Regulated by VFSC and ASIC, 7 markets (forex e.g.) are available to trade in Fusion Markets. It also offers $0 commission with the minimum deposit of $0. "Phil Horner" is the founder of this broker.

Fusion Markets Company Overview and Regulation

Fusion Markets is registered in Vanuatu (Company Number 40256) under the trading name “Gleneagle Securities Pty Limited”. The broker operates under the watchful eye of the Vanuatu Financial Services Commission (VFSC) and the Australian Securities and Investment Commission (ASIC).

To further ease its clients’ minds, the company deposits all of its users’ funds in segregated accounts with two top-tier banks, HSBC and National Australia Bank (NAB). Key points about Fusion Markets:

- Phil Horner is the Founder and CEO of the company;

- No minimum account size;

- US Share trading with $0.0 commission;

- Winner of multiple awards as the “Lowest Spread Forex Broker”.

Fusion Markets Broker Specifications

The company claims that it has 36% lower costs than competitors. Let's take a closer look at what Fusion Markets brings to the table.

Broker | Fusion Markets |

Account Types | Zero, Classic, Swap-Free |

Regulating Authorities | ASIC, VFSC |

Based Currencies | USD, EUR, GBP, AUD, JPY, SGD, THB, CAD |

Minimum Deposit | $0 |

Deposit Methods | VISA, MasterCard, PayPal, Perfect Money, PayID, Bank Wire, Crypto, Skrill, Neteller |

Withdrawal Methods | VISA, MasterCard, PayPal, Perfect Money, Bank Wire, Crypto, Skrill, Neteller |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, MAM |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, TradingView, cTrader |

Markets | Forex, Indices, Share CFDs, Commodities, Metals, Energy |

Spread | Classic (from 0.9 pips) Zero (from 0.0 pips) |

Commission | Classic $0.0 Zero $4.5 |

Orders Execution | Market, Limit, Stop, Trailing Stop, Take Profit |

Margin Call / Stop Out | 90% / 20% |

Trading Features | Copy Trading, MAM Accounts, VPS, Calculators, Economic Calendar |

Affiliate Program | Yes |

Bonus & Promotions | Referral |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Live Chat, Phone, Ticket |

