WeGetFunded is a prop firm with a minimum challenge fee of $79 and a profit split that is customizable between 80% and 90% options.

Also, this company provides funding up to a whopping $4,000,000 through scaling. There are 2 evaluation models: Classic & Unlimited.

Company Information Overview

WeGetFunded is a proprietary trading firm that facilitates funding for traders via challenges. Founded in 2023 by a team of over 80 seasoned traders as claimed by the company, this prop firm understands the challenges and aspirations of traders.

Based on the data found on the Google Maps platform, this firm is headquartered in DDP 24522, IFZA, Business Park, Dubai, United Arab Emirates.

Main Features and Specifics

To give you a clear picture of what the prop firm offers, here's a concise summary of its key features:

Account Currency | USD |

Minimum Price | $79 |

Maximum Leverage | 1:100 |

Maximum Profit Split | 90% |

Instruments | Forex, Indices, Stocks, Crypto, Bonds, etc. |

Assets | Not Specified |

Evaluation Steps | 1-Step, 2-Step |

Withdrawal Methods | Bank Transfer, Crypto |

Maximum Fund Size | $4,000,000 Through Scaling |

First Profit Target | 8% |

Max. Daily Loss | From 5% |

Challenge Time Limit | Unlimited |

News Trading | Allowed |

Maximum Total Drawdown | From 12% |

Trading Platforms | cTrader |

Commission Per Round Lot | Not Specified |

Trustpilot Score | 4.2/5 |

Payout Frequency | First Withdrawal is Accepted After Four Weeks Next Payouts Are Done Bi-weekly |

Established Country | United Arab Emirates |

Established Year | 2023 |

Advantages And Disadvantages

Like any trading opportunity, WeGetFunded comes with some significant pros and cons. Let's break them down:

Advantages | Disadvantages |

High Profit-Sharing Ratio (Up To 90%) | Quarterly Performance Reviews May Add Pressure |

