Sieg Fund offers over 220 tradable assets across 5 markets [Forex, Indices, Energy Resources, US Stocks, Metals] in 3 trading platforms [MetaTrader 4, MetaTrader 5, KCM WebTrader.]

One-step accounts, with an 8% profit target, are priced in a range of $85-3,000 on this prop firm.

Company Overview and Specifics

Sieg Fund emerged on the prop trading scene in 2016, establishing its headquarters in Hong Kong. Company Key Points:

- Legal Name: Sieg Corporation Limited

- Registered Address: Units 1902-5, 19/F, Dah Sing Financial Centre, 248 Queen's Road East, Wan Chai, Hong Kong SAR

- Company Number: 65938113

Key Specifications and Details

In this section, we are going to have a look at the prop firm's important specifics and details in a table:

Account Currency | USD |

Minimum Price | $65 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 80% |

Instruments | Forex, Indices, Energy Resources, US Stocks, Metals |

Assets | +220 |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Bank Transfers, PayPal, USDT Wallet |

Maximum Fund Size | $400K |

First Profit Target | 8% on 1-Step Programs 10% on 2-Step Accounts |

Max. Daily Loss | Up to 5% |

Challenge Time Limit | 180 Days for Each Phase |

News Trading | Allowed |

Maximum Total Drawdown | Up to 10% |

Trading Platforms | MetaTrader 4, MetaTrader 5, KCM WebTrader |

Commission Per Round Lot | Zero |

Trustpilot Score | 4.1/5 |

Payout Frequency | Bi-weekly |

Established Country | Hong Kong |

Established Year | 2016 |

Pros and Cons of Trading with Sieg Fund

Let's delve into the overall advantages and disadvantages of SiegFund's services at a glance:

Pros | Cons |

Flexible Leverage Up To 1:100 | Strict Evaluation Rules and Phases |

+220 Trading Symbols | Time Limits on Trading |

Payout Processing in 3 Hours | - |

Copy Trading Features | - |

While Sieg Fund offers numerous benefits, traders should carefully consider the stringent rules and potential drawbacks before committing to the platform.

How is The Funding and Prices Structure?

SiegFund caters to traders with varying capital needs and risk appetites. Here's a breakdown of their funding options:

Funding | One-Step Challenge Price | Two-Step Challenge Price |

$5,000 | $85 | $65 |

$10,000 | $155 | $145 |

$20,000 | $315 | $285 |

$50,000 | $475 | $375 |

$100,000 | $755 | $590 |

$200,000 | $1,500 | $1,150 |

$400,000 | $3,000 | $2,350 |

This wide range allows traders to choose an account size that aligns with their experience and trading goals.

