Bullish offers access to Crypto Spot and Perpetual markets with a maximum leverage of 1:7. The exchange charges no maker fees, and taker fees range from 0.0% to 2.0%. Spreads for ETH/USDC and BTC/USDC pairs are $0.01 and $0.10, respectively.

Bullish; An Introduction to the Crypto Exchange

Bullish is a blockchain-based crypto exchange founded in 2021 as a subsidiary of Block.one backed by PayPal cofounder "Peter Thiel".

The company operates through three legal entities in multiple jurisdictions, including Global, Germany, and Hong Kong, with the following licenses:

- Hong Kong Securities and Futures Commission (SFC) with CE No. BUQ958

- Gibraltar Financial Services Commission (GFSC) with DLT license No. FSC1038FSA

- German Federal Financial Supervisory Authority (BaFIN)

This Bullish review will explore the global branch’s offerings and features.

Bullish Exchange Table of Specifications

Led by CEO "Tom Farley", the crypto exchange offers a wide range of solutions, from API services to perpetual trading.

Exchange | Bullish |

Launch Date | 2021 |

Levels | 5 levels |

Trading Fees | Up to 0.02% for Spot Taker Orders 0% for Maker Orders |

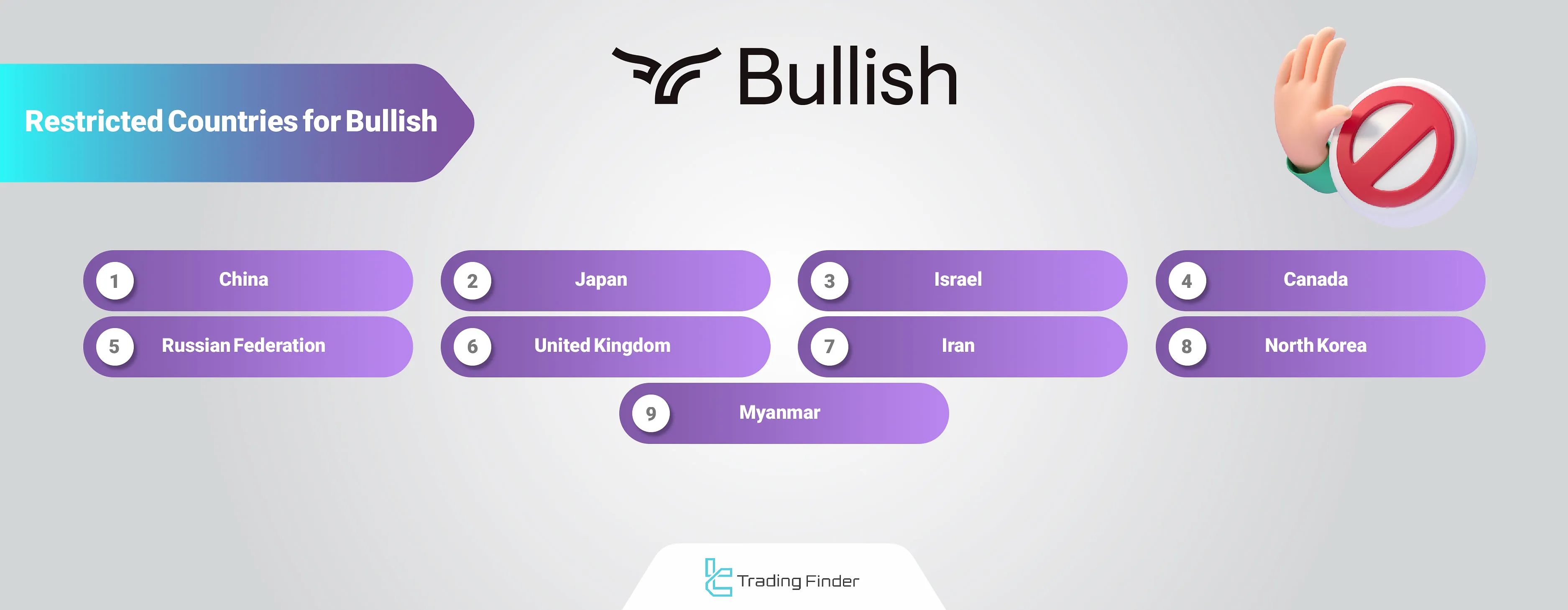

Restricted Countries | Canada, China, Japan, Israel, The Russian Federation, United Kingdom, Iran, North Korea, Myanmar |

