BDSwiss provides Forex and CFD trading services on over 250 financial instruments through its Zero-Spread and VIP accounts. Leverage options of up to 1:2000 andspreads from 1.3 pips are available with a minimum deposit of $10.

The broker operates multiple account types: Cent, Classic, VIP, and Raw. The VIP account, for instance, requires a minimum deposit of $250 and provides spreads from 1.0 pip, while the Raw account offers ultra-tight spreads from 0.3 pips for a $500 minimum deposit.

BDSwiss; An Introduction to the Company and Its Regulatory Status

BDSwiss is a well-established and regulated Forex and CFD broker serving traders worldwide since 2012. While the broker was previously licensed by CySEC, its restructuring in 2023 changed the focus to MENA, LATAM, and APAC regions.

German entrepreneur and investor Jan Malkus leads the broker and now operates as part of the BDS Ltd company, registered in Mahe, Seychelles. Here is a list of BDSwiss licenses in various countries.

- Financial Services Authority (FSA) Seychelles: SD047

- Financial Services Commission (FSC) Mauritius: C116016172

- International Services Authority (MISA): T2023244

- Securities & Commodities Authority (SCA) UAE: 20200000188

Here are the regulatory details of the broker:

Parameters/Branches | BDSwiss (Seychelles) Ltd | BDSwiss Markets (Mauritius) Ltd |

Regulation | Financial Services Authority (FSA), Licence SD047 | Financial Services Commission (FSC), Licence C116016172 |

Regulation Tier | N/A | N/A |

Country | Seychelles | Mauritius |

Investor Protection Fund / Compensation Scheme | None | None |

Segregated Funds | Yes | Yes |

Negative Balance Protection | N/A | N/A |

Maximum Leverage | 1:2000 | N/A |

Client Eligibility (Exclusions) | DRC, Eritrea, India, Iran, Japan, DPRK, Libya, Mauritius, Myanmar, Seychelles, Somalia, Sudan, Syria, USA (and reportable persons), UK | Canada, DRC, Eritrea, India, Indonesia, Iran, Japan, DPRK, Libya, Malaysia, Mauritius, Myanmar, Pakistan, Philippines, Russia, Seychelles, Somalia, South Africa, Sudan, Syria, Thailand, USA (and reportable persons), UK, Vietnam, EU; Cyprus & USA nationals excluded |

Specific Details about BDSwiss Broker

BDSwiss is one of the top Forex brokers (Fastest Growing Multi-Asset Broker 2023), which offers a comprehensive suite of trading services and features designed to cater to novice and experienced traders.

Broker | BDSwiss |

Account Types | Cent, Classic, VIP, Raw |

Regulating Authorities | FSC, FSA, MISA, SCA |

Based Currencies | ZAR, USD, GBP, EUR |

Minimum Deposit | $10 |

Deposit Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Crypto |

Withdrawal Methods | Credit/Debit Cards, Bank Transfer, E-Payments, Crypto |

Minimum Order | 0.01 lots |

Maximum Leverage | Default Leverage (up to 1:400) Dynamic Leverage (up to 1:2000) |

Investment Options | None |

Trading Platforms & Apps | MT4, MT5, BDSwiss mobile app, Proprietary WebTrader |

Markets | Forex, Indices, Commodities, Stocks, Crypto |

Spread | Variable based on the account type and instrument |

Commission | Variable based on the account type and instrument |

Orders Execution | Market |

Margin Call / Stop Out | 50% / 20% |

Trading Features | Mobile Trading, PAMM, Trading Analysis, Autochartist Integration |

Affiliate Program | Yes |

Bonus & Promotions | Partnership |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Ticket |

Customer Support Hours | 24/5 |

BDSwiss Account Types

BDSwiss offers four main live account types, each catering to a different level of trading experience and funding capacity:

- Cent Account: Designed for beginners, it requires a minimum deposit of just $10, supports micro-lot trading, and provides leverage up to 1:2000. However, the number of available assets is limited, and MT5 is not supported

- Classic Account: A standard choice with a $10 minimum deposit, spreads from 1.3 pips, no commission, and access to over 250 instruments. Suitable for casual and intermediate traders

- VIP Account: Geared toward more active traders, this account starts at $250, offers tighter spreads from 1.0 pip, and includes premium tools, exclusive webinars, and dedicated support

- Raw Account: Tailored for professionals and scalpers, it offers spreads from 0.3 pips with a $5 commission per lot. Requires a$500 minimum deposit. Swap-free mode is not available

All accounts provide leverage up to 1:2000 (dynamically adjustable), except where limited by jurisdiction. A demo account is available for Classic, VIP, and Raw accounts, preloaded with $10,000 in virtual funds and has no expiration, ideal for trading strategy testing.

Why BDSwiss? (Pros & Cons)

When considering BDSwiss as your broker of choice, it's essential to weigh its advantages and disadvantages.

Upsides | Downsides |

More than a decade of experience | Limited tradable assets (250+ CFDs) |

Comprehensive educational resources | $30 inactivity fee after 90 days |

A wide range of account types (Cent and Zero-Spread) | High minimum deposit for Zero-Spread account |

Negative balance protection | Lack of 24/7 customer support |

So for anyone looking for a wide range of accounts, educational resources, and reliability, BDSwiss is a great option.

