GTCFX provides Raw spreads from 0.0 pips for a minimum deposit of $3,000 through its ECN account. It offers access to Signal Center, Autochartist, and a 20% tradable bonus. The broker rewards its IBs with 70% cashbacks.

GTCFX (Company Information and Regulatory Status)

GTCFX is a well-established online trading platform prioritizing regulatory compliance and client security. With over 985,000 clients across more than 100 countries, the broker has built a strong reputation in the global financial market. The company is licensed and regulated by multiple prestigious financial authorities, including:

- Australian Securities and Investments Commission “ASIC” (496371)

- The UAE Securities and Commodities Authority “SCA” (20200000007)

- The UK Financial Conduct Authority “FCA” (744501)

- The Financial Services Commission of Mauritius “FSC” (GB22200292)

- Vanuatu Financial Services Commission “VFSC” (40354)

GTCFX has received multiple awards, including “Best Liquidity Provider” and “Best STP Broker”, reflecting its strength in execution quality and institutional-grade infrastructure.

GTCFX Specific Features

GTC FX was founded in 2012 by Jack Zheng in Dubai. The Forex broker stands out from the competition with its impressive array of features designed to cater to novice and experienced traders.

Broker | GTCFX |

Account Types | Standard, Pro, ECN |

Regulating Authorities | ASIC, FCA, SCA, FSCM, VFSC |

Based Currencies | USD, JPY, CAD |

Minimum Deposit | $0 |

Deposit Methods | MasterCard, VISA, Bank Wire, GTCPay, Perfect Money, TCPay, My Fatoorah, Tether |

Withdrawal Methods | MasterCard, VISA, Bank Wire, GTCPay, Perfect Money, TCPay, My Fatoorah, Tether |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:2000 |

Investment Options | Copy Trading, PAMM |

Trading Platforms & Apps | MT4, MT5 |

Markets | Forex, Stock CFDs, Equity Indices, Metals, Energies, Commodities |

Spread | Variable based on the account type |

Commission | $5 per lot on ECN account |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Mobile Trading, Market Analysis, Signals |

Affiliate Program | Yes |

Bonus & Promotions | Referral, 20% Tradable Bonus |

Islamic Account | N/A |

PAMM Account | Yes |

Customer Support Ways | Phone, Email, Post Office Box, WhatsApp, Live Chat, Ticket |

Customer Support Hours | 24/7 |

GTCFX Account Offerings

The company offers three main account types, including Standard, Pro, and ECN, to cater to a diverse range of traders.

Features | Standard | Pro | ECN |

Min Deposit | $0 | $50 | $3,000 |

Leverage | 1:2000 | 1:2000 | 1:500 |

Avg. Spreads | 1.4 pips | 0.9 pips | Raw Spreads from 0.0 pips |

Commission | $0 | $0 | $5 per lot |

Extra Features | - | 80+ technical analysis tools | tier 1 liquidity with ECN technology, VPS |

GTCFX Broker Pros and Cons

To provide a balanced view, we must take a look at the advantages and disadvantages of trading with GTC FX.

Upsides | Downsides |

Wide range of trading instruments | Complex fee structure for some account types |

