TradingFinder Interest Rate Tool

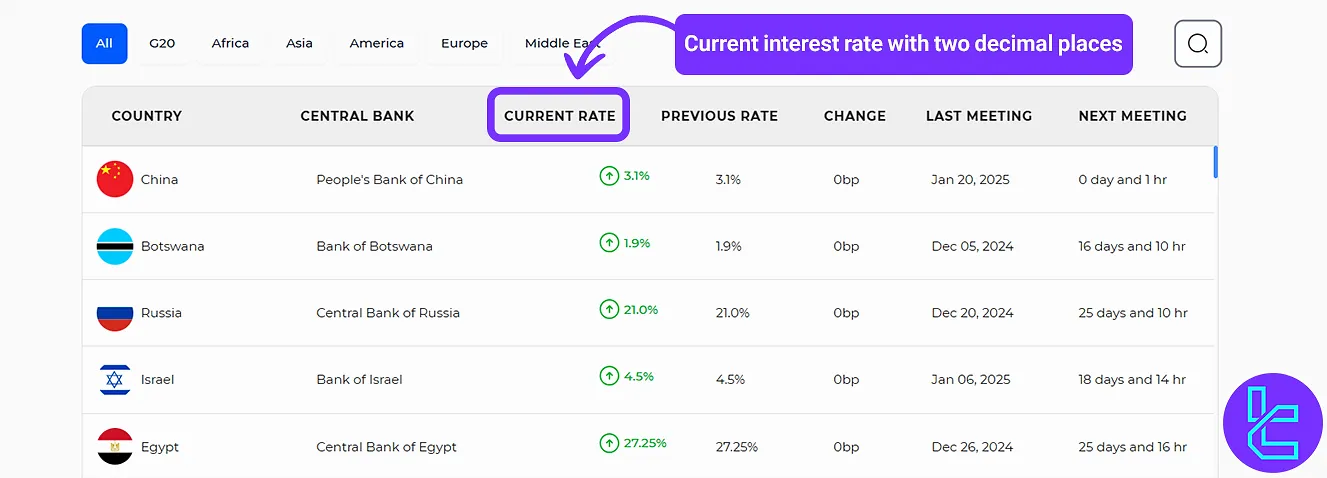

TradingFinder's interest rate tool shows current central bank borrowing rates, previous figures, and change amounts with two decimal places.

Additionally, the next meeting date for each central bank is specified, and as soon as the meeting is held and the result is announced, the interest rate on TradingFinder is updated.

What is Interest Rate?

"Interest Rate" is the amount of profit that a bank pays to investors for deposits.

Central banks worldwide use this concept to control inflation, economic growth, and increase or decrease of currency values; thus, interest rates directly impact financial markets [cryptocurrency, forex, stocks, etc.], demand levels, and volatility.

Using TradingFinder's interest rate tool, you'll stay informed about the latest interest rate changes of all central banks.

How to Use the Interest Rate Tool in Fundamental Analysis?

Interest rates are among the most important price drivers in fundamental analysis.

The TradingFinder Interest Rate Tool displays accurate data on the current rate, previous rate, and the rate change.

This information helps determine whether a monetary policy is hawkish (tightening) or dovish (easing).

