Forex Sessions & Market Hours by TradingFinder

The TradingFinder Market Hours tool acts as a and helps you throughout your trading journey by providing precise Forex session schedules, opening and closing times, and session overlaps.

forex market time zone converter

Forex Sessions & Market Hours Applications

To have a smooth trading experience, you must familiarize yourself with major Forex session times, their overlaps, and the high trading volume hours.

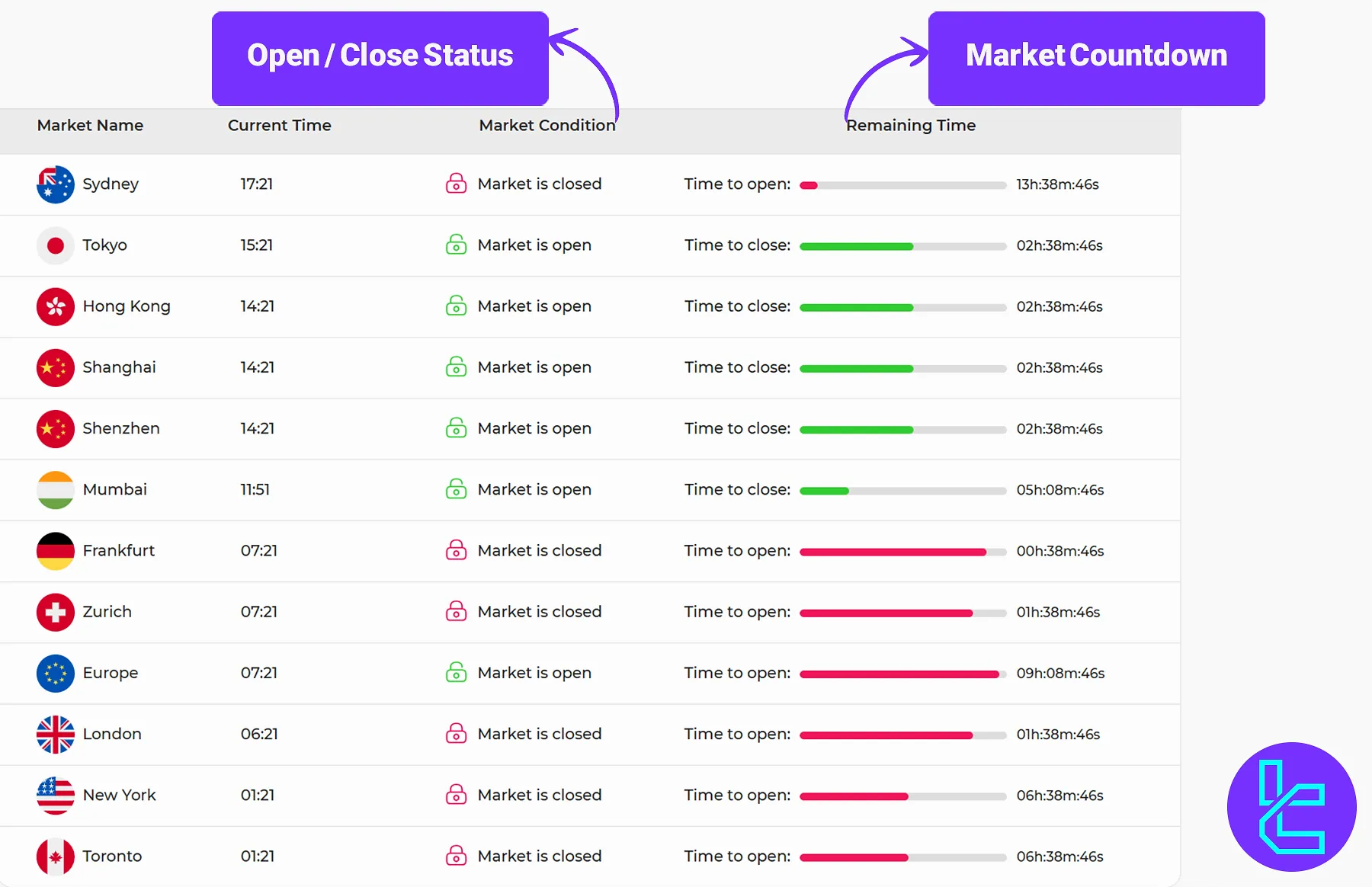

The Market Hours tool is one of TradingFinder's products that shows which Forex sessions are open and closed, the Forex session countdown to opening and closing times, and the high trading volume hours in your local time zone.

