Interactive Investor is a British broker managed by “Richard Wilson”. This broker offers 4 account types [SIPP, Stocks & Shares ISA, Managed ISA, Trading Account], where you can start trading with $0.

Besides These, Interactive Investor broker provides Loyalty Program, Referral Program and Deposit Bonus for traders.

Interactive Investor Broker Introduction and Regulation

Interactive Investor (ii) has established itself as a powerhouse in the UK investment landscape, trusted by over 400,000 savvy investors.

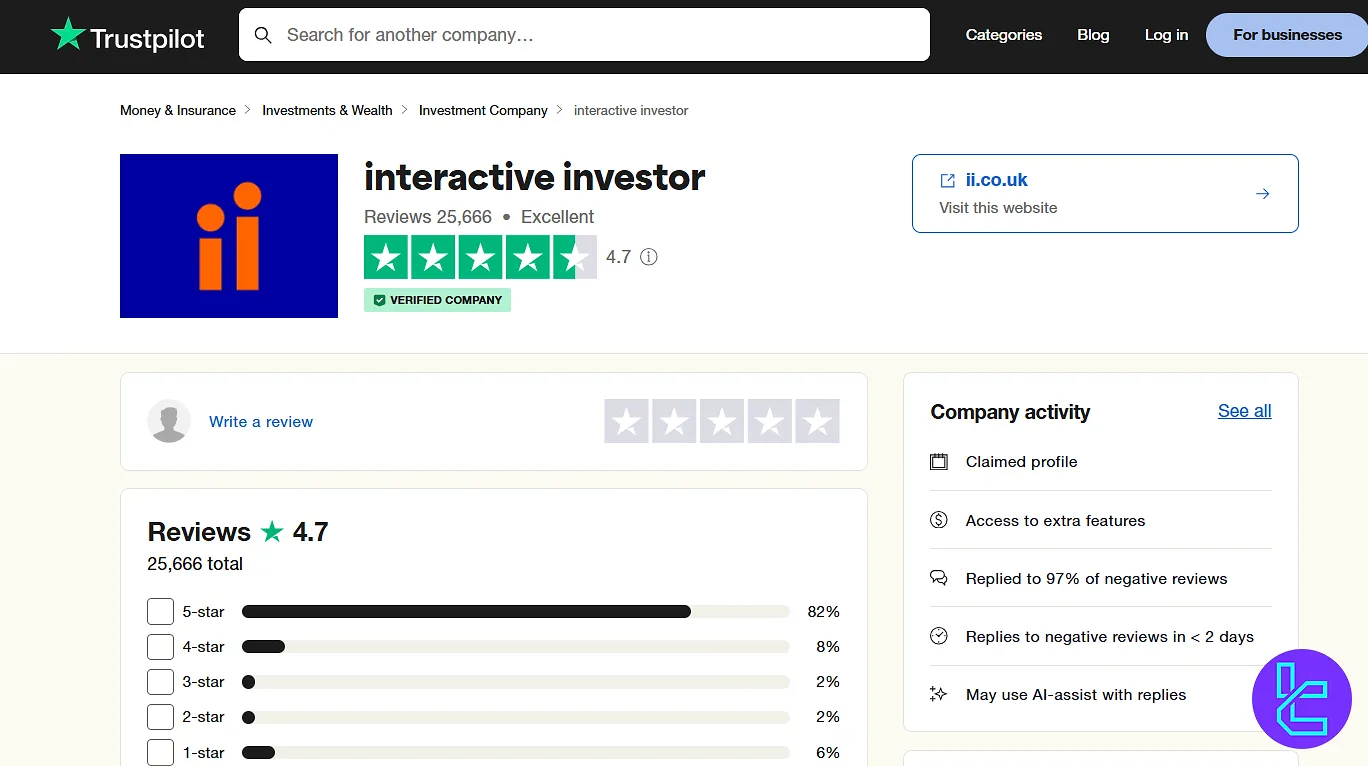

Founded in 1995, this veteran platform has weathered market storms and technological revolutions, emerging as the UK's most trusted investment platform with an impressive 4.7/5 rating on Trustpilot, backed by over 22,000 reviews.

ii's offerings span a diverse range of investment vehicles, including:

- Stocks and Shares ISAs

- Self-Invested Personal Pensions (SIPPs)

- Cash Savings

- 4 Investing Plans

The platform's staying power is evident in its loyal customer base – over half of ii's users have been with the Forex broker platform for more than a decade.

It's not just retail investors who trust ii; a quarter of all UK share trades flow through their systems.