Supported Coins | 39 |

Futures Trading | Yes |

Minimum Deposit | $1 |

Deposit Methods | Wire Transfer, Crypto |

Withdrawal Methods | Wire Transfer, CUBIX, Crypto |

Maximum Leverage | 1:7 |

Minimum Trade Size | $1 |

Security Factors | Two-Factor Authentication (2FA), Cold storage, Multi-signature wallets |

Services | Spot Trading, Perpetual Markets, AMM, Dated Futures, API services |

Customer Support Ways | Ticket |

Customer Support Hours | N/A |

Fiat Deposit | Yes |

Affiliate Program | No |

Orders Execution | Market |

Native Token | No |

Bullish Pros & Cons

The exchange supports crypto spot and futures trading in 9 markets. However, like any trading platform, Bullish has some downsides, too.

Pros | Cons |

Variable trading services, from Spot and Futures to Automated Market Making | Relatively new in the market |

Strong foundation and backing from industry leaders | A complex fee structure can be confusing for beginners |

Deep liquidity pools and tight spreads | No mobile app available |

Regulated and compliant platform | Limited cryptocurrency offerings |

Bullish User Levels

The exchange doesn’t offer a traditional user level system. However, it categorizes clients based on two parameters: Average Daily Taker Volume (ADTV) and Same-Direction.

- Average Daily Taker Volume (ADTV): Measures the percentage of the client’s daily taker volume out of all taker orders

- Same-Direction: Measures the percentages of subsequent taker orders sent by all market participants on the same market in the same direction as your taker order

