Anzo Capital verification is a fast 2-step KYC procedure required for activating your account and enabling withdrawals. It includes uploading a valid identity document and proof of address.

Anzo Capital KYC Process and Full Walkthrough Overview

The authentication process is initiated after finalizing Anzo Capital registration. Once documents are submitted and reviewed, users can access all financial features on the Anzo Capital broker.

Anzo Capital verification main steps:

- Upload identity and address confirmation documents;

- Track document review status.

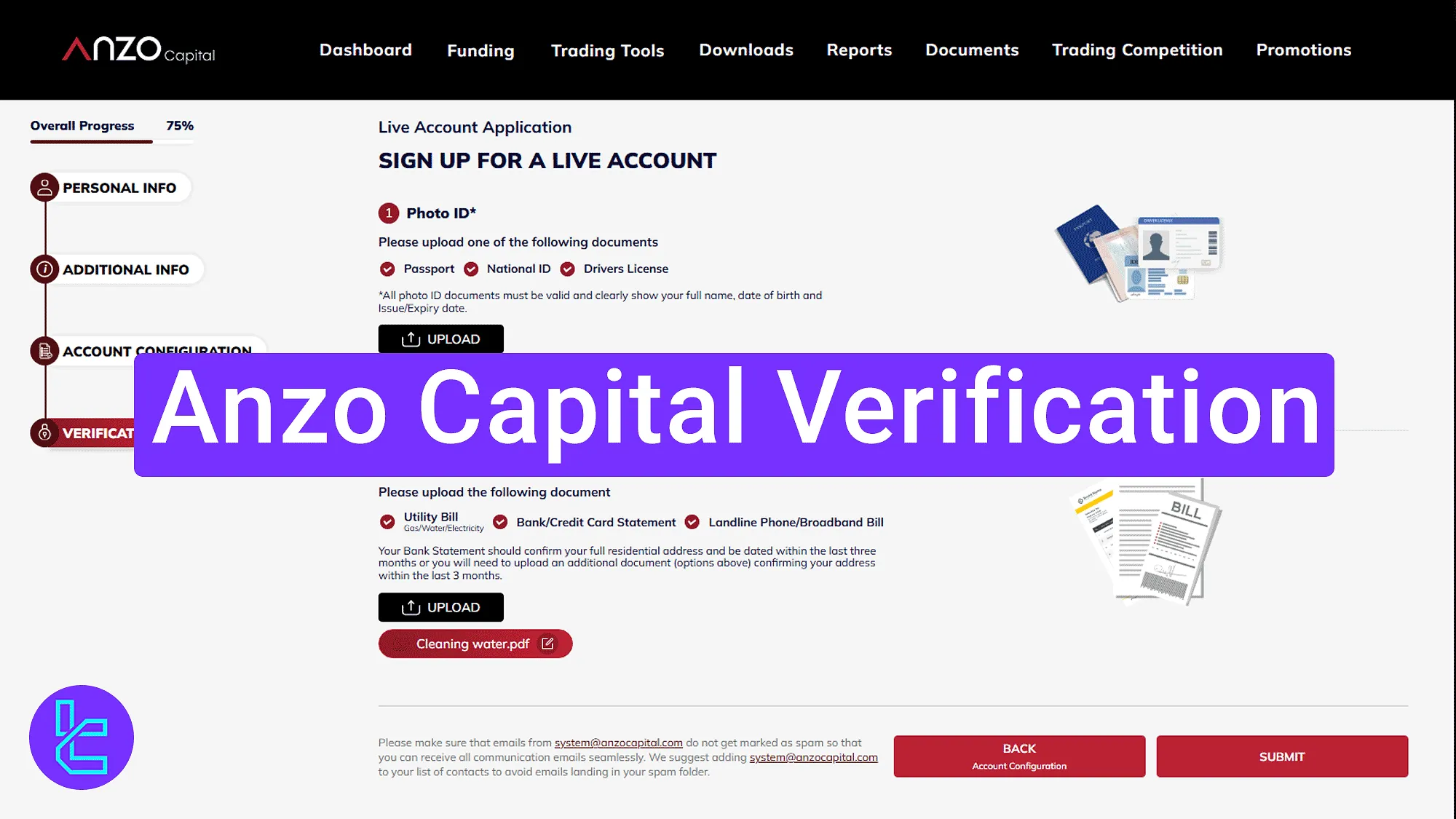

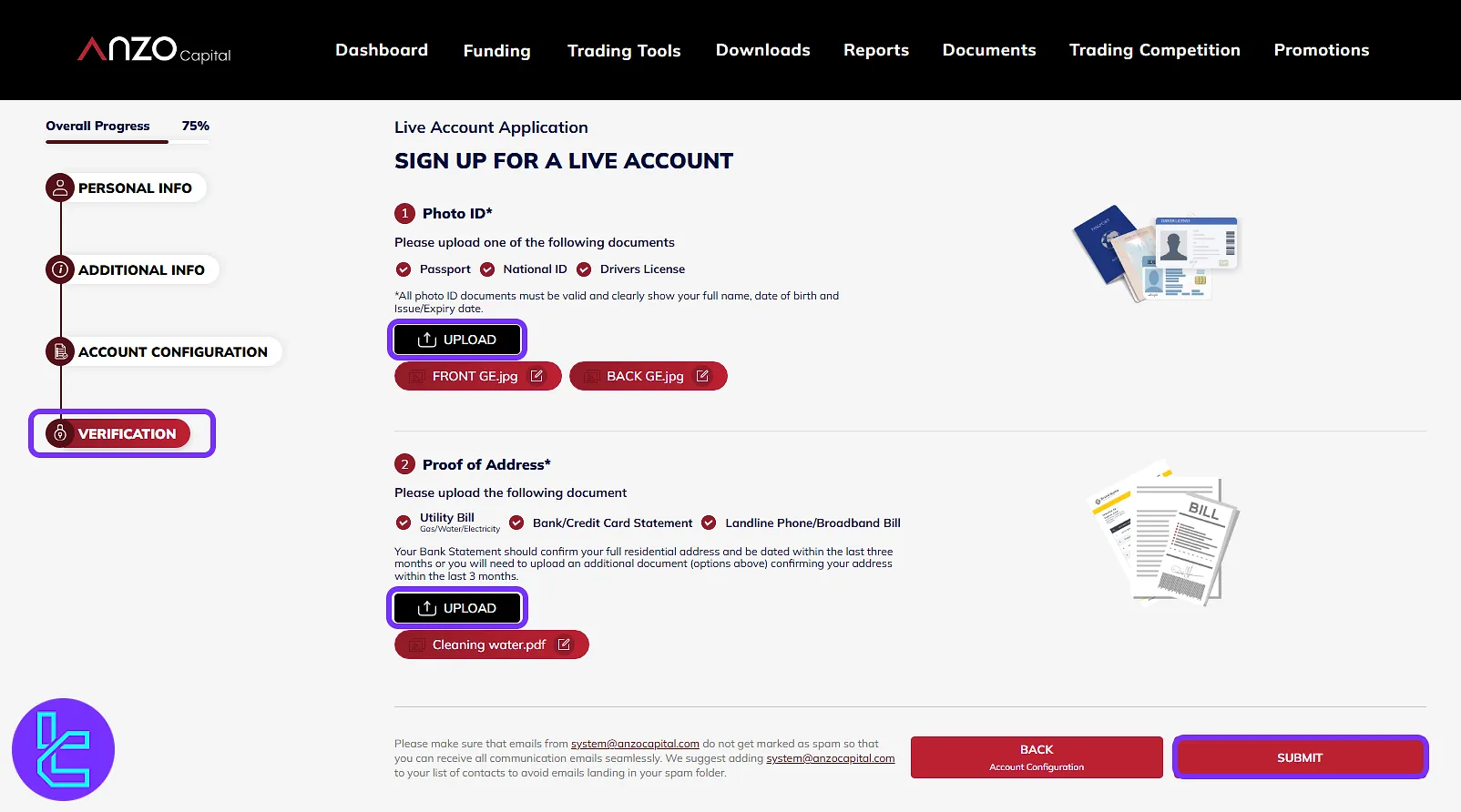

#1 Submitting Identity and Address Documents

Navigate to the "Verification" section on the Anzo Capital dashboard and upload the required files for both identity and residence confirmation.