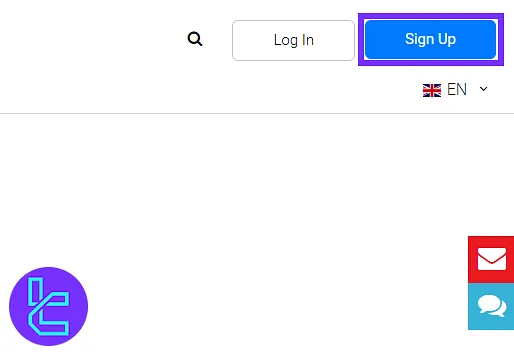

BDSwiss Account Opening and Verification

Creating a new trading account and verifying it with BDSwiss broker is easy and only requires completing a few simple steps. BDSwiss registration:

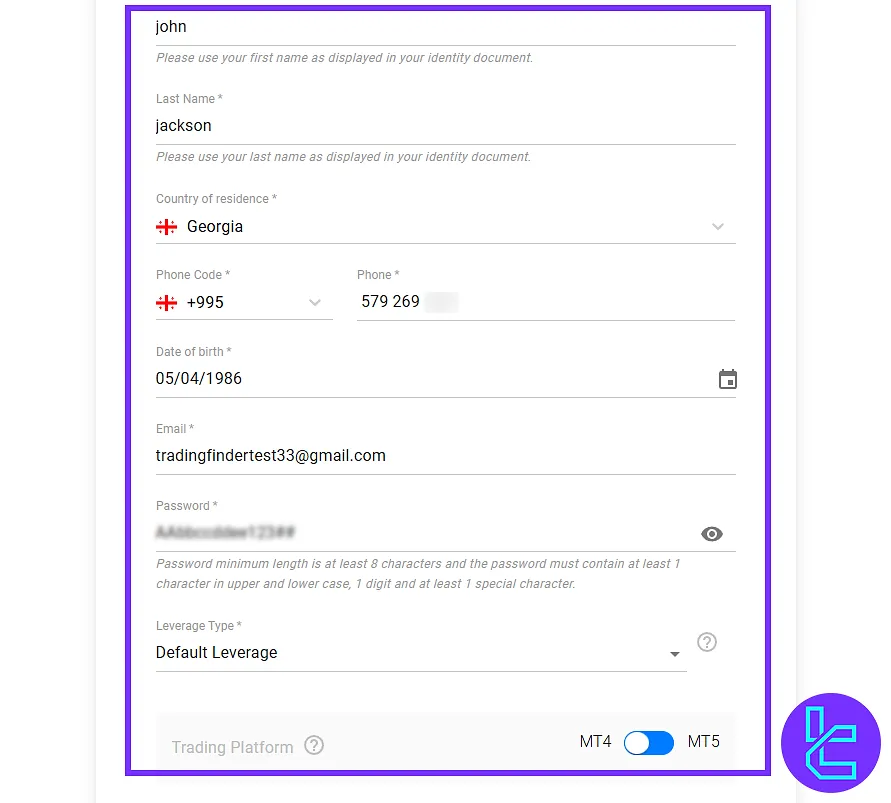

#1 Start the Sign-Up Process

Head to the official BDSwiss website and click on “Sign Up” to access the account registration form.

#2 Submit Personal & Trading Info

Fill in the form with the following details:

- First and last name

- Country of residence

- Mobile number

- Date of birth

- Email address

- Secure password

- Select preferred trading platform (MT4 or MT5)

- Choose the desired leverage level

- Confirm you're over 18 and agree to terms

Then, click “Submit” to proceed.

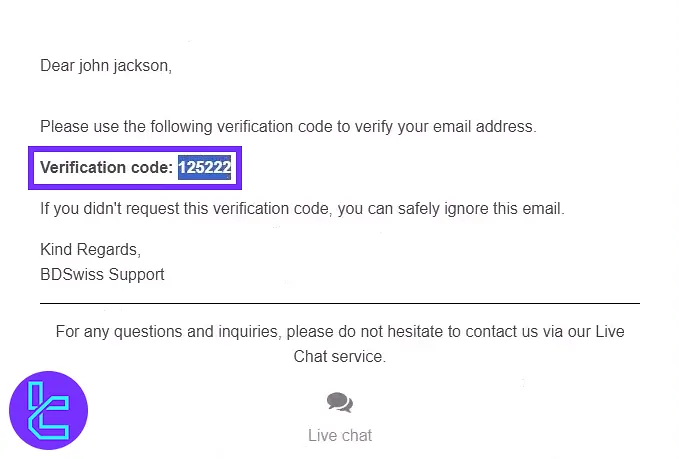

#3 Verify Your Email

Check your inbox for a6-digit code sent by BDSwiss. Paste it into the confirmation field and click “Proceed and Secure Account” to activate your dashboard.

