IC Markets EU offers raw spreads and commission-free trading with an average execution time of 66ms on 2250+ instruments.

The company offers MetaTrader and cTrader platforms with support available 7 days a week.

IC Markets EU; Company Information and Regulation

IC Markets (EU) Ltd operates under the watchful eye of CySEC, one of Europe's most stringent financial regulators, with license No. 362/18.

The company was incorporated in Limassol, Cyprus, on the 25th of June 2018, with registration No. HE 356877. Key features of IC Markets EU:

- Regulated by CySEC

- Compensation fund of up to €20,000 per client

- Segregated accounts for client money in accordance with MiFID regulations

- Leverage options of up to 1:30 for retail clients and up to 1:500 for professional clients

- Support 7 days a week

IC Markets EU Specifications

As a CySEC-licensed firm, IC Markets EU operates within a robust regulatory framework, ensuring compliance with both Cypriot and European financial regulations.

Let’s take a quick look at what the broker has to offer.

Broker | IC Markets EU |

Account Types | cTrader Raw Spread, Raw Spread, Standard |

Regulating Authorities | CySEC |

Based Currencies | US, EUR, GBP |

Minimum Deposit | $200 |

Deposit Methods | Visa, MasterCard, PayPal, Neteller, Skrill, Wire Transfer |

Withdrawal Methods | Visa, MasterCard, PayPal, Neteller, Skrill, Wire Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 (1:500 for professional clients) |

Investment Options | Investment Model Portfolios |

Trading Platforms & Apps | MT4, MT5, cTrader, WebTrader |

Markets | Forex, CFDs (Commodities, Stocks, Indices, Crypto, Futures, Bonds) |

Spread | Raw Spreads (with a 0.8 pips mark-up on Standard accounts) |

Commission | Raw Spread account $3.5 per lot per side Standard account $0.0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 50% |

Trading Features | CFDs, Demo Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Ticket, Tel, Live Chat, Chatbot |

Customer Support Hours | 7 days a week |

IC Markets EU Broker Accounts

IC Markets EU offers three primary account types, each with distinct fee structures and trading platforms.

Features | cTrader Raw Spread | Raw Spread | Standard |

Trading Platform | cTrader | MetaTrader | MetaTrader |

Min Deposit | $200 | $200 | $200 |

Leverage | 1:30 | 1:30 | 1:30 |

Spreads from (Pips) | 0.0 | 0.0 | 0.8 |

Commission | $3.0 per lot per side | $3.5 per lot per side | $0.0 |

Min Order Size | 0.01 lots | 0.01 lots | 0.01 lots |

Margin Call | 100% | 100% | 100% |

Stop Out | 50% | 50% | 50% |

IC Markets EU Pros and Cons

The broker boasts low latency connectivity, superior liquidity, and support for robust trading platforms (MT4/5 and cTrader).

However, it certainly has some flaws as well.

Pros | Cons |

Raw spreads | No copy trading or money management services |

Strong regulatory oversight (CySEC) | No support for TradingView |

No dealing desk intervention (ECN/STP model) | Limited leverage options (up to 1:30) |

7 days a week support | Recent regulatory penalties by CySEC (a €50,000 fine) |

IC Markets EU Registration and KYC

IC Markets EU signing up involves a straightforward process that adheres to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