Forex Major Sessions

Forex market participants trade 24/5 across 4 major sessions:

- Sydney

- Tokyo

- London Forex session time

- New York session

The Forex market is technically always open, and traders are opening and closing positions somewhere in the world. However, when is the best time to trade Forex?

The best time for Forex trading usually occurs when two or more main sessions are open. The Forex Market Hours Converter lets you check the open markets, trading volume map, and global time in one view. It is also worth noting that traders can use Forex session indicator to visualize various sessions and choose thier perfect time for trading.

Market | Opening Time (GMT) | Closing Time (GMT) |

Sydney (SSX) | 10:00 PM | 07:00 AM |

Tokyo (JPX) | 12:00 AM | 09:00 AM |

Hong Kong (HKEX) | 01:00 AM | 10:00 AM |

Shanghai (SSE) | 01:00 AM | 10:00 AM |

Shenzhen (SZSE) | 01:00 AM | 10:00 AM |

Mumbai (BSE) | 03:30 AM | 12:30 PM |

Frankfurt (FSX) | 07:00 AM | 04:00 PM |

Zurich (SIX) | 07:00 AM | 04:00 PM |

Europe | 07:00 AM | 04:00 PM |

London (LSE) | 08:00 AM | 05:00 PM |

New York (NYSE) | 01:00 PM | 10:00 PM |

Toronto (TSX) | 01:00 PM | 10:00 PM |

Forex Trading Volume

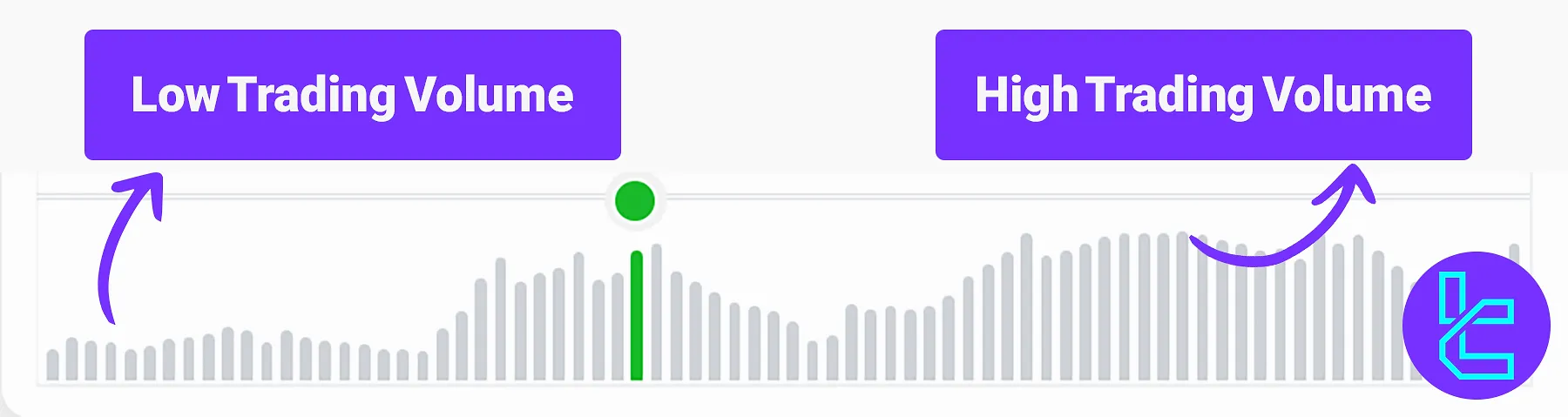

Understanding high trading volume hours in Forex trading is essential for optimizing strategies and improving trade outcomes.

Liquidity is highest during peak periods, such as the London session and New York Forex session time overlap, resulting in tighter spreads and reduced transaction costs.