Sieg Fund Registration and Verification Guide

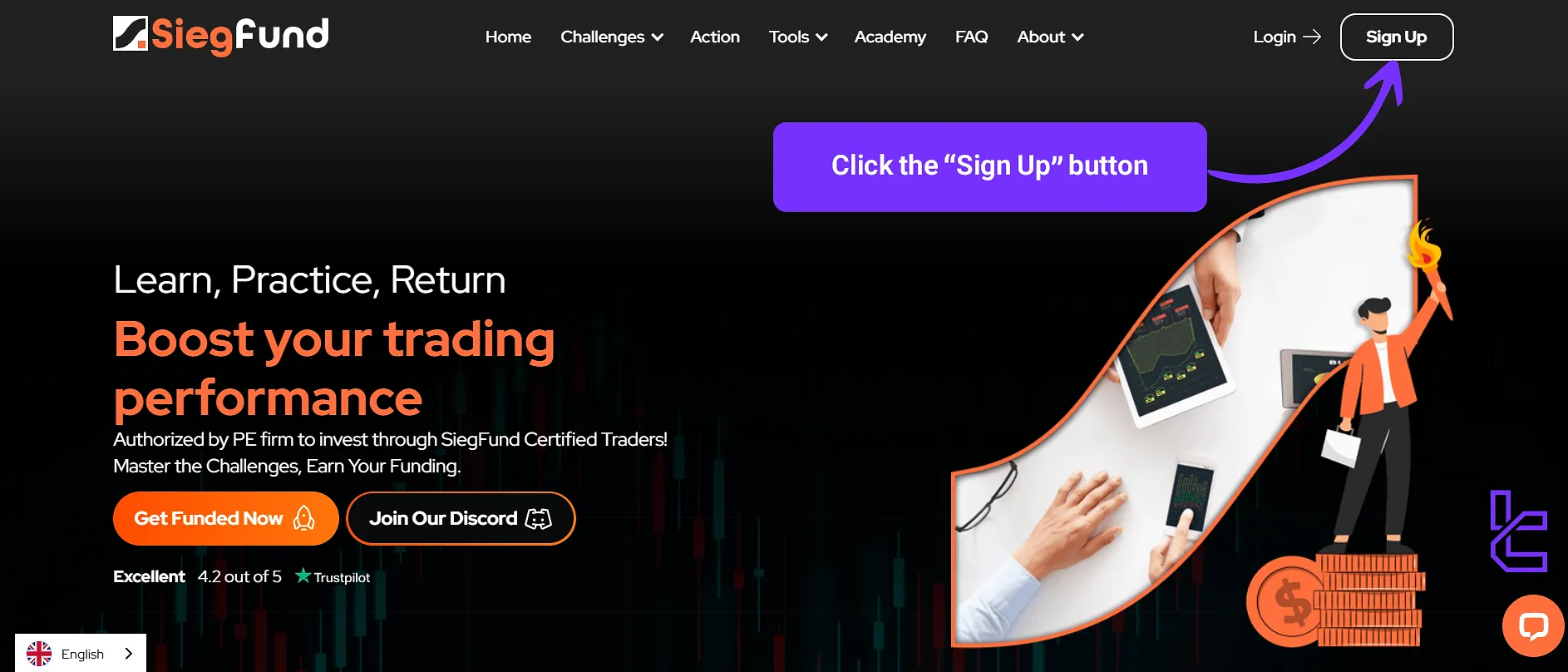

Getting started with this prop firm is a simple process and can be completed in less than 3 minutes. Follow the steps below to sign up:

Alt: Sieg Fund "Sign Up" button

Caption: Click the button as shown in the screenshot on the Sieg Fund website's home page

- Visit the official SiegFund website and click "Sign Up";

- Create a username and fill in the form with your personal information, including name, country, and email address;

- Create a password and declare your agreement with the Terms and Conditions.

Now that you have completed signing up with the prop firm, you can log in with your account. For AML/KYC verification, first, complete your profile with additional information, then submit the required documents.

Evaluation Programs and Rules

Sieg Fund offers two distinct evaluation models with different sets of rules. You can choose one based on your skill level and preference:

- 1-Step

- 2-Step

We will explain each one in detail in the next sections.

1-Step Challenge

The 1-Step Challenge is designed for traders who are confident in their ability to generate consistent profits within a shorter timeframe and want a quicker path to funding:

Profit Target | 8% |

Max. Daily Loss | 3% |

Max. Total Drawdown | 6% (Trailing) |

Profit Split | 80% |

Leverage | 1:30 |

Min. Trading Days | 4 |

Challenge Time Limit | 180 Days |

2-Phase Evaluation

The 2-Step Challenge offers a more gradual approach, allowing traders to demonstrate their skills over a longer period:

Profit Target | 10%-5% |

Max. Daily Loss | 5% |

Max. Total Drawdown | 10% (Static) |

Profit Split | 80% |

Leverage | 1:100 |

Min. Trading Days | 5-3 |

Challenge Time Limit | 180 Days (per Stage) |

Available Bonuses and Promo Codes

As of our latest investigations, Sieg Fund does not offer any specific bonuses or promotions. However, currently, there is an active promo code for getting a 15% discount on $5K to $100K accounts: [NOV15].

Also, there are discount codes occasionally appearing on third-party websites. Check them frequently to get one.