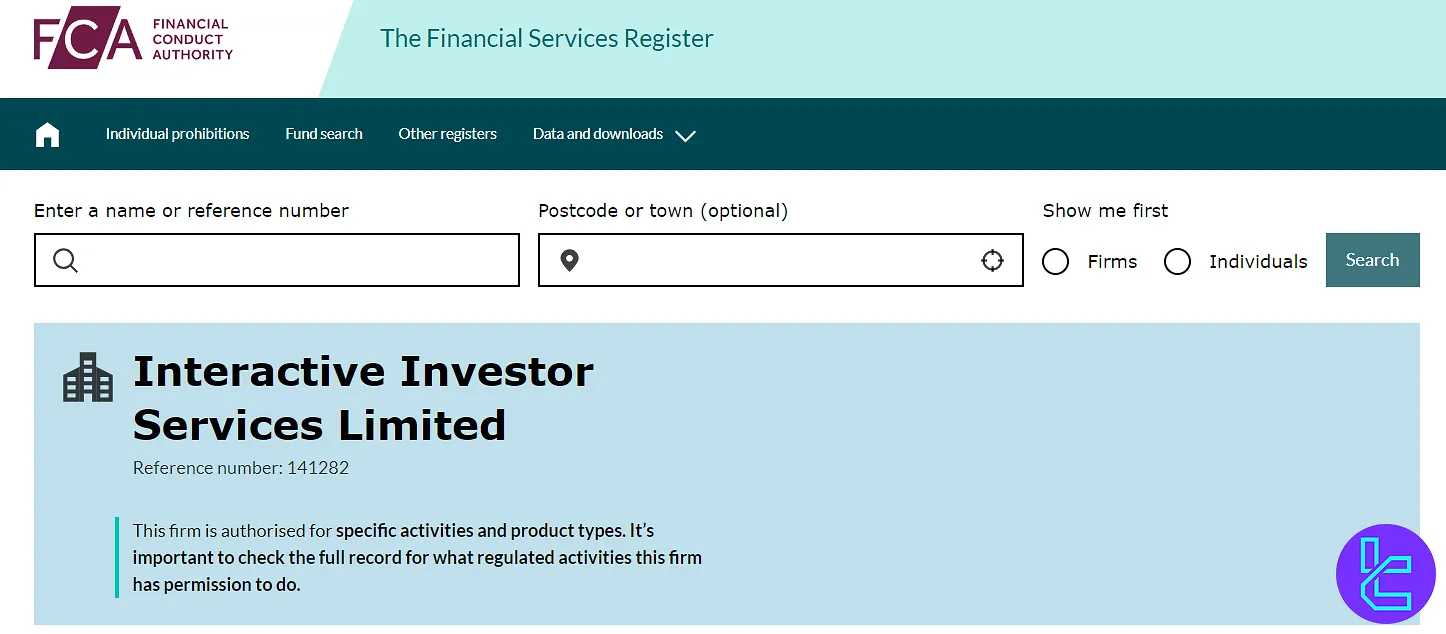

Crucially, ii operates under the watchful eye of the UK's Financial Conduct Authority (FCA). In the event of firm insolvency, eligible clients are entitled to compensation of up to £85,000.

This regulatory oversight ensures that ii adheres to strict standards of conduct and provides appropriate protections for its clients' assets and interests.

Interactive Investor is now part of the abrdn group, the UK’s largest active asset manager, following its acquisition in 2022.

The company has previously expanded by acquiring notable direct-to-consumer platforms such as TD Direct Investing, EQi, and The Share Centre.

This consolidation has helped position ii as a top-tier investment service provider, rivaled only by Hargreaves Lansdown.

Entity Parameters / Branches | Interactive Investor Services Limited |

Regulation | Financial Conduct Authority (FCA), UK |

Regulation Tier | Tier-1 |

Country | United Kingdom |

Investor Protection Fund / Compensation Scheme | Financial Services Compensation Scheme (FSCS) – up to £85,000 per eligible client |

Segregated Funds | Yes |

Negative Balance Protection | Yes |

Maximum Leverage | 1:1 |

Client Eligibility | Retail and professional clients based in the UK and selected international regions |

The platform promotes transparency and accessibility, with a mission to make investing “simple and open to all”.

Table of Specifications

To give you a clearer picture of what Interactive Investor offers, let's break down some key specifications:

Broker | Interactive Investor |

Account Types | Self-Invested Personal Pension (SIPP), Stocks & Shares ISA, Managed ISA, Trading Account |

Regulating Authorities | FCA |

Based Currencies | USD/EUR/GBP |

Minimum Deposit | $0 |

Deposit Methods | Bank Transfer, Debit Card |

Withdrawal Methods | Bank Transfer, Debit Card |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:1 |

Investment Options | Ready-made Portfolios, Quick-start Funds |

Trading Platforms & Apps | Proprietary Web-Platform, Mobile App |

Markets | Stocks, Bonds, Mutual Investment Funds, ETFs |

Spread | 1.5% |

Commission | £9.99/Month for Each Account |

Orders Execution | Market Execution |

Trading Features | Quick Start Funds, Ready-Made Portfolios, Investment Managers |

Affiliate Program | Yes |

Bonus & Promotions | Loyalty Program, Referral Program, Deposit Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Ticket, Phone Call, Messaging. Ticket |

Customer Support Hours | 7:45 A.M to 5:30 P.M |

Restricted Countries | Iran, Yemen, Syria, North Korea, Iraq, Crimea, Myanmar, DR Congo |

It's worth noting that while ii primarily caters to UK investors, they do offer international trading capabilities.

However, the regulatory landscape can vary depending on your location, so it's crucial to verify the specifics for your region.

Interactive Investor Broker Account Types Overview

Each account type comes with ii's signature flat fee structure, though exact costs may vary.

The platform's design allows for both self-directed and managed investment approaches, accommodating investors of varying experience levels and time commitments.

ii Account Types:

Self-Invested Personal Pension (SIPP)

- Tax-efficient way to save for retirement

- Wide range of investment options

- Flat monthly fee structure

- Potential for employer contributions

Stocks & Shares ISA

- Tax-free investing up to annual allowance (£20,000 for 2023/24)

