Reviewing forex brokers is an important task since traders are entrusting their hard-earned capital to these platforms. Trading Finder emerges as a beacon of trust, meticulously evaluating forex brokers to empower you with informed decisions. At the heart of Trading Finder's expertise lies our comprehensive methodology, a testament to our commitment to transparency and objectivity. This robust framework guides our team of seasoned forex market specialists in scrutinizing every aspect of a broker's offerings.

Delving into the Core Elements of Our Evaluation

Trading Finder Experts use 19 data metrics to evaluate brokers:

| Metric | Description |

| Regulations and Licenses | Trading Finder ensures the legitimacy and regulation of each brokerage by reviewing their licenses and certifications, confirming their operation under the supervision of international financial authorities, and providing programs to protect customer assets. |

| Broker’s Summary | Information such as the year of establishment, founders, headquarters location, and other details are important in the review of brokerages by Trading Finder specialists. |

| Account Types Variety | Each trader has their own investment strategy, risk tolerance, and trading outlook. Trading Finder reviews various broker accounts such as standard accounts, micro accounts, PAMM accounts, ECN accounts, and others to find the best fit and diversity of accounts based on customer needs. |

| Variety of Tradable Symbols | The variety of trading instruments in the forex market, such as currency pairs, stocks, ETFs, and CFDs, is one of the main criteria in selecting a top broker. Trading Finder gives special consideration to the breadth of a broker's offerings. |

| Commissions and Fees | The broker's commissions on trades, deposits, withdrawals, along with account inactivity charges, have a significant impact on trader profits and losses. Trading Finder collects information on broker commissions and fees by reviewing data and directly using broker services. |

| Deposits and Withdrawals | Broker commissions on trades, deposits, and withdrawals, along with other fees such as account inactivity charges, significantly impact traders' profits and losses. Trading Finder gathers information on broker commissions and fees by reviewing data and directly using broker services. |

| Trading Platforms and Apps | The availability of various trading platforms and the ability to use broker services on platforms such as cTrader, MetaTrader 4 and 5, and mobile applications are among the key criterias Trading Finder uses to evaluate brokers. |

| Opening Account and Verification | Trading Finder examines the entire process of account opening and verification with brokers from start to finish to ensure its optimized for best user experience. |

| Investment and Copytrade | The availability of copy trading allows forex traders to benefit from the experience and expertise of more seasoned market participants. Trading Finder evaluates whether brokers offer copy trading, as well as the quality of its implementation and the associated costs. |

| Customer Support and Social Media | The importance of customer support in resolving user issues and improving the overall experience with a broker's financial services is undeniable. Trading Finder ensures the quality of broker support by directly communicating with support teams and monitoring their activities on websites and social media platforms. |

| Important Micro Datas | Trading Finder ensures the usefulness of the data provided by analyzing important micro datas on the broker's website and platforms. |

| Broker’s Offices | Trading Finder always considers the presence of multiple broker offices in various parts of the world and the provision of suitable services to market participants as one of the most important criteria in analyzing forex brokers. |

| Education Materials and Tools | Education is the key to success in financial markets. Trading Finder considers the quality and variety of educational resources provided by brokers in various formats such as images, videos, and podcasts as one of the positive aspects of any forex brokerage. |

| Trustpilot Score | Trust Pilot is undoubtedly one of the most reputable websites active in reviewing and assessing businesses based on customer feedback. Trading Finder relies on customer reviews on this website to make a final assessment about a particular broker. |

| News and Updates | Staying up-to-date and providing a suitable user experience for the audience, is one of the main criteria for Trading Finder when making decisions about the quality of broker services. |

| Useful Data in Infography | Presenting relevant broker-related education in simple and useful formats such as infographics is one of the most important factors Trading Finder considers when reviewing brokers. |

| Broker’s Response | Resolving user issues in the quickest and most effective manner possible is one of the points that Trading Finder pays attention to. It is essential for every brokerage to have sections such as FAQs, online chat, Help Center and etc. |

| Alerts or Scam Reports | Trading Finder aims to evaluate broker activities by examining the accuracy of fraud reports, aiming to prevent traders from jeopardizing their capital. |

| Sponsorship & Charities | Trading Finder also considers philanthropic activities and sponsorship efforts as one of the criteria in evaluating brokers, as they can significantly impact the expansion of broker audiences. |