Flexible Challenge Options | Limited Choice Of Trading Platforms |

Scaling Plan Up To $4 Million | Support Only Available via Email |

Refund Of Challenge Costs Upon Success | - |

Funding & Price Range On WeGetFunded

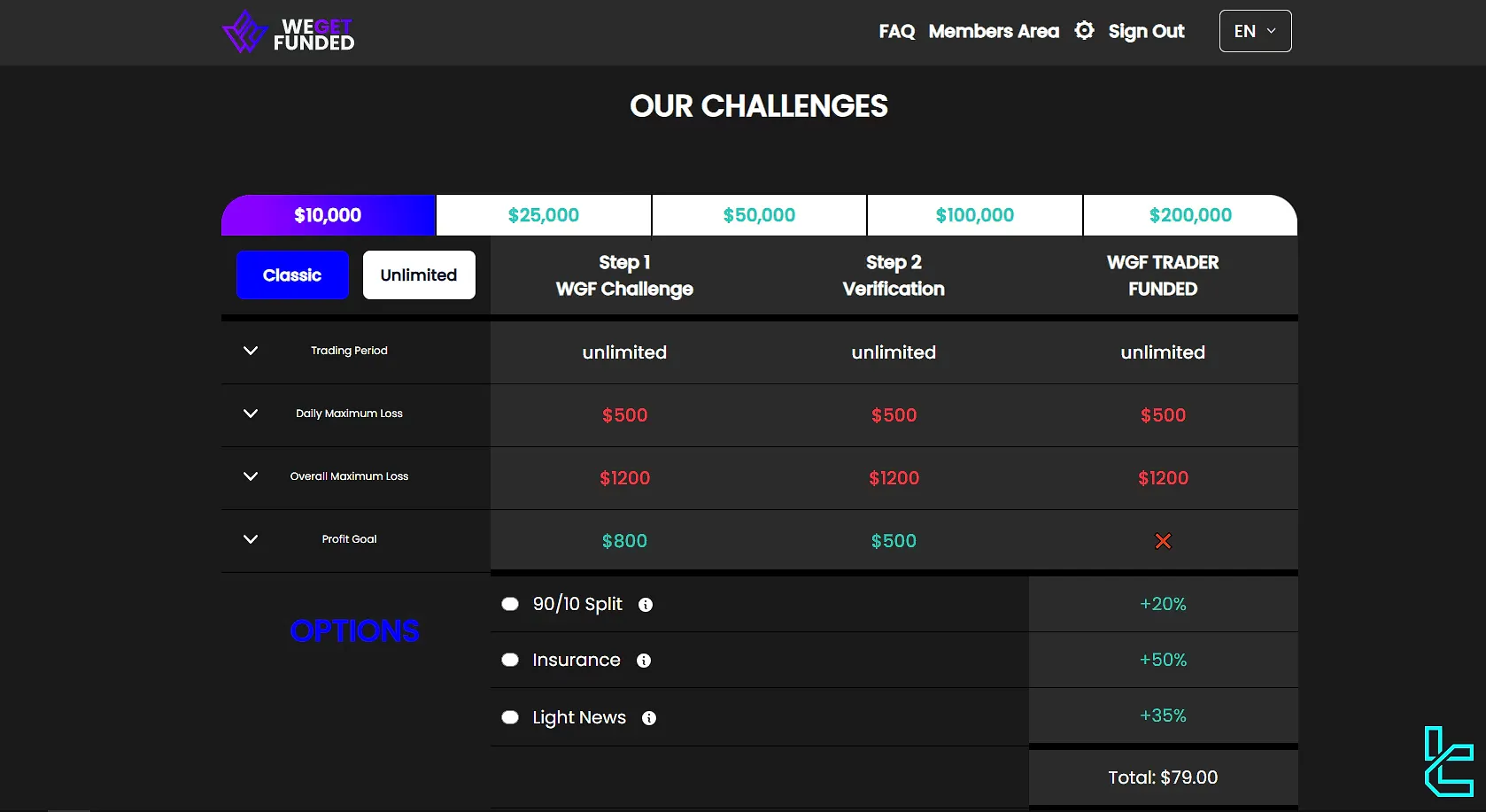

WeGetFunded offers a range of funding options to suit different trader needs and experience levels. Here's an overview of their pricing and funding structure:

- Funding: From $10K to $200K for the initial balance, up to $4,000,000 via scaling

- Price: From $79 to $1,149 for classic and unlimited challenges

Account Registration and Identity Verification

Getting started with WGF is a straightforward and fast process that will be discussed and reviewed in this section. Account Registration with WeGetFunded:

- Visit the website and click "Members Area";

Click the link addressed in the screenshot to reach WeGetFunded registration form - Click "Create Account";

- Complete the registration form with information about your identity and residence location;

- Authorize your email address.

Now, your account is created with the prop firm. For identity verification, first, you need to buy a challenge, then upload the necessary documents related to your identity and residence location.

Evaluation Stages and Program Specifics

WeGetFunded offers two distinct evaluation processes to facilitate a versatile experience for its traders. We will discover each program in its corresponding table. 2-Step Program (Classic):

Funding | $10K | $25K | $50K | $100K | $200K |

Trading Period | Unlimited | ||||

Max. Daily Loss | 5% | ||||

Max. Total Drawdown | 12% | ||||

Profit Target | 8%-5% | ||||

Profit Split | 80% (Upgradable to 90%) | ||||

Price | $79 | $199 | $299 | $499 | $979 |

1-Step Model (Unlimited):

Funding | $25K | $50K | $100K | $200K |

Trading Period | Unlimited | |||

Max. Daily Loss | 4% | |||

Max. Total Drawdown | 6% | |||

Profit Target | 10% | |||

Profit Split | 80% (Upgradable to 90%) | |||

Price | $229 | $349 | $649 | $1,149 |

Also, a "Free Trial" account is available for practice without any fees.

WeGetFunded Bonuses and Promotions

Based on our investigations, the company does not currently offer any specific bonuses or promotions. Prop firms occasionally offer discount codes through official or third-party sources; therefore, always check these sources for any promotions.

Does WeGetFunded Offer Multiple Platforms?

WeGetFunded exclusively uses the cTrader platform, which is known for its advanced features and user-friendly interface. Here's why cTrader stands out:

- Low-latency execution for precise order placement

- Advanced charting tools and technical indicators

- Customizable interface to suit individual trading styles

- Algorithmic trading capabilities for those using EAs

- Mobile app for trading on-the-go

- Robust risk management features

However, some traders might prefer more platform options and find focusing on a sole choice a drawback.

Tradable Markets

WGF, like many other prop firms, offers a decent range of tradable instruments in different markets. In the list below, we will mention some of them:

- Forex

- Indices

- Stocks

- Cryptocurrencies

- Bonds

The company's website does not go into detail regarding this topic and only gives a general image of its offerings. It states that all available assets on the cTrader platform are accessible to WGF's clients.

Which Options Are Available for Payments?