- Choose your own investments

- Access to shares, funds, ETFs, and more

- No capital gains tax on profits

Managed ISA

- Hands-off approach for less experienced investors

- ii experts select and manage investments

- Range of risk profiles available

- Still benefits from ISA tax advantages

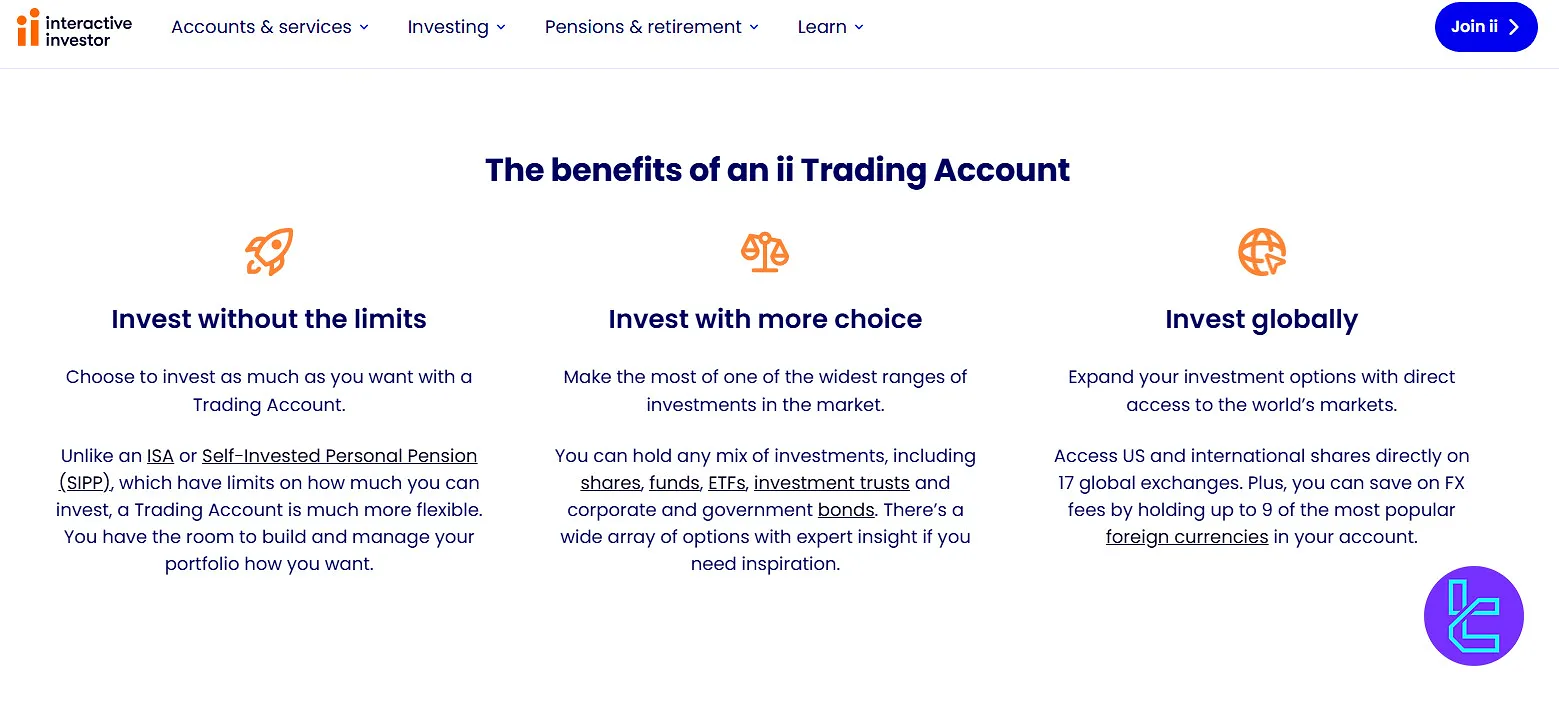

Trading Account

- General investment account with no tax benefits

- Unrestricted investing (no annual limits)

- Full range of investment options

- Suitable for investing beyond ISA/SIPP allowances

Pros and Cons

As all brokers, Interactive Investor has its own advantages and disadvantages; Let's weigh the strengths and weaknesses of Interactive Investor:

Pros | Cons |

Cost-Effective Flat Fee Structure (Especially for Larger Portfolios) | No Forex or CFD Trading Options |

Extensive Investment Options (40,000+ Stocks, Shares, Funds, Etc.) | Complex User Interface |

Excellent Customer Service | 24/7 Support Not Provided |

Comprehensive Research Tools and Educational Resources | - |

How to Open an Account in Interactive Investor Broker? Complete Guide!

Opening an account with Interactive Investor (ii) is quick and fully digital, offering access to investment products like ISAs, SIPPs, and general trading accounts.

The platform supports UK regulatory compliance, electronic verification, and flexible funding options, all within a secure user environment.

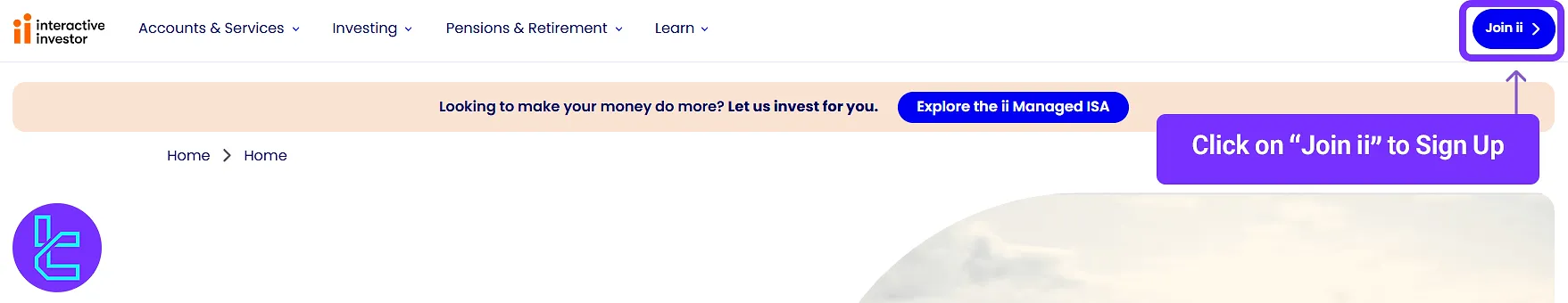

#1 Visit the Official Website

Go to the Interactive Investor website and click on “Join ii” to begin the registration process.

#2 Choose Your Account Type

Select the investment product that suits your needs, such as a Stocks & Shares ISA, SIPP, or Trading Account.

#3 Enter Personal Details

Provide the required information, including:

- Full name, gender, and date of birth

- Email address and phone number

- UK postcode and country of birth

- National Insurance number and tax residency status

#4 Verify Your Identity

Upload a validpassport or UK driving license.

For proof of address, submit a recent utility bill or bank statement.

#5 Select a Funding Method

Choose your preferred deposit method, typically a bank transfer or debit card.

#6 Account Activation

Most accounts are verified electronically and activated within 24 hours. In rare cases, additional documentation may be requested.