This increased liquidity also minimizes price manipulation and creates a more predictable trading environment, benefiting traders who rely on frequent, small price movements.

The highest Forex trading volume hours in your local time zone

The highest Forex trading volume hours in your local time zoneHigh-volume hours often align with significant market events or economic announcements, providing opportunities to capitalize on increased volatility.

By trading during these periods, traders can achieve more efficient execution and mitigate risks like slippage, where orders are filled at unexpected prices due to low liquidity.

The Forex Market Hours tool helps you to align trades with active sessions, resulting in enhanced profitability and lower costs.

Forex Session Overlaps

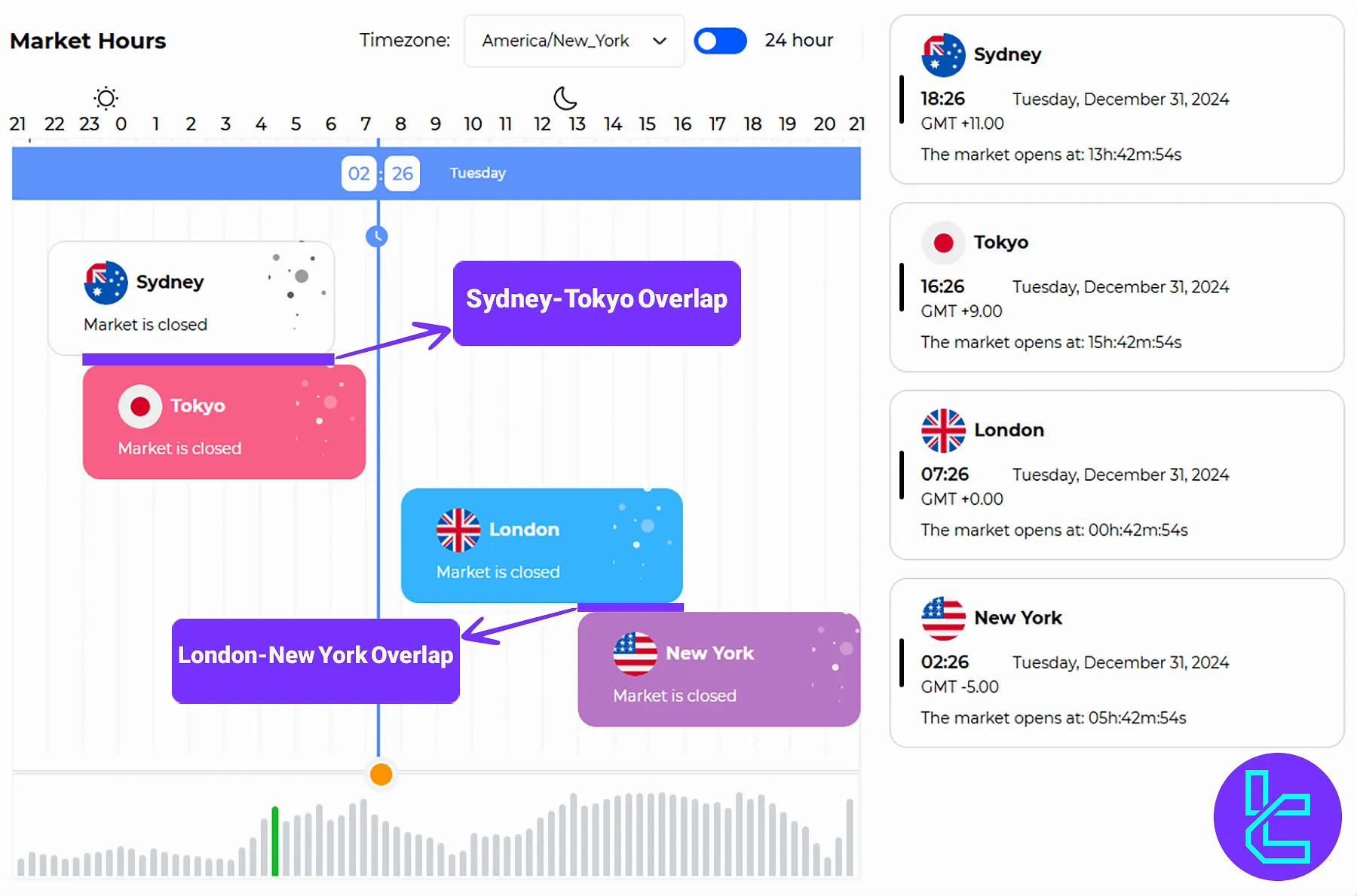

The best Forex trading times align with high liquidity periods, especially during market Forex session time overlaps.

