XLTrade offers attractive 1-cycle and 2-cycle challenges for traders. With a maximum fund size of $3 million, XLTrade Prop firm provides ample scaling opportunities.

The firm sets a first profit target of 10%, allowing traders to measure their success effectively.

With leverage of up to 1:500 and without commissions, XLTrade ensures traders benefit from competitive conditions.

The firm's global reach extends to over 160 countries, and it is supported by flexible payment options like Visa, MasterCard, Bank Wire, and Crypto.

XLTrade prop firm company overview

XLtrade, established in 2016 and headquartered in London, United Kingdom, is a prominent player in the proprietary trading (prop trading) industry.

Operated by Chimara Ltd, with its platform registered in the Virgin Islands, the firm offers traders access to substantial trading capital without requiring a significant personal investment.

This unique model has positioned XLTrade as a leading choice for both aspiring and professional traders, enabling them to enhance their trading capabilities on a larger scale.

XLTrade specifications summary

To provide a clearer picture of XLtrade's offerings, let's break down the prop firm's key specifications:

Account currency | USD |

Minimum price | $250 |

maximum leverage | N/A |

maximum profit split | %90 |

Instruments | Equity Indices, Stocks, Forex, Cryptos, Metals, Energy, Commodities |

Assets | EUR/USD, GBP/USD, USD/JPY, Tesla, NASDAQ, Gold, Silver, Oil |

evaluation steps | Cycle1, Cycle 2 |

Trading platform | MetaTrader5, WebTrader |

Withdrawal methods | Bank Wire, Crypto |

maximum fund size | $3M scaling |

first profit target | 10% |

Max. daily loss | - |

Challenge time limit | No limits |

news trading | YES |

Maximum total drawdown | 10% |

commission per round lot | No |

trust pilot score | 4.6 out of 5 |

payout frequency | Weekly |

established country | Virgin Islands |

established year | 2016 |

XLtrade's model is designed to attract serious traders with its high funding amounts and favorable profit-sharing terms. However, the lack of direct regulation and the high initial costs may cause some traders to pause.

XLTrade prop firm pros & cons

Let's weigh the advantages and disadvantages of trading with XLtrade:

Pros | Cons |

High funding amounts (up to $3 million scaling) | High minimum funding amount ($50,000) |

Generous 90% profit split | Lack of direct regulatory oversight |

Weekly payouts | Mixed customer reviews and transparency concerns |

No profit limits or daily loss restrictions | Limited educational resources |

Use of popular MT5 platform | - |

While XLTrade prop firm offers attractive terms for experienced traders, the high entry barriers and lack of transparency may deter some potential users.

