Alpha Capital Group is a prop firm with 2-step evaluation accounts starting at the price of $97. Traders have access to a leverage of up to 1:100 with this firm, and the maximum profit split is 80%.

There is no time limit for challenges, and profits are paid to traders every 2 weeks.

Alpha Capital Group; Company Information

Alpha Capital Group Limited is a private limited company incorporated in the UK in November 2021. Based on the company's official website, its registered office is located at 10 Lower Thames Street, Billingsgate, London, England, EC3R 6AF. This firm is led by George Kohler and Andrew Blaylock as managing director and director, respectively.

Key aspects of the company:

- Offering virtual trading accounts up to $2 million;

- Providing comprehensive educational resources;

- Delivering market insights and virtual trading strategies.

Specifications Summary

Alpha Capital Group offers a range of features and specifications that cater to traders of various experience levels. Here's a summary of what the firm provides:

Account Currency | USD, GBP, EUR |

Minimum Price | $97 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 80% |

Instruments | Forex, CFDs, Metals |

Assets | 41 |

Evaluation Steps | 2 |

Withdrawal Methods | Wise, Rise, Bank Wire Transfer |

Maximum Fund Size | Up To $2M |

First Profit Target | 5% |

Max. Daily Loss | 5% |

Challenge Time Limit | No Limits |

News Trading | Yes On Evaluation Phases |

Maximum Total Drawdown | 10% |

Trading Platforms | MetaTrader 5, cTrader, Dxtrade |

Commission Per Round Lot | $5 |

Trust Pilot Score | 4.4 Out Of 5 |

Payout Frequency | Every 2 Weeks |

Established Country | United Kingdom |

Established Year | 2021 |

This comprehensive offering allows traders to test their strategies in a controlled environment while potentially accessing significant capital.

Advantages & Disadvantages

Like any reliable prop trading firm, Alpha Capital Group comes with its own set of pros and cons. Let's examine these to give you a balanced view:

Advantages | Disadvantages |

$0 Commission Trading Across All Asset Classes | Strict Risk Management Rules |

Real-Time Pricing And Unlimited Trading Days For Strategy Optimization | Limited Tradable Instruments And Assets |

1-On-1 Risk Reviews For Traders Who Fail Initial Assessments | Relatively High Minimum Price |

Access To Several Trading Platforms And An Institutional-Grade Trading Environment | - |

Funding and Prices

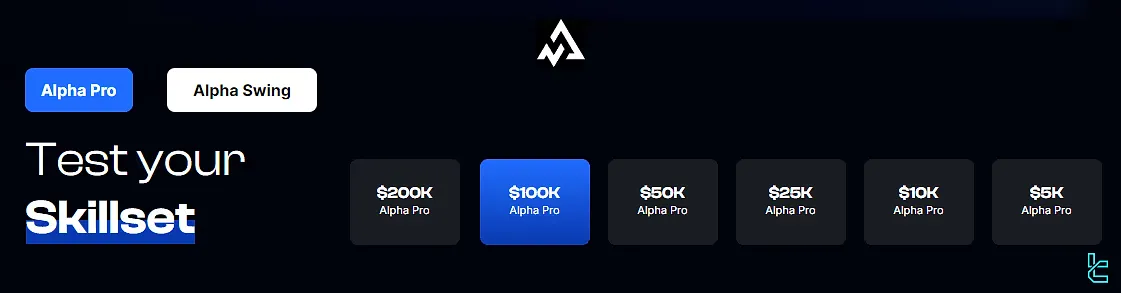

Alpha Capital Group offers a range of virtual trading account sizes to accommodate different trader needs and experience levels. Here's a breakdown of their funding options:

- Account sizes range from $5,000 to $200,000;

- Pricing starts at $97 for the smallest account size;

- The largest account size is priced at $997;

- Free trial accounts are available for platform testing.

As for growth, Alpha’s scaling plan allows traders to increase their capital allocation incrementally. If you grow your account by 10% and follow all drawdown rules, you may request a scale-up, potentially managing up to $2,000,000 in capital, all while keeping the original risk limits.

Registration and Verification Guide

To open a Qualified Trader account with Alpha Capital Group, prospective traders must complete a Know Your Customer (KYC) verification process. Alpha Capital Group registration process is explained in the later sections.

