BrightFunded Rules about News Trading is unrestricted in Phase 1 & 2, but Funded Star Accounts have a 10-minute window restriction.

Expert Advisors (EAs) are allowed, but manual supervision is required to meet the daily loss limit.

List of essential rules in BrightFunded

The rules set by BrightFunded Prop Firm are in different categories; BrightFunded Standards Category:

- News Trading

- Expert Adviser

- Prohibited Strategies

- Copy Trading

- Positions overnight

- Positions over weekends

- Hedging

- VPN/VPS

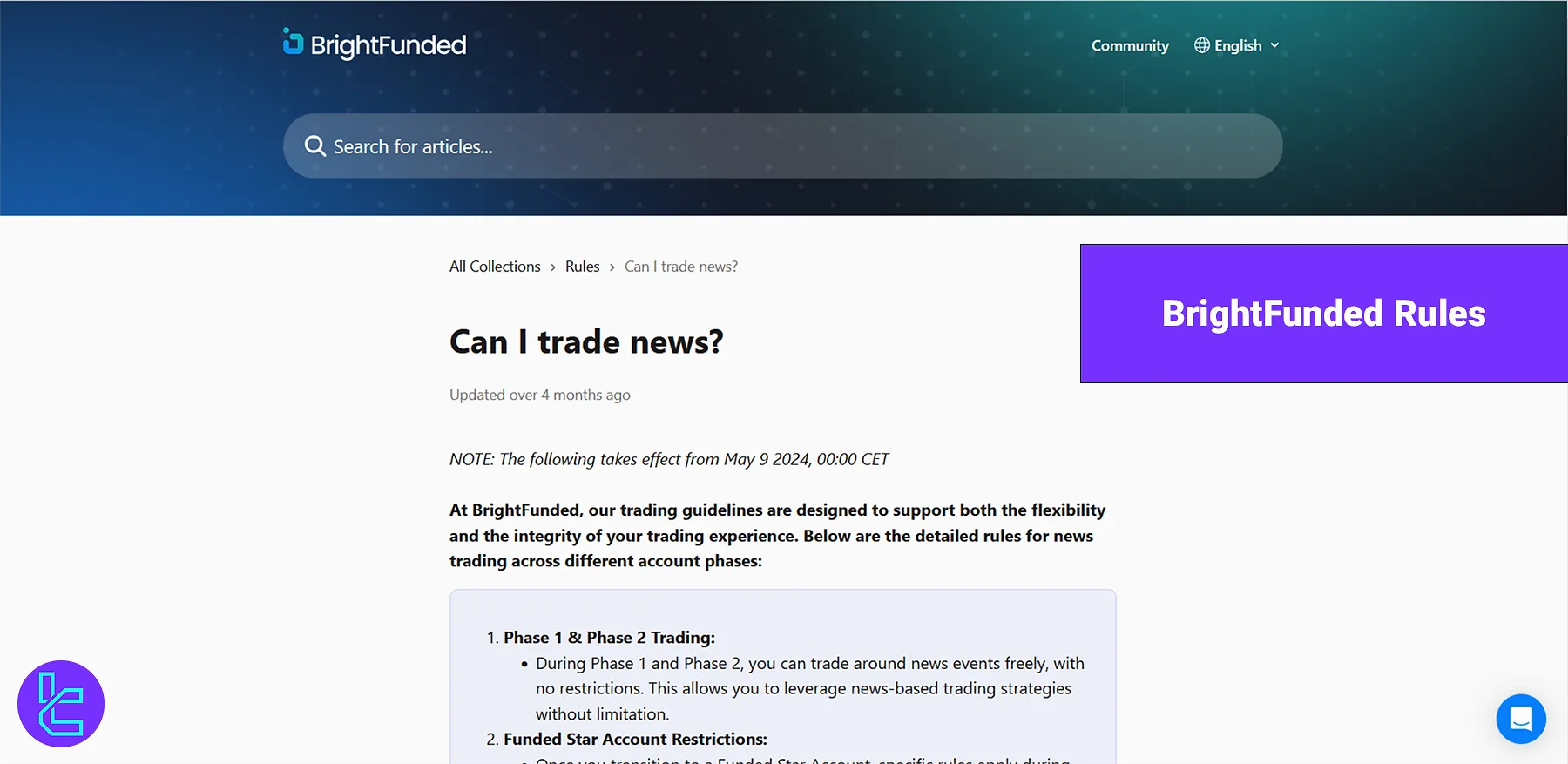

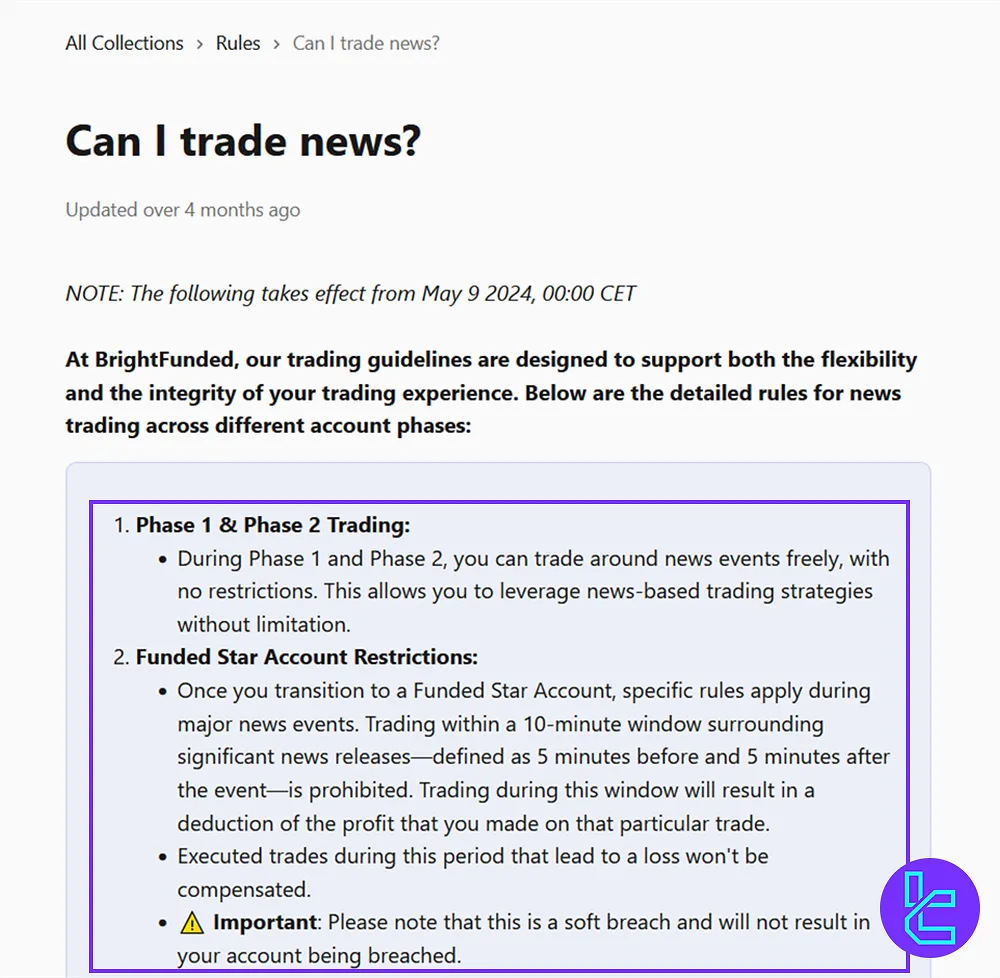

BrightFunded News Trading Rules

- Phase 1 & 2: No restrictions on news trading; you can trade freely around events;

- Funded Star Account: Trading is prohibited within a 10-minute window (5 minutes before & after major news). Profits made during this period will be deducted;

- Execution Rules: Opening/closing trades, stop loss, and take profit executions within the restricted window are soft breaches but won’t breach your account;

- 48-Hour Exemption: Trades held for 48+ hours before a red folder news event are exempt from news trading restrictions;

- Policy Updates: Previous news trading rules for Funded accounts are null and void; new restrictions apply immediately.

BrightFunded Expert Adviser Rules

- BrightFunded Allows EAs: Traders can use Expert Advisors (EAs) for automated trading;

- Trading Rules Still Apply: EAs must comply with daily and total loss limits;

- Third-Party EAs: Other traders may use the same EA and strategy, affecting performance;

- Risk Management: Regularly monitor and adjust your EA to avoid unnecessary risks;

- Oversight Required: While automation helps, manual supervision is still essential for success.

