Coinbase is the number one crypto exchange in USA (according to Business Insider), and more than 185 billion dollars are traded in it every season!

Coinbase exchange is founded by “Brian Armstrong” and right now, offers 11,750 cryptocurrencies to trade. Coinbase has over 245000 partnerships in more than 100 countries.

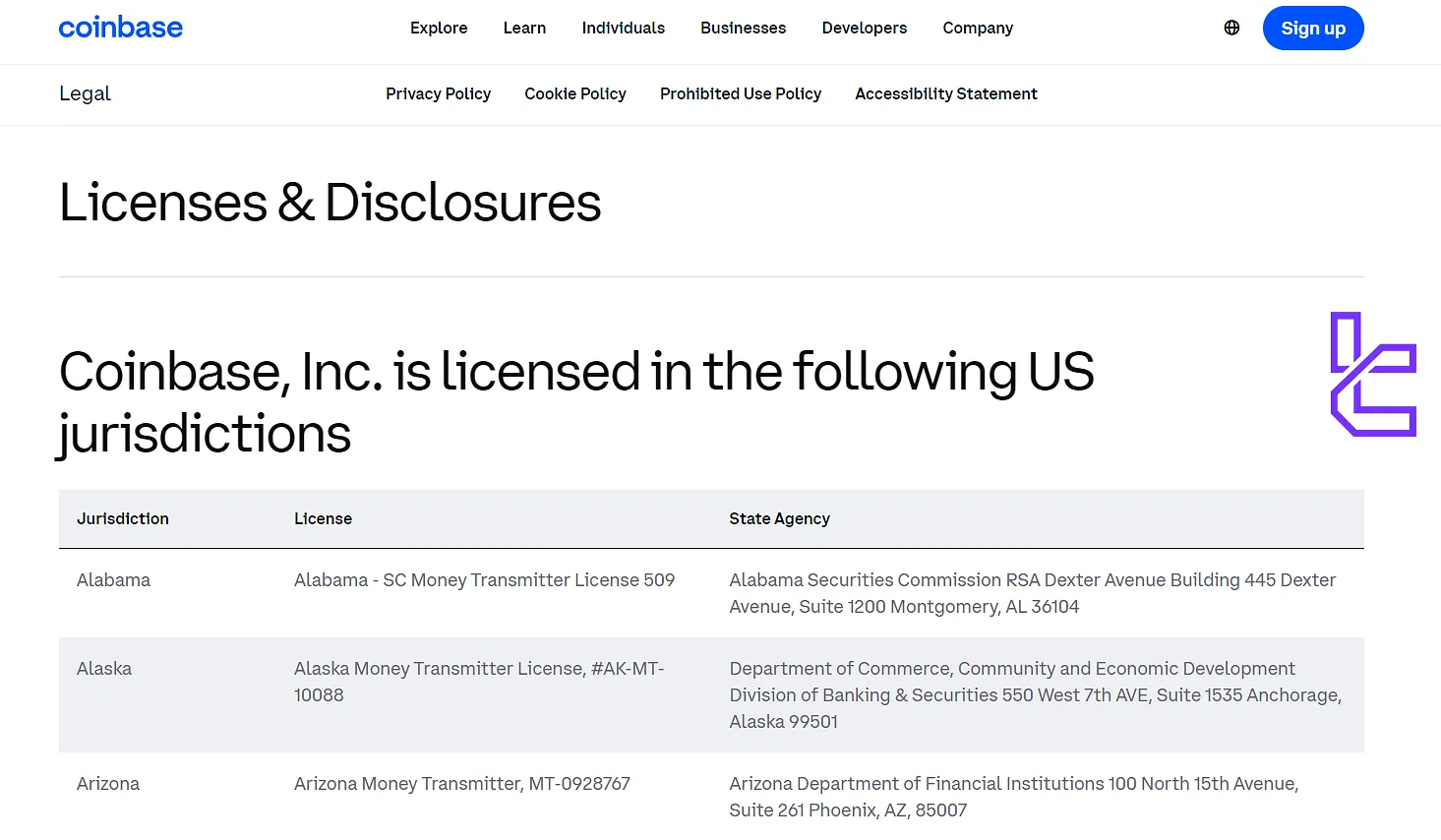

Coinbase Company Information & Regulation

Coinbase crypto exchange, founded in 2012, has become a household name in the cryptocurrency industry. As a publicly-traded company (NASDAQ: COIN), it operates under strict regulatory oversight of U.S. Securities and Exchange Commission (SEC). Additionally, Coinbase exchange is regulated in some other jurisdictions. Coinbase regulation and licenses:

- Compliant with FinCEN regulations

- S. Department of the Treasury’s Office of Foreign Assets Control (OFAC)

- BitLicense from the NY Department of Financial Services

- German Bundesanstalt für Finanzdienstleistungsaufsicht (the Federal Financial Supervisory Authority)

- Central Bank of Ireland

- Financial Authority in US States

- Financial Conduct Authority in the United Kingdom

Despite its strong regulatory stance, Coinbase has faced some legal challenges. In 2023, the SEC filed a lawsuit against the company, alleging that it listed unregistered securities. This ongoing case highlights the complex regulatory landscape surrounding cryptocurrencies.

Summary of Specifications

Coinbase exchange launched its native stablecoin, USDC, in September 2018 through a joint venture. This is only one part of the Coinbase exchange profile. Coinbase exchange specifications:

Exchange | Coinbase |

Launch Date | 2012 |

Levels | 3 |

Trading Fees | Varies Based on Trading Volume |

Supported Coins | 12750+ |

Futures Trading | Yes |

Minimum Deposit | $2 |

Deposit Methods | 3d Secure Card, Bank Transfer, Paypal, Sepa Transfer, Apple Pay, Google Pay |

Withdrawal Methods | 3d Secure Card, Bank Transfer, Paypal, Sepa Transfer, Apple Pay, Google Pay |

Maximum Leverage | 3x |

Minimum Trade Amount | $2 |

Security Factors | Cold Storage, Two-Factor Authentication, Aes-256 Encryption, Whitelisting |

Services | Staking, ENS Profile, Wallet, Card, Learning Rewards, Coinbase Advanced, Earn, Coinbase One, Prime, Onramp |

Customer Support Ways | Live Chat, Email, Faq, Phone Support |

Customer Support Hours | 24/7 |

Fiat Deposit | Yes |

Affiliate Program | Yes |

Orders Execution | Limit Order, Market Order |

Native Token | USDC (Joint Venture with Circle) |

Restricted Countries | Cuba, Iran, North Korea, Syria, Crimea Region of Ukraine, Venezuela |

Pros and Cons

Although Coinbase does not provide attractive features like other exchanges such as Kucoin or Binance, it is one of the most reliable. Advantages and disadvantages of Coinbase:

Pros | Cons |

User-Friendly Interface Ideal for Beginners | Higher Fees Compared to Some Competitors |

Wide Selection of Cryptocurrencies (11750+) | Limited Advanced Trading Features on The Main Platform |

Strong Security Measures | Customer Support Can Be Slow During Peak Times |

Regulated and Publicly Traded Company | Ongoing Regulatory Challenges |

Offers Educational Resources and Rewards | - |

Integrated Wallet Service | - |

Coinbase User Levels

Coinbase offers different user levels, which are based on verification and has their own features. Coinbase user levels:

- Level 1: username, password, personal details and verification with phone number; Lower trading and withdrawal limits.

- Level 2: ID & Address verification; All Level 1 features, plus increased limits.

- Level 3: Additional documentation and review process; Highest limits, access to all Coinbase services.

Fees and Commission

Coinbase's fee structure varies based on just one factor which is “Trading Volume”. The higher the transaction volume, the lower the fee; Coinbase commission:

Tier | Taker Fee | Maker Fee |

$0K-$10K | 60bps | 40bps |

$10K-$50K | 40bps | 25bps |

$50K-$100K | 25bps | 15bps |

$100K-$1M | 20bps | 10bps |

$1M-$15M | 18bps | 8bps |

$15M-$75M | 16bps | 6bps |

$75M-$250M | 12bps | 3bps |

$250M-$400M | 8bps | 0bps |

$400M+ | 5bps | 0bps |

Unlike many exchanges, deposit and withdrawal fees in the Coinbase exchange are not completely free and are as described in the table below.

