Intertrader is a multi-award-winning [10+ in the recent years] spread betting and CFD provider. Features such as negative balance protection, $0 commission on forex, 1:200 maximum leverage, €20,000 insurance for client funds and 4 trading platforms [Intertrader +, MetaTrader 4, MetaTrader 5, Mobile Trading] are offered by Intertrader.

Intertrader Broker Company Information & Regulation

Intertrader is a heavyweight contender backed by some serious credentials, such as FCA and GFSC regulations.

Initially launched in 2008 as Party Markets via a partnership with City Index, the company rebranded as Intertrader after transitioning to the London Capital Group (LCG) platform in 2010. It operated under GVC Holdings PLC until being sold to a private firm, at which point Intertrader began operating independently.

Here's what you need to know about this brokerage:

Regulatory Powerhouse

Intertrader operates under the watchful eye of the Gibraltar Financial Services Commission (GFSC) and is registered with the UK Financial Conduct Authority (FCA). This dual regulatory approach ensures a high level of investor protection and operational transparency.

Corporate Backing

As a subsidiary of the FTSE-listed GVC Holdings PLC, Intertrader benefits from a rock-solid financial foundation. This connection provides a 100% parental guarantee, effectively safeguarding client funds.

Market-Neutral Model

Unlike some brokers who might be tempted to trade against their clients, Intertrader operates on a market-neutral model. This means they don't take the opposite side of your trades, resulting in superior execution quality and aligning their interests with yours.

Revenue Model

Intertrader's income is derived from client trading volume rather than client losses. This transparent approach fosters trust and ensures that the broker's success is directly tied to the trading activity of its clients.

Summary of Specifics

Intertrader isn't just another run-of-the-mill broker; it's a powerhouse of trading opportunities wrapped in a user-friendly package. Let's break down the key specifics that make this broker stand out in the crowded world of online trading. Intertrade Broker Specifics:

Broker | Intertrader |

Account Types | Live |

Regulating Authorities | FCA, GFSC |

Based Currencies | GBP/EUR/USD |

Minimum Deposit | $500 |

Deposit/Withdrawal Methods | VISA, MasterCard, Maestro, Skrill, Neteller |

Minimum Order | 0.01 |

Maximum Leverage | 1:200 |

Investment Options | None |

Trading Platforms & Apps | Intertrader +, MetaTrader 4, MetaTrader 5, Mobile Trading |

Markets | Shares, Indices, Forex, Commodities |

Spread | From 0.3 Pips |

Commission | $3 |

Orders Execution | Market |

Margin Call/Stop Out | No Information Provided |

Trading Features | High Trust Scores, $500 Minimum Deposit, MT4 & MT5 Are Supported, 1:200 Maximum Leverage |

Affiliate ProGFSCm | Yes |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Indoor Meeting, Live Chat, Email, Ticket |

Customer Support Hours | 24/5 |

How Many Accounts Are Offered by Intertrader?

When it comes to account types, Intertrader keeps things simple. Unlike many brokers who have various accounts and each of them targets a specific range of traders, Intertrader offers just one live account type. Intertrade Live Account Features:

- Minimum Deposit: $500

- Maximum Leverage: 1:200

- Spreads: Competitive, starting from 0.3 pips on major pairs

- Commission: $3

- Instruments: Access to all available markets (Shares, Indices, Forex, Commodities)

- Platforms: Intertrader +, MetaTrader 4, MetaTrader 5, Mobile Trading

Advantages and Disadvantages

Every broker has its strengths and weaknesses, and Intertrader is no exception. Let's break down the pros and cons to give you a balanced view:

Advantages | Disadvantages |

Strong Regulation (GRA & FCA) | Limited Account Types |

Competitive Spreads | No US Clients Accepted |

Multiple Trading Platforms | No Room for Cryptocurrency Trading |

Negative Balance Protection | No Social/Copy Trading |

Segregated Client Funds | High Minimum Deposit ($500) |

No Commissions on Forex | Limited Educational Resources |

Market Neutral Model | No 24/7 Customer Support |

How to Create an Intrader Account? Step-by-Step Guide for Traders

Embarking on your trading journey with Intertrader forex broker is not that hard, but it's important to understand each step to ensure a smooth onboarding experience.