#4 Complete the KYC Process

To complete the BDSwiss verification process, traders must provide the following documents:

- Proof of identity: Passport, ID card, driver's license

- Proof of address: Utility bill or bank statement

Available Trading Platforms on BDSwiss Broker

BDSwiss supports a diverse suite of trading platforms tailored to various trader preferences and experience levels:

- MetaTrader 4 (MT4): Offers customizable charting, robust order types, and automated trading via expert advisors (EAs), making it ideal for forex-focused traders

- MetaTrader 5 (MT5): Builds on MT4 with depth of market features, more asset classes, and advanced technical indicators, suitable for multi-asset strategies

- BDSwiss WebTrader: A lightweight, browser-based platform powered by TradingView charting. It’s user-friendly and convenient, but lacks layout customization and algorithmic trading tools

- Mobile Apps: Available for Android and iOS, enabling users to monitor and execute trades with real-time data and notifications

A standout feature is BDSwiss’s proprietary AI-powered trend analysis tool, integrated into the WebTrader since 2021. It delivers automated signals and real-time trend insights to support trade timing and risk management.

However, BDSwiss does not offer cTrader or a full TradingView terminal, which may be a limitation for traders relying on those ecosystems.

BDSwiss Broker Fee Structure

BDSwiss uses a mix of spread-based and commission-based pricing models depending on the account type and asset class:

- Classic & VIP Accounts: No commission on forex trades. Index trades incur a flat $2 fee per lot, while share CFDs are charged 0.15% of the trade value.

- Zero-Spread Account: Designed for professional traders, it offers raw spreads from 0.0 pips but applies a $6 commission per lot on forex and commodities, $2 on indices, and 0.15% on shares.

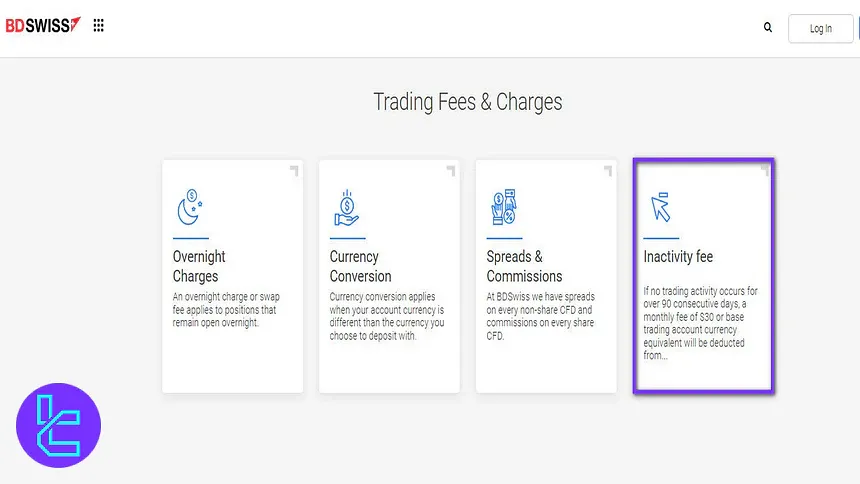

Spreads vary by account type, starting at 1.6 pips (Cent), 1.3 pips (Classic), 1.0 pip (VIP), and 0.0 pips (Raw). Non-trading fees include a $30 inactivity charge applied monthly after 90 consecutive days of no activity. Withdrawals are mostly free, except for bank wires under $100, which incur a $10 fee. Deposits are free across all methods.

Additional charges, such as overnight swap rates or guaranteed stop-loss order fees, are transparently disclosed. Traders may incur currency conversion costs if their deposit currency differs from their base account currency.

BDSwiss Swap Fees

Trading positions that remain open beyond 21:00 GMT incur financing costs known as swap or rollover charges. These overnight fees differ from one instrument to another, and the full schedule is detailed in the broker’s CFD Asset List & Charges.

BDSwiss applies several operational rules to its rollover model:

- Wednesday carries a triple-swap adjustment, reflecting the weekend rollover;

- The company may modify a client’s swap rate if trading behavior suggests potential swap-related abuse;

- Swap values are variable and can be updated without prior notice.

BDSwiss provides clear,instrument-specific information on swap short and swap long rates for every tradable pair directly on its official website.

BDSwiss Non-Trading Fees

BDSwiss applies an inactivity charge to accounts with no trading activity for more than 90 days, deducting $30 per month (or the equivalent in the account’s base currency).

The deduction continues until the account balance is depleted, reflecting the platform’s administrative and maintenance costs for inactive accounts.

The broker does not impose its own fees on deposits or withdrawals; however, clients may still incur bank transfer charges depending on their payment provider.

