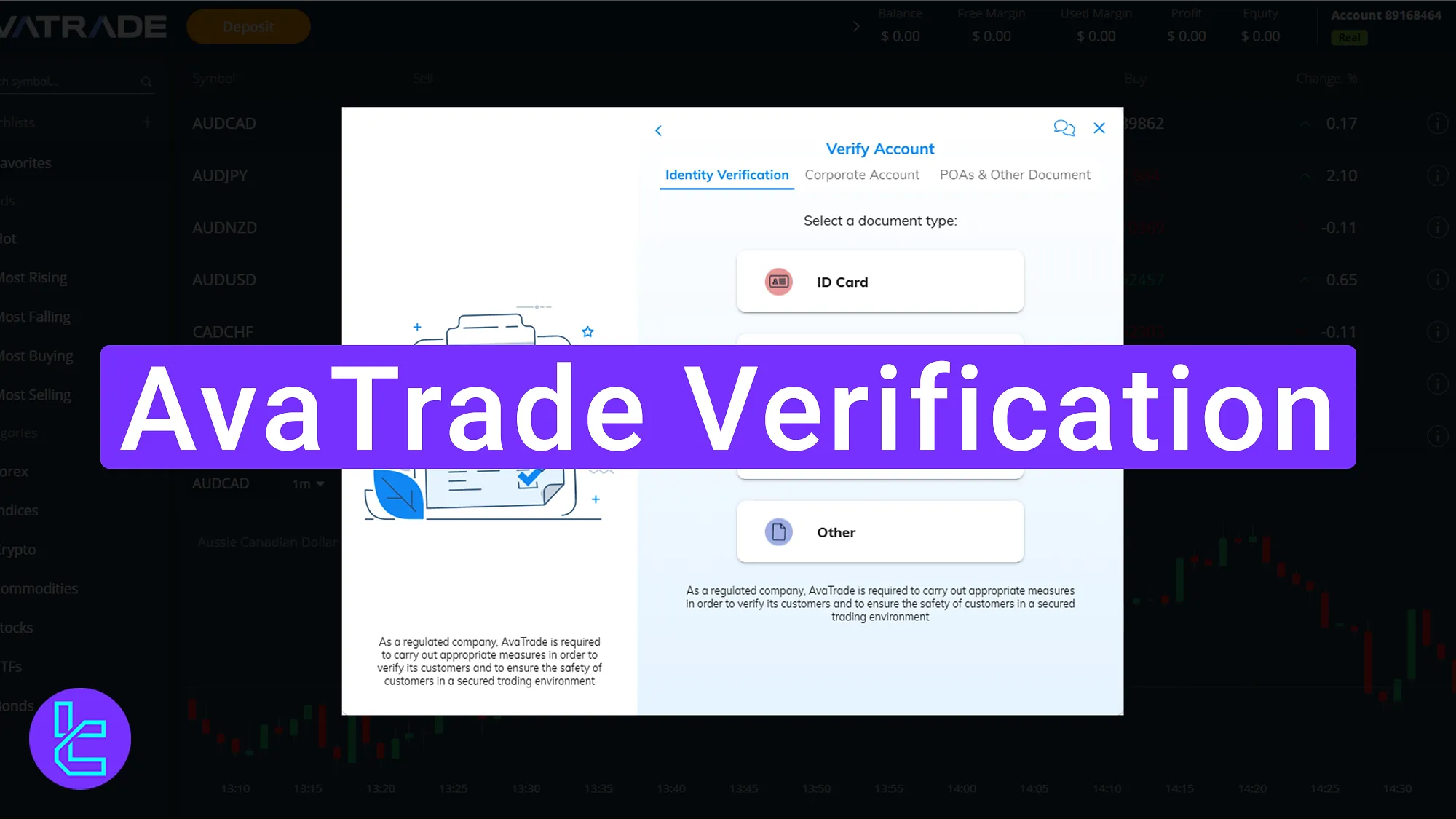

The AvaTrade verification process is a mandatory 3-step procedure that allows traders to access essential trading features. This process involves submitting valid identification and address documents, as well as ensuring compliance with regulatory requirements.