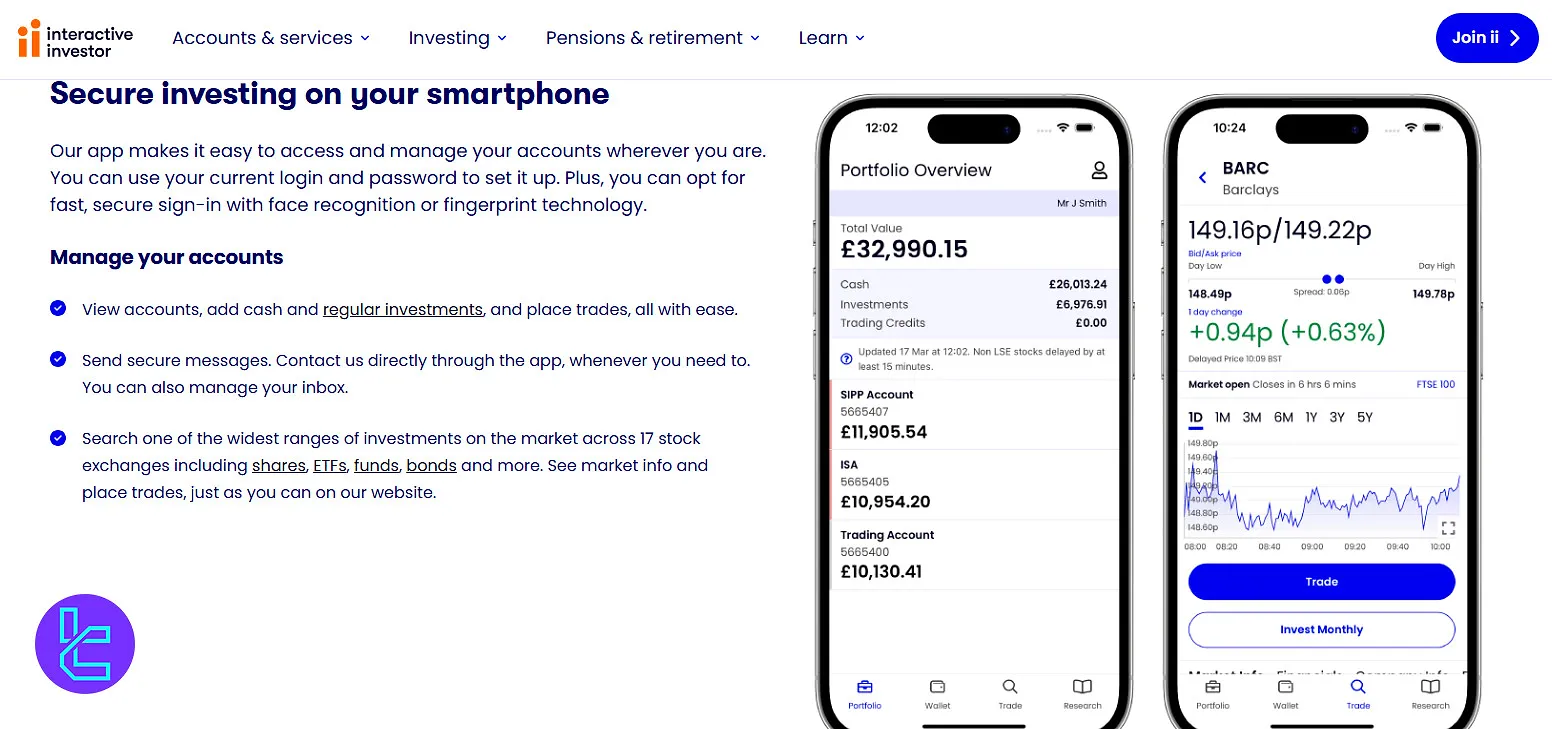

What Trading Platforms are Available in Interactive Investor?

Interactive Investor offers a robust suite of trading platforms to cater to various investor needs, but it doesn’t support MetaTrader 4, MetaTrader 5,cTrader and other popular platforms.

ii Trading Platforms:

Web-based Platform:

- Clean, intuitive interface

- Real-time pricing and charts

- Advanced stock screening tools

- Portfolio analysis features

- Access to research and market news

Mobile App (iOS and Android):

- Seamless account management on-the-go

- Place trades and monitor positions

- Real-time price alerts

- Fingerprint/Face ID login for security

- Syncs with web platform for consistent experience

Both platforms provide access to ii's full range of investment products across global markets.

They offer:

- Advanced charting tools

- Real-time data feeds

- Watchlists and alerts

- Fund comparison tools

While not as feature-rich as some specialized trading platforms, ii's offerings strike a balance between functionality and user-friendliness, suitable for both novice and experienced investors.

Commission and Fees

Interactive Investor's fee structure is designed to be transparent and cost-effective, especially for larger portfolios.

Here's a breakdown:

Account Fees

- £9.99/month for ISA, SIPP, or Trading Account

- Includes one free trade per month

Trading Commissions

- UK Shares, ETFs, Funds: £3.99 per trade

- US Shares: £3.99 per trade

- Other international shares: From £19.99 per trade

Regular Fees

- Fund Custody Fee: None (included in monthly account fee)

- Withdrawal Fees: One free withdrawal per month, £15 thereafter

While the flat fee model can lead to significant savings for larger portfolios, investors with smaller amounts might find percentage-based platforms more cost-effective.

Always consider your investment size and trading frequency when evaluating costs.