BrightFunded Prohibited Strategies

- Hedging (conditioned)

- Exploiting service errors (e.g., price display delays)

- Using an external or slow data feed for trades

- Manipulative trading (e.g., placing opposite positions in multiple accounts)

- Trading against platform or provider terms

- Using AI, ultra-high-speed trading, or mass data entry to gain an unfair advantage

- Gap trading during major news events or macroeconomic releases

- Trading practices that harm the provider (e.g., overleveraging, overexposure, one-sided bets, account rolling)

- Grid Trading

- High-Frequency Trading (HFT)

- Tick Scalping

- Negative Available Margin Trading

- Arbitrage

- Any strategy that does not reflect live market conditions

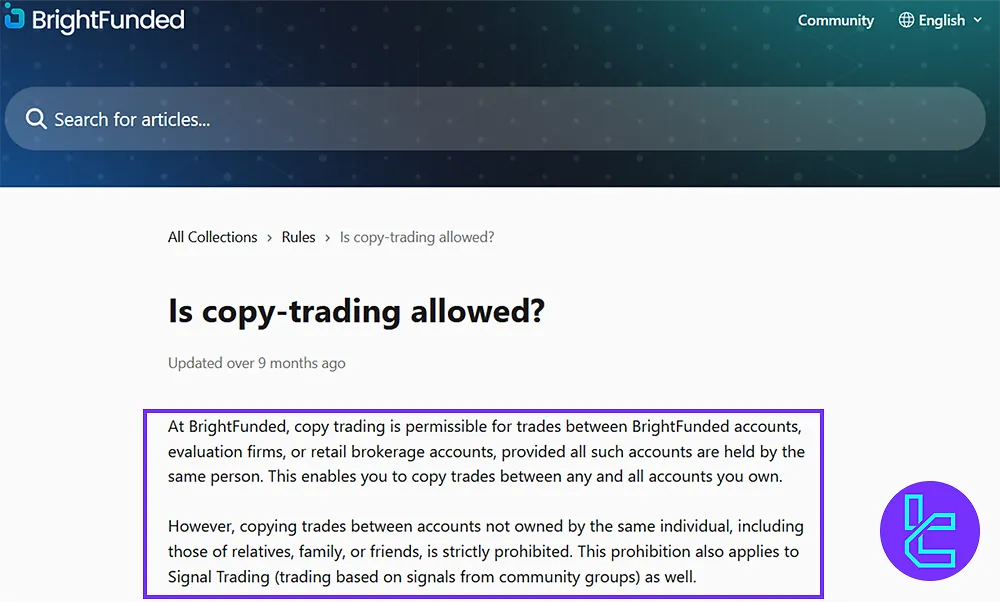

BrightFunded Copy Trading Rules

- Copy trading is only allowed between accounts registered to the same person;

- Sharing trades between different individuals is strictly prohibited;

- Breaking these rules may lead to profit cuts, warnings, or account closure;

- Managing third-party accounts or selling trading assistance is not permitted.

BrightFunded Rules for Positions overnight

BrightFunded does not require traders to close positions overnight, allowing for long-term strategies. However, overnight trades carry risks due to market fluctuations.

BrightFunded Rules for Positions Over Weekends

As with many Prop Firms, BrightFunded allows traders to hold positions over the weekend, offering flexibility for long-term strategies.

However, weekend trades carry risks due to potential price gaps when markets reopen.

BrightFunded VPN/VPS Rules

- Using a VPN, VPS, or different IPs while traveling is allowed. Traders have the flexibility to trade from anywhere;

- Only the account owner is permitted to trade. No one else can use the Challenge or Funded Account;

- Different IP addresses will not result in penalties. As long as the owner is trading, there are no restrictions;

- Unauthorized account usage is strictly prohibited. Violations may lead to penalties or account closure.

BrightFunded Hedging Rules Explained

- Hedging between different accounts is prohibited: A first violation results in a warning (Soft Breach), while a second violation leads to permanent account closure (Hard Breach;)

- Hedging within the same account is allowed. Traders can buy and sell the same instrument in one account to manage risk;

- Hedging between different prop firms is strictly forbidden: Using multiple firms to offset trades distorts performance evaluation;

- Violations are detected automatically: The system flags and enforces penalties for prohibited hedging activities;

- The policy ensures fair trading. Traders must rely on their own strategies without exploiting multiple accounts or firms.

Conclusion and Final Words

BrightFunded Rules about Hedging prohibit different accounts from offsetting trades, with Soft Breach warnings leading to Hard Breach closure if repeated.

VPN/VPS Rules allow different IPs, but only the owner can trade to prevent unauthorized use. For more articles about the platform, check the BrightFunded Tutorials page.