WeGetFunded understands the importance of flexible and secure payment options. They offer three main methods for deposits and withdrawals:

- Bank Transfer: Traditional and widely accessible

- Crypto: For those preferring cryptocurrency transactions

- Credit/Debit Card: Convenient payments for challenges

WeGetFunded Prop Firm Commissions And Costs

This prop firm tries to keep a competitive fee structure. Here's what you need to know:

- No hidden fees or commissions on trades

- One-time challenge fee (refunded upon first withdrawal after success)

- Standard spreads for all trades

However, there's no exact information regarding trading commissions and spreads. The firm only states that there are "exceptionally low commissions and ultra-competitive spreads." The lack of clear data can be considered a drawback.

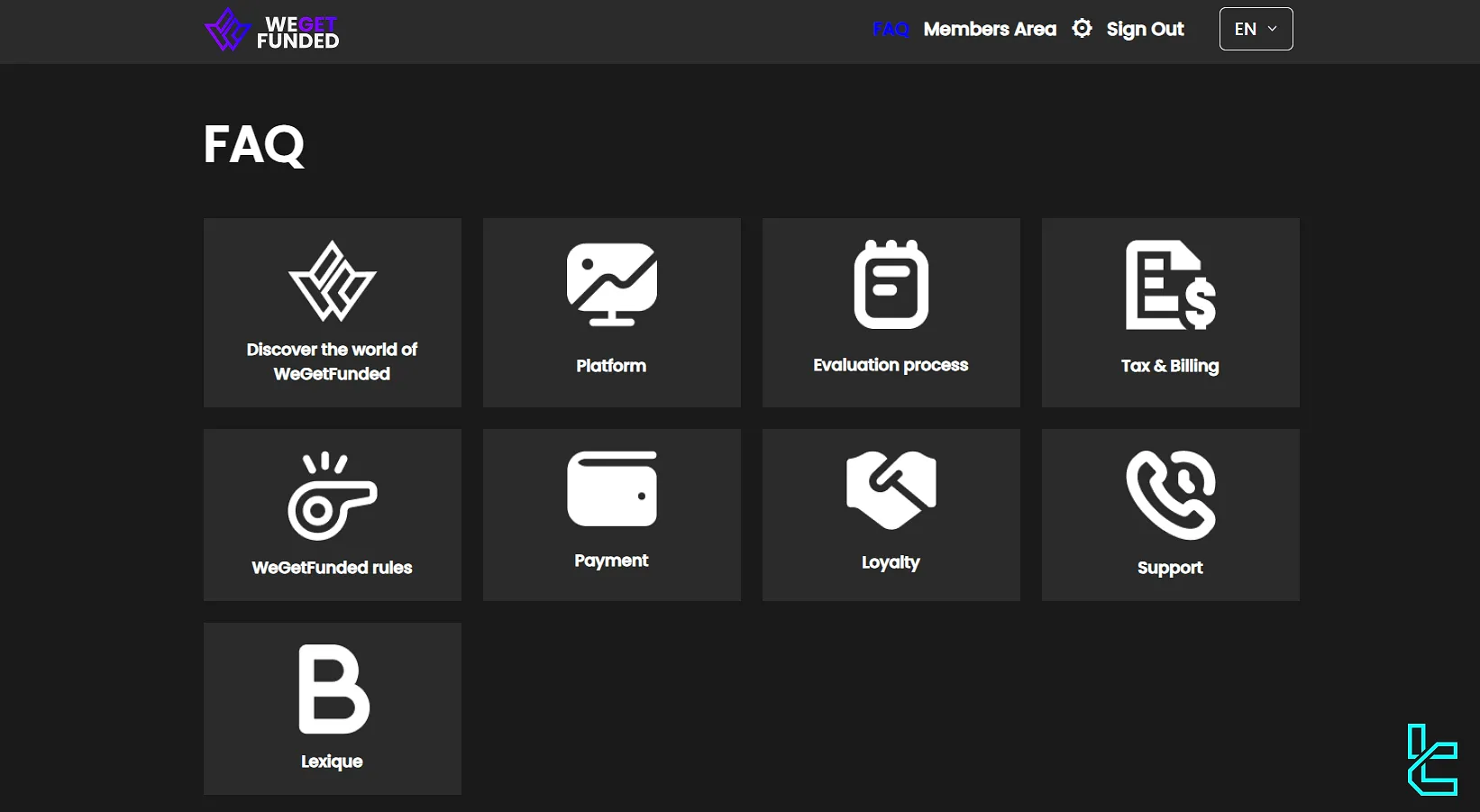

Education and Tutorials

While WGF doesn't offer an extensive educational platform, they do provide some resources to support traders. This company's website consists of a FAQ section that Covers most common queries about their services. Also, there's a terminology of financial terms and words titled "Lexique".

You can also use TradingFinder's Forex education section to access comprehensive learning materials.

How Are The Trust Scores on Reputable Websites?