Accepted identity documents:

- Passport

- National ID

- Driver’s license

Accepted proof of address:

- Utility bill (gas, water, electricity)

- Bank/credit card statement

- Landline phone or broadband bill

Proof of address documents must be valid, clearly legible, and issued within the last 3 months.

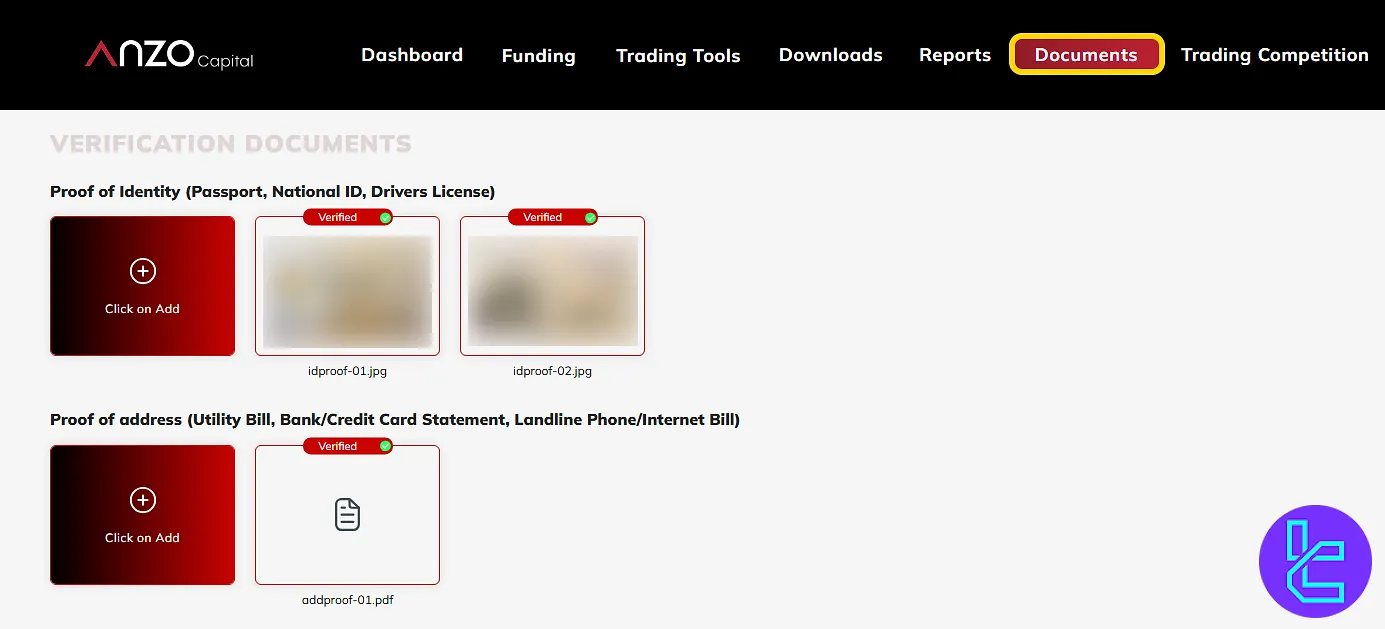

#2 Reviewing the Document Status

After uploading the files, navigate to the "Documents" section in the dashboard. There you can view the status of each uploaded document.

TF Expert Suggestion

Anzo Capital verification takes less than 10 minutes to complete, with documents typically approved within one business day.

Traders can submit passport, driver’s license, or ID card as proof of identity and a utility bill, Bank/credit card statement, or Landline phone or broadband bill as proof of address.

Now that your account is verified, explore Anzo Capital deposit and withdrawal methods by checking the articles on the Anzo Capital tutorial page to fund it.