Pocket Option isn't obligated to provide its clients' data to authorities for tax purposes and laws since it's not regulated by any authorities [CySEC, FCA, ASIC, and so on].

Pocket Option tax rate is 20% in China and 30% [plus surcharges on speculative income] in India.

In the United States, Pocket Option traders must follow IRS regulations. Short-term gains (under one year) are taxed as regular income at rates from 10% to 37%, while long-term gains fall under capital gains tax brackets of 0%, 15%, or 20%.

Traders can also deduct up to $3,000 in net losses annually, and any profits exceeding $600 per year must be reported to the IRS.

Pocket Option Taxes – Does The Company Provide Clients' Financial Information to Authorities?

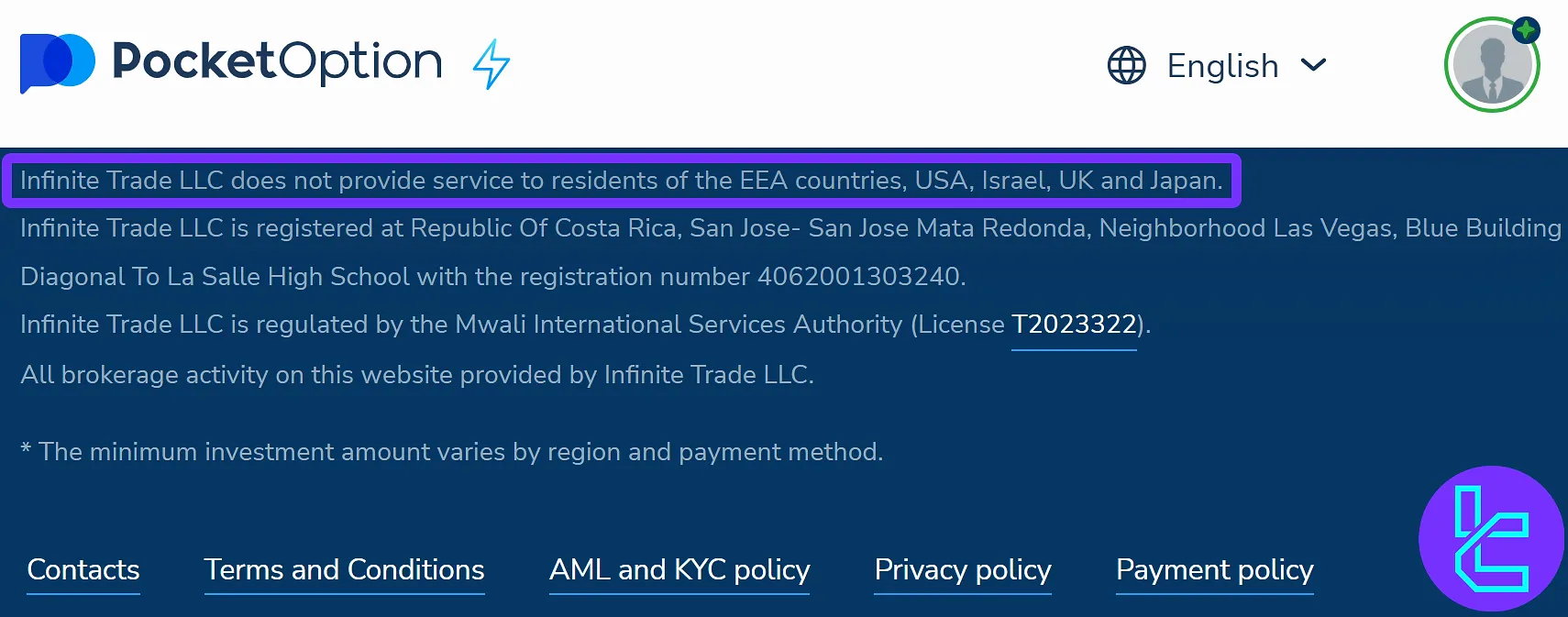

The company is an offshore binary options broker registered in Costa Rica. As an unregulated entity operating from a known tax haven, Pocket Option should not be obligated to report clients' information for tax purposes.