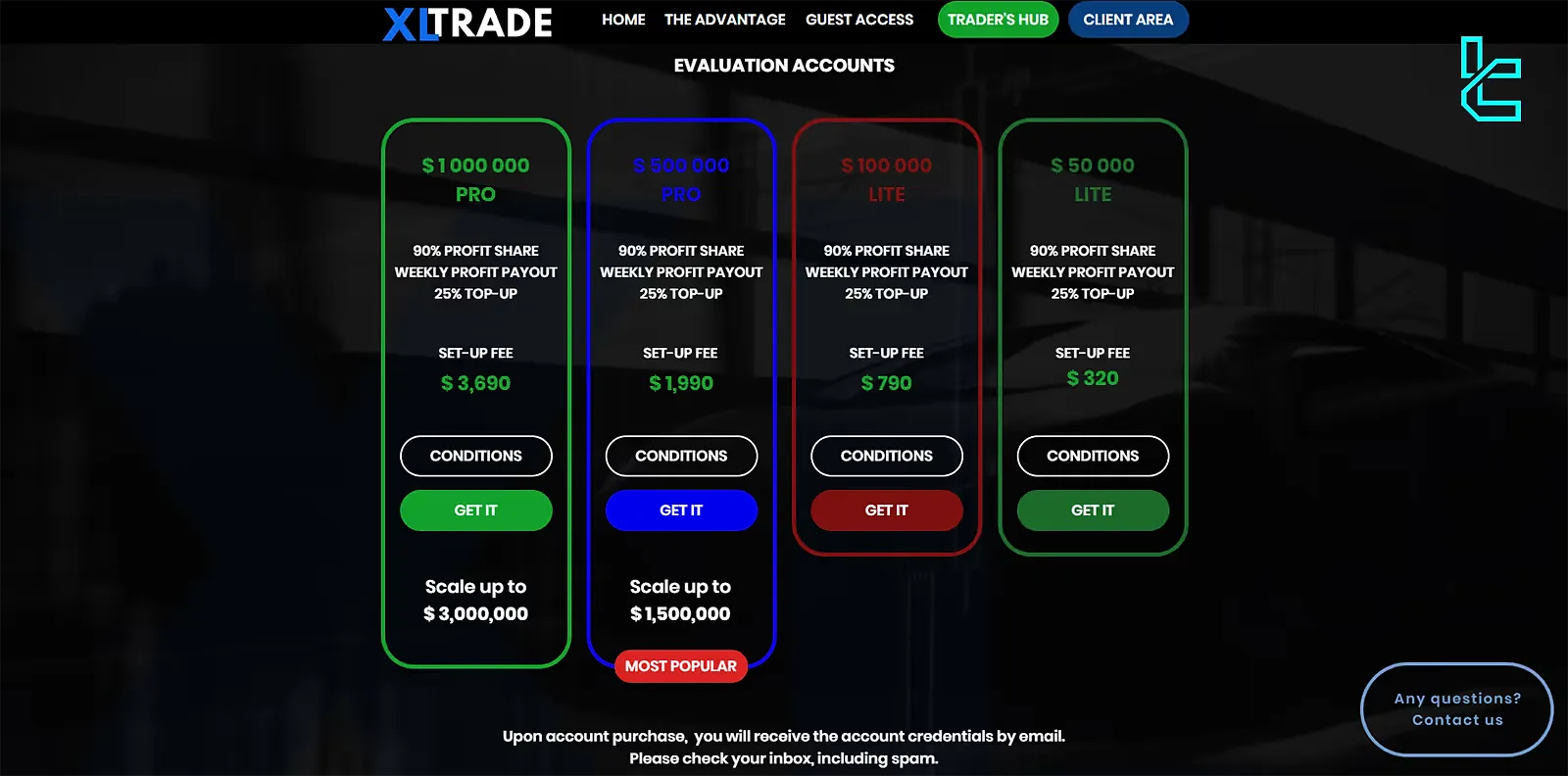

XLTrade funding & price

XLtrade's funding model is designed to cater to traders with various experience levels and capital requirements.

Here's a breakdown of their funding options:

Account Type | Capital Provided | Setup Fee |

Lite1 | $50,000 | $250 |

Lite2 | $100,000 | $500 |

Pro1 | $500,000 | $1,490 |

Pro2 | $1,000,000 | $2,990 |

It's worth noting that while these funding amounts are substantial, the associated setup fees are non-trivial. Traders should consider their ability to meet the evaluation criteria before committing to these fees.

XLTrade registration & verification Process

Joining XLTrade involves a straightforward process:

- Visit the XLTrade website and click on "Start Now";

- Complete the registration form with your details;

- Get your password;

- Use the password for Guest Access and enter;

- Choose your preferred account type and funding amount;

- Fill in the billing details and make a payment;

- Go to the dashboard by clicking on “Access Dashboard”;

- Head to the verification section to verify your identity by submitting the required documents (typically proof of ID and address).

XLTrade claims to cater to traders from over 160 countries, emphasizing their global reach. However, verifying whether your country is eligible before proceeding with registration is crucial.

XLTrade Evaluation steps

XLTrade employs a two-cycle evaluation process (for all accounts) to assess traders' skills and risk management abilities:

Cycle | Duration | Profit Target | Maximum Drawdown | Max. Leverage |

Cycle One | 30 days | 10% | 5% | 1:500 |

Cycle Two | 30 days | 10% | 5% | 1:500 |

Traders must complete both cycles to receive a fully funded account. The absence of daily loss limits provides flexibility but requires traders to exercise strong self-discipline and risk-management skills.