Traders who verify their accounts with this broker can benefit from 1:400 leverage and access various tradable instruments across multiple platforms, including MT4, MT5, DupliTrade, and AvaOptions.

How to Complete the AvaTrade Verification Process

After the AvaTrade registration process, complete the KYC process to unlock all trading capabilities. AvaTrade broker verification steps:

- Access the verification section;

- Upload proof of identity (POI) documents;

- Submit proof of address (POA) documents.

Check the Table below to see if you have all the required documents and information to verify your AvaTrade account.

Verification Requirement | Yes/No |

Full Name | No |

Country of Residence | No |

Date of Birth Entry | No |

Phone Number Entry | No |

Residential Address Details | No |

Phone Number Verification | No |

Document Issuing Country | Yes |

ID Card (for POI) | Yes |

Driver’s License (for POI) | Yes |

Passport (for POI) | Yes |

Residence Permit (for POI or POA) | Yes |

Utility Bill (for POA) | Yes |

Bank Statement (for POA) | Yes |

2-Factor Authentication | No |

Biometric Face Scan | No |

Financial Status Questionnaire | No |

Trading Knowledge Questionnaire | No |

Restricted Countries | Yes |

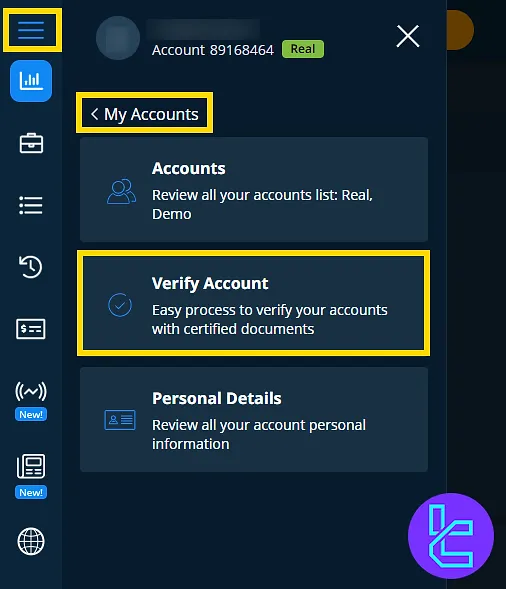

#1 Accessing the Verification Section from the Dashboard

Log in to the AvaTrade Forex broker, select "My Account", and then click on "Verify Account" to begin.

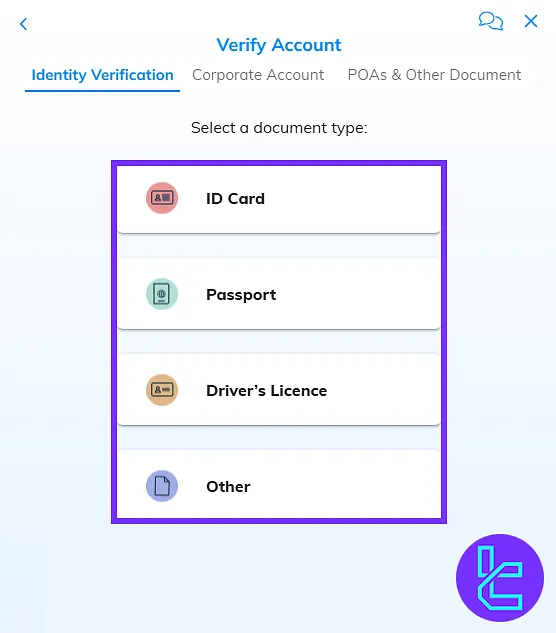

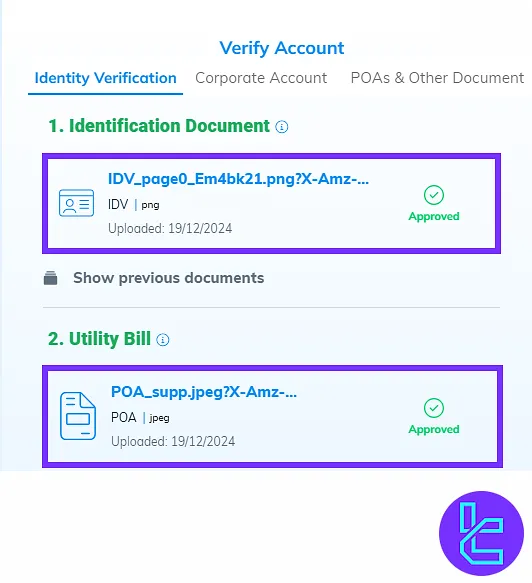

#2 Uploading Proof of Identity (POI)