Methods | Deposit Fee | Withdrawal Fee |

ACH | Free | Free |

Wire (USD) | $10 USD | $25 USD |

SEPA (EUR) | €0.15 EUR | Free |

Swift (GBP) | Free | £1 GBP |

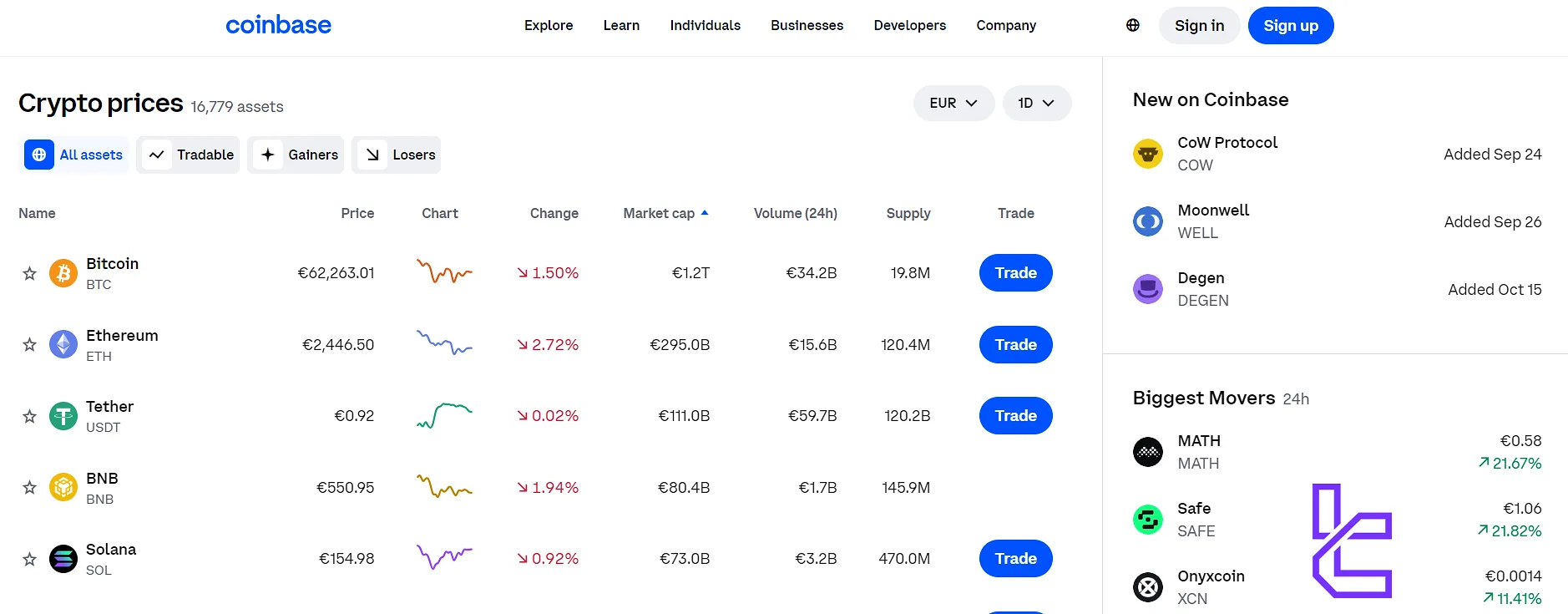

Coinbase Exchange Supported Coins: Full List

When writing this article, more than 11,750 cryptocurrencies, including the oldest cryptocurrencies such as Bitcoin, Ethereum, etc., are tradable in Coinbase. The list of Coinbase currencies is regularly updated, and more currencies are becoming tradable. List of Coinbase-supported assets:

- Bitcoin (BTC);

- Ethereum (ETH);

- Litecoin (LTC);

- Bitcoin Cash (BCH);

- Dogecoin (DOGE);

- Cardano (ADA);

- Solana (SOL).