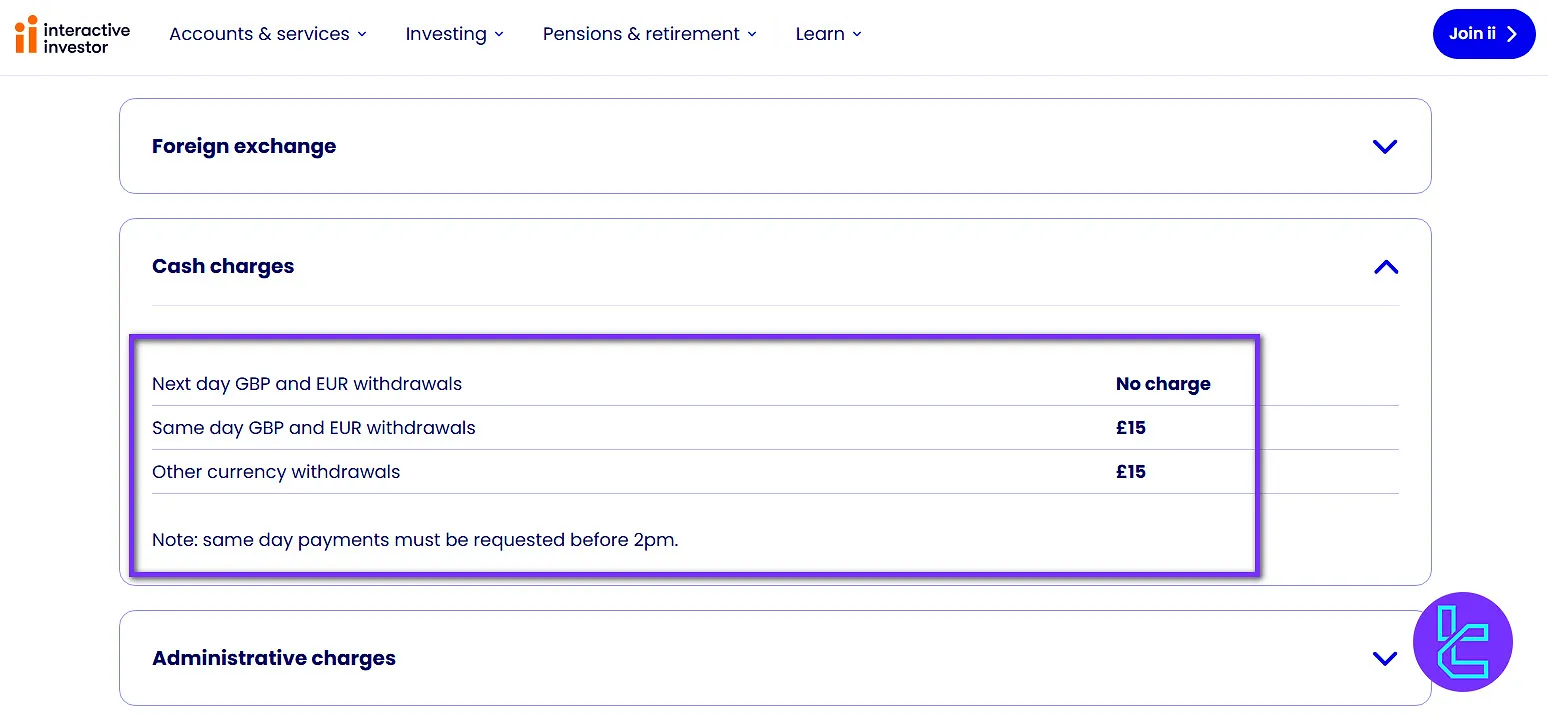

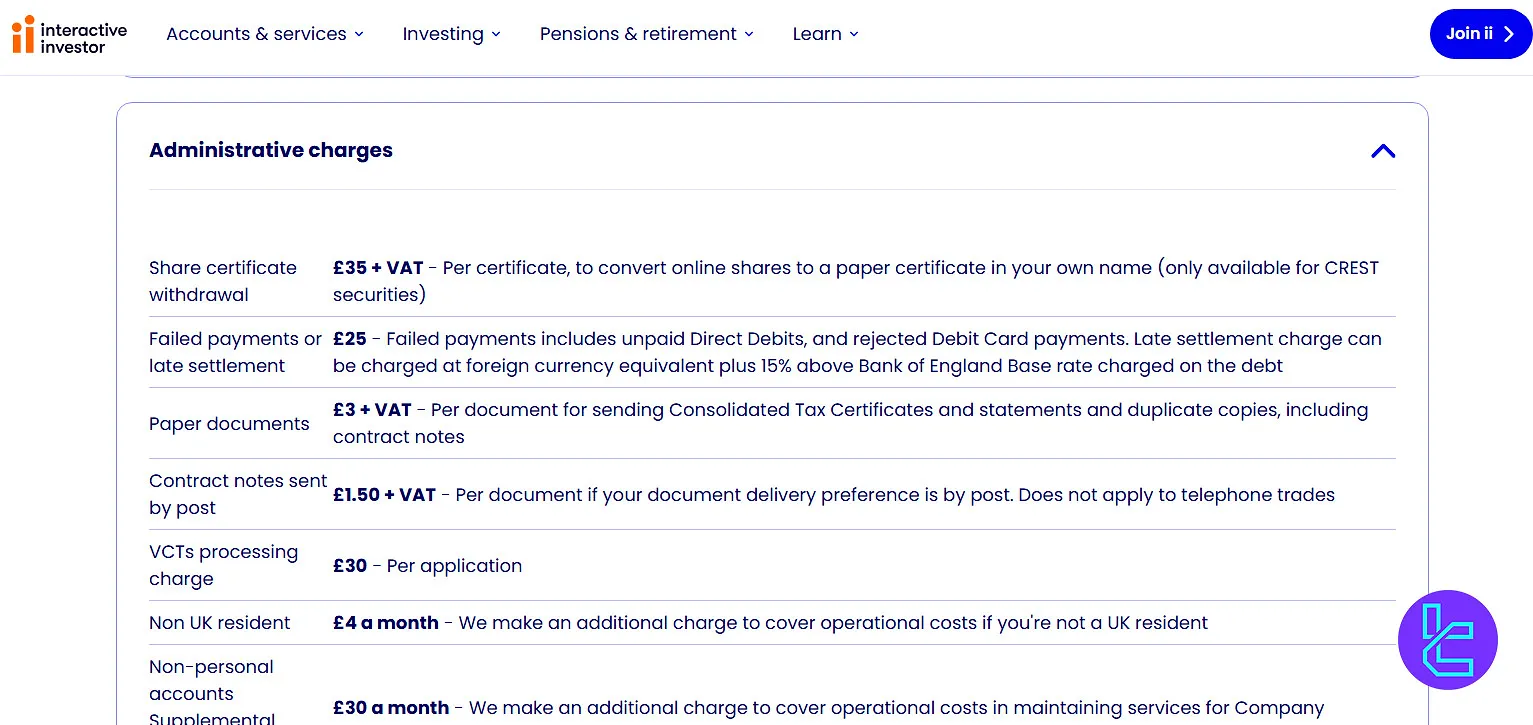

Interactive Investor Non-Trading Fees

Interactive Investor charges a range of non-trading fees, covering cash withdrawals, document handling, administrative services, and various transaction levies across multiple markets. These fees apply to both individual and institutional accounts.

