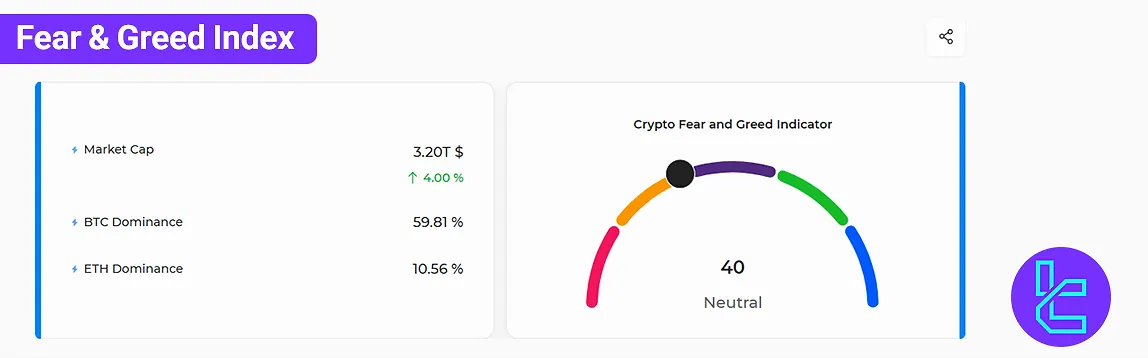

In this tool, the Fear & Greed Index is analyzed across 5 different ranges:

- Range 0 to 19: Extreme fear of further market decline among traders

- Range 20 to 39: Fear among traders

- Range 40 to 59: Neutral market sentiment

- Range 60 to 79: Reflecting FOMO among traders regarding price increases

- Range 80 to 100: Reflecting extreme FOMO among traders

What are the applications of TradingFinder's Crypto Fear & Greed Index Tool?

This index can be used alongside other TradingFinder trading tools; Applications of the Crypto Fear & Greed Index:

- Identifying entry and exit points;

- Risk management;

- Trend reversal prediction;

- Confirmation of other tools' signals.

How is TradingFinder's Fear & Greed Index calculated?

The index figure is an average of 5 different criteria. Criteria for calculating the Fear & Greed Index:

- Volatility

- Trading volume and market momentum

- User activity on social networks including X (Twitter) and Reddit

- Cryptocurrency dominance

- Market trends

- Range 0 to 19: Extreme fear of further market decline among traders

- Range 20 to 39: Fear among traders

- Range 40 to 59: Neutral market sentiment

- Range 60 to 79: Reflecting FOMO among traders regarding price increases

- Range 80 to 100: Reflecting extreme FOMO among traders

What are the applications of TradingFinder's Crypto Fear & Greed Index Tool?

This index can be used alongside other TradingFinder trading tools; Applicationsof the Crypto Fear & Greed Index:

- Identifying Entry and Exit Points: When fear intensifies, it often presents a good buying opportunity. Conversely, during periods of extreme greed, traders may consider selling positions;

- Better Understanding of Market Trends: The index helps provide a clearer picture of the overall market direction;

- Risk Management: By detectingoverbought and oversold conditions and timing market entries and exits more effectively, traders can reduce their trading risks.

How is TradingFinder's Fear & Greed Index calculated?

The index figure is an average of 5 different criteria. Criteria for calculating the Fear & Greed Index:

- Market Volatility: 25%

- Market Volume or Momentum: 25%

- Google Search Trends: 10%

- Social Media Activity: 15%

- Online Surveys: 15%

- Bitcoin Dominance: 10%

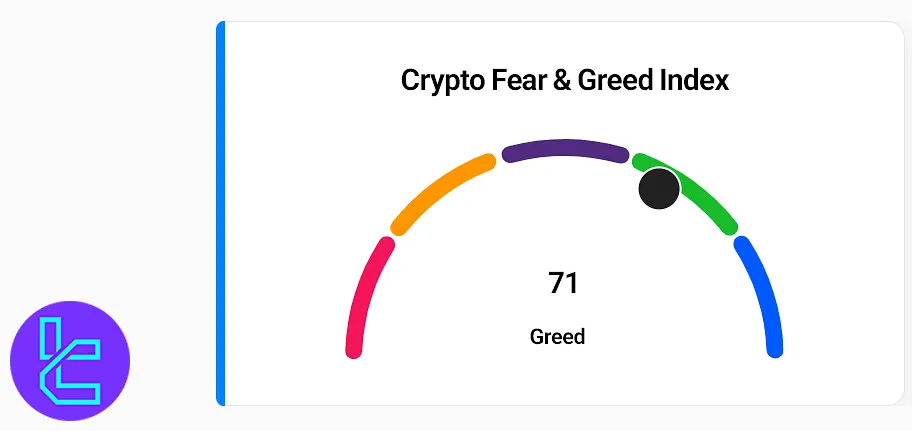

Trading Strategies Based on the Fear and Greed Index

The best strategies using the Fear and Greed Index include:

- Buy During Extreme Fear: When the index drops below 30, it often signals a good buying opportunity;

- Sell During Extreme Greed: If the index rises above 70, it may be a profitable time to sell;

- Contrarian Trading: Some traders prefer to act against prevailing market sentiment, using the index as a contrarian signal.

How to Use the Fear and Greed Index in Trading?

To use the Fear and Greed Index tool in your trading decisions, follow these steps:

- Visit the TradingFinder website;

- Review the index reading and the overall market sentiment, and combine this information with technical and fundamental analysis;

- Make your trading decisions based on your strategy framework.

How to Manage Risk Using the Fear and Greed Index?

One of the primary uses of the TradingFinder Fear and Greed Index is risk management. Here’s how to manage risk with this tool:

- Adjust Trade Size: During extreme fear or greed, consider reducing your position size to limit exposure;

- Set Stop-Loss Levels: In fearful markets (especially inshort positions), place your stop-loss closer to the entry point. In greedy conditions, widen the stop to accommodate greater volatility;

- Avoid Premature Entries and Exits: During emotionally driven markets and volatile shifts in the Fear and Greed Index, avoid making hasty decisions.

Conclusion

TradingFinder's Fear & Greed Index tool reflects traders' real-time sentiment. This tool calculates the Fear & Greed index with high accuracy by combining various criteria.