BDSwiss Deposit and Withdrawal

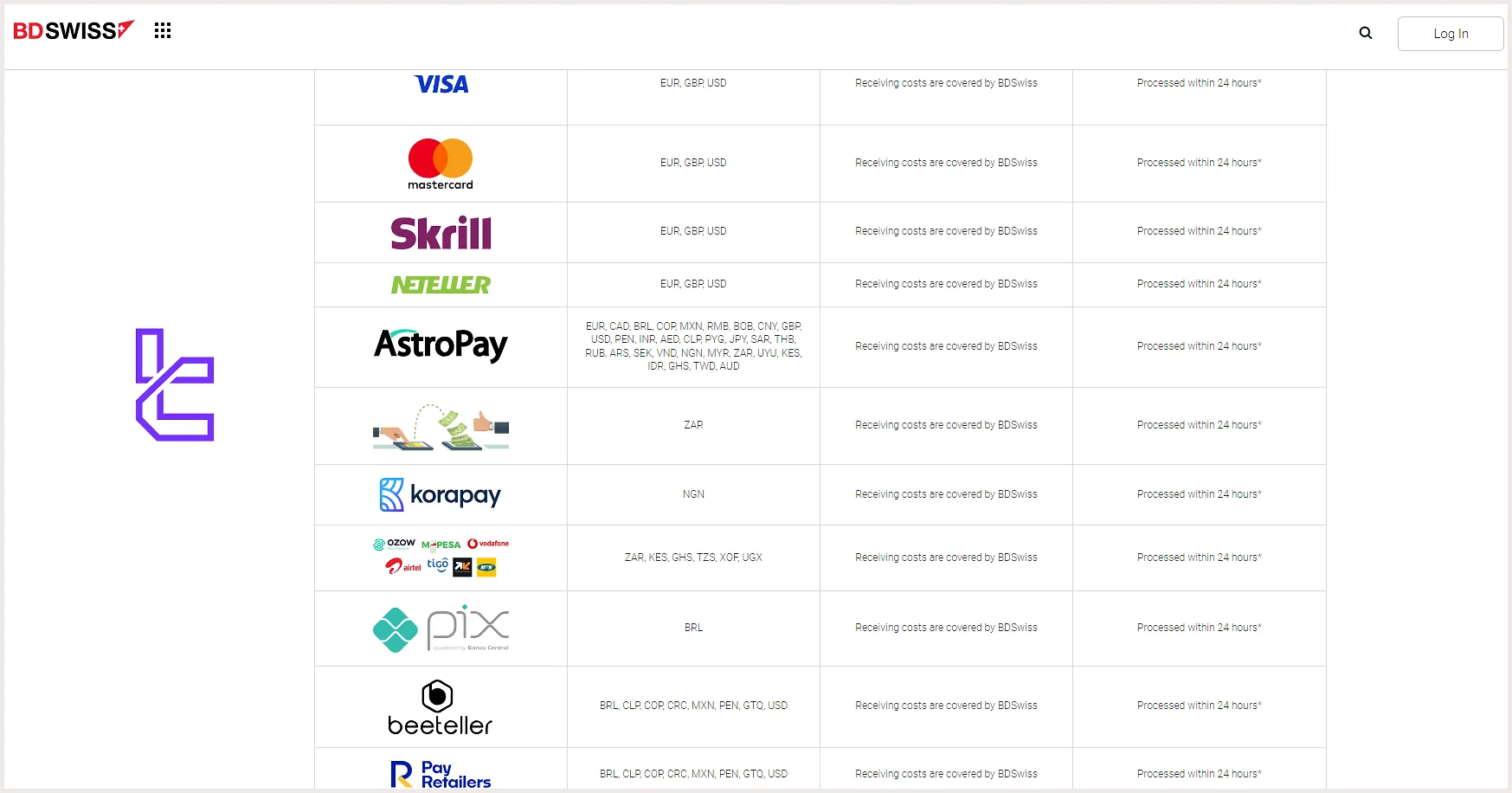

BDSwiss offers a wide array of deposit and withdrawal options, from bank transfers to e-payments, to cater to its global client base. BDSwiss deposit and withdrawal methods:

- Deposit Methods: Include credit/debit cards (Visa, Mastercard), bank transfers, and a variety of e-wallets like Skrill, Neteller, AstroPay, and cryptocurrency payments (BTC, ETH, USDT, etc.). Deposits are fee-free and typically processed instantly

- Withdrawal Methods: Mirror deposit options and are processed within 24 hours. Withdrawals are free for most methods, except for bank wire withdrawals under $100, which incur a $10 fee

- Base Account Currencies: Traders can choose between USD, EUR, GBP, or ZAR, helping reduce currency conversion costs

- Minimum Deposit: Starts from $10 globally, except for $100 in GCC countries

- Security & Verification: Identity verification (KYC) is required before withdrawal, and all transactions are secured with encryption protocols

BDSwiss clearly outlines any applicable currency conversion or overnight swap charges in advance, ensuring cost transparency at every stage.

If you are interested in learning how you can fund your account with one of the best available methods, we suggest checking the BDSwiss Tether ERC20 deposit article.

BDSwiss Deposit

BDSwiss offers a broad selection of funding options through established payment service providers, giving traders flexibility when adding funds to their accounts.

All deposit actions are handled through a secure client portal designed to protect both personal data and financial transactions.

Most supported methods, ranging from traditional VISA / Mastercard, to e-wallets such as Skrill and Neteller, regional systems like Pix and PromptPay, and multiple cryptocurrencies, are processed almost instantly.