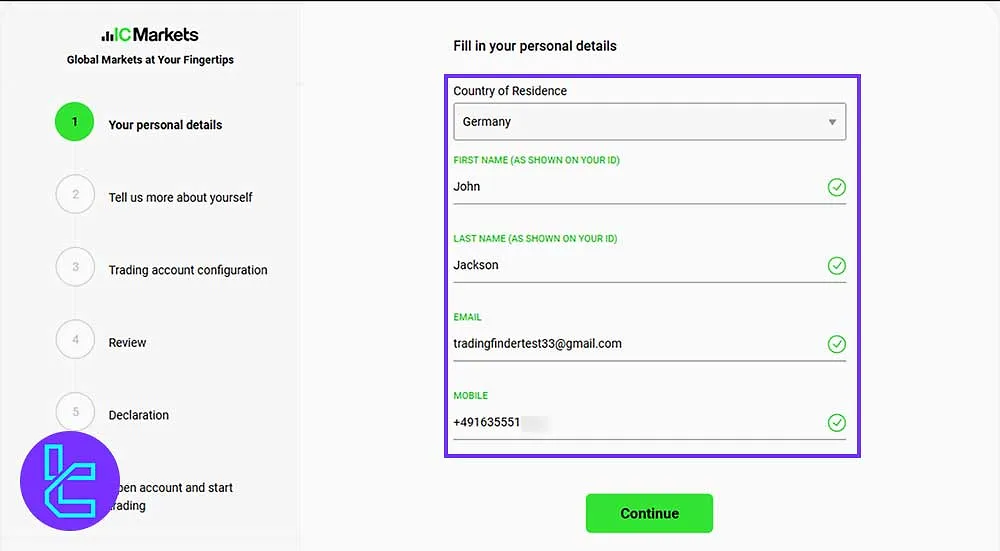

#1 Begin the Signup Process

Visit the IC Markets EU website and start by clicking either “Open an Account” or “Start Trading Now” to reach the registration page.

#2 Enter Your Basic Information

Fill out the form with these details:

- Country of residence

- Full name

- Email address

- Phone number

Afterwards, proceed to the next step.

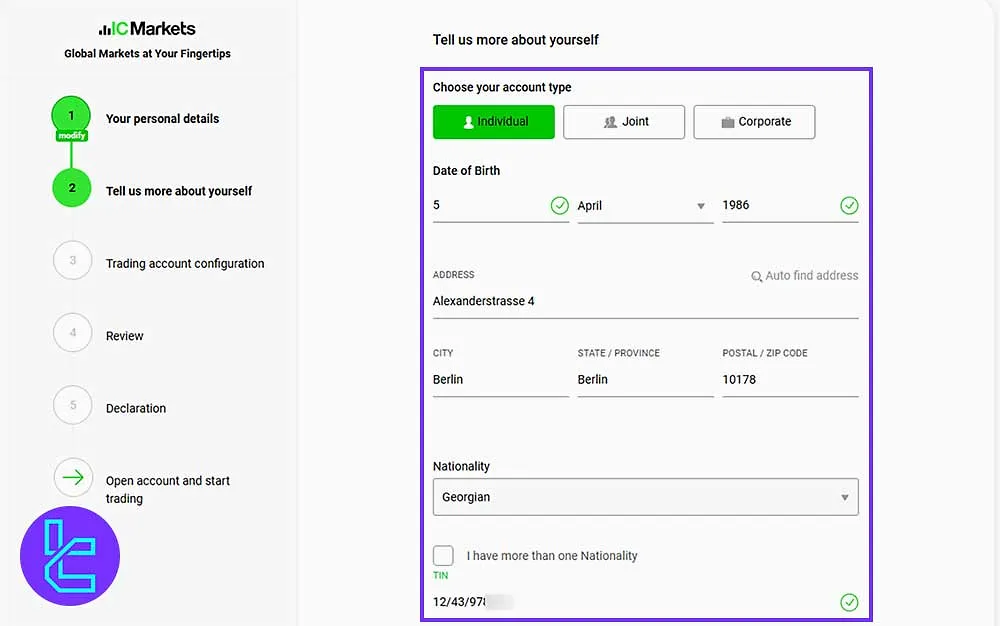

#3 Submit Personal and Tax Details

Provide these data in the form:

- Account type

- Date of birth

- Full address

- Nationality

- Tax Identification Number (TIN)

#4 Define Account Preferences

Choose your desired trading platform, account configuration, and base currency for funding and trading.

#5 Verify and Confirm

Carefully review all entered details to ensure accuracy, then proceed by setting a security question and agreeing to IC Markets' terms and conditions.

#6 Create a Secure Password

Check your email for the IC Markets confirmation message. Click the “Secure Client Area” link, set a strong password (8–15 characters with uppercase, lowercase, digits, and symbols).

#7 Complete the KYC

Complete the “Appropriateness Assessment”. Then, provide Photo ID and proof of residence (bank statement or utility bill).

IC Markets EU Trading Platforms

We must discuss the trading platforms in this IC Markets EU review. The broker provides traders with access to some of the most popular and advanced trading platforms in the industry, including MetaTrader 4 and MetaTrader 5:

MetaTrader 4 (MT4)

- MT4 Android

- MT4 iOS

- Desktop

- Web

MetaTrader 5 (MT5)

- MT5 Android

- MT5 iOS

- Desktop

- Web

cTrader

- cTrader Android

- cTrader iOS

- Desktop

- Web

IC Markets EU Broker Fees Explained

The company’s fee structure mainly consists of spreads, commissions, and swaps, since it doesn’t charge any hidden or transaction fees.

