MTS Capital is a Thai Brokerageand 90% of its share belongs to “MTS Gold Group”. This broker is regulated by Thailand SEC and supports copy trading.

MTS Capital broker provides 1:100 maximum leverage with spreads starts from 0.8 pips.

MTS Capital is a Thai broker launched in 2007

MTS Capital is a Thai broker launched in 2007

MTS Capital Broker Company Information & Regulation

MTS Capital forex broker, established in 2007, has carved out a niche for itself in the online trading world, particularly in the Thai market.

With its headquarters nestled in the bustling city of Bangkok, Thailand, the company has leveraged its deep roots in the gold and silver trading.

Key points about MTS Capital include:

- Founded in 2007 in Bangkok, Thailand

- Specializes in forex, the futures market, and derivatives trading

- Operates as a full clearing member of the Thailand Futures Exchange (TFEX)

- Holds the distinction of being the first founding member of Gold Futures and Silver Futures contracts

- Regulated by the Securities and Exchange Commission (SEC) of Thailand

- Adheres to international standards for gold bullion refining

- Reported annual revenue of $3.28 million as of December 31, 2022

MTS Capital is part of the MTS Gold Group, a Thailand-based entity with roots in the precious metals market.

While its association with a long-standing gold trader may inspire some confidence, MTS Capital itself provides limited public information about its management structure, leadership team, or financials, a lack of transparency that may deter risk-conscious investors.

MTS Capital does not maintain segregated client accounts, and trader funds are held jointly with the firm's operational capital. Additionally, there are no investor protection guarantees or insurance schemes in place.

These omissions expose users to high levels of counterparty and operational risk in the event of insolvency or misconduct.

Summary of Specifics

MTS Capital offers a comprehensive suite of trading services, with a particular focus on gold futures trading. Here's a snapshot of what they bring to the table:

Broker | MTS Capital |

Account Types | MT5 Account, Derivatives Account, Demo Account |

Regulating Authorities | SEC Thailand |

Based Currencies | THB |

Minimum Deposit | 1 THB |

Deposit/Withdrawal Methods | Bank Transfer, ATS |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:100 |

Investment Options | Copy Trading, EA |

Trading Platforms & Apps | Ultra High-Speed Trader, MTS Smart Webtrader, MTS Smart Technic, MTS Mobile Trader, MT5 |

Markets | Forex, Futures, Commodities, Indices, Cryptocurrencies, Interest Rates |

Spread | From 0.8 Pips |

Commission | Varies by Contract Size |

Orders Execution | Market |

Margin Call/Stop Out | 70%/30% |

Trading Features | Spreads From 0.8 Pips, 1:100 Maximum Leverage, EAs Allowed, Copy Trading |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Email, Phone Call, Live Chat |

Customer Support Hours | N/A |

What Are MTS Capital Broker Account Types?

MTS Capital caters to a variety of traders with different account types, each designed to meet specific trading needs and preferences. Let's break down the available options:

MT5 Account

- Utilizes the more advanced MetaTrader 5 platform;

- Expands trading options to include stocks and futures;

- Features enhanced analytical tools and timeframes;

- Allows for more complex trading strategies.

Derivatives Account

- Specifically designed for futures trading;

- Provides access to TFEX products, including gold futures;

- Offers leverage and margin trading capabilities;

- Includes specialized tools for derivatives analysis.

Demo Accounts (MT5)

- Virtual trading environment with real market conditions;

- Allows risk-free practice and strategy testing;

- Available for MT5 platform;

- Ideal for beginners or traders testing new strategies.

Advantages and Disadvantages

Like any broker, MTS Capital has its own set of pros and cons. Let's weigh them up:

Advantages | Disadvantages |

Specialized Expertise in Gold Futures Trading | Limited International Reach Compared to Global Brokers |

Regulated By the Thailand SEC | Product Range Might Be Narrower Than Some Competitors |

Offers Advanced Trading Platforms, Including Proprietary Options | Customer Support May Be Primarily in Thai, Potentially Challenging for International Clients |

Provides Access to TFEX Products, Unique in The Thai Market | No Bonuses Offered |

Comprehensive Educational Resources and Market Analysis | - |

1 THB Minimum Deposit | - |

Traders should weigh these factors against their personal needs and trading goals when considering MTS Capital as their broker.

How to Sign Up for MTS Capital? Step-by-Step Guide for Traders!

To access MTS Capital’s trading platform, users must complete a KYC-verified registration process. This includes submitting identity documents and selecting the appropriate account type. Once verified, you can fund your account and start trading on supported platforms.

#1 Fill Out the Registration Form

Go to the MTS Capital website, click “Open Account”, and enter your information:

- Full name

- Date of birth

- Residential address

- Phone number

In order to register with MTS Capital, click on Open Account

In order to register with MTS Capital, click on Open Account

#2 Choose Account Type & Accept Terms

Select your preferred account type, carefully review the terms and conditions, and confirm agreement before submitting the form.