BDSwiss covers the receiving costs for all deposit channels except blockchain-based transfers, where standard network fees apply. Deposit processing times vary slightly, with bank wire transfers requiring up to several business days.

Here are the details for all the deposit methods:

Payment Option | Accepted Currencies | Fees | Processing Time |

VISA | EUR, GBP, USD | Receiving costs covered by BDSwiss | Instant |

Mastercard | EUR, GBP, USD | Receiving costs covered by BDSwiss | Instant |

Skrill | EUR, GBP, USD | Receiving costs covered by BDSwiss | Instant |

Neteller | EUR, GBP, USD | Receiving costs covered by BDSwiss | Instant |

Astro Pay | EUR, CAD, BRL, COP, MXN, RMB, BOB, CNY, GBP, USD, PEN, INR, AED, CLP, PYG, JPY, SAR, THB, RUB, ARS, SEK, VND, NGN, MYR, ZAR, UYU, KES, IDR, GHS, TWD, AUD | Receiving costs covered by BDSwiss | Instant |

PayO | ZAR | Receiving costs covered by BDSwiss | Instant |

Korapay | NGN | Receiving costs covered by BDSwiss | Instant |

OZOW, MPESA, Airtel, Vodafone, MTN, Airtel Tigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Receiving costs covered by BDSwiss | Instant |

Pix | BRL | Receiving costs covered by BDSwiss | Instant |

Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Receiving costs covered by BDSwiss | Instant |

Pay Retailers | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Receiving costs covered by BDSwiss | Instant |

PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Receiving costs covered by BDSwiss | Instant |

UPI | INR | Receiving costs covered by BDSwiss | Instant |

LetKnow, SpeedlightPay, ChipPay (Crypto) | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZEC, ADA | Network fee applies | Instant |

Bank Wire | EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK | Receiving costs covered by BDSwiss | 1–5 days |

BDSwiss ERC20 Deposit

The BDSwiss ERC20 deposit method allows traders to fund their accounts using Tether (USDT) on the ERC-20 network in a fast and simple process that typically takes 3–5 minutes.

The minimum transfer amount is $10, making it accessible for most users. This option is part of BDSwiss’ broader range of cryptocurrency payment methods, offering a convenient way to add funds directly through blockchain transactions.

To complete an ERC-20 deposit, traders log into their BDSwiss dashboard, open the Transactions section, select the trading account and deposit amount, and choose the ERC-20 funding option.

The platform then provides a unique wallet address that must be copied for the transfer. Once the payment is sent, users can return to the Transactions page to confirm that the deposit has been successfully credited.

BDSwiss Withdrawal

BDSwiss supports fund withdrawals through a wide range of global and regional payment systems, allowing traders to move capital using their preferred method.

All requests are handled through a secure infrastructure designed to ensure transparent processing and to maintain transaction safety.

Most withdrawal options, including VISA, Mastercard, Skrill, Neteller, AstroPay, regional services like MPESA, Pix, and cryptocurrency channels such as USDT, BTC, and ETH, are generally completed within 24 hours.

BDSwiss covers the receiving costs for every withdrawal method listed. Processing times for bank wire transfers follow the same internal 24-hour handling window, though external banking times may vary.

Let’s check out the details for all of the available methods:

Payment Option | Accepted Currencies | Fees / Commission | Processing Time |

VISA | EUR, GBP, USD | Receiving costs covered by BDSwiss | Within 24 hours |

Mastercard | EUR, GBP, USD | Receiving costs covered by BDSwiss | Within 24 hours |

Skrill | EUR, GBP, USD | Receiving costs covered by BDSwiss | Within 24 hours |

Neteller | EUR, GBP, USD | Receiving costs covered by BDSwiss | Within 24 hours |

Astro Pay | EUR, CAD, BRL, COP, MXN, RMB, BOB, CNY, GBP, USD, PEN, INR, AED, CLP, PYG, JPY, SAR, THB, RUB, ARS, SEK, VND, NGN, MYR, ZAR, UYU, KES, IDR, GHS, TWD, AUD | Receiving costs covered by BDSwiss | Within 24 hours |

PayO | ZAR | Receiving costs covered by BDSwiss | Within 24 hours |

Korapay | NGN | Receiving costs covered by BDSwiss | Within 24 hours |

OZOW, MPESA, Airtel, Vodafone, MTN, Airtel Tigo, Orange Money | ZAR, KES, GHS, TZS, XOF, UGX | Receiving costs covered by BDSwiss | Within 24 hours |

Pix | BRL | Receiving costs covered by BDSwiss | Within 24 hours |

Beeteller | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Receiving costs covered by BDSwiss | Within 24 hours |

Pay Retailers | BRL, CLP, COP, CRC, MXN, PEN, GTQ, USD | Receiving costs covered by BDSwiss | Within 24 hours |

PromptPay, VietQR, DuitNow, PayMaya, GCash | THB, IDR, PHP, VND, MYR | Receiving costs covered by BDSwiss | Within 24 hours |

LetKnow, SpeedlightPay, ChipPay (Crypto) | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZEC, ADA | Receiving costs covered by BDSwiss | Within 24 hours |