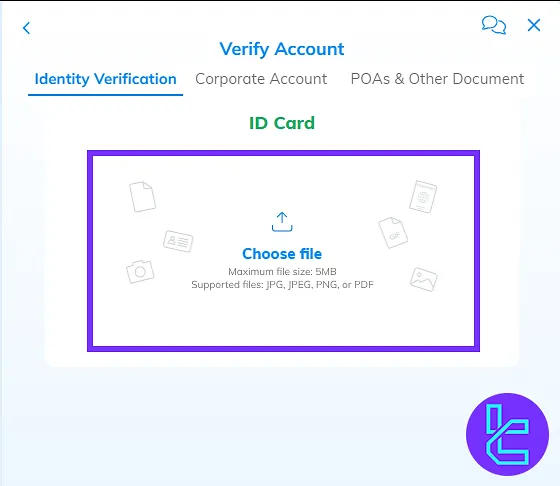

Choose the type of document for identity verification. Acceptable options include a National ID card, a passport, or a driver’s license.

Upload a clear photo of the front and back sides of your chosen ID document, ensuring all four corners and the expiration date are visible.

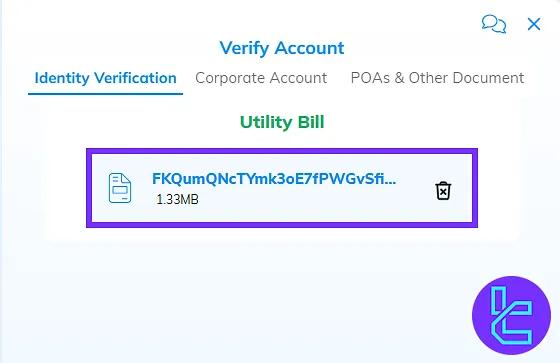

#3 Submitting Proof of Address (POA)

Next, upload a recent proof of address document. Accepted documents include utility bills (electricity, gas, water), bank statements, or an official residence certificate.

Ensure the document is issued within the last 6 months and displays your full name and current address.

After uploading, you can check your KYC status by selecting "My Account" and clicking on "Verify Account" on the AvaTrade dashboard.

Now that your account is verified, you can cash out profits using the AvaTrade Neteller withdrawal methods.

AvaTrade KYC vs Other Brokers

Check the table below to see the difference between AvaTrade KYC requirements and other brokers.

Verification Requirement | AvaTrade Broker | |||

Full Name | No | Yes | No | No |

Country of Residence | No | No | No | Yes |

Date of Birth Entry | No | Yes | No | No |

Phone Number Entry | No | No | No | No |

Residential Address Details | No | Yes | No | Yes |

Phone Number Verification | No | Yes | No | No |

Document Issuing Country | Yes | Yes | No | No |

ID Card (for POI) | Yes | Yes | Yes | Yes |

Driver’s License (for POI) | Yes | Yes | Yes | Yes |

Passport (for POI) | Yes | Yes | Yes | Yes |

Residence Permit (for POI or POA) | Yes | Yes | No | No |

Utility Bill (for POA) | Yes | No | Yes | Yes |

Bank Statement (for POA) | Yes | No | Yes | Yes |

2-Factor Authentication | No | No | No | No |

Biometric Face Scan | No | No | Yes | No |

Financial Status Questionnaire | No | Yes | No | Yes |

Trading Knowledge Questionnaire | No | Yes | No | No |

Restricted Countries | Yes | Yes | Yes | Yes |

TF Expert Suggestion

The AvaTrade verification process requires the submission of proof of identity (POI) and proof of address (POA) documents. Document uploads typically take 5 to 7 minutes, with broker approval processed within 1 to 2 business days.

After your account is verified, learn about AvaTrade's deposit and withdrawal options to submit payout requests by visiting the AvaTrade tutorial page.