Reviewing prop trading platforms is a delicate and complex task because each company has specific rules and regulations for funding successful traders. Trading Finder leverages the deep knowledge and experience of experts to thoroughly examines the active platforms in this field. In this section, we will introduce you to the methodology of Trading Finder and discuss the evaluation criteria for prop trading platforms.

Delving into the Core Elements of Our prop firm Evaluation

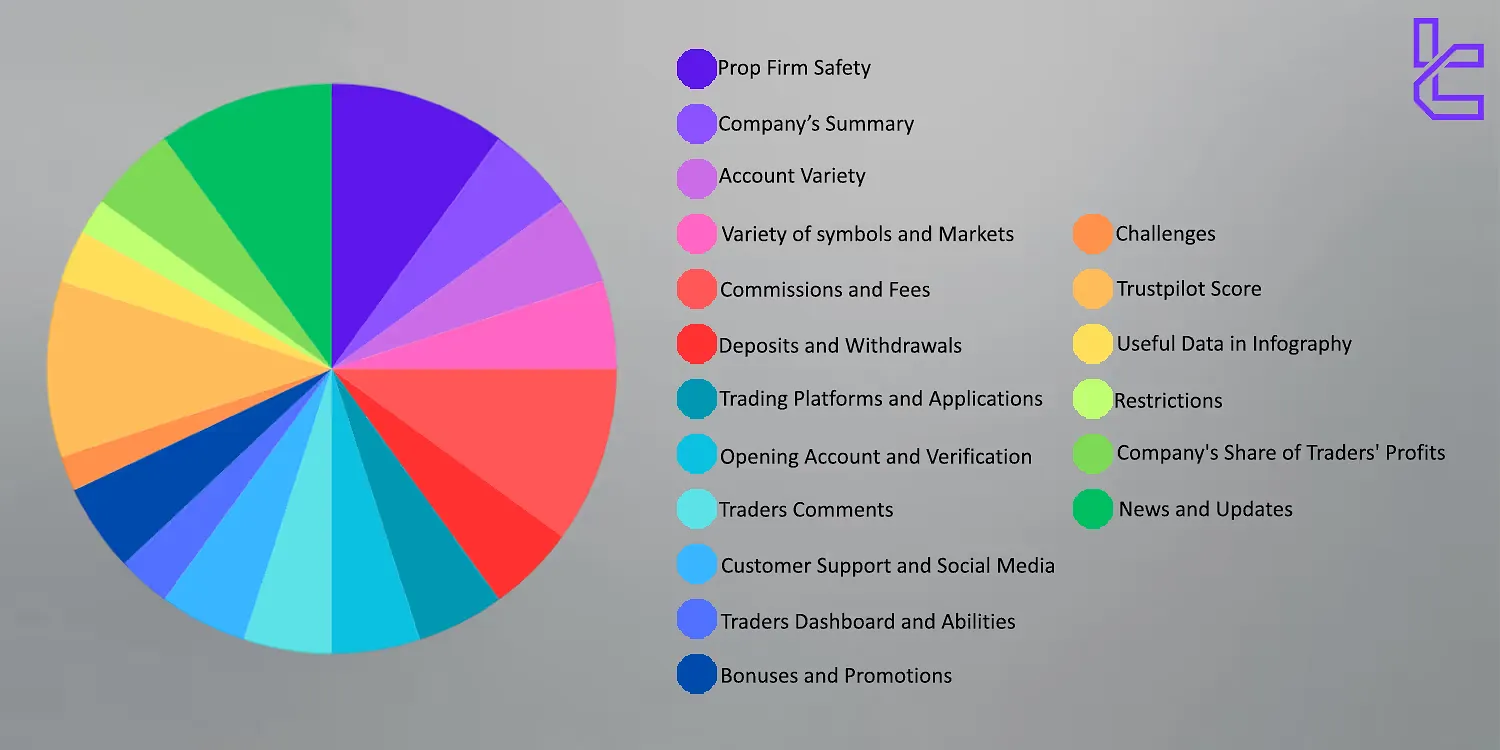

Trading Finder Experts use 18 data metrics to evaluate Proprietary trading firms:

| Metric | Why It’s Important |

| Prop Firm Safety | The security and performance of prop firms and has always been a subject of question and doubt for many traders. Trading Finder ensures traders' security by thoroughly examining the track record and credibility of prop firms. |

| Company’s Summary | General information such as the establishment year, founders, headquarters location of the prop firm, company performance and etc., are important factors considered by Trading Finder's experts when evaluating prop firms. |