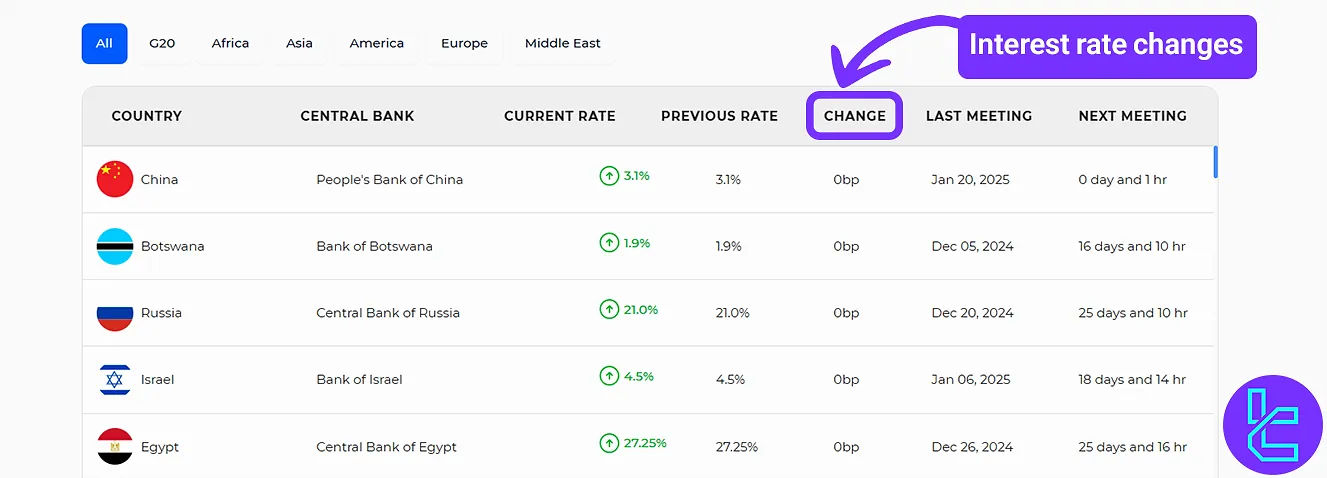

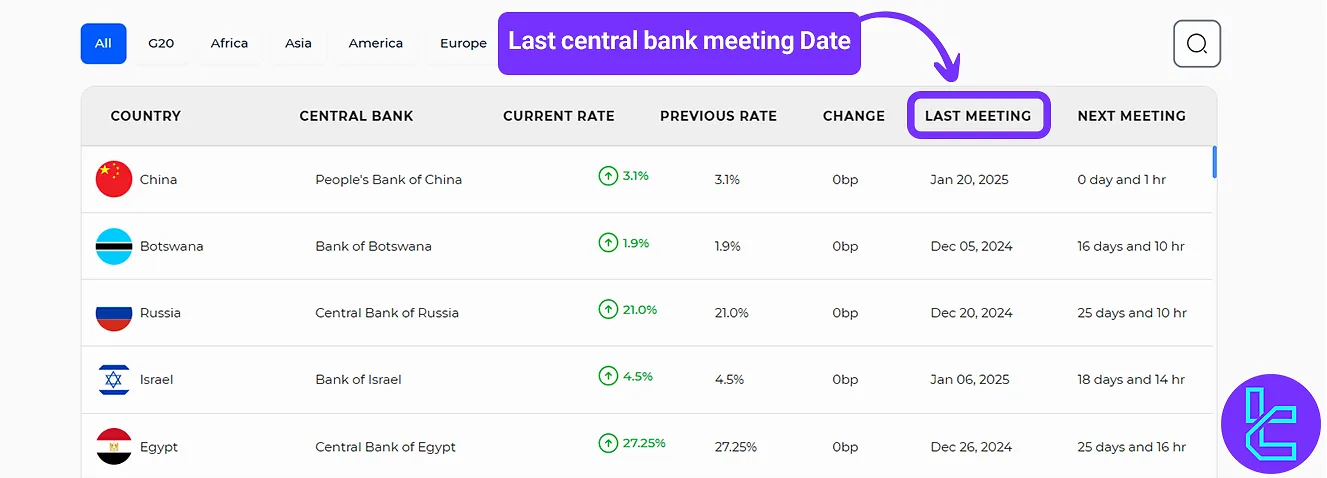

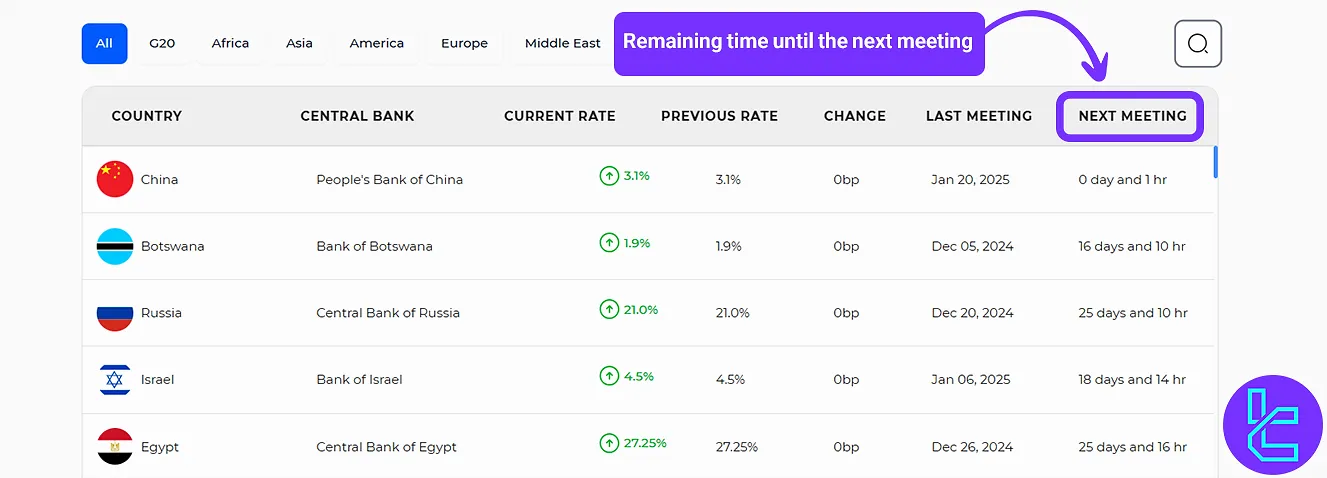

In addition, the "Last Meeting" and "Change" columns allow users to analyze the market’s reaction to recent central bank decisions.

What are the Applications of TradingFinder's Interest Rate Tool?

