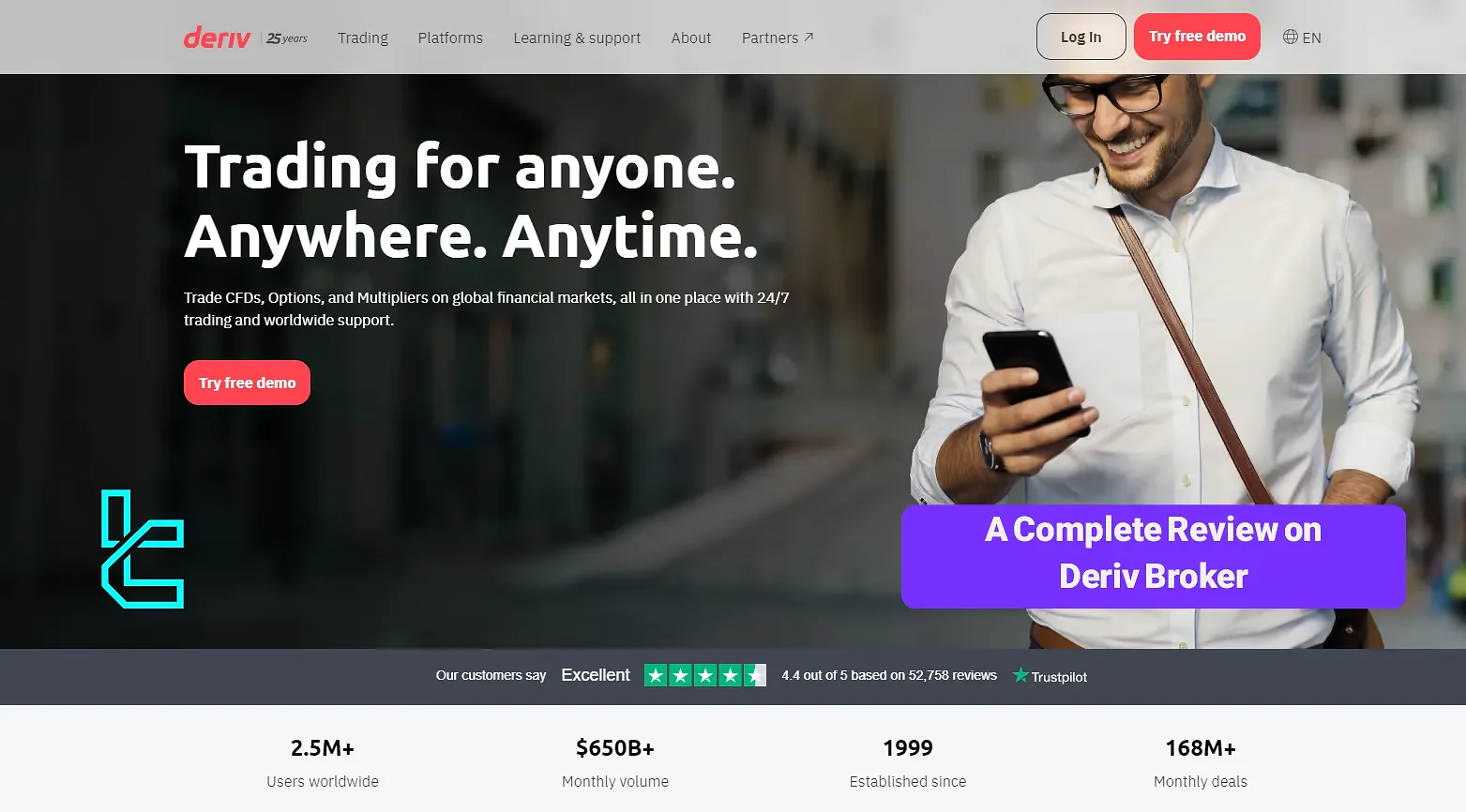

Deriv offers complex derivative products, including Options and Multipliers on 5 asset classes (e.g., Forex, Stocks, and Cryptocurrencies) with floating spreads from 0.24 pips and no commissions. The FSA-regulated broker offers its affiliates a monthly income of up to $34,000.

