Instant Funding Rules are used to avoid overleveraging and comply with restrictions on news trading and copy trading. Inactivity for more than 60 days could result in account suspension. Additionally, certain trading strategies like Martingale, grid trading, and high-frequency trading (HFT) are prohibited.

Instant Funding Prohibited Strategies and Practices

To maintain a secure and fair trading environment, Instant Funding has prohibited several strategies and behaviors; Instant Funding Limits:

- Overleveraging & Gambling

- News & Copy Trading Restrictions

- Reverse and Group Trading

- Expert Advisors (EAs)

- Account Misuse & Management Violations

- System Exploits & Trading Platform Manipulation

- Martingale Strategy

- One-Sided Bets

- Grid Trading

- High-Frequency Trading (HFT)

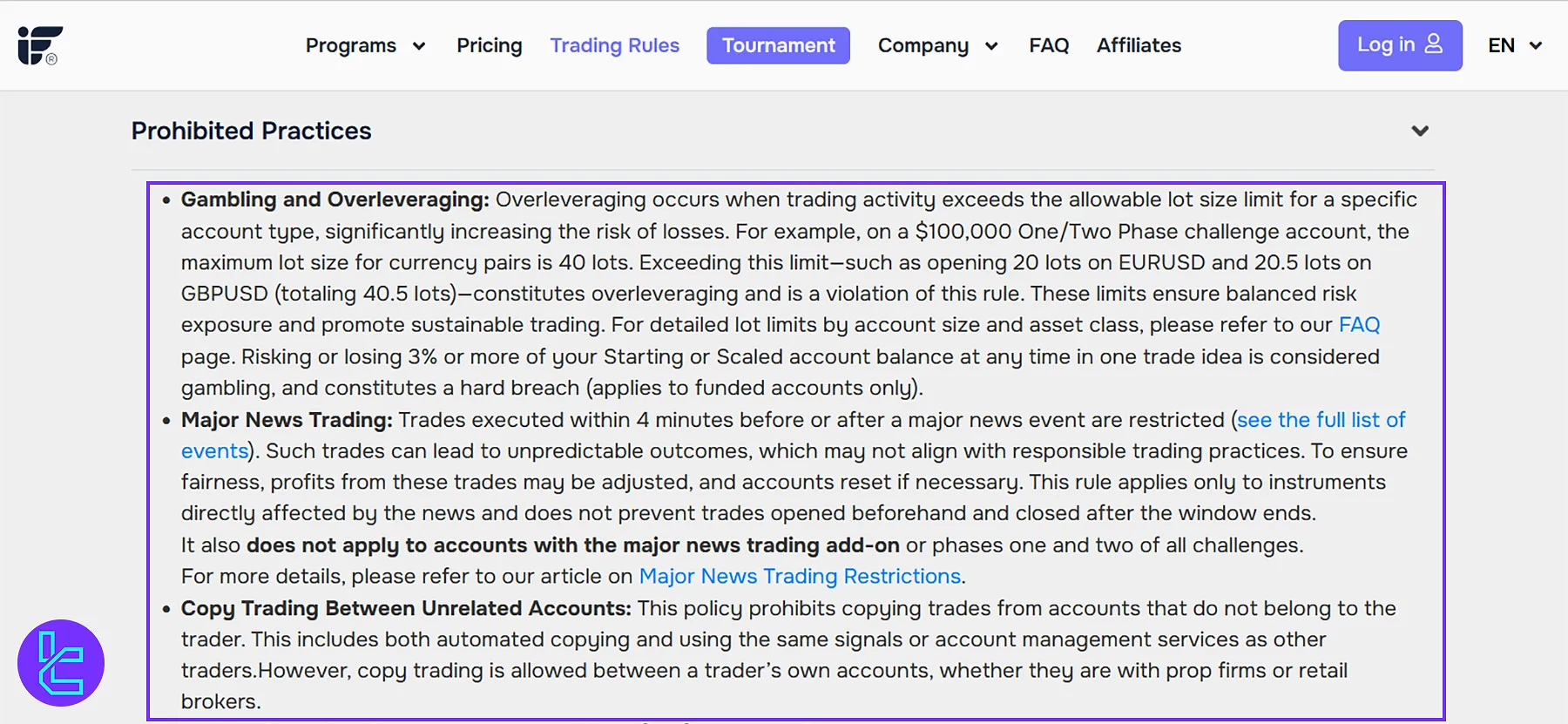

Instant Funding Overleveraging & Gambling

Overleveraging and gambling create excessive risks that violate funding rules; Gambling Rules in Instant Funding:

- Overleveraging occurs when a trader exceeds the allowable lot size. A $100,000 instant funding account has a maximum of 40 lots for currency pairs. Exceeding this violates the rules;

- Gambling is defined as risking or losing 3% or more of the starting or scaled balance in a single trade idea. This is a hard breach for funded accounts.

Instant Funding News & Copy Trading Restrictions

Strict rules govern news trading and copy trading; Instant Funding News & Copy Trading Conditions:

- News Trading: Trading within ±4 minutes of a major news event is prohibited unless a major news trading add-on applies;

- Copy Trading: Allowed only between a trader’s own accounts but not between unrelated accounts.

Instant Funding Restricted Trading Practices

As with many Prop Firms, some trading methods are considered manipulative and are strictly prohibited; Instant Funding Prohibited Activities:

- Reverse Trading: Taking opposite positions across multiple accounts to eliminate risk;

- Group Hedging: Coordinated trading among multiple traders to reduce exposure;

- Public Third-Party EAs: Automated trading tools from external sources are restricted.

Instant Funding Account Misuse & Management Violations

Account management breaches include any unauthorized trading practices; Instant Funding Violations:

- Group Copying: Using the same EA settings or identical trade setups in multiple accounts;

- Account Management: Only the account owner can trade; managing others' accounts is banned;

- Account Churning: Repeatedly opening and closing challenge accounts to bypass restrictions.

Instant Funding Inactivity Rule

Traders must remain active to keep their accounts valid:

- Maximum Inactivity Period is 60 days;

- Failure to trade within this period may lead to account suspension.

Instant Funding Holding Positions Rules

Holding positions is allowed under specific conditions; Instant Funding Holding Positions Limits:

- Overnight Holding: Permitted but requires careful risk management;

- Weekend Holding: Allowed for phases one and two of challenges and accounts with the major news trading add-on.

Instant Funding System Exploits & Trading Platform Manipulation

Exploiting inefficiencies in the trading environment is prohibited; Instant Funding Manipulation Cases:

- Platform glitches

- Latency arbitrage

- Gap trading

- Toxic order flow

- Other system exploits to gain unfair advantages

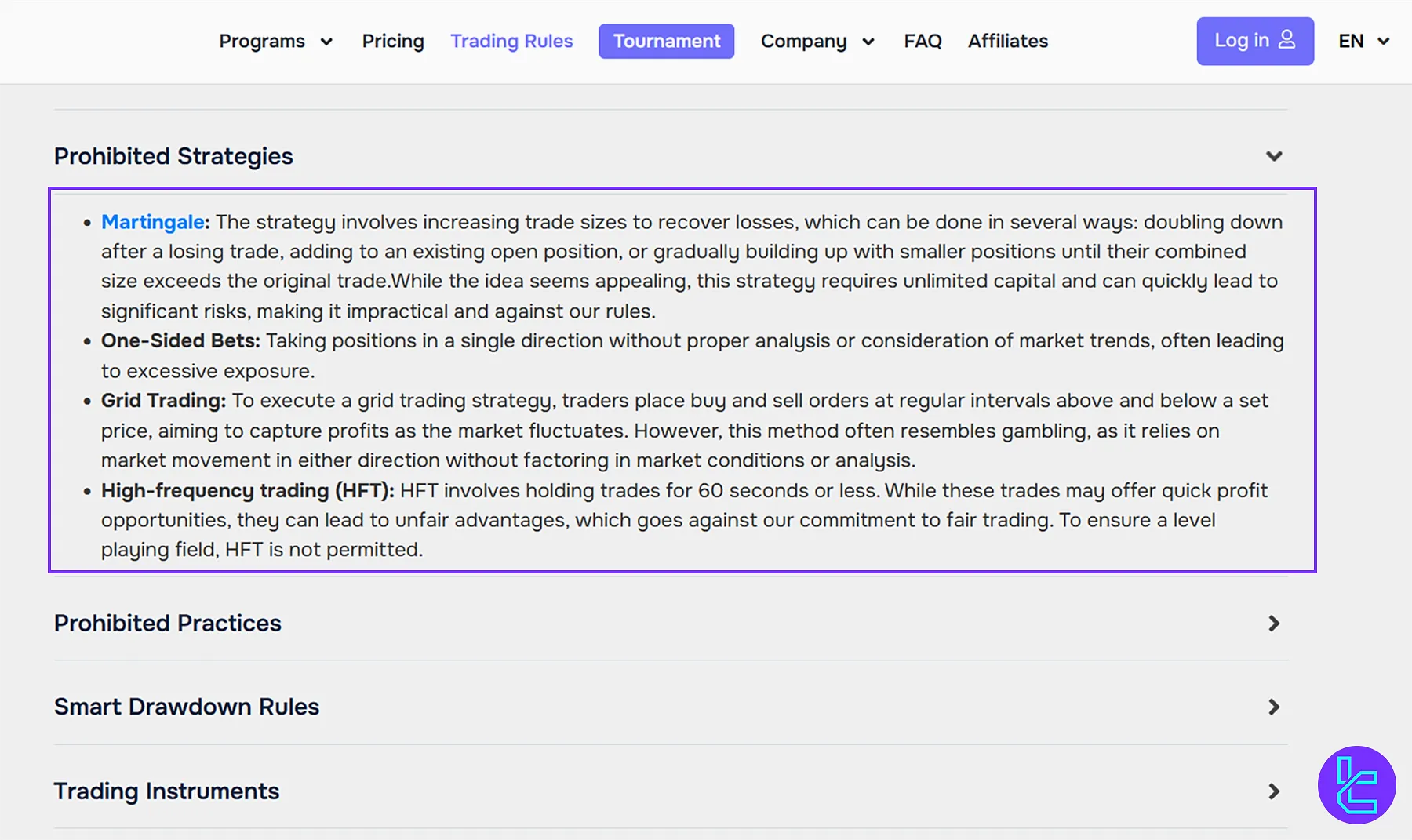

Instant Funding Martingale Strategy

The Martingale strategy involves excessive risk and is against the rules; Instant Funding Martingale Limitations:

- Definition: Increasing trade sizes to recover losses, including doubling down or gradual trade expansion;

- Risk: Requires unlimited capital and can result in severe account drawdowns.

Instant Funding One-Sided Bets

Traders must use proper analysis before opening positions; Instant Funding Betting Rules:

- Definition: Taking all positions in one direction without market evaluation;

- Risk: Creates high exposure, violating risk management principles.

Instant Funding Grid Trading

Grid trading is restricted as it lacks market-based decision-making; Grid Trading in Instant Funding:

- Definition: Placing buy and sell orders at set intervals above and below a chosen price;

- Risk: Resembles gambling as it does not factor in market trends or conditions.

Instant Funding High-Frequency Trading (HFT)

HFT is strictly prohibited due to the potential for unfair advantages; HFT Rules in Instant Funding:

- Definition: Holding trades for 60 seconds or less

- Risk: Disruption in market conditions and creating imbalances

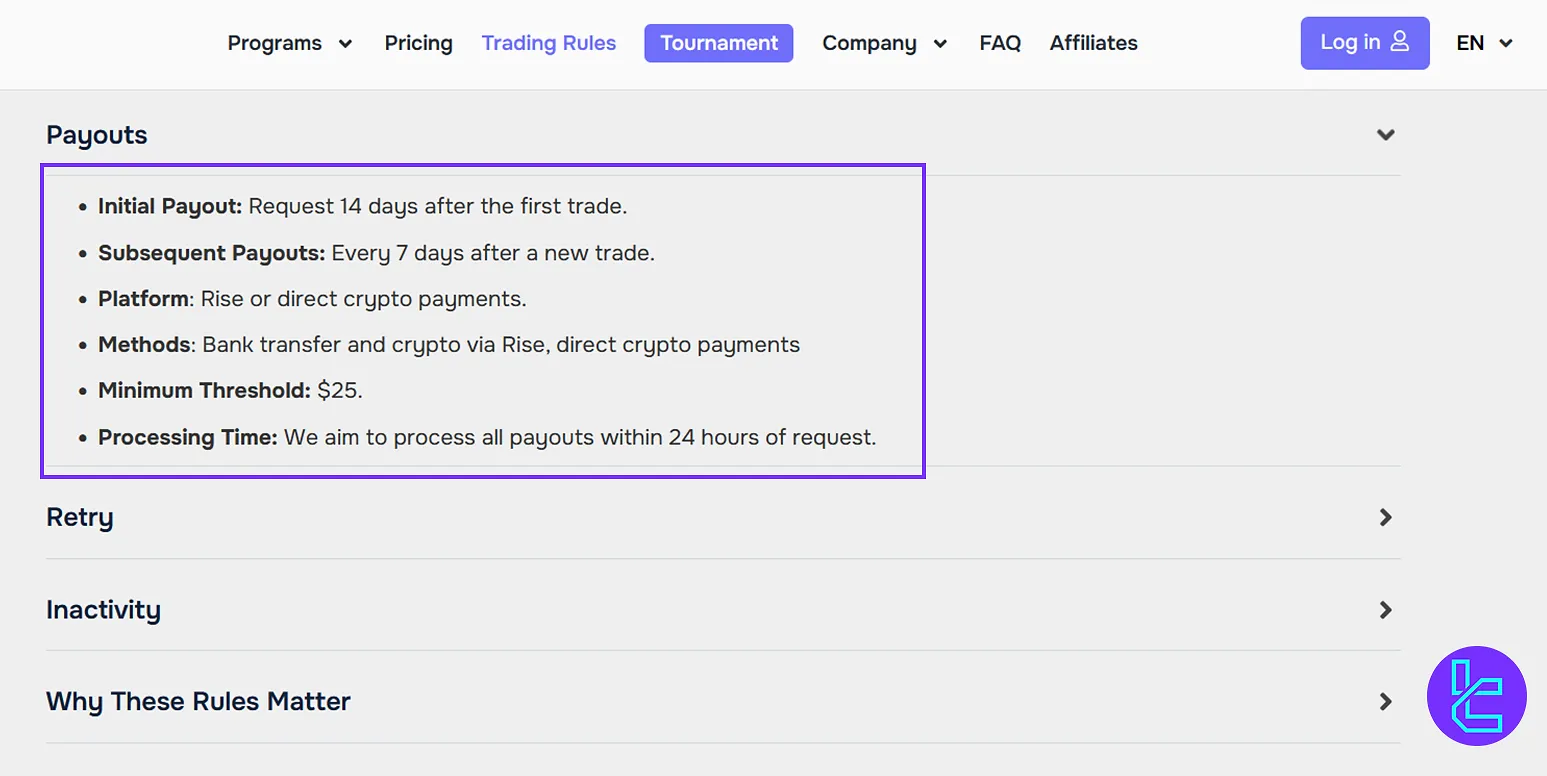

Instant Funding Payout Rules

Payouts follow a structured schedule to ensure traders receive earnings efficiently; Instant Funding Withdrawal Rules:

- Initial Payout: Available 14 days after the first trade

- Subsequent Payouts: Every 7 days after a new trade

- Payout Platform: Available through Rise or direct crypto payments

- Payment Methods: Bank transfer and crypto payments via Rise

- Minimum Threshold: At least $25 to request a payout

- Processing Time: Within 24 hours of request

Writer’s Opinion and Conclusion

Instant Funding Rules, such as the 14-day initial payout and 7-day subsequent payouts, are designed to provide transparency and efficiency.

Traders should also manage their risk carefully, following trade size limits (e.g., 40 lots for currency pairs), and understand that holding positions over the weekend is permitted under specific conditions. For more articles, check the Instant Funding Tutorials page.