OlympTrade regulations mainly consist of two licenses from an offshore financial authority (VFSC) and an independent dispute resolution center (FinaCom).

To determine whether OlympTrade is real or fake, we must examine the broker’s regulatory status, compensation scheme, awards, and verifiable quotes.

OlympTrade Regulations (Licenses and Company Registration)

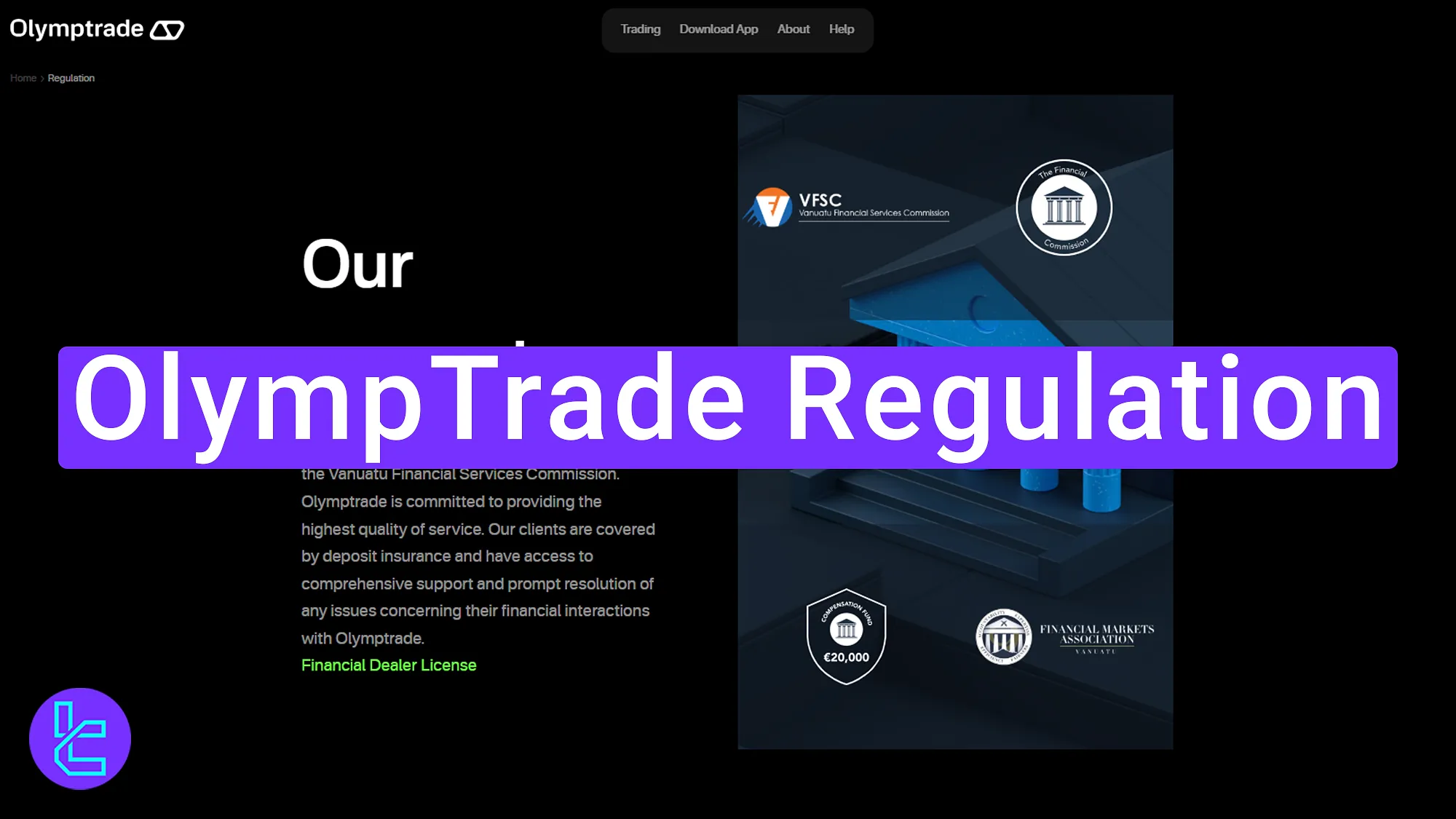

OlympTrade operates under registered entities, including Aollikus Limited, Saledo Global LLC, VISEPOINT LIMITED, and MARTIQUE LIMITED. The company has acquired licenses from two main authorities, including:

- The Vanuatu Financial Services Commission (VFSC);

- International Financial Commission (FinaCom).

Based on these regulators' guidelines, OlympTrade is required to verify traders' identity to comply with international anti-money laundering (AML) laws. For a detailed walkthrough of the OlympTrade verification process, watch the video below.

OlympTrade VFSC regulation

The Vanuatu Financial Services Commission (VFSC) is an offshore financial authority that isn’t as reliable as top-tier entities like CySEC, ASIC, and FCA.

OlympTrade acquired the VFSC license through one of its legal companies named “Aollikus Limited” (Company No. 40131) on January 26, 2017.

OlympTrade FinaCom Membership

The Financial Commission (FinaCom) is an independent alternative dispute resolution (ADR) organization dedicated to safeguarding the rights of retail traders.

It operates by providing a platform for resolving conflicts between traders and brokers, fostering transparency, fairness, and accountability in the financial markets.

OlympTrade legal companies, including Masedo LLC, Saledo Global LLC, and Aollikus Limited, are all members of the Financial Commission (FinaCom) since 2016.

What is the OlympTrade Customer Compensation Scheme?

OlympTrade's Customer Compensation Scheme is a program involved in the FinaCom license. It indicates that each client is entitled to up to €20,000 if the broker’s wrongdoing is proven.

Clients can contact the OlympTrade Client Relations Department to resolve issues. If they’re not satisfied with the proposed solution or if the problem is not resolved within 14 days, they can file a formal complaint with FinaCom.

OlympTrade Regulations Pros and Cons

The VFSC is a popular offshore broker jurisdiction due to its lower capital requirements and affordable administrative fees. Here are the upsides and downsides of the OlympTrade VFSC license.

Pros | Cons |

High leverage offerings (1:500) | The VFSC does not perform extensive background checks on companies |

Tax advantages | Fund segregation is not strictly monitored |

Moderate KYC procedure | The license cost is cheap, and any broker can acquire it |

Other Safety Factors on OlympTrade Broker

To check if OlympTrade is real or fake, we can consider some other factors, including global awards, certificate of order execution, and additional safety measures.

- Awards: 17 global awards, such as “Most Transparent Broker 2023” and “Most Trusted Financial Broker LATAM”

- Clientele: The broker has over 129M users and 2M followers on social media platforms

- Safety Measures: Negative balance protection and 3rd party verification of market prices

You can also check "Is OlympTrade legit" article to read about the trust scores and user reviews.

Writer's opinion and conclusion

Licensing from the Vanuatu Financial Services Commission (VFSC) and membership of The Financial Commission (FinaCom) are the two main facts about OlympTrade regulations.

Offering a €20,000 compensation fund, winning multiple awards (e.g., “Best Online Trading and Investment Platform MENA 2023”), and a huge client base with 129M users showcases the broker’s reliability and give a vivid answer to the question, “Is OlympTrade safe?”.

Now that you have the answer, read the OlympTrade registration article on OlympTrade tutorial page, to open an account with this broker.