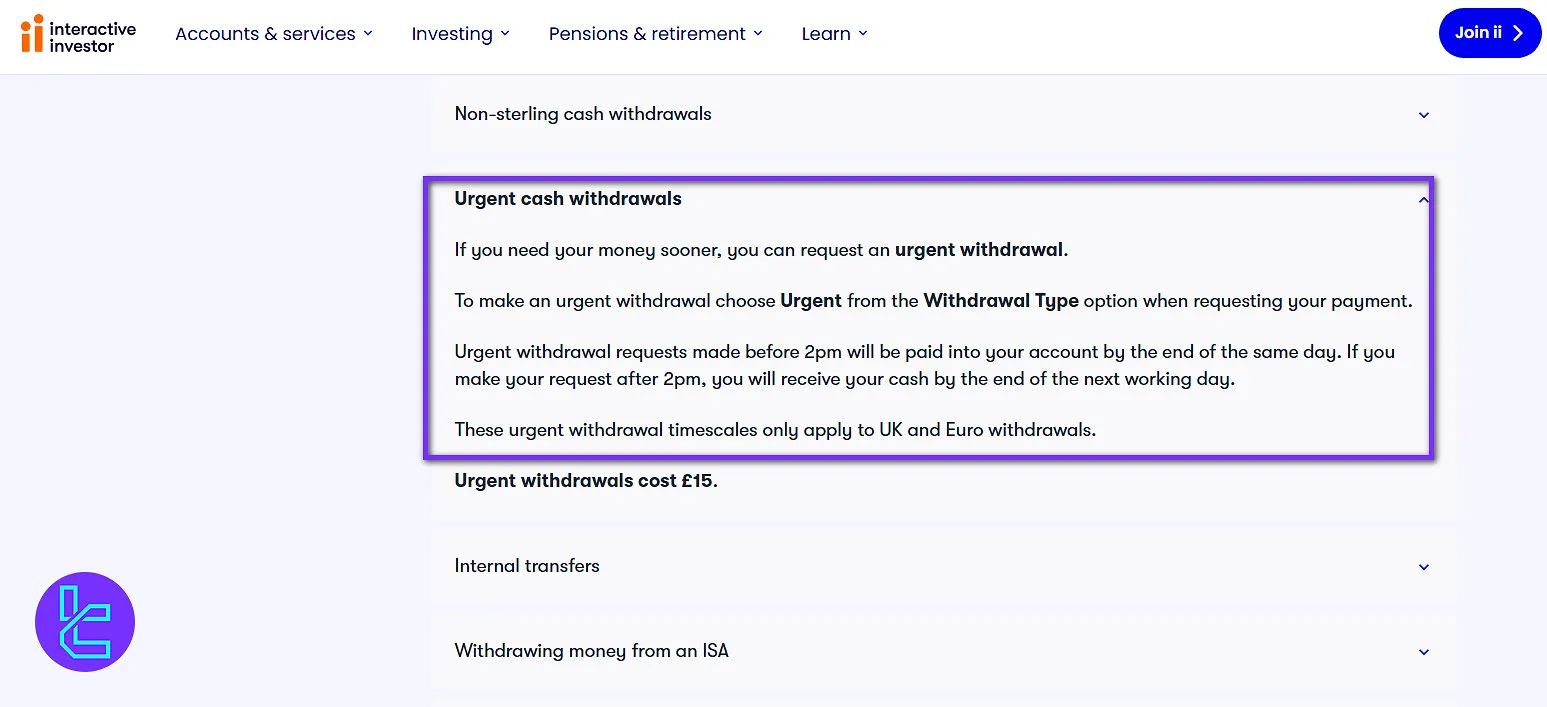

Cash Withdrawal Charges:

- Next-day GBP and EUR withdrawals: Free of charge

- Same-day GBP and EUR withdrawals: £15 (requests must be submitted before 2 pm)

- Other currency withdrawals: £15

Document and Certificate Fees:

- Share certificate conversion (CREST securities): £35 + VAT per certificate to convert online holdings to paper format in your name

- Failed payments or late settlements: £25, including unpaid Direct Debits or rejected debit card payments. Late settlement can include additional interest, calculated as 15% above the Bank of England Base Rate in foreign currency equivalent

- Paper documents (tax certificates, statements, contract notes duplicates): £3 + VAT per document

- Contract notes by post: £1.50 + VAT per document (excluding telephone trades)

Additional Charges:

- VCT application processing: £30 per application

- Non-UK resident fee: £4 per month to cover operational costs

- Supplemental administration (non-personal accounts, e.g., Company or Trust Accounts): £30 monthly

- Quotestream service: £20 + VAT per month, additional to standard plan fees

Stamp Duties and Transaction Levies:

- UK equities: 0.50% Stamp Duty

- Irish equities: 1.00% Stamp Duty

- PTM Levy (UK equities > £10,000): £1.50 flat rate

- ITP Levy (Irish equities > €12,500): €1.25 flat rate

- Hong Kong: Transactional levy 0.0027%, trading fee 0.005%, and Stamp Duty 0.10% (rounded up to nearest HKD)

- Singapore Clearing Fee: 0.0325% per transaction

- French financial transaction tax: 0.40% on eligible stock purchases

- Italian financial transaction tax: 0.10% on eligible stock purchases

- Spanish financial transaction tax: 0.20% on eligible stock purchases

What Payment Methods Interactive Investor Supports?

ii offers 2 payment methods for funding and withdrawing.