| Account Variety | Prop Firm's account diversity gives traders greater flexibility based on their personal strategy. Trading Finder puts especial emphasis on this point |

| Variety of symbols and Markets | Wide range of tradable symbols in prop firms allows traders to diversify their capital allocation and reduce trading risks. Market diversity is one of the key factors Trading Finder considers when reviewing prop firms. |

| Commissions and Fees | Commissions and fees per trade are among the most important factors that Trading Finder considers in its analysis of prop firms. These costs allocate a significant portion of traders' profits and can directly impact their profitability. |

| Deposits and Withdrawals | Having multiple options for withdrawing profits such as cryptocurrencies, bank cards, etc., is important. The variety of deposit/withdrawal methods offered by a company to ensure traders' peace of mind is one of the key points that Trading Finder pays special attention to. |

| Trading Platforms and Applications | The diversity of trading platforms such as CTrader, MetaTrader 4 - 5, and mobile applications, which traders are familiar with, are among the key criteria that Trading Finder considers when analyzing prop firms. |

| Opening Account and Verification | Trading Finder considers the steps involved in opening an account plus the identity verification process, when its evaluating prop firm. Based on the ease or difficulty of these processes, it assigns special scores to the company. |

| Traders Comments | The active traders' feedback on each prop firm is one of the best indicators to understand the quality of the relationship between company managers with profitable traders. Trading Finder places special value on user experience when it comes to interacting with prop firms. |

| Customer Support and Social Media | The importance of support in resolving traders' issues and improving overall collaboration experience with prop firms is undeniable. Trading Finder ensures the quality of their performance by establishing direct communication with prop firms' support teams and monitoring their activities on websites and social media pages. |

| Traders Dashboard and Abilities | A trading dashboard is an all-in-one tool for market data, research, investment, and news tracking. In other words, a company should provide everything a trader needs for trading so that their focus remains solely on making profitable trades. The presence of a comprehensive dashboard that fulfills traders' needs is crucial to Trading Finder analysts, evaluations. |

| Bonuses and Promotions | Trading Finder also considers the awards and bonuses offered by prop platforms in its evaluation process. These rewards can serve as incentives for traders to increase their activity on the platform and compete with other traders. |

| Trustpilot Score | The Trust Pilot website is one of the most reputable platforms for reviews and evaluations of businesses. Trading Finder considers the customer reviews on this website to form the final opinion about the desired prop trading firms. |

| News and Updates | Trading Finder considers the quality of services provided by prop trading firms by taking into account their up-to-dateness and offering suitable user experiences. Providing innovative tools and features, continuous platform updates and ultimately meeting the needs of traders in financial markets such as Forex or crypto, are very important. |

| Useful Data in Infography | The complexities of operating on prop trading platforms have led Trading Finder to give special consideration to companies that present information in the simplest possible manner for users. |

| Restrictions | Each prop trading firm has limitations on the number of trades, trading intervals, maximum drawdown, and so on. Trading Finder examines these conditions and restrictions to ensure that traders do not encounter any issues during their activities. |

| Capital Allocated to Traders and The Company's Share of Traders' Profits | The two key factors in Trading Finder's analysis of prop firms are the amount of capital allocated to traders and the company's share of their profits. These elements indicate the level of financial resources available to traders, profit-sharing structure between the company and traders and ultimately the risk/reward balance in prop trading. |

| Challenges | Finding traders who consistently generate profits is not an easy task and requires a precise process of selection and screening. Trading Finder pays special attention to quality and diversity of these challenges on prop firm websites. |

The importance of each metric in Trading Finder’s prop firm evaluation

The chart in the next section illustrates the importance of each criterion when analyzing and reviewing prop firms.

About Trading Finder’s analysts

The Trading Finder analysis team consists of experienced and skilled experts with extensive backgrounds in various financial markets. These individuals leverage their deep knowledge and valuable experience to meticulously and thoroughly review the most important criteria for selecting best prop firms for market participants.

Trading Finder Values

In today's fast-paced world, financial markets are expanding and gaining popularity at an impressive rate. The Trading Finder team, understands this rapid growth and strives to offer an innovative and comprehensive platform to meet all the needs of participants in this field.

Conclusion

Financial markets such as (Forex, stock, crypto, etc.) have experienced significant growth in recent years, attracting a large number of individuals to invest and act in them. Among these, prop trading has gained high popularity as a way to enter these markets with minimal initial capital. The Trading Finder team assists traders in making the right choice when it comes to choosing prop firms. Thank you for staying with us until the end.