Bank Wire | EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK | Receiving costs covered by BDSwiss | Within 24 hours |

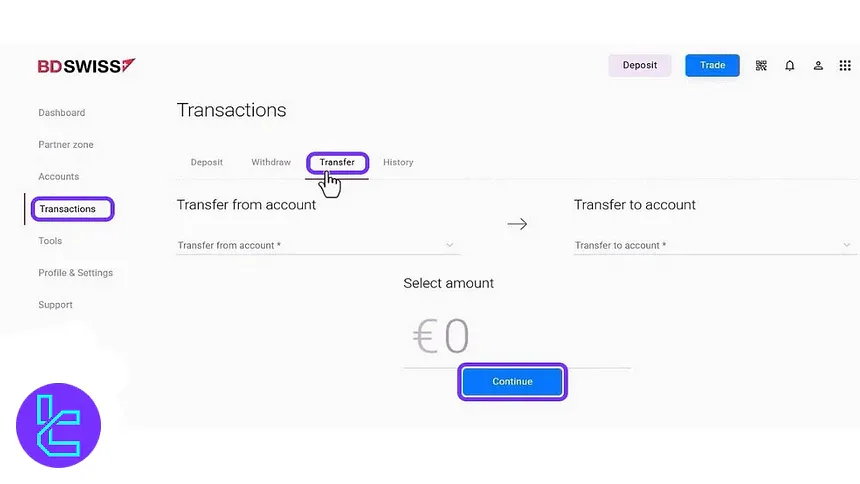

Transactions Section on the BDSwiss Dashboard

The BDSwiss dashboard is divided into several core areas, but the Transactions section functions as the central hub for all monetary actions.

From here, traders can initiate deposits, submit withdrawal requests, move funds between trading accounts, and review full transaction records.

Each tab, Deposit, Withdraw, Transfer, and History, is designed to streamline account funding and ensure easy monitoring of every operation performed through the client area.

Within this section, users can select the preferred trading account, choose a payment method, enter the amount, and complete a transfer with only a few steps.

The History tab supports detailed filtering by date or account, allowing traders to track deposits, withdrawals, and internal transfers.

This layout makes the Transactions page one of the most essential components of the BDSwiss client panel, especially for users managing multiple accounts or using methods such as ERC20 deposits.

Does BDSwiss Offer Copy Trading or any Investment Plans?

While the company offers no investment plans, it has an exclusive copy trading service for partners. The program works as a PAMM account service and allows BDSwiss partners to become master traders and earn commissions and performance fees.

- Automatic copying of selected strategies

- A transparent record of the Master Trader’s performance

- Commissions and direct revenue share on all profits for strategy providers

- Accessible on MT4 live accounts

BDSwiss Trading Assets

BDSwiss provides access to over 250 CFD instruments across five major asset classes. While the range is solid for retail traders, it lacks broader investment tools such as bonds, ETFs, or real-stock investing. Clients can trade:

Category | Type of Instruments | Number of Symbols | Competitor Average | Maximum Leverage |

Forex | Standard, Micro, Ultra Low accounts | 50+ Currency Pairs (majors & exotics) | 50–70 currency pairs | Up to 1:2000 |

Stocks | CFDs on shares (via MT5 platform) | 900+ global stocks | 800–1200 | Up to 1:5 |

Commodities | CFDs on commodities | 6+ instruments (Gold, Silver, Brent, US Crude) | 10–20 instruments | Up to 1:200 |

Indices | CFDs on global indices | 9+ indices (S&P 500, Dow Jones, FTSE 100) | 10–20 indices | Up to 1:200 |

Cryptocurrencies | CFDs on 28+ crypto assets (BTC, ETH, ADA) | 28+ assets, available 24/7 | No Available Information | Up to 1:5 |

BDSwiss supports leverage up to 1:2000 for qualified jurisdictions and offers margin trading across all instruments. However, it does not support futures market, options, ETFs, or actual copy trading, except via internal PAMM-style programs accessible through partner networks.

Does BDSwiss Broker Offer Bonuses and Promotional Programs?

While the company doesn’t have any traditional bonus plans, it offers several partnership programs, including Affiliate, IB, and Loyalty. BDSwiss has more than 17,500 registered partners and pays them a monthly amount of €7M+.

- Affiliate: Commission-based rewards (CPA, Revenue Share, or Hybrid) for referring new clients

- Introducing Broker (IB): Higher commissions for larger volume introducers with dedicated account managers and a personal dashboard

- Loyalty Program: Exclusive rewards, from a luxury supercar to a Las Vegas trip, for top-performing partners

You can check the latest promotional programs in the BDSwiss dashboard.