#3 Upload Identity Documents

Submit supporting documents through the broker's client dashboard:

- Government-issued ID: Passport or National ID

- Proof of Address: Utility bill or Bank statement (no older than 3 months)

#4 Await Verification & Fund Your Account

The review typically takes 1–2 business days. After approval, you can fund your account and access the trading platform.

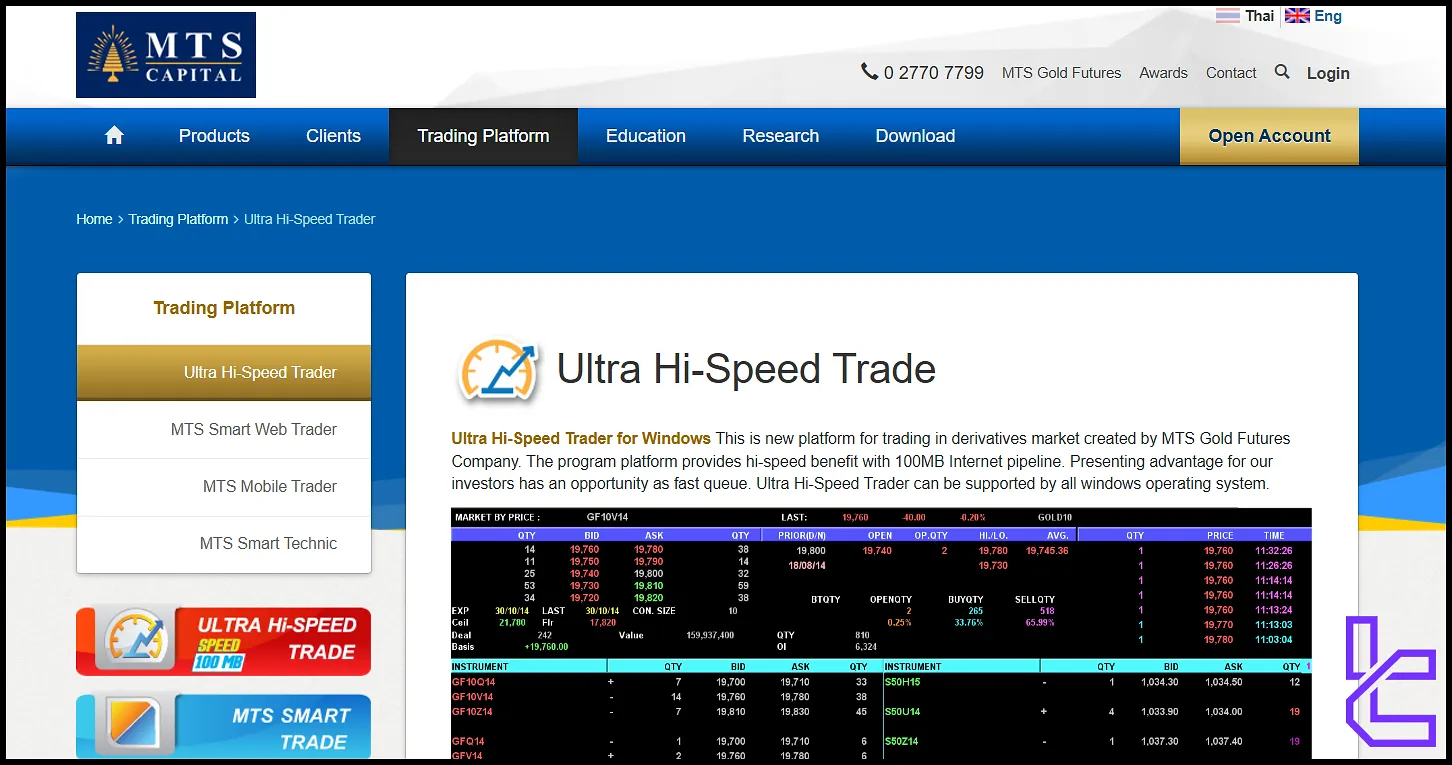

MTS Capital Broker Trading Platforms

MTS Capital offers 5 trading platforms [Ultra High-Speed Trader, MTS Smart Webtrader, MTS Smart Technic, MTS Mobile Trader, MetaTrader 5] to cater to different trading styles and preferences.