Deriv Company Information

Deriv, formerly known as Binary.com, is a member of the Regent Markets Group, established in 1999. With its rebranding in 2020, the company has expanded its offerings to leveraged trading and CFD instruments.

The broker processes more than $46M in withdrawals per month and has a monthly volume of $650B. While it’s not licensed by any top-tier regulatory bodies, Deriv is regulated by multiple entities, including:

- Malta Financial Services Authority (MFSA) – License 70156

- Labuan Financial Services Authority (FSA) – License MB/18/0024

- Vanuatu Financial Services Commission (VFSC) – License 14556

- British Virgin Islands Financial Services Commission (BVI) License SIBA/L/18/1114

The company was founded by CEO Jean-Yves Sireau to provide a better trading experience than traditional brokers, focusing on innovation and accessibility. Key features of Deriv.com:

- Regulated by multiple financial authorities worldwide

- Over 2.5 million registered users across 16 countries

- More than 1,300 employees representing over 70 nationalities

- 187M+ monthly trades

- 20 global locations, including Berlin, Paris, Cyprus, Hong Kong, Singapore, and Dubai

It's important to note that the products offered by Deriv carry significant risks. 70.78% of retail investor accounts lose money when trading CFDs with this provider.

Specifics of Deriv Broker

More than ten payment methods, 24/7 support, and a wide range of trading instruments are some of the features that make the broker stand out. Key specifications of Deriv.com:

Broker | Deriv |

Account Types | Standard, Financial, Swap-Free |

Regulating Authorities | MFSA, FSA, VFSC, BVI |

Based Currencies | USD, EUR, GBP, USDT, BTC, ETH, LTC, USDC |

Minimum Deposit | $5 |

Deposit Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Withdrawal Methods | Credit/Debit Cards, Online Banking, Mobile Payments, E-Wallets, Crypto, Voucher, Deriv P2P |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:1000 |

Investment Options | Copy Trading |

Trading Platforms & Apps | MT5, cTrader, Deriv X |

Markets | Forex, Stocks, Indices, Commodities, Cryptocurrencies, ETFs |

Spread | Floating from 0.24 pips |

Commission | $0.0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | Blog, Copy Trading, MT5 Signals |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, Live Chat, WhatsApp |