Customer Support Hours | 24/7 |

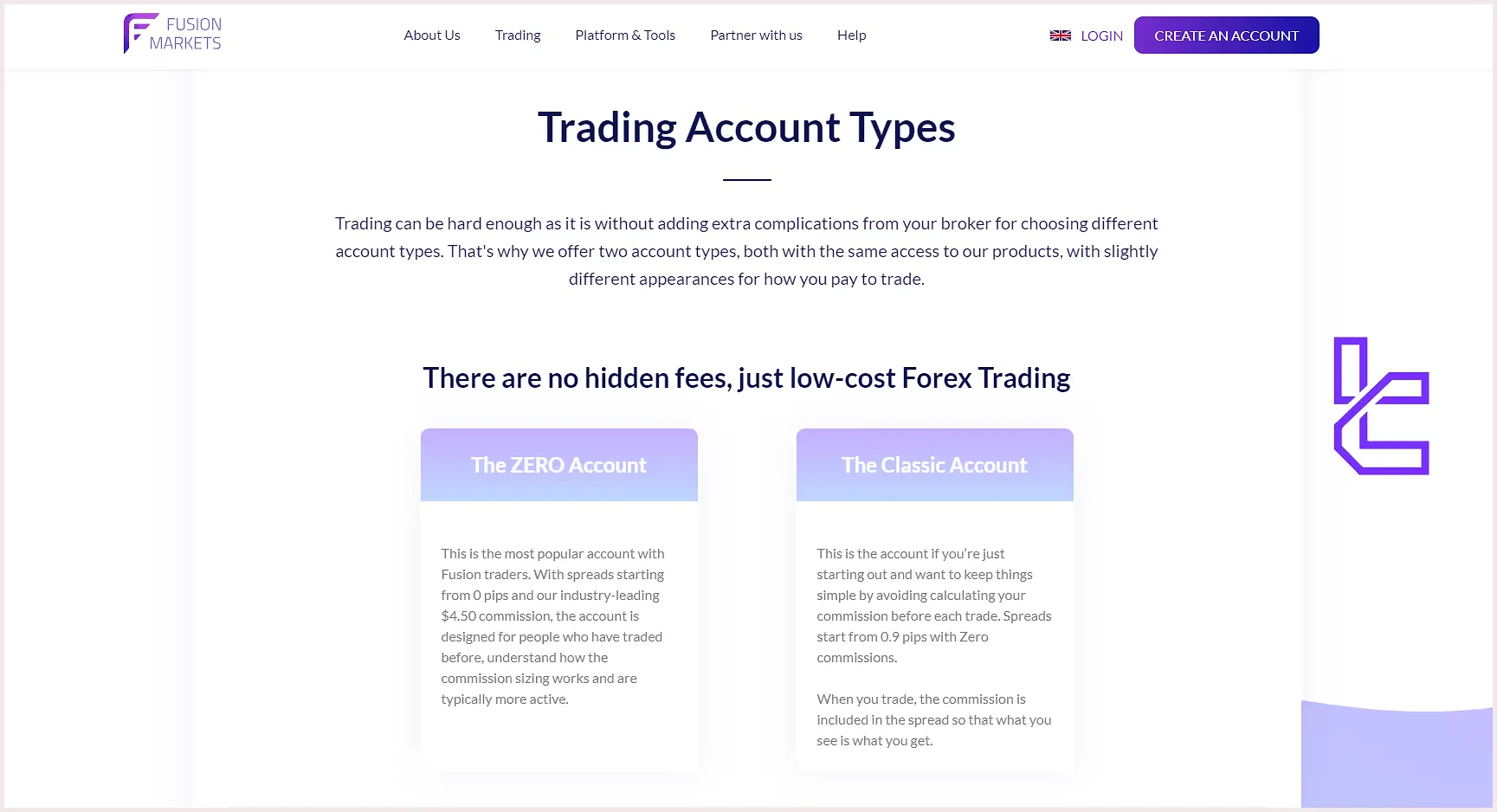

Fusion Markets Account Types

Fusion Markets copy trading forex broker offers a variety of account types to cater to different trading styles and preferences.

- Zero: perfect for traders who want raw spreads with spreads starting from 0.0 pips and a fixed commission of $2.25 per side;

- Classic: Suitable for those who prefer an all-inclusive experience with spreads from 0.9 pips and $0 commission.

Why Fusion Markets? (Pros & Cons)

No-commission trading, 250+ instruments, and fast execution speed are some of the advantages you’ll get by trading with Fusion Markets. But surely there are downsides, too.

Pros | Cons |

Ultra-low trading costs | Limited range of educational resources |

No minimum Deposit | No proprietary trading platform |

Zero deposit fees | Relatively new broker (launched in 2019) |

Regulated by VFSC and ASIC | Limited financial instruments |

Copy trading capabilities through Fusion+ | Lack of investor protection fund |

Sponsored VPS program | - |

A full package of trading platforms (MT4, MT5, cTrader, TradingView) | - |

Account Opening and KYC Verification on Fusion Markets

We must discuss the KYC verification on the Fusion Markets review. Opening an account with the broker is a straightforward process designed to get you trading as quickly as possible while ensuring compliance with regulatory requirements. Fusion Markets Sign Up:

- Navigate to the broker’s official website at “https://fusionmarkets.com/”

- Click “Start Trading”

- Fill in the application form

- Complete the “Personal Details” form

- Choose your account settings

- Provide proof of identity (passport or driver’s license) and proof of address (utility bill or bank statement) documents. You can read Fusion Markets verification if you need more help.

Available Trading Platforms on Fusion Markets

The broker offers a variety of trading solutions to cater to different preferences and styles. Fusion Markets trading platforms:

MetaTrader 4 (MT4)

MetaTrader 5 (MT5)

TradingView

cTrader

Commission and Spread on Fusion Markets Broker

The next subject in this Fusion Markets review is the fee structure. One of the broker’s key selling points is its ultra-low trading costs.

Account Type | Spread | Commission |

Zero | From 0.0 pips | $4.5 per lot |

Classic | From 0.9 pips | $0.0 |

Swap Free | From 1.4 pips | $0.0 |

The broker charges no fees on deposits and withdrawals and has no other hidden costs or markups.