Ultra Hi-Speed Trader

- Proprietary high-speed trading platform

- 100MB internet pipeline for ultra-fast execution

- 50x faster trade execution compared to standard platforms

- Quick order placement and shortcut trading functions

Ultra Hi-Speed Trade is available for Windows

Ultra Hi-Speed Trade is available for Windows

MTS Smart Web Trader

- Web-based platform accessible from any device

- No software installation required

- Supports multiple browsers (Chrome, Firefox, Safari)

- Offers advanced charting and technical analysis tools

MTS Smart Technic

- Advanced charting and technical analysis platform

- Real-time gold pricing

- Comprehensive tools for in-depth market research

- Ideal for developing and testing trading strategies

MTS Mobile Trader

- Mobile app for on-the-go trading

- Available for iOS and Android devices

- Access to multiple markets (precious metals, indices, currencies)

- Real-time quotes and charting capabilities

MetaTrader 5 (MT5)

- Industry-standard platform with advanced features

- Multiple asset classes

- Algorithmic trading and Expert Advisors

- Extensive technical analysis tools and indicators

Each platform is designed to offer a unique trading experience, catering to different trader needs - from high-speed execution to comprehensive analysis tools.

TradingFinder has developed a wide range of MT5 indicators that you can use for free.

How Much Are MTS Capital Broker Spreads and Commissions?

MTS Capital's pricing model includes both spreads and commissions and is based on contracts traded per day:

Spreads

- Variable spreads that fluctuate based on market conditions

- Tighter spreads on major currency pairs and gold futures from 8.0 pips

- Wider spreads may apply to exotic pairs and less liquid instruments

Commissions

- Variable based on the number of contracts traded per day (starting from 97.00 Baht)

- Volume-based pricing model (higher volumes generally lead to lower per-contract costs)

Note: Specific commission rates should be verified directly with MTS Capital, as they may change.

MTS Capital Broker Deposit & Withdrawal

Efficient fund management is crucial for smooth trading operations. MTS Capital offers 2 options for deposits and withdrawals:

Deposit Methods:

- Bank Transfer: Direct transfer from your bank account to MTS Capital

- ATS (Automatic Transfer System): Automated system for Thai banks

Withdrawal Methods:

- Bank Transfer: Funds are sent back to your registered bank account

- ATS: For quick withdrawals to Thai bank accounts

Are Copy Trading & Investment Options Available on MTS Capital?

While MTS Capital primarily focuses on direct trading, they do offer some additional investment options, such as copy trading:

- Expert Advisors (EAs): Automated trading algorithms available on the MT5 platform, allowing for 24/7 trading based on pre-set parameters

- Copy Trading: An opportunity to copy professional and successful traders

What Markets and Symbols Are Tradable in MTS Capital?

MTS Capital offers six markets [forex, futures, commodities, indices, cryptocurrencies, interest rates] and their symbols for trading:

- Forex: Major, minor, and exotic currency pairs with competitive spreads on popular pairs

- Futures: Gold futures, other metal futures (silver, copper), currency futures and index futures

MTS Capital supports metals futures trading - Commodities: Precious metals (gold, silver), energy products (crude oil, natural gas)

- Indices: major global stock indices such as Dow Jones, Thai stock index futures

- Cryptocurrencies: limited cryptocurrency offering

- Interest Rates: interest rate futures contracts

Does MTS Capital Offer Bonuses and Promotions?

As we discovered in the MTS Capital review, this broker does not offer traditional bonuses or an affiliate program. This approach aligns with regulatory trends that discourage bonus schemes in forex and CFD trading.

MTS Capital Broker Support

Although there is no information on MTS Capital support hours, you can contact them via the channels below:

- Phone Support: Direct line for immediate assistance

- Live Chat: Real-time support for quick queries

- Email: For detailed inquiries or documentation needs

- FAQ Section: Comprehensive guide addressing common questions

Note: User feedback suggests inconsistent response times and limited availability.