Tier | Client ADTV | Client Same-Direction |

Level 1 | Under 0.01% | Any |

Level 2 | Over 0.01% | Under 60% |

Level 3 | Over 0.01% | 60% to 75% |

Level 4 | Over 0.01% | 75% to 88% |

Level 5 | Over 0.01% | Over 88% |

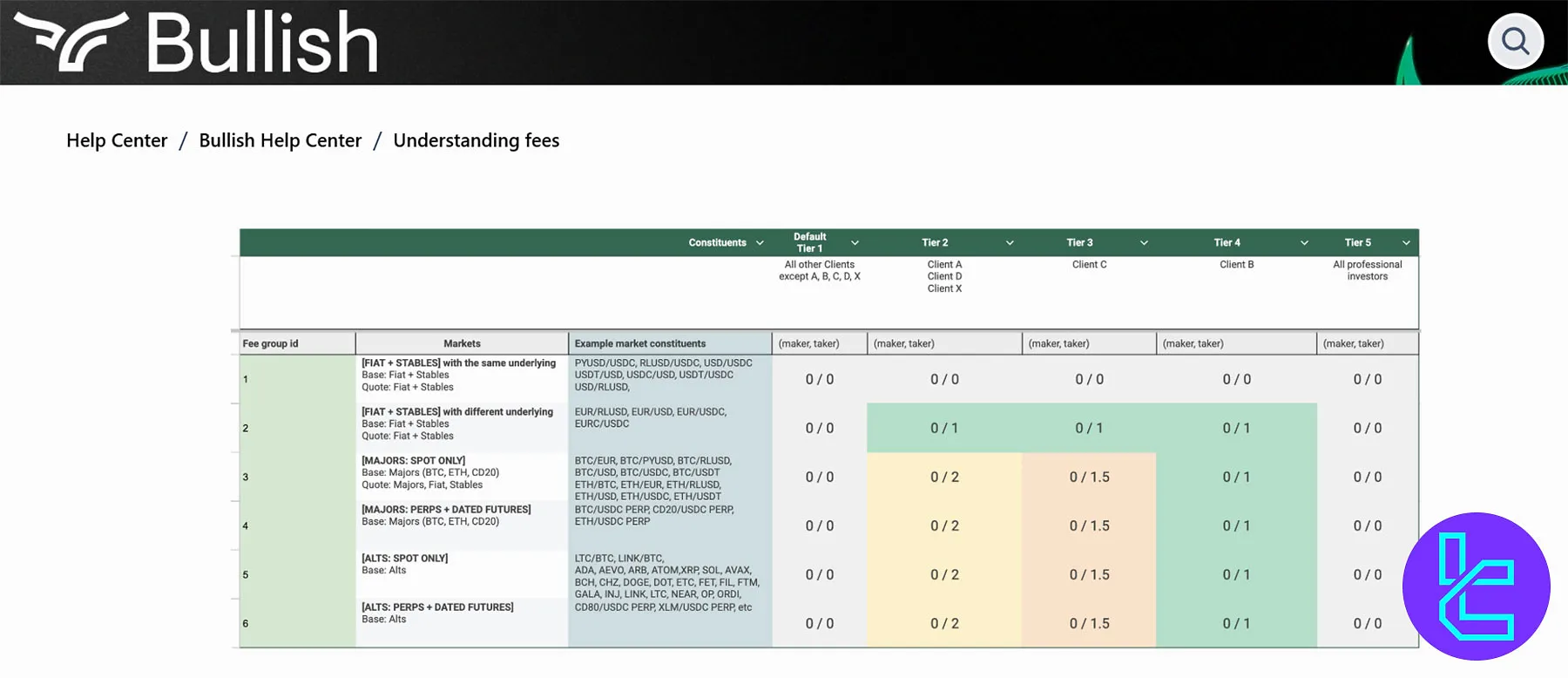

Bullish Exchange Fees and Commissions

The company has implemented a maker/taker fee structure. While it charges no fees on maker orders, Taker fees are calculated based on the user level and the digital asset:

User Level | Spot fiat/stable markets with the same underlying | Spot fiat/stable markets with a different underlying | All other markets |

Level 1 | 0% | 0% | 0% |

Level 2 | 0% | 0.01% | 0% |

Level 3 | 0% | 0.01% | 0.01% |

Level 4 | 0% | 0.01% | 0.015% |

Level 5 | 0% | 0.01% | 0.02% |

The platform charges hourly interest rates for borrowing assets to participate in the Margin market. At least one hour’s interest (APR) applies to all loans. Bullish exchange formula for the perpetual market interest rates:

- Borrower Interest Charge = ((1 + APR) ^ (1 / 365 * 24) - 1) * Borrow * (1 + Multiplier * Taker Fee)

For the AMM (Automated Market Making) services, the exchange calculates fees in three tiers, including 25%, 10%, and 0%. It also charges an additional 0.5% rate for each order that the Liquidation Engine fills.

Available Digital Assets on Bullish

In this Bullish review, we must mention that the exchange offers spot trading in USD, EUR, RLUSD (Ripple USD), PYUSD (PayPal USD), USDC, USDT, BTC, XRP, and ETH markets. A list of some of the popular cryptocurrencies available on Bullish:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Dogecoin (DOGE)

- Solana (SOL)

- Aave (AAVE)

- Chainlink (LINK)

- Curve DAO Token (CRV)

- Sushiswap (SUSHI)

- Uniswap (UNI)

It's important to note that asset availability may vary by jurisdiction.