#1 Start Your Application

Go to Intertrader’s official website and click "Create a live account". Register using a valid email and password.

#2 Personal & Regulatory Info

Select your country of residence and nationality, and answer a brief questionnaire about your trading experience and financial goals.

#3 Identity Details

Fill in your full name, date of birth, and phone number. Choose your account currency (USD, EUR, GBP) and your desired leverage.

#4 Document Verification

Upload a government-issued ID and a recent utility bill to meet KYC and AML requirements.

#5 Final Review & Activation

Intertrader’s compliance team will verify your documents, typically within one to two business days. Once approved, fund your account and access live markets.

What Are Intertrader Trading Platforms?

They shine In this section of the Intertrader review because of supporting 4 trading platforms such as MetaTrader 4 and MetaTrader 5; Intertrader Trading Platforms:

Intertrader+ (Web-based Platform)

Intertrader's proprietary web-based platform offers a seamless trading experience without the need for downloads. Key Features:

- User-friendly interface

- Advanced charting and trading tools

- Real-time market data

- Quick trade execution

- Customizable workspace

- Accessible from any device with an internet connection

Great for traders who prefer flexibility and don't want to install software.

MetaTrader 4 (MT4)

The gold standard in forex trading platforms, MT4 is known for its robust features and user-friendly interface. Key Features:

- Advanced charting tools with 30+ built-in indicators

- Expert Advisors (EAs) for automated trading

- Customizable interface

- Mobile version available for iOS and Android

- Real-time quotes and execution

- One-click trading

Perfect for experienced traders who value customization and automated trading options.

MetaTrader 5 (MT5)

The next-generation platform, building on MT4's success with enhanced features. Key Features:

- Access to more markets (stocks, futures)

- Economic calendar integration

- Advanced pending orders

- More timeframes and graphical objects

- Improved strategy tester

- MQL5 programming language

Ideal for traders looking for a more comprehensive platform with access to multiple asset classes.

Mobile Trading Apps

Trade on the go with Intertrader's mobile applications. Key Features:

- Available for iOS and Android devices

- Real-time quotes and charts

- Full trading functionality

- Push notifications for market events

- Secure login with biometric authentication

Perfect for traders who need to monitor and execute trades while away from their desk.