The standard account has no commissions, but its spreads are subject to a 0.8 pips markup.

The Raw Spread account offers market spreads from 0.0 pips with a $7 commission per lot round turn (commission is $6 for cTrader accounts). Note that the commission varies based on the asset class you’re trading.

Asset Class | Commission |

FX | $7 |

Metals | $7 |

Futures | 0 |

Energies | 0 |

Cryptos | 0 |

Equity Indices | 0 |

US Shares | $0.02 per volume |

AUS Shares | 0.1% of total value |

The following demonstrates the spreads on some of the popular trading pairs in Raw Spread accounts:

| Trading Pair | Average Spread |

| EURUSD | 0.06 |

| GBPUSD | 0.26 |

| XAUUSD | 0.08 |

| USDCAD | 0.23 |

| XBRUSD | 0.03 |

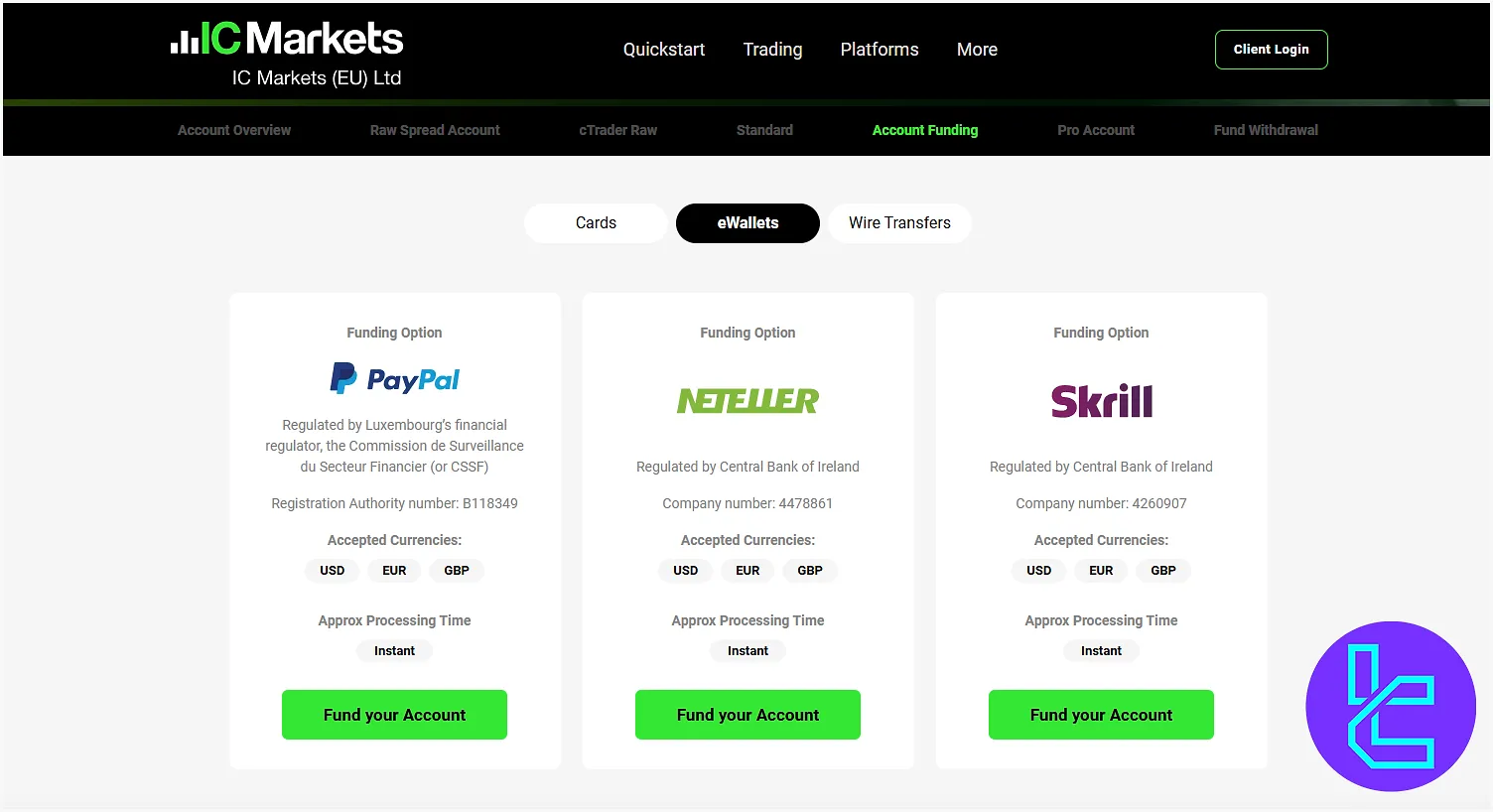

IC Markets EU Withdrawal and Deposit

The broker provides a variety of deposit and withdrawal options, from Cards to eWallets, to cater to different trader preferences.