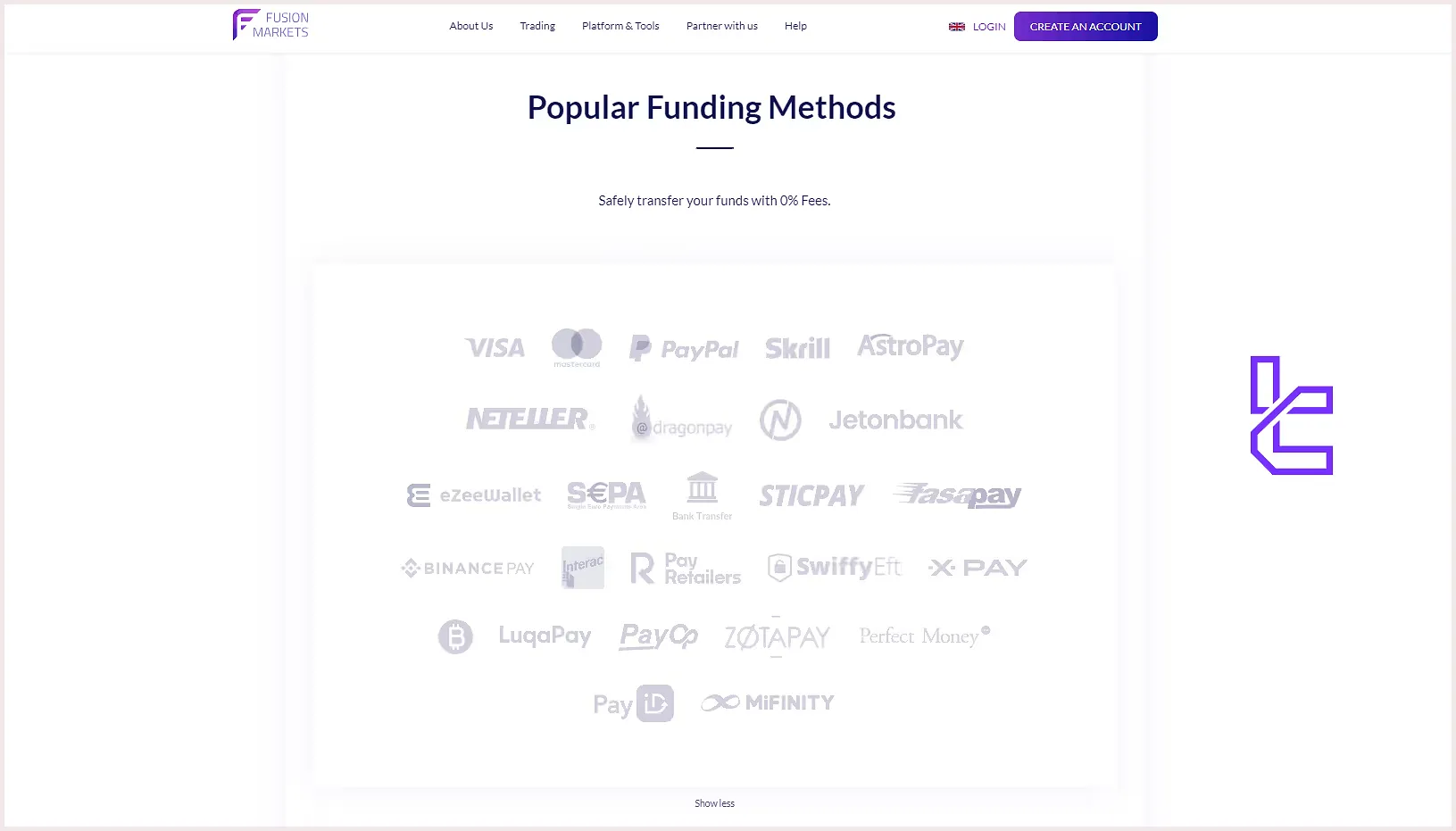

Fusion Markets Broker Deposit/Withdrawal Methods

The company offers a wide range of deposit and withdrawal options to cater to its global client base. Fusion Markets payment options:

- Bank wire transfer;

- Credit/debit cards (Visa, Mastercard);

- E-wallets (PayPal, Skrill, Neteller);

- Cryptocurrencies;

- Local bank transfer options (varies by region).