TradingFinder's interest rate tool shows all necessary information related to interest rates. Applications of the Interest Rate tool:

- Current Interest Rate: The current interest rate is displayed with two decimal places, green or red color [for decrease or increase], and an upward or downward arrow.

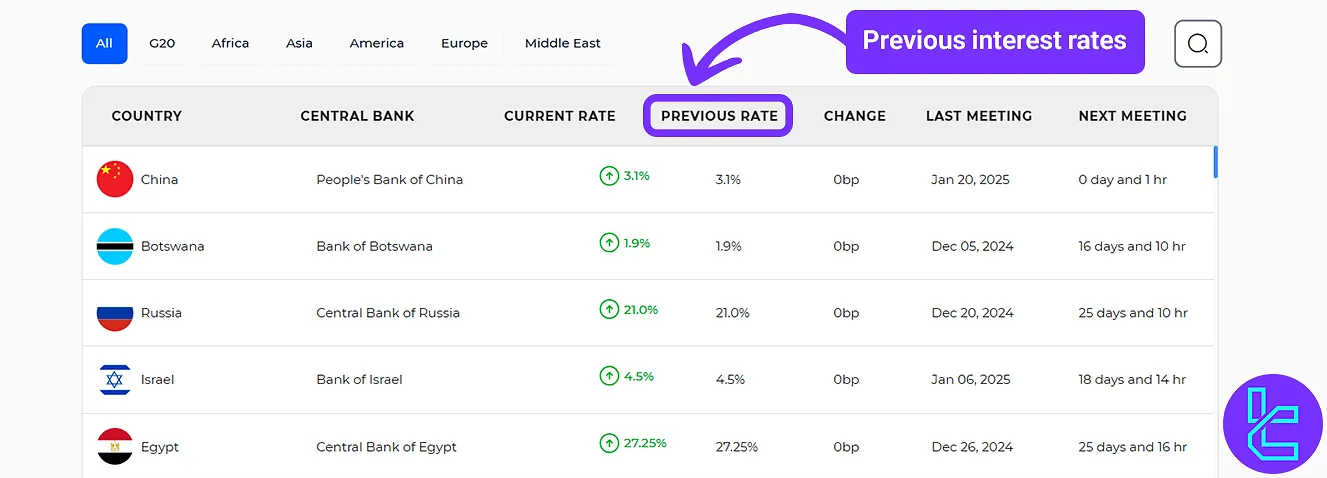

- Previous Interest Rate: The previous interest rate is shown with two decimal places.