The London-New York overlap (01:00 PM to 05:00 PM GMT) is the most active, offering tight spreads, high volatility, and numerous opportunities for major currency pairs.

The Tokyo-Sydney overlap, occurring early in the Asian Forex session trading day, provides steady market flow and moderate volatility, particularly for Asian-Pacific currency pairs like AUD/JPY and NZD/JPY.

These overlaps cater to different trading styles, from high-intensity strategies to steadier approaches.

Forex Market sessions overlap and opening/closing times

Forex Market sessions overlap and opening/closing times

This TradingFinder tool is available as an Session and Global Market Hours extension; This tool can be used for real-time volume analysis.

What Are the Most Active Forex Hours?

The most active hours to trade during Forex hours in when to sessions overlap. These active hours happen 3 times during the working days which includes:

- New York and London overlap: Between 8:00 am – 12:00 noon EST

- Sydney and Tokyo overlap: Between 7:00 pm – 2:00 am EST

- London and Tokyo overlap: Between 3:00 am – 4:00am EST

Forex Summer and Winter time

Daylight Saving Time (DST) plays a major role in the timing of global Forex sessions, especially for London and New York. During the winter months, the London market operates from 8:00 AM to 5:00 PM GMT, while the New York market opens an hour later, from 1:00 PM to 10:00 PM GMT. When DST begins, both sessions shift one hour earlier.

The Sydney and Tokyo markets also experience minor time differences between seasons, reflecting their regional DST rules.

Trading Session | Winter Hours (GMT) | Summer Hours (GMT) |

Sydney | 21:00 – 06:00 | 22:00 – 07:00 |

Tokyo | 23:00 – 08:00 | 23:00 – 08:00 |

London | 08:00 – 17:00 | 07:00 – 16:00 |

New York | 13:00 – 22:00 | 12:00 – 21:00 |

What Time is the Break in Forex Sessions?

Although the Forex market operates continuously from Monday to Friday, there is a short period each day when activity significantly slows down. This “Forex break” occurs between the close of the New York session and the opening of the Tokyo session, roughly between 10:00 PM and 12:00 AM GMT.

During this time, global trading volume drops, volatility decreases, and price movements tend to be minimal. Because most major financial centers are closed, liquidity is thin and spreads can widen, making this an inefficient window for short-term trading.

For traders, recognizing this quiet interval is essential for effective liquidity management and risk control. Many professionals avoid entering new positions during the break, instead using it to adjust strategies, review performance, or plan trades for upcoming high-liquidity sessions such as London–New York overlaps.

Forex Sessions in Various Countries and Local Times

The table below shows Forex sessions and market hours in the local time of various countries.