Interactive Investor Deposit and Withdrawal Methods:

Bank Transfer:

- Most popular method

- No fees from ii (check with your bank)

- Typically credited within 1-2 business days

Debit Card:

- Instant funding

- Visa, Maestro, Mastercard accepted

- Daily limit of £25,000

Always ensure you're comfortable with the payment method and aware of any associated fees before proceeding.

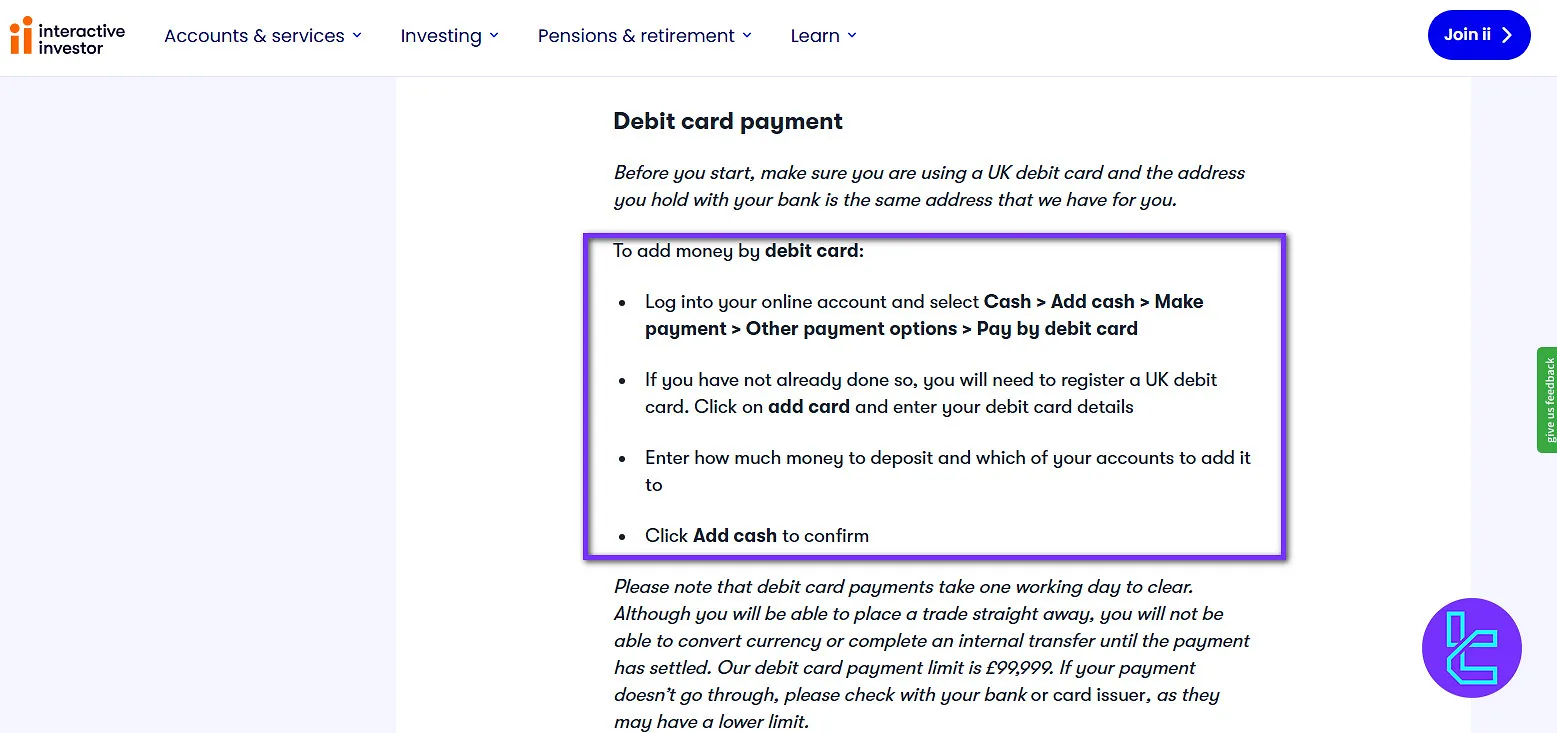

Interactive Investor Deposit

Interactive Investor provides two main options for depositing and withdrawing funds: bank transfer and debit card.

Bank transfers are the most common method and incur no fees from Interactive Investor, although it is advisable to confirm any charges with your own bank.

Payments through bank transfer are typically credited within one to two business days. Sterling transfers must originate from your registered UK bank account, and the seven-digit II account number should be included as a reference.

If a payment is sent from an unregistered account, the funds are returned the same day, with standard credit processed the following working day.

Debit card payments offer instant account funding and support Visa, Mastercard, and Maestro. While deposits appear immediately, the clearing process takes one working day.

Before making a debit card deposit, ensure that the card is registered in the UK and that the billing address matches the address on file with Interactive Investor.

Here are the details of the two deposit methods available on Interactive Investor:

Method | Processing Time | Fees |

Bank Transfer | 1–2 business days | None from II (bank fees may apply) |

Debit Card | Instant (clears in 1 day) | None from II |

Interactive Investor Withdrawal

Interactive Investor allows clients to withdraw funds primarily via bank transfer. To initiate a withdrawal, a nominated bank account must be registered for the currency being withdrawn.

Standard withdrawals requested before 2 pm are credited by the end of the next working day, while requests made after 2 pm take two working days to process. It is important to ensure sufficient funds are available in the account to cover both the withdrawal amount and any applicable fees.

For non-sterling withdrawals, Interactive Investor supports Euros, US Dollars, and Canadian Dollars.

Each currency requires a separate nominated bank account. Withdrawals in currencies other than Sterling or Euros incur a £15 charge per transaction, and processing may take up to five working days.

Clients who require faster access to their funds can select the urgent withdrawal option. Urgent requests made before 2 pm are credited the same day, while those made after 2 pm are processed by the end of the next working day.