Note that minimum amounts and processing times vary by the methods (instant for some e-wallets, 1-3 business days for bank transfers).

Does Fusion Markets Offer Copy Trading and Growth Plans?

The brokerage company offers several options for copy trading and managed accounts, from Fusion+ to MAM/PAMM accounts.

- Fusion+: Free platform exclusively designed for money managers who trade at least 2.5 lots of FX/Metals per month (otherwise, there is a monthly $10 fee);

- DupliTrade: Partner service for copy trading with the ability to automatically copy strategies of selected experienced traders;

- Multi Account Manager (MAM): MetaFX platform for professional money managers with flexible order types, order sizes, and trading styles with a cost of 0.1 pips per trade.

Fusion Markets Broker Financial Instruments

The company offers a diverse range of trading instruments (250+ markets) to cater to various trading preferences.

- Forex: Major, minor, and exotic currency pairs;

- Precious Metals: Popular products like Gold, Silver, Platinum, Aluminum, Copper, Nickel, and Lead;

- Indices: Major global stock market indices (e.g., S&P 500, FTSE 100);

- Cryptocurrencies: Bitcoin, Ethereum, and 11 other major cryptocurrencies;

- US Share CFDs: Leveraged exposure to American equities (e.g., Apple, Amazon, and Microsoft) with zero commission;

- Energy and Soft Commodities: Popular commodities like Brent, Natural Gas, US Oil, Raw Sugar, Soybeans, etc.

Fusion Markets Bonus Plans

In this Fusion Markets review, we must mention the promotional programs. The broker doesn’t offer traditional promotions, such as welcome bonuses, due to regulatory compliance. However, it offers several attractive features and partnership programs, including:

- VPS (Virtual Private Server): Free VPS hosting for qualifying traders ensures stable and fast trading execution;

- Affiliate: Earn one-off fees or CPA (cost-per-acquisition) for referring new clients with access to an affiliate portal with statistics and tracking;

- Introducing Broker (IB): Designed for forex trading businesses, education companies, and trading websites to earn commissions on referred clients;

- Refer a Friend: Simple sign-up process with rewards for both referrer and friend.

How to Reach Fusion Markets Broker Customer Support

Fusion Markets prides itself on providing responsive and helpful customer support 24/7 through various channels, including:

help@fusionmarkets.com | |

Phone | +61 3 8376 2706 |

Address | Govant Building, BP 1276 Port Vila, Vanuatu |

Ticket | On the “Contact Us” page |

Live Chat | Available on the official website |

Restricted Countries on Fusion Markets

Due to regulatory restrictions, Fusion Markets cannot accept clients from certain countries. As of the latest update, these restricted countries include:

- Afghanistan;

- Congo;

- Iran;

- Iraq;

- Japan;

- Myanmar;

- New Zealand;

- North Korea;

- Ontario (Canada);

- Palestine;

- Russia;

- Spain;

- Somalia;

- Sudan;

- Syria;

- Ukraine;

- Yemen;

- United States and its territories.

Fusion Markets on Review Websites (Trust Scores)

One of the most important topics in this Fusin Markets review is user satisfaction. The broker has garnered generally positive reviews across various review platforms.

4.6 out of 5 based on 1,778 comments | |

Forex Peace Army | 4.7 out of 5 based on 262 reviews |

Fusion Markets Educational Materials

The broker provides educational resources primarily through its blog. The content covers various topics, including:

- Market analysis and trading insights

- Platform tutorials and guides

- Trading strategy articles

- Economic calendar and market news updates

Conclusion and Final Words

Fusion Markets offers trading tools such as copy trading, PAMM/MAM accounts and economic calendar. In all of its 3 account types [Zero, Classic, Swap-Free], Fusion Markets offers 1:500 maximum leverage. On the contrary, educational resources offered by Fusion Markets are limited.

Need more guide on using this broker? read TradingFinder Fusion Market tips.