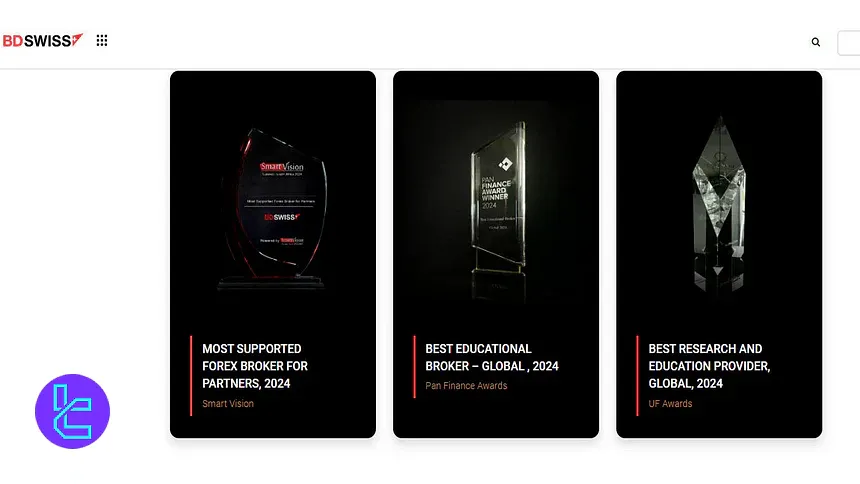

BDSwiss Awards

BDSwiss has earned extensive recognition across the global financial markets for its trading services, educational resources, research, and partnership programs.

Prestigious awarding bodies have highlighted the broker’s achievements in multiple categories and regions, such as Global, LATAM, APAC, Africa, and the Middle East.

These accolades reflect BDSwiss’ commitment to innovation, quality trade execution, and comprehensive trader support.

Recent Awards and Recognitions:

- Most Supported Forex Broker for Partners, 2024 – Smart Vision

- Best Educational Broker – Global, 2024 – Pan Finance Awards

- Best Research and Education Provider – Global, 2024 – UF Awards

- Best Trade Execution – Global, 2024 – UF Awards

- Best Education and Market Research – Global, 2024 – Global Brand Awards

- Best Forex Research Provider – Global, 2024 – Global Brand Awards

- Fastest Growing Forex Broker, 2024 – Fastbull Awards

- Best Research and Education Provider – LATAM, 2024 – UF Awards

- Most Innovative Broker – LATAM, 2024 – UF Awards

- Best IB Program, 2024 – HQMena Awards

- Broker of the Year, 2023 – Mindanao Traders Expo

- Best FX Educational Broker, 2023 – HQMena Awards

- Best Global Partnership Programme, 2023 – UF Awards

- Best Forex Research & Education Provider, 2023 – UF Awards

- Best IB/Affiliate Programme – APAC, 2023 – UF Awards

- Fastest Growing Forex Broker Dubai Award, 2023 – Global Banking & Finance Awards

- Best IB/Affiliate Program Africa, 2023 – FAME Awards

- Fastest Growing Multi-Asset Broker LATAM, 2023 – Gazet International Magazine

- Best Partners Program, 2022 – International Investor Awards

- Fastest Deposits & Withdrawals, 2022 – HQMena Awards

- Best Broker for Investor Education, 2022 – Fazzaco Business Awards

These BDSwiss awards illustrate the broker’s ongoing influence in the forex and CFD trading sectors, highlighting excellence in education, research, partner programs, and trading performance.

How to Reach BDSwiss Broker Customer Support?

The company provides comprehensive multilingual 24/5 support to assist traders with various inquiries through various channels, including:

support@global.bdswiss.com | |

Live Chat | Available on the website |

Ticket | Through the “Contact Us” page |

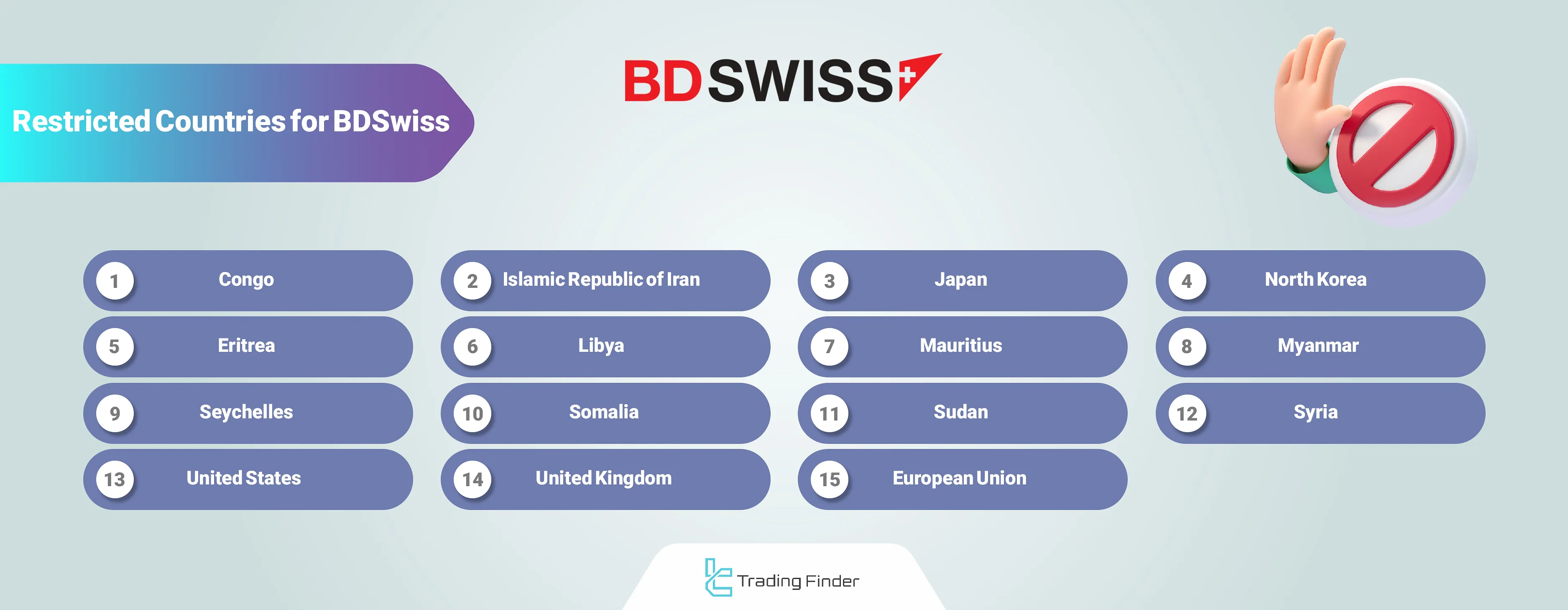

Restricted Countries on BDSwiss

The company has restrictions on providing services to certain countries due to regulatory requirements and internal policies. Red flag countries on BDSwiss:

- Congo

- Eritrea

- Iran

- Japan

- Democratic People’s Republic of Korea (North Korea)

- Libyan Arab Jamahiriya

- Mauritius

- Myanmar

- Seychelles

- Somalia

- Sudan

- Syrian Arab Republic

- United States

- United Kingdom

- European Union (EU)

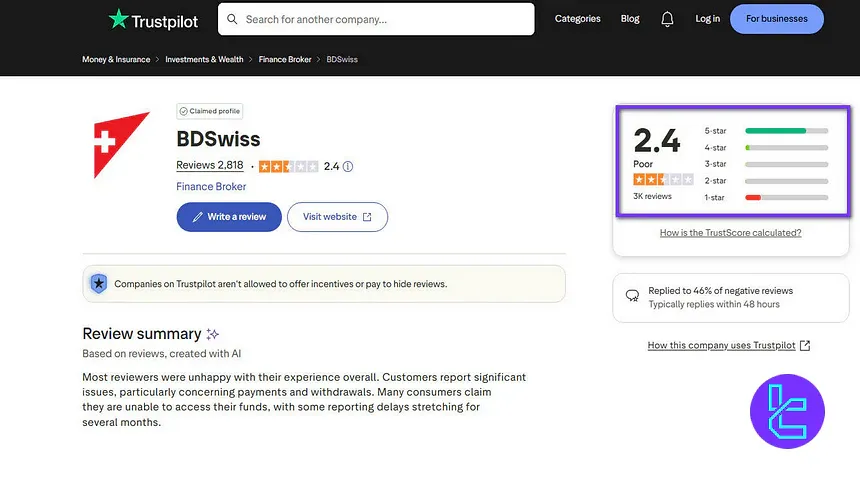

BDSwiss User Satisfaction

Trust score is One of the most important topics in this BDSwiss review. Before the broker underwent changes in 2023 (forfeiting CySEC license), it had a clean record of service.

2.4 out of 5.0 based on 3K ratings | |

Forex Peace Army | 1.6 out of 5.0 based on 76 ratings |

However, in the past year, its profiles on review websites have been filled with complaints.

BDSwiss Broker Trading Academy

The company recognizes the importance of educating traders and offers a full suite of resources in its “Academy” to empower clients.

- Learning Center

- Forex eBooks

- Live Education

- Basic Lessons

- Glossary

- Videos

- Seminars

Detailed Comparison of BDSwiss and Other Forex Brokers

The table below helps you understand why BDSwiss might be the right choice for you in comparison with other brokers.

Parameters | BDSwiss Broker | Exness Broker | XM Broker | |

Regulation | FSC, FSA, MISA, SCA | FSA, CySEC, ASIC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.6 Pips |

Commission | From $2 | From $3 | From $0.2 to USD 3.5 | $0 (except on Shares account) |

Minimum Deposit | $10 | $200 | $10 | $5 |

Maximum Leverage | 1:2000 | 1:500 | Unlimited | 1:1000 |

Trading Platforms | MT4, MT5, BDSwiss mobile app, Proprietary WebTrader | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | Cent, Classic, VIP, Raw | Standard, Raw Spread, Islamic | Standard, Standard Cent, Pro, Raw Spread, Zero | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 250+ | 2,250+ | 200+ | 1400+ |

Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

BDSwiss offers attractive prizes, including a Supercar and a Las Vegas trip, in its Loyalty program. While regulated in multiple jurisdictions (FSC,FSA, MISA, SCA), BDSwiss broker can’t provide services in the USA. The company has a low TrustPilot score of 1.9and has harbored many complaints since its globalization in 2023 and the forfeiture of its CySEC license.