#1 Visit the Signup Portal

Head over to the official website and access the Client Area from the homepage to initiate the signup.

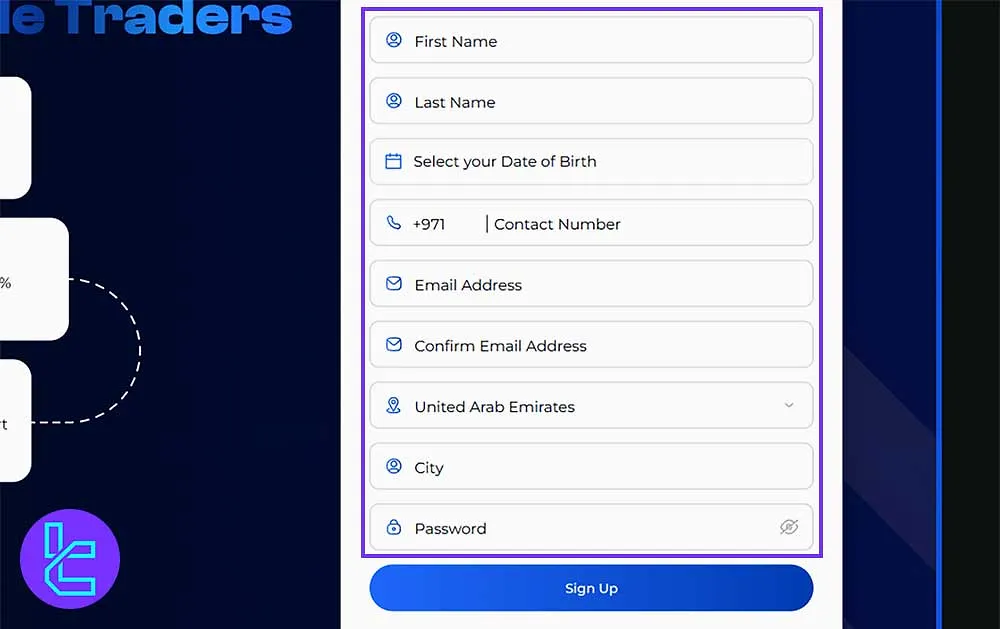

#2 Submit Personal Information

Provide key details as listed below:

- Full name

- Date of birth

- Mobile number

- Email (twice)

- Country

- City

Afterwards, create a safe and complex password.

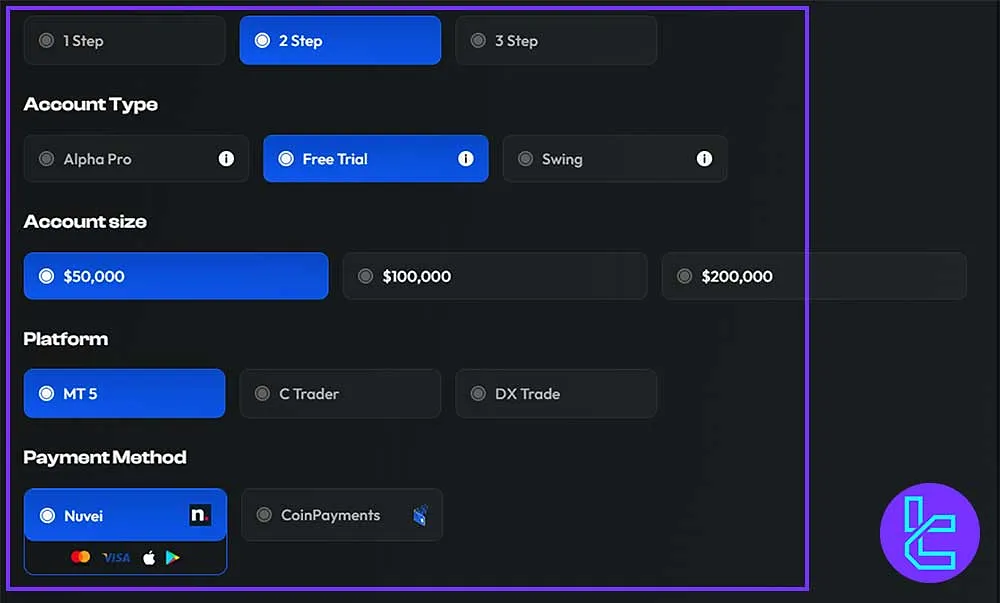

#3 Choose Your Trading Parameters

Select these parameters:

- Evaluation model (1-step, 2-step, or 3-step)

- Desired account size ($50K–$200K)

- Commission plan (Raw Spread or No Commission)

- Payout method (Bi-weekly or On-demand)

Confirm EA usage and complete payment preferences via Nuvei or Crypto.