- Change Amount: The change in countries' borrowing rates is shown in basis points "BP" in both positive [for increase] and negative [for decrease] states.

- Last Meeting Date: The Gregorian date of the last meeting of each country's central bank is provided.

- Next Meeting Date: The number of days and hours remaining until the next central bank meeting can be viewed in this section.

Which Countries' Interest Rates are Availble in the Interest Rate Tool?

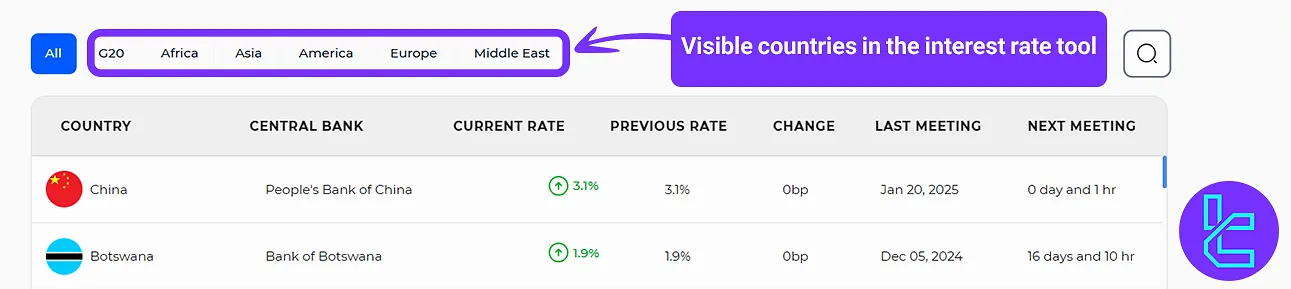

The Interest Rate tool includes more than 200 countries from different continents; these countries are divided into G20, Africa, Asia, America, Europe, and Middle East categories.

Available Countries in TradingFinder's Interest Rate tool:

Country Categories | Members |

G20 Group | United States, Canada, Mexico, Argentina, Saudi Arabia, and European Union |

Africa | Egypt, Morocco, South Africa, Algeria, and Mozambique |

Asia | China, South Korea, Japan, Malaysia, and Iran |

America | United States (Federal Reserve), Brazil, Canada, Argentina, Uruguay, and Colombia |

Europe | Turkey, Britain, Russia, Norway, and Poland |

Middle East | Israel, Egypt, Jordan, Kuwait, Iran, Saudi Arabia, Qatar, and UAE |

How to Search Countries in TradingFinder's Interest Rate Tool?

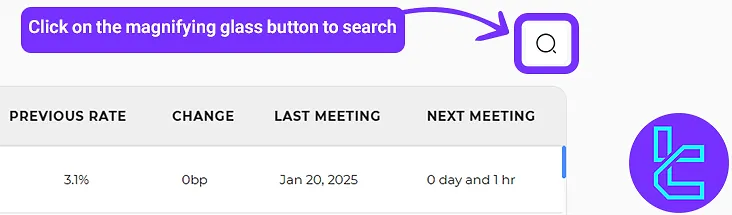

Using the magnifying glass button, you can type and search for the desired country name.

After writing the country name, TradingFinder's Interest Rate tool will automatically display the central bank's interest rate information.

In Which Trading Strategies Is the Interest Rate Tool Useful?

This tool is directly applicable in strategies such as carry trading, pre-central bank meeting trades, and interest rate hedging:

- Carry Trade: Profiting frominterest rate differentials by buying currencies with higher interest rates and selling those with lower rates;

- Pre-Central Bank Meeting Trades: Entering positions based on rate expectations in the days leading up to an official interest rate announcement;

- Interest Rate Hedging: Hedging against the risk of future interest rate changes.

Conclusion

The TradingFinder Interest Rate Tool categorizes countries into groups such as G20, Europe, Asia, Americas, Middle East, and Africa, allowing users to track and compare interest rates across multiple economies.

This tool is useful for executing carry trades, interest rate hedging, correlation-based macro analysis, and monetary policy trading strategies.