This option is only available for UK and Euro withdrawals and carries a £15 fee.

It is important to note that any funds withdrawn from an ISA lose their tax-efficient status, and the withdrawn amount cannot be replaced without impacting the annual ISA allowance.

While bank transfer is the primary withdrawal method, cheque withdrawals are also available. Cheque requests do not require a nominated bank account and must be arranged by contacting Interactive Investor directly.

In the table below, you can see an overview of withdrawal methods:

Withdrawal Type | Processing Time | Fee |

Standard (GBP, EUR) | Next working day if requested before 2 pm; two working days if after 2 pm | None |

Non-sterling (USD, CAD) | Up to 5 working days | £15 per withdrawal |

Urgent (GBP, EUR) | Same day if requested before 2 pm; next working day if after 2 pm | £15 |

Cheque | Varies; request via phone | None |

Is Copy Trading Available on Interactive Investor? Investment Options Overview

While Interactive Investor doesn't offer copy trading functionality, they provide two alternative investment options for those seeking guidance or diversification:

Ready-made Portfolios

- Professionally managed, diversified portfolios

- Different risk levels available

- Regular rebalancing to maintain optimal asset allocation

Quick-start Funds

- Curated selection of well-regarded, low-cost funds

- Simplifies choice for beginner investors

While not offering direct copy trading, these options provide guidance and structure for investors who prefer not to make all decisions independently.

Remember, all investments carry risk, and past performance doesn't guarantee future results.

What Markets are Available to Trade in Interactive Investor?

Unlike many brokers, including TMGM, InstaForex, Alpari, etc., ii does not support Forex market trading! Tradable instruments and assets in Interactive Investor:

Category | Type of Instruments | Number of Symbols / Options | Competitor Average |

Stocks | UK shares (FTSE 100, 250, AIM), US stocks (NYSE, NASDAQ), European shares, Asian market access | Wide selection across global markets | 800–1200 global stocks |

Bonds | Government bonds (Gilts), Corporate bonds, International bonds | Multiple instruments across regions | Varies by broker, 50–100 common bonds |

Mutual Investment Funds | Active and passive funds, covering various sectors and geographies | Over 3,000 funds | 1,500–3,000 funds |

ETFs (Exchange-Traded Funds) | Broad market ETFs, sector ETFs, commodity ETFs, currency ETFs | Extensive selection across multiple categories | 500–1,500 ETFs |

Does Interactive Investor Offers Bonuses and Promotions?

Interactive Investor frequently runs promotional offers to attract new customers and reward existing ones.

SIPP Cashback

- New or existing customers (excluding current SIPP holders)

- £100 to £2,000 cashback based on deposit/transfer amount

- Minimum £10,000 deposit/transfer required

Referral Plan

- £200 reward for existing customers

- When referred friend opens a qualifying account

Interactive Investor Awards

Interactive Investor has been consistently acknowledged for its high-quality platform, investment services, and customer support.

Interactive Investor awards reflect the company’s commitment to empowering investors with tools, insights, and platforms to manage their financial portfolios effectively.

Here are the latest awards:

- Online Money Awards 2025: Best Investment Platform

- Which? 2025: Recommended SIPP Provider

- Boring Money 2025: Consumer Choice Winner, Best Buy ISA, Best Buy Pension, Best for Customer Services

- Kepler 2025: Best All-Rounder SIPP Provider

Support

Interactive Investor does not provide 24/7 support, which is one of their weaknesses. Besides that, You can only contact them from Monday to Friday and from 7:45AM to 5:30PM (GMT).

ii Support Ways:

- Phone Call

- Help Centre

- Messaging

- Ticket

In Interactive Investor Review, we found out that this brokerage did not consider live chat for support; This issue is one of their major weaknesses and it should be seen whether they will take any action to fix it in the future.

Interactive Investor Broker Restricted Countries

While Interactive Investor primarily serves UK-based investors, they do offer some international services.

However, like any other Broker, access may be restricted in certain countries due to regulatory requirements. ii Restricted Countries:

- Iran

- Yemen

- Syria

- North Korea

- Iraq

- Crimea

- Myanmar

- DR Congo

Trust Score

Interactive Investor has garnered a strong reputation among UK investors, reflected in its user satisfaction ratings in sites such as Trustpilot:

- ii Trustpilot: 4.7/5 (based on over 22,000 reviews)

- ForexPeaceArmy: 2.5 out of 5 (based on 159 reviews)

- REVIEWS.io: 2.3/5

Does Interactive Investor Offers Educational Material?

In the Interactive Investor Review, we discovered that this brokerage performs well in training traders. They provide the following resources to traders:

- Blog articles

- Investment ideas, including super 60 investments and ace 40 investments

- Knowledge center

- Free newsletter

- E-books and documents

Interactive Investor Compared to Other Brokerages

This table makes a comparison between ii and some of the best players in the Forex market:

Parameter | Interactive Investor Broker | FXGlory Broker | HFM Broker | LiteForex Broker |

Regulation | FCA | No | CySEC, DFSA, FCA, FSCA, FSA | CySEC |

Minimum Spread | 1.5% | From 0.1 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | £9.99/Month for Each Account | $0 | From $0 | From $0.0 |

Minimum Deposit | $0 | $1 | From $0 | $50 |

Maximum Leverage | 1:1 | 1:3000 | 1:2000 | 1:30 |

Trading Platforms | Proprietary Web-Platform, Mobile App | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Self-Invested Personal Pension (SIPP), Stocks & Shares ISA, Managed ISA, Trading Account | Standard, Premium, VIP, CIP | Cent, Zero, Pro, Premium | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 40,000+ | 45 | 1,000+ | N/A |

| Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market |

TradingFinder Conclusion and Final Words

Proprietary platform, various trading features [Quick Start Funds, Ready-Made Portfolios, Investment Managers] and deposit bonus are the reasons why Interactive Investor has obtained 4.7/5 rating in Trustpilot.

Beyond these, ii has disadvantages too; It does not offer forex trading and has a complex user interface.