#4 Verify Your Email

Check your inbox for a confirmation email and click the verification link to finalize your registration.

#5 Verification

- Upload the required documents for KYC verification;

- Wait for the verification process to complete (this may take 1-2 business days).

If you encounter any issues during the KYC screening, you can contact the support team via email, Discord, or live chat for assistance. Note that by registering, you agree to the specific terms and conditions set by Alpha Capital Group.

Evaluation Stages

Alpha Capital Group employs a two-step evaluation process to assess traders' skills and risk management abilities. Here's a detailed look at each phase:

| - | Phase 1 | Phase 2 |

Virtual Profit Target | 8% | 5% |

Minimum Trading Days | 3 | 3 |

Maximum Total Drawdown | 10% Of The Initial Account Balance | 10% Of The Initial Account Balance |

Maximum Daily Loss | 5% | 5% |

Traders have unlimited calendar days to complete each phase, allowing for thorough strategy testing and refinement.

Upon successful completion of both phases, traders can potentially transition to a Qualified Analyst account.

Bonuses and Discounts

Currently, this prop firm offers only 1 bonus, which is the "Performance Fee" bonus.

This one is paid to the "successfully qualified analysts" on the first performance fee request. The amount is 0.25% of the initial account size.

Alpha Capital Group Rules

This section reviews the trading rules set by ACG. You must be aware of them before getting started:

- VPN Usage: Alpha Capital Group allows the use of VPNs and VPS but stresses the importance of safeguarding account credentials;

- Hedging: Hedging is allowed within a single account, but any form of price/spread arbitrage or hedging across multiple Alpha Capital Group accounts is prohibited;

- Expert Advisors (EAs): EAs are permitted on the MT5 platform, but they require pre-approval. EAs can use virtual stop losses. You need to enable EAs during the checkout process and submit the EA for review;

- Prohibited Strategies: Arbitrage, latency trading, high-frequency trading, and other manipulative strategies are prohibited;

- News Trading: Varies based on the account type.

VPN Usage

At Alpha Capital Group, the use of Virtual Private Networks (VPNs) and Virtual Private Servers (VPS) is permitted, offering flexibility in your trading activities. However, it is essential to protect your account credentials at all times.

While VPNs and VPS are valid tools, group trading (multiple traders accessing the same account) is strictly prohibited, and any attempt to engage in this activity will result in account closure.

You are allowed to use multiple IP addresses and devices, but only the individual who has completed the KYC process and is the official account holder may perform trades.

Hedging

Hedging is allowed, meaning you can hold both long (buy) and short (sell) positions on the same instrument simultaneously. However, strategies such as price/spread arbitrage are prohibited, and any form of hedging across multiple Alpha Capital Group accounts will result in the closure of your account.

Ensure that all hedging activities are carried out within the same account and are in line with our guidelines.

Expert Advisors (EAs)

Alpha Capital Group permits the use of Expert Advisors (EAs) on the MT5 platform. However, currently, EA functionality is not available on the cTrader and DXTrade accounts. Before using an EA, you must seek pre-approval.

To do so, send an email to support@alphacapitalgroup.uk with the EX5 (Set File) and MQ5 (Source Code) for review.

Additionally, when purchasing an account, ensure to select the "Enable EA" option at checkout. You will still need to reach out to our support team to activate your EA.

Martingale and Arbitrage Strategies

Alpha Capital Group does not permit arbitrage, latency trading, high-frequency trading, or any other manipulative trading practices. Engaging in these strategies will result in the invalidation of the affected trades and potential account termination.