XLTrade bonuses and discount offerings

XLTrade does not explicitly offer bonuses or discounts as part of its services. Its focus is on providing high funding amounts and favorable profit-sharing terms rather than promotional offers. However, XLTrade does emphasize several attractive features of their service:

- 90% profit share for traders

- Weekly profit payouts

- No profit limits or restrictions

XLTrade trading platforms

XLTrade provides access to one of the most popular trading platforms (MetaTarder5) and its WebTrader version in the Forex and CFD trading world.

MetaTrader 5 features:

- More advanced version of MT4

- Additional timeframes and order types

- Enhanced backtesting capabilities

- Access to a wider range of markets

XLtrade's provision of MT5 allows traders to choose the platform that best suits their trading style and needs. The support for automated trading is particularly noteworthy as it enables traders to implement and test complex strategies.

TradingFinder has developed various advanced MT5 indicators that you can use for free.

What instruments & symbols can I trade on XLTrade prop firm?

XLTrade provides a wide selection of trading instruments, from the Forex market to indices, accommodating different trading styles and strategies:

Markets | Instruments |

Forex | EUR/USD, GBP/USD, USD/JPY , … |

Stocks | Various global stocks like US Stocks |

Indices | S&P 500, NASDAQ, FTSE 100 |

Commodities | Gold, Silver, Oil |

This wide selection of instruments allows traders to diversify their portfolios and exploit opportunities across different markets. However, it's crucial to note that the availability of specific symbols may vary, and traders should always check the current offerings and any associated trading conditions or restrictions.

XLTrade payment methods

XLTrade offers several payment methods to accommodate traders from different regions:

Transaction Type | Payment Methods |

Withdrawals | Bank Wire, Crypto (Trader provides bank details or Crypto address) |

Deposits | Visa, Master Card, Bank Transfer, Crypto |

While XLTrade claims to offer various payment methods, the available options may depend on your location. It's advisable to check with their support team for the most up-to-date information on available payment methods in your region.

XLTrade commission & costs

Understanding the fee structure is crucial when considering a prop firm. Here's a breakdown of XLtrade's commission and costs:

Category | Details |

Trading Costs | No commissions, Spreads vary, Overnight swap fees may apply |

Withdrawal Fees | No fees by XLtrade, Third-party fees may apply |

Inactivity Fees | No clear info provided |

It's also worth noting that while XLTrade prop firm doesn't charge commissions, the spread costs can add up, especially for high-frequency traders.

When evaluating the overall value proposition, always consider the total cost of trading, including spreads.