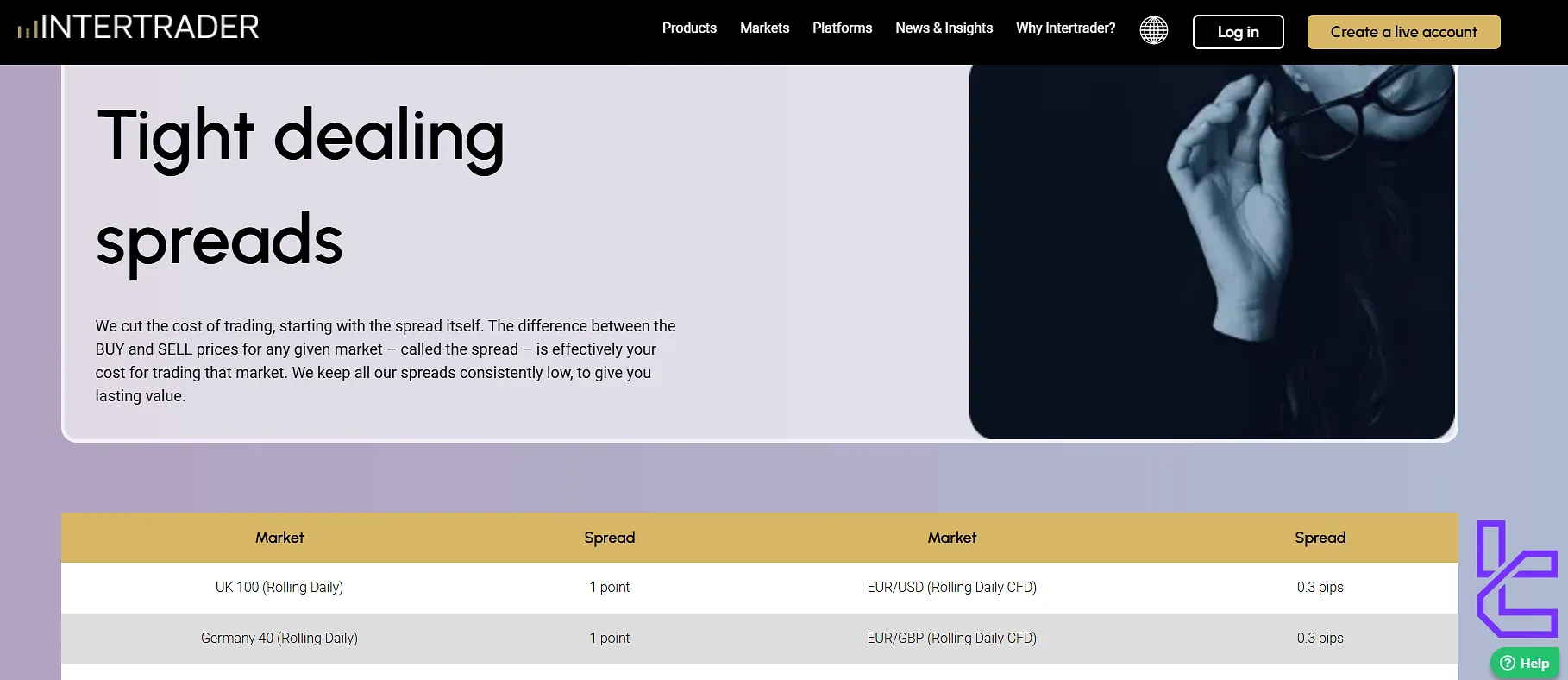

Spreads and Commissions

Understanding the cost structure of your trades is crucial for long-term profitability. Intertrader offers a competitive pricing model that's designed to cater to various trading styles.

Spreads

Intertrader offers variable spreads that are among the most competitive in the industry because it starts from 0.3 pips; Major Pairs Spreads:

- EUR/USD: From 0.3 pips

- EUR/GBP: From 0.3 pips

- AUD/USD: From 0.4 pips

- GBP/USD: From 0.4 pips

It's important to note that these are variable spreads, meaning they can widen during times of high market volatility or important economic announcements.

Commissions

Trading with Intertader broker is not commission-free, and based on the official information released by the broker, you have to pay $3 for each position.

Regarding non-trading costs, there are not any kinds of deposit, withdrawal, or inactivity fees involved with the broker.

What Are Intertrader Deposit & Withdrawal Methods?

When it comes to funding your trading account, Intertrader offers 5 payment methods. Intertrader Deposit and Withdrawal Methods:

- Credit/Debit Cards: VISA, MasterCard, and Maestro;

- E-wallets: Skrill and Neteller.

Intertrader aims to make the funding process as smooth as possible for its clients. Here are some key points to note:

What Investment Option Are Offered by Intertrader?

Interestingly, Intertrader does not currently offer copy trading or social trading feature! This might come as a surprise to some traders who are used to these options being available with other brokers. Beside copy trading, there are no investment options available in this broker.

Tradable Instruments and Assets

Intertrader offers a diverse range of tradable markets and it’s a good choice for traders who want to diversify their trading options. Intertrader Broker Markets:

- Forex Market: Over 40 currency pairs of major, minor, and exotics

Forex trading is available in this broker with more than 40 assets - Indices: Access to major global stock indices including popular ones like S&P 500, FTSE 100, and DAX

- Shares: Hundreds of individual stocks from various global markets

- Commodities: Range of hard and soft commodities including gold, silver, oil, and agricultural products

Does Intertrader Offer Bonuses and Promotions?