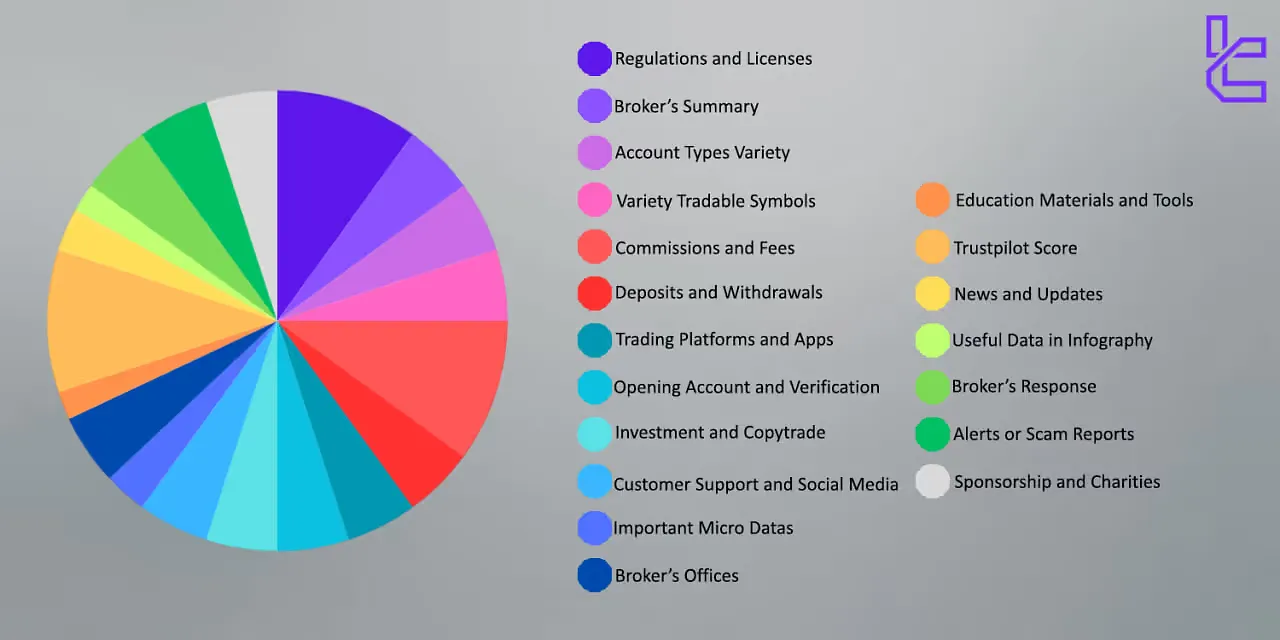

The importance of each metric in Trading Finder’s broker evaluation

The chart provided in the next section illustrates the importance of each metric when analyzing and reviewing brokers:

About Trading Finder’s analysts

The Trading Finder analysis team consists of experts with extensive experience in highly volatile financial markets.

Our Analysts use their Knowledge and expertise to review and examine the most important criteria in the process of broker selection by market participants.

To learn more about our content policies, read the Editorial Guidelines article.

Trading Finder Values

With the increasing popularity of financial markets like (forex, stocks, crypto, etc.), the Trading Finder team aims to create a comprehensive and innovative platform that fulfills all the needs of market participants. Our core values at Trading Finder revolve around providing accurate and useful information to our audience, making precise and informed disicions.

Conclusion

The Trading Finder team aims to analyze forex brokers based on criteria that directly impact traders' experience in global markets, using the latest knowledge from experts and active participants in the forex market. In this article, we discussed important factors in analyzing forex brokers and examined the methodology of Trading Finder. We hope you find the information in this text valuable.