ICM.com offers 1000s trading instruments with leverage options of up to 1:200 and tight spreads from 0.0 pips.

The broker provides commission-free trading across Forex, Metals, and US Stocks. ICM officially sponsors Swisspod and London’s Chestertons Polo in the Park.

ICM.com; Company Background and Regulatory Status

ICM.com was founded in London in December 2009. The broker has over 20 offices across Europe, the Middle East, Africa, Asia, and Latin America.

The company’s global approach has driven it to acquire multiple regulatory licenses, including:

- Financial Conduct Authority (FCA) with Reg No. 520965

- Abu Dhabi Global Markets (ADGM) Financial Services Regulatory Authority (FSRA) with Reg No. 210045

- Financial Services Commission (FSC) of Mauritius under license No. C118023357

- Financial Services Authority (FSA) of Seychelles with license No. SD201

- Financial Services Authority (FSA) of Saint Vincent and the Grenadines under Reg No. 1853 LLC 2022

- Financial Sector Conduct Authority (FSCA) of South Africa with FSP No. 53234

- Association Romande des Intermediaries Financiers (ARIF) under Reg No. CHE-497.911.976

The company had previously been associated with sports sponsorships, including Newcastle United FC and Fulham FC.

Note that this ICM Capital review will explore the global branch, which is regulated by the FSC Mauritius.

ICM Capital Table of Specifications

ICM.com has implemented an insurance scheme of up to $1,000,000 for its 300,000+ client base. Let’s take a quick look at what the Forex broker has to offer:

Broker | ICM.com |

Account Types | Direct, Zero |

Regulating Authorities | FCA, FSRA, FSC, FSA, FSA SVG, FSCA, ARIF |

Based Currencies | USD, EUR, GBP, SGD |

Minimum Deposit | N/A |

Deposit Methods | MasterCard, Skrill, Neteller, Bitcoin, MonetixAPM, Finrax, Bank Wire |

Withdrawal Methods | MasterCard, Skrill, Neteller, Bitcoin, MonetixAPM, Finrax, Bank Wire |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:200 |

Investment Options | MAM/PAMM Accounts, Securities |

Trading Platforms & Apps | MT4, MT5, cTrader, ICM Securities |

Markets | Forex, US Stocks, Metals, Index Futures, Energy Futures, Commodities, Cash CFDs, Securities, Crypto, US Treasury & Currency Futures |

Spread | Variable based on the account type |

Commission | Variable based on the account type |

Orders Execution | Market |

Margin Call / Stop Out | N/A / 0% |

Trading Features | Commission-free Trading, PAMM Accounts, Islamic Account, Economic Calendar, Dynamic Leverage, Equinix Data Center |

Affiliate Program | Yes |

Bonus & Promotions | Partnership, Referral, 10% Credit Bonus |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Tel, WhatsApp, Ticket, Live Chat |