Does Coinbase exchange support Futures and Margin trading?

As of 2024, Coinbase does not offer margin trading on its main platform. However, they provide margin trading in Coinbase pro and futures trading on the Advanced Trading platform.

- Futures Trading: futures is available on Coinbase Advanced Trading with 7 futures contracts and 3x leverage.

- Margin Trading: Available in Coinbase Pro with Limit orders, stop order, Advanced charting tools, Order book visibility and Lower fees compared to the standard Coinbase platform.

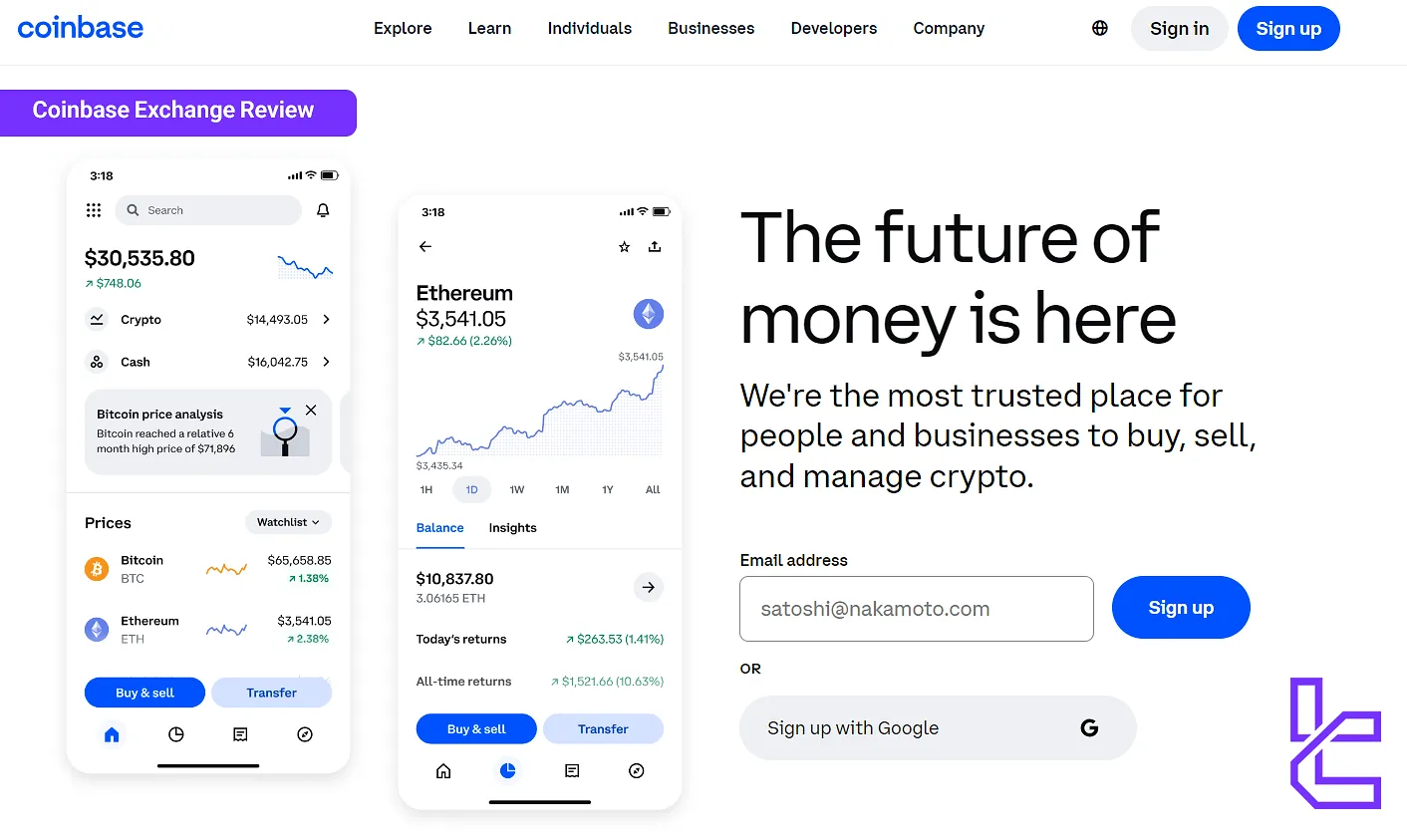

How to Sign Up and Register In Coinbase Exchange?