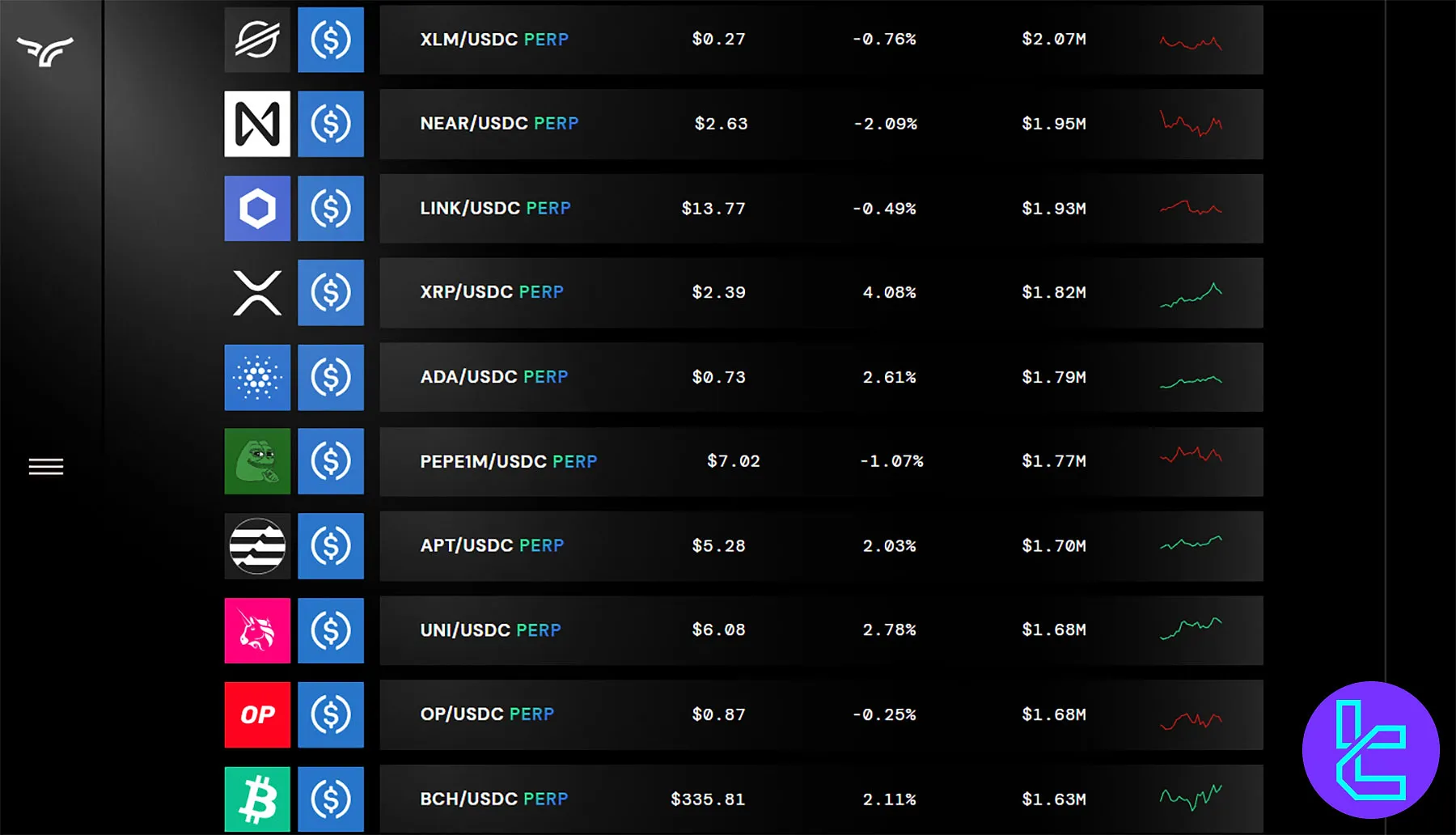

Bullish Futures Market

The exchange has a Perpetual market offering leveraged trading of up to 1:7 on 28 Crypto/USDC trading pairs. Available cryptocurrencies for margin trading on Bullish exchange:

- BTC

- ETH

- CD20 index

- AVAX

- XLM

- LINK

- NEAR

- XRP

- ADA

- UNI

- OP

- BCH

The exchange also offers access to Dated-Futures, which involves buying or selling a specific asset at a predetermined price and date in the future, with the contract expiring on that particular date.