Customer Support Hours | 24/5 |

Trading Accounts

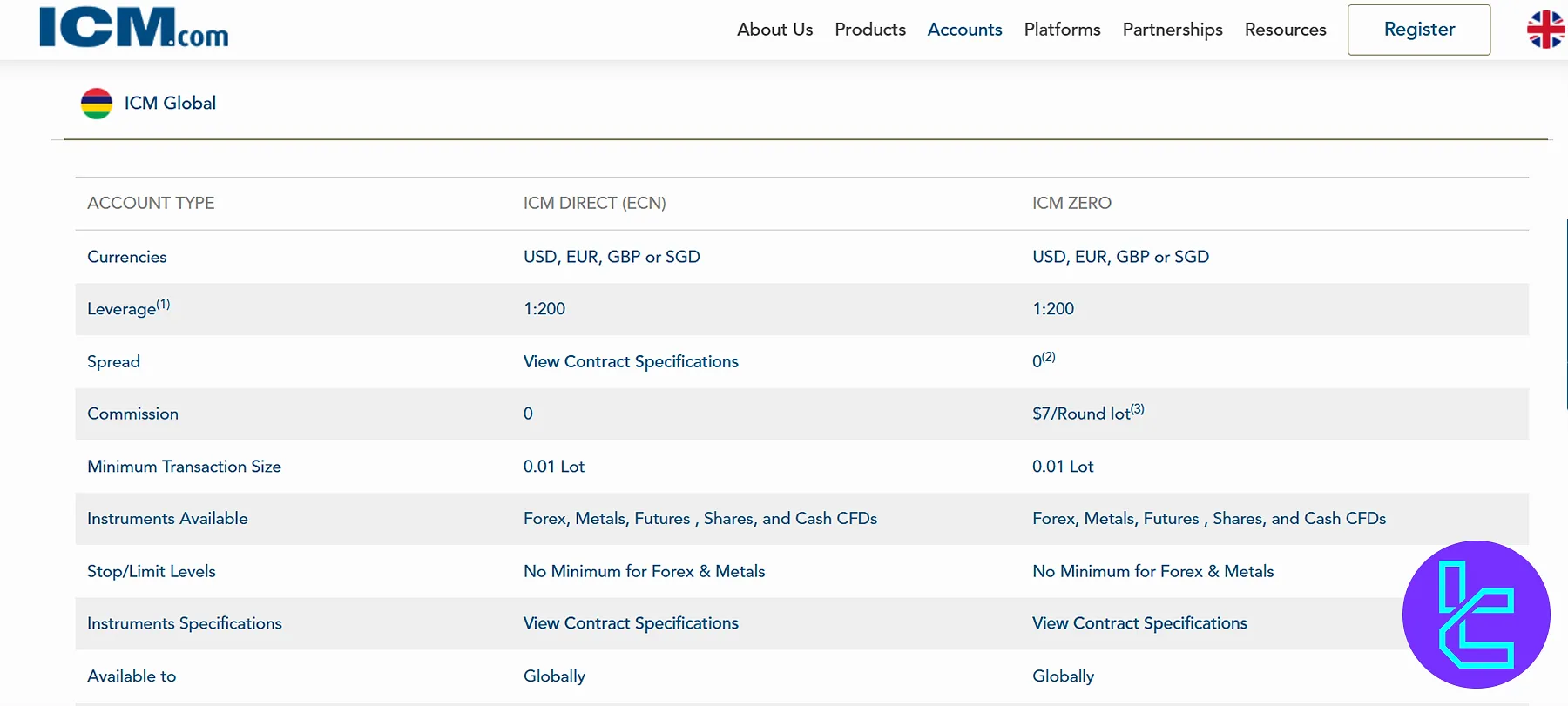

ICM caters to a diverse range of traders with two primary account types: Direct and Zero.

Features | Direct (ECN) | Zero |

Base Currencies | USD, EUR, GBP, SGD | USD, EUR, GBP, SGD |

Leverage | 1:200 | 1:200 |

Commission | $0.0 | $7/Round lot |

Min Order Size | 0.01 lots | 0.01 lots |

Swap Free Option | Yes | Yes |

Execution | Market | Market |

Stop Out Level | 0% | 0% |

Note that leverage options are flexible and may change depending on market conditions. Also, the stop out level in Asia is 50%.

ICM Capital Broker Pros and Cons

Led by Shoaib Abedi, the founder and CEO, the company has won over 40 global awards since 2011, including the “Most Popular Forex Broker 2024” and the “Best Financial Institution 2024”. However, it has downsides, too. Let's weigh the advantages and disadvantages of trading with the broker.

Pros | Cons |

Multi-regulated by top-tier authorities | Some features and promotions vary by region |

