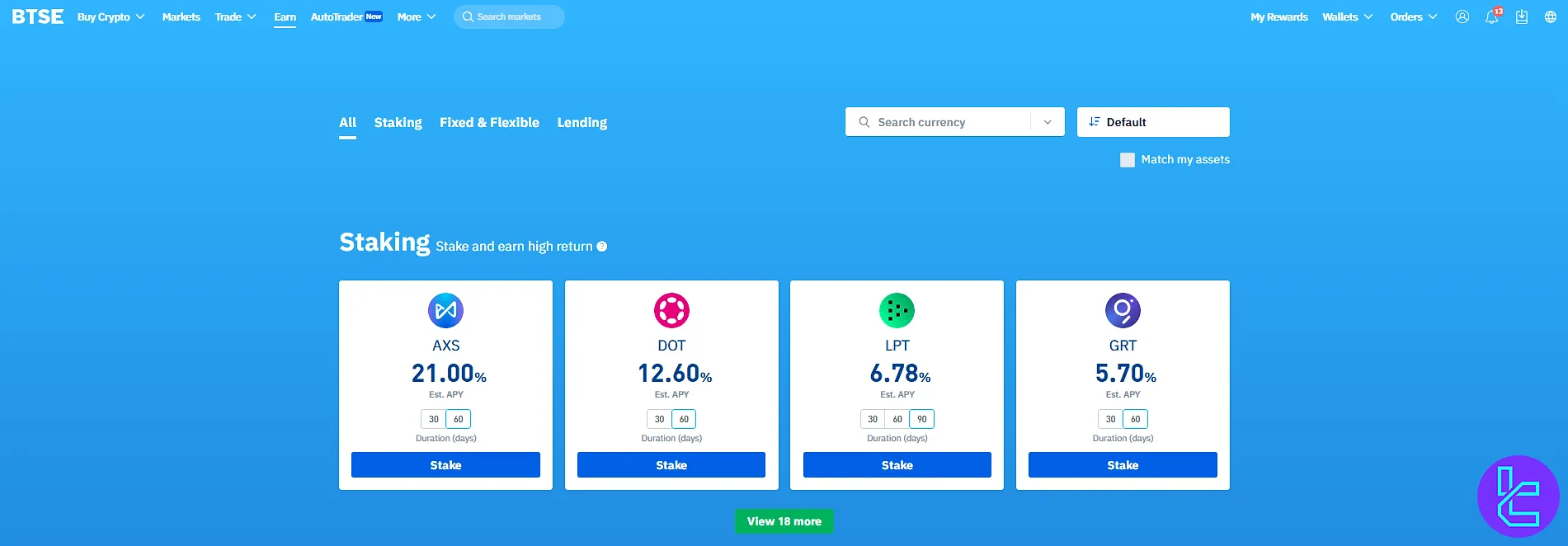

BTSE supports copy trading, where users can follow and mirror trades of experienced traders. Additionally, users can benefit from staking, which is available for multiple currencies including USDT, DOT, AXS and GRT.

BTSE Investment Options:

- Copy Trade (choose from a list of pro traders)

- Earn (Yield Tools) via automated farming

- Staking

These tools aim to balance manual trading with passive income opportunities.

What Countries Are Restricted to Use BTSE?

Due to regulatory restrictions, users from the following countries are prohibited from using BTSE services. These restrictions apply to both account creation and trading functionalities.

Restricted Countries:

- United States

- Canada

- Belarus

- Cuba

- Eritrea

- Iran

- North Korea

- Syria

- Singapore

- Taiwan

- Russia

- Venezuela

Compliance with international sanctions and financial regulations is a core part of BTSE's operational model.

Comparison of BTSE with Other Crypto Exchanges

BTSE’s positioning as a hybrid exchange places it in competition with both traditional centralized platforms and more flexible, trader-oriented venues. BTSE Vs other exchanges:

Parameters | BTSE Exchange | |||

Number of Assets | 300+ | 7800+ | 700+ | 1700+ |

Maximum Leverage | 1:100 | 1:12 | 1:200 | 1:100 |

Minimum Deposit | Varies By the Deposit Method | N/A | $1 | $1 or 0,0001 in BTC |

Spot Maker Fee | From 0.2% | -0.01% - 0.14% | From 0.02% | From 0.04% |

Spot Taker Fee | From 0.2% | 0.03% - 0.23% | From 0.02% | From 0.045% |

Mandatory KYC | Yes | Yes | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | Yes | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | No | Yes |

Staking | Yes | Yes | Yes | Yes |

Copy Trading | Yes | Yes | Yes | Yes |

Expert Suggestion & Conclusion

BTSE offers a volume-based fee model [form 0.2%], asset support [over 300], and VIP program [10 user levels]; But, the lack of real-time support [live chat or phone call] and mixed trust reviews suggest room for improvement in customer experience.