During our investigations on the company's website, we found out that it "does not provide the clients' financial information to any third parties". However, it also says that the data can be provided "in case of an official demand from government agencies".

While Pocket Option does not provide traders' information to third-party companies, it is obligated to do so in response to a government agency's demand. Therefore, traders are required to complete the Pocket Option verification process for such occasions. To learn about the KYC procedure on this broker, watch the video below.

Tax Rules for Trading With Pocket Option in Different Regions

Tax treatment of binary options profits varies widely depending on your location. Some countries classify it as capital gains, while others may treat it as regular income, gambling winnings, etc.

It's crucial to research the specific rules that apply in your jurisdiction. In the next section, we will examine the tax landscape in 3 key regions:

- North America

- Europe

- Asia-Oceania

Summary of Pocket Option Trading Taxes in Different Countries:

Country | Pocket Option Tax Rate / Rule |

United States | Short-term gains: 10–37% (as regular income); Long-term gains: 0%, 15%, or 20% (capital gains); must report profits over $600/year; up to $3,000 losses deductible. |

Canada | Profits treated as capital gains; 50% of net profits taxed; losses offset revenue (rules vary by province). |

Germany | 25% flat tax on profits; no tax if yearly profit < €600. |

France | 30% capital gains tax on trading profits. |

China | 20% capital gains tax; no tax for immigrants with <5 years residency. |

India | 30% tax rate + surcharges on speculative income. |

Japan | 20.315% flat tax rate as “miscellaneous income.” |

Note that according to the company's statement on its official website, no services are available to clients from the EEA countries, USA, Israel, UK, and Japan. Therefore, the tax rules related to the mentioned countries in this article are proposed in case these restrictions are ever lifted.

Tax Rules in North America

North America region consists of two countries in terms of tax regulations for this binary options broker:

- United States of America

- Canada

Rules in the US

Let's investigate Pocket Option tax rules in the United States:

- Short-term gains (held less than 1 year) are treated as normal income and taxed 10%-37%;

- Long-term gains are considered capital gains and are subject to 0%, 15%, or 20% tax brackets;

- Up to $3,000 in net losses can be deducted annually;

- Profits over $600 in a fiscal year must be reported to the IRS.

Laws in Canada

Here are the tax instructions in Canada:

- Rules vary depending on the province, but generally, binary options profits are classified as capital gains;

- A 50% flat rate is applied for net profits;

- Losses offset the total revenue.

What Are The Tax Rules in Europe?

European tax rules on trading in Pocket Option vary by country. In this section, we will review the structure for 3 countries:

- UK: Previously tax-free as gambling income, but rules have changed and are unclear since 2018;

- Germany: 25% flat tax rate on profits, no tax if the profits are less than 600 EUR in a fiscal year;

- France: Taxed as capital gains at 30%.

Pocket Option Tax Rules in Asia

This region has diverse approaches that differ from country to country. We are going to take a look at the rules in 3 countries here:

- China: 20% capital gains tax (no tax for immigrants with less than 5 years of residency);

- Japan: 20.315% flat tax rate as "miscellaneous income";

- India: 30% tax rate plus surcharges on "speculative" income.

Important Tips on Pocket Option Binary Tax

In this part, we will mention some critical tips regarding Pocket Option binary options tax for clients:

- Keep detailed records of all trades, including dates, amounts, and outcomes;

- Understand your country's specific tax rules for binary options;

- Consider using tax software or hiring a professional accountant;

- Be aware of any reporting thresholds in your jurisdiction;

- Set aside a portion of profits for potential tax payments;

- Stay informed about changes in local tax laws affecting traders.

Conclusion And Final Words

Pocket Option tax rates in Canada vary based on the client's province of residence [Ontario, Quebec, Alberta, and others]. Still, mainly, profits gained from binary options trading are classified as capital gains with a 50% flat rate.

Nevertheless, the company has officially stated that it provides users with financial information only in case of an official demand from government agencies. Now that you are familiar with the tax information on this broker, we suggest reading the Pocket Option registration article on the Pocket Option Tutorial page to open your account with this broker.