Follow these steps to create your Coinbase account and start trading:

- Visit Coinbase website and click on "Sign Up";

- Choose your account type;

- Enter your email address;

- Write first & last name, then create your password;

- Verify the email address you entered earlier;

- Enter your phone number and verify it;

- Click on “Document Verification” to Verify your identity by uploading a government-issued ID;

- Complete Proof of Address by uploading Bank statement, credit card statement or utility bill;

Once your account is set up and verified, you can start buying, selling, and trading cryptocurrencies on Coinbase.

Application and Platforms

Coinbase digital exchange, along with a versatile mobile application for trading, has also launched its digital wallet, which is available for mobile. To use these applications, you must download them first via the links below.

Coinbase Exchange Mobile Application

The Coinbase mobile app is available for both iOS and Android devices, offering a seamless trading experience; it is suitable for Buy, sell, and convert cryptocurrencies, Real-time price alerts, Portfolio tracking. Coinbase mobile Application Download Link:

Coinbase Exchange Mobile Wallet

Coinbase Wallet is a separate app that gives users full control over their crypto assets and protect it. It’s a Self-custodial wallet (you control the private keys), Supports multiple blockchains and NFTs.

Coinbase wallet download:

Coinbase Security Measurements

Coinbase takes security seriously, implementing multiple layers of protection:

- Cold Storage: 98% of customer funds stored offline;

- Two-Factor Authentication (2FA): Required for all accounts;

- AES-256 Encryption: For data at rest and in transit;

- Insurance: Coverage for digital assets held online;

- Bug Bounty Program: Rewards for identifying security vulnerabilities;

- Whitelisting: Option to restrict withdrawals to approved addresses;

- Device Management: Monitor and control which devices can access your account.

Withdrawal and Deposit Methods

Coinbase supports various methods for moving funds in and out of your account. Coinbase payment methods:

Payment Method | Speed |

3D Secure Card | Instant |

Bank Transfer | Up to 2 hours |

PayPal | 1 business day |

SEPA Transfer | 1-3 working days |

Apple Pay | Instant |

Google Pay | Instant |

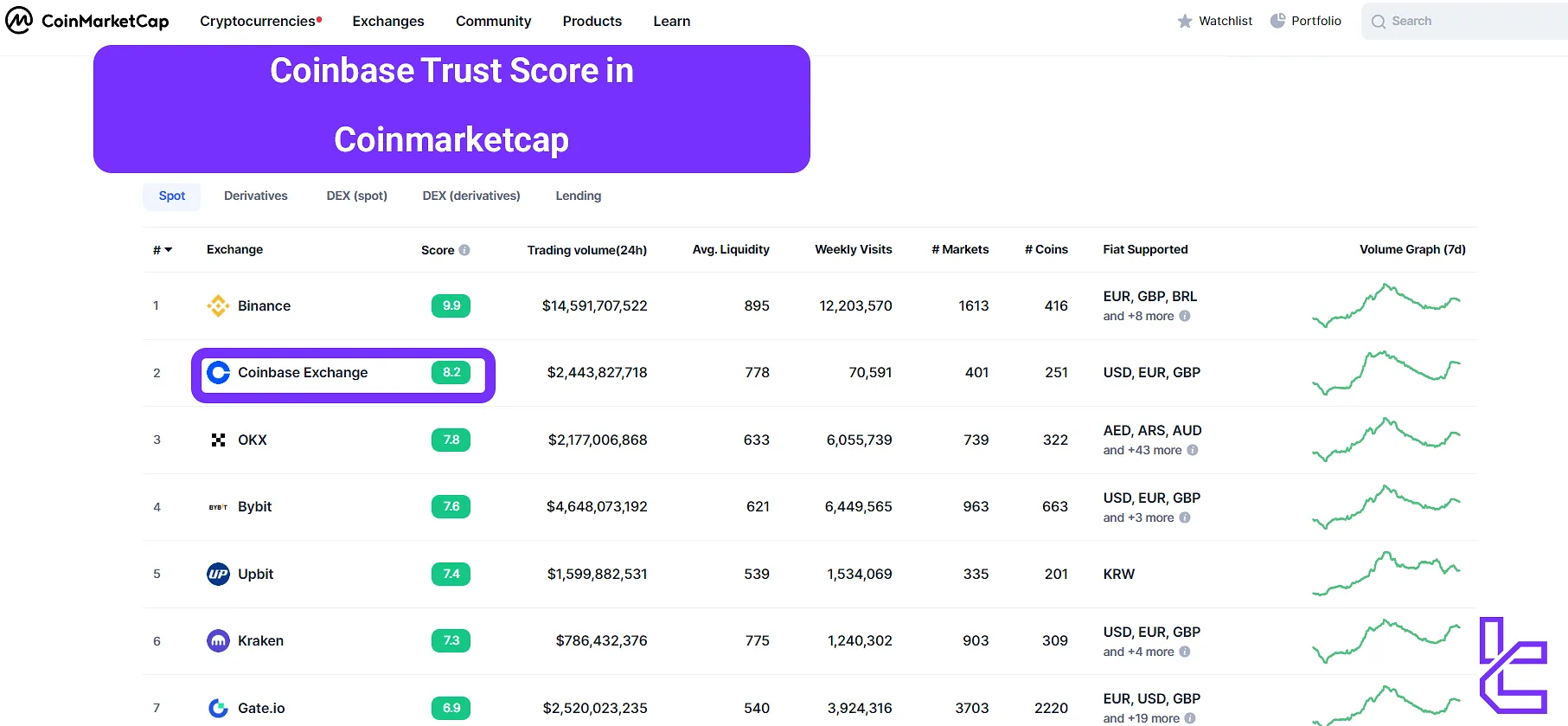

Coinbase Exchange Trust Scores

Coinbase consistently ranks high in trust scores [sites such as Coingecko and Coinmarketcap] among cryptocurrency exchanges:

- CoinGecko: 10/10;

- CoinMarketCap: 8.2/10;

- Trustpilot: 1.8/5 based on 9333 reviews;

- Reviews.io: 4.3 out 5 from 854 reviews.

Although Coinbase has received very high scores in reputable sources such as CoinMarketCap and Reviews.io, it does not have an interesting status in TrustPilot. The reviews on TrustPilot are very contradictory; although some are dissatisfied, many users are satisfied with Coinbase's services.

Customer Services and Support

Coinbase offers 24/7 support channels to help its traders.

- Help Center: Comprehensive FAQ and troubleshooting guides;

- Email: Available for all users;

- Live Chat: available 24/7;

- Phone Call: Available for some issues and account types;

- Social Media: Active presence on Twitter for updates and support;

- Community Forums: Peer-to-peer assistance and discussions.

While Coinbase has improved its customer support in recent years, response times can still be slow during periods of high market volatility.

Which Copy Trading and Investment Services Does Coinbase Exchange Offer?

Coinbase offers direct copy trading services and let people copy from top traders. Besides that, it has other investment plans which are:

- Coinbase Earn: “Put your crypto to work and earn rewards.” that’s the slogan for Coinbase earn;

- Staking: Earn passive income from staking cryptocurrencies;

- Coinbase Index Fund: For accredited investors (minimum $250,000 investment).

Restricted Countries: Full List

Coinbase's services are available in more than 100 countries but they don’t provide services to some countries because of OFAC (Office of Foreign Assets Control) sanctions. As of 2024, some restricted countries include:

- Cuba;

- Iran;

- North Korea;

- Syria;

- Crimea region of Ukraine;

- Venezuela (partial restrictions).

Trading Finder Writer's Opinion and Conclusion

With $2 minimum deposit, you can trade in Coinbase spot and futures using 3x maximum leverage. Coinbase is not limited to USA and provide its services to over 100 countries and safeguards $273B assets of its users.

Coinbase exchange has its own disadvantages including limited advanced trading features and regulatory challenges with SEC.