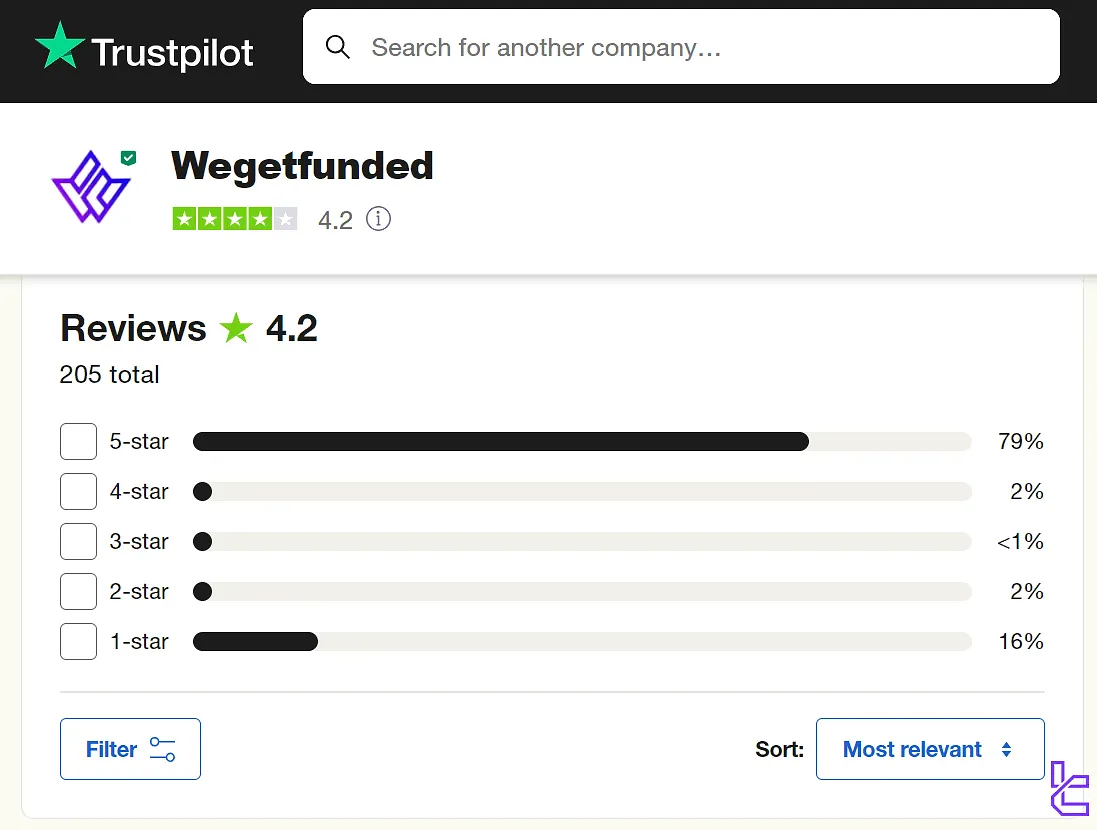

Trust is crucial in the prop trading industry, and WeGetFunded's Trustpilot scores reflect positively on their reputation:

- Overall rating is 4.2 out of 5 stars (based on over 200 reviews)

- Nearly 80% of reviews are 5-star ratings

WGF actively responds to negative reviews (+90% response rate), demonstrating its commitment to addressing customer concerns and maintaining service quality. However, there are no ratings and reviews on other credible websites.

Support Team Contact Channels and Working Hours

This is where WeGetFunded does a poor job. Most companies in various fields, including finance, provide 3 or more contact methods for customer services, but WGF only provides an email address: support@wegetfunded.com.

Besides, the team is not available 24/7, and the schedule is Monday to Friday, 8:00-20:00 (UTC+2). Support section in this prop firm is one of its most significant weaknesses.

Social Media Accounts and Pages

WeGetFunded maintains an active presence on various social media platforms. You will find the links to the corresponding accounts here:

- WeGetFunded Facebook

- WeGetFunded Tiktok

- WeGetFunded Discord

- X (Formerly Twitter)

- YouTube

- Telegram

- Medium

Following WeGetFunded on these platforms can provide valuable insights into their services, trading tips, and company updates.

Expert Suggestions

WeGetFunded, a prop trading firm, offers a maximum leverage of 1:100 in the cTrader trading platform. The company has received a score of 4.2 out of 5 on the Trustpilot website. This rating is based on +200 reviews.

The firm enables payments via 3 main methods [bank transfer, crypto, credit/debit card] and provides its support services through email, Monday to Friday, 8:00 to 20:00 (UTC+2).