Additionally, account management services are not allowed, and all trades must be executed by the trader whose name appears on the account. If you are unsure about whether your strategy is compliant, we recommend setting up a free trial account and getting our team’s approval before proceeding.

News Trading

Alpha Capital Group allows news trading, but it is subject to specific restrictions based on the account type:

- Swing Accounts: News trading is permitted; however, if a trade is initiated within 2 minutes before or after a major news release, the trade must remain open for at least 2 minutes for it to be valid;

- Other Accounts (Assessment Phase): During the assessment phase, you are free to trade during all news releases without restriction;

- Qualified Analyst Accounts (Pro Plans): No new trades or closures are allowed 2 minutes before or 2 minutes after major news releases. The 4-minute window (2 minutes on either side of the news) should have no executed trades;

- Qualified Analyst Accounts (One & Three Plans): These accounts face a 5-minute restriction (5 minutes before and 5 minutes after the news) during which no trades can be executed.

In all cases, if a Stop Gain (adjusted Stop Loss in profit) or Take Profit is triggered during the restricted time window, it will be considered a Soft Breach, and any profits will not count toward your performance fee.

Please note that any losses incurred during these periods are the trader's responsibility, and Alpha Capital Group will not remove them due to slippage under high-impact news conditions.

Affected Instruments

The news trading restrictions apply to all instruments, including but not limited to:

- Macroeconomic Announcements (CPI, FOMC Statements, Non-Farm Payrolls, etc.)

- Major Currency Pairs (USD, EUR, GBP, CAD, AUD, JPY, etc.)

- Commodities (XAUUSD, XAGUSD, USOIL, etc.)

- Economic Indicators (PMI, Retail Sales, GDP Growth, etc.)

Traders are advised to check the economic calendar for specific news events and adhere strictly to the news trading windows as outlined for each account type.

Available Platforms

Alpha Capital Group provides traders with access to industry-standard platforms, ensuring a familiar and robust trading environment. The main platforms offered are:

- MetaTrader 5 (MT5): A powerful and widely used platform known for its advanced charting capabilities, automated trading features, and extensive range of technical indicators.

- cTrader: A modern, intuitive platform that offers advanced order types, detailed market depth, and customizable interfaces.

- DXTrade: A multi-asset trading platform that provides a user-friendly interface and advanced risk management features, and analytics tools.

To download and install MT5 indicators, visit the relevant page on our website.

Tradable Instruments and Symbols

Alpha Capital Group offers a limited range of tradable instruments, which could be frustrating to some traders. The main asset classes available include:

- Forex Market: top most traded currency pairs

- CFDs: on some commodities and popular indices

- Metals: Gold & Silver

Total assets available on this firm is only around 40.

Payment Methods

For qualified traders who become external analysts, Alpha Capital Group offers a limited number of payment methods for receiving performance fees:

- Rise: A digital payment platform (https://www.riseworks.io/)

- Wise: An international money transfer service (https://wise.com/)

- Bank Transfer (WIRE): Traditional bank wire transfers

To initiate a performance fee withdrawal, traders can submit a request through their dashboard profile.

Payouts are processed on a bi-weekly (14-day) frequency, ensuring regular compensation for successful traders.

Fees & Costs

Alpha Capital Group operates on a competitive fee structure designed to benefit both the firm and its traders. Here's a breakdown of the main fees and costs:

- Challenge Fees: One-time fees ranging from $97 to $997, depending on the chosen account size

- Commissions: $0 for standard accounts, $5 per lot for raw accounts

- Spreads: Competitive spreads that vary by instrument and market conditions

- Overnight Fees: May apply for positions held overnight, varying by instrument

A forex profit calculator predicts the outcome of a trade based on its fees. Also, a crypto profit/loss calculator tool is available.

Does Alpha Capital Group Offer Enough Educational Resources?