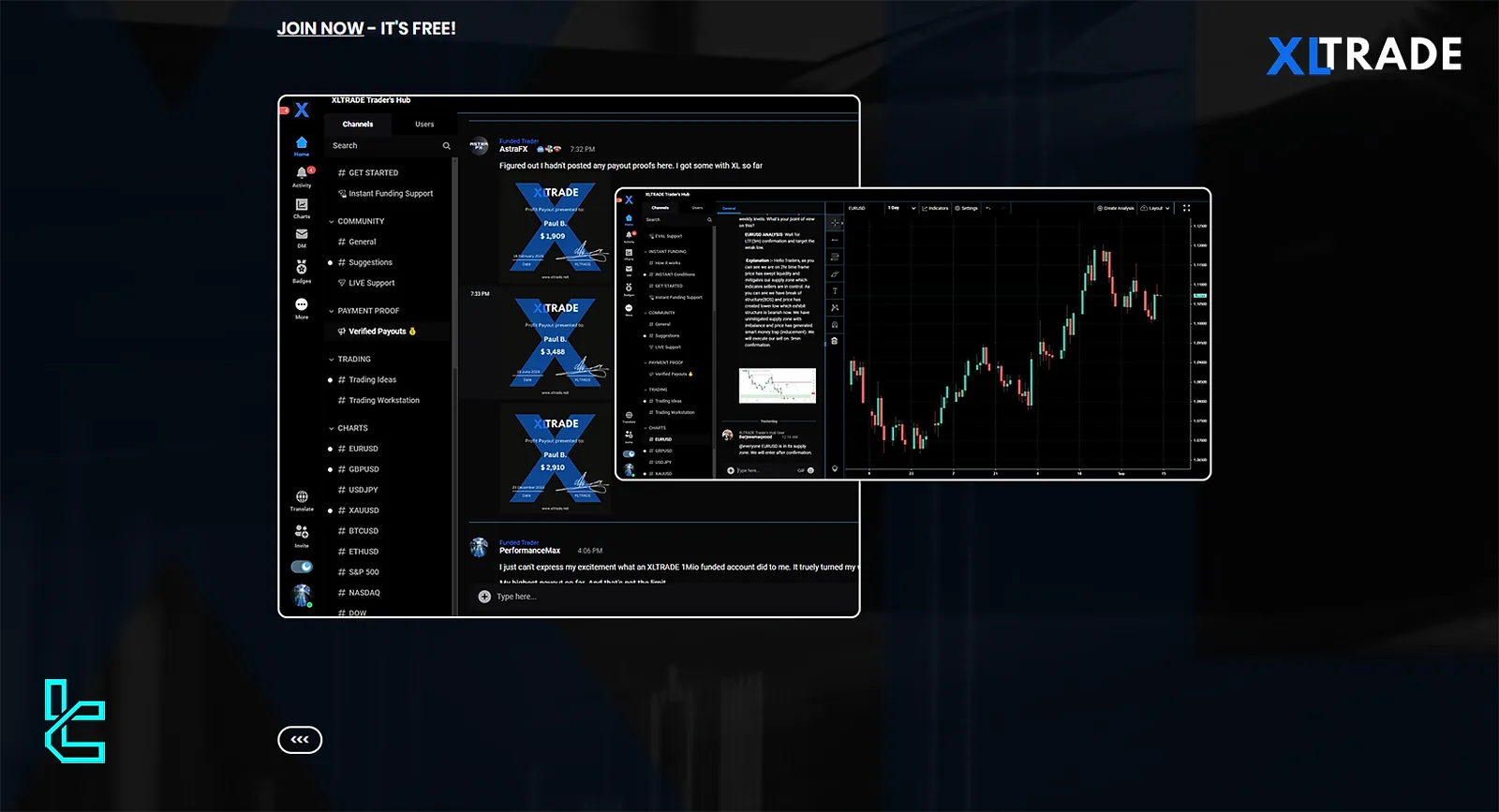

Does XLTrade offer vast educational resources?

Unfortunately, XLTrade falls short in the area of educational resources.

Unlike many reputable prop firms and brokers that offer comprehensive educational materials, XLtrade's offerings in this department are quite limited. Instead, the firm has dedicated a section named Trader's Hub, where traders can join the community to seek help and ask advanced questions.

XLTrade Trust Scores on Review Websites

Trust scores and customer reviews play a crucial role in assessing the reliability of a prop firm. Let's examine XLtrade's standing on Trustpilot:

- XLtrade TrustpilotScore: 4.6/5 (based on 101 reviews as of 2023).

This score indicates a generally positive sentiment among reviewers. Key points from the reviews include:

Aspect | Positive | Negative |

Details | Efficient support, fair trading conditions, helpful staff | misunderstandings of trading rules, account termination complaints |

It's important to note that while the Trustpilot score is high, it contrasts with the lower rating on the Forex Peace Army (FPA) website. This discrepancy underscores the importance of consulting multiple sources when evaluating a prop firm's reputation.

XLTrade prop firm customer support

Customer support is a critical aspect of any trading service. XLTrade offers several channels for customer support:

- Ticket System

- Live Chat (Trader’s Hub)

- Phone Support: +44 (0) 203 289 9020

XLTrade social media channels

In today's digital age, a company's social media presence can provide valuable insights into its operations and customer engagement. XLTrade maintains a presence on some social media platforms:

- YouTube

However, the overall social media engagement appears limited compared to other prop firms.

Expert suggestions

In conclusion, XLTrade stands out with its low entry point starting at $250 and an appealing profit split of up to 90%.

The firm provides access to a wide range of trading instruments on popular platforms such as MetaTrader 5 and WebTrader.

While XLTrade prop firm may lack educational resources, its trading conditions, like 0 commission, bi-weekly payouts, and allowance for news trading, make it an attractive choice for prop traders.

Trustpilot reviews highlight the firm's efficient support, fair trading conditions, and helpful staff, earning it a score of 4.6/5 based on 101 reviews as of 2023.