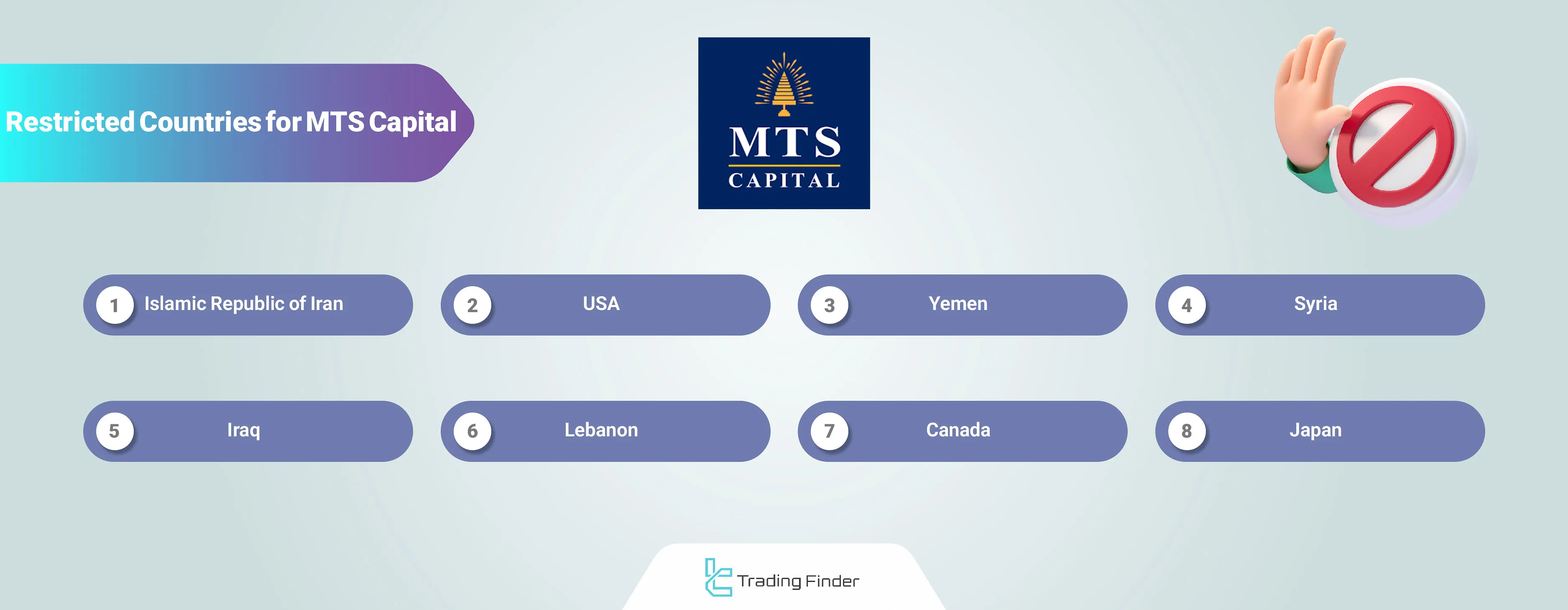

Restricted Countries

While MTS Capital primarily serves the Thai market, it also offers its services to select countries. On the other hand, some countries are banned from using MTS Capital due to sanctions or regulations.

MTS Capital Restricted Countries:

- Iran

- USA

- Yemen

- Syria

- Iraq

- Lebanon

- Canada

- Japan

MTS Capital Broker Trust Scores & Reviews

At the time of writing this article, there are no available trust scores for MTS Capital in review platforms such as Trustpilot, ForexPeaceArmy, or Reviews.io, which is a red flag for this Thai broker.

Does MTS Capital Broker Offer Educational Resources?

One thing we noticed in the MTS Capital review is the fact that this broker demonstrates a commitment to trader education through various resources and activities:

- Seminars and Webinars: Regular online and offline educational events covering trading strategies, technical analysis, and platform tutorials

- MTS Trading Tips: Daily or weekly trading insights, market analysis, and potential trading opportunities

- Market Research: In-depth analysis of financial markets, with a focus on gold and other futures markets

- MTS Channels: YouTube channel with educational videos and market commentary

You can also check TradingFinder's Forex education section for additional resources.

MTS Capital Compared to Other Brokers

The table below provides a comprehensive comparison between MTrading and the top forex brokers:

Parameter | MTS Capital Broker | Fusion Markets Broker | TMGM Broker | AvaTrade Broker |

Regulation | SEC Thailand | ASIC, VFSC | ASIC, VFSC, FSC, FMA | ASIC, CySEC, CBI, FSA, FSCA, MiFID, ADGM, PFSA, ISA |

Minimum Spread | From 0.8 Pips | From 0.0 pips | From 0.0 Pips | From 0.0 Pips |

Commission | From 97.00 Baht | From $0.0 | From $0.0 | $0 |

Minimum Deposit | 1 THB | $0 | $100 | $100 |

Maximum Leverage | 1:100 | 1:500 | 1:1000 | 1:400 |

Trading Platforms | Ultra High-Speed Trader, MTS Smart Webtrader, MTS Smart Technic, MTS Mobile Trader, MT5 | MetaTrader 4, MetaTrader 5, TradingView, cTrader | MT4, MT5, IRESS, TMGM Mobile App | MetaTrader 4, MetaTrader 5, Mobile App, WebTrader |

Account Types | MT5 Account, Derivatives Account, Demo Account | Zero, Classic, Swap-Free | EDGE, CLASSIC | Standard, Demo, Professional |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Assets | 5,000+ | 250+ | 12000+ | 1250+ |

Trade Execution | Market | Market, Instant | Market, Instant | Instant |

Expert Opinion and Conclusion

MTS Capital is a Thai broker founded by “Kritcharat and Nuttapong Hirunyasiri” and serve more than 10000 clients as of now.

They won Outstanding Derivative House award for 3 years in row. On the dark side of the moon, MTS Capital broker does not offer any bonuses, no news trading and no trust scores are available.