In an interesting departure from many of its competitors, Intertrader does not offer any bonuses or promotional offers to its clients. This approach aligns with the broker's focus on providing a transparent and straightforward trading environment.

Customer Support

Intertrader offers 24/5 customer support (Monday to Friday), which means they are not available on the weekends. The broker provides multiple channels for traders to get in touch with their support team:

- Live Chat: Available directly from the website for quick queries

- Email: For more detailed inquiries or documentation needs

- Indoor Meeting: Accessible with appointment

- Ticket System: For tracking and resolving complex issues

Restricted Countries

While Intertrader aims to provide its services to a global audience, there are certain countries from which they cannot accept clients due to regulatory restrictions.

Intertrade Broker Prohibited Countries:

- United States

- Iran

- North Korea

- Syria

- Yemen

- Iraq

- Russia

You should check directly with Intertrader or consult their terms and conditions to confirm whether their country of residence is eligible for opening an account.

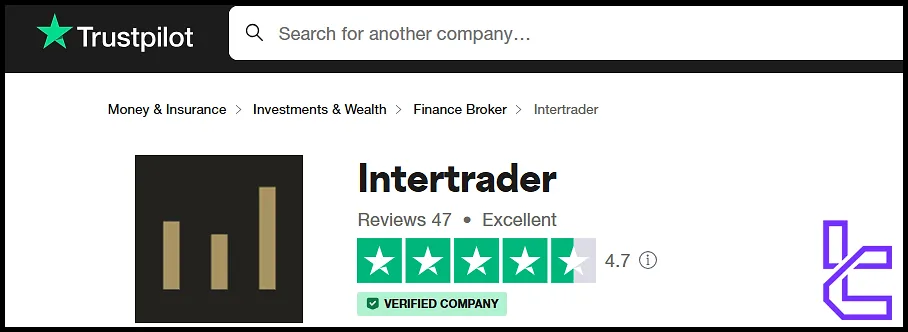

Intertrader Broker Trust Scores

Trust and reputation are crucial factors when choosing a forex broker. Intertrader has received mixed reviews across industry-known platforms such as ForexPeaceArmy and Trustpilot:

- Intertrader ForexPeaceArmy: 2.5/5 out of just 5 reviews

- Trustpilot: 4.7 out of 5 based on 45+ reviews

The high rating on Trustpilot suggests that many clients have had positive experiences with Intertrader. Common Praises Include:

- Excellent customer service

- User-friendly trading platforms

- Competitive spreads and fast execution

However, the lower rating on ForexPeaceArmy indicates that some traders have faced challenges or dissatisfaction with the broker's services.

What Educational Materials Are Offered by Intertrader?

Intertrader offers a range of forex educational resources to help traders improve their skills and stay informed about market developments:

- Market Insights: Regular analysis and commentary on various markets

Intertrader provides regular market insights such as analysis - Economic Calendar: Up-to-date information on important economic events and releases

- Market Buzz: Real-time news and updates affecting the financial markets

Table of Comparison with Top Brokers

The table below compares Intertrader with the competition based on critical parameters such as the trading platform, spreads, commissions, etc.:

Parameter | Intertrader Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FCA, GFSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | From 0.3 Pips | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | $3 | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $500 | $200 | $5 | $50 |

Maximum Leverage | 1:200 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | Intertrader +, MetaTrader 4, MetaTrader 5, Mobile Trading | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Live | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | No | Yes | Yes | No |

Number of Tradable Assets | N/A | 2,250+ | 1400+ | N/A |

Trade Execution | Market | Market | Market, Instant | Market |

Expert Conclusion and Final Words

4 Markets and 100+ assets [with spreads from 0.3 pips] are available to trade in Intertrader. It als has 0.01 minimum order and achieved 4.7/5 rating in Trustpilot. On the other hand, there is only one account, no possibility of copy trading, and no bonus!