Tight spreads and high leverage | Limited educational resources for beginners |

Regulated by multiple reputable authorities | Geo-Restrictions |

Advanced trading platforms | Lack of cryptocurrency offerings |

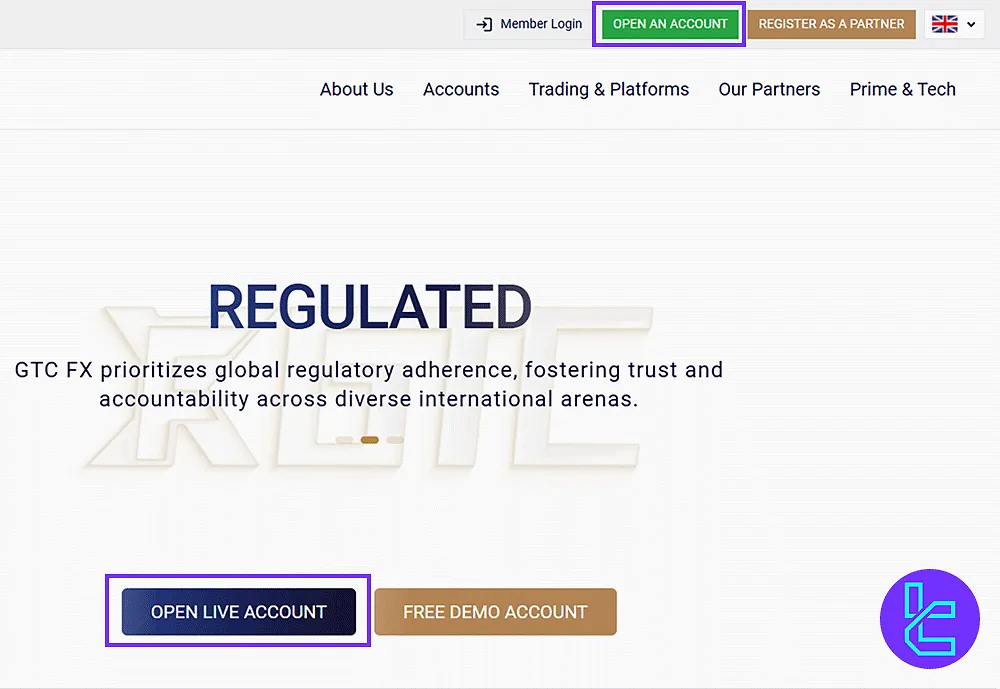

GTCFX Registration and KYC Verification

Opening an account with GTC FX is a straightforward process, but it involves thorough Know Your Customer (KYC) and compliance procedures to ensure the security and integrity of the platform. GTCFX registration is explained in the following section.

#1 Visit the GTCFX Registration Portal

Navigate to the broker’s official site and click on “Open an Account” to access the sign-up interface.

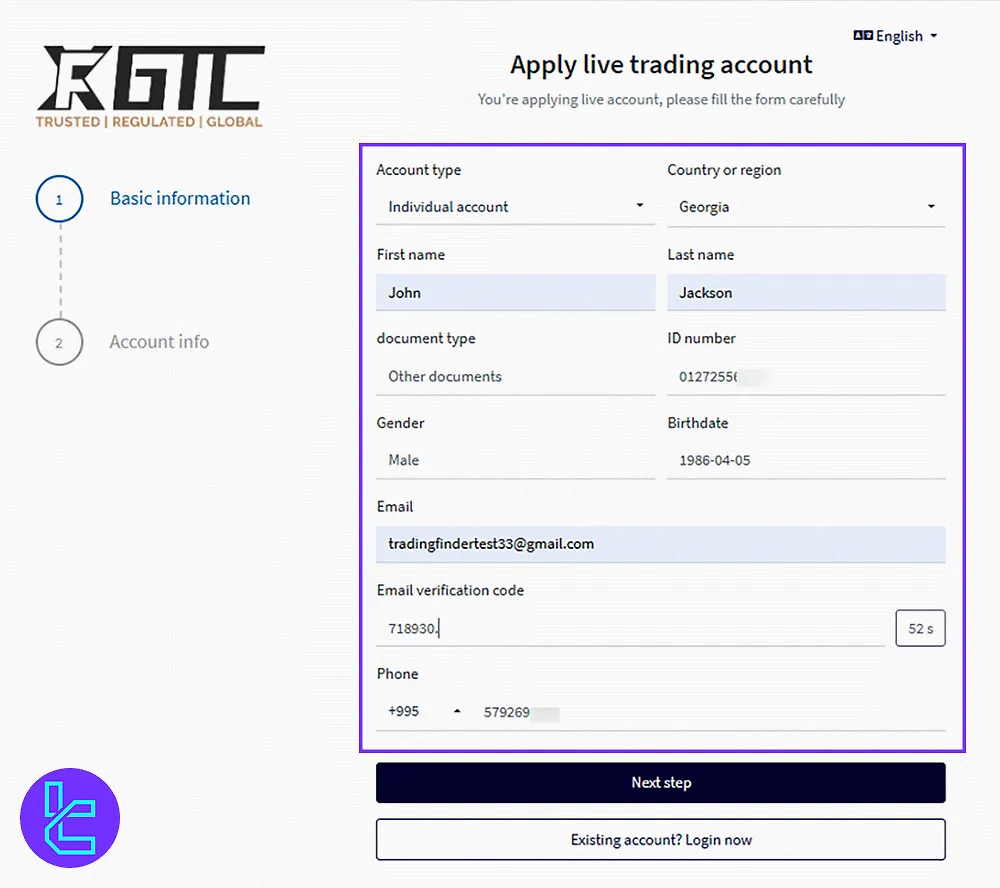

#2 Enter Personal Details

Fill out the registration form with required fields such as:

- First and last name

- Country of residence

- ID type (passport, ID card, etc.)

- ID number

- Gender, and date of birth

#3 Verify Contact Information

Enter your email address and mobile number. Retrieve the code sent to your inbox and input it into the platform for verification.

#4 Set Trading Parameters

Customize your trading experience:

- Choose your trading platform, account type, base currency, and leverage

- Set and confirm a strong password (including upper/lowercase letters, numbers, and symbols)

#5 Finalize the Agreement

Accept both terms and conditions, sign the user agreement, and submit the form to complete your registration.

