Trade The Pool rules offer accounts with a 70/30 payout split for day trading and 50/50 for swing models. The platform has strict rules, including a 30% maximum position profit ratio and a 14-day inactivity rule.

Copy trading is allowed only between two Mini BP, Super BP, or MAX/FLEX accounts with a size of $50k or lower.

Trade The Pool Rule Topics

Compared to other platforms, Trade The Pool Prop Firm sets complex rules for trading; Trade The Pool Key Rule Subjects:

- Day Trade Program

- Copy Trading

- Overnight Positions

- News Trading

- Consistency Rules

- Payout Rules

- Inactivity Rule

Trade The Pool Challenge Rules

Knowing the evaluation rules is crucial; Trade The Pool Challenge Limits:

Program | Model | Account Size | Target | Daily Pause | Max Loss | Minimum Positions | Payout Split |

Day Trade | Flexible | $5,000 | 6% | 2% | 4% | 10 | 70/30 |

$25,000 | 6% | 2% | 4% | 10 | 70/30 | ||

$50,000 | 6% | 2% | 4% | 10 | 70/30 | ||

$100,000 | 6% | 2% | 4% | 10 | 70/30 | ||

$200,000 | 6% | 2% | 4% | 10 | 70/30 | ||

Disciplined | $5,000 | 6% | 1% | 3% | 20 | 70/30 | |

$25,000 | 6% | 1% | 3% | 20 | 70/30 | ||

$50,000 | 6% | 1% | 3% | 20 | 70/30 | ||

$100,000 | 6% | 1% | 3% | 20 | 70/30 | ||

$200,000 | 6% | 1% | 3% | 20 | 70/30 | ||

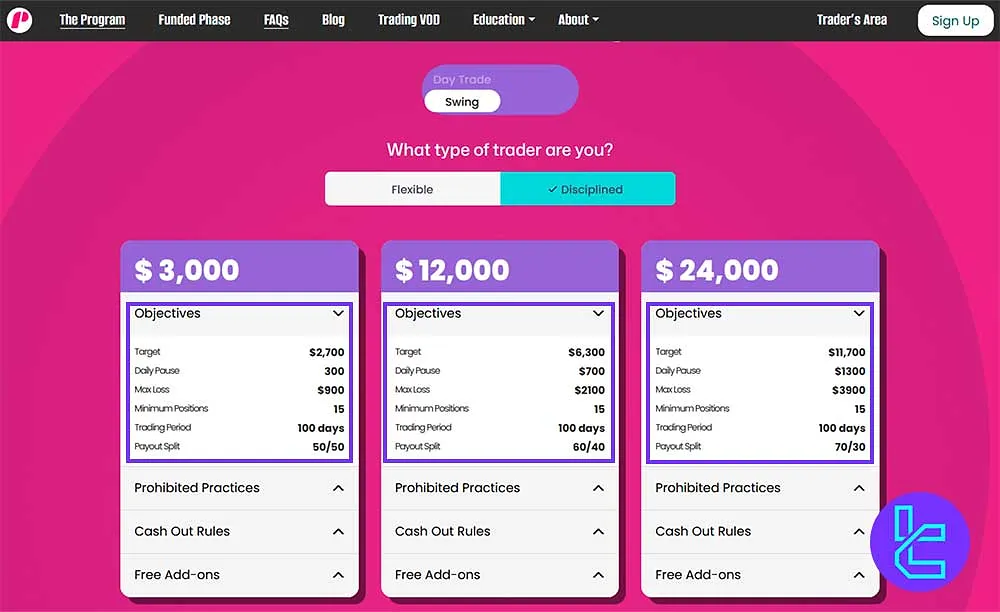

Swing | Disciplined | $3,000 | $2,700 | $300 | $900 | 15 | 50/50 |

$12,000 | $6,300 | $700 | $2,100 | 15 | 60/40 | ||

$24,000 | $11,700 | $1,300 | $3,900 | 15 | 70/30 | ||

$39,000 | $18,000 | $2,000 | $6,000 | 15 | 80/20 |

Based on the statement on the website, Swing Flexible objectives are coming soon.