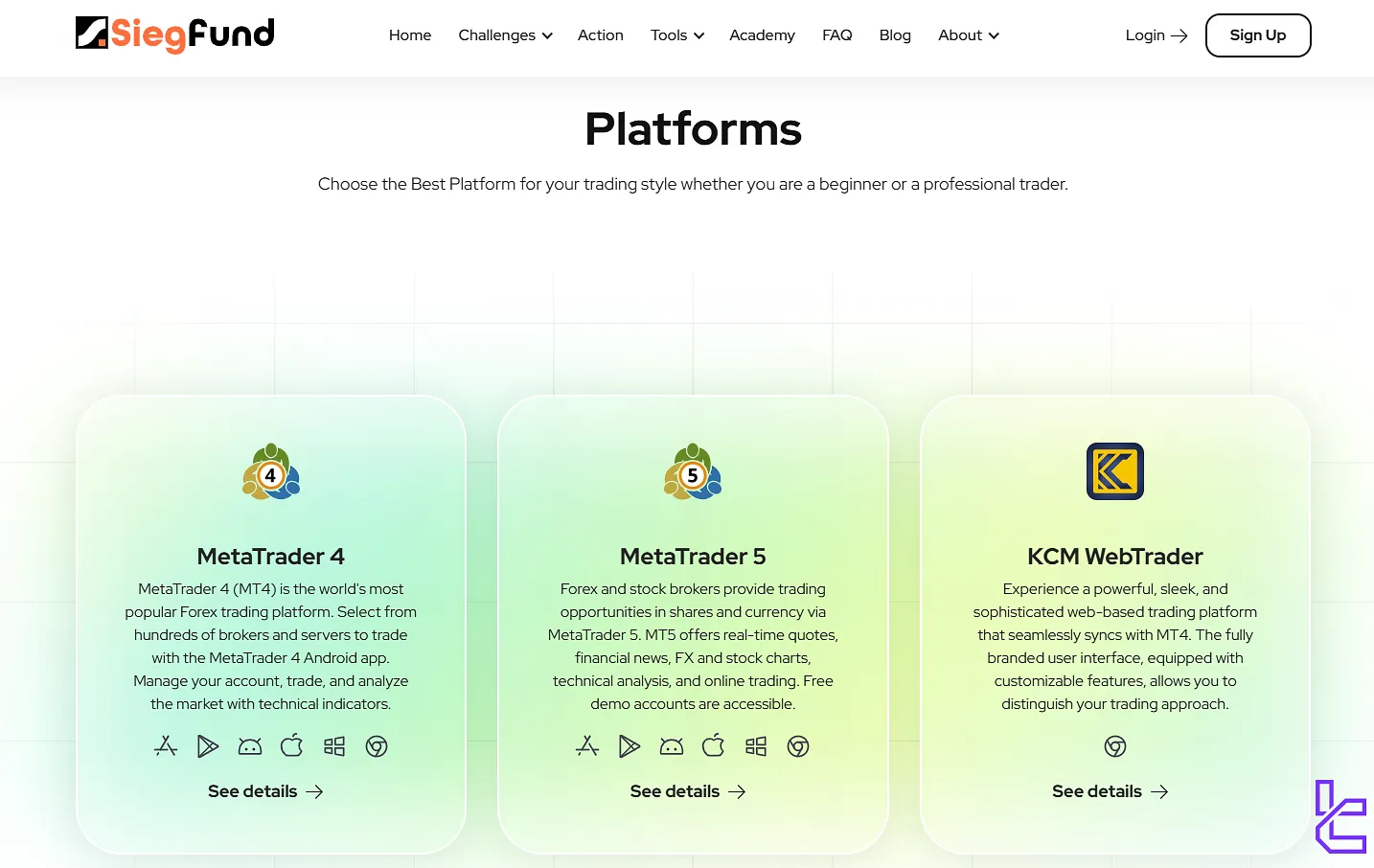

Trading Platforms and Their Features

SiegFund supports three popular trading platforms: MetaTrader 4, MetaTrader 5, and KCM WebTrader. The first two are so famous that they need no introduction, but KCM is a web-based trading software that syncs with MT4.

All platforms provide real-time data and full functionality with helpful analytics tools for your trading needs, ensuring a seamless experience regardless of your chosen interface. Download Links:

MetaTrader 4:

MetaTrader 5:

Also, you can click on KCM to access the proprietary platform on the web.