Bullish Exchange Registration and KYC

To register on Bullish, you need an email address, a strong password, and a two-factor authenticator, such as WebAuthn passkey, Google Authenticator, and Authy.

#1 Access and Begin Registration

Visit the platform’s official website and click “Sign Up” to initiate the account creation process.

#2 Verify Email and Set Credentials

Enter a valid email address, verify it through the confirmation link, choose a security question, and create a secure password.

#3 Activate 2FA

Enable two-factor authentication (2FA) using an app like Google Authenticator to enhance login security.

#4 Complete KYC via Persona

Upload valid ID documents, provide proof of address, and finish the liveness check using Persona to fully verify your identity.

Bullish App and Platform

One of the biggest letdowns in this bullish review is the lack of a dedicated mobile application. Trading is only available through a web-based platform.

While the lack of a dedicated mobile app might be inconvenient for some users, the web platform's responsiveness ensures that traders can still access their accounts and execute trades from their mobile devices through a web browser.

Bullish Exchange Security

The platform prioritizes clients’ funds safety by supporting various two-factor authenticators, including hardware security tokens through WebAuthn. Bullish security factors:

- Regulated by multiple financial authorities, including the SFC, GFSC, and BaFIN

- Audited by Deloitte

- Two-Factor Authentication (2FA)

- Cold storage

- Offline cold key storage

- Multi-signature wallets

- Globally distributed backup keys

- Partnerships with BitGo and Fireblocks as custody solution providers

- Verified track record of no successful hacks

It's worth noting that the exchange does not employ an investor protection fund scheme despite being regulated.

Available Payment Options on Bullish

The exchange supports USD and EUR fiat transactions in addition to Crypto deposits and withdrawals. The available options for fiat funding are SWIFT, SEPA, and CBIT. Available fiat payment methods on Bullish:

- SWIFT

- SEPA

- CBIT

- CUBIX (only withdrawal)

- Bank Wire

While all deposits and CUBIX withdrawals are free of charge, wire withdrawals incur a $30 commission.