Copy Trading in Trade The Pool

Copying trades is only permitted between 2 accounts, both of which must meet specific requirements; Copy trading on Trade The Pool:

- The accounts must be either Mini BP, Super BP, or MAX/FLEX with a size of $50k or lower;

- This includes MAX/FLEX accounts of $5k, $25k, or $50k

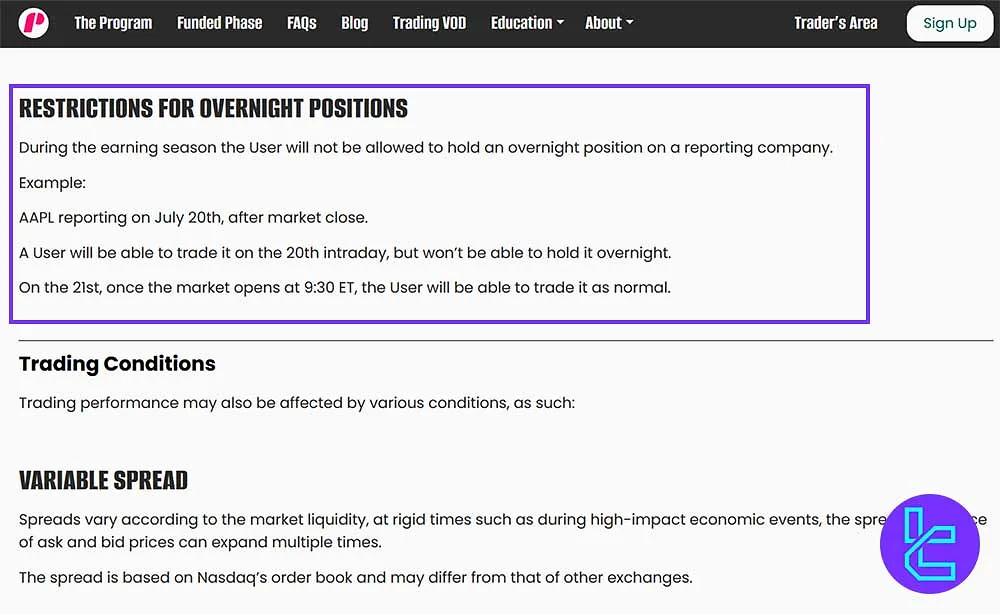

Trade The Pool Overnight Positions

During earnings season, overnight positions are prohibited on stocks reporting earnings; For example, AAPL reporting on July 20 means intraday trading is allowed, but holding overnight is not.

News Trading on Trade The Pool

Generally, the news trading is allowed but traders are advised to monitor the event schedule closely and adjust their exposure by shifting limit and stop orders to mitigate risks.

Trade The Pool Consistency Rules

The maximum position profit ratio is 30% of the total valid profit unless specified otherwise; Trade The Pool Consistency Application:

- Evaluations

- Payouts

- Scaling from funded accounts

Payout on Trade The Pool

Payouts are available to funded users who have a minimum balance of $300 and have waited at least 14 days from their last payout or account activation.

Trade The Pool Inactivity Rule

If an account remains inactive for 14 days, it may face penalties, including account closure.

Trade The Pool Prohibited Strategies

Several trading strategies are strictly prohibited to maintain fairness and prevent system exploitation; Trade The Pool Forbidden Practices:

- Arbitrage Trading

- High-frequency trading (HFT)

- Bracketing strategy around high-impact news

- One-sided bets

- Expert advisors that scalp during rollover-night

- Tick Scalping

- Hedge Arbitrage Trading

- Account sharing or reselling

- Using software or AI to manipulate trades

Writer’s Opinion and Conclusion

Trade The Pool rules prohibit overnight positions, such as on AAPL on July 20. For payouts, a minimum balance of $300 is required, and they must be requested after 14 days.

High-frequency and arbitrage trading are strictly prohibited to maintain fairness in the system.

For more educational articles, check out Trade The Pool Tutorials.