Country | Sydney Session | Tokyo Session | London Session | New York Session |

Bangladesh | 04:00 – 13:00 | 05:00 – 14:00 | 13:00 – 22:00 | 18:00 – 03:00 |

South Africa | 00:00 – 09:00 | 01:00 – 10:00 | 09:00 – 18:00 | 14:00 – 23:00 |

Pakistan | 03:00 – 12:00 | 04:00 – 13:00 | 12:00 – 21:00 | 17:00 – 02:00 |

India | 03:30 – 12:30 | 04:30 – 13:30 | 12:30 – 21:30 | 17:30 – 02:30 |

UAE | 02:00 – 11:00 | 03:00 – 12:00 | 11:00 – 20:00 | 16:00 – 01:00 |

Germany | 23:00 – 08:00 | 00:00 – 09:00 | 08:00 – 17:00 | 13:00 – 22:00 |

Philippines | 06:00 – 15:00 | 07:00 – 16:00 | 15:00 – 00:00 | 20:00 – 05:00 |

Nigeria | 23:00 – 08:00 | 00:00 – 09:00 | 08:00 – 17:00 | 13:00 – 22:00 |

Japan | 07:00 – 16:00 | 08:00 – 17:00 | 16:00 – 01:00 | 21:00 – 06:00 |

Kenya | 01:00 – 10:00 | 02:00 – 11:00 | 10:00 – 19:00 | 15:00 – 00:00 |

Kuwait | 01:00 – 10:00 | 02:00 – 11:00 | 10:00 – 19:00 | 15:00 – 00:00 |

Malaysia | 06:00 – 15:00 | 07:00 – 16:00 | 15:00 – 00:00 | 20:00 – 05:00 |

Sri Lanka | 03:30 – 12:30 | 04:30 – 13:30 | 12:30 – 21:30 | 17:30 – 02:30 |

Canada | 18:00 – 03:00 | 19:00 – 04:00 | 03:00 – 12:00 | 08:00 – 17:00 |

United Kingdom | 23:00 – 08:00 | 00:00 – 09:00 | 08:00 – 17:00 | 13:00 – 22:00 |

Traders who reside in the United States of America must remember these US Forex session times:

- Sydney Session: 10:00 PM to 7:00 AM GMT

- Tokyo Session: 11:00 PM to 8:00 AM GMT

- London Session: 7:00 AM to 4:00 PM GMT

- New York Session: 12:00 PM to 9:00 PM GMT

What Are Forex Gaps and How Are They Connected to Trading Sessions?

A Forex gap occurs when the closing price of one session and the opening price of the next differ significantly, leaving a blank space on the chart. These gaps often appear after weekends or major global events like economic reports or geopolitical news, signaling sudden shifts in market sentiment.

Their connection to trading sessions comes from liquidity changes between markets. When one major session closes, such as New York, and another like Sydney or Tokyo hasn’t yet opened, trading volume drops.

This reduced liquidity can cause sharp price openings once markets resume. Recognizing these gaps helps traders anticipate volatility and plan risk management more effectively.

Forex Session Killzones

Within the structure of global Forex sessions, Kill Zones refer to specific high-activity time windows when institutional traders and banks execute the majority of their orders. These periods, typically occurring during overlaps of major sessions such as London and New York, are marked by increased liquidity and sharp price movements.

In practical terms, traders observe Kill Zones to anticipate when market volatility is most likely to occur, helping them align entries with institutional order flow. For instance, during the early hours of the London session or the first part of the New York session, liquidity injections often lead to trend initiation or stop-hunting movements.

Recognizing these windows allows traders to plan trades more efficiently, rather than reacting to random price fluctuations. While trading sessions define the broader timeline of global market activity, Kill Zones highlight the most dynamic portions within those sessions, serving as crucial decision-making periods for intraday and scalping strategies.

Forex Holidays

Forex holidays refer to days when major financial centers or banks are closed, leading to reduced market liquidity and lower trading volume. During holidays in key regions such as the United States, United Kingdom, China, or Saudi Arabia, price movements often slow, spreads widen, and volatility decreases.

Traders use tools like the TradingFinder Holiday Calendar to track global market closures and adjust their trading sessions, ensuring better timing and strategy alignment with active markets.

Unique Features of the Forex Sessions & Market Hours Tool

TradingFinder offers a range of products, especially the Forex session clock, to help you improve your trade planning, reduce risks, and increase profits in the Forex market.