Customer Support Hours | 24/7 |

Account Types

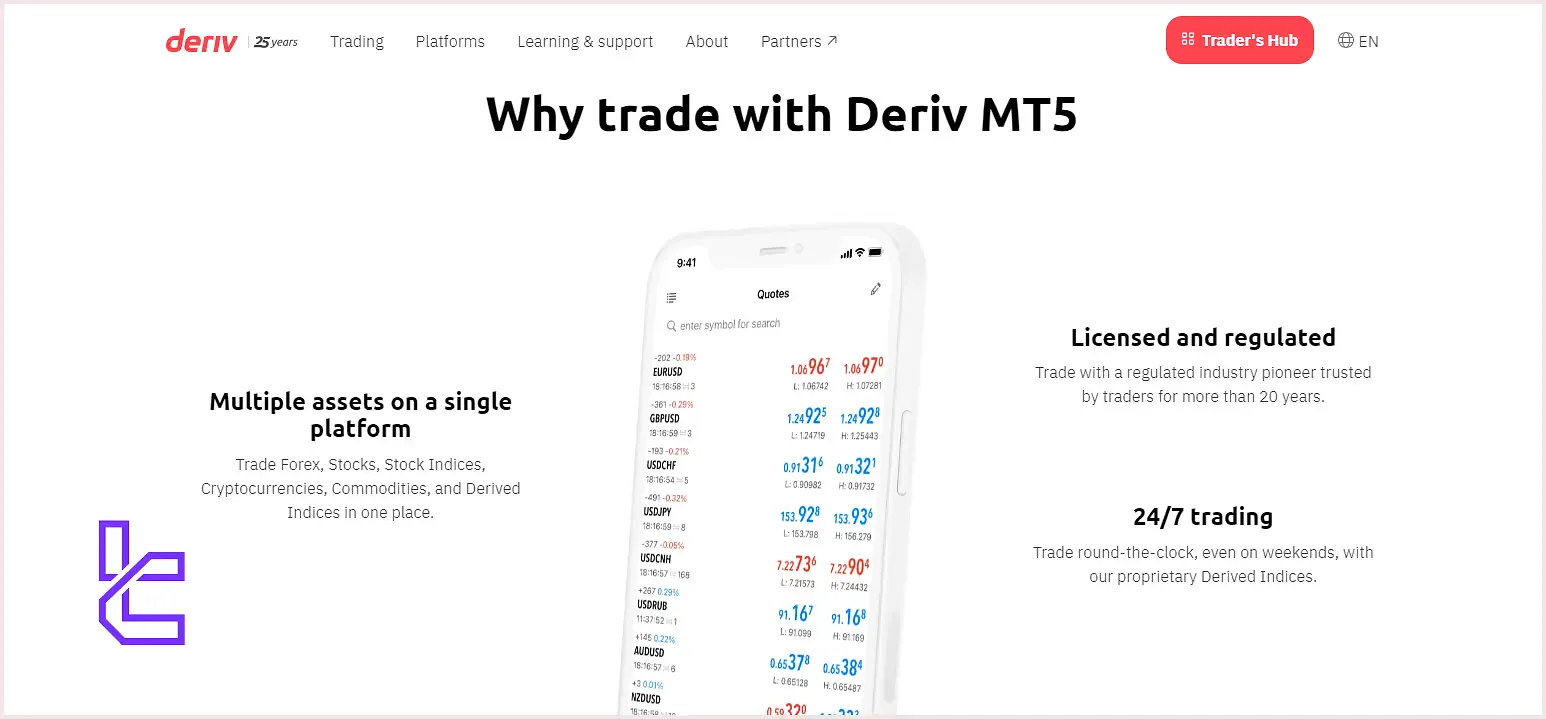

Deriv offers two main account types for different trading preferences and experience levels: Deriv Trader and Deriv MT5. The first one is designed to provide Options trading on financial markets.

The MT5 account is exclusively for trading CFDs on Forex, Indices, Stocks, and Cryptocurrencies; Key features of Deriv MT5 Account:

Features | Standard | Financial | Swap-Free |

Min Deposit | $5.0 | $5.0 | $5.0 |

Leverage | 1:1000 | 1:1000 | 1:1000 |

Assets | 210+ | 170+ | 40+ |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

Base Currency | USD, EUR, GBP, USDT, BTC, ETH, LTC, USDC | ||

There is also a free Demo account for beginners who might prefer practicing platform before depositing any money.

Deriv Pros & Cons

The broker provides secure segregation of client funds and uses SSL encryption to protect customer data, ensuring a safe trading environment. To help you make an informed decision, let's break down the main advantages and potential drawbacks of trading with Deriv.

Pros | Cons |

Wide range of tradable assets | Limited support options |

Leverage up to 1:1000 | Complex user interface |

Regulated by multiple financial authorities | No PAMM or MAM accounts |

24/7 multilingual customer support | - |

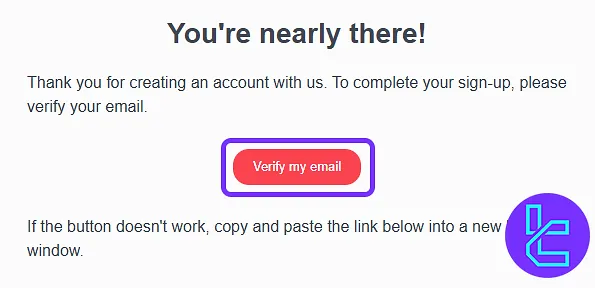

Registration and KYC on Deriv

The Deriv Registration requires only an email address. You can also sign up with Google, Facebook, or Apple accounts. You’ll select your account currency (USD, BTC, ETH, etc.), enter personal data, and complete email verification - all within 10 minutes.

#1 Begin at the Deriv Official Website

Click “Try Free Demo” on Deriv’s homepage and submit your email address to start.

#2 Confirm Your Email on Deriv

Check your inbox and click “Verify my email” to activate the signup flow.