#6 Verify Your Identity

Provide the type of identification document you chose on the second stage to go through the GTCFX verification and KYC process.

GTCFX Trading Platforms

GTC FX offers two powerful trading platforms to cater to different trader preferences: MetaTrader 4 and MetaTrader 5.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

Accessing the robust MT4 and MT5 indicators is one of the advantages of trading with GTCFX.

GTCFX Fee Structure

The broker takes a simple approach to fees and commissions. It offers trading with tight spreads and zero commissions (except for the ECN account).

Account Type | Spreads from (Pips) | Commission (per standard lot) |

Standard | 1.4 | $0 |

Pro | 0.9 | $0 |

ECN | 0.0 | $5 |

Regarding other costs, deposits and withdrawals are free across all methods and currencies. However, traders should note that a $5 monthly inactivity fee applies to dormant accounts.

GTCFX Broker Payment Options

Payment options are among the most important topics in all of the GTCFX reviews. Providing a wide range of deposit/withdrawal methods ensures that traders from across the globe can easily make transactions. Here’s a list of GTC FX offerings.

- MasterCard

- VISA

- Bank Wire

- GTCPay

- PerfectMoney

- TCPay

- My Fatoorah

- USDT

Note that while the minimum deposit amount for all the methods mentioned above is $10, you can deposit as low as $1 via USDT.

Does GTCFX Offer Copy Trading or Investment Plans?

GTC FX provides several options for traders looking to automate their trading or invest in managed accounts.

- Copy Trading: Follow and automatically copy trades of successful traders with customizable risk levels;

- PAMM (Percentage Allocation Management Module): Invest in professionally managed accounts;

- MAM (Multi-Account Manager): It's suitable for money managers and institutional clients to manage multiple client accounts simultaneously.

Available Trading Assets on GTCFX Broker

GTC FX offers a diverse range of trading assets to cater to various trading preferences.

- Forex Market

- Energy

- Shares

- Stocks

- Commodities

- Equity Indices

- Precious Metals

GTCFX Bonus Offerings

Promotion is the most attractive topic in all GTCFX reviews. The broker offers seasonal bonuses and promotional programs, such as a deposit bonus, affiliate, and IB.

- 20% Tradable Bonus: available till October 31, 2024, only after verifying your account and making a deposit

- Affiliate: Available in 80+ countries with CPA commissions up to $1850

- IB: Up to 70% rebates

GTCFX Broker Support Channels

The company offers comprehensive 24/7 multilingual customer support through various channels, including:

support@gtcfx.com | |

Phone | +971 800 667788 |

Post Office Box | 393526 |

Address | Business Center 1, M Floor, Meydan Hotel, Nad Al Sheba, Dubai, United Arab Emirates |

https://api.whatsapp.com/send?phone=971800667788 | |

Live Chat | Accessible through the “Contact Us” page |

Ticket | Available on the “Contact Us” page |

Red Flag Countries on GTCFX

GTC FX, like many regulated brokers, cannot provide services to residents of certain countries due to regulatory restrictions or high-risk designations.

- The United States

- Russia

- Afghanistan

- Angola

- Bahamas

- Botswana

- Myanmar

- Cote d’Ivoire (Ivory Coast)

- Crimea and Sevastopol

- Cuba

- Democratic Republic of Congo

- Liberia

- Ghana

- Iran

- Iraq

- Mongolia

- North Korea

GTCFX Reviews and Trust Scores

User satisfaction is one of the most important topics in all GTCFX reviews. The company has garnered good scores across various platforms, especially TrustPilot.

There are 201 reviews on GTC FX TrustPilot profile rating the broker 4.3 out of 5.0; an excellent score.

GTCFX Broker Educational Materials

While the company doesn’t offer an exclusive Forex education section on its website, it offers a range of trading tools to help traders elevate their skills.

- Market Analysis: Daily and weekly market reports

- Trading Signals: Real-time trading ideas and recommendations

- Economic Calendar: Up-to-date economic events and their potential market impact

- Glossary: An extensive list of trading terms and definitions

GTCFX Compared to Other Brokers

This section evaluates the broker's offerings and features in comparison to its peers:

Parameter | GTCFX Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | ASIC, FCA, SCA, FSCM, VFSC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | Variable Based on the Account Type | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $5 per lot on an ECN Account | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | None | $10 | From $0 | $100 |

Maximum Leverage | 1:2000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | MetaTrader 4, MetaTrader 5 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Standard, Pro, ECN | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 27,000+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and Final Words

GTCFX provides access to 27,000+ trading instruments across 6 different asset classes, including Forexand Stocks. The broker offers 3 main account types with leverage options of up to 1:2000 through the robust MT4/5 platforms.

GTCFX broker is regulated by multiple entities, including SCA, FSCM, and VFSC, and has a great rating of 4.3 on TrustPilot.