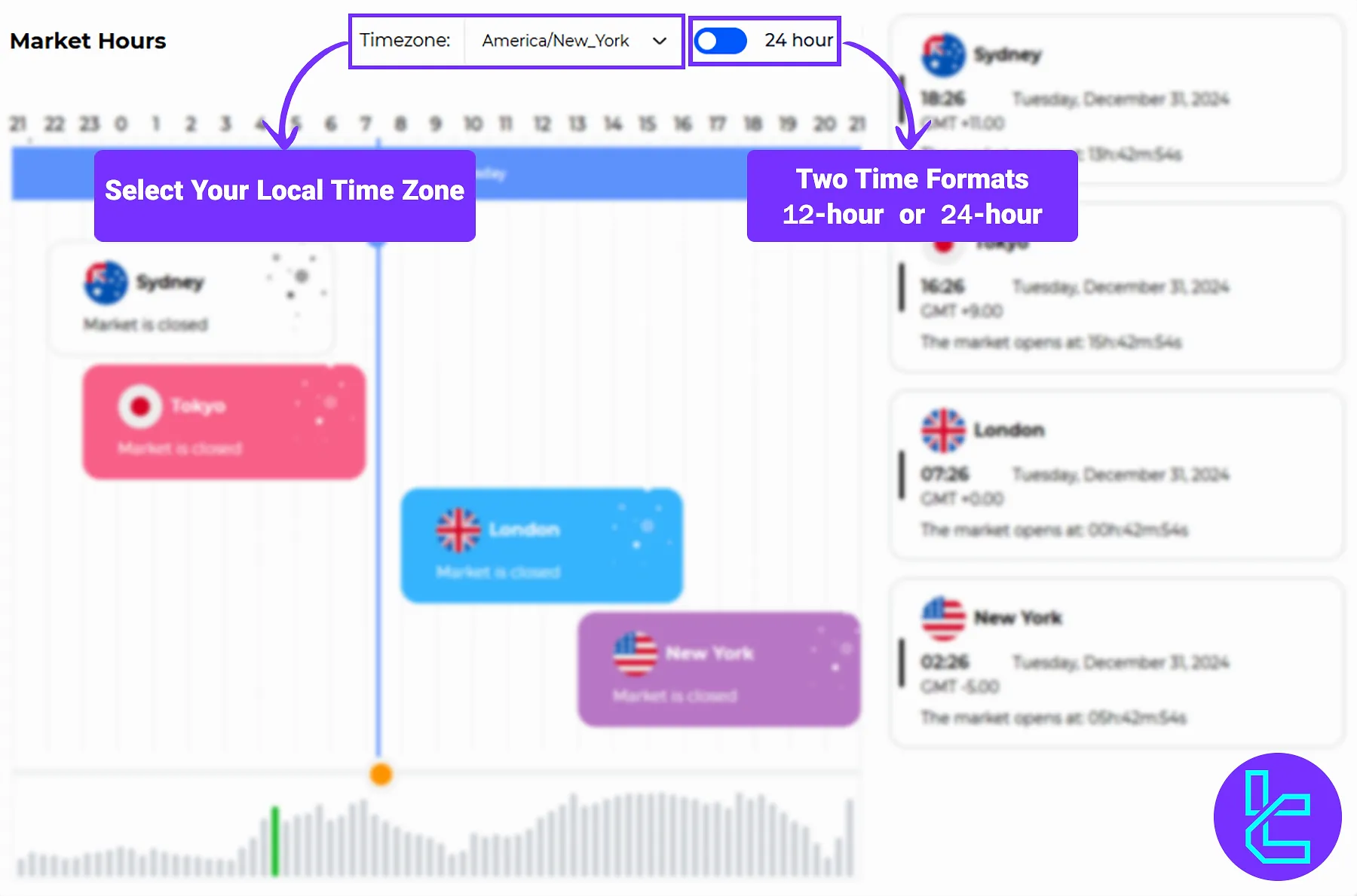

What makes the TradingFinder forex session converter tool unique?

- Ease of access: Accessible directly from a web browser on a desktop, Android, or iOS with no installation required

- Fast and optimized: Forex time zone converter offers Completely free access with no registration

- Customization: Selecting your preferred sessions and time zone

- Multiple time formats: Two formats, including 12-hour and 24-hour

Which Trading Strategies Can Be Executed Using the Forex Session Tool?

The Forex time zone converter and global market time tool provides access to the timeframes necessary to execute various trading strategies.

These strategies include:

- Scalping strategy During the London–New York Overlap: Identifying precise market entry times during periods of high liquidity;

- Breakout Strategy: Spotting breakouts from Asian session ranges at the start of the London session;

- ICT Strategy: Executing ICT models based on market opening times, such as Judas Swing and the London Killzone.

Traders can also trade Forex session breakouts to earn high profits during high volatility. We suggest using the Breakout Zone MT5 indicator to confirm the breakouts.