Alpha Capital Group recognizes the importance of trader education and provides several resources to support its traders' growth:

- 1-on-1 Mentoring: Personalized guidance from experienced traders

- Alpha Academy: Access to educational courses, strategies, indicators, and EAs

- Video Tutorials: A wide range of educational videos on their YouTube channel

- Community Forums: Active Discord server for trader interaction and knowledge sharing

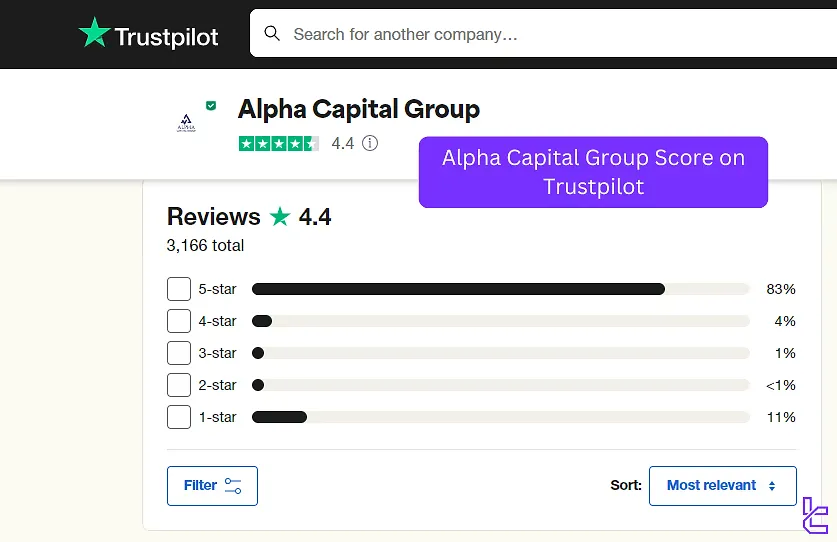

Trust Scores on Trustpilot

Trust scores and reviews play a crucial role in assessing the reliability of a prop trading firm. Alpha Capital Group has garnered generally positive feedback from the trading community:

- ACG Trustpilot Score: 4.4 out of 5 stars (based on over 3,100 reviews)

Positive Highlights:

- Excellent trading platform performance

- Clear and well-defined evaluation rules

- Responsive and helpful customer support

- Transparency and continuous improvement efforts

Areas of Concern:

- Some reports of delayed payouts

- Instances of merged account errors

Alpha Capital Group Support: Channels & Opening Hours

Alpha Capital Group offers multiple support channels to assist traders:

- Live Chat: Available on their website for real-time assistance

- Email Support: [info@alphacapitalgroup.uk]

- FAQ Page: Comprehensive information on common queries

The firm's stated business hours are Monday to Friday, 8 AM to 8 PM GMT.

Presence on Social Media

Alpha Capital Group maintains an active presence across various social media platforms.

This firm shares insights, educational content, and updates on these channels, in addition to facilitating traders' engagement. Alpha Capital Group prop firm social media channels:

- YouTube

- Discord

Alpha Capital Group Against Other Prop Firms

The table in this section makes a comparison between ACG and its peers based on several important parameters:

Parameters | Alpha Capital Group Prop Firm | ||||

Minimum Challenge Price | $97 | $39 | $15 | $33 | $42 |

Maximum Fund Size | $200,000 | $250,000 | $100,000 | $400,000 | $1,000,000 |

Evaluation steps | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step | 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding | 1-Step, 2-Step, 3-Step |

Profit Share | 80% | 100% | 85% | 100% | 90% |

Max Daily Drawdown | 5% | 5% | 4% | 7% | 5% |

Max Drawdown | 10% | 10% | 8% | 14% | 8% |

First Profit Target | 5% | 5% | 8% | 6% | 5% |

Challenge Time Limit | Unlimited | Unlimited | Unlimited | Unlimited | Unlimited |

Maximum Leverage | 1:100 | 1:100 | 1:75 | 1:100 | 1:20 |

Payout Frequency | Bi-weekly | Bi-weekly | 10 Days | Weekly | 14 Days |

Number of Trading Assets | 40 | 3000+ | 400+ | 40+ | N/A |

Trading Platforms | MetaTrader 5, cTrader, Dxtrade | Metatrader 5 | Match-Trader, cTrader | MetaTrader 5, Match Trader | MetaTrader 4 |

Expert Suggestions

Alpha Capital Group is a prop trading firm that serves more than 215,000 traders. George Kohler and Andrew Blaylock are the managing director and the director of the company, respectively.

ACG has received a trust score of 4.4/5, based on more than 3,100 reviews on the Trustpilot platform.