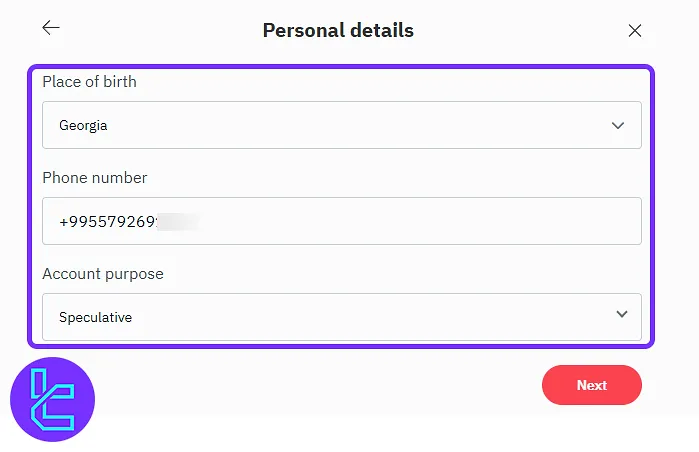

#3 Set Up Your Deriv Account

Choose your residence, create a secure password, and select your trading currency. Then enter your name, birth details, contact number, employment status, tax information, and account purpose.

#4 Add Address Details & Accept Deriv Terms

Provide your city, postal code, and region, then agree to the platform's terms to complete the setup.

#5 Deriv Verification

After successfully creating an account, you can make deposit and withdrawal transactions up to $10,000 before Deriv Verification. However, let’s play it safe. Upload the KYC documents in the “Verification” menu from “Account Settings” in your dashboard. Deriv KYC documents:

- Proof of Identity: Passport or driver’s license

- Proof of Address: Utility bill or bank statement

Available Trading Platforms on Deriv

Deriv offers 2 primary trading platforms, each designed to cater to different trading preferences and styles. While Deriv Trader is designed for options trading, the designated platform for CFD trading is the robust MetaTrader 5. Deriv MT5 download links:

Deriv also offers copy trading services on 150+ financial assets with zero commissions through cTrader. DerivTrader download link:

The broker also offers integrity with the cutting-edge trading platform, TradingView, through its Deriv X platform. Use it to trade Forex, Stocks, and Indices. Deriv X download links:

Trading Costs (Commission and Spread)

One of Deriv's standout features is its zero-commission trading accounts, which can potentially lead to significant cost savings for traders. The broker only charges spreads from 0.0 pips on CFD trading. Deriv broker’s spreads on various markets:

Asset Class | Spreads from (pips) | Max Leverage |

Forex | 0.3 | 1:1000 |

Derived Indices | 0.24 | 1:4000 |

Stocks | 0.6 | 1:50 |

Stock Indices | 0.6 | 1:100 |

ETFs | 1.0 | 1:5 |

Commodities | 0.6 | 1:500 |

Cryptocurrencies | 0.8 | 1:100 |

Here are the detailed spreads across different assets:

- EUR/USD: From 0.5 to 0.8 pips

- GBP/USD: From 0.5 to 0.8 pips

- Gold: From $0.29

- Bitcoin: Around $30

Available Payment Methods

It’s time to explore payment options in this Deriv review. The broker offers a variety of methods to cater to its global client base. Deposit/Withdrawal methods on Deriv.com:

Methods | Gateway | Min/Max Deposit | Min/Max Withdrawal | Currencies |

Credit/Debit Cards | VISA, MasterCard, Maestro, Diners Club, Discover | 10 / 5,000 | 10 / 10,000 | USD, EUR, AUD |

Online Banking | Bank Wire, Pix, Help2Pay, ZingPay, Ozow, UPI | 5 / 5,000 | 10 / 10,000 | USD, EUR, AUD |

Mobile Payments | MTN, Airtel, Equitel, Vodafone, M-Pesa | 5 / 1,000 | 5 / 1,000 | USD |

E-Wallets | Volet, AirTM, Jeton, Neteller, Perfect Money, Skrill | 5 / 10,000 | 5 / 10,000 | USD, EUR, AUD |

Crypto | Bitcoin, Ethereum, Litecoin, Tether, USD Coin | Unlimited | Unlimited | BTC, USDT, ETH, LTC, USDC |

Voucher | OXXO, SPEI, 1Voucher, VeitQR, Jeton Cash | 5 / 5,000 | 5 / 1,000 | USD, EUR, AUD |

Deriv P2P | Deriv P2P | Up to 10,000 | Up to 10,000 | USD |

Deriv maintains a minimum deposit starting at just $5, though this may vary depending on the payment method or currency. For example:

- E-wallets and cards: $5

- Crypto: No enforced minimum

- P2P: $500

Copy Trading and Growth Plans

The broker offers copy trading functionality through its Deriv cTrader platform, allowing less experienced traders to benefit from the expertise of successful traders. Key features of Deriv copy trading service:

- Automatically replicate trades of experienced Strategy Providers;

- Access global financial markets, including Forex, ETFs, stocks, indices, and Derived Indices;

- 24/7 trading is available on some instruments;

- Covers 150+ tradable assets.