Wide range of tradable assets | Limited cryptocurrency offerings |

Multiple trading platforms (MT4, MT5, cTrader) | No US clients |

Comprehensive Forex education | - |

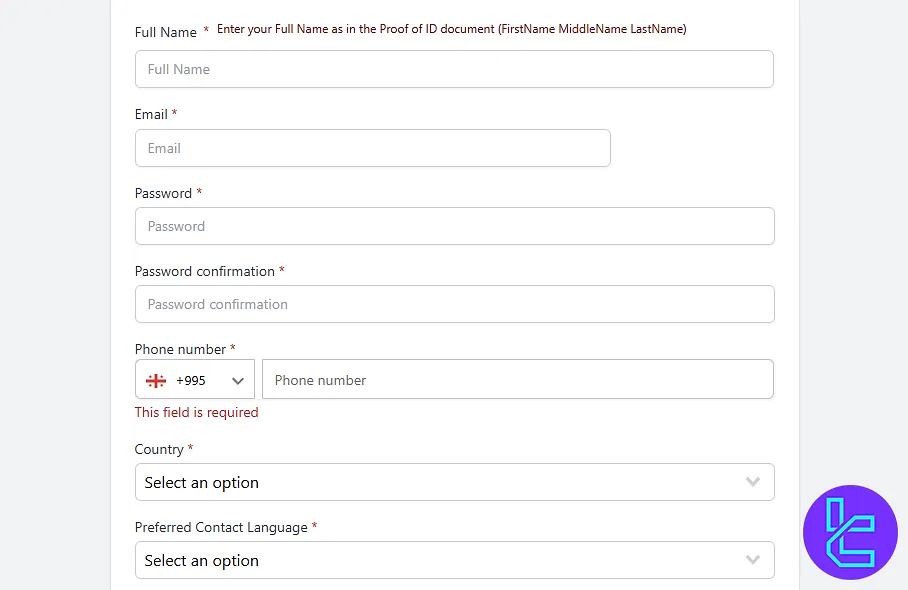

Registration and Verification

ICM.com registration is a streamlined experience tailored for traders of all levels. The entire process takes about 5 minutes to complete.

#1 Start from ICM.com’s Official Portal

Head to the broker’s official website and select the “Register” or “Open an Account” button to initiate the sign-up.

#2 Fill in Identification & Contact Details

Provide the required details as follows:

- Full name

- Residence country

- Phone number

Then, set a secure password.

#3 Input Residential Profile

Enter your birthdate, nationality, and complete address, including postal code and city.

#4 Submit Financial & Trading Background

Specify your employment status, income bracket, and your prior trading exposure to Forex, CFDs, stocks, or futures.

#5 Configure Your Account Settings

Select preferred trading platform, currency, and account type, then indicate your intended initial deposit.

Accept the terms and conditions to finish the registration process.

#6 Verify Your Identity

To go through the ICM.com verification, provide proof of ID (passport or driving license) and proof of address (bank statement or utility bill).

ICM Capital Global Trading Platforms

The broker offers three popular trading platforms and a proprietary solution exclusively for the Securities market.

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

- Web

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

- Web

cTrader

- cTrader Android

- cTrader iOS

- Desktop

- Web

ICM Securities

The wide range of trading platforms allows clients to utilize the robust MT5 indicators, cTrader advanced charting tools, and the MT4 Expert Advisor (EA) capability.

ICM.com Broker Fees Explained

The company charges no commissions for the Futures market and stock trading. Clients can also trade in the Forex market and Metals commission-free via the ICM Direct account.

However, the Zero account has a $7 fee per round lot for Foreign Exchange and precious metals. The table below gathers the trading spread data for the most popular currency pairs.

Forex Pair | ICM Direct | ICM Zero |

AUDCAD | 3.8 | 0.4 |

EURUSD | 1.3 | 0.0 |

EURGBP | 1.3 | 0.1 |

GBPJPY | 2.1 | 0.0 |

USDSGD | 13.0 | 1.2 |

USDCHF | 1.5 | 0.2 |

NZDUSD | 2.0 | 0.2 |

ICM Capital Payment Methods

The broker provides multiple payment options, from Credit/Debit Cards to E-Wallets, to cater to the needs of its global clientele.

- Bank Wire

- MasterCard

- Skrill

- Neteller

- MonetixAPM

- Finrax (Crypto)

Available payment methods may vary by region. Always check with ICM Capital for the most up-to-date information.

Does ICM.com Offer Copy Trading or Investment Plans?