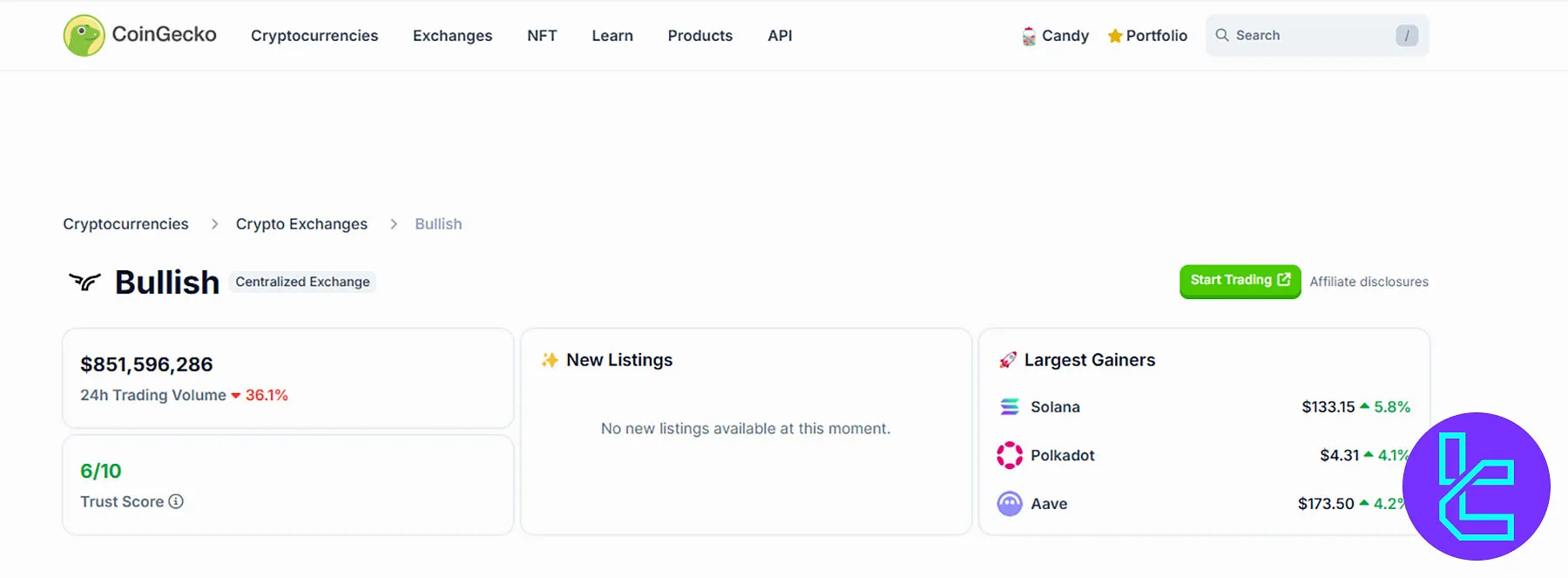

Bullish Exchange Trust Scores

There are no Bullish reviews on platforms like Trustpilot and Forex Peace Army. However, CoinGecko experts have rated the platform as an average crypto exchange. The Bullish Exchange CoinGecko profile has a 6 out of 10 score.

ScamAdviser, a website evaluation platform, has assigned a decent "Trustscore" of 76/100 to the mentioned exchange, based on rankings from Tranco, DNSFilter, and Maltiverse, as well as other factors.

Bullish Customer Support

Another downside in this Bullish review is the lack of proper support channels like live chat or a call center. The exchange provides a comprehensive “Help Center” with answers to the most common questions.

It also implements a ticket system as the single method for contacting the support team.

Investment and Growth Plans on Bullish Exchange

While the platform doesn’t offer traditional copy/social trading services, it has developed various Crypto indices tracking price changes of digital asset bundles, including:

- CoinDesk 20 (CD20)

- CoinDesk 80 (CD80)

- CoinDesk Meme (CDMEME)

- CoinDesk 100 (CD100)

Prohibited Countries on Bullish Exchange

The platform doesn’t service persons in China, Japan, Israel, Canada, the Russian Federation, or any jurisdiction subject to sanction, such as Iran and North Korea. Bullish Red Flag Countries:

- China

- Japan

- Israel

- Canada

- Russian Federation

- United Kingdom (Only available to professional investors)

- Iran

- North Korea

- Myanmar

Comparison Between Bullish and Other Exchanges

For a fair evaluation of Bullish's specifications from a comparison point of view, check out this table:

Features | Bullish Exchange | LBank Exchange | Bybit Exchange | |

Number of Assets | 39 | 700+ | 1300+ | 800+ |

Maximum Leverage | 7x | 1:125 | 1:100 | 1:125 |

Minimum Deposit | $1 | Varies by Cryptocurrency | Varies by Cryptocurrency | $1 |

Spot Maker Fee | 0% | 0.02% | 0.005% - 0.1% | 0.005% - 0.1% |

Spot Taker Fee | 0% - 0.02% | 0.02% | 0.015% - 0.1% | 0.02% - 0.1% |

Mandatory KYC | Yes | No | Yes | Yes |

Futures Trading | Yes | Yes | Yes | Yes |

Mobile Application | No | Yes | Yes | Yes |

Fiat Payment | Yes | Yes | Yes | Yes |

Staking | No | Yes | Yes | Yes |

Copy Trading | No | Yes | Yes | Yes |

Writer's Opinion and Conclusion

Bullish exchange provides access to 39 cryptocurrencies, 28 perpetual trading pairs, and 71 spot contracts. The exchange accepts CUBIX, SEPA, and SWIFT payments with no minimum deposit requirements. It has a 6/10 score on CoinGecko.