Deriv Broker Financial Markets

The next step in this Deriv review is exploring available markets and financial instruments on the broker.

- Forex: Over 60 Major, minor, and exotic currency pairs

- Stocks: CFDs on shares of global companies

- Indices: Exclusive Derived Indices available for trade 24/7

- Commodities: Metals, energies, and agricultural products

- Cryptocurrencies: Over 30 assets, including Bitcoin, Ethereum, and other popular digital currencies

- ETFs: 30+ popular Exchange-traded Funds

Does Deriv Offer Bonus and Promotion Plans?

While the broker doesn't offer traditional bonuses or promotions for traders, they do have an attractive affiliate program.

- Up to $34,000 income per month

- Commissions for qualified referrals who deposit on Deriv platforms

- Available in over 190 countries

- Over $47 million in payouts to affiliates since inception

- Marketing materials

- 24/7 customer support for affiliates

Customer Support

Another key aspect of the Deriv review is customer support. The broker prioritizes customers by providing several contact channels. However, a lack of phone support can be a letdown for potential clients.

complaints@deriv.com | |

Live Chat | Message |

Deriv Broker Geo-restrictions

The list of restricted countries is one of the most important topics in this Deriv review. Before creating an account and depositing funds, you should ask if the broker provides services in your region. Restricted countries on Deriv broker:

- USA

- Canada

- Israel

- Malaysia

- Belarus

- Caribbean

- Cayman Islands

- Hong Kong

- Jersey

- Iran

Trust Scores

The company has established itself as a reputable broker in the online trading industry. With a score of 4.4 on TrustPilot, it’s safe to say that the majority of clients are happy with the company. Deriv trust scores:

4.4 out of 5 based on 52,758 reviews | |

Reviews.io | 3.4 out of 5 based on 7 reviews |

Does Deriv Broker Provide Educational Materials?

The last topic that we discuss in this Deriv review is the educational material provided by the broker. The company offers some educational resources, though they may be limited compared to other brokers.

- Blog with articles on basic trading concepts and strategies

- A community to share ideas, knowledge, and many more

Deriv in Comparison with Others

Let's compare the key features of Deriv with some other brokers; Deriv Comparison:

Parameters | Deriv Broker | ||||

Regulation | MFSA, FSA, VFSC, BVI | ASIC, VFSC | FSC | FSA, FSC, Misa, FinaCom | No |

Minimum Spread | 0.24 pips | 0.0 Pips | 0.0 Pips | 0.0 Pips | 0.1 Pips |

Commission | $0 | $0 | $0 | $0 | $0 |

Minimum Deposit | $5 | $0 | $200 | $100 | $1 |

Maximum Leverage | 1:1000 | 1:500 | 1:3000 | 1:3000 | 1:3000 |

Trading Platforms | MT5, cTrader, Deriv X | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MetaTrader 4, MetaTrader 5, FXTM Trader App | MetaTrade 4, MetaTrade 5, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Demo, Standard, Financial, Swap-Free | Zero, Classic | ADVANTAGE, STOCKS, ADVANTAGE, ADVANTAGE PLUS | Standard, ECN, Fixed, Crypto | Standard, Premium, VIP, CIP |

Islamic Account | Yes | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 200+ | 250+ | 1000+ | 700+ | 45 |

Trade Execution | Market | Market, Limit, Stop, Trailing Stop, Take Profit | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Deriv provides CFDs, Futures, and Options trading with a low entry barrier of $5. It also offers some assets like crypto and customized Indices (Derived Indices) for 24/7 trading.

Deriv broker has a leverage options of up to 1:1000, and provides commission-free trading. Derive reviews on TrustPilot has gained the company a great score of 4.4.