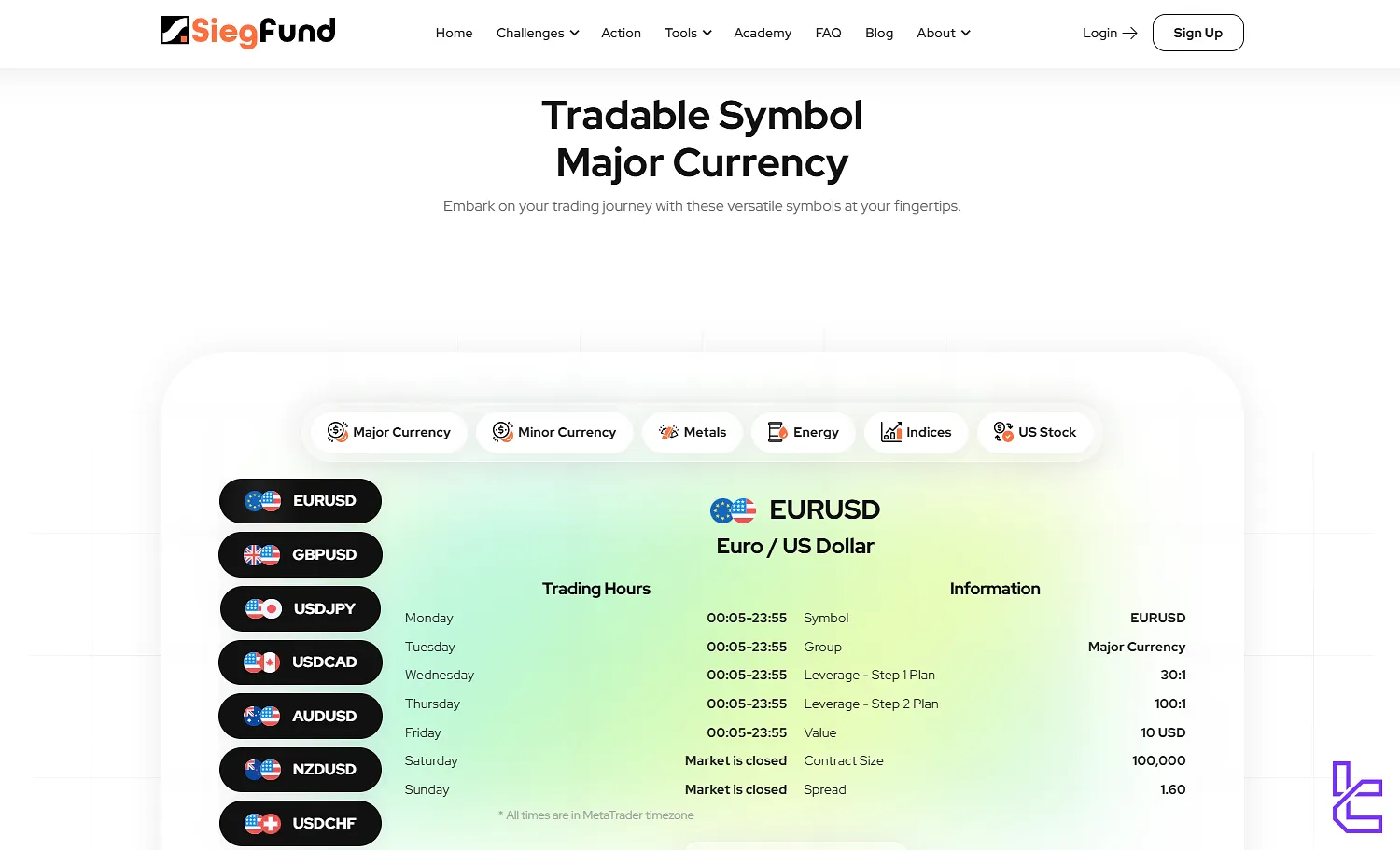

Which Instruments Can I Trade on Sieg Fund?

The prop firm offers a good range of tradable instruments with a relatively high number of assets. Trading Markets on SiegFund:

- Forex: Major and minor currency pairs

- Energy: Crude oil

- Metals: Gold and Silver

- Indices: AUS200, US100, FA40, CN50, and so on

- US Stocks: Top American equities such as NVDA, NFLX, AAPL, TSLA, and more

Deposit and Withdrawal Methods

The firm's website does not provide exact information about this topic, but the support team told us Sieg Fund supports these withdrawal methods:

- Bank transfers

- PayPal

- USDT wallet

For challenge fees, you have these options for payment:

- USDT

- Credit/debit card

- Bank transfers

Spreads and Fees; Does SiegFund Charge Trading Commissions?

The firm prides itself on transparency regarding fees and commissions:

- No hidden fees or commissions on trades, regardless of the chosen account

- Initial challenge costs are one-time payments

- No activation charges

Education Materials and Resources

Sieg Fund offers a decent suite of educational content to support traders and help them improve even more:

- Academy: Articles on technical and fundamental analysis, market outlooks, and trading strategies for all experience levels

- FAQ: Answers to common questions about account setup, trading rules, profit withdrawals, and challenge models

- Blog: Regular updates with market insights, trading tips, and in-depth analyses of popular trading indicators and strategies

However, the FAQ page isn't the best in the industry, as we couldn't find the answer to some of our questions about the firm's services.

Trust Scores; Is Sieg Fund Reliable for My Funds?

The prop firm has garnered an overall of positive reviews on Trustpilot, boasting a respectable 4.1/5 rating. However, the number of reviews is not high enough to be taken into account; There have been only 6 reviews submitted for the firm.

However, these statistics are for the time of writing this article and might change in the future.

Customer Services and Support Options

The support department should be a priority when choosing a financial company. Sieg Fund offers multiple channels for customer services:

- Ticket System: Accessible through the website

- Email: cs@siegfunds.com

- Live Chat: Via the website or the Telegram account [@siegfund]

The firm does not specify a schedule for the support team's services, which is a drawback. Also, during our conversation via the live chat, they took too long to respond, and we weren't happy with the service.

Sieg Fund Social Media Accounts

The firm has established several pages and channels on various popular social networks. Here are the links to each of them:

Engaging with SiegFund's social media channels can keep you updated on the latest developments and promotional offers.

Expert Suggestions

Sieg Fund, a prop trading firm, provides 7 account sizes [$5K, $10K, $20K, $50K, $100K, $200K, $400K,] each priced at $65, $145, $285, $375, $590, $1,150, and $2,350 for the 1-step evaluation.

The company's legal name is Sieg Corporation Limited, registered under the number 65938113.