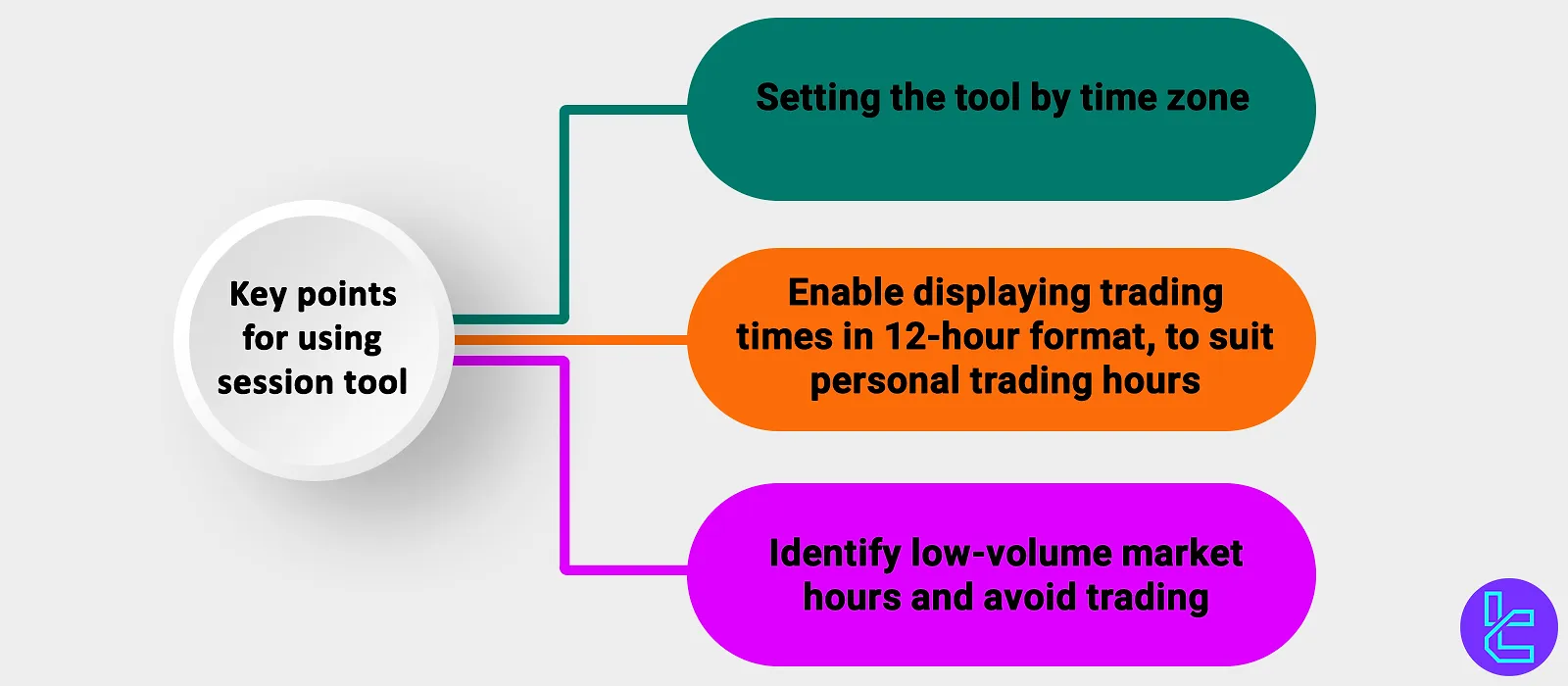

Key Tips for Using the Forex Session Tool and Global Market Hours

To make the most of the TradingFinder Forex Session calender and Global Market Clock, keep the following points in mind:

- Adjust the tool to your local time zone for accurate session tracking;

- Enable the 12-hour clock format if your trading system uses it;

- Identify low-volume hours using the tool and avoid trading during those times.

A Tool for Both Professionals and Beginners

The TradingFinder Forex Sessions & Market Hours tool helps you reduce trading risks by identifying high-volatility market hours, familiarize yourself with the movement patterns of different sessions, and better manage your trading day by knowing the market's opening and closing hours in your local time zone.