- Credit/Debit Cards: Visa and Mastercard

- eWallets: Neteller, Skrill, and PayPal

- Wire Transfer: Transactions from four banks, including Alpha Bank, Hellenic Bank, OpenPayd, and Fibank

Does IC Markets EU Offer Copy Trading or Growth Plans?

Unfortunately, the broker doesn’t offer any investment plans, money management features (PAMM and MAM), or copy trading services.

IC Markets EU mainly focuses on providing CFD instruments for various asset classes.

IC Markets EU Instruments

The next topic on this IC Markets EU review is the available financial markets. The broker offers 2,250+ CFD instruments across 7 asset classes, including:

- Forex Market: 61 major, minor, and exotic currency pairs;

- Indices: 25 global stock indices, including S&P 500, FTSE 100, and DAX;

- Cryptocurrencies: 21 digital assets, such as BTC, MATIC, UNI, BNB, and DOGE;

- Commodity: 21 energies (WTI, BRENT, and NGAS), precious metals, and agricultural products (e.g., Cocoa, Coffee, and Cotton);

- Bonds: 9 fixed income debt securities, such as JGB10Y-Z4, UST10Y-H5, and UST0fY-H5;

- Stocks: 2100+ CFDs on industry giant shares in global markets, including NYSE, NASDAQ, EURONEXT, Xetra (Germany and Paris), London, and Bolsa Madrid;

- Futures: CFDs on 4 future indices, including DXY, VIX, BRENT, and WTI, with leverage options of up to 1:10.

IC Markets EU Broker Promotions

Due to regulatory compliance, the company offers no bonus, promotion, affiliate, IB, or partnership programs.

The lack of passive income solutions may be a letdown for potential clients who seek to earn by utilizing their influence on a certain group of people.

IC Markets EU Customer Support

The company provides comprehensive support 7 days a week through various channels, including:

support@icmarkets.eu | |

Tel | +35725010480 |

Ticket | Through the “Contact Form” |

Chatbot | Available on the broker’s official website |

Live Chat | Request the Chatbot to connect you to an agent |

Users highlight the quality and reliability of the company's support team in their reviews of the brokerage.

IC Markets EU Geo-Restrictions

As a Cyprus-based and CySEC-regulated broker, IC Markets EU operates primarily within the European Economic Area (EEA). However, it denies services to individuals from certain countries, including:

- Brazil

- Belgium

- the United Kingdom

- the United States

- Iran

- North Korea

- Other countries from outside Europe

IC Markets EU Trust Score

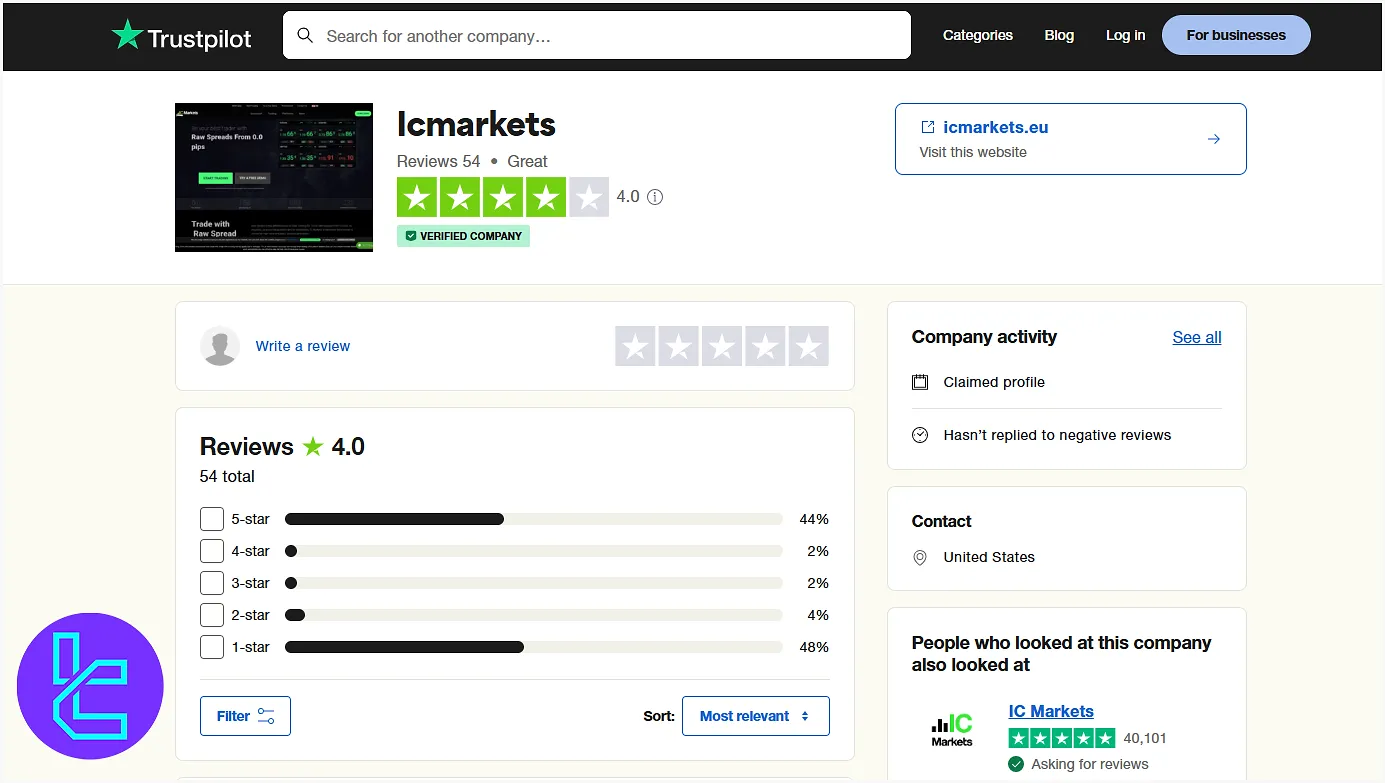

User satisfaction is the most important topic of this review. IC Markets EU Trustpilot has garnered generally positive reviews, gaining a great score of 4.0/5 based on 54 reviews.

On this website, less than 45% of the reviews on the mentioned broker are 5-star, which could be a concerning fact. It's worth noting that IC Markets EU hasn't replied to any of the negative reviews on its claimed Trustpilot profile.

IC Markets EU Broker Education

The company offers comprehensive educational resources covering trading basics, market trends, and many more. Key topics in IC Markets EU education section:

- What is Forex;

- What is a CFD;

- Web TV: Daily recorded videos from the floor of the New York Stock Exchange.

Comparison Between IC Markets EU and Other Brokers

The table below compares the reviewed brokerage with some of its main competitors in financial markets:

Parameter | IC Markets EU Broker | LiteForex Broker | Exness Broker | HFM Broker |

Regulation | CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA |

Minimum Spread | Raw Spreads (with a 0.8 pips Mark-up on Standard Accounts) | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | Raw Spread account $3.5 per lot per side Standard account $0.0 | From $0.0 | From $0.2 to USD 3.5 | From $0 |

Minimum Deposit | $200 | $50 | $10 | From $0 |

Maximum Leverage | 1:30 (1:500 for professional clients) | 1:30 | Unlimited | 1:2000 |

Trading Platforms | MT4, MT5, cTrader, WebTrader | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App |

Account Types | cTrader Raw Spread, Raw Spread, Standard | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium |

Islamic Account | No | No | Yes | Yes |

Number of Tradable Assets | 2,250+ | N/A | 200+ | 1,000+ |

Trade Execution | Market | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit |

Conclusion and Final Words

IC Markets EU provides CFD trading across 7 different asset classes, from FX and Bonds to Futures and Cryptocurrencies.

The company offers MT4/5 platforms with access to Autochartist and TradingCentral tools with a $7 commission and 0.0 spreads.

IC Markets EU broker has a great score of 4.0/5 on TrustPilot. However, the lack of promotional programs (e.g., IB, and Affiliate), copy trading features, and investment plans are the biggest weaknesses in this IC Markets EU review.