While the broker doesn’t offer a dedicated copy trading feature, it has implemented PAMM and MAM services as part of its partnership program for asset managers and professional traders with the following features:

- No limit on account numbers

- Adjustable allocation parameters

- Rebates from ICM

- Expert Advisor (EA) friendly

ICM.com also provides access to various global stock exchanges, such as NASDAQ, AMEX, NYSE, LSE, and CHIX. So, investors can diversify their portfolios and invest in companies across the United States, Europe, and Arab countries.

ICM Capital Global Tradable Assets

The company offers 1000s trading instruments across 9 asset classes, from Forex to US Treasury & Currency Futures.

- Forex: Over 60 major, minor, and exotic currency pairs

- Metals: Spot and Futures trading on Precious metals, such as Gold, Silver, and Palladium

- US Stocks: CFDs on major US shares

- Indices: CFDs on Index Futures, such as Dow Jones, E-mini NASDAQ, FTSE 100, and DAX

- Energy: CFDs on Energy Futures, including WTI, NGAS, BRENT, and Gasoil

- Cash CFDs: CFDs with no expiry date on XTI, DOW30, Euro50, BRENT, Germany40, Japan225, UK100, US500, USTech100, France40, and Spain35

- Crypto: Cryptocurrency CFDs on assets like BTC, BCH, LTC, ETH, XLM, and EOS

- Commodities: Futures contracts on agricultural products, including Cocoa, Cotton, and Sugar

- US Treasury & Currency Futures: US10YT, EUR, JPY, CHF, and GBP

- Securities: Major stock exchanges, including ADX, DFM, CHIX, LSE, and NSDQ

ICM.com Promotions

The broker has implemented several promotional programs, from referral to a 10% credit bonus, to attract new clients and reward the loyal ones.

- Affiliate: Refer a friend and win up to $150

- 10% Credit Bonus: Receive 10% extra credit on each deposit above $1,000

- Partnership Programs: Become IB, white label, regional partner, or educational partner of ICM

ICM Capital Global Support Channels

The broker offers 24/5 assistance to its clients through multiple channels, including:

support@icm.com | |

Phone | +44 207 634 9779 |

+44 7575 070707 | |

Ticket | Accessible through the “Contact Us” page |

Live Chat | Available on the website |

ICM.com Geo-Restrictions

The ICM brand has 300,000+ customers and 6+ regulatory licenses. While it strives to serve a global clientele, the regulatory requirements and local laws prevent it from providing services in certain jurisdictions, including:

- United States

- North Korea

- China

Trust Score and User Satisfaction

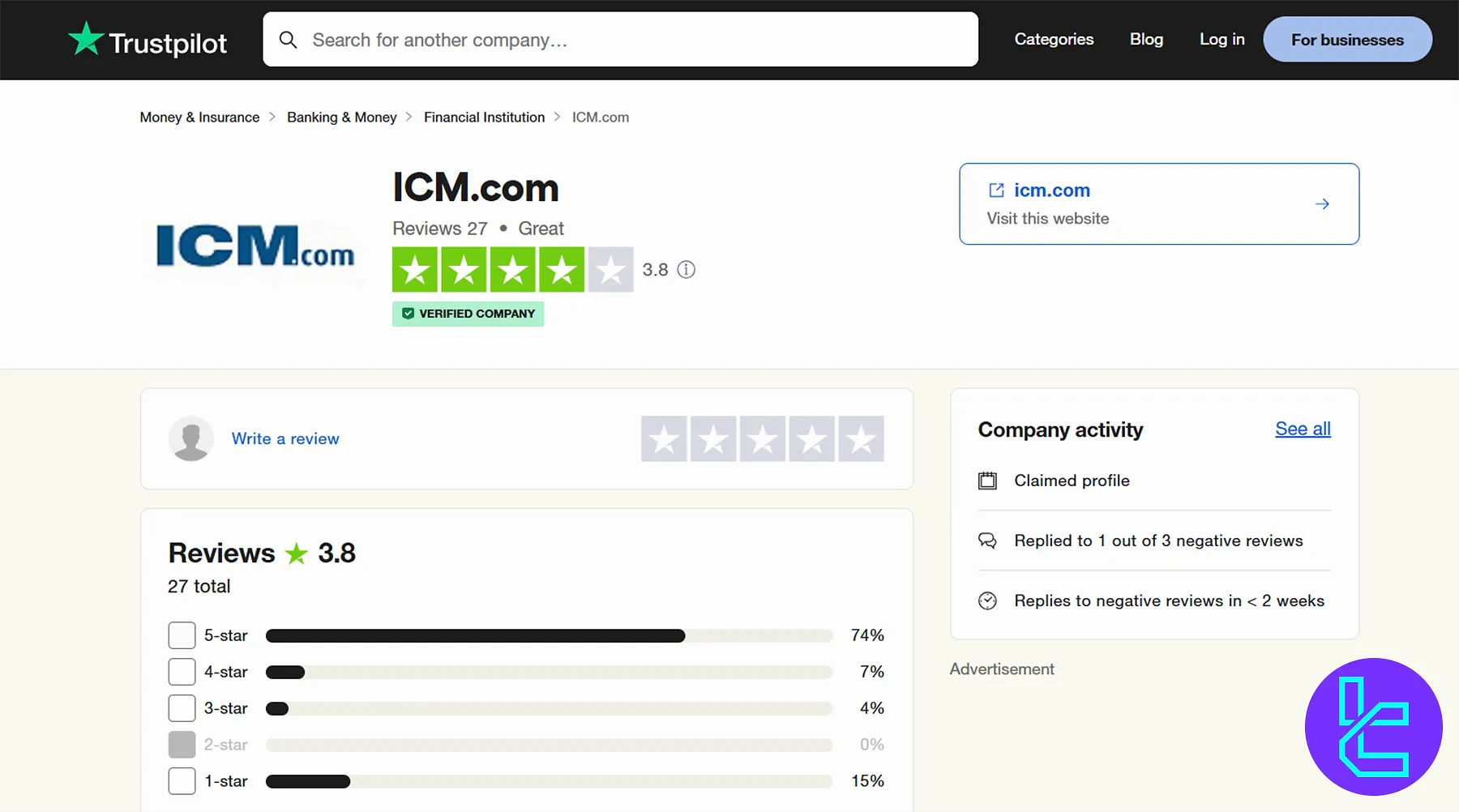

Oddly, there are not that many ICM reviews on reputable websites like TrustPilot and Forex Peace Army. The broker has garnered mixed feedback on these platforms.

3.8/5 based on 27 comments | |

Forex Peace Army | 2.7/5 based on 23 reviews |

Reviews.io | 2.3/5 based on 12 ratings |

While 81% of ICM.com reviews on TrustPilot are positive (4-star and 5-star), only 15% are negative (1-star).

Educational Materials

ICM.com provides a comprehensive range of educational resources, from Forex basics to trading tools.

- Trading Central: Technical analysis and MT4 indicators

- Tools: Economic Calendar and VPS hosting

- Forex Tutorials: Basics and examples

- Glossary: Trading terms

ICM.com Compared to Other Brokerages

Here's a table comparing the reviewed broker against some of the best companies in the industry:

Parameter | ICM.com Broker | XM Broker | FXGlory Broker | HFM Broker |

Regulation | FCA, FSRA, FSC, FSA, FSA SVG, FSCA, ARIF | ASIC, FSC, DFSA, CySEC | No | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | Variable Based on the Account Type | From 0.6 Pips | From 0.1 Pips | From 0.0 Pips |

Commission | Variable Based on the Account Type | $0 (except on Shares account) | $0 | From $0 |

Minimum Deposit | N/A | $5 | $1 | From $0 |

Maximum Leverage | 1:200 | 1:1000 | 1:3000 | 1:2000 |

Trading Platforms | MT4, MT5, cTrader, ICM Securities | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App |

Account Types | Direct, Zero | Micro, Standard, Ultra Low, Shares | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 1,000+ | 1400+ | 45 | 1,000+ |

Trade Execution | Market | Market, Instant | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

ICM.com provides access to 9 asset classes, including Forex and US Treasury & Currency Futures, through MT4/5, cTrader, and ICM Securities platforms.

The broker has 6+ regulatory licenses and a TrustPilot score of 3.8. It supports Skrill, Neteller, and MasterCard payments with no transaction fees.